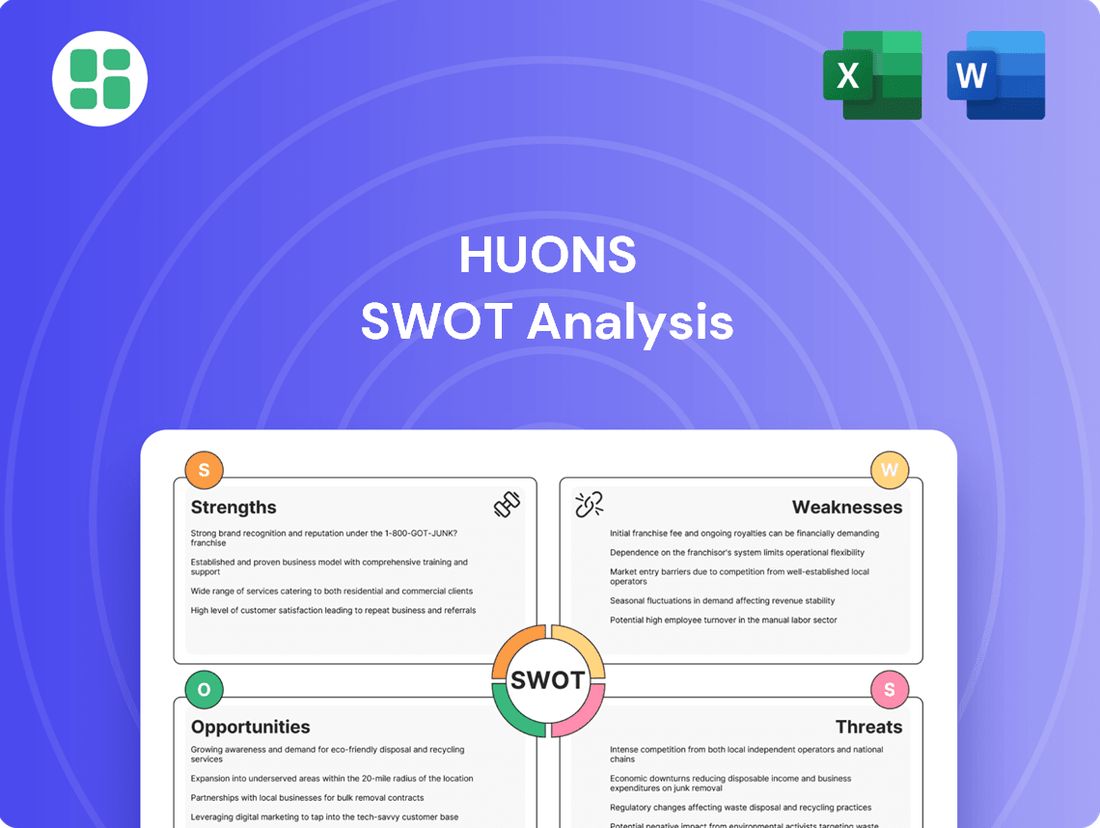

Huons SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Huons Bundle

Huons demonstrates significant strengths in its established market presence and product innovation, but faces potential threats from evolving industry regulations and competitive pressures.

Want the full story behind Huons' strategic advantages, potential vulnerabilities, and future growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Huons Co., Ltd. boasts a robust and integrated business portfolio spanning pharmaceuticals, medical devices, health functional foods, and cosmeceuticals. This broad operational scope provides a wide array of products, from essential prescription drugs and accessible over-the-counter medications to specialized aesthetic products, ensuring multiple avenues for revenue generation.

This strategic diversification is a key strength, significantly reducing the company's vulnerability to market fluctuations or challenges within a single sector. For instance, in 2023, Huons reported consolidated revenue of approximately KRW 1.1 trillion, with its diverse segments contributing to this stable financial performance.

Furthermore, Huons extends its expertise through contract manufacturing services for other pharmaceutical entities. This capability not only broadens its market penetration but also leverages its established manufacturing infrastructure and technical know-how, adding another layer to its business resilience and market presence.

Huons shows a serious dedication to new ideas, boosting its research and development spending by a significant 34% in the first quarter of 2025. This increased investment is crucial for creating new medicines, improving existing ones, and advancing biopharmaceutical projects, including promising treatments for dry eye syndrome and human hyaluronidase.

The company also actively pursues open innovation and partnerships to broaden its product offerings, focusing on areas like obesity, Alzheimer's disease, and hair loss treatments. This strategy highlights Huons' proactive stance on developing future products.

Huons demonstrates exceptional market leadership in crucial segments, particularly in local anesthetics. Its lidocaine product alone holds an impressive 82% market share, a testament to its product quality and market penetration.

The company's dominance extends to dental anesthetics, where it commands an 87% share, soaring to an estimated 92% when accounting for contract manufacturing. This strong foothold in specialized areas highlights Huons' established brand trust and significant competitive edge, underpinning its consistent revenue streams.

Expanding Global Presence and FDA Approvals

Huons has made significant strides in expanding its global reach, notably through securing multiple U.S. Food and Drug Administration (FDA) approvals for its injectable products. Key among these are lidocaine hydrochloride and bupivacaine hydrochloride, which are crucial for entering the substantial North American market. These approvals are not just regulatory milestones; they directly enhance Huons' export potential and demonstrate its capacity to adhere to the highest international quality and safety benchmarks.

The company's commitment to global standards is further evidenced by its increasing exports of both injectable and ophthalmic drugs to the United States and various other international territories. This expansion signifies Huons' growing global footprint and its proven ability to navigate complex regulatory landscapes, positioning it for continued growth in diverse markets.

Key achievements include:

- U.S. FDA approvals for lidocaine hydrochloride and bupivacaine hydrochloride.

- Enhanced export capabilities to the North American market.

- Growing international sales of injectable and ophthalmic drugs.

Consistent Profitability and Strategic Acquisitions

Huons has showcased remarkable financial resilience, achieving its highest quarterly revenue in Q2 2025. This consistent profitability is a testament to the robust performance of its core business segments.

The company's strategic acquisition of PanGen Biotech in early 2025 has significantly bolstered its biopharmaceutical R&D and CDMO capacities. This move is projected to unlock new avenues for growth and enhance Huons' competitive edge in the biopharmaceutical sector.

- Highest Quarterly Revenue: Q2 2025 marked a new high for Huons' revenue.

- Profitability Boost: Significant increases in operating and net profit were reported for Q2 2025.

- Strategic Acquisition: PanGen Biotech acquisition strengthens R&D and CDMO capabilities.

- Synergistic Growth: Acquisitions are creating new growth engines and improving market position.

Huons demonstrates significant market leadership in key areas, particularly with its local anesthetics. The company holds an impressive 82% market share for its lidocaine product and dominates the dental anesthetic market with an 87% share, which rises to an estimated 92% when contract manufacturing is included. This strong market position translates to established brand trust and a distinct competitive advantage, ensuring consistent revenue streams.

What is included in the product

Analyzes Huons’s competitive position through key internal and external factors, identifying its strengths, weaknesses, opportunities, and threats.

Huons' SWOT analysis provides a clear, actionable framework, transforming complex strategic challenges into manageable insights for decisive action.

Weaknesses

Huons faces a weakness in specific business segments, as evidenced by a revenue drop in its beauty and wellness sector during Q2 2025. This follows a slight decline in consolidated sales in Q1 2025, highlighting uneven performance across its diversified operations. Such inconsistencies suggest that while diversification offers breadth, strategic focus is needed to bolster underperforming areas.

While Huons' commitment to research and development is a key driver of innovation, it also represents a significant financial challenge. The company's R&D expenses have been on an upward trend, which, as seen in its financial reports, has put pressure on operating profit margins. This increased investment is necessary for developing new drug candidates, advanced biopharmaceuticals, and complex biosimilars.

The journey from initial research to market approval for these products is fraught with inherent risks. These include lengthy development cycles, the substantial financial outlay required for rigorous clinical trials, and the ever-present uncertainty surrounding regulatory body approvals. For instance, the path to market for a new biologic can easily span over a decade and cost hundreds of millions of dollars.

Any setbacks or delays in critical pipeline projects can have a direct and adverse effect on Huons' future earnings potential and overall growth trajectory. A failure in late-stage clinical trials or a rejection from regulatory agencies for a promising new therapy could significantly impact the company's valuation and its ability to achieve its strategic objectives.

Huons faces a formidable challenge in South Korea's pharmaceutical sector, where it contends with established domestic giants and powerful international companies. This crowded marketplace means constant pressure on pricing and market share, demanding relentless innovation and substantial marketing investment to simply hold its ground.

Potential Over-reliance on Domestic Market Growth

While Huons is actively pursuing international expansion, a substantial part of its revenue still originates from the South Korean pharmaceutical market. Projections indicate that the South Korean pharmaceutical market's compound annual growth rate (CAGR) is anticipated to be moderate, especially when compared to the more dynamic growth rates seen in emerging global markets.

This reliance on the domestic market presents a potential constraint on Huons' overall growth trajectory. If the pace of international expansion doesn't sufficiently accelerate or if the domestic market encounters unfavorable shifts, the company's growth potential could be significantly capped.

- Domestic Market Dependency: A significant portion of Huons' revenue is tied to the South Korean market.

- Modest Domestic Growth: South Korea's pharmaceutical market is expected to grow at a more modest pace compared to other regions.

- Risk to Growth Potential: Slow international expansion or domestic market downturns could limit overall company growth.

Challenges in Subsidiary Performance Consistency

Huons faces challenges in ensuring consistent performance across its subsidiaries. For instance, while some affiliates improved their financial standing, Huons Meditech saw a downturn, with reported declining sales and increased operating losses in the first quarter of 2025. This disparity highlights a key weakness in maintaining uniform profitability and operational efficiency throughout the group.

The difficulty in achieving synchronized positive results across all its diverse business units can negatively impact the overall financial health of Huons. Such inconsistencies can dilute the group's profitability and hinder the realization of potential synergies, making it harder to leverage the strengths of each subsidiary effectively.

- Inconsistent Subsidiary Profitability: Huons Meditech's Q1 2025 performance, marked by declining sales and operating losses, exemplifies the challenge of maintaining uniform financial success across all group entities.

- Synergy Realization Hurdles: The varied performance levels among subsidiaries can impede the effective integration and synergy realization, potentially limiting the overall group's operational efficiency and strategic advantage.

- Diluted Group Performance: Inconsistent results from individual business units can drag down the consolidated financial performance, impacting key metrics like overall profitability and return on investment.

Huons' reliance on the South Korean market presents a significant weakness, as this market is projected for more moderate growth compared to emerging economies. For example, the South Korean pharmaceutical market's CAGR is estimated to be around 4-5% for the 2024-2025 period, while some Asian markets are expected to see double-digit growth.

This domestic dependency limits the company's ability to capitalize on higher-growth international opportunities. If the pace of its global expansion doesn't accelerate, Huons' overall growth potential could be capped, especially if the domestic market faces any slowdowns.

Furthermore, Huons faces intense competition within South Korea from both domestic leaders and global pharmaceutical giants. This necessitates substantial investment in marketing and continuous innovation just to maintain market share, putting pressure on profitability.

| Market | Projected CAGR (2024-2025) | Key Competitors |

|---|---|---|

| South Korea | 4-5% | Domestic giants (e.g., Yuhan Corp, Hanmi Pharmaceutical), International players (e.g., Pfizer, Novartis) |

| Emerging Asian Markets | 8-12% | Local pharmaceutical companies, multinational corporations |

Full Version Awaits

Huons SWOT Analysis

The preview you see is the same document the customer will receive after purchasing. This ensures transparency and guarantees you're getting the actual, professionally prepared Huons SWOT analysis.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout, offering you the full, detailed insights into Huons' strategic position.

This is the same SWOT analysis document included in your download. The full content is unlocked after payment, providing you with a comprehensive understanding of Huons' Strengths, Weaknesses, Opportunities, and Threats.

Opportunities

The South Korean pharmaceutical market is a significant opportunity, with projections indicating it will reach USD 26.11 billion by 2030, growing at a 2.40% compound annual growth rate. This expansion is fueled by demographic shifts like an aging population and the increasing incidence of chronic illnesses.

Further strengthening this outlook, the market is expected to hit USD 30.20 billion by 2035, reflecting a 2.88% CAGR. Government initiatives bolstering biomedical research and development are also a key driver, creating a supportive ecosystem for companies like Huons.

South Korea is rapidly becoming a major center for biopharmaceutical licensing, with deal values seeing significant increases. Huons' strategic acquisition of PanGen Biotech, a contract development and manufacturing organization (CDMO) specializing in biopharmaceuticals, directly taps into this burgeoning market. This move bolsters Huons' research and development prowess and its manufacturing capacity within the biopharmaceutical space.

The acquisition particularly enhances Huons' capabilities in developing human hyaluronidase biosimilars. This provides a crucial entry point into a sector experiencing robust growth, leveraging PanGen Biotech's established expertise and Huons' expanding infrastructure to capture market share.

Huons is well-positioned to capitalize on global market expansion, with a notable increase in injectable drug exports to the United States and a growing presence in international markets for ophthalmic solutions.

Active participation in key industry events such as Dubai Derma 2025 and Hospitalar 2024 presents significant avenues for growth in medical devices and aesthetic products, enabling Huons to access burgeoning global medical aesthetics and pharmaceutical sectors.

Advancements in Digital and AI-driven Drug Development

South Korea's biopharmaceutical sector is rapidly integrating digital and AI technologies, with significant growth in AI-powered drug discovery and the development of digital therapeutics. Huons can capitalize on this by focusing its R&D on these advanced areas and forging strategic partnerships.

Huons' HyDIFFUZE platform, for instance, exemplifies how the company can leverage innovative technologies for improved drug delivery, such as converting IV formulations to subcutaneous ones. This aligns with the broader industry trend of enhancing patient convenience and treatment efficacy.

- AI in Drug Discovery: The global AI in drug discovery market was valued at approximately $1.2 billion in 2023 and is projected to reach over $10 billion by 2030, indicating substantial growth opportunities.

- Digital Therapeutics: The digital therapeutics market is also expanding, with a growing number of companies investing in software-based interventions for various health conditions.

- Formulation Innovation: Huonslab's HyDIFFUZE platform represents a key area where the company can differentiate itself by offering advanced drug delivery solutions.

Increasing Demand for Health Functional Foods and Cosmeceuticals

The global medical aesthetics market is projected to reach $21.9 billion by 2025, a substantial increase from previous years, fueled by a growing consumer emphasis on appearance and beauty. Huons is well-positioned to leverage this trend through its established cosmeceutical offerings and the recent profitability of its health supplement arm, Huons EN.

Huons can further capitalize on this expanding market by focusing on the development and marketing of innovative health functional foods and aesthetic products. These initiatives are expected to unlock new revenue streams and tap into previously unaddressed market segments, enhancing overall company growth.

- Growing Market: The global medical aesthetics market is set for robust expansion, indicating strong consumer interest.

- Huons' Strengths: The company's existing cosmeceutical business and the profitable Huons EN provide a solid foundation.

- New Avenues: Developing advanced health functional foods and aesthetic solutions can create significant new revenue opportunities.

- Market Penetration: These new product lines offer a pathway to capture a larger share of the expanding wellness and beauty sectors.

Huons is strategically positioned to benefit from the expanding South Korean pharmaceutical market, which is projected to reach USD 30.20 billion by 2035. The company's acquisition of PanGen Biotech enhances its biopharmaceutical capabilities, particularly in human hyaluronidase biosimilars, tapping into a high-growth sector. Furthermore, Huons can leverage the global medical aesthetics market, expected to reach $21.9 billion by 2025, through its existing cosmeceutical products and the profitable Huons EN, while also exploring new health functional foods.

| Opportunity Area | Projected Market Value/Growth | Huons' Strategic Alignment |

| South Korean Pharma Market | USD 30.20 billion by 2035 (2.88% CAGR) | Government support, aging population, chronic diseases |

| Biopharmaceutical Licensing & CDMO | Increasing deal values, PanGen Biotech acquisition | Enhanced R&D and manufacturing for biosimilars |

| Global Medical Aesthetics | USD 21.9 billion by 2025 | Existing cosmeceuticals, Huons EN profitability, new product development |

Threats

Huons faces a highly competitive South Korean pharmaceutical landscape, where established domestic firms and global giants actively compete for market share. This intense rivalry can force price reductions and escalate marketing costs, potentially impacting Huons' profitability and market standing.

The pharmaceutical sector faces increasingly stringent and dynamic regulations, particularly concerning government pricing frameworks that prioritize value-based care. These rules can lead to tighter reimbursement ceilings, as seen in markets like South Korea, potentially impacting profitability.

Heightened regulatory oversight, the complexities of maintaining compliance, and the possibility of shifts in drug pricing policies pose a significant threat to Huons. Such changes could adversely affect the company's bottom line and its ability to reach key patient populations.

Ongoing global economic uncertainties, including potential downturns and geopolitical tensions, pose a significant threat to Huons' export-oriented businesses. For instance, the International Monetary Fund (IMF) projected global growth to slow to 2.9% in 2024, down from 3.0% in 2023, highlighting a challenging international market environment that could impact Huons' sales volumes and revenue streams.

Furthermore, disruptions in global supply chains for essential raw materials or manufacturing components present a tangible risk. The lingering effects of the COVID-19 pandemic and geopolitical conflicts have continued to strain supply networks, potentially leading to increased production costs for Huons or delays in getting their products to market, thereby affecting operational efficiency and market competitiveness.

Risks Associated with Patent Expirations

The expiration of key patents, such as the human hyaluronidase patent in Korea (March 2024) and the U.S. (2027), while opening doors for biosimilar opportunities for Huons, simultaneously ushers in heightened competition for its existing, once-protected products. This competitive pressure can directly impact sales figures for these now-vulnerable patented items as rivals introduce lower-cost generic or biosimilar alternatives.

Huons faces the threat of market share erosion and potential price erosion on its flagship products once their patent protection lapses. For instance, if competitors can quickly and effectively bring biosimilar versions of its successful products to market, Huons' revenue streams from these particular offerings could see a significant downturn. This dynamic is a common challenge in the pharmaceutical and biotech sectors as exclusivity periods end.

The company must proactively strategize to mitigate the impact of patent expirations. This includes:

- Accelerating biosimilar development: Launching its own biosimilar versions of competitor products or its own expiring patents can help Huons retain market share and capture new revenue.

- Diversifying product portfolio: Reducing reliance on a few key patented products by investing in new research and development for novel therapies or expanding into different therapeutic areas.

- Strengthening marketing and sales efforts: Emphasizing product differentiation, efficacy, and customer loyalty to retain existing customers even when cheaper alternatives become available.

Challenges in Securing Funding for Bioventures

Despite the overall growth trajectory of the biopharmaceutical industry, securing funding for smaller bioventures in South Korea presents a persistent hurdle. This challenging funding landscape can impact Huons' ability to finance its strategic collaborations and internal biopharmaceutical initiatives.

For instance, in 2023, venture capital investment in South Korea's biotech sector saw a notable dip compared to previous years, making it more difficult for emerging companies to raise capital. This could potentially delay or constrain Huons' R&D pipelines and expansion efforts through partnerships.

- Weak Funding Environment: South Korea's bioventure funding remains challenging for smaller entities.

- Impact on Huons' Ventures: Huons' strategic biotech investments may face difficulties in securing sufficient external capital.

- R&D and Expansion Delays: Insufficient funding could slow down critical research and development projects or expansion plans for Huons' biopharmaceutical ventures.

- 2023 Investment Trends: Venture capital investment in Korean biotech experienced a slowdown in 2023, exacerbating funding challenges.

Huons operates in a fiercely competitive South Korean pharmaceutical market, facing pressure from both domestic and international players. This intense rivalry can lead to price wars and increased marketing expenditures, potentially squeezing profit margins and weakening the company's market position.

The company is also vulnerable to evolving regulatory landscapes, particularly regarding drug pricing and reimbursement policies that increasingly favor value-based care. Changes in these frameworks, as seen in South Korea, could negatively impact Huons' revenue streams.

Global economic instability, including potential recessions and geopolitical events, poses a threat to Huons' export business. The IMF's forecast of slowing global growth for 2024 underscores a challenging international market environment that could dampen sales.

Patent expirations for key products, such as human hyaluronidase, introduce significant threats. While these create biosimilar opportunities, they also invite increased competition for Huons' existing revenue streams, potentially leading to market share erosion and price declines.

SWOT Analysis Data Sources

This SWOT analysis for Huons is built upon a foundation of robust data, including their official financial statements, comprehensive market research reports, and expert industry analyses. These diverse sources ensure a well-rounded and accurate assessment of the company's strategic position.