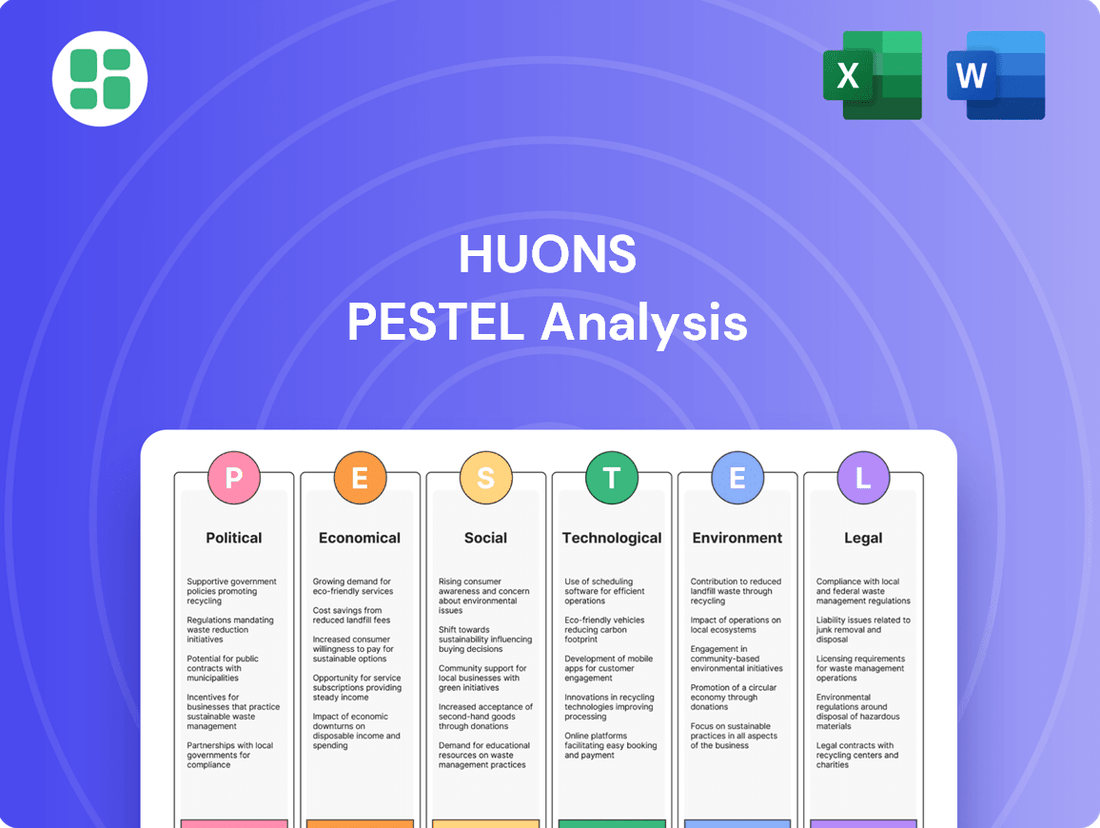

Huons PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Huons Bundle

Uncover the critical external factors shaping Huons's trajectory with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and technological advancements are creating both challenges and opportunities for the company. Gain a strategic advantage by leveraging these insights to refine your own market approach. Download the full PESTLE analysis now for actionable intelligence.

Political factors

The South Korean government's healthcare reform initiatives, particularly the 'Second Comprehensive National Health Insurance Plan' (2024-2028), are designed to foster new drug development and ensure equitable reimbursement for innovative pharmaceuticals. These policies, in effect since 2024, aim to create a more supportive ecosystem for companies like Huons by improving patient access to treatments and bolstering research and development efforts.

Furthermore, the government's 2024 Action Plan for Key Policies prioritizes expanding the medical workforce, increasing medical school admissions, and dedicating substantial financial resources to essential healthcare services. This strategic focus could influence the overall market demand and accessibility of medical products and services, potentially impacting Huons' market penetration.

In 2025, South Korea's Ministry of Food and Drug Safety (MFDS) is implementing significant regulatory streamlining, targeting a reduction in new drug approval times to an average of 295 days. This initiative, coupled with simplified Good Manufacturing Practice (GMP) evaluations, is designed to accelerate the market entry of innovative pharmaceuticals, potentially benefiting companies like Huons.

A new Pharmaceutical Data Protection System, commencing February 21, 2025, will replace the existing re-examination program. This system is set to provide enhanced data exclusivity for both new and modified drugs, offering stronger intellectual property protection for Huons and incentivizing further research and development.

South Korea's healthcare system is navigating a significant medical crisis in 2024-2025, triggered by government policies aimed at increasing medical student admissions. This has resulted in widespread resignations by resident and intern doctors, causing substantial delays in medical procedures and impacting patient care.

This situation underscores the government's commitment to tackling doctor shortages, particularly in underserved rural regions and critical medical specialties. The ongoing adjustments to these policies could reshape the nation's healthcare delivery model and influence the market demand for various medical products and services.

Further demonstrating this focus, the government's proposed 2025 budget allocates substantial financial resources to bolster training programs for junior doctors and bolster essential medical services, signaling a long-term investment in the healthcare workforce.

Government Support for Bio-Health Industries

The South Korean government has identified the pharmaceutical and bio-health sectors as crucial engines for future economic growth. This strategic focus translates into substantial financial backing for research and development in new drug discovery and advanced biopharmaceutical technologies. For instance, the launch of the National Bio Committee in January 2025 underscores this commitment, aiming to accelerate the development of novel drugs and enhance the nation's global standing in biopharmaceutical innovation. This governmental support is designed to streamline drug development processes and reduce associated costs, creating a more favorable landscape for companies like Huons to thrive and innovate.

This robust governmental support is expected to foster a dynamic environment for Huons' expansion and technological advancements. The administration's proactive stance in investing in R&D and facilitating international market access for bio-health companies provides a significant tailwind.

- Government Prioritization: South Korea has designated bio-health as a key growth industry.

- R&D Investment: Significant funding is allocated to new drug research and development.

- International Market Support: Initiatives are in place to help companies expand globally.

- National Bio Committee (Jan 2025): Launched to boost global competitiveness in novel drugs and biopharma tech.

ESG Regulatory Landscape

The Korean pharmaceutical sector, including companies like Huons, is navigating a rapidly evolving ESG regulatory environment. Mandatory ESG disclosures are set to become a reality by 2030, pushing companies to integrate sustainability and ethical governance into their core strategies.

While many domestic firms are still in the early stages of ESG adoption, there's a clear push towards tangible improvements. This includes initiatives focused on reducing carbon footprints, enhancing equitable access to healthcare, and strengthening corporate governance structures. For instance, South Korea's Financial Services Commission has been actively developing guidelines for ESG reporting, aiming to align with international standards.

Huons must proactively align its operations and reporting with these escalating global and domestic ESG mandates. Failure to do so could jeopardize international credibility and limit access to crucial investment opportunities, especially as investors increasingly prioritize companies with robust ESG performance. By 2024, many multinational pharmaceutical companies have already published comprehensive sustainability reports, setting a benchmark for the industry.

Key areas of focus for Huons in the ESG landscape include:

- Environmental Impact: Reducing greenhouse gas emissions and waste management in manufacturing processes.

- Social Responsibility: Ensuring fair labor practices, product safety, and equitable access to medicines.

- Governance: Implementing transparent board structures, ethical business conduct, and robust risk management.

South Korea's government is actively prioritizing the bio-health sector as a key economic driver, evidenced by substantial R&D funding and the January 2025 launch of the National Bio Committee. This committee aims to accelerate novel drug development and bolster the nation's global competitiveness in biopharmaceutical technology. These initiatives are designed to streamline drug development and reduce costs, creating a more favorable environment for companies like Huons.

What is included in the product

This PESTLE analysis of Huons examines the critical external macro-environmental factors influencing the company, from government policies and economic shifts to societal trends, technological advancements, environmental regulations, and legal frameworks.

It provides a comprehensive overview of how these forces create both challenges and strategic opportunities for Huons within its operating landscape.

Huons' PESTLE analysis provides a clear and simple language summary, making complex external factors accessible to all stakeholders for better strategic alignment.

Economic factors

South Korea's aging demographic presents a significant challenge to its healthcare system. The National Health Insurance Service (NHIS) is expected to see its cost burden escalate, with projections suggesting it could consume as much as one-quarter of individual incomes by 2072.

While the NHIS contribution rate remains frozen for 2025, it has shown a consistent upward trend in recent years, signaling growing financial strain on the public healthcare infrastructure. This increasing pressure may drive a stronger focus on value-based care and cost-efficient medical interventions.

Consequently, these financial dynamics could influence drug pricing strategies and the framework for reimbursement policies within the South Korean healthcare market, potentially impacting pharmaceutical companies like Huons.

The South Korean pharmaceutical market is a dynamic landscape, with projections indicating a growth from an estimated $23.19 billion in 2025 to $26.11 billion by 2030. This expansion is significantly fueled by substantial research and development (R&D) investments and robust government backing, creating a fertile ground for innovation.

Global pharmaceutical giants are recognizing South Korea's potential, increasingly directing their R&D capital towards drug development within the country. This trend underscores South Korea's position as a key player in a globally innovation-driven economy.

For Huons, this burgeoning R&D ecosystem and expanding market present a significant opportunity. The company can strategically capitalize on these trends to accelerate its own growth trajectory and enrich its product pipeline by aligning with the nation's focus on pharmaceutical advancement.

South Korea's pharmaceutical exports have surged, reaching a record ₩12.67 trillion (around $9.3 billion) in 2024, marking a substantial 28.2% increase from the previous year. This robust growth highlights the increasing global demand for Korean pharmaceutical products and positions the nation as a significant player in the international market.

The biopharmaceutical segment is a key contributor to this export success, with innovator drug licensing agreements alone reaching $7.86 billion year-to-date in 2025. This represents an impressive 113% jump compared to the same period in 2024, signaling a strong trend of innovation and international partnership within the sector.

This positive export trajectory and the burgeoning international collaborations offer Huons a prime opportunity to broaden its global reach. The company can leverage this favorable environment to expand its contract development and manufacturing organization (CDMO) services, capitalizing on the growing demand for specialized biopharmaceutical manufacturing capabilities worldwide.

Inflationary Pressures and Supply Chain Costs

Inflationary pressures and persistent supply chain disruptions continue to be significant economic factors affecting the pharmaceutical industry. For companies like Huons, these broader macroeconomic trends directly influence the cost of essential raw materials, manufacturing processes, and global logistics. These increased operational expenses can place considerable pressure on profit margins, underscoring the critical need for robust supply chain management and stringent cost control measures.

Huons' financial performance in Q1 2025 provides a clear illustration of this dynamic. The company reported improved profitability, a significant portion of which can be attributed to the successful implementation of company-wide cost control initiatives. This demonstrates a proactive approach to mitigating the impact of rising inflationary pressures and supply chain complexities.

- Global inflation rates in early 2025 averaged around 4.5% across developed economies, impacting input costs for pharmaceuticals.

- Supply chain lead times for key pharmaceutical ingredients saw an average increase of 15% year-over-year in late 2024.

- Huons' Q1 2025 operating expenses were reduced by 8% compared to the previous quarter due to focused cost management strategies.

- The company's gross profit margin in Q1 2025 expanded by 2 percentage points, reflecting the positive impact of cost efficiencies.

Capital Investment Environment

The capital investment environment for South Korea's biopharma sector, especially for smaller companies, has been challenging. Venture capital investment in biomedicine hasn't reached its previous highs, although larger deals are increasing, focusing on advanced areas like new modalities and drug delivery systems. For an established player like Huons, securing capital may be more straightforward, but understanding the broader investment trends is crucial for potential collaborations or acquisitions.

Recent data highlights this trend: while overall venture capital investment in Korea saw a significant increase in 2023, the biomedical sector's share remained relatively modest compared to its peak. For instance, in 2023, venture capital investment in the biomedical sector reached approximately KRW 1.5 trillion, a notable figure but still below the KRW 2 trillion peak observed in 2021. This indicates a selective investment approach by VCs, favoring companies with strong technological differentiation.

- Venture capital investment in South Korea's biomedical sector in 2023 was around KRW 1.5 trillion.

- This figure represents a decrease from the peak investment level of approximately KRW 2 trillion recorded in 2021.

- Investment trends show a preference for innovative areas such as new therapeutic modalities and advanced drug delivery technologies.

- Huons, as an established entity, likely benefits from greater capital accessibility compared to smaller biotechs.

Economic factors like inflation and supply chain issues directly impact Huons' operational costs. For instance, global inflation in early 2025 averaged 4.5% in developed economies, increasing input expenses. Supply chain disruptions also led to a 15% year-over-year increase in lead times for key pharmaceutical ingredients by late 2024, directly affecting manufacturing and logistics.

Huons' Q1 2025 performance demonstrated resilience, with an 8% reduction in operating expenses due to cost management, leading to a 2 percentage point expansion in gross profit margin. This highlights the company's ability to navigate these economic headwinds effectively.

The capital investment landscape for South Korea's biopharma sector shows a trend toward selective funding, with venture capital investment in biomedicine around KRW 1.5 trillion in 2023, down from a 2021 peak. Investment favors advanced areas like new therapeutic modalities, indicating a need for companies like Huons to demonstrate strong technological differentiation to attract capital.

| Economic Factor | Impact on Huons | Supporting Data (2024-2025) |

|---|---|---|

| Inflation | Increased input and operational costs | Global average inflation ~4.5% (early 2025) |

| Supply Chain Disruptions | Extended lead times for ingredients | 15% YoY increase in lead times (late 2024) |

| Cost Management Initiatives | Improved profitability and margins | 8% reduction in Q1 2025 operating expenses; 2 pp gross profit margin expansion |

| Capital Investment Environment | Selective funding favoring innovation | Biomedical VC investment ~KRW 1.5 trillion (2023) |

What You See Is What You Get

Huons PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Huons covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

You'll gain valuable insights into market trends, competitive landscapes, and strategic opportunities for Huons. The content and structure shown in the preview is the same document you’ll download after payment, offering a complete and actionable business intelligence tool.

Sociological factors

South Korea's demographic landscape has fundamentally shifted, officially entering 'super-aged' status in 2024. This means more than 20% of its citizens are now 65 or older, a proportion expected to climb even higher in the coming years. This significant demographic change directly influences societal needs and economic trends.

This aging trend is closely linked to an increase in chronic diseases. It's reported that a substantial 89.5% of South Korea's elderly population manages at least one chronic condition, such as hypertension, diabetes, or musculoskeletal issues. This widespread prevalence of long-term health challenges creates a consistent and growing demand for healthcare solutions.

Consequently, there's a burgeoning market for pharmaceuticals, advanced medical devices, and specialized health functional foods designed to meet the specific needs of an older demographic. This evolving consumer demand presents a clear opportunity for companies like Huons, whose product lines are well-positioned to cater to these increasing healthcare requirements.

South Korea is experiencing a significant shift towards health and wellness, with consumers increasingly prioritizing preventative care and seeking out products that enhance their well-being. This trend fuels a robust market for health functional foods and the burgeoning cosmeceuticals sector.

Huons is strategically positioned to benefit from this societal evolution, leveraging its established expertise in dermatology and aesthetics. The company is well-aligned with the powerful K-beauty phenomenon and the growing demand for anti-aging solutions, a market segment that saw significant growth in 2024.

Demonstrating its agility, Huons launched its NMN-based anti-aging supplements in April 2025. This move directly addresses the escalating consumer desire for scientifically backed anti-aging products, reflecting a keen understanding of current market drivers.

Modern lifestyles, marked by increased sedentary behavior and environmental stressors, are contributing to a rise in chronic diseases. This trend, observed globally, could bolster demand for specialized treatments in therapeutic areas like ophthalmology, a key focus for Huons. For instance, the increasing screen time among younger demographics is linked to higher rates of digital eye strain and related conditions, potentially expanding the market for ophthalmic solutions.

Shifting dietary patterns and elevated stress levels are also influencing health needs, driving growth in sectors like health functional foods and over-the-counter (OTC) medications. In South Korea, the health functional food market saw significant growth, reaching an estimated 5.6 trillion KRW (approximately $4.2 billion USD) in 2023, reflecting a societal emphasis on preventative health and wellness.

Huons' broad product portfolio, encompassing pharmaceuticals, medical devices, and health functional foods, positions it well to capitalize on these evolving societal health demands. By offering solutions across various health spectrums, the company can adapt to changing consumer needs driven by lifestyle transformations and an increased focus on personal well-being.

Public Perception of Pharmaceutical Industry

Public perception of the pharmaceutical industry significantly impacts companies like Huons. Concerns over drug safety, the transparency of pricing strategies, and the ethics of marketing practices are key drivers of this perception. Maintaining high ethical standards and clear, open communication are crucial for Huons to build and sustain public trust.

The South Korean regulatory landscape is evolving to address industry practices. An amended act, effective October 2024, mandates a CSO reporting system and compulsory training to combat issues such as illegal rebates. These measures are designed to foster greater accountability and, consequently, improve public confidence in the pharmaceutical sector.

- Drug Safety Concerns: Incidents of adverse drug reactions or recalls can erode public trust.

- Pricing Transparency: High drug costs without clear justification often lead to public scrutiny.

- Ethical Marketing: Practices like aggressive promotion or misleading claims can damage industry reputation.

- Regulatory Impact: New regulations, like South Korea's CSO reporting system from October 2024, aim to enhance ethical conduct and public perception.

Healthcare Access and Equity

South Korea's government is actively working to bolster domestic healthcare capabilities and broaden access to vital medical services. This includes targeted efforts to address healthcare disparities in rural regions and critical medical specialties, aiming for more equitable distribution of resources.

Policies introduced in 2024 and projected for 2025 are designed to ensure fair compensation for groundbreaking pharmaceuticals and to expand the scope of risk-sharing agreements. These initiatives are intended to improve patient access to innovative treatments and foster a more sustainable healthcare ecosystem.

Huons' capacity to develop and deliver accessible, equitable healthcare solutions is crucial. By aligning with these government priorities, the company can significantly strengthen its social license to operate and achieve deeper market penetration, particularly in underserved areas.

- Government Focus: Strengthening local healthcare infrastructure and ensuring wider access to essential medical services across South Korea.

- Policy Impact: Fair compensation for innovative drugs and expanded risk-sharing agreements aim to boost patient access to new treatments.

- Huons' Opportunity: Contributing to equitable healthcare solutions enhances social license and market reach, especially in rural or underserved regions.

South Korea's demographic shift to a super-aged society, with over 20% of the population aged 65+ in 2024, drives demand for healthcare. This is compounded by an 89.5% chronic disease rate among the elderly, creating significant market opportunities for pharmaceuticals and health functional foods, areas where Huons is well-positioned.

Societal trends toward wellness and preventative care are fueling growth in health functional foods and cosmeceuticals, with the health functional food market reaching an estimated 5.6 trillion KRW in 2023. Huons' focus on dermatology, aesthetics, and anti-aging solutions, including its April 2025 NMN supplement launch, aligns perfectly with these consumer priorities.

Evolving lifestyles, including increased sedentary behavior and stress, contribute to chronic diseases, potentially boosting demand for Huons' ophthalmic solutions, especially given rising digital eye strain. Public perception of the pharmaceutical industry, influenced by drug safety and pricing, necessitates ethical practices and transparency, a challenge addressed by new regulations like South Korea's CSO reporting system from October 2024.

Government initiatives to bolster domestic healthcare and improve access, including fair compensation for innovative drugs and expanded risk-sharing agreements, create opportunities for Huons to enhance its social license and market reach by providing equitable healthcare solutions.

Technological factors

Artificial intelligence (AI) is revolutionizing drug discovery, slashing development times and costs. AI-designed drug candidates are demonstrating improved success rates in clinical trials, a trend expected to accelerate. For instance, in 2024, AI platforms are increasingly being integrated into early-stage research, with some studies indicating a potential 30-50% reduction in preclinical research timelines.

The South Korean government is heavily backing AI in drug development, with plans for significant investments through 2029. These funds are earmarked for developing robust AI-enabled preclinical and clinical modeling capabilities, aiming to position South Korea as a leader in this field. This strategic focus underscores the national commitment to fostering innovation in biopharmaceuticals.

Huons can capitalize on these technological shifts and government support to streamline its research and development efforts. By integrating AI into its R&D pipeline, Huons can accelerate the discovery and development of novel pharmaceuticals, potentially bringing new treatments to market more efficiently and cost-effectively.

South Korea's Digital Medical Products Act (DMPA), effective January 2025, is a significant development for digital health technologies. This legislation aims to streamline the regulatory process for innovations like AI-powered medical devices and digital therapeutics. For a company like Huons, this presents a clear framework to explore integrating digital components into its existing product lines, such as medical devices and health functional foods, potentially improving patient engagement and treatment outcomes.

Huons is actively bolstering its biopharmaceutical research and development capabilities, alongside its contract development and manufacturing organization (CDMO) operations. A key move in late 2024 was Huons increasing its stake in PanGen Biotech, a strategic acquisition designed to enhance its standing in this specialized sector.

PanGen Biotech possesses vital Good Manufacturing Practice (GMP) certified facilities and proprietary cell line development technology. These assets are fundamental for producing complex biopharmaceuticals and delivering high-quality CDMO services, aligning with industry standards for drug manufacturing.

This strategic expansion directly positions Huons to leverage the escalating global demand for advanced biopharmaceutical manufacturing solutions. The CDMO market, particularly for biologics, has seen significant growth, with projections indicating continued expansion driven by the outsourcing trend among pharmaceutical companies.

Advanced Drug Delivery Systems

Technological advancements in drug delivery are reshaping how treatments are administered, with South Korea's biopharma sector showing significant innovation. A prime example is the development of hyaluronidase, an enzyme that can convert intravenous drugs into subcutaneous formulations, enhancing patient convenience and broadening treatment accessibility.

Huons, a key player in this space, is strategically positioned to capitalize on these trends. Its subsidiary, Huonslab, is actively developing a human hyaluronidase candidate, HLB3-002. This development is on track, with plans for a regulatory submission anticipated in late 2025.

The potential impact of these advanced drug delivery systems is substantial:

- Improved Patient Compliance: Subcutaneous delivery often offers greater ease of use compared to intravenous injections, potentially leading to better adherence to treatment regimens.

- Expanded Market Opportunities: By enabling new administration routes, Huons can access broader patient populations and therapeutic areas.

- Competitive Edge: Early adoption and successful development of novel drug delivery technologies can provide a significant competitive advantage in the rapidly evolving biopharmaceutical landscape.

Research and Development Investment

Huons significantly boosted its research and development (R&D) spending, with a notable 34% increase in the first quarter of 2025. This strategic financial move underscores the company's dedication to identifying and advancing new drug candidates, alongside providing essential support for ongoing clinical trials involving both Huons and its subsidiaries, such as Huonslab.

This heightened investment in R&D is a critical component for Huons to maintain its competitive edge within the rapidly changing pharmaceutical and medical device industries. Such a commitment is fundamental for fostering innovation and ensuring the development of advanced, market-leading products.

Huons' continuous focus on R&D is instrumental in its strategy to cultivate a pipeline of cutting-edge medical solutions, thereby solidifying its market presence and future growth prospects.

- R&D Investment Growth: Huons reported a 34% surge in R&D expenditure for Q1 2025.

- Strategic Focus: The investment targets securing new drug candidates and bolstering clinical trial support.

- Subsidiary Involvement: Huonslab is a key beneficiary of this increased R&D commitment.

- Industry Competitiveness: Enhanced R&D is crucial for staying ahead in the dynamic pharma and medtech sectors.

Technological advancements are significantly impacting Huons' operations, particularly in AI-driven drug discovery and advanced drug delivery systems. The company's Q1 2025 R&D spending surged by 34%, highlighting a commitment to innovation. Huons is also strategically enhancing its biopharmaceutical capabilities through investments like its increased stake in PanGen Biotech in late 2024.

South Korea's supportive regulatory environment, including the January 2025 Digital Medical Products Act, is poised to accelerate the adoption of digital health technologies. Huons' subsidiary, Huonslab, is developing a human hyaluronidase candidate, HLB3-002, with a regulatory submission planned for late 2025, aiming to improve drug administration and patient compliance.

| Area | Key Technology/Development | Impact on Huons | Timeline/Status |

|---|---|---|---|

| Drug Discovery | Artificial Intelligence (AI) | Accelerated research, reduced costs, improved success rates | Increasing integration in early-stage research (2024 onwards) |

| Drug Delivery | Hyaluronidase for Subcutaneous Formulation | Enhanced patient compliance, expanded market access | Huonslab's HLB3-002 candidate; regulatory submission planned for late 2025 |

| Manufacturing | GMP-certified facilities & Cell Line Development | Enhanced CDMO services for complex biopharmaceuticals | Strengthened through PanGen Biotech investment (late 2024) |

| Digital Health | AI-powered medical devices, digital therapeutics | Streamlined regulatory pathways, potential for integrated product lines | Enabled by South Korea's Digital Medical Products Act (effective Jan 2025) |

Legal factors

The Pharmaceutical Affairs Act amendments, effective February 21, 2025, establish an express data protection system for marketing authorizations. This crucial update offers enhanced legal protection for clinical trial data, thereby safeguarding market exclusivity for new and modified pharmaceuticals. This change directly benefits innovative drug developers like Huons by preventing competitors from leveraging their proprietary data for a defined period.

The Digital Medical Products Act (DMPA), effective January 24, 2025, establishes a clear regulatory landscape for digital health innovations. This Act specifically defines and governs products like digital medical devices, digital integrated drugs, and digital medical support devices, creating a crucial framework for companies like Huons.

For Huons, the DMPA offers defined regulatory pathways should it expand into digital health solutions or develop innovative drug-device combination products. Navigating these new regulations is paramount for successful market entry and the commercialization of any such offerings.

The Ministry of Food and Drug Safety (MFDS) is implementing significant Good Manufacturing Practice (GMP) reforms in 2025, aiming to simplify drug approval processes. These changes include shortening the registration period for imported active pharmaceutical ingredients (APIs) and consolidating required documentation, a move that could expedite market entry for pharmaceutical products.

For Huons, these streamlined procedures present an opportunity to enhance manufacturing efficiency and bolster its contract manufacturing services by reducing administrative burdens and potentially accelerating supply chain timelines. This reform is particularly beneficial as Huons aims to expand its global reach, where navigating diverse regulatory landscapes is paramount.

Maintaining strict adherence to these evolving GMP standards is crucial for Huons to uphold product quality, ensure patient safety, and preserve its regulatory compliance across all markets. The MFDS's proactive approach signals a broader trend towards harmonizing international pharmaceutical regulations, which Huons can leverage for competitive advantage.

Regulations on Rebates and Ethical Practices

Amendments to South Korea's Pharmaceutical Affairs Act, slated for October 2024, will impose a dual punishment system on Contract Sales Organizations (CSOs) for illicit rebates. This legislation also mandates detailed expenditure reports outlining economic benefits given to healthcare professionals, aiming to foster greater transparency and ethical conduct in pharmaceutical promotions. Huons must rigorously adhere to these anti-bribery and transparency mandates to mitigate legal repercussions and safeguard its reputation.

The new regulations underscore a significant shift towards accountability in the pharmaceutical sector. For instance, in 2023, the Ministry of Food and Drug Safety (MFDS) investigated numerous cases of illegal rebate provisions, highlighting the persistent challenges in maintaining ethical promotional practices. Huons' proactive compliance strategy will be crucial.

- Dual Punishment for CSOs: CSOs found engaging in illegal rebate practices will face stricter penalties under the amended Pharmaceutical Affairs Act.

- Mandatory Expenditure Reporting: Detailed reports on economic benefits provided to healthcare professionals are now required, increasing transparency.

- Enhanced Transparency Focus: The regulations aim to create a more ethical and transparent pharmaceutical promotion environment.

- Reputational and Legal Risk Mitigation: Huons' adherence to these laws is vital to avoid legal penalties and protect its brand image.

Clinical Trial Regulations and Patient Safety

South Korea's Ministry of Food and Drug Safety (MFDS) is enhancing its regulatory framework, particularly for advanced therapies like CAR T-cell treatments. This includes mandatory reporting of adverse reactions, aiming to align with international patient safety benchmarks. This focus on cutting-edge treatments signals a broader move towards stricter safety protocols across the pharmaceutical and medical device sectors in the country.

Huons needs to ensure its clinical trial processes and post-market surveillance for all its products are in strict compliance with these heightened safety standards. This proactive approach is crucial for maintaining regulatory approval and public trust.

- MFDS Regulatory Focus: Increased oversight on advanced therapies, demanding stringent adverse event reporting.

- Global Alignment: Regulations are being updated to match international patient safety standards.

- Broader Impact: This signifies a general trend of tightening safety regulations for all medical products in South Korea.

- Huons' Responsibility: Ensuring all clinical trials and post-market surveillance meet these rigorous safety requirements.

South Korea's evolving legal landscape presents both opportunities and obligations for pharmaceutical companies like Huons. The upcoming amendments to the Pharmaceutical Affairs Act in October 2024, which introduce a dual punishment system for Contract Sales Organizations (CSOs) involved in illicit rebates and mandate detailed expenditure reports for healthcare professionals, underscore a significant drive towards enhanced transparency and ethical conduct. This move is critical for Huons to maintain its reputation and avoid legal repercussions, especially given the Ministry of Food and Drug Safety's (MFDS) investigations into such practices in 2023.

Furthermore, the Pharmaceutical Affairs Act amendments effective February 21, 2025, establishing an express data protection system for marketing authorizations, will directly benefit Huons by safeguarding its proprietary clinical trial data and ensuring market exclusivity for its innovative products. Concurrently, the Digital Medical Products Act (DMPA), effective January 24, 2025, provides a much-needed regulatory framework for digital health innovations, offering clear pathways for companies like Huons that may venture into this growing sector.

The MFDS's 2025 GMP reforms, which aim to simplify drug approval processes by shortening registration periods for imported APIs and consolidating documentation, present a significant opportunity for Huons to boost manufacturing efficiency and accelerate its contract manufacturing services. These streamlined procedures are particularly advantageous for Huons' global expansion strategies, reducing administrative burdens and potentially expediting supply chain timelines.

The MFDS is also strengthening regulations for advanced therapies, such as CAR T-cell treatments, by mandating stringent adverse reaction reporting to align with international patient safety standards. This heightened focus on safety protocols, evident in the MFDS's proactive approach, necessitates that Huons maintain rigorous compliance in its clinical trials and post-market surveillance to uphold regulatory approval and public trust.

| Legal Factor | Key Legislation/Amendment | Effective Date | Impact on Huons | Relevant Data/Context |

|---|---|---|---|---|

| Data Protection & Market Exclusivity | Pharmaceutical Affairs Act Amendments | February 21, 2025 | Enhanced protection for clinical trial data, securing market exclusivity for new pharmaceuticals. | Protects proprietary data from competitor leverage. |

| Digital Health Regulation | Digital Medical Products Act (DMPA) | January 24, 2025 | Establishes clear regulatory pathways for digital health solutions and drug-device combinations. | Facilitates market entry for digital health innovations. |

| Manufacturing & Approval Simplification | MFDS GMP Reforms | 2025 (Ongoing Implementation) | Streamlined drug approval, expedited market entry for APIs, enhanced contract manufacturing efficiency. | Shortened registration periods for imported APIs. |

| Ethical Pharmaceutical Promotions | Pharmaceutical Affairs Act Amendments | October 2024 | Dual punishment for CSOs on illicit rebates, mandatory expenditure reports for healthcare professionals. | MFDS investigated numerous illegal rebate cases in 2023. |

| Patient Safety & Advanced Therapies | MFDS Regulatory Enhancements | Ongoing | Stricter adverse reaction reporting for advanced therapies, aligning with global safety benchmarks. | Focus on CAR T-cell treatments and similar innovations. |

Environmental factors

The Korean pharmaceutical sector, including Huons, is experiencing growing pressure to integrate Environmental, Social, and Governance (ESG) principles. Mandatory ESG disclosures are anticipated by 2030, pushing companies to enhance their sustainability reporting.

As of mid-2024, a significant gap exists, with only about 50% of leading Korean pharmaceutical and biotech firms having published sustainability reports. This indicates a clear need for more robust environmental action and transparent reporting across the industry.

Huons must proactively develop and communicate its environmental performance metrics, such as carbon emission reduction targets and waste management strategies. Meeting these evolving investor and regulatory demands is crucial for maintaining market confidence and competitive positioning.

Carbon emissions management is a crucial environmental factor for Huons, especially given its manufacturing operations in the healthcare sector. Companies like Huons are increasingly expected to quantify and actively reduce their greenhouse gas output during production processes. This focus aligns with broader ESG (Environmental, Social, and Governance) expectations from investors and regulators.

Many South Korean pharmaceutical companies are stepping up their climate commitments, with several setting ambitious targets for carbon neutrality, often aiming for achievement by 2050. This trend indicates a significant shift in industry practices and a growing awareness of climate change's impact on business operations and reputation.

For Huons, this translates into a need for strategic investment in more sustainable manufacturing methods. This could include adopting eco-friendly production techniques and increasing the use of renewable energy sources. Such initiatives are vital for minimizing its environmental footprint and bolstering its overall sustainability credentials, which can positively influence market perception and investor confidence.

The pharmaceutical industry, including companies like Huons, faces significant challenges in managing waste generated during manufacturing. This waste can include chemical byproducts and expired or contaminated pharmaceutical materials, necessitating advanced pollution control systems. For instance, in 2023, the global pharmaceutical waste management market was valued at approximately USD 14.5 billion, highlighting the scale of this issue and the investment required for compliance.

Environmental regulations are increasingly stringent, particularly concerning the disposal of hazardous pharmaceutical waste and the control of water and air pollution. By 2025, we anticipate even tighter enforcement of these standards globally. Huons must therefore demonstrate a strong commitment to adhering to national and international environmental protection laws, such as those governed by the European Medicines Agency or the US Environmental Protection Agency, to avoid penalties and maintain its operational license.

Implementing best practices for waste reduction, such as process optimization and material substitution, alongside safe and compliant disposal methods, is crucial for Huons. This includes investing in advanced wastewater treatment technologies and air filtration systems. Companies that proactively manage their environmental footprint often see improved efficiency and a stronger brand reputation, as evidenced by the growing investor interest in ESG (Environmental, Social, and Governance) factors, which saw global ESG investments reach trillions in 2024.

Resource Scarcity and Supply Chain Resilience

Potential resource scarcity, especially for critical raw materials in pharmaceuticals and medical devices, presents significant environmental and economic risks for Huons. For instance, the global supply of certain rare earth elements, crucial for some advanced medical technologies, faced price volatility in 2024 due to geopolitical tensions and mining disruptions, impacting manufacturing costs.

Climate change and increasingly frequent extreme weather events pose a direct threat to global supply chains. In 2024, severe droughts in key agricultural regions affected the availability of plant-derived compounds used in some Huons products, leading to temporary supply chain adjustments. Similarly, disruptions from floods and storms can impact transportation networks, delaying shipments and increasing logistical expenses.

Huons must proactively assess and bolster its supply chain's resilience against these environmental risks. This involves diversifying sourcing locations, building strategic inventory buffers, and investing in technologies that can predict and mitigate the impact of climate-related disruptions. Exploring sustainable and ethically sourced alternatives for raw materials is also paramount for long-term business continuity and environmental stewardship.

- Resource Volatility: The pharmaceutical sector, including companies like Huons, relies on a complex web of raw materials, some of which are becoming increasingly scarce or subject to price fluctuations due to environmental factors. For example, the availability of specific botanical extracts can be directly impacted by changing weather patterns and agricultural yields.

- Supply Chain Disruptions: Climate change is leading to more frequent and intense extreme weather events globally. In 2024, events like prolonged droughts in Southeast Asia and severe flooding in Europe have already demonstrated the potential to disrupt transportation, manufacturing, and the availability of essential components for Huons' operations.

- Resilience Strategy: Huons needs to enhance its supply chain resilience by identifying critical dependencies and developing contingency plans. This includes exploring dual-sourcing strategies for key materials and investing in supply chain visibility tools to better anticipate and respond to environmental shocks.

- Sustainable Sourcing: A proactive approach to sustainable sourcing can mitigate risks associated with resource scarcity. By partnering with suppliers committed to environmentally responsible practices and exploring bio-based or recycled materials where feasible, Huons can secure its long-term supply and reduce its environmental footprint.

Green Manufacturing and Packaging Trends

The healthcare sector, including companies like Huons, is increasingly embracing green manufacturing and sustainable packaging. This shift is driven by a global demand for environmentally responsible practices. For instance, the global green packaging market is projected to reach $400 billion by 2027, indicating significant growth and adoption potential.

Adopting eco-friendly production methods and utilizing recyclable or biodegradable packaging materials can significantly reduce Huons' environmental footprint. This not only appeals to a growing segment of eco-conscious consumers and business partners but also aligns with broader corporate social responsibility mandates. Many pharmaceutical companies are setting ambitious targets; for example, by 2025, over 70% of major pharmaceutical companies aim to have implemented sustainable packaging solutions.

- Growing demand for sustainable packaging: The global market is expanding rapidly, with projections indicating substantial growth by 2027.

- Reduced environmental impact: Implementing green manufacturing and biodegradable materials lowers a company's carbon footprint.

- Enhanced brand reputation: Eco-friendly practices resonate with environmentally aware consumers and stakeholders.

- Alignment with CSR goals: Sustainable initiatives support broader corporate social responsibility objectives and regulatory compliance.

Huons faces increasing pressure to adopt sustainable practices, with mandatory ESG disclosures expected by 2030, yet many Korean pharma firms lag in sustainability reporting as of mid-2024. The company must prioritize quantifying and reducing carbon emissions from its manufacturing, aligning with industry-wide climate commitments and investor expectations for enhanced environmental performance.

Managing pharmaceutical waste, a significant environmental challenge, requires advanced pollution control systems, with the global waste management market valued at $14.5 billion in 2023. Huons must invest in waste reduction and compliant disposal to meet increasingly stringent regulations, especially concerning hazardous materials and pollution control.

Resource scarcity, particularly for critical raw materials, poses economic risks due to price volatility, as seen with rare earth elements in 2024. Climate change also threatens supply chains through extreme weather events, impacting raw material availability and logistics, necessitating resilience strategies like supply chain diversification and inventory management.

| Environmental Factor | Industry Trend/Challenge | Huons' Strategic Imperative | Relevant Data Point (2023-2025) |

|---|---|---|---|

| Carbon Emissions | Growing pressure for carbon neutrality targets (e.g., by 2050) | Invest in sustainable manufacturing and renewable energy | Global ESG investments reached trillions in 2024 |

| Waste Management | Stringent regulations on hazardous waste disposal | Implement advanced pollution control and waste reduction | Global pharmaceutical waste management market ~$14.5 billion (2023) |

| Resource Scarcity | Price volatility of critical raw materials | Diversify sourcing and build supply chain resilience | Rare earth element price volatility in 2024 |

| Climate Change Impacts | Supply chain disruptions from extreme weather | Develop contingency plans and enhance supply chain visibility | Droughts in Southeast Asia and floods in Europe impacted logistics in 2024 |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Huons is built upon a comprehensive review of data from reputable sources including government regulatory bodies, leading financial institutions, and industry-specific market research firms. We meticulously gather information on political stability, economic indicators, technological advancements, environmental policies, and societal trends to provide a robust understanding of the macro-environment.