HudBay Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HudBay Bundle

Uncover the strategic brilliance behind HudBay's market approach by delving into its Product, Price, Place, and Promotion. This analysis reveals how their integrated marketing efforts create a powerful competitive advantage.

Ready to gain a comprehensive understanding of HudBay's marketing success? Access the full, detailed 4Ps analysis now to unlock actionable insights for your own business strategies.

Product

Hudbay Minerals' diversified metal portfolio, featuring copper as its cornerstone alongside gold, zinc, silver, and molybdenum, offers a robust hedge against market fluctuations. This broad product mix appeals to a wide array of industrial applications and investor preferences, ensuring consistent demand across different economic cycles.

The company’s strategic emphasis on copper, a critical component in renewable energy technologies and electric vehicles, positions it favorably for long-term growth. For instance, global copper demand is projected to reach 30 million tonnes by 2030, driven by electrification and infrastructure development, a trend Hudbay is well-placed to capitalize on.

Hudbay's high-quality mineral reserves are a cornerstone of its product strategy, with long-life mines situated in stable, tier-one jurisdictions like Peru and Canada. These operations, including Constancia in Peru and Snow Lake in Manitoba, provide a reliable foundation for its metal supply.

The company's commitment to robust geological assessments and detailed mine planning underpins the substantial reserves at these key locations, such as Copper Mountain in British Columbia. This ensures a consistent and high-quality offering of essential metals for the market.

Hudbay's commitment to sustainable and responsible sourcing significantly bolsters its product offering. By integrating Environmental, Social, and Governance (ESG) principles, the company appeals to a growing segment of investors and consumers who value ethical production. This focus is not just about compliance; it's a strategic advantage in the current market.

In 2023, Hudbay reported a 15% reduction in Scope 1 and 2 greenhouse gas emissions intensity compared to their 2018 baseline, demonstrating tangible progress in environmental stewardship. Furthermore, their community investment programs saw a 10% increase in funding in 2024, reflecting a dedication to social responsibility.

Growth-Oriented Project Pipeline

Hudbay's growth-oriented project pipeline is a cornerstone of its future product strategy, aiming to substantially boost copper production. Key projects like Copper World in Arizona and Mason in Nevada are central to this expansion. These initiatives underscore Hudbay's commitment to increasing its resource base and solidifying its market position for the long term.

The company is actively investing in these future product offerings, anticipating significant increases in copper output beyond current operations. This strategic development pipeline is crucial for meeting projected market demand and enhancing shareholder value.

- Copper World (Arizona): Targeting an average annual production of approximately 125,000 tonnes of copper and 10,000 tonnes of zinc over its initial 16-year mine life. Construction is expected to commence in 2025, with initial production anticipated in 2027.

- Mason (Nevada): This project is in the feasibility study phase, with preliminary estimates suggesting an average annual production of around 110,000 tonnes of copper and 3,000 tonnes of zinc over a 20-year mine life.

- Exploration Efforts: Hudbay continues active exploration programs at its existing operations, such as Snow Lake in Manitoba, aiming to extend mine life and discover new, economically viable deposits.

Concentrate and Dore s

Hudbay's core products are metal concentrates, such as copper concentrate, and doré, which is a mix of gold and silver. These are essentially intermediate products that Hudbay sells to other companies who then refine them into pure metals. The value of these products hinges on their precise composition and the efficiency with which Hudbay can extract the metals.

The specifications that make Hudbay's concentrates attractive to smelters and refiners worldwide include the grade of the metals contained and the recovery rates achieved during processing. For instance, in 2023, Hudbay reported an average copper recovery rate of 86.5% across its operations, a figure crucial for its customers' profitability. These metrics directly influence the marketability and pricing of Hudbay's output.

Hudbay actively focuses on improving its operational efficiency to boost the value of its concentrates and doré. This involves optimizing mill throughput, which is the amount of material processed per unit of time, and enhancing metallurgical recovery rates. Such efforts ensure that the company extracts as much valuable metal as possible from the ore, directly impacting its revenue and competitiveness in the global market.

- Copper Concentrate: A key output, sold to third-party smelters and refiners.

- Doré: A semi-pure alloy of gold and silver, also sold for further refining.

- Key Product Specifications: Metal grades and recovery rates are critical selling points.

- Operational Focus: Optimizing mill throughput and metallurgical recoveries to enhance product value.

Hudbay's product strategy centers on high-quality copper and zinc concentrates, alongside gold and silver doré. These are intermediate products sold to smelters and refiners, with their value determined by metal grades and recovery rates. For example, in 2023, Hudbay achieved an average copper recovery rate of 86.5% across its operations, a critical factor for customer profitability.

| Product | Description | Key Value Drivers | 2023 Production (Tonnes) | Projected Copper Production Increase (by 2027) |

| Copper Concentrate | Intermediate product for smelting and refining | Copper grade, recovery rates, impurity levels | ~74,000 (Copper content) | Significant increase from Copper World project |

| Zinc Concentrate | Intermediate product for smelting and refining | Zinc grade, recovery rates | ~63,000 (Zinc content) | Included in Copper World project |

| Gold & Silver Doré | Semi-pure alloy of gold and silver | Gold and silver content, purity | ~34,000 (Gold equivalent ounces) | Associated with copper and zinc production |

What is included in the product

This analysis offers a comprehensive examination of HudBay's marketing strategies, dissecting its Product, Price, Place, and Promotion tactics with real-world examples and strategic implications.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of overwhelming data for strategic decision-making.

Provides a clear, concise overview of HudBay's 4Ps, easing the burden of understanding and communicating their market approach.

Place

Hudbay's metals, like copper and zinc, are fundamental raw materials traded on global commodity markets, not sold directly to consumers. This strategy grants them access to a wide array of buyers, from industrial giants to specialized traders and financial players across the globe. The inherent liquidity and price discovery mechanisms within these markets are crucial for Hudbay's sales strategy.

Hudbay's operational footprint is strategically positioned across Peru, Manitoba, and British Columbia, with ambitious growth projects slated for Arizona and Nevada in the United States. These locations are not random; they are selected for their abundant mineral deposits and their standing as tier-one mining jurisdictions, which ensures a dependable supply of resources. This diverse geographical spread is crucial for minimizing regional operational risks and bolstering the security of its supply chain.

Hudbay's direct sales strategy primarily targets industrial buyers like smelters and refiners, essential partners for processing their metal concentrates. These long-term relationships are vital for securing consistent demand and managing the complex logistics involved in transporting bulk commodities from their mine sites to processing plants. For instance, in 2023, Hudbay's zinc concentrate sales were largely underpinned by agreements with third-party smelters, ensuring a predictable revenue stream for this segment.

Efficient Logistics and Supply Chain

Hudbay's 'place' strategy hinges on its sophisticated logistics for moving vast quantities of ore and concentrates. This involves intricate networks to transport materials from remote mine locations to processing facilities and ultimately to global ports for export. The company's substantial infrastructure investment is key to managing this complex, worldwide distribution efficiently.

Ensuring products reach buyers promptly and cost-effectively requires meticulous inventory management and optimized transportation routes. For instance, in 2023, Hudbay reported significant progress in its logistical operations, including advancements in its transportation corridors, which are vital for its international market presence and competitive advantage.

- Mine-to-Plant Transportation: Utilizing specialized fleets and infrastructure to handle bulk ore movement from sites like Snow Lake to processing centers.

- Concentrate to Port Logistics: Managing rail and truck transport of processed concentrates to major ports such as Churchill, Manitoba, and Thunder Bay, Ontario.

- Global Distribution Network: Leveraging established relationships with shipping lines and port authorities to facilitate international sales and timely delivery to customers.

- Supply Chain Cost Optimization: Continuously seeking efficiencies in fuel consumption, route planning, and inventory holding to reduce overall supply chain expenditures.

Investor and Capital Markets Presence

Hudbay's investor and capital markets presence is crucial, extending beyond its physical mining operations to its listings on major stock exchanges like the Toronto Stock Exchange (TSX) and the New York Stock Exchange (NYSE). This dual listing provides broad access to capital and a diverse investor base. For instance, as of early 2024, Hudbay's market capitalization fluctuated, reflecting investor sentiment and commodity prices, demonstrating the direct link between its operational performance and its standing in financial markets.

The company actively engages in investor relations to foster transparency and build confidence among financial stakeholders. This includes regular financial reporting, investor calls, and participation in industry conferences. These efforts are vital for attracting new investment and maintaining the liquidity of its shares, which is essential for its ongoing capital-raising activities and overall financial health. In 2023, Hudbay reported significant progress in its sustainability initiatives, a key factor increasingly considered by investors in their decision-making processes.

- Dual Exchange Listings: Hudbay is traded on both the TSX and NYSE, enhancing its accessibility to a global investor pool.

- Capital Raising: Its presence in capital markets facilitates the raising of funds necessary for project development, exploration, and operational expansion.

- Investor Relations: Proactive engagement with investors ensures clear communication regarding company performance, strategy, and ESG (Environmental, Social, and Governance) factors.

- Market Liquidity: Active trading on major exchanges provides essential liquidity for shareholders, allowing for easier buying and selling of Hudbay stock.

Hudbay's place strategy is deeply rooted in its global operational footprint and sophisticated logistics. The company mines in Peru, Manitoba, and British Columbia, with expansion plans in Arizona and Nevada. This geographical diversity is key to managing supply chain risks and ensuring resource availability.

The movement of mined materials is a critical component, involving extensive infrastructure for transport from mines to processing facilities and then to global ports. In 2023, Hudbay highlighted advancements in its transportation corridors, underscoring the importance of efficient logistics for its international market presence and competitive edge.

Hudbay's sales primarily occur through global commodity markets, accessing a broad range of industrial buyers, traders, and financial entities. Its 2023 zinc concentrate sales, for instance, were largely secured through agreements with third-party smelters, providing a stable revenue base.

The company's logistical network is designed for cost-effectiveness and timely delivery, managing everything from mine-to-plant ore movement to concentrate transport to ports like Churchill and Thunder Bay. This global distribution network is vital for meeting customer demands worldwide.

| Operational Locations | Key Logistics Hubs | Primary Sales Channels |

|---|---|---|

| Peru, Manitoba, British Columbia | Churchill, Manitoba; Thunder Bay, Ontario | Global Commodity Markets |

| Expansion: Arizona, Nevada (USA) | Rail, Truck, Shipping Lines | Industrial Buyers (Smelters, Refiners) |

| Focus on Tier-One Jurisdictions | Supply Chain Cost Optimization | Long-term Sales Agreements |

What You See Is What You Get

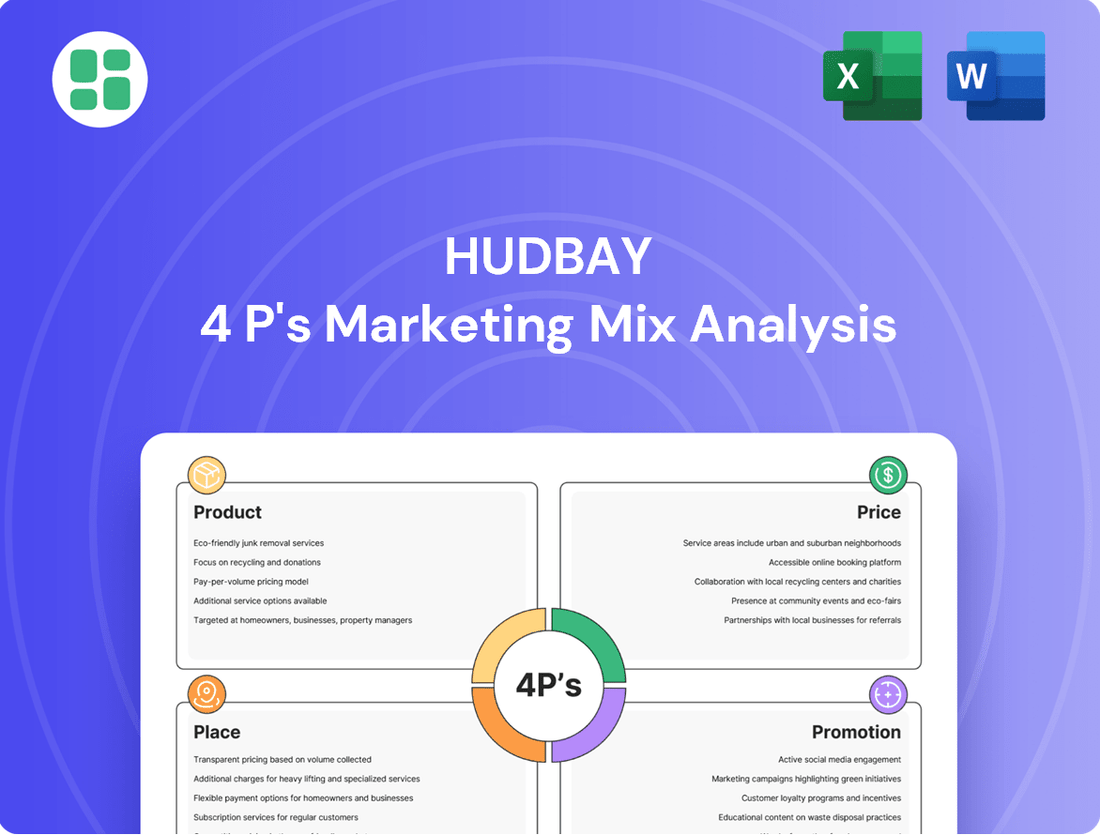

HudBay 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive HudBay 4P's Marketing Mix Analysis is fully complete and ready for your immediate use. You're viewing the exact version you'll download, ensuring you get precisely what you expect.

Promotion

Hudbay's promotional strategy heavily emphasizes investor relations, aiming to connect with a financially savvy audience comprising institutional and individual investors, analysts, and other financial professionals. This engagement is facilitated through consistent communication channels such as quarterly earnings calls, in-depth investor presentations, and timely news releases. These platforms provide crucial updates on financial performance, operational milestones, and the company's forward-looking strategy, with the ultimate objective of fostering investor confidence and securing necessary capital for growth.

Hudbay consistently provides detailed annual reports and quarterly financial results, offering stakeholders transparent insights into its business operations and financial performance. These reports are crucial for understanding the company's progress and strategic direction.

For instance, Hudbay's 2024 third-quarter report, released in November 2024, highlighted a significant increase in revenue driven by strong zinc and copper prices. The company also provided updated production guidance for the full year 2024, indicating a positive outlook for its key mining operations.

These disclosures, often supplemented by webcasts and conference calls, serve as primary communication channels. They allow Hudbay to effectively inform investors and analysts about its financial achievements, operational updates, and future strategic plans, fostering greater transparency and trust.

Hudbay emphasizes its dedication to sustainability, environmental care, and community involvement. This commitment is clearly communicated through specific sections in their annual reports and on their official website, showcasing responsible mining and climate strategies.

In 2023, Hudbay reported a 20% reduction in Scope 1 and 2 greenhouse gas emissions intensity compared to their 2018 baseline, demonstrating tangible progress in their climate change strategies. This focus on responsible operations is designed to attract investors prioritizing environmental, social, and governance (ESG) factors.

Corporate Website and Digital Presence

Hudbay's corporate website is the cornerstone of its digital presence, offering a comprehensive repository for investors, employees, and the public. It provides immediate access to crucial data, including financial reports and operational updates, fostering transparency. For instance, as of Q1 2024, Hudbay reported adjusted EBITDA of $118 million, a figure readily available on their investor relations portal.

This digital platform functions as a 24/7 communication channel, ensuring stakeholders worldwide can access the latest news, sustainability initiatives, and corporate governance information. It’s designed for ease of navigation, facilitating informed decision-making for a diverse audience. The site also highlights Hudbay's commitment to environmental, social, and governance (ESG) principles, a key focus for many investors in 2024.

- Centralized Information Hub: Official website serves as the primary source for all corporate news, financial data, and sustainability reports.

- Global Accessibility: Ensures stakeholders across the globe can easily access up-to-date information on Hudbay's performance and activities.

- Continuous Communication: Acts as an always-on channel for disseminating important corporate updates and investor materials.

- Transparency and Engagement: Facilitates informed decision-making by providing readily available and transparent information, crucial for investor confidence in 2024.

Industry Conferences and Presentations

Hudbay actively engages in key industry conferences, such as the BMO Capital Markets Global Metals, Mining & Critical Minerals Conference, which in 2024 saw over 1,500 attendees, including a significant number of institutional investors and mining executives. These platforms are crucial for senior management to directly communicate Hudbay's strategic direction, operational performance, and exploration success to a highly relevant audience.

Presentations at these events, including the Denver Gold Forum, allow Hudbay to highlight its unique value proposition, such as the integrated operations in the 777 mine and the Copperton mill, and its progress on projects like the Copper World development in Arizona. This direct communication helps to build credibility and attract potential investors by showcasing tangible growth opportunities and operational efficiencies.

These appearances serve a dual purpose: reinforcing Hudbay's market position as a responsible and growth-oriented mid-tier producer and actively seeking to broaden its investor base. For instance, in 2023, Hudbay presented at over a dozen investor and mining-focused conferences, facilitating direct dialogue with analysts and portfolio managers, which is vital for valuation and market perception.

- Targeted Audience Engagement: Conferences attract investors, analysts, and industry peers, providing direct access to key decision-makers.

- Strategic Communication: Management leverages these forums to articulate Hudbay's growth strategy, operational strengths, and project advancements.

- Market Positioning: Consistent participation enhances visibility and reinforces Hudbay's reputation within the mining and investment community.

- Investor Relations: These events are critical for fostering relationships, attracting new capital, and supporting the company's stock performance.

Hudbay's promotional efforts are deeply integrated with its investor relations strategy, focusing on clear, consistent communication to a financially astute audience. This includes detailed financial reports, sustainability disclosures, and active participation in industry events to build investor confidence and attract capital.

The company's commitment to ESG principles is a significant promotional element, highlighted by a 20% reduction in Scope 1 and 2 greenhouse gas emissions intensity by 2023 compared to a 2018 baseline. This focus resonates with investors prioritizing responsible operations.

Hudbay leverages its corporate website as a central hub for information, ensuring global accessibility to financial data, operational updates, and sustainability initiatives. As of Q1 2024, the company reported adjusted EBITDA of $118 million, a figure readily available to stakeholders.

Furthermore, participation in key industry conferences, such as the BMO Capital Markets Global Metals, Mining & Critical Minerals Conference in 2024, allows Hudbay's senior management to directly communicate strategic direction and operational performance to a targeted audience of investors and executives.

| Communication Channel | Key Information Disseminated | Target Audience | 2024/2025 Relevance |

|---|---|---|---|

| Investor Relations (Earnings Calls, Presentations) | Financial performance, operational milestones, strategic outlook | Institutional and individual investors, analysts | Regular updates on zinc and copper production, project development (e.g., Copper World) |

| Annual and Quarterly Reports | Detailed financial results, operational progress, ESG initiatives | All stakeholders | Transparency on financial health and sustainability efforts |

| Corporate Website | Latest news, financial data, ESG reports, governance information | Global investors, employees, public | 24/7 access to critical data, including Q1 2024 adjusted EBITDA of $118 million |

| Industry Conferences | Strategic direction, operational strengths, growth opportunities | Investors, analysts, industry peers | Direct engagement to showcase value proposition and attract investment |

Price

Hudbay's revenue is intrinsically tied to the global commodity markets, where its primary products—copper, gold, zinc, and silver—are traded. For instance, as of mid-2024, copper prices have seen fluctuations, trading around $4.00 per pound, while gold has remained strong, hovering near $2,300 per ounce. These prices are not set by Hudbay but are instead dictated by broader supply and demand forces, macroeconomic trends, and geopolitical stability.

As a price-taker, Hudbay has no control over the selling price of its output. This means the company's financial performance is directly exposed to the volatility of these external commodity markets. For example, a significant drop in zinc prices, which have recently traded in the range of $1.00 to $1.20 per pound, would directly reduce Hudbay's revenue without any ability to offset it through pricing adjustments.

Consequently, Hudbay's strategic imperative is to maintain rigorous cost efficiency throughout its operations. By focusing on lowering its production costs, the company can better preserve profit margins even when commodity prices are unfavorable. This focus on operational excellence is crucial for navigating the inherent price-taking nature of its business in the global marketplace.

Hudbay's pricing strategy is deeply rooted in its cost leadership, striving for industry-leading margins to buffer against commodity price volatility. This approach is crucial for maximizing profitability, especially given the inherent fluctuations in metal markets.

The company has demonstrated remarkable success in cost control, notably achieving negative copper cash costs in certain periods. This impressive feat is largely due to substantial by-product credits generated from gold and other metals mined alongside copper.

For instance, in the first quarter of 2024, Hudbay reported a total cash cost of $0.72 per pound of copper, significantly below the market price, showcasing their cost efficiency. This allows them to maintain profitability even when copper prices experience downturns.

Hudbay's by-product credits from gold, silver, and zinc are a significant factor in its cost structure. For instance, in the first quarter of 2024, by-product credits reduced Hudbay's copper production costs by approximately $0.60 per pound. This effectively lowers the company's net cash cost for copper, making its primary product more competitive.

These credits are vital for Hudbay's profitability, directly impacting its bottom line. In 2023, the company reported total by-product revenues of over $250 million, which substantially offset its operating expenses. The higher the market prices for these metals, the greater the reduction in Hudbay's net copper costs.

Strategic Hedging and Financial Management

Hudbay's strategic hedging, particularly its unrealized copper hedges, aims to cushion the impact of fluctuating commodity prices, offering a degree of revenue predictability. For instance, in the first quarter of 2024, the company reported that its hedging program provided a benefit of approximately $10 million to its adjusted EBITDA, demonstrating its effectiveness in managing price volatility.

Beyond hedging, robust financial management is crucial. Hudbay's focus on debt reduction and generating strong free cash flow enhances its resilience. As of the end of the first quarter of 2024, the company had a net debt of $1.1 billion, and its continued efforts to improve cash generation are key to navigating market downturns.

- Strategic Hedging: Unrealized strategic copper hedges in Q1 2024 benefited adjusted EBITDA by approximately $10 million.

- Financial Strength: Focus on debt reduction, with net debt standing at $1.1 billion at the end of Q1 2024.

- Cash Flow Generation: Strong free cash flow is vital for navigating market cycles and funding operations.

- Market Resilience: Effective financial management allows Hudbay to better withstand commodity price swings.

Long-Term Metal Assumptions

Hudbay's long-term metal price assumptions are crucial for validating the economic feasibility of its mineral reserves and estimating future resources across copper, gold, silver, zinc, and molybdenum. These assumptions are foundational for strategic investment decisions, particularly for new project development and extending the operational life of existing mines.

The company's approach focuses on a sustained, long-term perspective of commodity market prices, deliberately setting aside short-term volatility to ensure robust financial planning. For instance, as of early 2024, Hudbay's internal assumptions for copper were around $3.50 per pound, gold at $1,800 per ounce, and zinc at $1.20 per pound, reflecting a cautious yet optimistic outlook on market stability.

- Copper: Assumed long-term price of $3.50/lb (early 2024).

- Gold: Assumed long-term price of $1,800/oz (early 2024).

- Zinc: Assumed long-term price of $1.20/lb (early 2024).

- Silver and Molybdenum: Prices are also factored into reserve and resource estimations, though specific figures vary based on market analysis.

Hudbay operates as a price-taker, meaning it must accept the prevailing market prices for its copper, gold, zinc, and silver. This reliance on global commodity markets makes its revenue highly susceptible to price fluctuations. For example, as of mid-2024, copper prices hovered around $4.00 per pound, while gold remained strong near $2,300 per ounce, illustrating the external forces dictating Hudbay's earnings.

The company's strategy centers on cost leadership to mitigate the impact of price volatility. By achieving industry-leading low production costs, Hudbay aims to maintain healthy profit margins even during periods of depressed commodity prices. This focus on operational efficiency is paramount for its financial stability.

A key element of Hudbay's cost management involves leveraging by-product credits. The gold, silver, and zinc mined alongside copper significantly reduce the net cost of copper production. In Q1 2024, by-product credits lowered Hudbay's copper cash costs by approximately $0.60 per pound, demonstrating their substantial contribution to profitability.

To further manage price risk, Hudbay employs strategic hedging. In Q1 2024, its unrealized copper hedges provided a benefit of about $10 million to adjusted EBITDA, offering a degree of revenue predictability and cushioning against market downturns.

| Commodity | Market Price (Mid-2024 Est.) | Hudbay Long-Term Price Assumption (Early 2024) | Q1 2024 Copper Cash Cost (Net) | Q1 2024 By-Product Credit Impact on Copper |

|---|---|---|---|---|

| Copper | ~$4.00/lb | $3.50/lb | $0.72/lb | ~$0.60/lb |

| Gold | ~$2,300/oz | $1,800/oz | N/A | Significant |

| Zinc | ~$1.00-$1.20/lb | $1.20/lb | N/A | Significant |

4P's Marketing Mix Analysis Data Sources

Our HudBay 4P's Marketing Mix Analysis is grounded in comprehensive data, including official company reports, investor briefings, and direct observations of their product offerings and market presence. We also incorporate industry analyses and competitive intelligence to ensure a holistic view of their strategy.