HudBay Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HudBay Bundle

HudBay's competitive landscape is shaped by the interplay of buyer power and the threat of substitutes, influencing their pricing strategies and market share. Understanding the intensity of these forces is crucial for navigating the mining sector effectively.

The complete report reveals the real forces shaping HudBay’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Mining operations are heavily dependent on highly specialized and expensive equipment, like excavators and haul trucks. The limited number of global manufacturers for this machinery can grant them considerable bargaining power, particularly for proprietary technologies or essential maintenance. For instance, in 2024, the global mining equipment market saw significant price increases for advanced machinery due to supply chain constraints and high demand, impacting companies like Hudbay.

The global mining sector, including companies like Hudbay, relies heavily on a specialized workforce. This includes geologists, mining engineers, metallurgists, and experienced equipment operators. These professionals possess critical knowledge and skills essential for exploration, extraction, and processing.

Shortages in specialized mining talent, especially in remote operational areas, can significantly amplify the bargaining power of these skilled labor groups. This scarcity directly translates to increased labor costs for mining companies and can lead to project delays if expertise is not readily available.

In 2024, the mining industry continued to grapple with these labor dynamics. For instance, reports indicated a global deficit of skilled tradespeople and engineers in mining, impacting project development timelines and operational efficiency across the sector.

Hudbay, like its peers, must actively compete to attract and retain this essential talent. This competition directly influences its operational expenditures and the scheduling of its various mining and development projects, underscoring the strategic importance of human capital management in the industry.

Energy providers hold significant bargaining power over mining companies like Hudbay, primarily because mining is inherently energy-intensive. For instance, in 2023, the global mining industry's electricity consumption was projected to reach over 1,000 terawatt-hours, highlighting the critical reliance on stable energy supplies. Fluctuations in energy prices, such as the average Brent crude oil price which saw considerable volatility in 2024, directly impact operational costs and profitability for miners. Furthermore, the availability of reliable energy sources is crucial, especially for remote mining operations, giving suppliers leverage.

Hudbay's strategy to mitigate this supplier power includes securing long-term energy contracts, which can lock in prices and ensure supply stability. Additionally, their ongoing investments in energy efficiency initiatives, aiming to reduce overall consumption, can lessen their dependence on external suppliers and thereby diminish the suppliers' bargaining strength. These measures are vital for managing the inherent risks associated with energy costs in the mining sector.

Chemical and Consumable Suppliers

The bargaining power of chemical and consumable suppliers for mining operations like HudBay is a key consideration. Mining processes, especially ore concentration, rely heavily on chemicals such as reagents, explosives, and grinding media. While many of these are standard commodities, certain specialized chemicals or those subject to stringent environmental regulations may only be available from a select group of suppliers.

The essential nature of these inputs for efficient mineral extraction grants these suppliers a degree of leverage. For instance, the global demand for critical minerals in 2024 continues to drive up the cost of specialized reagents needed for advanced processing techniques. Companies like HudBay must carefully manage these supplier relationships to ensure consistent supply and competitive pricing, as disruptions can significantly impact production volumes and profitability.

- Reliance on specialized chemicals: Certain mining processes require unique chemical formulations that are not widely available, concentrating power with a few key manufacturers.

- Supply chain vulnerability: Geopolitical factors or production issues affecting major chemical producers can create shortages and price volatility for essential mining consumables.

- Environmental regulations: Increasingly strict environmental standards may limit the types of chemicals that can be used, potentially narrowing the supplier base for compliant alternatives.

Logistics and Transportation Services

Hudbay's reliance on logistics and transportation services in its Peru and Manitoba operations presents a potential area of supplier bargaining power. The movement of raw materials, machinery, and finished goods is essential for its mining and smelting activities.

Given the specific geographic locations and the nature of mining operations, Hudbay may be dependent on a limited number of specialized transportation providers. For instance, access to remote mining sites in Manitoba often requires specialized trucking or rail services, and shipments from Peru might depend on specific port facilities. This limited availability of alternatives can significantly enhance the bargaining power of these logistics providers, potentially leading to higher costs or less favorable terms for Hudbay.

- Limited Infrastructure: In 2024, regions like Manitoba continue to face infrastructure challenges, particularly in remote areas, increasing reliance on providers with specialized equipment and expertise.

- Transportation Costs: Global shipping rates have seen volatility. For example, the Baltic Dry Index, a key indicator of shipping costs, experienced significant fluctuations throughout 2023 and into early 2024, impacting the cost-effectiveness of transporting bulk commodities.

- Supply Chain Criticality: Delays or disruptions in logistics can halt production, making timely and reliable transportation a critical need for Hudbay, thereby strengthening the hand of dependable logistics partners.

Suppliers of specialized mining equipment wield significant power over Hudbay due to the limited number of manufacturers and the high cost of these essential assets. In 2024, the global mining equipment market faced price hikes driven by supply chain issues and robust demand, directly impacting companies like Hudbay.

The bargaining power of skilled labor is substantial for Hudbay, given the critical need for specialized professionals like geologists and engineers. Labor shortages in the mining sector, particularly in remote locations, intensified in 2024, leading to increased wage demands and potential project delays.

Energy suppliers possess considerable leverage over Hudbay due to mining's high energy consumption. The volatility of energy prices, such as Brent crude oil in 2024, directly affects operational costs, while the necessity of reliable power for remote sites amplifies supplier influence.

Chemical and consumable suppliers also exert influence, particularly for specialized reagents crucial for ore processing. Rising global demand in 2024 has increased the cost of these essential chemicals, making consistent supply and competitive pricing a key concern for Hudbay.

Logistics and transportation providers can hold sway over Hudbay, especially given the company's operations in remote areas with limited infrastructure. Fluctuations in global shipping costs, as seen with the Baltic Dry Index in early 2024, highlight the financial impact of these services.

| Supplier Category | Key Factors Influencing Bargaining Power | Impact on Hudbay | 2024 Data/Trends |

| Specialized Equipment Manufacturers | Limited suppliers, high capital costs, proprietary technology | Increased capital expenditure, potential delays in equipment acquisition | Global mining equipment market prices increased due to supply chain constraints and demand. |

| Skilled Labor (Geologists, Engineers, Operators) | Scarcity of specialized talent, critical operational knowledge | Higher labor costs, potential project schedule disruptions | Reports of a global deficit in skilled tradespeople and mining engineers continued in 2024. |

| Energy Providers | High energy intensity of mining, reliance on stable supply | Volatile operational costs, dependence on supplier reliability | Brent crude oil prices experienced significant volatility throughout 2024. |

| Chemical and Consumable Suppliers | Reliance on specialized reagents, supply chain vulnerabilities | Increased input costs, potential production disruptions | Demand for critical minerals in 2024 drove up costs for specialized processing reagents. |

| Logistics and Transportation Services | Limited infrastructure in remote areas, criticality of timely delivery | Higher transportation costs, potential impact on supply chain efficiency | Baltic Dry Index showed significant fluctuations in early 2024, impacting bulk commodity transport costs. |

What is included in the product

Analyzes the competitive forces impacting HudBay, including supplier and buyer power, the threat of new entrants and substitutes, and existing rivalry within the mining industry.

Understand and mitigate competitive threats with a visual breakdown of industry power dynamics.

Quickly identify and address potential disruptions from new entrants or substitute products.

Customers Bargaining Power

Hudbay's reliance on copper, zinc, gold, and silver, which are largely undifferentiated commodities, significantly amplifies customer bargaining power. Because these metals are perceived as interchangeable, buyers can easily shift their purchases to suppliers offering more favorable pricing or better availability, making price a primary determinant in purchasing decisions.

This commodity nature means Hudbay's competitive advantage hinges on operational efficiency and production volume, rather than unique product characteristics. In 2023, global copper prices, for example, averaged around $3.80 per pound, illustrating the price-sensitive environment in which Hudbay operates.

Hudbay operates in global metal markets where prices are set by broad supply and demand, not by individual companies like Hudbay. This means Hudbay has limited power to set its own prices for its main products, making it a price-taker.

Customers, such as industrial manufacturers and metal traders, can easily source metals from many different suppliers around the world. In 2024, for instance, the global copper market saw significant price volatility driven by macroeconomic factors and supply chain disruptions, highlighting the competitive landscape for producers.

The wide availability of alternative suppliers globally significantly weakens the bargaining power of Hudbay's customers. They can readily switch to other producers if Hudbay's pricing or terms are not competitive, further constraining Hudbay's pricing flexibility.

Customer concentration can significantly impact Hudbay's bargaining power. While the global metals market is immense, certain industrial sectors or individual large buyers might procure substantial quantities of specific metals. If a small number of major clients represent a large percentage of Hudbay's revenue, these customers gain leverage to negotiate more favorable pricing or contract terms. For instance, in 2023, Hudbay's sales were diversified across various end-markets, but understanding the specific concentration within key segments like copper or zinc is crucial for assessing this force.

Importance of Metals to Customers

For many industrial customers, base metals like copper and zinc are absolutely essential for their manufacturing operations. Without these materials, production lines would simply halt. For example, copper is a critical component in electrical wiring, automotive parts, and construction, while zinc is vital for galvanizing steel and producing alloys.

However, these customers typically source their metals from a variety of suppliers. This diversification strategy serves a dual purpose: ensuring a consistent supply chain and enabling them to negotiate better prices. This broad supplier base significantly dilutes the bargaining power any single producer, like Hudbay, can wield.

The bargaining power of customers is therefore moderated by the essential nature of the metals they purchase, but also by the wide availability of alternative suppliers. This dynamic means that while metals are critical inputs, customers can often switch between providers if prices become unfavorable or supply is disrupted. In 2023, global copper demand was projected to reach over 25 million metric tons, underscoring its importance, yet the market featured numerous producers capable of meeting this demand.

- Essential Inputs: Base metals like copper and zinc are fundamental to industries such as construction, automotive, and electronics.

- Supply Security: Customers procure metals from multiple sources to mitigate risks of supply chain disruptions.

- Competitive Pricing: Diversified sourcing allows customers to leverage competition among metal suppliers to secure favorable pricing.

- Supplier Availability: The presence of numerous global metal producers limits the individual market power of any single supplier like Hudbay.

Low Switching Costs for Customers

The bargaining power of customers is significantly amplified by low switching costs in the base and precious metals industry. Because these commodities are largely standardized, buyers can easily move between suppliers without incurring substantial expenses or operational disruptions. This ease of transition means that unless Hudbay provides exceptional value through logistics, financing, or long-term agreements, customers are free to pursue the best market prices or immediate supply availability from competitors.

This dynamic directly pressures Hudbay to maintain competitive pricing and reliable delivery. For instance, in 2024, global copper prices, a key commodity for Hudbay, experienced volatility. Buyers could readily switch to other producers if Hudbay's pricing was not aligned with market trends or if competitors offered more favorable delivery schedules. This lack of customer loyalty, driven by low switching costs, is a critical factor in the industry's competitive landscape.

- Low Switching Costs: Base and precious metals are commodities, meaning customers face minimal costs when changing suppliers.

- Price Sensitivity: Customers can easily compare prices and availability across different producers, leading to a focus on cost.

- Competitive Pressure: Hudbay must remain competitive on price and service to retain customers who can readily switch to rivals.

The bargaining power of customers for Hudbay is substantial due to the commodity nature of its products and the low switching costs involved. Buyers can easily shift to alternative suppliers if Hudbay's pricing or terms are not competitive, putting constant pressure on Hudbay to maintain operational efficiency and cost control.

In 2024, global copper prices, a key commodity for Hudbay, saw fluctuations, reinforcing the price-sensitive environment. For example, LME copper prices traded in a range, demonstrating the leverage customers have to seek the best available rates from various producers.

The essential nature of metals for manufacturing, coupled with a wide global supplier base, means customers have significant leverage. This allows them to negotiate favorable terms and prices, as they can readily access comparable products from numerous other mining companies.

| Metal | 2023 Average Price (USD) | 2024 Forecasted Range (USD) | Customer Leverage Factor |

|---|---|---|---|

| Copper | ~$3.80/lb | ~$3.50 - $4.50/lb | High |

| Zinc | ~$1.00/lb | ~$0.90 - $1.20/lb | High |

| Gold | ~$1970/oz | ~$2000 - $2400/oz | Moderate |

| Silver | ~$23/oz | ~$22 - $28/oz | Moderate |

What You See Is What You Get

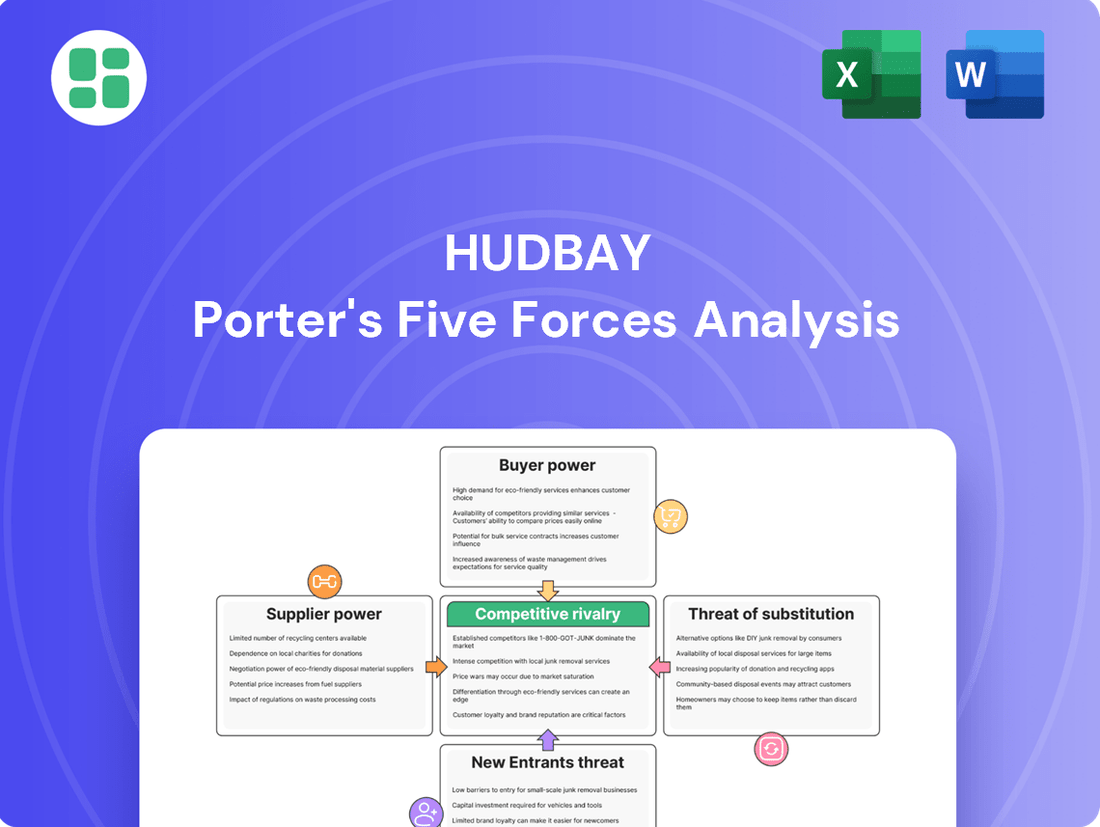

HudBay Porter's Five Forces Analysis

This preview showcases the complete HudBay Porter's Five Forces Analysis, offering a thorough examination of the competitive landscape. The document you see here is precisely the same professionally formatted report you will receive immediately after purchase, ensuring no discrepancies or missing information.

You are looking at the actual, fully detailed Porter's Five Forces Analysis for HudBay, providing actionable insights into industry rivalry, buyer and supplier power, and the threat of new entrants and substitutes. Once you complete your purchase, you’ll get instant access to this exact, ready-to-use file.

Rivalry Among Competitors

The global base and precious metals mining sector features a vast array of companies, from colossal multinational giants to nimble, locally focused operations. Hudbay Minerals operates within this crowded field, facing competition from entities with diverse cost efficiencies, operational capacities, and geographical footprints. This wide spectrum of competitors fuels a robust rivalry as each player strives to capture a larger share of the market.

The demand for base and precious metals, the core of HudBay's operations, is intrinsically linked to the ebb and flow of global economic growth and industrial output. This cyclical nature means that when demand slows, competition heats up. Companies tend to fight harder for their current slice of the market, rather than investing in expansion, leading to more aggressive pricing and marketing efforts.

In 2024, the mining industry, including base metals, is experiencing a mixed demand environment. While infrastructure spending in some regions provides a tailwind, broader economic uncertainties in others are tempering overall growth. This dynamic can lead to periods of excess capacity, particularly if new projects come online during a downturn, further intensifying competitive pressures and potentially driving down commodity prices.

Hudbay's core products—copper, zinc, gold, and silver—are commodities, meaning they are largely indistinguishable from those produced by competitors. This lack of product differentiation forces companies like Hudbay into intense price competition, where cost efficiency and production volume become paramount. For instance, fluctuations in global copper prices, which saw significant volatility in 2024 influenced by supply chain issues and demand shifts, directly impact Hudbay's revenue and its ability to compete on price against larger, more cost-advantaged miners.

High Fixed Costs and Exit Barriers

The mining sector, including companies like HudBay, is characterized by extremely high fixed costs. Significant capital is required for exploration, developing mines, and setting up processing plants. For instance, major mining projects often involve investments in the billions of dollars. This capital intensity naturally leads to substantial exit barriers, as divesting from such large-scale, specialized assets is complex and costly.

These high fixed costs and the long-term nature of mining operations mean companies are often locked into production, even when market prices are low. To cover ongoing expenses and avoid abandoning sunk costs, firms may continue to extract resources. This behavior can exacerbate oversupply in the market, intensifying competition among existing players and making it difficult for new entrants to gain a foothold without similarly massive upfront investment.

In 2023, for example, global mining capital expenditures were projected to exceed $100 billion, underscoring the industry's capital-intensive nature. Companies facing these realities are compelled to maintain production levels to service debt and recover investments, contributing to a competitive environment where price wars can become more prevalent due to the pressure to keep operations running.

- Capital Intensity: Mining requires billions in upfront investment for exploration, development, and infrastructure.

- Exit Barriers: High sunk costs and specialized assets make it difficult and expensive to leave the industry.

- Production Pressure: Companies often continue production during downturns to cover fixed costs, increasing rivalry.

- Market Impact: This can lead to oversupply and price competition, as firms aim to recoup investments.

Global Nature of Competition

Hudbay operates in a truly global arena, facing competition from established producers in North and South America, as well as emerging players across Africa, Asia, and Australia. This broad geographical spread means rivals are continually seeking efficiencies and cost advantages wherever they can find them.

Geopolitical shifts, currency volatility, and differing regulatory landscapes significantly impact production costs and competitive positioning. For instance, in 2024, the copper price experienced fluctuations due to supply concerns in South America and robust demand from China, directly affecting the cost competitiveness of various global operations.

- Global Production Footprint: Competitors span multiple continents, including major mining regions like Chile, Peru, the Democratic Republic of Congo, and Australia.

- Cost Influences: Geopolitical stability, energy prices, and labor costs vary widely, creating dynamic cost structures for global rivals.

- Market Access: Access to key markets, particularly for metals like copper and zinc, is influenced by trade agreements and logistical networks.

- Technological Adoption: The pace at which competitors adopt new mining and processing technologies can create significant competitive advantages.

The competitive rivalry within the base and precious metals sector is intense due to the commodity nature of Hudbay's products, forcing a focus on cost efficiency and production volume. Global economic conditions, as seen in 2024 with mixed demand signals, directly influence this rivalry by potentially creating oversupply and driving price competition. The high capital intensity and significant exit barriers in mining also compel companies to maintain production, further intensifying competition among existing players.

| Competitor Type | Key Characteristics | Impact on Hudbay |

|---|---|---|

| Large Diversified Miners | Lower per-unit costs, economies of scale, broad product portfolios | Direct price competition, market share pressure |

| Mid-Tier Producers | Similar product focus, varying cost structures, regional strengths | Competition for specific market segments and resources |

| Exploration & Development Companies | Focus on new discoveries, potential future competitors | Long-term competitive landscape shifts |

SSubstitutes Threaten

For base metals like copper and zinc, the threat from alternative materials is a persistent concern. For instance, aluminum and plastics are increasingly used as substitutes for copper in electrical wiring and piping, offering lighter weight and often lower costs. In 2023, the global aluminum market was valued at over $150 billion, highlighting its significant presence as a substitute material.

Similarly, zinc faces competition from other alloys and advanced composites in applications such as coatings and die-casting. The development of new high-performance polymers and advanced ceramics continually introduces new possibilities for substitution across various manufacturing sectors. This dynamic landscape necessitates ongoing innovation and cost management for base metal producers.

The growing emphasis on environmental responsibility and the circular economy is significantly boosting metal recycling efforts. This trend means that recycled copper, zinc, gold, and silver are increasingly viable substitutes for metals extracted from new mining operations, directly impacting the demand for primary production.

For instance, the global copper recycling market was valued at approximately USD 35 billion in 2023 and is projected to grow. Similarly, the zinc recycling market is expanding, with significant volumes recovered annually. While Hudbay might engage in recycling, a substantial pivot by the industry towards secondary metal sourcing could diminish the market share and pricing power of companies focused on primary mining, like Hudbay.

Technological advancements pose a significant threat of substitution for Hudbay. For example, the ongoing development of advanced materials and lightweight composites in sectors like automotive and aerospace can decrease the demand for traditional metals such as copper and zinc, which are key products for Hudbay. This trend is amplified as industries prioritize sustainability and efficiency, seeking alternatives that offer comparable or superior performance with a lower environmental footprint.

Behavioral Shifts and Miniaturization

Behavioral shifts, like the growing preference for digital services over physical media, can significantly impact demand for certain metals. For instance, the ongoing trend towards miniaturization in electronics, a key driver in consumer behavior, means fewer raw materials are needed for each device. This reduction in material intensity per unit, while not a direct replacement for a metal, effectively diminishes the total volume of metals consumed in the industry. In 2023, the average smartphone size saw a slight decrease in overall dimensions compared to previous years, reflecting this ongoing miniaturization trend.

This evolution in product design and consumer preference acts as a subtle yet powerful substitute in the broader market for metals. As devices become smaller and more efficient, the aggregate demand for specific metals used in their construction can stagnate or even decline. Consider the automotive sector; the push for lighter vehicles to improve fuel efficiency often involves using advanced alloys and composites, indirectly reducing the reliance on traditional, heavier metals like steel in certain applications.

- Miniaturization in Electronics: Devices require less metal per unit, impacting aggregate demand.

- Digitalization of Services: Shift from physical to digital can reduce demand for metals used in physical media production.

- Lightweighting in Automotive: Use of advanced alloys and composites can substitute traditional metals.

- Consumer Preference Shifts: Changing tastes influence product design and material requirements.

Price-Performance Trade-offs

The viability of substitutes for Hudbay's primary metals—copper, zinc, gold, and silver—is largely determined by their respective price-performance trade-offs. If prices for these metals experience substantial increases, or if alternative materials emerge that offer similar functionality at a reduced cost, the threat of substitution becomes more pronounced. For instance, in the electrical conductivity sector, aluminum continues to be a key substitute for copper, with its price point being a significant driver of adoption. As of early 2024, the price differential between copper and aluminum significantly influences decisions in wiring and cable applications.

Hudbay needs to closely track these evolving dynamics to anticipate potential shifts in market demand. For example, advancements in composite materials or novel alloys could offer performance characteristics that rival traditional metals in certain applications. A sustained high price for gold, beyond its intrinsic value, might encourage greater use of gold-plated or imitation jewelry, impacting demand for the precious metal. Similarly, the cost-effectiveness of zinc in galvanizing versus alternative anti-corrosion coatings is a constant consideration for manufacturers.

- Price Sensitivity: Fluctuations in the global prices of copper, zinc, gold, and silver directly impact the attractiveness of their substitutes.

- Performance Parity: The development of substitutes that match or exceed the performance metrics of Hudbay's metals is a critical factor.

- Technological Advancement: Innovations in materials science can create new substitutes or improve the cost-performance of existing ones.

- Market Monitoring: Continuous analysis of substitute pricing and performance is essential for Hudbay to gauge potential demand erosion.

The threat of substitutes for Hudbay's core products, copper and zinc, is a significant factor. Alternatives like aluminum and plastics are increasingly competitive in applications such as electrical wiring, offering cost and weight advantages. For instance, the global aluminum market's valuation exceeding $150 billion in 2023 underscores its substantial role as a substitute.

Furthermore, advancements in composite materials and polymers continuously introduce new substitution possibilities, particularly in sectors prioritizing lightweighting and performance. The growing emphasis on sustainability also fuels the use of recycled metals, which directly compete with primary production. By early 2024, the price difference between copper and aluminum remained a key determinant in the adoption of aluminum for wiring.

| Metal | Key Substitutes | Factors Influencing Substitution |

|---|---|---|

| Copper | Aluminum, Plastics, Advanced Composites | Price, Weight, Electrical Conductivity, Cost-Performance Trade-off |

| Zinc | Other Alloys, Advanced Composites, Polymers | Corrosion Resistance, Cost, Performance Characteristics |

| Gold | Gold-Plated Materials, Imitation Jewelry | Price Volatility, Intrinsic Value vs. Aesthetic Appeal |

| Silver | Other Precious Metals, Industrial Materials | Industrial Applications, Investment Demand, Price Fluctuations |

Entrants Threaten

The mining industry demands colossal upfront investment, often running into billions of dollars for exploration, feasibility studies, mine construction, and essential infrastructure. These substantial capital requirements act as a significant hurdle, effectively limiting the number of new players who can realistically enter the market. For instance, developing a new copper mine can easily cost over $1 billion, a figure that deters many potential competitors.

The mining industry is heavily burdened by extensive regulatory and permitting processes. Establishing a new mine requires navigating complex environmental assessments, securing land use permits, and obtaining social licenses to operate. These hurdles can span many years and involve substantial costs, with a significant risk of denial or delays, thereby acting as a substantial barrier to entry for new competitors.

The threat of new entrants into the mining sector, particularly for companies like Hudbay, is significantly mitigated by the escalating difficulty in accessing high-quality ore bodies. Discovering and acquiring economically viable, rich mineral deposits is a growing challenge.

Most of the easily accessible and high-grade ore bodies have already been identified and are firmly held by established mining operations. This means new players must contend with higher exploration costs and greater geological uncertainty.

For instance, global exploration spending for base metals has seen fluctuations, but the trend over recent years points to increasing costs per discovery. In 2023, while specific figures vary by commodity, the general trend indicated that finding new, substantial deposits requires more advanced technology and deeper exploration efforts, often costing hundreds of millions of dollars before any production is even considered.

Hudbay's established reserves, built over years of strategic exploration and acquisition, represent a substantial competitive advantage, creating a significant barrier to entry for potential newcomers.

Economies of Scale and Experience Curve

Existing players like Hudbay leverage significant economies of scale in their operations, from mining and processing to raw material procurement. This scale allows them to achieve lower per-unit production costs, a barrier that new entrants would find difficult to overcome without substantial initial investment and immediate high-volume output. For instance, Hudbay's integrated operations at its Snow Lake operations in Manitoba, which include the Lalor mine and the New Britannia mill, contribute to cost efficiencies through shared infrastructure and expertise.

The mining industry also benefits from an experience curve; as companies like Hudbay gain more operational experience, they develop more efficient methods and a deeper understanding of geological complexities. This accumulated knowledge translates into improved recovery rates and reduced operational risks, further solidifying the cost advantage of incumbents. By 2024, Hudbay's long-standing presence and continuous operational improvements have honed its ability to manage these factors effectively, making it challenging for newcomers to compete on cost alone.

New entrants would face considerable hurdles in matching Hudbay's established cost structure. Consider the capital required for new mine development; projects often run into billions of dollars. For example, the estimated capital expenditure for new large-scale mining projects can easily exceed $1 billion. Without the benefit of existing infrastructure, established supply chains, and the learning curve advantages that Hudbay possesses, new entrants would likely operate at a significant cost disadvantage, limiting their ability to compete on price or profitability.

- Economies of Scale: Hudbay's integrated operations provide cost advantages in production, processing, and procurement.

- Experience Curve: Accumulated operational knowledge leads to greater efficiencies and risk management for incumbent firms.

- Cost Disadvantage for New Entrants: Newcomers struggle to match incumbent cost structures without significant initial investment and volume.

- Capital Investment Barrier: The high cost of developing new mining projects, often exceeding $1 billion, deters new market entrants.

Brand Reputation and Customer Relationships

Established mining companies like Hudbay often possess deep-rooted relationships with industrial buyers, refiners, and traders, built over years of consistent performance. These long-standing connections are crucial in securing off-take agreements and navigating complex supply chains. For instance, Hudbay's reputation for reliability and ethical sourcing, as evidenced by its operational history, provides a significant barrier to entry for newcomers. Building comparable trust and market access requires substantial time and investment, making it difficult for new players to displace incumbents.

New entrants face the daunting task of replicating the established brand reputation and customer loyalty that companies like Hudbay have cultivated. In the metals sector, where product differentiation is minimal, these relationships become paramount. A new mine operator would need to demonstrate not only a competitive cost structure but also a proven commitment to quality, environmental standards, and supply chain integrity to attract and retain customers. Hudbay's operational track record, including its consistent production levels, lends it considerable credibility in this regard.

- Brand Reputation: Established players benefit from years of consistent supply and quality, fostering trust with buyers.

- Customer Relationships: Long-term partnerships with key industrial buyers and traders create significant switching costs for customers.

- Time and Investment: New entrants require substantial capital and time to build comparable credibility and market access.

- Hudbay's Advantage: Hudbay's operational history and established network provide a strong defense against potential new competitors.

The mining industry presents formidable barriers to new entrants, primarily due to the immense capital required for exploration, development, and infrastructure, often exceeding $1 billion for a single project. Regulatory hurdles, including lengthy environmental assessments and permitting processes, further delay and increase the cost of entry. Established companies like Hudbay benefit from significant economies of scale and an experience curve, leading to lower per-unit production costs that are difficult for newcomers to match.

Accessing high-quality ore bodies is increasingly challenging, with most easily discoverable deposits already claimed by incumbents. Hudbay's established reserves and operational expertise create a substantial competitive advantage, making it difficult for new players to compete on cost or efficiency. Furthermore, deep-rooted relationships with industrial buyers and a strong brand reputation built on consistent performance and ethical sourcing act as significant deterrents for potential new entrants.

| Barrier Type | Description | Impact on New Entrants | Hudbay's Position |

|---|---|---|---|

| Capital Requirements | Developing new mines costs billions; exploration alone can reach hundreds of millions. | High hurdle, limits the number of potential competitors. | Established financial strength and access to capital. |

| Regulatory & Permitting | Complex, lengthy, and costly processes for environmental and land use approvals. | Significant delays and risk of project denial. | Experience navigating regulatory landscape. |

| Ore Body Access | High-grade, accessible deposits are scarce and controlled by incumbents. | Requires higher exploration costs and geological uncertainty. | Existing, proven reserves and strategic land holdings. |

| Economies of Scale & Experience | Incumbents benefit from lower per-unit costs and operational efficiencies. | New entrants face cost disadvantages without immediate high volume. | Integrated operations and years of honed expertise. |

| Customer Relationships & Brand | Established trust and long-term buyer relationships are hard to replicate. | Difficulty securing off-take agreements and market access. | Reputation for reliability and established supply chain partnerships. |

Porter's Five Forces Analysis Data Sources

Our HudBay Porter's Five Forces analysis is built upon a foundation of diverse and credible data sources, including HudBay's official annual reports, investor presentations, and press releases. This is supplemented by industry-specific market research reports and data from reputable financial information providers to ensure a comprehensive and accurate assessment of the competitive landscape.