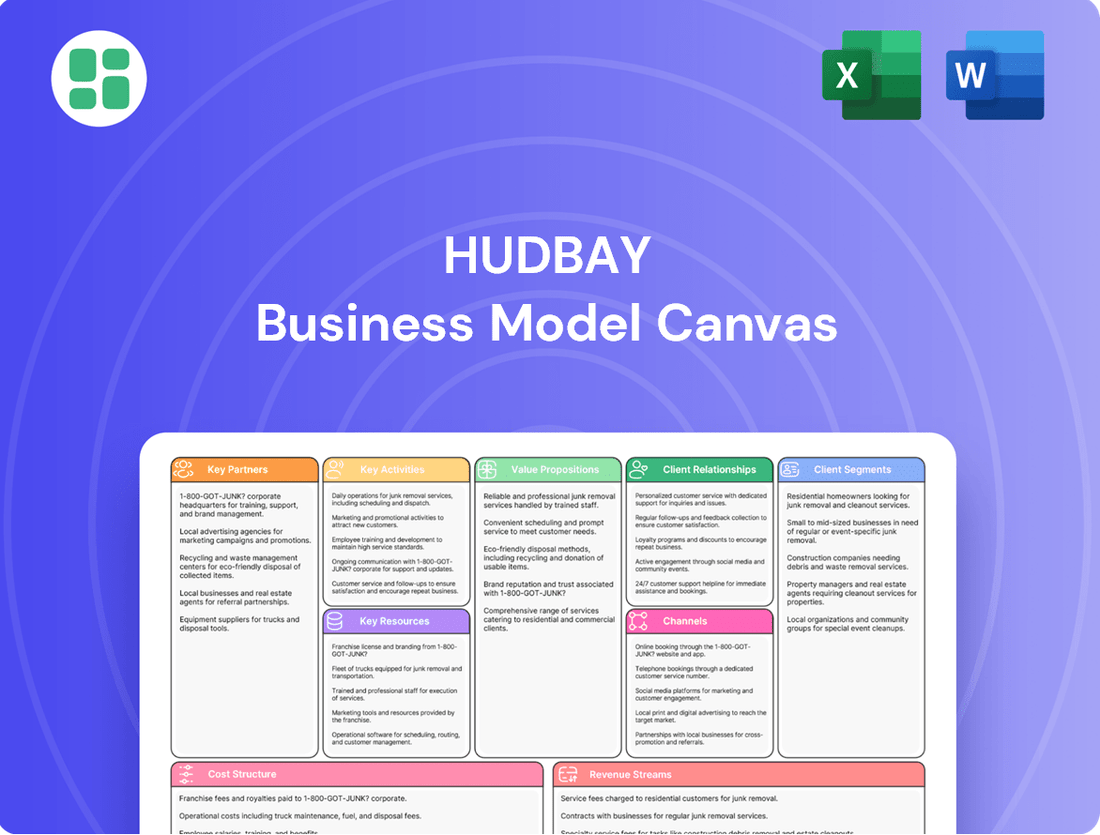

HudBay Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HudBay Bundle

Unlock the strategic blueprint of HudBay's operations with our comprehensive Business Model Canvas. This detailed analysis breaks down their value proposition, customer segments, and revenue streams, offering invaluable insights for anyone studying or competing in the mining sector.

Discover the core components that drive HudBay's success. Our full Business Model Canvas provides a clear, actionable framework detailing their key resources, activities, and cost structures, perfect for strategic planning and competitive analysis.

Ready to gain a competitive edge? Download the complete HudBay Business Model Canvas to explore their unique market approach, crucial partnerships, and channels to market. This is your key to understanding their proven strategy.

Partnerships

Hudbay is committed to fostering strong, respectful relationships with Indigenous communities in Peru, Manitoba, and Arizona. This involves creating a dedicated Indigenous relations strategy and participating in cultural awareness initiatives to promote mutual benefit and economic reconciliation.

Hudbay actively partners with government and regulatory bodies to obtain essential permits and adhere to stringent environmental and operational regulations. This collaboration is crucial for maintaining their license to operate and ensuring sustainable mining practices.

A key milestone in 2024-2025 was Hudbay securing all major permits for its Copper World project in Arizona. This success demonstrates effective navigation of the regulatory landscape and positive engagement with governmental agencies.

Hudbay actively partners with local suppliers and service providers, especially in Peru, to bolster its supply chain. This strategy directly contributes to the economic growth of its host communities, fostering goodwill and ensuring a more resilient operational base.

In 2024, Hudbay's commitment to local procurement in Peru saw significant growth, with a stated goal to increase the percentage of goods and services sourced from local businesses. This focus not only strengthens community ties but also diversifies Hudbay's supplier network, mitigating risks associated with single-source dependencies.

Mining Industry Associations and Safety Organizations

Hudbay actively participates in key industry associations like the Mining Association of Canada (MAC). Through these memberships, Hudbay engages with programs such as Towards Sustainable Mining (TSM), aiming to foster collaboration and share advancements in operational efficiency and safety.

These partnerships are crucial for Hudbay to stay at the forefront of industry best practices. For instance, the TSM program, which Hudbay adheres to, provides a framework for environmental, social, and governance performance. In 2023, the Canadian mining sector, represented by MAC, continued to emphasize responsible resource development, with TSM being a cornerstone of this commitment.

- Industry Collaboration: Membership in organizations like MAC facilitates knowledge exchange on safety protocols and environmental stewardship.

- Sustainability Focus: Adherence to programs like TSM demonstrates a commitment to responsible mining practices, aligning with global sustainability goals.

- Best Practice Adoption: These partnerships enable Hudbay to adopt and contribute to industry-wide improvements in safety and operational standards.

Strategic Joint Venture Partners for Project Development

Hudbay is strategically seeking minority joint venture partners for its significant growth initiatives, such as the Copper World project. This approach is designed to share the financial burden and reduce the inherent risks associated with large-scale capital investments. By bringing in external partners, Hudbay can also tap into specialized knowledge and additional funding sources crucial for advancing projects through definitive feasibility studies and into full development.

These partnerships are vital for Hudbay’s expansion plans, particularly for projects requiring substantial upfront capital. For instance, in 2024, Hudbay continued to engage with potential partners to secure funding for the Copper World project, aiming to share the costs of detailed engineering and environmental assessments. This collaborative model allows the company to pursue ambitious growth while managing its financial exposure effectively.

- Joint Venture Focus: Targeting minority partners for major growth projects like Copper World.

- Risk Mitigation: Sharing capital expenditure and de-risking large project development.

- Expertise & Capital Leverage: Accessing external knowledge and financial resources for feasibility studies and project advancement.

- 2024 Activity: Continued engagement with potential partners to fund Copper World's definitive feasibility study phase.

Hudbay's key partnerships extend to Indigenous communities, governments, local suppliers, and industry associations. These relationships are foundational for operational continuity, regulatory compliance, and sustainable development. In 2024, securing key permits for Copper World highlighted effective governmental engagement. Furthermore, a strategic focus on local procurement in Peru in 2024 aimed to bolster the supply chain and foster community economic growth.

| Partner Type | Purpose | 2024/2025 Focus/Activity | Impact |

|---|---|---|---|

| Indigenous Communities | Mutual benefit, economic reconciliation | Dedicated relations strategy, cultural awareness initiatives | Stronger community ties, social license to operate |

| Government & Regulatory Bodies | Permitting, regulatory compliance | Secured major permits for Copper World (Arizona) | License to operate, adherence to standards |

| Local Suppliers & Service Providers | Supply chain resilience, community economic growth | Increased local procurement in Peru | Economic development, diversified supplier base |

| Industry Associations (e.g., MAC) | Best practice sharing, advocacy | Participation in TSM program, knowledge exchange | Enhanced safety, environmental stewardship, operational efficiency |

| Potential Joint Venture Partners | Capital investment, risk sharing | Engaging partners for Copper World funding | De-risking large projects, accessing expertise and capital |

What is included in the product

A detailed HudBay Business Model Canvas outlining its mining operations, focusing on key customer segments like metal refiners and manufacturers, and its value proposition of reliable, responsibly sourced base metals.

This canvas provides a clear overview of HudBay's operational structure, revenue streams from metal sales, and cost drivers, offering insights into its strategic approach to resource extraction and market engagement.

The HudBay Business Model Canvas acts as a pain point reliever by providing a structured, visual representation of complex business operations, enabling quick identification of inefficiencies and areas for improvement.

It streamlines strategic planning by condensing intricate details into a single, easily digestible page, thereby reducing the time and effort traditionally spent on understanding and articulating a business model.

Activities

Hudbay actively pursues mineral exploration to grow its reserves, focusing on areas near current mines and promising new sites like Copper World and Mason. This strategy is crucial for long-term sustainability and future production.

In 2024, Hudbay continued its commitment to resource expansion through significant exploration expenditures. For instance, at the Copper World project, exploration efforts were geared towards defining and expanding the known mineralized zones, aiming to convert a substantial portion of its inferred resources into economically viable reserves.

The company’s approach involves detailed geophysical surveys and extensive infill drilling programs. These activities are designed to precisely delineate ore bodies and improve the confidence level of resource estimates, thereby supporting the conversion of inferred resources to measured and indicated categories, and ultimately to proven and probable reserves.

Hudbay's core activity revolves around the safe and efficient extraction of valuable minerals like copper, zinc, gold, and silver from its diverse mining sites in Peru (Constancia), Manitoba (Snow Lake operations, notably Lalor), and British Columbia (Copper Mountain). This necessitates ongoing efforts to refine mining techniques and upgrade machinery.

In 2024, Hudbay reported a significant increase in copper production, reaching 102,911 tonnes, a substantial rise from 79,334 tonnes in 2023, driven by strong performance at Constancia. Zinc production also saw an uptick, with 77,536 tonnes produced in 2024, compared to 73,713 tonnes in the prior year.

Hudbay operates concentrators at its mine sites, transforming raw ore into valuable copper, zinc, gold, and silver concentrates. These facilities employ sophisticated metallurgical techniques like crushing, grinding, and flotation to efficiently separate the desired metals from waste rock. In 2023, Hudbay's operations produced approximately 80,000 tonnes of copper concentrate and 150,000 tonnes of zinc concentrate, demonstrating the scale and effectiveness of its mineral processing.

Metal Marketing and Sales

Hudbay's metal marketing and sales function is crucial for distributing its primary products, including copper, zinc, gold, and silver concentrates, to a worldwide customer base. This involves a complex interplay of logistics management, the negotiation of sales contracts, and a keen awareness of global market demand for both base and precious metals.

The company actively manages the entire sales process, ensuring that its metal concentrates reach international markets efficiently. This requires navigating diverse regulatory environments and building strong relationships with buyers. For instance, in 2023, Hudbay's sales revenue was approximately $1.9 billion, underscoring the significant scale of its marketing and sales operations.

- Global Reach: Selling copper, zinc, gold, and silver concentrates to customers across various continents.

- Logistics Management: Overseeing the transportation and delivery of mined materials to buyers.

- Contract Negotiation: Securing favorable terms and pricing for its metal products through direct sales agreements.

- Market Responsiveness: Adapting sales strategies to fluctuations in global commodity prices and demand.

Environmental Management and Sustainability Initiatives

A core activity for Hudbay involves implementing responsible and sustainable mining practices. This encompasses minimizing environmental footprints, actively reducing greenhouse gas emissions, and diligently managing biodiversity. Reclamation efforts are also a critical part of this commitment.

Hudbay strives for excellence in sustainability, targeting high ratings within recognized protocols such as the Towards Sustainable Mining (TSM) initiative. This focus underscores their dedication to environmental stewardship throughout their operations.

- Responsible Mining Practices: Implementing measures to reduce environmental impact, including water management and waste rock disposal.

- Greenhouse Gas Emission Reduction: Setting targets and strategies to lower carbon intensity across operations, aligning with global climate goals.

- Biodiversity Management: Developing and executing plans to protect and enhance ecosystems in and around their mining sites.

- Reclamation Activities: Undertaking progressive and final site reclamation to restore land disturbed by mining.

Hudbay's key activities are centered around the responsible extraction and processing of valuable minerals. This includes exploration to expand reserves, like the ongoing work at Copper World, and the efficient mining and milling of ore at its operating sites in Peru and Canada. The company focuses on producing high-quality copper, zinc, gold, and silver concentrates.

In 2024, Hudbay reported significant production figures, with copper output reaching 102,911 tonnes and zinc production at 77,536 tonnes. These numbers reflect the successful operation of its concentrators, which transform raw ore into saleable metal concentrates, a critical step in their value chain.

The company's marketing and sales efforts are vital, ensuring these concentrates reach global markets. This involves managing complex logistics and negotiating sales contracts, with 2023 sales revenue approximating $1.9 billion. Furthermore, Hudbay prioritizes sustainable practices, aiming to reduce its environmental footprint and emissions, as demonstrated by its commitment to initiatives like Towards Sustainable Mining.

| Activity | 2024 Production (Tonnes) | 2023 Production (Tonnes) | Key Focus Area |

|---|---|---|---|

| Copper Production | 102,911 | 79,334 | Resource expansion and efficient extraction |

| Zinc Production | 77,536 | 73,713 | Operational efficiency and market demand |

| Exploration & Development | N/A | N/A | Growing reserves at sites like Copper World |

| Sales Revenue | N/A | ~$1.9 Billion | Global market penetration and contract negotiation |

Delivered as Displayed

Business Model Canvas

The HudBay Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you are seeing the complete, professionally formatted canvas, ready for your strategic planning needs. No mockups or samples, just the real deal, ensuring full transparency and immediate usability.

Resources

Hudbay's core strength lies in its substantial proven and probable mineral reserves, along with identified deposits of copper, zinc, gold, and silver. These resources form the bedrock of its operations and future growth potential.

The company's key mining assets are strategically located across North and South America. This includes the significant Constancia mine in Peru, the Snow Lake operations in Manitoba, Canada, the Copper Mountain mine in British Columbia, Canada, and the promising Copper World project situated in Arizona, USA.

As of the end of 2023, Hudbay reported total proven and probable mineral reserves of approximately 1.7 billion pounds of copper and 1.9 billion pounds of zinc. Gold and silver reserves also contribute significantly, with proven and probable gold reserves at roughly 3.2 million ounces and silver reserves at approximately 69.3 million ounces.

Hudbay's mining and processing infrastructure is the backbone of its operations, encompassing mines, concentrators, and processing plants. This includes vital power supply infrastructure and all the equipment needed for extracting and refining minerals.

Significant capital is consistently allocated to maintaining and enhancing this critical asset base. For instance, in 2023, Hudbay reported capital expenditures of $113.1 million, with a substantial portion directed towards sustaining and developing its mining properties and processing facilities, including mill optimization projects aimed at improving efficiency.

Hudbay's operations rely on a deeply experienced workforce, encompassing skilled geologists, engineers, and operators. This human capital is fundamental to optimizing extraction, ensuring efficient processing, and driving successful project development, all critical for maintaining profitability and achieving strategic objectives.

The company's management team boasts a proven track record in the mining sector, demonstrating expertise in strategic planning, financial management, and navigating complex regulatory environments. Their leadership is instrumental in guiding Hudbay through market fluctuations and identifying growth opportunities.

In 2024, Hudbay continued to invest in talent development and rigorous training programs, reinforcing its commitment to operational excellence and safety. A strong safety culture is paramount, minimizing risks and ensuring the well-being of its employees, which directly impacts productivity and operational continuity.

Capital and Financial Strength

Hudbay's capital and financial strength are underpinned by robust financial resources, including significant cash reserves and access to established credit facilities. This financial flexibility is crucial for funding its ongoing operations, ambitious exploration initiatives, and strategic growth projects across its portfolio. The company's commitment to maintaining a strong balance sheet and actively reducing its net debt is a key pillar of its financial strategy.

In 2024, Hudbay has been focused on enhancing its financial position. For instance, as of the first quarter of 2024, the company reported cash and cash equivalents of approximately $231 million. Furthermore, Hudbay has access to a revolving credit facility, providing additional liquidity. This financial discipline aims to ensure the company can weather market fluctuations and capitalize on opportunities.

- Cash Reserves: Approximately $231 million in cash and cash equivalents as of Q1 2024, providing immediate operational funding.

- Access to Credit: Maintains access to a revolving credit facility, offering substantial borrowing capacity for flexibility.

- Debt Management: Strategic focus on reducing net debt to strengthen the balance sheet and improve financial resilience.

- Free Cash Flow Generation: Efforts to generate positive free cash flow are integral to funding growth and shareholder returns.

Permits, Licenses, and Land Rights

Permits, licenses, and land rights are the bedrock of Hudbay's operations, enabling everything from exploration to full-scale production. These legal and regulatory approvals are not just formalities; they are critical gatekeepers for any new development. For instance, the Copper World project in Arizona faced a lengthy and complex permitting process, highlighting the significant undertaking involved in securing these essential rights.

Hudbay's ability to secure and maintain these rights directly impacts its project pipelines and overall business continuity. The company actively manages these requirements to ensure compliance and operational readiness. Key aspects include:

- Mining Permits: Essential for exploration, development, and extraction activities, ensuring adherence to safety and operational standards.

- Environmental Licenses: Crucial for managing environmental impact, including water usage, emissions, and land reclamation, often requiring detailed impact assessments and ongoing monitoring.

- Land Use Rights: Securing ownership or access to mineral rights and surface land is fundamental for project execution, involving negotiations and legal agreements with various stakeholders.

Hudbay's key resources are its substantial mineral reserves, strategically located mining assets, and robust infrastructure. These form the foundation for its operations and future growth.

The company's financial strength, including significant cash reserves and access to credit, combined with its experienced workforce and management team, are critical enablers.

Securing and maintaining necessary permits, licenses, and land rights are paramount for operational continuity and project development.

| Key Resource | Description | As of Q1 2024 / 2023 |

| Mineral Reserves | Proven and probable reserves of copper, zinc, gold, and silver. | Copper: 1.7 billion lbs, Zinc: 1.9 billion lbs, Gold: 3.2 million oz, Silver: 69.3 million oz (end of 2023) |

| Mining Assets | Constancia (Peru), Snow Lake (Canada), Copper Mountain (Canada), Copper World (USA). | Key operational and development sites. |

| Infrastructure | Mines, concentrators, processing plants, power supply, equipment. | Capital expenditures of $113.1 million in 2023 for maintenance and development. |

| Financial Resources | Cash reserves, revolving credit facility, focus on debt reduction. | Cash and cash equivalents: ~$231 million (Q1 2024). |

| Human Capital | Experienced geologists, engineers, operators, management team. | Ongoing investment in talent development and training in 2024. |

| Permits & Rights | Mining permits, environmental licenses, land use rights. | Critical for exploration, development, and extraction. |

Value Propositions

Hudbay offers a dependable stream of crucial metals like copper, zinc, gold, and silver. These are essential for industries worldwide and the shift towards cleaner energy. In 2023, Hudbay reported copper production of 77,200 tonnes and zinc production of 113,800 tonnes, demonstrating their capacity to meet demand.

Hudbay is dedicated to responsible mining, aligning with robust environmental, social, and governance (ESG) principles. This commitment includes adherence to the Towards Sustainable Mining (TSM) protocols and ambitious Greenhouse Gas (GHG) emission reduction targets, demonstrating a proactive approach to sustainability.

These practices resonate strongly with a growing segment of customers and investors who actively seek out and support companies prioritizing sustainably sourced materials and ethical operations.

In 2023, Hudbay reported a 15% reduction in Scope 1 and 2 GHG emissions intensity compared to their 2018 baseline, showcasing tangible progress towards their climate goals.

Hudbay's geographically diversified operations, with mines in Canada, Peru, and the United States, significantly reduce the risk associated with operating in a single region. This spread across stable jurisdictions ensures a more resilient production base, insulating the company from localized political or economic disruptions.

In 2024, this diversification proved crucial. For instance, while certain operational challenges might arise in one location, the consistent output from mines in other countries, such as the Snow Lake operations in Canada, helped maintain overall production levels and supply chain security for Hudbay's key commodities like copper and zinc.

Leverage to Copper and Gold Markets

Hudbay provides investors with substantial leverage to both copper and gold markets, a strategic advantage that balances its portfolio. The company's primary focus is copper, but its gold production acts as a crucial complementary element, enhancing overall financial performance and offering a hedge against market volatility.

This dual exposure is particularly beneficial during periods of elevated metal prices. For instance, in 2023, Hudbay's operations demonstrated strong free cash flow generation, directly benefiting from the favorable copper and gold price environment. This resilience allows for significant capital allocation flexibility.

- Copper Focus: Hudbay's core operations are centered around copper production, offering direct exposure to this essential industrial metal.

- Gold Complementarity: Gold production acts as a valuable secondary revenue stream, diversifying income and improving cash flow.

- Price Leverage: The company's financial results are highly sensitive to copper and gold price movements, creating significant leverage during upswings.

- Resilience and Cash Flow: This strategic market positioning contributes to operational resilience and attractive free cash flow generation, especially when metal prices are high.

Growth Potential from Project Pipeline

Hudbay's business model capitalizes on significant long-term growth opportunities stemming from its robust project pipeline. This pipeline is a key value proposition, promising substantial future returns for stakeholders.

A prime example is the fully permitted Copper World project located in Arizona. This development is poised to dramatically boost Hudbay's copper production volumes, underscoring the company's strategic focus on expanding its output of this critical metal.

- Copper World Project: Expected to be a major contributor to future copper supply.

- Production Increase: Significant uplift in copper output anticipated from development projects.

- Stakeholder Value: Projects are designed to create lasting value for investors and partners.

Hudbay's value proposition centers on its reliable production of essential metals like copper and zinc, crucial for global industries and the energy transition. The company's commitment to sustainable, ESG-focused mining practices, including GHG emission reductions, appeals to ethically-minded investors and customers. Furthermore, Hudbay offers investors significant leverage to copper and gold markets, supported by a robust project pipeline including the key Copper World development, promising future production growth and stakeholder value.

| Metric | 2023 Actual | 2024 Outlook (as of early 2024) | Notes |

|---|---|---|---|

| Copper Production (tonnes) | 77,200 | 75,000 - 85,000 | Reflects operational performance and guidance. |

| Zinc Production (tonnes) | 113,800 | 105,000 - 115,000 | Demonstrates consistent zinc output. |

| GHG Emissions Intensity Reduction (vs. 2018) | 15% | Targeting further reductions | Shows progress on sustainability goals. |

Customer Relationships

Hudbay cultivates robust customer relationships through long-term commercial contracts, primarily with industrial buyers of its base and precious metals. These agreements, often spanning multiple years, ensure a stable demand for its copper, zinc, gold, and silver concentrates, underscoring the importance of reliable supply and consistent product quality in fostering these enduring partnerships.

Hudbay actively cultivates strong investor relations through transparent communication, ensuring all stakeholders, from individual investors to large institutions, are well-informed. This commitment to openness is demonstrated through regular financial reports, investor presentations, and dedicated conference calls that detail company performance and strategic direction.

Hudbay actively cultivates robust, respectful connections with its host communities, prioritizing local hiring and investing in development initiatives. In 2024, Hudbay reported that its operations supported approximately 1,500 direct and indirect jobs in its operating regions, with a significant portion filled by local residents.

This dedication to social responsibility is foundational to building trust and maintaining a supportive environment for its operations. The company's community investment programs in 2024 focused on education and infrastructure, contributing to the long-term well-being of the areas where it operates.

Government and Stakeholder Dialogue

Hudbay actively engages in continuous dialogue and collaboration with governments, regulators, and other key stakeholders. This ensures compliance with regulations, facilitates the securing of necessary permits, and allows for proactive addressing of concerns. For instance, in 2023, Hudbay reported ongoing discussions with various levels of government regarding environmental, social, and governance (ESG) initiatives and project development timelines.

This proactive engagement is crucial for navigating complex regulatory landscapes and maintaining a strong social license to operate. By fostering these relationships, Hudbay aims to mitigate potential risks and create a stable operating environment. Their commitment to transparency in these dialogues is a cornerstone of their stakeholder management strategy.

- Government Relations: Maintaining open communication channels with national and local government bodies to align on operational standards and future development.

- Regulatory Compliance: Proactively working with regulatory agencies to ensure all permits and licenses are secured and maintained, as demonstrated by their adherence to environmental standards in 2023.

- Stakeholder Engagement: Collaborating with communities, indigenous groups, and NGOs to address concerns and build mutually beneficial relationships, a key aspect of their ESG framework.

- Permitting Processes: Streamlining and managing complex permitting processes through consistent dialogue, which is vital for project advancement and operational continuity.

Industry Collaboration and Best Practice Sharing

Hudbay actively engages with industry peers and associations to foster a culture of continuous improvement. This collaboration is vital for sharing best practices in critical areas such as safety protocols, environmental stewardship, and optimizing operational efficiency across the mining sector.

Through these partnerships, Hudbay benefits from collective knowledge, leading to enhanced industry-wide standards. For instance, in 2024, participation in forums like the Mining Association of Canada’s annual conference allowed for direct exchange on topics like reducing water usage in processing, a key focus for Hudbay’s sustainability goals.

- Safety Benchmarking: Participating in industry safety initiatives helps Hudbay align with and often exceed sector benchmarks. In 2023, the company reported a Total Reportable Injury Frequency Rate of 0.95, demonstrating a commitment to operational safety influenced by shared best practices.

- Environmental Management: Collaboration on environmental best practices, particularly in areas like tailings management and emissions reduction, directly informs Hudbay's sustainability strategy. The company aims to reduce its greenhouse gas intensity by 20% by 2030, a target supported by insights gained from industry collaborations.

- Operational Efficiency: Sharing insights on new technologies and process improvements with industry peers allows Hudbay to identify opportunities for greater efficiency. This can translate into cost savings and improved resource utilization, contributing to overall profitability.

- Knowledge Exchange Platforms: Engaging with associations provides access to research and development findings, as well as case studies on successful operational strategies from other leading mining companies.

Hudbay's customer relationships are primarily built on long-term contracts with industrial clients who purchase its base and precious metals. These agreements are crucial for securing stable demand and rely on Hudbay's consistent product quality and reliable supply. The company also actively manages investor relations through transparent reporting and engagement, ensuring stakeholders are informed about performance and strategy.

Furthermore, Hudbay prioritizes its relationships with host communities, focusing on local employment and development initiatives. In 2024, its operations supported around 1,500 direct and indirect jobs, with a substantial portion filled by local residents, underscoring a commitment to community well-being through investments in education and infrastructure.

Government and regulatory engagement is also key, ensuring compliance and facilitating operational continuity. Hudbay's proactive dialogue with these bodies, as seen in 2023 discussions on ESG and project timelines, is vital for navigating complex landscapes and maintaining its social license to operate.

Industry collaboration further enhances Hudbay's operational standards. By sharing best practices in safety, environmental stewardship, and efficiency, as demonstrated by participation in industry forums in 2024, the company aims for continuous improvement across its operations.

Channels

Hudbay primarily utilizes direct sales channels to move its metal concentrates, including copper, zinc, gold, and silver, to smelters, refiners, and other industrial customers worldwide. This approach involves direct negotiation of terms and the complex management of logistics to ensure timely delivery.

In 2024, Hudbay's direct sales strategy is crucial for its revenue generation, with metal prices significantly impacting its performance. For instance, the average realized price for copper in Q1 2024 was $3.84 per pound, directly reflecting the success of these direct sales negotiations.

Hudbay's investor relations website is the primary hub for all official company communications, including quarterly and annual financial reports, sustainability initiatives, and crucial news updates. This digital platform ensures that investors and the public have readily available access to comprehensive corporate data, fostering transparency.

Publications such as the annual report, which in 2023 detailed Hudbay's progress in key projects and financial performance, are vital for stakeholders. These documents, alongside investor presentations and press releases, provide in-depth insights into the company's strategy and operational achievements, supporting informed decision-making.

Hudbay actively participates in key financial and metals/mining conferences, alongside dedicated investor roadshows. These engagements are crucial for direct dialogue with investors, analysts, and financial professionals, offering them insights into Hudbay's strategic direction and operational performance.

In 2024, Hudbay's presence at events like the BMO Capital Markets Global Metals & Mining Conference and the TD Securities Mining Conference provided essential platforms. These gatherings allow the company to showcase its progress and future outlook, fostering transparency and investor confidence.

Press Releases and News Media

HudBay leverages official press releases distributed via wire services to announce significant business, operational, and financial achievements. This strategic communication channel ensures broad dissemination of information to a wide array of stakeholders, including investors and the financial community. For example, in 2024, HudBay continued to provide timely updates on its production figures and exploration successes.

Financial news outlets play a crucial role in amplifying these announcements, providing analysis and context that reaches an even wider audience. This coverage is essential for maintaining transparency and building confidence in the company's performance and future outlook. HudBay's commitment to sustainability is also a key theme communicated through these channels, highlighting their environmental and social governance (ESG) efforts.

- Press Release Distribution: Utilizes wire services for broad reach.

- Financial News Coverage: Amplifies announcements and provides analysis.

- Key Information Disseminated: Business, operating, financial, and sustainability performance.

- Stakeholder Engagement: Reaches investors, analysts, and the general public.

Sustainability Reports and ESG Platforms

Hudbay actively publishes dedicated sustainability reports, offering detailed insights into its environmental, social, and governance (ESG) performance. For instance, their 2023 sustainability report highlighted a 15% reduction in Scope 1 and 2 greenhouse gas emissions intensity compared to their 2020 baseline.

Participation in reputable ESG rating platforms like MSCI and Sustainalytics further amplifies Hudbay's commitment. These platforms provide a standardized framework for investors and stakeholders to assess the company's ESG practices, with Hudbay aiming to maintain or improve its ratings in these crucial areas.

- Dedicated Sustainability Reports: Providing in-depth data on environmental stewardship, social impact, and corporate governance.

- ESG Rating Platforms: Engaging with MSCI and Sustainalytics to benchmark performance and enhance transparency for investors.

- Communication Channel: Effectively conveying Hudbay's ESG strategy and achievements to a broad, specialized audience.

- Performance Benchmarking: Utilizing external assessments to identify areas for improvement and demonstrate progress.

Hudbay's channels focus on direct sales of its metal concentrates, primarily to smelters and refiners globally. This direct approach necessitates robust logistics management and negotiation expertise to secure favorable terms for copper, zinc, gold, and silver. The company also leverages digital platforms and in-person engagements to communicate with investors and stakeholders, ensuring transparency regarding its operations and financial performance.

In 2024, Hudbay's direct sales strategy remains paramount, with market prices directly influencing its financial outcomes. For example, the company reported an average realized copper price of $3.84 per pound in the first quarter of 2024, underscoring the importance of these direct sales channels.

Hudbay's investor relations website serves as a central repository for all official corporate information, including financial reports and sustainability efforts. This digital channel ensures accessibility for investors seeking comprehensive data. Furthermore, the company actively participates in industry conferences and investor roadshows, such as the BMO Capital Markets Global Metals & Mining Conference in 2024, to foster direct engagement and provide insights into its strategic direction.

Press releases, distributed through wire services, are a key channel for announcing significant business and operational updates, with timely information on production figures and exploration successes being provided throughout 2024. Financial news outlets amplify these announcements, offering analysis that broadens reach and builds stakeholder confidence, particularly concerning Hudbay's ESG initiatives.

| Channel Type | Key Activities | 2024 Relevance/Data |

| Direct Sales | Negotiation with smelters/refiners | Q1 2024 realized copper price: $3.84/lb |

| Investor Relations Website | Financial reports, news updates | Central hub for corporate data |

| Conferences & Roadshows | Direct engagement with investors | Participation in BMO Metals & Mining Conference 2024 |

| Press Releases | Announcements via wire services | Timely updates on production and exploration in 2024 |

Customer Segments

Global smelters and refiners represent Hudbay's core customer base, directly purchasing its copper, zinc, gold, and silver concentrates. These entities are industrial powerhouses, transforming raw materials into finished metals essential for various global industries.

These customers operate on a massive scale, requiring substantial and consistent volumes of concentrates to fuel their refining processes. Their operations are critical links in the supply chain, taking Hudbay's output and making it usable for manufacturing and other applications.

In 2024, the global demand for refined copper remained robust, driven by the energy transition and infrastructure development, with prices fluctuating around $8,000-$9,000 per tonne. Similarly, zinc prices saw volatility, influenced by supply constraints and industrial activity, trading in the range of $2,200-$2,600 per tonne.

Industrial manufacturers and consumers of metals are the bedrock of demand for Hudbay's products. These sectors, including automotive, electronics, construction, and renewable energy, rely heavily on base and precious metals for their manufacturing processes. For instance, the burgeoning electric vehicle market significantly drives the demand for copper, a key commodity for Hudbay. In 2024, the global automotive sector's appetite for copper is projected to remain robust, with EVs alone expected to consume substantial quantities.

Institutional investors and fund managers, including large pension funds and mutual funds, represent a crucial customer segment for HudBay. These entities seek capital appreciation and stable dividends, making HudBay's financial performance and growth outlook key considerations. In 2024, HudBay's strategic focus on advancing its Snow Lake operations and optimizing its existing mine portfolio is designed to appeal to their long-term investment horizons and demand for robust financial returns.

Individual Retail Investors

Individual retail investors, a diverse group from beginners to seasoned traders, are a key customer segment for HudBay. They are drawn to the mining sector for its potential to diversify investment portfolios and provide exposure to fluctuating commodity prices. These investors actively seek out information through a variety of channels, including financial news websites, investment forums, and direct company reports.

In 2024, retail investor participation in the stock market remained robust, with platforms like Robinhood and Charles Schwab reporting significant user growth. For instance, the average daily volume of shares traded by retail investors on major exchanges continued to be substantial, reflecting their active engagement. These investors often look for companies with clear growth strategies and stable commodity price outlooks, making HudBay's operational updates and financial disclosures particularly important for their decision-making.

- Diversification: Retail investors use mining stocks to spread risk across different asset classes.

- Commodity Exposure: They aim to profit from price movements in metals like copper and zinc.

- Information Sources: Access to company filings, financial news, and online investment communities is crucial.

- Market Trends: Interest in mining often correlates with global economic growth and infrastructure development.

Financial Analysts and Advisors

Financial analysts and advisors are key to Hudbay’s success, as they interpret the company's performance for a wider investment audience. These professionals, including those at major financial institutions, rely on detailed financial reports and market intelligence to formulate their recommendations. For instance, in 2024, analysts closely examined Hudbay's production figures, with the company aiming for significant growth in copper and zinc output.

- Data Needs: Analysts require access to Hudbay's quarterly earnings reports, production guidance, cost structures, and reserve estimates.

- Market Analysis: They scrutinize commodity prices, global demand trends for copper and zinc, and competitor performance to assess Hudbay's competitive position.

- Strategic Insights: Information on Hudbay's exploration activities, project development timelines, and capital allocation strategies is crucial for their valuations.

- 2024 Focus: Key areas of analysis in 2024 included the ramp-up of the Copper World project and the company's efforts to optimize its cost base amidst fluctuating market conditions.

Hudbay's customer segments are diverse, ranging from large-scale industrial smelters and refiners to individual investors. Global smelters and refiners are direct purchasers of Hudbay's concentrates, requiring substantial and consistent volumes. Industrial manufacturers and consumers of metals, including those in the automotive and electronics sectors, form another critical base, relying on Hudbay's output for their production processes.

Institutional investors and fund managers seek capital appreciation and dividends, making Hudbay's financial performance and growth strategies paramount. Similarly, individual retail investors are drawn to the mining sector for portfolio diversification and commodity price exposure, actively seeking information on company performance and market trends. Financial analysts and advisors play a vital role in interpreting Hudbay's data for the broader investment community, focusing on production, costs, and strategic developments.

| Customer Segment | Key Needs | 2024 Focus/Data Points |

|---|---|---|

| Global Smelters & Refiners | Consistent volume of copper, zinc, gold, silver concentrates | Robust copper demand driven by energy transition; zinc prices volatile due to supply constraints. |

| Industrial Manufacturers & Consumers | Metals for automotive, electronics, construction, renewable energy | Strong EV market demand for copper; construction sector's reliance on zinc for galvanizing. |

| Institutional Investors & Funds | Capital appreciation, stable dividends, long-term growth | Advancing Snow Lake operations; optimizing mine portfolio for robust financial returns. |

| Retail Investors | Portfolio diversification, commodity exposure, information access | Active market participation; interest in clear growth strategies and stable commodity outlooks. |

| Financial Analysts & Advisors | Detailed financial reports, market intelligence, production guidance | Analysis of production figures, cost optimization efforts, Copper World project ramp-up. |

Cost Structure

Mining and processing operating costs are the most significant elements in Hudbay's cost structure. These expenses encompass labor, energy such as fuel and electricity, essential consumables like reagents and explosives, and the upkeep of mining equipment. Contractor services at the mine sites also contribute substantially to these costs.

Hudbay actively pursues operational efficiencies to manage and reduce these substantial mining and processing expenses. For instance, in the first quarter of 2024, the company reported total cash costs per payable zinc of $1.05 per pound, demonstrating a focus on cost control within its operations.

Hudbay dedicates substantial capital and operating funds to exploration, aiming to uncover new mineral wealth. These expenditures cover essential activities like drilling programs and in-depth geological surveys to pinpoint promising deposits.

Developing new projects, such as the Copper World development, also represents a significant cost. This involves comprehensive feasibility studies and the initial groundwork required to bring a new mine into production, reflecting a long-term investment strategy.

For 2024, Hudbay's capital expenditures were projected to be between $430 million and $480 million, with a significant portion earmarked for growth projects like Copper World and Snow Lake. Exploration spending was also a key component, supporting the ongoing search for new resources.

Capital expenditures are a significant part of Hudbay's business, split between maintaining current operations and investing in future growth. In 2023, Hudbay reported sustaining capital expenditures of $123.7 million, essential for keeping their existing mines running smoothly.

Looking ahead, Hudbay is allocating substantial growth capital. For 2024, they have guided growth capital expenditures to be between $250 million and $300 million, with a notable portion earmarked for mill improvements and the development of the Copper World project in Arizona.

General and Administrative (G&A) Costs

Hudbay's General and Administrative (G&A) costs represent the essential corporate overhead that supports its mining operations. These include salaries for the executive team and administrative personnel, rent and utilities for corporate offices, and crucial expenses like legal counsel and ensuring regulatory compliance across its diverse mining sites. Hudbay actively pursues cost discipline throughout its operations to manage these overheads efficiently.

For 2024, Hudbay reported G&A expenses that reflect this commitment to operational efficiency. For instance, their focus on streamlined corporate functions aims to keep these costs in check relative to their revenue and production levels. Specific figures for G&A can be found within their detailed financial reports, often presented as a consolidated line item.

- Corporate Overhead: Covers executive salaries, administrative staff compensation, and office-related expenses.

- Professional Services: Includes significant outlays for legal fees, accounting services, and consulting.

- Regulatory Compliance: Costs associated with meeting environmental, social, and governance (ESG) standards and mining regulations.

- Cost Discipline: Hudbay's strategy emphasizes controlling these expenses to support overall profitability.

Environmental and Social Compliance Costs

Hudbay's cost structure significantly includes expenses tied to environmental and social compliance. These are not just regulatory burdens but strategic investments. For instance, in 2023, Hudbay reported expenditures on environmental rehabilitation and community relations as part of their operational costs. These outlays are crucial for maintaining their social license to operate and ensuring long-term sustainability.

Key components of these compliance costs involve:

- Environmental Regulations: Adhering to strict standards for emissions, water management, and waste disposal, which can involve significant capital and operational spending.

- Community Engagement: Funding programs and initiatives that benefit local communities where Hudbay operates, fostering positive relationships and addressing social impacts.

- Reclamation Activities: Costs associated with restoring land disturbed by mining operations, including site preparation, revegetation, and ongoing monitoring.

- Sustainability Initiatives: Investments in areas like decarbonization technologies to reduce greenhouse gas emissions and biodiversity conservation efforts to protect local ecosystems. For example, Hudbay has outlined targets for reducing its carbon footprint, which necessitates investment in cleaner energy sources and more efficient operational practices.

Hudbay's cost structure is heavily influenced by its mining and processing operations, with significant outlays for labor, energy, consumables, and equipment maintenance. The company's commitment to cost discipline is evident in its efforts to optimize these expenditures, as seen in its first quarter 2024 total cash costs per payable zinc of $1.05 per pound.

Beyond operational costs, substantial investments are directed towards exploration and project development, such as the Copper World project. For 2024, Hudbay projected capital expenditures between $430 million and $480 million, with a considerable portion allocated to growth initiatives and exploration.

Corporate overhead, including salaries, professional services, and regulatory compliance, forms another key part of Hudbay's cost structure. The company emphasizes cost discipline in managing these administrative expenses to maintain overall profitability.

Environmental and social compliance also represents a significant cost, viewed as a strategic investment for long-term sustainability and maintaining a social license to operate. These costs encompass adherence to environmental regulations, community engagement, and reclamation activities.

| Cost Category | Key Components | 2024 Projections/Data |

|---|---|---|

| Mining & Processing | Labor, Energy, Consumables, Equipment Maintenance, Contractor Services | Q1 2024 Cash Costs (Zinc): $1.05/lb |

| Exploration & Development | Drilling, Geological Surveys, Feasibility Studies, Project Groundwork | Capital Expenditures: $430M - $480M (including growth projects) |

| Corporate Overhead (G&A) | Executive Salaries, Admin Staff, Office Expenses, Legal, Accounting, Compliance | Focus on cost discipline and efficiency |

| Environmental & Social Compliance | Regulatory Adherence, Community Programs, Reclamation, Sustainability Initiatives | Expenditures on rehabilitation and community relations (2023 data) |

Revenue Streams

Hudbay's primary revenue stream is the sale of copper concentrate. This segment consistently represents the largest portion of the company's overall income, underscoring copper's central role in its operations.

In 2024, Hudbay's copper sales are projected to be a significant driver of its financial performance. The company's operations in Peru and Canada are key contributors to its copper output, with market demand for this essential metal remaining robust.

Gold sales represent a crucial and growing revenue stream for Hudbay, contributing significantly to its overall financial performance. This income is generated both from operations where gold is a primary output, such as at its Snow Lake operations, and as a valuable by-product from its copper mining activities.

The company has seen a substantial uplift in revenue from gold, largely driven by favorable market conditions. For instance, in the first quarter of 2024, Hudbay reported that gold sales contributed $100 million to its revenue, a notable increase from previous periods, reflecting the impact of robust gold prices.

Revenue is also generated from the sale of zinc concentrate, a key base metal produced by Hudbay's diversified mining operations. In 2023, Hudbay reported that zinc accounted for approximately 23% of its total revenue, highlighting its significance as a revenue driver.

Zinc often functions as a valuable by-product credit within Hudbay's operations. This means that the revenue from zinc sales helps to offset the costs associated with producing other primary metals, thereby improving the company's overall cost structure and profitability.

Silver Sales

Silver, often generated as a secondary product from copper and gold extraction, plays a role in Hudbay's income. These silver by-product credits, similar to those from zinc, contribute to reducing the company's overall net cash costs.

For instance, in the first quarter of 2024, Hudbay reported that its silver sales contributed significantly to offsetting its production costs. The average realized price for silver during this period was $22.62 per ounce, underscoring its importance as a revenue enhancer.

- Silver as a By-Product: Silver is primarily an ancillary output of Hudbay's core copper and gold mining operations.

- Cost Reduction: Sales of silver help to lower the company's net cash costs for its main metal products.

- Q1 2024 Performance: In the first three months of 2024, Hudbay benefited from silver sales, with an average realized price of $22.62 per ounce.

By-Product Credits and Other Metal Sales

Beyond its primary metal outputs, Hudbay's revenue streams are enhanced by the sale of by-product credits and other metals. For instance, the Constancia mine in Peru generates significant revenue from molybdenum, a valuable metal often found alongside copper. This diversification of revenue sources helps to offset operational expenses and bolsters overall profitability.

In 2024, Hudbay's by-product revenue played a crucial role in managing production costs. For example, molybdenum sales from Constancia contributed to reducing the net cash costs of copper production. This strategy is vital for maintaining a competitive cost structure in the often-volatile base metals market.

- Molybdenum Sales: The Constancia mine is a key contributor to Hudbay's by-product revenue through its molybdenum output.

- Cost Offsetting: Revenue from by-products directly reduces the net cash costs associated with producing primary metals like copper.

- Profitability Enhancement: The sale of secondary metals diversifies income and improves the company's overall financial performance.

- Market Volatility Mitigation: By-product credits provide an additional layer of financial resilience against fluctuations in primary metal prices.

Hudbay's revenue is primarily driven by the sale of copper concentrate, with significant contributions from gold and zinc sales, often generated as by-products. The company also benefits from the sale of other metals like molybdenum, which helps offset production costs and enhance overall profitability.

| Metal | Primary Role | 2024 Projection/Contribution |

|---|---|---|

| Copper | Primary revenue stream | Significant driver of financial performance; operations in Peru and Canada key contributors. |

| Gold | Crucial and growing revenue stream | Contributed $100 million in Q1 2024; strong market demand. |

| Zinc | Key base metal, by-product credit | Accounted for ~23% of total revenue in 2023; offsets production costs. |

| Silver | By-product credit | Helps lower net cash costs; Q1 2024 realized price of $22.62/oz. |

| Molybdenum | By-product revenue | Generated from Constancia mine, reduces copper production costs. |

Business Model Canvas Data Sources

The HudBay Business Model Canvas is informed by a blend of internal financial reports, operational data, and extensive market research. These sources provide a comprehensive view of HudBay's current operations and future potential.