H World Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

H World Group Bundle

Gain an edge with our in-depth PESTEL Analysis—crafted specifically for H World Group. Discover how political stability, economic growth, and technological advancements are shaping the company’s future, and use these insights to strengthen your own market strategy. Download the full version now and get actionable intelligence at your fingertips.

Political factors

The Chinese government's commitment to boosting inbound tourism through proactive reforms is a significant political factor. By June 2025, these reforms included expanded visa-free policies for citizens of 47 countries, a move designed to simplify travel and encourage foreign visitors. This directly benefits hotel groups like H World by increasing the potential pool of international guests.

Geopolitical tensions and economic uncertainties significantly impacted Chinese outbound travel in 2024, with a marked decrease in long-haul trips as travelers favored domestic and nearby international destinations. This trend directly affects H World Group, whose primary market remains China.

H World Group's strategic expansion, including the 2024 rebranding of Deutsche Hospitality to H World International, is a key move to broaden its global reach. This diversification is crucial for mitigating the risks tied to an overdependence on the Chinese market, especially given the sensitivity of the travel industry to international relations and policy shifts.

The Chinese government's regulatory landscape for hospitality is constantly shifting, affecting everything from how hotels operate to how they are licensed and how consumers are protected. H World Group, with its vast network of hotels both within China and abroad, needs to stay agile and compliant with these evolving rules. This means keeping up with local operating permits and stringent health and safety standards.

Government's Focus on Domestic Consumption

China's government is strongly prioritizing domestic consumption and tourism as primary engines for economic expansion. This strategic emphasis, combined with increasing disposable incomes, has fueled a significant rise in domestic travel, providing a robust environment for H World Group's broad network across China. For instance, in 2023, China's domestic tourism revenue reached approximately 4.91 trillion yuan, a substantial increase from previous years, underscoring the strength of this trend.

H World Group's expansion strategy, particularly its move into lower-tier cities, directly supports this national economic objective. By targeting these less saturated markets, the company is effectively capitalizing on the growing demand driven by government initiatives and rising consumer spending power. This alignment positions H World Group to benefit from the ongoing economic rebalancing towards internal demand.

- Government Push: China's commitment to boosting domestic consumption and tourism is a key political factor influencing the hospitality sector.

- Economic Impact: Rising disposable incomes and increased domestic travel, evidenced by 2023 revenues of nearly 5 trillion yuan, create a favorable market for hotel groups.

- Strategic Alignment: H World Group's focus on lower-tier cities aligns with national development priorities, accessing new growth opportunities.

Cross-Border Data Transfer Regulations

China's data protection landscape is continually shifting, with laws like the Cybersecurity Law, Data Security Law, and Personal Information Protection Law directly influencing H World Group's global operations. These regulations impose strict requirements on how customer data is handled and transferred across borders.

In 2024 and 2025, there have been efforts to clarify and provide exemptions for certain data transfers. For instance, transfers necessary for employee human resources management or the performance of contracts have seen some easing of restrictions. However, a global hotel chain like H World Group, managing extensive customer data, must still navigate these rules with meticulous attention to compliance to avoid penalties.

- Cybersecurity Law (CSL): Enacted in 2017, it established foundational rules for network security and data protection.

- Data Security Law (DSL): Effective from September 2021, it categorizes data based on its importance and impact, with stricter rules for "core" and "important" data.

- Personal Information Protection Law (PIPL): Implemented in November 2021, it aligns with global standards like GDPR, governing the processing of personal information.

- 2024-2025 Clarifications: Specific exemptions for intra-group data transfers related to HR and contract fulfillment aim to facilitate smoother operations for multinational companies.

The Chinese government's focus on inbound tourism, evidenced by expanded visa-free policies for 47 countries by June 2025, directly benefits hotel groups like H World by increasing potential international guest numbers.

Geopolitical shifts in 2024 led to a notable decrease in Chinese outbound travel, with a preference for domestic and nearby destinations, impacting H World's primary market.

H World's strategic rebranding of Deutsche Hospitality to H World International in 2024 aims to diversify its global presence, mitigating risks associated with market over-reliance.

China's evolving data protection laws, including the PIPL implemented in November 2021, necessitate strict compliance for global hotel chains like H World in handling customer data transfers.

What is included in the product

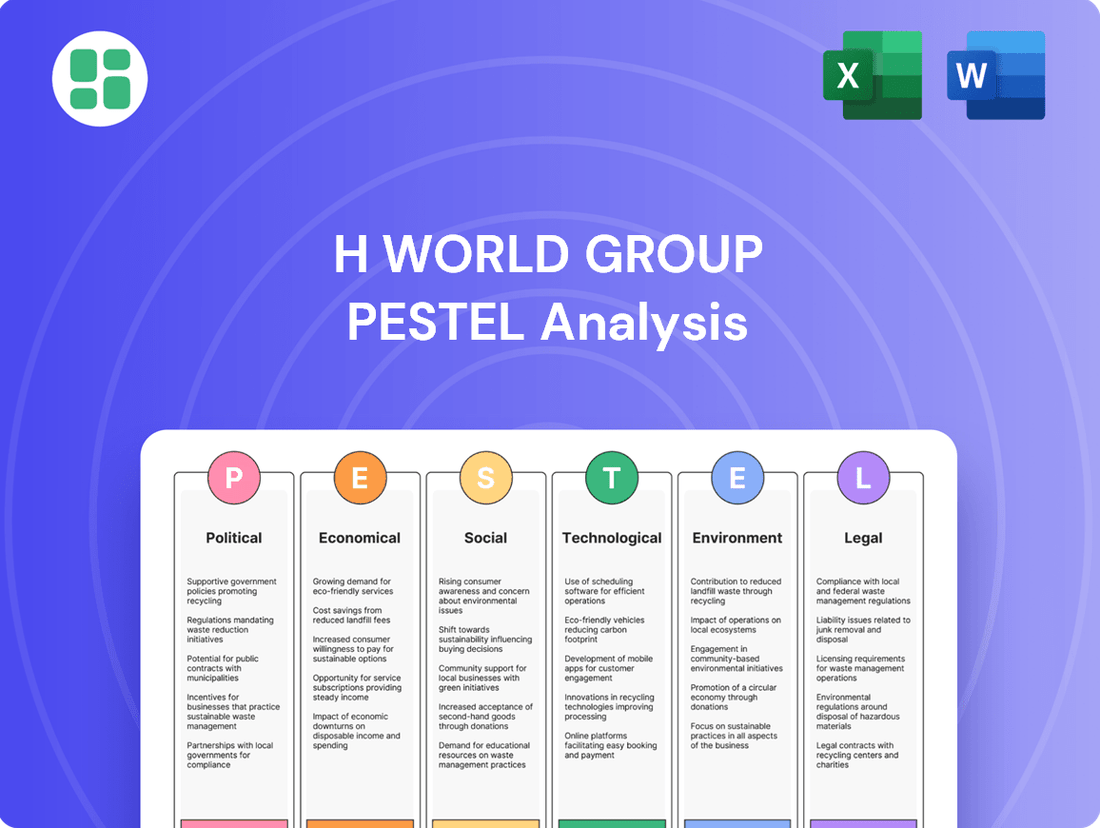

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting H World Group, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying potential threats and opportunities within the group's operating landscape.

Provides a concise PESTLE analysis of H World Group, simplifying complex external factors into actionable insights for strategic decision-making.

Helps H World Group navigate market complexities by offering a clear overview of political, economic, social, technological, environmental, and legal influences.

Economic factors

China's travel and tourism sector is on a strong rebound, with forecasts indicating it will reach ¥13.7 trillion by 2025, surpassing pre-pandemic levels by over 10%. This economic expansion is directly linked to a growing middle class and increased disposable income among Chinese consumers.

This surge in spending power allows more individuals to pursue domestic and international travel, creating a favorable environment for hospitality companies like H World Group. The company is well-positioned to capitalize on this trend, particularly in its mid-to-upscale hotel offerings.

Rising operational costs, particularly for labor and raw materials, present a significant hurdle for China's hotel sector. H World Group, despite its asset-light approach, needs to carefully manage these expenses to safeguard its profit margins.

The company's strategic emphasis on cost reduction and enhancing efficiency, especially within its international segment (Legacy-DH), is paramount for navigating inflationary pressures effectively. For instance, in the first quarter of 2024, H World Group reported that its hotel operating costs per available room saw an increase, reflecting these broader industry trends.

Consumer spending on travel is projected to see an uptick in 2025, particularly among high-income demographics keen on premium and unique travel experiences. While high-end segments are robust, overall travel frequency expectations for 2025 suggest a more measured approach compared to the rebound seen in 2024, reflecting a more discerning traveler.

H World Group's strategic advantage lies in its broad brand spectrum, from economy to upscale offerings. This allows the company to effectively capture demand across different consumer segments, including the growing preference for luxury accommodations and highly personalized travel plans, which are key trends for 2025.

Foreign Exchange Fluctuations

H World Group's financial performance in 2024 demonstrated the significant impact of foreign exchange fluctuations, with the company reporting foreign exchange losses that affected its net income. This underscores the inherent risk associated with operating in multiple currencies, a challenge that will only intensify as H World Group continues its international expansion beyond China.

As the company broadens its global footprint, effective management of foreign exchange risk is becoming a critical strategic imperative. The volatility in currency markets can directly influence profitability, making robust hedging strategies and careful financial planning essential for sustained growth and stability.

- 2024 Impact: Foreign exchange losses were a notable factor in H World Group's 2024 financial results, impacting net income.

- Growing International Presence: The company's expansion beyond China increases its exposure to currency volatility.

- Risk Management Focus: Effective management of foreign exchange risk is crucial for safeguarding profitability as the global footprint grows.

- Currency Volatility: Fluctuations in exchange rates can directly affect the value of international earnings when converted back to the reporting currency.

Asset-Light Strategy and Revenue Mix

H World Group is increasingly adopting an asset-light strategy, prioritizing managed and franchised hotels over company-owned or leased properties. This strategic pivot is designed to foster steady margin growth and robust cash flow generation.

The shift is evident in the revenue mix, with managed and franchised hotels contributing 40% of H World's total revenue in 2024. This marks a significant increase from 35% in 2023, signaling a successful execution of their asset-light model.

- Asset-Light Focus: H World is concentrating on management and franchise agreements, reducing capital expenditure on property ownership.

- Margin Expansion: This strategy is projected to drive gradual and continuous improvement in profit margins.

- Cash Flow Generation: The model is expected to produce strong and consistent cash flows.

- Revenue Mix Shift: Managed and franchised hotels accounted for 40% of revenue in 2024, up from 35% in 2023.

China's economic growth is a primary driver for H World Group, with consumer spending on travel expected to reach ¥13.7 trillion by 2025, a 10% increase over pre-pandemic levels. This expansion fuels demand for hospitality services, particularly in the mid-to-upscale segments where H World Group has a strong presence.

However, rising operational costs, especially for labor and raw materials, are a significant concern. H World Group's strategic focus on cost reduction and efficiency, particularly in its international operations, is crucial for maintaining profitability amidst these inflationary pressures. For instance, hotel operating costs per available room saw an increase in Q1 2024.

The company's asset-light strategy, emphasizing managed and franchised hotels, is key to navigating these economic headwinds. This shift, with managed and franchised hotels contributing 40% of revenue in 2024, up from 35% in 2023, aims to enhance margins and cash flow generation.

| Economic Factor | 2024/2025 Projection/Data | Impact on H World Group |

|---|---|---|

| Travel & Tourism Market Size (China) | ¥13.7 trillion by 2025 (10% above pre-pandemic) | Increased demand for hospitality services |

| Consumer Spending Power | Growing middle class, increased disposable income | Favorable for domestic and international travel |

| Operational Costs | Rising labor and raw material costs | Pressure on profit margins, need for efficiency |

| Asset-Light Strategy Adoption | Managed/franchised revenue: 40% in 2024 (vs. 35% in 2023) | Supports margin growth and cash flow |

Preview the Actual Deliverable

H World Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of H World Group delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

What you’re previewing here is the actual file—fully formatted and professionally structured. It offers actionable insights into the external forces shaping H World Group's strategic landscape.

The content and structure shown in the preview is the same document you’ll download after payment. Gain a deep understanding of the opportunities and threats facing H World Group through this detailed PESTLE framework.

Sociological factors

Chinese travelers are increasingly favoring spontaneous bookings, a notable shift from traditional advance planning. This trend is coupled with a rising demand for premium and personalized travel experiences, indicating a move towards higher-value offerings.

The concept of 'bleisure' travel, blending business and leisure, is gaining significant traction, requiring hospitality providers to accommodate flexible and integrated experiences. Affluent travelers, in particular, are seeking customized itineraries, highlighting the need for adaptable service models.

By 2024, the Chinese outbound tourism market is projected to see substantial recovery, with a focus on quality over quantity. For instance, data from 2023 indicated a strong preference for unique, experiential travel among younger demographics, a segment H World Group can strategically target with tailored packages.

Domestic tourism in China is experiencing a significant surge, with 2024 showing a strong rebound and projections indicating continued growth into 2025. This trend is fueled by a growing middle class with more disposable income and improved transportation networks making travel more accessible.

H World Group is strategically positioned to benefit from this domestic travel boom. The company is actively expanding its footprint into lower-tier cities, recognizing the increasing demand for quality lodging in these developing regions. This complements their established presence in major metropolitan areas, allowing them to capture a broader segment of the market.

Chinese travelers are increasingly prioritizing wellness and unique experiences over standard tourism. This shift is evident as the global wellness tourism market, valued at $738.5 billion in 2022, is projected to reach $1.5 trillion by 2027, with Asia-Pacific expected to see significant growth. H World Group can capitalize on this by expanding its portfolio to include more specialized offerings.

This includes developing or acquiring brands focused on spa resorts, wellness retreats, and eco-tourism. For instance, a growing segment of Chinese millennials and Gen Z are actively seeking out "digital detox" experiences and immersive cultural activities, presenting a clear market for H World Group to innovate and cater to these evolving preferences.

Demographic Shifts and Multigenerational Travel

Demographic shifts are significantly reshaping travel patterns, with a notable rise in multigenerational trips. This trend sees a growing number of middle-aged and senior travelers joining younger family members on vacations, often prioritizing experiences that involve culture and nature. For instance, a 2024 report indicated that over 30% of family vacations now include three or more generations, seeking shared memories and diverse activities.

H World Group's strategic advantage lies in its broad brand portfolio, which is well-positioned to address the distinct preferences of these varied age demographics. The company offers a spectrum of choices, from budget-friendly accommodations appealing to younger travelers to more premium and amenity-rich options designed for families and older adults. This adaptability ensures H World Group can effectively capture market share across different segments of the expanding multigenerational travel market.

- Rising Multigenerational Travel: A significant portion of family travel now involves three or more generations, driven by a desire for shared experiences.

- Experience-Seeking Seniors: Older demographics are increasingly active travelers, often seeking cultural immersion and nature-based activities.

- H World Group's Brand Diversification: The company's portfolio caters to a wide range of age groups and spending capacities, from economy to upscale.

- Market Opportunity: This demographic trend presents a substantial opportunity for hotel groups that can offer tailored accommodations and services for diverse family units.

Influence of Digital Media and Social Platforms

Digital content and social media are powerful forces shaping how Chinese travelers plan and book their trips. Platforms like Xiaohongshu (Little Red Book) and Douyin (TikTok) are crucial for destination discovery and influencing choices. H World Group must actively engage on these platforms, showcasing unique experiences and leveraging influencer marketing to reach a broad audience.

By 2024, over 70% of Chinese internet users are expected to be active on social media, making it an indispensable channel for marketing. H World Group's strategy should focus on creating visually appealing and shareable content that resonates with younger, digitally-native travelers. Enhancing digital accessibility, including user-friendly booking systems and responsive customer service via social channels, is key to capturing market share.

- Platform Engagement: Actively participate on Xiaohongshu and Douyin to showcase hotel offerings and travel inspiration.

- Content Strategy: Develop visually rich content, including user-generated reviews and influencer collaborations, to build trust and desire.

- Digital Accessibility: Ensure seamless online booking experiences and responsive customer support across all digital touchpoints.

- Targeted Marketing: Utilize data analytics from social platforms to understand traveler preferences and tailor marketing campaigns accordingly.

Changing consumer values are increasingly emphasizing experiences over material possessions, a trend particularly strong among younger Chinese travelers. This societal shift means hotels need to offer more than just a room; they must provide memorable activities and cultural immersion. For instance, a 2024 survey highlighted that over 40% of Chinese travelers prioritize unique local experiences when choosing a destination.

The growing awareness of environmental sustainability is also influencing travel decisions, with a noticeable preference for eco-friendly accommodations and practices. This aligns with a broader global trend, where consumers are more conscious of their environmental impact. H World Group can leverage this by highlighting its sustainability initiatives, which resonate with an increasingly eco-conscious traveler base.

The rise of the "experience economy" is a significant sociological factor, with travelers, especially millennials and Gen Z, willing to spend more on unique activities and personal growth. This demographic, representing a substantial portion of the outbound market, seeks authenticity and connection. By 2025, it's projected that experiential travel spending by these groups will continue to outpace traditional tourism.

Technological factors

Technological factors are significantly reshaping China's hospitality sector, with H World Group at the forefront of this digital evolution. The company is expected to continue its substantial investments in smart technologies, aiming to elevate guest experiences and boost operational efficiency. This includes further deployment of features like mobile check-in, automated room controls, and AI-powered concierge services, directly addressing the growing expectations of modern travelers.

The tourism sector is seeing significant growth thanks to AI, big data, and IoT. These technologies are key to improving services and driving digital change. For instance, by the end of 2023, global tourism spending was projected to reach $1.5 trillion, showing the industry's reliance on technological innovation.

H World Group can harness data analytics to offer tailored customer experiences, predict travel demand with greater accuracy, and refine pricing models. This strategic use of data is crucial for staying ahead in a competitive market, especially as the global digital transformation in travel is expected to accelerate further in 2024 and 2025.

Smart hotel technologies are rapidly advancing, with robots for room service, contactless payments, and AI-driven services becoming more common. H World Group is integrating these innovations, exemplified by their flagship products adopting modular construction. This approach speeds up building timelines and reduces environmental impact, showcasing a forward-thinking strategy in hotel development and operations.

Impact of Online Travel Agencies (OTAs) and Direct Booking Platforms

While established Online Travel Agencies (OTAs) continue to command a large share of the market, the increasing trend of spontaneous travel and a growing preference for digital-first interactions mean hotels must prioritize their mobile booking experiences. H World Group's H Rewards program and its online booking platform are vital for fostering direct customer relationships and maintaining its substantial membership, which helps lessen dependence on third-party channels.

For H World Group, this technological shift translates into a strategic imperative to enhance its direct booking channels. In 2023, online travel bookings globally were projected to exceed $800 billion, highlighting the significant influence of platforms like Booking.com and Expedia. However, a growing segment of travelers, particularly younger demographics, are increasingly turning to hotel-specific apps and websites for more personalized offers and loyalty benefits. This trend is supported by data indicating a rise in mobile bookings, with some reports suggesting that over 50% of travel bookings are now made on mobile devices.

- OTA Dominance: Traditional OTAs still represent a significant portion of travel bookings, influencing pricing and visibility for hotels.

- Mobile-First Imperative: The rise of spontaneous travel and digital-native consumers necessitates optimized mobile booking experiences for hotels.

- Direct Booking Strategy: H World Group's H Rewards program and online platform are key to building direct customer relationships and reducing third-party reliance.

- Loyalty Program Value: A strong loyalty program encourages repeat business and provides valuable data for personalized marketing efforts.

Cybersecurity and Data Security Requirements

As businesses become more digital, keeping information safe is incredibly important. For H World Group, a major hotel company that manages a lot of customer data, this means paying close attention to cybersecurity and data privacy.

China's data protection rules are quite strict, especially with new laws coming into effect in 2025. These laws specifically cover how network data is secured and how data can be moved across borders. H World Group needs to make sure its technology systems are strong and that it follows all these rules carefully.

- Increased Digitalization: The ongoing shift towards digital operations necessitates advanced cybersecurity measures.

- China's Data Protection Laws: H World Group must comply with stringent regulations, including those effective January 1, 2025, focusing on network data security and cross-border data transfers.

- Robust IT Infrastructure: Significant investment in IT infrastructure is required to ensure compliance and protect sensitive customer information.

Technological advancements are pivotal for H World Group's growth, driving innovation in guest experience and operational efficiency through AI, big data, and IoT. The company's focus on smart hotel technologies, including modular construction, streamlines development and enhances sustainability.

H World Group is enhancing its direct booking channels, recognizing the shift towards mobile-first interactions and personalized offers, as evidenced by the projected over $800 billion in global online travel bookings for 2023.

Cybersecurity and data privacy are paramount, especially with China's evolving data protection laws, including those effective January 1, 2025, requiring robust IT infrastructure and strict compliance with network data security and cross-border transfer regulations.

| Technology Area | Impact on H World Group | 2024/2025 Outlook |

|---|---|---|

| AI & Big Data | Personalized guest experiences, demand forecasting, dynamic pricing | Increased adoption for hyper-personalization and predictive analytics |

| IoT & Smart Hotels | Automated room controls, contactless services, robotic assistance | Expansion of smart features for enhanced convenience and efficiency |

| Mobile Booking & Digital Platforms | Direct customer relationships, loyalty program engagement | Continued investment to capture growing mobile booking market share |

| Cybersecurity & Data Privacy | Compliance with China's data laws (effective Jan 2025), data protection | Strengthened IT infrastructure to meet stringent regulatory requirements |

Legal factors

China's Personal Information Protection Law (PIPL) and Data Security Law (DSL) create a robust legal environment for data handling. These regulations mandate explicit consent for collecting personal information and impose rigorous security assessments for any data transferred outside of China.

For H World Group, with its extensive customer base and global reach, strict adherence to PIPL and DSL is crucial. Non-compliance can lead to substantial penalties, impacting financial performance and operational continuity. For instance, violations can incur fines up to 5% of the previous year's annual turnover or RMB 50 million, whichever is higher, as stipulated by PIPL.

H World Group, as a major player in China's hospitality sector, navigates a landscape shaped by anti-monopoly and fair competition laws. These regulations are designed to foster a healthy market by preventing any single entity from gaining excessive market power. For instance, China's Anti-Monopoly Law, enacted in 2008 and amended in 2022, sets clear boundaries on business practices that could stifle competition.

The company's strategic moves, including expanding its portfolio of brands and increasing its market presence, are scrutinized to ensure they don't lead to monopolistic tendencies. Failure to comply can result in significant penalties, impacting financial performance and brand reputation. In 2023, China's State Administration for Market Regulation (SAMR) continued to enforce these regulations, issuing fines and directives to various industries to maintain competitive fairness.

H World Group, operating a vast network of hotels in China, must navigate the country's robust labor laws. These regulations cover minimum wage requirements, which saw adjustments in various Chinese provinces in 2024, as well as mandated working hours, overtime pay, and employee social insurance contributions. For instance, in Shanghai, the minimum wage was increased to ¥2,600 per month as of April 1, 2024, impacting H World Group's operational costs.

Adherence to these labor statutes is paramount for H World Group to foster a stable and motivated workforce, thereby preventing costly litigation and reputational damage. The company's compliance efforts directly influence employee relations and operational continuity, especially given the high volume of employment across its diverse hotel portfolio.

Property and Licensing Laws

H World Group's reliance on an asset-light model, primarily utilizing managed and franchised properties, means its operations are deeply intertwined with property and licensing laws. This strategy is particularly sensitive to regulations in China, where the company has a significant presence, and other international markets. Navigating these legal landscapes is paramount for securing sustainable growth and minimizing potential risks associated with franchise agreements and licensing requirements.

Key legal considerations for H World Group include:

- Franchise Agreement Compliance: Ensuring all franchise agreements adhere strictly to Chinese contract law and relevant franchise regulations, which have seen evolving interpretations and enforcement.

- Property Ownership and Lease Laws: Understanding and complying with China's complex property ownership and leasehold laws, especially for managed properties where H World Group operates but does not own the underlying real estate.

- Licensing and Permits: Obtaining and maintaining all necessary business licenses, operational permits, and brand usage rights in each jurisdiction, which can vary significantly and require ongoing renewal.

- Dispute Resolution Mechanisms: Establishing clear legal frameworks for dispute resolution within franchise and management contracts, considering China's legal system and international arbitration options.

International Compliance and Local Regulations

H World Group's expanding global footprint necessitates adherence to a patchwork of international compliance standards and local regulations. This includes navigating varying hotel licensing requirements, consumer protection laws, and specific business conduct mandates in each territory where it operates. For instance, as of early 2024, the group's presence across numerous Asian markets, alongside emerging ventures in Europe and North America, means a complex legal landscape must be managed.

The strategic rebranding to H World International in 2024 directly addresses this growing legal complexity. This move aims to streamline compliance efforts and present a unified corporate identity capable of managing diverse international legal frameworks more efficiently. This proactive approach is crucial for mitigating risks and ensuring sustainable growth in a globalized hospitality sector.

- International Compliance: H World International must adhere to varying data privacy laws (e.g., GDPR in Europe), labor laws, and anti-bribery regulations across its global operations.

- Local Regulations: Specific hotel licensing, zoning laws, and health and safety standards differ significantly between countries, requiring tailored compliance strategies.

- Consumer Protection: Ensuring fair advertising practices, transparent pricing, and robust complaint resolution mechanisms are key legal considerations in all markets.

- Business Conduct: Adherence to local tax laws, competition regulations, and corporate governance standards is paramount for maintaining operational integrity.

China's evolving legal framework, including the Personal Information Protection Law (PIPL) and Data Security Law (DSL), imposes strict data handling requirements on H World Group. These laws, with penalties for violations potentially reaching 5% of annual turnover or RMB 50 million, necessitate robust compliance measures for the group's extensive customer data. Furthermore, anti-monopoly and fair competition laws, reinforced by entities like China's State Administration for Market Regulation (SAMR), scrutinize business practices to prevent market dominance, impacting strategic expansion and market presence.

Environmental factors

H World Group is facing growing demands for corporate sustainability, pushing it to focus on Environmental, Social, and Governance (ESG) principles. This is a significant trend impacting businesses globally.

The company's 2024 Sustainability Report highlights its dedication to eco-friendly buildings, operations, and services. These efforts were acknowledged, with H World Group being recognized for Outstanding ESG Practice Cases in 2024, underscoring their commitment to tangible environmental improvements.

Climate change poses a significant environmental challenge, altering travel patterns and the very viability of tourist destinations, which directly impacts hotel occupancy rates and overall demand for H World Group. For instance, rising sea levels and extreme weather events could make coastal resorts less appealing or even inaccessible, forcing a reassessment of asset management strategies.

To navigate these evolving risks, H World Group must integrate climate considerations into its long-term strategic planning. This proactive approach is becoming increasingly common, with many hotel companies beginning to incorporate climate-related risks into their operational risk registers as early as 2025, ensuring resilience against future environmental shifts.

The hospitality sector, including giants like H World Group, faces scrutiny for its substantial resource consumption and waste generation. In 2023, hotels globally contributed to significant water usage and solid waste, with many nations implementing stricter regulations on waste disposal and resource efficiency. H World Group's commitment to 'green operations' through initiatives like smart linen management and advanced laundry systems directly addresses these environmental pressures, aiming to lower operational costs and enhance brand image by reducing their ecological footprint.

Demand for Eco-Friendly and Green Hotels

Travelers are increasingly prioritizing sustainability, driving a greater demand for hotels that adopt eco-friendly practices. This shift means that hotels with a clear commitment to green initiatives are likely to see enhanced brand loyalty and market appeal.

H World Group is well-positioned to capitalize on this trend. Their investment in green building technologies, such as modular construction, significantly reduces environmental impact. Furthermore, their dedicated 'Green Living' program directly caters to the eco-conscious traveler, reinforcing their commitment to sustainability and potentially attracting a larger customer base.

- Growing Consumer Preference: Studies in 2024 indicate that over 60% of travelers consider sustainability when booking accommodations.

- H World's Green Initiatives: The company's modular construction methods aim to reduce construction waste by up to 30% compared to traditional methods.

- Brand Differentiation: The 'Green Living' program offers guests tangible benefits and transparency regarding the hotel's environmental efforts, fostering trust and positive brand perception.

Environmental Regulations and Carbon Neutrality Goals

China's ambitious goal of reaching carbon neutrality by 2060 is significantly influencing the hospitality sector, pushing companies like H World Group to prioritize sustainable practices. This national directive encourages the adoption of green technologies and the promotion of eco-friendly travel options. For H World Group, aligning operations with these environmental targets means investing in sustainable development and low-carbon innovations. This strategic alignment is crucial not only for meeting regulatory expectations but also for contributing to China's broader environmental objectives and appealing to an increasingly eco-conscious traveler base.

To navigate this evolving landscape, H World Group should consider the following:

- Invest in Energy Efficiency: Implementing smart energy management systems in hotels can reduce consumption. For instance, upgrading to LED lighting and high-efficiency HVAC systems can yield substantial energy savings.

- Promote Sustainable Sourcing: Partnering with local and sustainable suppliers for food, amenities, and operational materials supports environmental goals and can enhance brand reputation.

- Reduce Waste and Water Usage: Implementing comprehensive recycling programs and water conservation measures, such as low-flow fixtures, can demonstrate a commitment to environmental stewardship.

- Offer Eco-Friendly Travel Options: Encouraging guests to utilize public transportation, offering electric vehicle charging stations, or promoting carbon offsetting programs for flights can further support neutrality goals.

Environmental factors are increasingly shaping H World Group's strategy, driven by growing demands for corporate sustainability and China's 2060 carbon neutrality goal. The company is actively investing in eco-friendly buildings and operations, as recognized by its 2024 ESG awards. Climate change also presents direct risks, impacting travel patterns and destination viability, necessitating integration of climate considerations into long-term planning.

| Environmental Factor | Impact on H World Group | H World Group's Response/Initiatives | Data/Evidence (2024/2025) |

|---|---|---|---|

| Climate Change & Extreme Weather | Threatens destination viability, affects travel patterns and occupancy rates. | Integrating climate risk into strategic planning and asset management. | Rising sea levels and extreme weather events are increasing risks for coastal resorts. |

| Resource Consumption & Waste Generation | High water usage and solid waste contribute to environmental impact and regulatory pressure. | Implementing 'green operations' like smart linen management and advanced laundry systems. | Global hotel waste and water usage remain significant concerns, with stricter regulations emerging. |

| Consumer Demand for Sustainability | Travelers increasingly prioritize eco-friendly accommodations, influencing booking decisions. | Investing in green building technologies (e.g., modular construction) and the 'Green Living' program. | Over 60% of travelers consider sustainability when booking (2024 studies); modular construction reduces waste by up to 30%. |

| National Environmental Policies (China) | China's carbon neutrality goal by 2060 mandates sustainable practices in the hospitality sector. | Prioritizing sustainable development and low-carbon innovations to align with national targets. | Emphasis on green technologies and eco-friendly travel options to meet regulatory expectations. |

PESTLE Analysis Data Sources

Our H World Group PESTLE analysis is built on a comprehensive review of data from reputable sources including government economic reports, international financial institutions like the IMF and World Bank, and leading market research firms. We also incorporate industry-specific publications and regulatory updates to ensure a thorough understanding of the macro-environmental landscape.