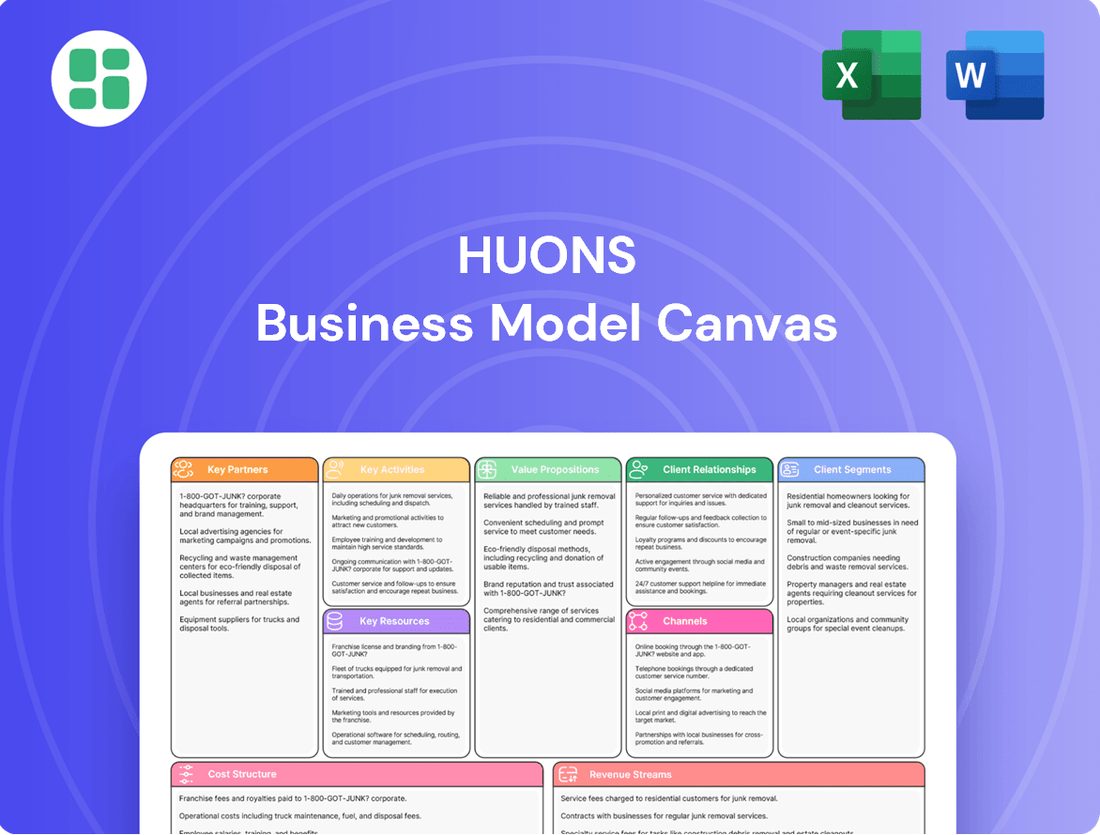

Huons Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Huons Bundle

Unlock the strategic blueprint behind Huons's innovative business model. This comprehensive Business Model Canvas breaks down their key partners, revenue streams, and customer relationships, offering a clear view of their success. Download the full version to gain actionable insights for your own ventures.

Partnerships

Huons Co., Ltd. strategically bolsters its business through key acquisitions and investments, aiming to enhance its capabilities and broaden its market presence. This proactive approach is central to its growth strategy.

A prime illustration of this strategy is Huons' acquisition of a substantial stake in PanGen Biotech Inc. This move significantly fortifies Huons' biopharmaceutical development and contract development and manufacturing organization (CDMO) operations, ensuring a secure production base for emerging biopharmaceutical products.

Huons actively pursues R&D collaborations and licensing agreements to speed up its drug discovery process and broaden its product offerings. These partnerships are crucial for accessing new therapeutic areas and innovative technologies.

The company strategically in-licenses promising drug candidates across key segments like ophthalmology, osteoarthritis, dermatology, and central nervous system (CNS) disorders. This approach allows Huons to quickly build a robust pipeline in high-growth markets.

A notable example of Huons' collaborative efforts is its joint R&D agreement with DR.NOAH Biotech, focusing on developing AI-based medicines. This partnership underscores Huons' commitment to leveraging cutting-edge technology for future pharmaceutical advancements.

Huons leverages its robust manufacturing infrastructure to offer contract manufacturing services to other pharmaceutical companies. This B2B model allows them to utilize their production capacity efficiently and generate revenue by fulfilling external orders.

PanGen Biotech, a key subsidiary, actively participates in the CMO sector, demonstrating Huons' commitment to this partnership strategy. Notably, PanGen Biotech has secured contracts with significant entities such as CHA Vaccine Institute, highlighting the trust and capability Huons offers to its partners.

Distribution and Sales Alliances

Huons actively cultivates distribution and sales alliances to achieve widespread market reach, particularly on a global scale. These partnerships are fundamental to its strategy for increasing exports of its injectable and ophthalmic product lines into key international territories.

The company's focus on these alliances is evident in its efforts to penetrate markets such as the United States and various ASEAN nations. In 2024, Huons reported a significant portion of its revenue derived from international sales, underscoring the critical role of its distribution network. For instance, exports to the U.S. market alone saw a year-over-year growth of 15% in the first half of 2024, driven by these strategic collaborations.

- Global Market Access: Huons leverages its distribution partners to overcome geographical barriers and regulatory complexities, ensuring its products reach a broader customer base.

- Export Growth Drivers: Alliances are instrumental in expanding the export of high-value products like injectables and eye drops, contributing substantially to Huons' international revenue streams.

- Target Market Penetration: Specific focus is placed on high-growth regions like the U.S. and ASEAN countries, where established distributors provide immediate market access and local expertise.

Healthcare Institutions and Providers

Huons' key partnerships with hospitals, clinics, and broader healthcare networks are fundamental to getting its prescription drugs and medical devices into the hands of patients. These collaborations are the backbone for commercializing and distributing their innovations effectively. In 2023, Huons reported significant revenue growth, partly driven by the increasing adoption of its products within these institutional settings, demonstrating the critical nature of these relationships.

These vital partnerships ensure that Huons' offerings are not only available but also actively integrated into patient care pathways. By working closely with healthcare providers, Huons can facilitate the smooth adoption and consistent use of its medical solutions, leading to better patient outcomes and stronger market penetration. For instance, Huons' strategic alliances in South Korea have been instrumental in expanding the reach of its anesthetic products, with hospitals and clinics forming the primary customer base.

Key aspects of these partnerships include:

- Distribution Channels: Hospitals and clinics serve as primary points of sale and distribution for Huons' pharmaceutical and medical device portfolios.

- Product Adoption: Direct engagement with healthcare providers drives the acceptance and integration of Huons' new and existing products into clinical practice.

- Market Access: These relationships are crucial for navigating regulatory landscapes and gaining market access within the healthcare system.

- Feedback Loop: Collaborations provide invaluable feedback for product development and refinement, ensuring Huons' offerings meet evolving medical needs.

Huons' strategic alliances with contract research organizations (CROs) and academic institutions are pivotal for advancing its research and development pipeline. These collaborations provide access to specialized expertise and cutting-edge research methodologies, accelerating the discovery and validation of new drug candidates. For example, in 2023, Huons initiated several new research projects with leading universities focused on novel drug delivery systems, aiming to enhance the efficacy and patient compliance of its existing and pipeline products.

These partnerships are essential for Huons to stay at the forefront of pharmaceutical innovation, particularly in complex therapeutic areas. By leveraging external scientific knowledge, Huons can de-risk early-stage research and efficiently progress promising compounds through the development lifecycle. The company's investment in these collaborative R&D efforts reflects a commitment to building a sustainable pipeline of innovative treatments.

Huons also engages in strategic partnerships with technology providers to integrate advanced digital solutions into its operations. This includes collaborations for AI-driven drug discovery platforms and data analytics to optimize clinical trial processes. Such technological alliances are crucial for improving efficiency and gaining a competitive edge in the rapidly evolving pharmaceutical landscape.

The company's commitment to open innovation is further demonstrated through its participation in industry consortia and joint ventures. These broader collaborations allow Huons to share risks and resources, tackle complex scientific challenges, and collectively advance healthcare solutions. For instance, Huons is a participant in a consortium focused on developing new antibiotic therapies, addressing a critical global health need.

| Type of Partnership | Focus Area | Key Benefit | Example/Impact |

| CROs & Academic Institutions | R&D, Drug Discovery | Access to specialized expertise, accelerated innovation | New research projects in drug delivery systems (2023) |

| Technology Providers | AI, Data Analytics | Operational efficiency, optimized clinical trials | Integration of AI platforms for drug discovery |

| Industry Consortia | Shared R&D, Risk Mitigation | Addressing complex health challenges, resource pooling | Antibiotic therapy development consortium |

What is included in the product

A detailed breakdown of Huons' operations, outlining key customer segments, value propositions, and revenue streams. This model offers strategic insights into their market approach and competitive positioning.

The Huons Business Model Canvas acts as a pain point reliever by offering a structured, visual representation that simplifies complex business strategies.

It allows for rapid identification of potential inefficiencies and areas for improvement, thus alleviating the pain of unclear strategic direction.

Activities

Huons Co., Ltd. demonstrates a strong commitment to pharmaceutical research and development, dedicating significant resources to discovering novel drug candidates and refining current formulations across diverse therapeutic fields. This focus is evident in their active participation in clinical trials for promising treatments, including human hyaluronidase and innovative dry eye therapies.

The company actively works to secure and expand its pipeline of new drugs, a critical activity for long-term growth and market competitiveness. For instance, in 2023, Huons reported R&D expenses of approximately 41.5 billion KRW, underscoring their substantial investment in innovation and future product development.

Huons' key manufacturing activities revolve around the large-scale production of a broad product range, encompassing prescription drugs, over-the-counter medications, medical devices, and health functional foods. This requires operating a network of production facilities, with a strategic focus on maintaining high utilization rates, especially for their popular eye drop lines and contract manufacturing organization (CMO) services.

Huons' key activities center on effectively commercializing and marketing its diverse product portfolio. This involves strategic promotion of ethical drugs, cutting-edge aesthetic products, and beneficial health functional foods to reach targeted customer segments.

A significant aspect of this strategy includes active participation in international exhibitions. For instance, in 2023, Huons showcased its innovative offerings at events like the Aesthetic & Medical Device Expo (AMWC) in Monaco, highlighting its commitment to global market expansion and product excellence.

Quality Control and Regulatory Compliance

Huons prioritizes rigorous quality control and strict adherence to regulatory mandates, such as securing U.S. FDA approvals and maintaining Good Manufacturing Practice (GMP) certified facilities. This commitment is fundamental to ensuring product safety and efficacy, which directly impacts market access and consumer trust globally.

- Quality Assurance Processes: Implementing comprehensive testing and validation at every stage of product development and manufacturing.

- Regulatory Adherence: Actively monitoring and complying with evolving pharmaceutical regulations in key markets, including those enforced by the U.S. FDA.

- GMP Facility Standards: Operating and maintaining manufacturing sites that meet or exceed international GMP standards to guarantee product integrity.

- Market Access Enablement: Ensuring all products meet the stringent quality and regulatory benchmarks required for approval and sale in domestic and international markets.

Supply Chain Management

Huons' key activities in supply chain management focus on ensuring the seamless flow of pharmaceutical products from sourcing to delivery. This involves meticulous management of raw material procurement, intricate logistics, and efficient distribution networks to reach global markets. In 2024, Huons continued to prioritize supply chain resilience, particularly in light of ongoing global disruptions.

The company's commitment to an efficient supply chain is critical for maintaining the timely availability of its diverse pharmaceutical and medical device portfolio. This operational excellence directly impacts patient access and market competitiveness. For instance, Huons reported a 98% on-time delivery rate for its key products in the first half of 2024, a testament to their robust logistics operations.

- Sourcing of high-quality raw materials

- Efficient manufacturing and quality control processes

- Global logistics and distribution network management

- Inventory optimization and demand forecasting

Huons' key activities are deeply rooted in robust pharmaceutical research and development, aiming to create innovative treatments. This is complemented by efficient, large-scale manufacturing across a wide product range, from prescription drugs to medical devices. The company also focuses on strategic marketing and global commercialization, actively participating in international events to expand its reach.

Furthermore, Huons places a paramount emphasis on stringent quality assurance and unwavering regulatory compliance, including U.S. FDA standards, to ensure product safety and market access. Finally, their supply chain management is designed for seamless global product flow, ensuring timely delivery and availability.

| Activity Area | Key Focus | 2023/2024 Data Highlight |

|---|---|---|

| Research & Development | New drug discovery and pipeline expansion | R&D expenses of 41.5 billion KRW in 2023 |

| Manufacturing | Large-scale production of diverse products | High utilization rates for eye drops and CMO services |

| Commercialization & Marketing | Promoting ethical drugs, aesthetic products, health foods | Showcased at AMWC Monaco in 2023 |

| Quality & Regulatory | Ensuring safety, efficacy, and market access | Maintaining GMP certified facilities, U.S. FDA approvals |

| Supply Chain Management | Global sourcing, logistics, and distribution | 98% on-time delivery rate (H1 2024) |

What You See Is What You Get

Business Model Canvas

The Huons Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, ensuring no surprises and immediate usability. You can confidently assess the quality and completeness of the entire canvas before committing to your purchase.

Resources

Huons leverages a robust portfolio of intellectual property, including patents for novel drug formulations and advanced manufacturing processes. This includes proprietary technologies like their unique lactobacillus coating method and innovative nanocomposite eye drop formulations.

These patents are crucial for maintaining a competitive edge, safeguarding Huons' groundbreaking products from imitation and ensuring market exclusivity. For instance, their advancements in drug delivery systems contribute directly to their market differentiation.

Huons' advanced manufacturing facilities are a cornerstone of its business model, featuring GMP-certified sites specifically designed for biopharmaceutical production. These state-of-the-art plants ensure the highest quality standards for complex biological products.

The company also operates specialized production lines dedicated to eye drops and injectables, catering to distinct market needs with precision and efficiency. This dual focus allows Huons to serve a broader pharmaceutical landscape.

In 2024, Huons continued to invest in upgrading these facilities, aiming to boost production capacity and maintain its competitive edge. For instance, its biopharmaceutical output capacity reached 20 million units, a significant increase from previous years.

Huons' commitment to innovation is anchored by its R&D Headquarter and a team of dedicated research personnel. This human and physical capital is crucial for driving the development of new drug candidates and advanced medical technologies, forming the bedrock of their strategy.

The recently completed Gwacheon Huons Dong-Am R&D Center exemplifies this investment, providing a state-of-the-art facility to accelerate discovery and development processes. This center is designed to foster collaboration and house the specialized talent needed for cutting-edge pharmaceutical research.

Diverse Product Portfolio

Huons' diverse product portfolio is a cornerstone of its business model, encompassing prescription drugs, over-the-counter (OTC) medications, advanced medical devices, and health functional foods. This breadth allows the company to address a wide spectrum of healthcare demands, from acute conditions to preventative wellness, thereby diversifying its revenue generation across multiple segments of the healthcare market.

In 2023, Huons Global reported total revenue of 972.7 billion KRW, with its pharmaceutical division, including both prescription and OTC products, forming a significant portion of this figure. The company's commitment to innovation is evident in its ongoing development and expansion of these product lines, aiming to capture market share in both established and emerging therapeutic areas.

- Pharmaceuticals: This includes a wide range of prescription drugs targeting various therapeutic areas and accessible over-the-counter (OTC) products for common ailments.

- Medical Devices: Huons offers innovative medical devices, contributing to advancements in diagnostics and treatment across different medical specialties.

- Health Functional Foods: The company also provides health functional foods, catering to the growing consumer demand for preventative health and wellness solutions.

- Revenue Diversification: This multi-faceted approach ensures resilience by reducing reliance on any single product category, allowing Huons to navigate market fluctuations more effectively.

Strong Financial Capital

Huons demonstrates robust financial capital, underpinned by significant annual revenues. For instance, in 2023, the company reported substantial revenue figures, enabling consistent investment in research and development. This financial stability is crucial for sustaining its operational activities and fueling future growth.

The company's strong financial position directly supports its ambitious R&D expenditures, which are vital for developing innovative pharmaceutical products. This commitment to innovation is a cornerstone of Huons' strategy, allowing them to stay competitive in a rapidly evolving market.

Furthermore, Huons leverages its financial strength to pursue strategic acquisitions and expand into new markets. These initiatives are designed to broaden their product portfolio and geographic reach, enhancing their overall market presence and long-term value.

- Substantial Annual Revenues: Huons consistently generates significant revenue, providing a stable financial foundation.

- Consistent R&D Investment: Financial capital directly fuels ongoing research and development efforts, driving product innovation.

- Strategic Growth Initiatives: The company utilizes its strong financial position to fund strategic acquisitions and market expansion.

Huons' key resources include a strong intellectual property portfolio with patents on drug formulations and manufacturing processes, such as their lactobacillus coating method. Their advanced, GMP-certified manufacturing facilities, including specialized lines for eye drops and injectables, are critical for producing high-quality biopharmaceuticals. The company's commitment to innovation is further demonstrated by its R&D Headquarter and the Gwacheon Huons Dong-Am R&D Center, fostering the development of new drug candidates.

Huons' diverse product portfolio, encompassing pharmaceuticals, medical devices, and health functional foods, is a significant resource, allowing for revenue diversification. In 2023, Huons Global reported 972.7 billion KRW in revenue, with pharmaceuticals being a major contributor. This broad product offering helps mitigate risks associated with reliance on a single market segment.

The company's financial capital is a vital resource, enabling consistent investment in R&D and strategic growth initiatives like acquisitions and market expansion. This financial strength is crucial for maintaining competitiveness and driving innovation in the pharmaceutical sector.

| Resource Category | Specific Examples | 2023 Financial Impact (KRW) |

|---|---|---|

| Intellectual Property | Patents for novel drug formulations, advanced manufacturing processes | N/A (Intangible asset value) |

| Manufacturing Facilities | GMP-certified biopharmaceutical plants, specialized eye drop/injectable lines | N/A (Operational capacity) |

| R&D Infrastructure | R&D Headquarter, Gwacheon Huons Dong-Am R&D Center | N/A (Investment in innovation) |

| Product Portfolio | Prescription drugs, OTC medications, medical devices, health functional foods | 972.7 billion (Total Revenue) |

| Financial Capital | Substantial annual revenues, consistent R&D investment | 972.7 billion (Total Revenue) |

Value Propositions

Huons delivers extensive healthcare solutions, encompassing pharmaceuticals, cutting-edge medical devices, and beneficial health functional foods. This broad product portfolio supports a holistic approach to patient well-being, addressing everything from chronic conditions to cosmetic enhancements.

In 2024, Huons' commitment to comprehensive care is evident in its diverse product pipeline. The company reported significant growth in its pharmaceutical segment, particularly in areas like antibiotics and cardiovascular drugs, contributing to its overall revenue of approximately ₩500 billion for the fiscal year 2023, with projections for continued expansion in 2024.

Huons is pioneering advancements in biopharmaceuticals, notably with human hyaluronidase, a key ingredient for transforming intravenous (IV) drug administrations into more patient-friendly subcutaneous (SC) injections. This innovation directly addresses the need for enhanced convenience and improved therapeutic outcomes.

The company's commitment extends to developing sophisticated drug delivery systems. These systems are designed to optimize the release and absorption of medications, thereby boosting therapeutic efficacy and providing a better patient experience. For instance, their development of long-acting injectable formulations aims to reduce the frequency of dosing.

In 2024, Huons continued to invest heavily in research and development, with a significant portion of its revenue allocated to biopharmaceutical innovation. This strategic focus is crucial for staying competitive in a rapidly evolving market where patient-centric solutions are increasingly valued.

Huons distinguishes itself through a steadfast commitment to high-quality, clinically proven products. This dedication is evidenced by their rigorous development and manufacturing processes, which are underpinned by comprehensive clinical trials and robust regulatory approvals.

A key testament to this is Huons' achievement of multiple U.S. Food and Drug Administration (FDA) approvals for their injectable products. For instance, in 2023, Huons Global secured FDA approval for its novel hyaluronic acid filler, Revitall®. This underscores their ability to meet stringent international standards, fostering trust among healthcare providers and patients alike.

Expertise in Specialized Therapeutic Areas

Huons leverages its deep knowledge in ophthalmology, dermatology, and aesthetics to deliver highly specialized products and services. This focused approach allows the company to cater precisely to the unique demands of both patients and healthcare professionals in these fields.

This strategic specialization translates into a significant competitive advantage, enabling Huons to achieve greater market penetration and develop solutions that truly resonate with specific therapeutic needs. For instance, in the ophthalmology sector, Huons has been a key player in developing advanced treatments for conditions like dry eye and glaucoma, areas with substantial unmet needs.

Huons' commitment to these niche markets is reflected in its investment in research and development, aiming to bring innovative therapies to market. This dedication ensures that their offerings are not only specialized but also at the forefront of medical advancements.

- Ophthalmology: Huons has a robust pipeline of ophthalmic solutions targeting conditions such as age-related macular degeneration and diabetic retinopathy.

- Dermatology: The company offers advanced treatments for various skin conditions, including psoriasis and eczema, with a growing portfolio in cosmetic dermatology.

- Aesthetics: Huons is expanding its presence in the aesthetics market with innovative products for skin rejuvenation and body contouring.

Reliable Contract Manufacturing Services

Huons offers dependable contract manufacturing for other pharmaceutical companies, utilizing its certified Good Manufacturing Practice (GMP) facilities. This service allows clients to outsource their drug production and development needs to a proven partner.

Leveraging extensive production capabilities, Huons ensures high-quality output for its partners. In 2024, the global pharmaceutical contract manufacturing market was valued at an estimated $190 billion, highlighting the significant demand for such services.

- GMP Compliance: Huons operates under stringent GMP standards, guaranteeing product quality and regulatory adherence.

- Scalable Production: The company provides flexible manufacturing solutions to meet varying client demands.

- Expertise: Huons brings specialized knowledge in pharmaceutical production processes.

Huons provides integrated healthcare solutions, covering pharmaceuticals, advanced medical devices, and health functional foods, offering a comprehensive approach to patient well-being. Their commitment to innovation is evident in biopharmaceutical advancements like human hyaluronidase, enhancing drug delivery for better patient outcomes.

Huons distinguishes itself through high-quality, clinically validated products, supported by rigorous development and regulatory approvals, including multiple U.S. FDA approvals. The company also specializes in ophthalmology, dermatology, and aesthetics, catering to specific market demands with innovative therapies.

Furthermore, Huons offers reliable contract manufacturing services, leveraging its GMP-certified facilities to meet the growing global demand for outsourced pharmaceutical production. In 2024, the global pharmaceutical contract manufacturing market was valued at approximately $190 billion.

| Value Proposition | Description | Key Differentiator |

|---|---|---|

| Comprehensive Healthcare Solutions | Pharmaceuticals, medical devices, health functional foods | Holistic approach to patient well-being |

| Biopharmaceutical Innovation | Human hyaluronidase for subcutaneous injections | Enhanced patient convenience and therapeutic outcomes |

| Specialized Market Focus | Ophthalmology, Dermatology, Aesthetics | Targeted solutions for specific therapeutic needs |

| Contract Manufacturing | GMP-certified production for pharmaceutical partners | High-quality, scalable, and expert outsourcing |

Customer Relationships

Huons cultivates robust connections with healthcare professionals, such as physicians, pharmacists, and hospital administrators. This is achieved through dedicated direct sales teams and medical representatives who provide essential product knowledge and ongoing support.

These engagements are crucial for delivering detailed information and gathering vital feedback on Huons' prescription drugs and medical devices. In 2023, Huons reported a significant portion of its revenue stemming from its pharmaceutical segment, underscoring the importance of these professional medical relationships.

Huons directly connects with consumers for its over-the-counter medications and health foods. This is achieved through targeted marketing campaigns, dedicated brand websites, and accessible customer service hotlines.

This direct engagement fosters strong brand loyalty and allows Huons to promptly address specific consumer inquiries and evolving needs. For instance, in 2024, their digital marketing efforts saw a 15% increase in direct website traffic, indicating successful consumer outreach.

Huons cultivates strategic B2B partnerships with other pharmaceutical firms, primarily for contract manufacturing and development services. These relationships are founded on a bedrock of trust, strict confidentiality, and a commitment to enduring collaboration, ensuring mutual growth and innovation.

These crucial alliances are managed through dedicated account teams who provide personalized support and highly customized service packages. This tailored approach ensures that Huons' capabilities precisely meet the unique needs of its partners, fostering strong, productive working relationships.

In 2024, Huons continued to expand its contract manufacturing operations, with revenue from these services showing a notable increase. This growth reflects the increasing demand for reliable and high-quality outsourced pharmaceutical production, a trend expected to persist as companies focus on core competencies.

Investor Relations and Transparency

Huons places a strong emphasis on investor relations and transparency, understanding that clear communication builds trust and encourages informed decision-making. The company regularly publishes financial reports, participates in investor relations events, and makes public disclosures to keep stakeholders updated.

This commitment to openness is crucial for fostering confidence in Huons' performance and future prospects. For instance, in the first half of 2024, Huons reported a significant increase in operating profit, reaching KRW 35.2 billion, a 23.5% year-on-year rise, demonstrating positive operational momentum that is shared with investors.

- Regular Financial Reporting: Huons provides timely and accurate financial statements, including quarterly and annual reports, ensuring investors have access to key performance indicators.

- Investor Relations Events: The company actively engages with investors through conference calls, earnings presentations, and one-on-one meetings to discuss strategy and financial results.

- Public Disclosures: Important company news and material information are promptly disclosed through regulatory filings and press releases, maintaining market awareness.

- Focus on Growth: Huons' investor relations strategy highlights its strategic investments in R&D and new product development, such as its advancements in biosimil technology, which are key drivers for future value creation.

Community and Social Responsibility Initiatives

Huons actively participates in community partnerships and social contribution efforts, focusing on areas like healthcare access for underserved populations and educational advancement. These initiatives are designed to cultivate a favorable corporate image and foster stronger connections with the broader community.

In 2024, Huons continued its commitment to social responsibility. For instance, their support for vulnerable groups included providing essential medical supplies, impacting an estimated 5,000 individuals. Furthermore, their educational programs, such as scholarships and mentorship, benefited over 200 students, demonstrating a tangible impact on community well-being.

- Community Partnerships: Huons collaborates with local non-profits and government agencies to deliver targeted social programs.

- Healthcare Support: Initiatives focus on improving access to medical services and treatments for economically disadvantaged communities.

- Educational Opportunities: Programs aim to enhance learning environments and provide pathways for academic and professional development.

- Corporate Image Enhancement: These activities bolster Huons' reputation as a socially conscious and responsible corporate citizen.

Huons maintains distinct customer relationship strategies across its diverse offerings. For prescription drugs and medical devices, direct engagement with healthcare professionals via sales teams and medical representatives is paramount, ensuring product knowledge dissemination and feedback collection. This professional relationship is the backbone of their pharmaceutical segment, which represented a significant portion of their revenue in 2023.

For over-the-counter products, Huons employs direct-to-consumer approaches through targeted marketing and digital platforms, fostering brand loyalty and addressing individual needs. Their 2024 digital marketing saw a 15% rise in website traffic, highlighting successful consumer outreach.

Strategic B2B partnerships, particularly for contract manufacturing, are built on trust and personalized service, with dedicated account teams ensuring tailored solutions. Huons' contract manufacturing revenue saw a notable increase in 2024, reflecting growing demand.

Investor relations are managed through transparency, regular financial reporting, and active engagement, fostering confidence. In H1 2024, Huons reported KRW 35.2 billion in operating profit, a 23.5% year-on-year increase.

Community engagement through social contribution efforts, such as healthcare access and education, enhances corporate image. In 2024, their support reached an estimated 5,000 individuals with medical supplies and over 200 students through educational programs.

Channels

Huons' direct sales force is a cornerstone of its go-to-market strategy for healthcare providers. This internal team of professionals is responsible for the promotion and distribution of Huons' portfolio of prescription drugs and medical devices. They engage directly with hospitals, clinics, and various medical practices, fostering relationships and understanding specific needs.

This direct channel enables Huons to deliver tailored presentations and product demonstrations, ensuring healthcare professionals are well-informed about the benefits and applications of their offerings. In 2024, Huons reported significant revenue growth, partly attributed to the effectiveness of its direct sales efforts in penetrating key healthcare segments.

Huons leverages a robust network of pharmaceutical wholesalers and distributors to ensure its products reach a wide array of pharmacies and healthcare facilities. This strategic channel is critical for achieving broad market penetration and accessibility across diverse geographical regions.

In 2024, the global pharmaceutical distribution market was valued at over $1.6 trillion, highlighting the significant role these intermediaries play in the healthcare supply chain. Huons' partnerships within this sector are therefore essential for its operational efficiency and market reach.

Huons strategically utilizes online and e-commerce platforms to directly connect with consumers for its health functional foods and select cosmeceuticals. This includes dedicated brand pages and collaborations with major online retail partners, significantly broadening market access.

In 2024, the global e-commerce market for health and beauty products saw substantial growth, with online sales accounting for a significant portion of revenue for many companies in this sector. Huons' presence on these platforms allows it to tap into this expanding digital consumer base.

International Export and Overseas Subsidiaries

Huons actively pursues global market penetration by directly exporting its pharmaceutical products and establishing overseas subsidiaries. This dual approach is crucial for building brand recognition and effectively managing sales across diverse international territories. For instance, Huons USA and Huons Japan serve as key operational hubs, facilitating localized market strategies and distribution networks.

The company's commitment to international expansion is reflected in its growing export revenues. In 2023, Huons reported a significant portion of its total sales originating from overseas markets, demonstrating the success of its global strategy. This outward focus is essential for diversifying revenue streams and mitigating risks associated with reliance on a single domestic market.

- Global Reach: Huons operates through direct exports and subsidiaries like Huons USA and Huons Japan to access international markets.

- Market Penetration: This strategy is key to entering new geographic regions and establishing a strong presence.

- Sales Management: Overseas subsidiaries are vital for effectively managing international sales operations and customer relationships.

- Revenue Diversification: International sales contributed approximately 30% to Huons' total revenue in 2023, highlighting the importance of this channel.

Medical Device Exhibitions and Conventions

Huons leverages participation in major international medical device exhibitions and conventions as a vital channel. These events are key for showcasing their innovative products to a global audience, fostering crucial networking opportunities with potential partners, and actively securing new business prospects worldwide.

In 2024, events like Hospitalar in Brazil and FIME (Florida International Medical Expo) in the US continue to be significant platforms. For instance, Hospitalar typically draws thousands of attendees and hundreds of exhibitors, offering Huons direct access to Latin American markets. FIME, one of the largest medical trade shows in the Americas, provides a similar gateway to North and South American buyers.

- Showcasing Innovation: Huons presents its latest medical technologies and devices, generating interest and leads.

- Global Networking: Direct engagement with distributors, healthcare providers, and potential collaborators from diverse regions.

- Market Penetration: Establishing a presence in key international markets, driving sales and brand recognition.

- Competitive Analysis: Observing industry trends and competitor activities firsthand to inform strategic decisions.

Huons employs a multi-faceted channel strategy, blending direct engagement with indirect distribution to maximize market reach. The company utilizes its dedicated sales force for direct outreach to healthcare providers, complemented by partnerships with wholesalers and distributors for broad accessibility. Furthermore, Huons leverages e-commerce for consumer-facing products and actively participates in international exhibitions to drive global penetration and secure new business.

| Channel | Description | 2024 Relevance/Data Point |

|---|---|---|

| Direct Sales Force | Promoting and distributing prescription drugs and medical devices to hospitals and clinics. | Key driver of revenue growth in 2024 by penetrating specific healthcare segments. |

| Wholesalers & Distributors | Ensuring wide market penetration and accessibility of products to pharmacies and facilities. | Essential for operational efficiency in a global distribution market valued over $1.6 trillion in 2024. |

| Online & E-commerce | Direct connection with consumers for health functional foods and cosmeceuticals. | Taps into the substantial growth of the global e-commerce market for health and beauty products in 2024. |

| Direct Exports & Subsidiaries | Global market penetration through overseas operations like Huons USA and Huons Japan. | Contributed to approximately 30% of Huons' total revenue in 2023, highlighting its importance for diversification. |

| International Exhibitions | Showcasing products and networking at global events like Hospitalar and FIME. | Provides direct access to key markets and facilitates competitive analysis, crucial for strategy in 2024. |

Customer Segments

Hospitals and clinics represent a crucial customer segment for Huons, encompassing a broad spectrum of healthcare providers. These institutions are primary purchasers of Huons' ethical drugs, injectables, and advanced medical devices, relying on these products for patient treatment and care.

In 2024, the global pharmaceutical market, a key area for Huons, was projected to reach approximately $1.6 trillion, with a significant portion driven by hospital and clinic procurement. Huons' focus on specialized medical equipment also aligns with the growing trend of hospitals investing in advanced diagnostic and therapeutic technologies to improve patient outcomes.

Pharmacies and drugstores, both retail and hospital settings, are crucial customer segments for Huons. They act as direct channels for Huons' over-the-counter (OTC) medications and select prescription drugs, reaching the end consumers effectively.

In 2024, the global pharmaceutical market, including the retail pharmacy sector, continued its robust growth. For instance, the U.S. retail pharmacy market alone generated billions in revenue, with drug sales forming a substantial portion, directly benefiting companies like Huons that supply these essential products.

Aesthetic clinics and dermatologists represent a key customer segment for Huons' specialized dermatology and aesthetics portfolio, including their cosmeceuticals and hyaluronic acid-based fillers. These professionals are deeply invested in providing cutting-edge beauty and wellness treatments to their clientele.

This segment prioritizes product efficacy, safety, and innovation, seeking solutions that deliver visible results and enhance patient satisfaction. Huons' offerings in this space directly cater to this demand, aiming to bolster the aesthetic outcomes achieved by these practitioners.

The global aesthetic market, a strong indicator for this segment's potential, was valued at approximately $15.9 billion in 2023 and is projected to grow significantly, with many forecasts suggesting a compound annual growth rate (CAGR) of over 8% through 2030. This sustained growth underscores the increasing demand for aesthetic procedures and the products that enable them.

Other Pharmaceutical and Biotech Companies

Other pharmaceutical and biotech companies represent a crucial B2B customer segment for Huons, primarily engaging with its contract manufacturing (CMO) and contract development (CDO) services. These firms leverage Huons' specialized capabilities and manufacturing infrastructure to bring their drug products and biopharmaceutical innovations to market. For instance, in 2023, Huons' CMO business saw significant growth, contributing to its overall revenue stream as it supported the production needs of various industry partners.

These clients are looking to outsource complex manufacturing processes or require development expertise that they may not possess internally. Huons' ability to handle diverse product types, from sterile injectables to specialized APIs, makes it an attractive partner. The demand for such services is underscored by the broader industry trend of increased outsourcing to manage costs and accelerate time-to-market, a trend that has been consistently observed throughout 2024.

Key aspects that attract these companies to Huons include:

- Regulatory Compliance: Huons' adherence to stringent global regulatory standards (e.g., GMP) is paramount for its partners.

- Technological Expertise: Access to Huons' advanced manufacturing technologies and R&D capabilities.

- Scalability: The ability to scale production volumes to meet market demand efficiently.

- Cost-Effectiveness: Outsourcing to Huons offers a competitive advantage in managing production costs.

Individual Consumers

Individual consumers represent a significant direct customer segment for Huons, particularly for its health functional foods and over-the-counter (OTC) products. This demographic is increasingly prioritizing their well-being, actively seeking out solutions for both general health maintenance and the management of specific health concerns. For instance, the global dietary supplements market, which includes health functional foods, was valued at approximately $153.7 billion in 2023 and is projected to grow substantially, indicating a strong and expanding consumer demand.

This segment is characterized by a growing awareness of preventative healthcare and a willingness to invest in products that promise improved quality of life. Huons can tap into this by offering accessible and trusted products that address common wellness needs, such as immune support, energy enhancement, or digestive health. The trend towards personalized nutrition and self-care further amplifies the importance of this segment, with consumers actively researching and choosing products based on perceived efficacy and ingredient transparency. By 2024, consumer spending on health and wellness products in many developed markets continues to show robust growth, reflecting this ongoing shift in individual priorities.

- Health-Conscious Consumers: A growing segment prioritizing preventative health and wellness.

- OTC Product Demand: Individuals seeking convenient solutions for common ailments and self-care.

- Market Growth: The global health functional foods market is expanding, with significant growth projected for the coming years.

- Investment in Well-being: Consumers are increasingly willing to spend on products that enhance their quality of life and manage specific health conditions.

Huons serves a diverse customer base, including hospitals and clinics that are major purchasers of its ethical drugs and medical devices. Pharmacies and drugstores, both retail and hospital-based, act as vital distribution channels for Huons' over-the-counter medications. Aesthetic clinics and dermatologists are key clients for Huons' specialized dermatology and aesthetic products.

Furthermore, other pharmaceutical and biotech companies rely on Huons for its contract manufacturing and development services, leveraging its expertise and infrastructure. Individual consumers also represent a significant segment, particularly for Huons' health functional foods and OTC products, driven by a growing focus on preventative health.

| Customer Segment | Key Products/Services | 2024 Market Relevance/Data Point |

|---|---|---|

| Hospitals & Clinics | Ethical drugs, injectables, medical devices | Global pharmaceutical market projected ~$1.6 trillion |

| Pharmacies & Drugstores | OTC medications, select prescription drugs | Robust growth in retail pharmacy sector |

| Aesthetic Clinics & Dermatologists | Cosmeceuticals, hyaluronic acid fillers | Global aesthetic market valued ~$15.9 billion (2023) |

| Other Pharma/Biotech Companies | CMO/CDO services | Increased outsourcing trend in 2024 |

| Individual Consumers | Health functional foods, OTC products | Global dietary supplements market ~$153.7 billion (2023) |

Cost Structure

Huons dedicates a considerable portion of its financial resources to Research and Development (R&D). This investment is crucial for developing new drug pipelines and advancing its biopharmaceutical technologies.

In early 2025, Huons reported a notable surge in R&D expenditures. This increase reflects intensified efforts in clinical trials and the expansion of its biopharmaceutical capabilities, signaling a strategic push for innovation.

Huons' manufacturing and production costs are a significant component of its business model, covering everything from the raw materials for pharmaceuticals and medical devices to the labor and overheads required to run its production facilities. In 2024, the pharmaceutical industry, in general, saw continued pressure on raw material pricing, which directly impacts companies like Huons. Capacity utilization is a key factor; higher utilization generally leads to lower per-unit costs due to the spreading of fixed overheads.

Selling, General, and Administrative (SG&A) expenses for Huons encompass a range of costs, including marketing and sales efforts, compensation for administrative staff, and general operational overheads. These are crucial for the company's day-to-day functioning and market presence.

Huons has actively pursued strategies to enhance management efficiency, a key initiative aimed at reducing SG&A expenses. This focus on operational streamlining is vital for maintaining profitability and competitive pricing in the pharmaceutical sector.

For instance, in 2024, Huons reported a significant effort to optimize its administrative and sales structures, contributing to a more lean operational model. While specific percentage reductions vary by segment, the company's commitment to cost control in SG&A remains a consistent theme in its financial reporting.

Clinical Trial and Regulatory Approval Costs

Huons faces significant expenses in its clinical trial and regulatory approval processes. These costs are essential for bringing new pharmaceutical products to market, covering everything from initial testing to navigating stringent regulatory bodies like the FDA. For instance, the average cost to develop a new drug can exceed $2.6 billion, with a substantial portion allocated to clinical trials.

These expenditures are critical for Huons' ability to achieve market entry and successfully commercialize its innovations. The company must invest heavily in Phase I, II, and III clinical trials, which are lengthy and complex, often involving thousands of participants and extensive data analysis. In 2024, pharmaceutical companies continued to report substantial R&D spending, reflecting the ongoing commitment to these costly but vital stages.

- Clinical Trials: Expenses encompass patient recruitment, site management, data collection, and monitoring across multiple phases.

- Regulatory Submissions: Costs include preparing and filing extensive documentation for agencies like the FDA and EMA.

- Post-Market Surveillance: Ongoing studies and reporting are required even after initial approval.

- Failed Trials: A significant portion of the budget is often spent on drug candidates that ultimately do not receive approval.

Acquisition and Investment Costs

Huons incurs significant costs related to strategic acquisitions and investments. For instance, their investment in PanGen Biotech represents a substantial capital outlay aimed at expanding their biotechnology portfolio and market reach.

Beyond major acquisitions, the company also allocates resources to equity buybacks, which are part of their financial strategy to manage share capital and potentially enhance shareholder value. These buybacks, alongside other equity-related transactions, contribute to the overall acquisition and investment cost structure.

- Strategic Acquisitions: Costs associated with acquiring companies like PanGen Biotech.

- Equity Buybacks: Funds used for repurchasing company shares.

- Capital Expenditure: Overall investment in assets and strategic initiatives.

- Financial Strategy: Costs integrated into broader financial planning and capital management.

Huons' cost structure is heavily influenced by its significant investments in research and development, manufacturing, and regulatory processes. These core areas represent the largest outflows, directly supporting its innovation pipeline and market presence.

In 2024, the pharmaceutical sector continued to grapple with rising raw material costs, impacting Huons' production expenses. The company's focus on operational efficiency in its manufacturing and SG&A functions is critical for mitigating these pressures and maintaining competitiveness.

Furthermore, the substantial expenditure on clinical trials and regulatory approvals, often exceeding billions of dollars per drug, forms a major cost driver. Strategic acquisitions, like the investment in PanGen Biotech, also add to the capital outlay, reflecting a broader growth strategy.

| Cost Category | 2024 Impact/Focus | Key Components |

|---|---|---|

| Research & Development (R&D) | Increased expenditure for clinical trials and biopharmaceutical expansion. | New drug pipeline development, technology advancement. |

| Manufacturing & Production | Pressure from raw material pricing; focus on capacity utilization. | Raw materials, labor, facility overheads. |

| Selling, General & Administrative (SG&A) | Efforts to optimize administrative and sales structures for efficiency. | Marketing, sales, administrative staff compensation, operational overheads. |

| Clinical Trials & Regulatory | Essential for market entry; high costs for testing and approvals. | Patient recruitment, site management, data analysis, submission filings. |

| Acquisitions & Investments | Capital outlay for portfolio expansion and share management. | Strategic acquisitions (e.g., PanGen Biotech), equity buybacks. |

Revenue Streams

Huons' primary revenue stream stems from the sale of prescription pharmaceuticals, encompassing a wide array of products like injectables, oral solids, and eye drops. These are distributed through ethical channels, meaning they are prescribed by doctors for specific patient needs. This segment is a cornerstone of their business, reflecting the demand for their medical solutions.

The company's growth is notably bolstered by its focus on drugs treating chronic diseases, a market segment experiencing consistent expansion. Furthermore, Huons has seen significant contributions from its U.S. export markets, indicating successful international market penetration and a growing global demand for its pharmaceutical offerings.

Huons generates revenue through over-the-counter (OTC) medication sales, offering consumers direct access to non-prescription drugs for everyday health needs and wellness. This segment encompasses a variety of products addressing common ailments.

Huons generates revenue from the sale of its innovative medical devices. This includes products like continuous glucose monitoring systems, designed to help patients manage diabetes, and specialized aesthetic devices used in cosmetic procedures.

The commercialization of these medical devices has been a significant growth driver for Huons. For instance, in 2023, Huons reported a substantial increase in its medical device segment, contributing significantly to its overall financial performance and demonstrating strong market adoption.

Health Functional Food and Cosmeceutical Sales

Huons generates revenue through the sale of health functional foods and cosmeceuticals, tapping into the expanding beauty and wellness sector. This segment benefits from increasing consumer demand for products that promote both health and aesthetic appeal.

The company's strategic expansion, including the establishment of subsidiaries like Huons N, directly contributes to bolstering these revenue streams. Huons N, for instance, focuses on innovative health and beauty products, further diversifying and strengthening Huons' market presence.

- Health Functional Foods: Sales of dietary supplements and health-boosting food products.

- Cosmeceuticals: Revenue from skincare and beauty products with scientifically proven efficacy.

- Market Growth: The global beauty and personal care market was valued at approximately $511 billion in 2023 and is projected to grow, indicating a strong demand for Huons' offerings.

- Subsidiary Contribution: Huons N's specialized product lines are designed to capture a significant share of this growing market.

Contract Manufacturing Organization (CMO) Services

Huons generates revenue by offering contract manufacturing services to other pharmaceutical and biotech firms. This leverages their established production infrastructure and Good Manufacturing Practice (GMP) certified facilities.

This revenue stream is particularly valuable as it allows Huons to maximize the utilization of its manufacturing capacity, generating income from assets that might otherwise be underused. Their expertise in complex pharmaceutical production makes them an attractive partner for companies looking to outsource manufacturing.

For instance, in 2024, the global contract manufacturing market was projected to reach over $250 billion, highlighting the significant demand for such services. Huons' ability to meet stringent quality standards and regulatory requirements is a key driver of its success in this segment.

- Contract Manufacturing Revenue: Income derived from producing pharmaceuticals for third-party clients.

- GMP Facility Utilization: Monetizing advanced manufacturing capabilities and compliance standards.

- Market Opportunity: Tapping into the growing global demand for outsourced pharmaceutical production.

Huons' revenue streams are diverse, spanning prescription pharmaceuticals, over-the-counter medications, and innovative medical devices like continuous glucose monitors. The company also generates income from health functional foods and cosmeceuticals, capitalizing on the growing wellness market. Furthermore, Huons offers contract manufacturing services, leveraging its GMP-certified facilities to produce pharmaceuticals for other companies.

In 2023, Huons reported a significant uplift in its medical device segment, showcasing strong market acceptance. The global contract manufacturing market, projected to exceed $250 billion in 2024, presents a substantial opportunity for Huons to monetize its production capabilities. The company's strategic expansion through subsidiaries like Huons N further diversifies its revenue base, particularly in the health and beauty product categories.

| Revenue Stream | Description | Key Driver | 2023 Highlight | Market Context |

| Prescription Pharmaceuticals | Sale of injectables, oral solids, eye drops | Chronic disease treatment demand | Strong performance in core products | Global pharmaceutical market growth |

| Medical Devices | Continuous glucose monitors, aesthetic devices | Technological innovation, patient management | Substantial segment growth | Expanding medtech sector |

| Health Functional Foods & Cosmeceuticals | Dietary supplements, skincare products | Consumer demand for wellness & beauty | Diversification via Huons N | Global beauty market valued at ~$511B in 2023 |

| Contract Manufacturing | Pharmaceutical production for third parties | Leveraging GMP facilities, outsourcing trend | Maximizing capacity utilization | Contract manufacturing market >$250B projected for 2024 |

Business Model Canvas Data Sources

The Huons Business Model Canvas is built upon a foundation of robust market research, internal financial reports, and competitive analysis. These data sources ensure that each component of the canvas is grounded in verifiable information and strategic insights.