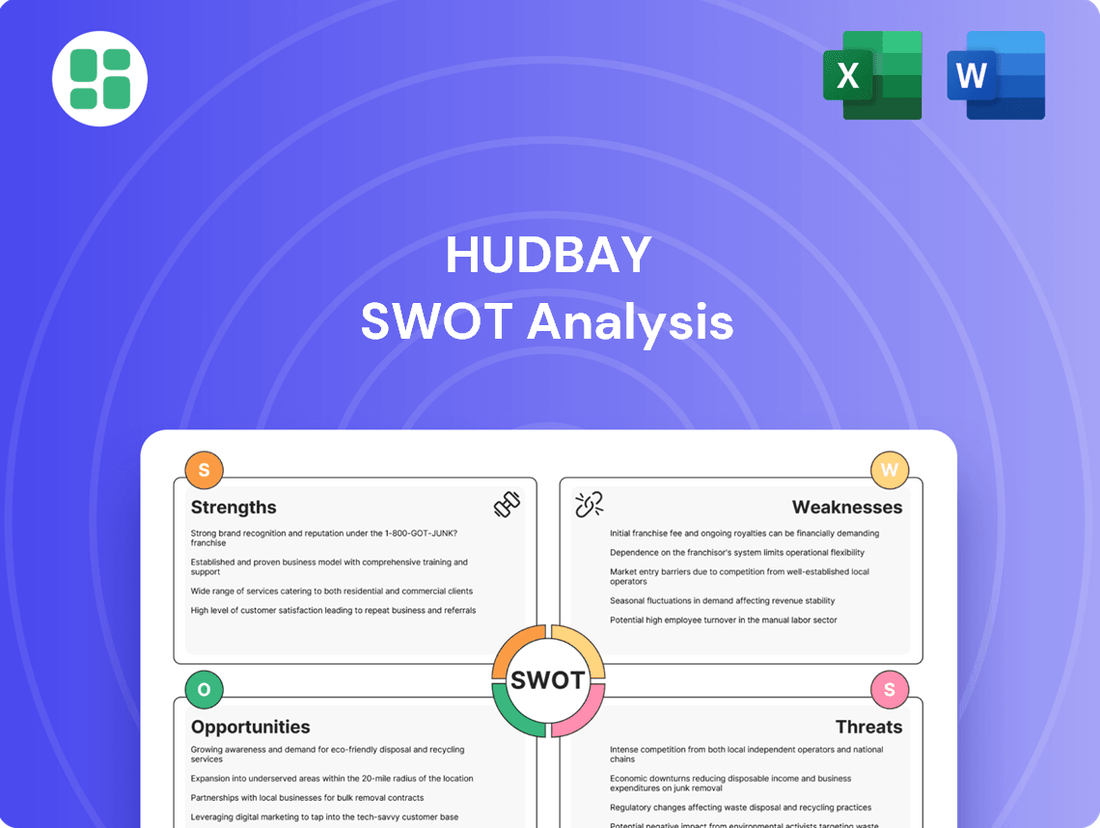

HudBay SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HudBay Bundle

HudBay's robust operational strengths and strategic acquisitions position it for significant growth, but understanding potential market volatility and regulatory hurdles is crucial for capitalizing on these opportunities. Our comprehensive SWOT analysis delves into these dynamics, offering a clear roadmap for navigating the competitive landscape.

Want the full story behind HudBay's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Hudbay's diversified production portfolio, spanning Peru and Canada, is a significant strength. The company mines a range of essential metals like copper, gold, zinc, and silver, which helps to smooth out revenue streams.

This broad product mix acts as a natural hedge against price swings in any single commodity. For example, in the first quarter of 2024, Hudbay reported that its copper production increased by 14% year-over-year, while zinc production saw a 5% rise, showcasing the benefit of its varied output.

Hudbay has showcased exceptional financial results, with 2024 and Q1 2025 marking periods of record adjusted EBITDA and robust free cash flow generation. This strong performance has directly translated into a significantly de-risked balance sheet, characterized by substantial debt reduction.

The company's proactive approach to financial management has positioned it favorably, achieving one of the lowest leverage ratios within the mining industry. This financial strength provides a solid foundation for future growth and investment opportunities.

Hudbay consistently demonstrates industry-leading margins, a testament to its robust cost control. Notably, in the first quarter of 2025, the company reported negative copper cash costs after accounting for by-product credits, highlighting exceptional efficiency.

Further strengthening this advantage, Hudbay is actively pursuing ongoing optimization initiatives at its British Columbia and Peru operations. These efforts are specifically designed to boost mill throughput and enhance overall operational efficiency, solidifying its competitive cost structure in the market.

Robust Project Pipeline and Mine Life Extensions

Hudbay's robust project pipeline is a significant strength, highlighted by the fully permitted Copper World project in Arizona. This development is projected to boost copper production by an impressive 50% by 2027, significantly enhancing the company's market position in a key commodity.

Furthermore, Hudbay has demonstrated effective long-term planning by extending the operational life of its core assets. The Constancia mine is now slated to operate until 2041, and the Snow Lake operations have been extended to 2037. These extensions provide crucial production stability and visibility for investors.

- Copper World Project: Expected to increase copper output by 50% by 2027.

- Constancia Mine Life Extension: Extended to 2041.

- Snow Lake Operations Life Extension: Extended to 2037.

Commitment to Sustainability and Responsible Mining

Hudbay demonstrates a strong commitment to sustainability, reflected in its consistent high performance within the Towards Sustainable Mining (TSM) protocols. This dedication to responsible mining is not just an ideal but a tangible operational strategy, aiming to minimize environmental impact and foster positive community relations. For instance, in 2023, Hudbay achieved an average of 91% for TSM performance across its operations, showcasing leadership in the sector.

Furthermore, the company has set ambitious targets for greenhouse gas (GHG) emission reductions, aligning with global climate goals. By focusing on environmental stewardship and a robust safety culture, Hudbay actively works to build trust with stakeholders and mitigate potential operational risks. This proactive approach is crucial for long-term viability and social license to operate.

Key aspects of Hudbay's sustainability strengths include:

- High TSM Performance: Consistently achieving high scores in the Towards Sustainable Mining (TSM) program underscores their commitment to best practices.

- Ambitious GHG Targets: Setting clear and measurable goals for reducing greenhouse gas emissions demonstrates a forward-thinking environmental strategy.

- Stakeholder Engagement: Prioritizing community relations and transparent communication builds essential trust and support.

- Risk Mitigation: A strong safety culture and environmental focus directly contribute to reducing operational disruptions and associated costs.

Hudbay's diversified production across Peru and Canada, encompassing copper, gold, zinc, and silver, provides revenue stability. This broad commodity mix naturally cushions against individual metal price volatility. For instance, Q1 2024 saw a 14% year-over-year increase in copper production and a 5% rise in zinc, highlighting the benefits of this varied output.

The company has achieved exceptional financial performance, with record adjusted EBITDA and strong free cash flow in 2024 and Q1 2025, significantly reducing debt. This financial prudence has resulted in one of the lowest leverage ratios in the mining sector, creating a robust foundation for future investments.

Hudbay consistently delivers industry-leading margins, driven by effective cost control. Notably, Q1 2025 saw negative copper cash costs after by-product credits, indicating superior operational efficiency. Ongoing optimization efforts at its British Columbia and Peru sites are further enhancing mill throughput and overall efficiency.

A strong project pipeline, including the fully permitted Copper World project in Arizona, is set to increase copper production by 50% by 2027. Additionally, life extensions for the Constancia mine (to 2041) and Snow Lake operations (to 2037) ensure production stability and long-term visibility.

Hudbay's commitment to sustainability is evident in its high performance within the Towards Sustainable Mining (TSM) protocols, achieving an average of 91% in 2023. The company also has ambitious greenhouse gas reduction targets and prioritizes community engagement and safety, reinforcing its social license to operate.

| Strength | Description | Supporting Data |

| Diversified Production | Mining multiple commodities (copper, gold, zinc, silver) in different geographies (Peru, Canada). | Q1 2024: Copper production up 14% YoY, Zinc up 5% YoY. |

| Financial Strength | Record adjusted EBITDA and strong free cash flow, leading to substantial debt reduction and low leverage. | Achieved one of the lowest leverage ratios in the mining industry. |

| Industry-Leading Margins | Robust cost control and operational efficiency. | Q1 2025: Negative copper cash costs after by-product credits. |

| Project Pipeline & Life Extensions | Growth through new projects and extended operational life of existing mines. | Copper World: 50% copper output increase by 2027. Constancia: Extended to 2041. Snow Lake: Extended to 2037. |

| Sustainability Commitment | High TSM performance and ambitious environmental targets. | 2023 TSM average performance: 91%. Setting GHG reduction targets. |

What is included in the product

Analyzes HudBay’s competitive position through key internal and external factors, highlighting its strengths in diversified mining operations and opportunities for growth, while also addressing weaknesses in cost management and threats from commodity price volatility.

Offers a clear, actionable framework for identifying and addressing HudBay's critical operational challenges.

Weaknesses

Hudbay's reliance on the Pampacancha satellite deposit in Peru presents a significant weakness, as its high-grade ore is projected to be depleted by late 2025. This depletion is expected to cause a dip in gold production for 2025, potentially impacting overall grades at the Constancia operations.

Consequently, the company faces a critical need to successfully develop and integrate new ore sources to sustain its production levels and mitigate the impact of Pampacancha's exhaustion. Failure to do so could lead to a substantial decline in output and profitability from its Peruvian assets.

HudBay's consolidated copper production is projected to see a slight dip through 2026, largely due to optimization efforts at Copper Mountain. This temporary reduction, while anticipated, could affect revenue streams in the short term before the company fully capitalizes on its growth initiatives.

The expected decrease in copper output, primarily impacting the period up to 2026, means that investors might see a more modest revenue contribution from this segment before the significant increase slated for 2027. This near-term production profile requires careful consideration when evaluating the company's immediate financial performance.

Hudbay's diversified operations, while a strength, introduce a weakness in the variability of by-product grades. For instance, planned lower grades of silver and zinc in Peru during 2024, a consequence of ongoing stripping activities, can lead to predictable fluctuations in quarterly production volumes and, consequently, revenue streams.

Lower Scores in Dividend and Resilience Factors

Analyst assessments, such as Smartkarma's Smart Scores, highlight Hudbay's lower scores in dividend and resilience factors. This indicates potential weaknesses in providing consistent shareholder returns and adapting to market volatility, even with strong operational performance. For example, while Hudbay's operational efficiency might be high, its dividend payout history or ability to weather economic downturns may not be as robust as some peers.

These lower scores in dividend and resilience suggest that investors seeking stable income streams or companies with a proven track record of weathering economic storms might find Hudbay less attractive. This could impact its valuation and ability to attract certain types of capital, especially during periods of market uncertainty.

- Dividend Score: Lower than industry averages, suggesting inconsistent or less attractive dividend payouts to shareholders.

- Resilience Score: Indicates potential vulnerabilities in the company's ability to withstand market shocks or economic downturns.

- Investor Perception: May deter income-focused investors or those prioritizing stability and predictability in their portfolios.

Potential for Operational Inefficiencies

Despite generally strong cost management, Hudbay has encountered instances where per-tonne milled costs have surpassed projections at specific operations. For example, in the first quarter of 2024, their cash cost guidance was revised upwards, partly due to these operational cost overruns. This points to persistent difficulties in achieving uniform operational efficiency across all of Hudbay's mining sites.

These inefficiencies can manifest in several ways:

- Higher than anticipated processing expenses: Some sites may be experiencing increased costs related to milling, grinding, or other beneficiation processes.

- Suboptimal equipment utilization: Challenges in maintaining peak performance or efficient scheduling of mining equipment could contribute to higher per-tonne costs.

- Labor and maintenance cost variances: Unexpected labor needs or increased maintenance requirements at certain locations can also impact overall operational efficiency and cost control.

- Supply chain disruptions affecting input costs: While not solely an operational issue, disruptions in the supply of essential consumables like reagents or energy can indirectly inflate per-tonne milled costs.

Hudbay's reliance on the Pampacancha satellite deposit in Peru presents a significant weakness, as its high-grade ore is projected to be depleted by late 2025. This depletion is expected to cause a dip in gold production for 2025, potentially impacting overall grades at the Constancia operations. Consequently, the company faces a critical need to successfully develop and integrate new ore sources to sustain its production levels and mitigate the impact of Pampacancha's exhaustion.

HudBay's consolidated copper production is projected to see a slight dip through 2026, largely due to optimization efforts at Copper Mountain. This temporary reduction, while anticipated, could affect revenue streams in the short term before the company fully capitalizes on its growth initiatives. The expected decrease in copper output, primarily impacting the period up to 2026, means that investors might see a more modest revenue contribution from this segment before the significant increase slated for 2027.

Hudbay's diversified operations, while a strength, introduce a weakness in the variability of by-product grades. For instance, planned lower grades of silver and zinc in Peru during 2024, a consequence of ongoing stripping activities, can lead to predictable fluctuations in quarterly production volumes and, consequently, revenue streams. Analyst assessments, such as Smartkarma's Smart Scores, highlight Hudbay's lower scores in dividend and resilience factors, indicating potential vulnerabilities in providing consistent shareholder returns and adapting to market volatility.

Despite generally strong cost management, Hudbay has encountered instances where per-tonne milled costs have surpassed projections at specific operations. For example, in the first quarter of 2024, their cash cost guidance was revised upwards, partly due to these operational cost overruns. This points to persistent difficulties in achieving uniform operational efficiency across all of Hudbay's mining sites.

| Production Segment | Projected Change (2025-2026) | Key Driver | Impact on Revenue |

| Gold (Peru) | Decrease | Pampacancha depletion | Short-term revenue dip |

| Copper (Consolidated) | Slight Dip | Copper Mountain optimization | Modest near-term contribution |

| Silver & Zinc (Peru) | Fluctuations | By-product grade variability | Quarterly revenue variation |

Preview the Actual Deliverable

HudBay SWOT Analysis

This is the actual HudBay SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're seeing a genuine excerpt of the comprehensive report. Purchase unlocks the entire in-depth version.

Opportunities

The Copper World project, now fully permitted, is a major growth catalyst for Hudbay, projected to boost its consolidated copper output by more than 50% compared to current production. This advancement is crucial for unlocking future value and improving market perception.

A key objective is to move the Copper World project towards a construction sanctioning decision by 2026. This timeline is critical for realizing the project's potential and capitalizing on favorable market conditions for copper.

Hudbay is significantly boosting its exploration efforts, particularly in the Snow Lake region of Manitoba and in Peru, near its current mining sites. This includes integrating newly acquired land packages into their exploration strategies, aiming to uncover new mineral deposits and expand existing resources.

These targeted exploration programs are designed to extend the life of current mines and build a robust pipeline of future production. For instance, in 2023, Hudbay reported a 20% increase in exploration expenditures compared to 2022, with a substantial portion allocated to Snow Lake, reflecting a strong commitment to resource growth.

The current market is exceptionally favorable for Hudbay, thanks to robust global demand for copper, a key component in renewable energy infrastructure and electric vehicles. This demand surge, coupled with sustained high gold prices, creates a powerful tailwind for the company.

Hudbay's strategic position with dual exposure to both copper and gold allows it to directly benefit from these positive price trends. This dual commodity exposure is a significant advantage, enabling the company to generate substantial free cash flow in the current economic climate.

Further Mill Throughput Improvements

Opportunities exist to further increase mill throughput at both the Constancia and Copper Mountain operations. A key project is the pebble crusher at Constancia, slated for commencement in late 2025. These enhancements are designed to boost production efficiency and could help mitigate the impact of any anticipated grade declines.

These throughput improvements are crucial for maximizing operational output. For instance, the Constancia pebble crusher project is anticipated to add approximately 1.5 million tonnes per annum (Mtpa) to its processing capacity. This expansion is a direct response to the operational strategy aimed at optimizing resource utilization.

- Constancia Pebble Crusher: Expected to add 1.5 Mtpa capacity, commencing late 2025.

- Copper Mountain Enhancements: Ongoing projects targeting increased processing efficiency.

- Offsetting Grade Declines: Throughput improvements are vital to maintain production levels despite potential grade variations.

Strategic Partnerships and Acquisitions

Hudbay's strengthened financial position, evidenced by its improved balance sheet, opens doors for strategic partnerships and accretive acquisitions. The company's full consolidation of the Copper Mountain mine in early 2024, for instance, highlights its capability to integrate new assets. This move is expected to contribute significantly to its production profile. For example, Copper Mountain is projected to add approximately 100 million pounds of copper annually to Hudbay's output.

These strategic moves can further diversify Hudbay's commodity exposure and operational footprint. By pursuing such opportunities, the company aims to enhance its overall scale and unlock potential synergies across its existing and future operations. This strategic flexibility is crucial for navigating the dynamic mining landscape and capturing value.

Potential benefits of these opportunities include:

- Portfolio Diversification: Expanding into new commodities or geographies to reduce reliance on a single asset or market.

- Enhanced Scale: Growing production volumes and reserves to achieve greater economies of scale and market influence.

- Synergy Realization: Capturing cost savings and operational efficiencies by integrating acquired assets or partnering with complementary businesses.

- Access to New Technologies: Acquiring or partnering with companies that possess advanced mining or processing technologies.

The fully permitted Copper World project is a significant growth driver, expected to increase Hudbay's copper production by over 50% from current levels, with a construction sanctioning decision targeted for 2026. Increased exploration, particularly in Snow Lake and Peru, aims to expand resources and extend mine life, with exploration expenditures rising 20% in 2023. Favorable market conditions, driven by strong copper demand for renewables and EVs, coupled with high gold prices, provide a substantial tailwind.

Hudbay is also enhancing operational efficiency through projects like the Constancia pebble crusher, set to add 1.5 Mtpa processing capacity by late 2025, and ongoing improvements at Copper Mountain. These initiatives are crucial for maintaining production levels amidst potential grade declines. The company's improved financial standing post-consolidation of the Copper Mountain mine in early 2024, which adds approximately 100 million pounds of copper annually, supports strategic partnerships and accretive acquisitions, further diversifying its portfolio and enhancing scale.

| Opportunity | Key Detail | Projected Impact | Timeline/Status |

|---|---|---|---|

| Copper World Project | Fully permitted | >50% consolidated copper output increase | Construction sanctioning decision by 2026 |

| Exploration Expansion | Snow Lake & Peru focus | Resource expansion, mine life extension | Increased capex in 2023 (20% YoY) |

| Market Conditions | High copper & gold prices | Strong revenue & cash flow generation | Ongoing |

| Throughput Enhancements | Constancia pebble crusher | +1.5 Mtpa processing capacity | Commencing late 2025 |

| Copper Mountain Consolidation | Full consolidation in early 2024 | ~100 million lbs copper/year addition | Completed |

Threats

Commodity price volatility poses a significant threat to Hudbay. The mining sector is intrinsically linked to the fluctuating global prices of key metals like copper, gold, zinc, and silver. For instance, copper prices, a crucial revenue driver, saw considerable swings in 2024, impacting profitability across the industry.

While Hudbay's diversified portfolio offers some buffer, a prolonged slump in metal prices could severely curtail its revenues, earnings, and available cash. This instability directly affects the company's ability to fund operations and future growth initiatives, making it a critical risk to manage.

Hudbay's operations in Peru are susceptible to disruptions from social unrest and political instability, including protests by informal miners, which can impact production schedules and the flow of materials. For example, in early 2024, protests in Peru led to temporary road blockades affecting various industries, highlighting the vulnerability of supply chains in the region.

Furthermore, mining companies across all operating regions, including Canada, the United States, and Peru, must navigate increasingly stringent and evolving environmental regulations. Obtaining and maintaining permits can be a complex and lengthy process, potentially delaying projects or increasing operational costs, as seen with the ongoing scrutiny of environmental impact assessments for new mining ventures globally.

The depletion of high-grade satellite deposits, such as Pampacancha, presents a significant challenge for Hudbay. This situation directly threatens the company's ability to sustain its current production levels and maintain the quality of its output.

Successful and timely development of new ore bodies is crucial to mitigate this threat. Without adequate replacement resources, Hudbay could face increased operating costs and a decline in overall production volume, impacting its financial performance.

Increased Operating Costs and Inflationary Pressures

The mining industry, including HudBay, faces significant risks from escalating operating expenses. Inflationary pressures on essential inputs like energy, labor, and raw materials can directly erode profitability, even with diligent cost management strategies.

For instance, if per-tonne milled costs see unexpected jumps, as has been noted in some mining operations, it directly squeezes profit margins. This sensitivity to input cost volatility is a persistent threat that requires constant monitoring and adaptation.

- Energy costs: Fluctuations in global energy prices directly impact mining operations, from extraction to processing.

- Labor expenses: Wage inflation and the cost of attracting and retaining skilled labor can significantly increase operational overhead.

- Supply chain disruptions: Increased costs for equipment, maintenance parts, and consumables due to global supply chain issues add further pressure.

- Regulatory compliance: Evolving environmental and safety regulations can necessitate additional capital expenditure and ongoing operating costs.

Competition for Resources and Projects

The escalating global demand for critical minerals, essential for the green energy transition, intensifies competition among mining firms. This rivalry directly impacts Hudbay by driving up the costs associated with acquiring new resource deposits, securing promising exploration sites, and attracting specialized talent crucial for project development. For instance, the price of copper, a key commodity for Hudbay, saw significant volatility in 2024, influenced by supply chain disruptions and surging demand from electric vehicle manufacturing, highlighting the competitive pressures on resource acquisition.

This heightened competition can constrain Hudbay's capacity to grow its mineral reserves and advance its project pipeline. Companies are aggressively bidding for exploration licenses and making strategic acquisitions, potentially leaving fewer attractive opportunities available or forcing higher entry costs. In 2024, several junior mining companies secured significant exploration acreage in regions where Hudbay also operates, demonstrating this competitive land grab.

Consequently, Hudbay faces the threat of increased operational expenses and potential delays in project execution due to the scarcity of readily available, high-quality resources and skilled personnel. This environment necessitates robust strategic planning and efficient capital allocation to maintain a competitive edge in securing and developing future mining projects.

- Increased Acquisition Costs: Bidding wars for exploration rights and existing mineral assets can inflate the price Hudbay must pay to expand its resource base.

- Talent Scarcity: Competition for experienced geologists, engineers, and project managers can lead to higher labor costs and recruitment challenges.

- Limited Project Opportunities: As competitors secure promising exploration targets, Hudbay may find fewer attractive greenfield opportunities to pursue.

- Supply Chain Strain: Competition for critical mining equipment and services can also lead to increased costs and longer lead times for project development.

Commodity price volatility remains a significant threat, directly impacting Hudbay's revenue and profitability. For example, copper prices experienced notable fluctuations throughout 2024, influenced by global economic sentiment and demand shifts. This instability makes financial forecasting challenging and can strain the company's ability to fund growth initiatives.

Social and political instability in operating regions, particularly Peru, presents ongoing risks. Protests and potential disruptions, such as road blockades seen in early 2024, can halt operations and impede the movement of materials, affecting production schedules and costs.

Increasingly stringent environmental regulations worldwide necessitate continuous adaptation and can lead to higher compliance costs and project delays. Obtaining and maintaining permits requires careful management of environmental impact assessments, a process that can be both time-consuming and expensive.

The depletion of high-grade ore bodies, such as Pampacancha, necessitates the successful and timely development of new resources to maintain production levels. Failure to replace depleted reserves could lead to increased operating expenses and a decline in output volume.

Escalating operating expenses, driven by inflation in energy, labor, and supply chain costs, pose a persistent threat. For instance, a 5% increase in energy costs, a common occurrence in 2024, can significantly squeeze profit margins if not offset by production efficiencies.

Intensified competition for critical minerals, fueled by the green energy transition, drives up acquisition costs for exploration rights and talent. In 2024, this competition led to a noticeable increase in bidding for promising exploration sites in regions where Hudbay operates.

SWOT Analysis Data Sources

This HudBay SWOT analysis is built upon a robust foundation of data, drawing from official company financial filings, comprehensive market research reports, and expert industry analysis to provide a well-rounded and accurate strategic overview.