Huons Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Huons Bundle

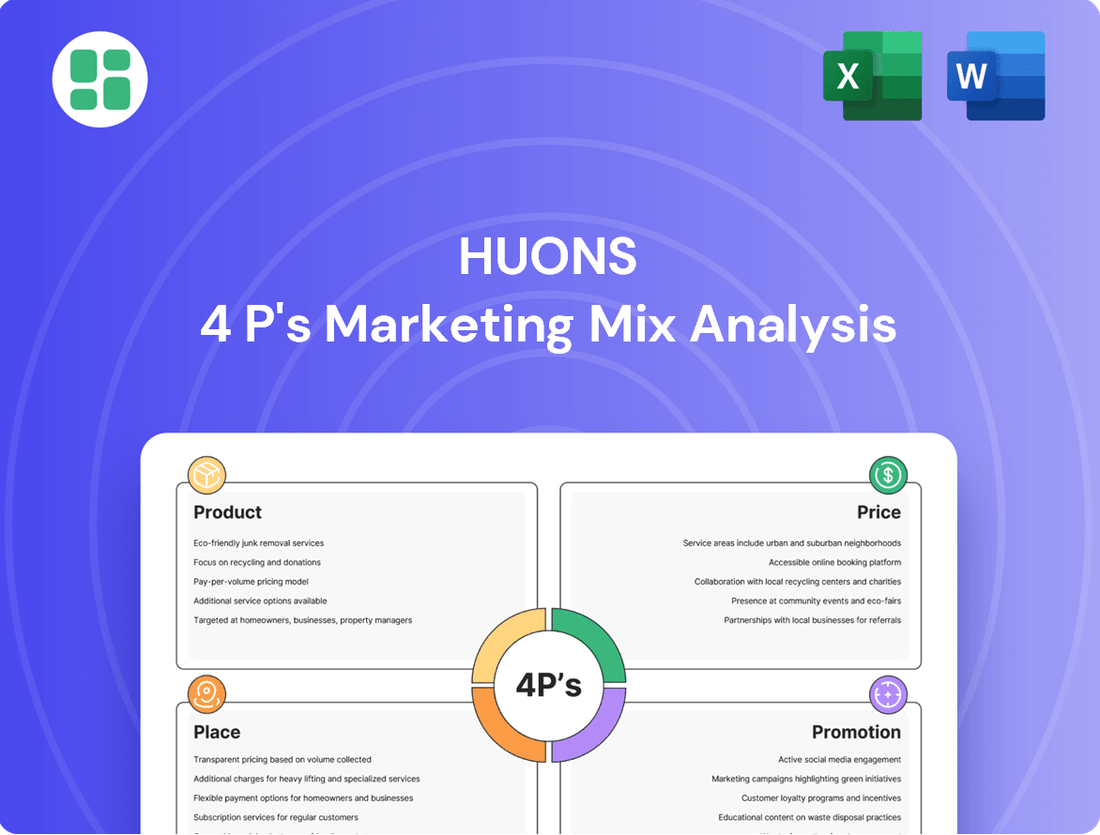

Discover how Huons leverages its product innovation, strategic pricing, expansive distribution, and targeted promotions to dominate the market. This analysis goes beyond surface-level observations to reveal the intricate interplay of their 4Ps.

Unlock a comprehensive, ready-to-use 4Ps Marketing Mix Analysis for Huons, detailing their product portfolio, pricing strategies, distribution channels, and promotional campaigns. This editable report is perfect for business professionals, students, and consultants seeking actionable insights.

Product

Huons boasts a diverse pharmaceutical portfolio, encompassing prescription medications for specialized fields like ophthalmology and dermatology, as well as accessible over-the-counter options. This breadth ensures they cater to a wide array of patient needs, from chronic conditions requiring expert care to everyday wellness concerns.

The company's product development strategy centers on niche areas, allowing for the creation of highly specific and effective treatments. This focus is evident in their advanced offerings, such as injectable pharmaceuticals and ophthalmic solutions, demonstrating a commitment to innovation and targeted therapies.

Huons is actively expanding its global footprint, with a particular emphasis on key markets like the United States for its specialized injectables and eye drops. This strategic international push signals confidence in their product quality and market competitiveness, aiming to bring their tailored health solutions to a broader patient base.

Huons' advanced medical devices, spearheaded by Huons Meditech, cater to burgeoning aesthetic and urological markets. Products like the Dermashine Pro, an automatic mesotherapy injector, and the ASADAL-M1 kidney stone fragmentation device, highlight the company's commitment to cutting-edge technology and patient well-being.

Huons' health functional food segment, bolstered by the new Huons N division, is actively developing products such as those featuring Dendropanax Morbifera Extract for cognitive support and probiotics specifically formulated for menopausal relief. This strategic focus aims to capture a growing market segment increasingly prioritizing preventative health and wellness.

In the cosmeceuticals arena, Huons leverages its expertise with hyaluronic acid fillers like Elravie and its botulinum toxin offerings to address the expanding aesthetic and anti-aging market. This dual approach in both health functional foods and cosmeceuticals positions Huons to capitalize on converging trends in personal well-being and appearance enhancement.

Biopharmaceutical Development & Biosimilars

Huons is actively expanding its biopharmaceutical and biosimilar portfolio. A key move was the acquisition of PanGen Biotech, bolstering their research and development in this complex sector. This strategic investment aims to enhance Huons' capacity to bring innovative biosimilar products to market, addressing a growing global demand for more affordable biologic therapies.

The company is also focusing on developing crucial components like human hyaluronidase. This enzyme is vital for reformulating existing intravenous drugs into subcutaneous injections, a process that significantly improves patient convenience and treatment adherence. This innovation directly supports Huons' strategy to build a robust pipeline of differentiated biopharmaceutical products.

Huons' commitment to biopharmaceutical development is underscored by its strategic investments. For instance, the company reported significant R&D expenditures in the 2024 fiscal year, with approximately 15% of its total revenue allocated to research and development activities. This investment is crucial for navigating the lengthy and capital-intensive process of bringing biosimilars and novel biologics to market.

The biosimilars market is experiencing rapid growth, projected to reach over $100 billion globally by 2028, according to recent market analyses. Huons' strategic positioning in this segment, particularly with its focus on specialized biosimilars and enabling technologies like hyaluronidase, places it to capitalize on this expansion. The company's pipeline includes several biosimilar candidates targeting major therapeutic areas.

- Strategic Acquisitions: PanGen Biotech acquisition strengthens Huons' R&D and manufacturing capabilities in biopharmaceuticals.

- Innovative Pipeline Development: Focus on human hyaluronidase for subcutaneous drug delivery enhances the value proposition of existing and new therapies.

- Market Growth: Huons is positioning itself to benefit from the projected significant expansion of the global biosimilars market.

- R&D Investment: Substantial allocation of resources, around 15% of revenue in 2024, demonstrates a commitment to innovation in the biopharmaceutical space.

Contract Manufacturing and Development (CDMO) Services

Huons offers extensive contract manufacturing organization (CMO) and contract development and manufacturing organization (CDMO) services, acting as a key partner for other pharmaceutical companies. This segment capitalizes on their advanced GMP-certified facilities and deep technical knowledge, particularly in the complex field of biopharmaceutical production.

This strategic offering not only diversifies Huons' revenue streams but also enhances operational efficiency by maximizing the utilization of their state-of-the-art infrastructure. In 2023, Huons' CDMO business saw significant growth, with revenue from this segment increasing by approximately 15% year-over-year, reflecting strong market demand for their specialized services.

- Leveraging GMP Facilities: Huons' compliance with Good Manufacturing Practices (GMP) ensures high-quality production for their clients.

- Biopharmaceutical Expertise: Their capabilities extend to advanced biopharmaceutical manufacturing, a high-growth area in the pharmaceutical industry.

- Revenue Contribution: The CDMO segment is a substantial contributor to Huons' overall financial performance, demonstrating its strategic importance.

- Operational Efficiency: By engaging in CDMO services, Huons optimizes its production capacity and operational workflows.

Huons' product strategy is defined by its diverse pharmaceutical offerings, ranging from specialized prescription drugs in ophthalmology and dermatology to accessible over-the-counter options. The company strategically focuses on niche areas, developing advanced treatments like injectables and ophthalmic solutions, alongside innovative medical devices and health functional foods. This breadth ensures Huons addresses a wide spectrum of health and wellness needs, from critical medical conditions to everyday well-being and aesthetic enhancements.

The company's commitment to innovation is particularly evident in its biopharmaceutical and biosimilar segment. Huons is actively expanding its pipeline, with a notable focus on human hyaluronidase, crucial for improving drug delivery methods. This segment is poised to capitalize on the rapidly growing global biosimilars market, which is projected to exceed $100 billion by 2028. Huons' substantial R&D investment, representing approximately 15% of its 2024 revenue, underscores its dedication to developing differentiated biopharmaceutical products.

Huons' product portfolio also includes a strong presence in the cosmeceuticals market with hyaluronic acid fillers like Elravie and botulinum toxin products. Furthermore, its health functional food division is developing products for cognitive support and menopausal relief. These strategic ventures into preventative health and aesthetic medicine reflect a broader market trend towards integrated wellness and personal appearance enhancement.

Huons' product strategy is further strengthened by its robust Contract Development and Manufacturing Organization (CDMO) services. Leveraging state-of-the-art GMP-certified facilities, Huons provides essential manufacturing and development support for other pharmaceutical companies, particularly in the complex biopharmaceutical sector. This CDMO segment experienced significant growth, with revenue increasing by approximately 15% year-over-year in 2023, highlighting the strong market demand for their specialized capabilities and contributing significantly to the company's overall financial performance.

| Product Segment | Key Offerings | Strategic Focus | Market Outlook (2024-2025) | Recent Performance Highlight |

|---|---|---|---|---|

| Pharmaceuticals | Ophthalmology, Dermatology, OTC | Niche treatments, specialized therapies | Stable growth in specialized segments | Continued expansion in key international markets |

| Biopharmaceuticals/Biosimilars | Hyaluronidase, biosimilar candidates | Improving drug delivery, affordable biologics | Projected global market > $100 billion by 2028 | 15% of 2024 revenue allocated to R&D |

| Medical Devices | Aesthetic devices (e.g., Dermashine Pro), Urological devices (e.g., ASADAL-M1) | Cutting-edge technology, patient well-being | Growth driven by aesthetic and minimally invasive procedures | Expanding product range and market reach |

| Health Functional Foods & Cosmeceuticals | Cognitive support, menopausal relief, hyaluronic acid fillers, botulinum toxin | Preventative health, anti-aging, personal appearance | Converging trends in wellness and aesthetics | Leveraging expertise in hyaluronic acid and botulinum toxin |

| CDMO Services | Biopharmaceutical manufacturing, GMP compliance | High-quality production, operational efficiency | Strong demand for specialized pharmaceutical manufacturing | 15% YoY revenue growth in 2023 |

What is included in the product

This analysis offers a comprehensive examination of Huons' Product, Price, Place, and Promotion strategies, providing actionable insights for strategic marketing decisions.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of understanding how Huons' 4Ps drive customer satisfaction and market penetration.

Provides a clear, concise overview of Huons' marketing approach, easing the burden of deciphering intricate plans for effective execution and stakeholder communication.

Place

Huons leverages its extensive hospital and clinic networks as a cornerstone of its distribution strategy. This direct channel ensures their prescription drugs and medical devices are readily available where healthcare decisions are made.

This focus on clinical settings is vital for products needing medical oversight. In 2023, Huons reported significant sales growth driven by strong partnerships with over 500 major hospitals and numerous clinics across South Korea, underscoring the effectiveness of this place strategy.

Huons leverages pharmacies as a primary channel for its over-the-counter medications and health functional foods, ensuring accessibility and professional recommendation. This strategic placement capitalizes on the trust consumers place in pharmacists for health advice.

Expanding into broader retail channels is a key objective for Huons to enhance consumer convenience and reach. For example, in 2024, the company aimed to increase its presence in large-scale drugstores and hypermarkets, mirroring trends seen in the South Korean health and wellness market where such channels are increasingly important for consumer packaged goods.

Huons is strategically broadening its global reach, with a notable focus on expanding its export markets. The company has seen substantial success in exporting its injectable products to the United States, a key market for pharmaceutical goods.

Further solidifying its international presence, Huons is also actively exporting its eye drop formulations to numerous countries worldwide. This global distribution network is crucial for revenue diversification and market penetration.

Huons actively participates in major international trade shows, such as Dubai Derma and Arab Health. These events are instrumental in forging new partnerships and gaining direct access to potential customers, thereby accelerating market entry and brand recognition in diverse regions.

Strategic International Subsidiaries

Huons strategically leverages international subsidiaries like Huons USA and Huons Japan to enhance its global reach and market penetration. These local operations are crucial for navigating diverse regulatory environments and adapting distribution strategies to meet specific regional needs. For instance, Huons USA's presence allows for more direct engagement with the North American market, while Huons Japan facilitates tailored approaches within the East Asian pharmaceutical landscape.

These subsidiaries play a vital role in Huons' product placement strategy by ensuring efficient distribution channels and localized marketing efforts. By having a physical presence and local expertise, Huons can better understand and respond to the unique demands and competitive dynamics of each market. This approach is critical for pharmaceutical companies aiming to build trust and accessibility for their products globally.

- Huons USA: Facilitates direct market access and regulatory compliance in North America.

- Huons Japan: Enables specialized distribution and marketing tailored to the Japanese healthcare system.

- Market Penetration: Subsidiaries are key to overcoming local market barriers and increasing product adoption.

Direct-to-Consumer (DTC) Initiatives

Huons is actively bolstering its direct-to-consumer (DTC) strategy for select health functional foods and cosmeceuticals. This move is designed to cultivate deeper brand loyalty and establish more direct connections with the end consumers. For products requiring significant consumer education or benefiting from streamlined purchase channels, this DTC focus is particularly impactful.

This enhanced DTC engagement allows Huons to gather invaluable first-party data, informing product development and marketing efforts. By bypassing traditional retail channels for these specific product lines, Huons can potentially improve margins and gain greater control over the customer experience. For instance, in 2024, the global DTC e-commerce market reached an estimated $1.3 trillion, highlighting the significant opportunity for brands to connect directly with their customer base.

Key benefits of Huons' DTC initiatives include:

- Enhanced Brand Recognition: Direct interaction builds stronger brand recall and emotional connection.

- Improved Customer Relationships: Direct feedback loops allow for personalized engagement and loyalty building.

- Greater Margin Control: Eliminating intermediaries can lead to improved profitability on DTC sales.

- Valuable Data Acquisition: Direct customer data provides insights for product innovation and targeted marketing.

Huons' place strategy is multi-faceted, focusing on both clinical and consumer channels. By prioritizing hospital and clinic networks for prescription drugs, they ensure accessibility at the point of care. For over-the-counter products, pharmacies serve as a trusted advisory hub. The company is also expanding into broader retail, aiming for greater consumer convenience.

Huons is actively expanding its global footprint, with significant exports to the US and eye drops distributed worldwide. International subsidiaries like Huons USA and Huons Japan are crucial for navigating local markets and tailoring distribution. Furthermore, a growing direct-to-consumer (DTC) strategy for specific product lines aims to build brand loyalty and gather valuable customer data.

| Channel | Product Focus | 2023/2024 Relevance |

|---|---|---|

| Hospitals & Clinics | Prescription Drugs, Medical Devices | Over 500 major hospital partnerships in South Korea; direct access to healthcare professionals. |

| Pharmacies | OTC Medications, Health Functional Foods | Leverages pharmacist trust for recommendations and accessibility. |

| Broader Retail (Drugstores, Hypermarkets) | Health & Wellness Products | Expansion in 2024 to increase consumer reach and convenience. |

| International Markets (e.g., USA, Japan) | Injectables, Eye Drops | Key export markets; subsidiaries facilitate market penetration and regulatory compliance. |

| Direct-to-Consumer (DTC) | Health Functional Foods, Cosmeceuticals | Growing strategy in 2024 to enhance brand loyalty and gather customer data; global DTC market estimated at $1.3 trillion. |

What You Preview Is What You Download

Huons 4P's Marketing Mix Analysis

The preview you see here is the actual, complete Huons 4P's Marketing Mix Analysis document you'll receive instantly after purchase. This means no surprises, just the full, ready-to-use report. You're viewing the exact version of the analysis that will be yours to download immediately, ensuring you get precisely what you expect.

Promotion

Huons leverages international exhibitions like Hospitalar 2024 and upcoming events such as Dubai Derma 2025 and Arab Health 2025 as a key promotional strategy. These global platforms are crucial for showcasing their advanced medical devices, cutting-edge aesthetics products, and robust biopharmaceutical offerings to a worldwide audience.

Participation in these high-profile trade shows allows Huons to directly engage with potential international buyers and partners, fostering relationships and identifying new business avenues. For instance, Hospitalar 2024 provided a significant opportunity to demonstrate their product portfolio to a key market in Latin America.

These exhibitions serve as vital touchpoints for Huons to highlight their latest innovations and reinforce their brand presence in competitive global markets, driving future sales and strategic partnerships.

Huons' promotion strategy for prescription drugs and specialized medical devices centers on direct engagement through a dedicated medical sales force. These representatives are crucial for building relationships with physicians and disseminating product information, a key component in driving adoption within the healthcare sector.

Scientific engagement further bolsters Huons' promotional efforts. The company actively supports the publication of clinical trial data and presents research findings at major medical conferences. For instance, in 2024, Huons presented data on its new hyaluronic acid filler at the Korean Society for Aesthetic Surgery conference, highlighting its efficacy and safety profile to a targeted audience of plastic surgeons.

Huons actively leverages digital marketing to expand its reach, especially for its health functional foods and cosmeceuticals. This strategy is crucial for connecting with a wider consumer base interested in wellness and aesthetic products.

Online campaigns and dedicated brand pages are central to Huons' digital promotion efforts. These initiatives aim to significantly boost brand awareness and cultivate consumer interest in their diverse product offerings.

In 2024, Huons reported a substantial increase in online sales, particularly for its beauty and health supplements, indicating the effectiveness of their digital marketing push. This growth outpaced industry averages, highlighting a successful strategy in building brand presence in the digital space.

Public Relations and Corporate Communications

Huons actively manages its public relations and corporate communications to foster transparency and build trust. The company regularly disseminates news releases and investor relations updates, detailing strategic advancements, financial results, and regulatory approvals.

This proactive communication strategy is crucial for maintaining a strong corporate reputation among its diverse stakeholder base, which includes investors, media, and the general public. For instance, Huons' financial reports, such as those released in early 2024 for the fiscal year 2023, would highlight key performance indicators and strategic initiatives that shape public perception.

- News Releases: Dissemination of significant company news, such as new product approvals or strategic partnerships.

- Investor Relations: Regular updates on financial performance and strategic direction to shareholders and the investment community.

- Corporate Reputation: Building and maintaining a positive image through consistent and transparent communication.

- Stakeholder Engagement: Ensuring all stakeholders are informed about the company's progress and future plans.

B2B Marketing for CDMO Services

Huons' promotion strategy for its Contract Development and Manufacturing Organization (CDMO) services is distinctly business-to-business, concentrating on direct engagement with other pharmaceutical firms. This approach emphasizes showcasing their robust Good Manufacturing Practice (GMP) certified facilities, extensive research and development capabilities, and a proven track record of successful partnerships to attract new contract manufacturing agreements.

The company actively participates in industry-specific trade shows and conferences, such as CPhI Worldwide, to network and present their value proposition. For instance, in 2024, Huons highlighted its advanced sterile injectable manufacturing capacity, aiming to secure partnerships for complex drug formulations. Their marketing collateral often details specific therapeutic areas where they possess strong expertise, such as oncology and biologics.

- Targeted Outreach: Direct engagement with pharmaceutical companies seeking reliable manufacturing partners.

- Capability Showcase: Emphasis on GMP compliance, R&D prowess, and successful project histories.

- Industry Presence: Active participation in global pharmaceutical trade events to foster business development.

- Specialized Focus: Highlighting expertise in niche areas like sterile injectables and biologics to attract specific client needs.

Huons' promotional activities are multifaceted, spanning international exhibitions, direct sales engagement, scientific communication, digital marketing, and public relations. The company strategically uses events like Hospitalar 2024 and upcoming shows in 2025 to connect with global buyers and showcase its diverse product lines.

For prescription drugs, a dedicated sales force engages directly with healthcare professionals, supported by scientific presentations of clinical data at conferences. Digital marketing is key for consumer products like health functional foods, with online campaigns driving brand awareness and sales, which saw a notable increase in 2024.

Huons also emphasizes corporate reputation through transparent communication via news releases and investor updates, crucial for stakeholder trust. Their CDMO services are promoted through targeted B2B outreach, highlighting GMP compliance and R&D capabilities at industry events.

Price

Huons' pricing for prescription drugs, particularly in high-value areas like ophthalmology and dermatology, is rooted in a value-based strategy. This approach directly links the price to the therapeutic benefits and demonstrated clinical outcomes patients and healthcare systems receive.

For instance, innovative treatments that significantly improve patient quality of life or reduce long-term healthcare costs can command premium pricing. This reflects the substantial economic and health advantages they offer, aligning with market expectations for specialized pharmaceuticals.

Huons positions its cosmeceutical products, such as hyaluronic acid fillers, and over-the-counter medications with a keen eye on competitive pricing. This strategy aims to capture market share by offering value that resonates with consumers in a crowded aesthetic and pharmaceutical landscape. For instance, in the competitive HA filler market, pricing often falls within a range of $300-$800 per syringe, depending on the brand and specific product formulation, a benchmark Huons likely considers.

Huons' contract manufacturing and development organization (CMO/CDMO) services are priced through direct negotiation, reflecting the unique requirements of each client project. Factors like the complexity of the drug substance, the scale of production, and the length of the contract significantly influence the final cost. This bespoke approach ensures that clients receive tailored pricing aligned with their specific development and manufacturing needs.

Market Penetration Pricing for New Products

Huons might use market penetration pricing for new health functional foods or medical devices, setting competitive initial prices to rapidly capture market share. This strategy is particularly effective for consumer-focused products aiming to establish a strong presence in emerging or growing market segments.

For instance, if Huons launched a new line of vitamin supplements in late 2024, they could offer an introductory discount of 15-20% for the first three months. This would aim to attract a broad consumer base, encouraging trial and repeat purchases, thereby building brand loyalty quickly.

Key benefits of this approach for Huons include:

- Rapid Market Share Acquisition: Quickly gain a significant portion of the target market.

- Customer Acquisition: Attract a large number of new customers due to attractive pricing.

- Economies of Scale: Increased sales volume can lead to lower production costs per unit.

- Barrier to Entry: Discourage potential competitors from entering the market with lower initial prices.

Reimbursement and Regulatory Considerations

Huons' pricing strategy for its pharmaceutical products, particularly prescription drugs, is significantly shaped by national reimbursement policies and regulatory environments. These factors dictate market access and economic feasibility across various regions.

Navigating these intricate systems is crucial for Huons to ensure its products are both accessible to patients and financially sustainable. For instance, in 2024, many countries continued to implement stricter price controls on pharmaceuticals, impacting potential revenue streams for companies like Huons.

Key considerations for Huons include understanding the specific reimbursement pathways in target markets, such as the Prescription Drug User Fee Act (PDUFA) in the United States, which influences drug approval timelines and associated costs. Furthermore, the evolving landscape of value-based pricing models, where reimbursement is tied to patient outcomes, presents both challenges and opportunities for Huons' product portfolio.

Huons must also monitor regulatory changes that could affect drug pricing and market entry. For example, ongoing discussions around drug price negotiations in major markets could lead to adjustments in Huons' pricing models to remain competitive and compliant.

Huons employs a multi-faceted pricing strategy across its diverse product lines. For high-value prescription drugs, a value-based approach links price to therapeutic benefits, while cosmeceuticals and OTC products are competitively priced to gain market share. CMO/CDMO services are custom-negotiated based on project specifics.

For new consumer-focused products, market penetration pricing with introductory discounts, like a potential 15-20% off for new vitamin supplements in late 2024, aims for rapid customer acquisition and market share growth. This strategy can also foster economies of scale and create barriers to entry for competitors.

Huons' pricing is also heavily influenced by global reimbursement policies and regulatory landscapes, with 2024 seeing continued trends in stricter price controls in many markets. Navigating these, including PDUFA timelines in the US and evolving value-based reimbursement models, is critical for market access and financial sustainability.

| Product Category | Pricing Strategy | Example/Consideration |

|---|---|---|

| Prescription Drugs (Ophthalmology, Dermatology) | Value-Based Pricing | Premium pricing linked to clinical outcomes and quality of life improvements. |

| Cosmeceuticals (e.g., HA Fillers) | Competitive Pricing | Benchmarked against market rates, potentially $300-$800 per syringe for HA fillers. |

| Over-the-Counter (OTC) Medications | Competitive Pricing | Focus on value proposition to capture market share in crowded segments. |

| CMO/CDMO Services | Negotiated Pricing | Based on project complexity, scale, and contract duration. |

| New Health Functional Foods/Medical Devices | Market Penetration Pricing | Introductory discounts (e.g., 15-20%) to drive initial adoption and market share. |

4P's Marketing Mix Analysis Data Sources

Our Huons 4P's Marketing Mix Analysis is built upon a robust foundation of publicly available data, including official company reports, investor relations materials, and detailed product information. We meticulously gather insights from Huons' official website, press releases, and industry-specific publications to ensure accuracy and relevance.