HudBay Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HudBay Bundle

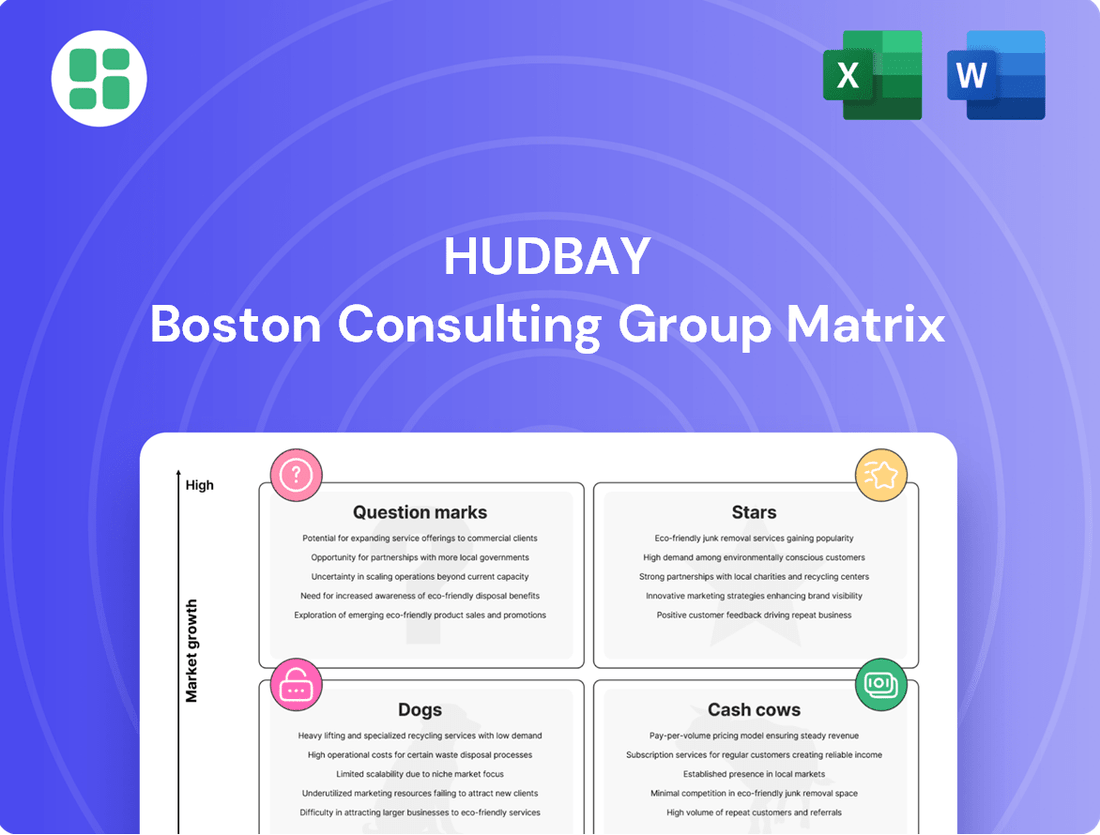

Curious about HudBay's strategic product portfolio? Our BCG Matrix preview offers a glimpse into their market positioning, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Don't miss out on the full picture; purchase the complete BCG Matrix for actionable insights and a clear roadmap to optimize HudBay's investments and drive future growth.

Stars

Hudbay is poised to benefit from the booming copper market, fueled by electrification and the global shift towards renewable energy. The company projects a significant uptick in its copper output, with consolidated production expected to jump 17% by 2027 from its 2024 levels. This expansion is a direct result of efficiency improvements at current operations and progress on key copper development projects.

The gold market has been exceptionally strong, with prices hitting record highs in 2024 and continuing this trend into 2025. This surge is largely driven by global geopolitical tensions and significant buying from central banks worldwide.

Hudbay capitalized on this robust market, achieving its highest-ever annual gold production in 2024. Gold’s contribution to Hudbay’s overall revenue is substantial and expanding, reflecting a solid position in a rapidly growing sector, allowing the company to fully leverage current market advantages.

Hudbay's acquisition of full ownership in the Copper Mountain mine is a game-changer, significantly boosting its copper output. By 2027, this asset is expected to contribute a remarkable 127% more attributable copper production compared to 2024 levels, solidifying its position in the copper market.

Industry-Leading Margins and Free Cash Flow

Hudbay's focus on operational efficiency has translated into impressive financial results. In 2024, the company achieved industry-leading margins, a testament to its streamlined production processes. This enhanced profitability also allowed Hudbay to generate record annual free cash flow.

This strong free cash flow generation, reaching $315 million in 2024, underscores the robust performance of its core copper and gold operations. These assets are not only highly efficient but also well-positioned to benefit from current market demand. Such financial strength provides a solid foundation for future strategic investments.

- Industry-Leading Margins: Hudbay's operational improvements have boosted profitability.

- Record Free Cash Flow: The company generated $315 million in free cash flow in 2024.

- Core Operation Strength: Copper and gold assets are performing exceptionally well.

- Investment Capacity: Strong cash flow enables funding of growth initiatives.

Strategic Reinvestment in Growth

Hudbay is strategically reinvesting significant capital into its most promising growth projects. This focus aims to bolster its presence and market share in the increasingly sought-after copper and gold sectors. For instance, in 2024, Hudbay continued to advance its mill throughput enhancement projects in British Columbia and Peru, underscoring a commitment to expanding its production capacity in these key commodities. This approach is typical for managing 'Star' products within the BCG matrix, ensuring they receive the necessary resources to maintain and accelerate their growth trajectory.

These investments are designed to solidify Hudbay's leadership in copper and gold. The company's 2024 capital expenditure plan reflected this, with a substantial allocation towards projects expected to yield high returns and increase output. By channeling funds into initiatives like the Copper World project in Arizona, which is projected to contribute significantly to copper production, Hudbay is actively nurturing its 'Star' assets. This proactive capital deployment is crucial for capitalizing on favorable market conditions for these metals.

- Strategic Reinvestment: Hudbay is channeling growth capital into high-return projects, particularly in copper and gold.

- Key Projects: Initiatives like mill throughput improvements in British Columbia and Peru are central to this strategy.

- Market Focus: The company aims to increase exposure and market share in high-demand copper and gold markets.

- Star Product Nurturing: This aggressive investment approach is characteristic of developing and sustaining 'Star' products within the BCG framework.

Hudbay's copper and gold operations are clearly its Stars in the BCG matrix, exhibiting high market growth and strong competitive positions. The company's strategic reinvestment into these sectors, as seen in its 2024 capital expenditure, is designed to capitalize on favorable market conditions and expand production. This focus ensures these high-performing assets continue to drive Hudbay's growth and profitability.

| Commodity | 2024 Production (k tonnes copper, koz gold) | Projected 2027 Production (k tonnes copper, koz gold) | Growth Driver | BCG Status |

|---|---|---|---|---|

| Copper | 105.7 (estimated 2024) | 240.8 (estimated 2027) | Copper Mountain acquisition, mill throughput enhancements | Star |

| Gold | 447.9 (record 2024) | N/A (focus on market leverage) | Strong market demand, central bank buying | Star |

What is included in the product

The HudBay BCG Matrix analyzes its business units by market share and growth rate.

It guides strategic decisions on investing in Stars, milking Cash Cows, developing Question Marks, and divesting Dogs.

A clear, visual HudBay BCG Matrix instantly clarifies which business units need investment and which are cash cows, reducing strategic uncertainty.

Cash Cows

The Constancia mine in Peru is a cornerstone of Hudbay's operations, with its mine life extending to 2041. It consistently produces copper, gold, and silver, providing a reliable stream of cash for the company.

This mature asset, despite the growing copper market, holds a significant market share and offers predictable financial contributions, underpinning Hudbay's stability.

Hudbay's established operations, particularly the Constancia mine in Peru, are mature assets that consistently generate substantial free cash flow, surpassing their operational needs. In 2023, Constancia was a significant contributor, demonstrating this robust cash-generating capability.

This reliable cash flow is vital for funding Hudbay's pipeline of growth projects, such as the development of the Copper World project in Arizona, and for bolstering the company's overall financial health.

The predictable nature of these cash inflows provides Hudbay with strategic flexibility, enabling prudent debt management and the pursuit of value-enhancing opportunities.

HudBay's mature operations, like its Snow Lake operations, are prime examples of cash cows. These sites benefit from optimized processes and established infrastructure, consistently generating high profit margins and efficient cash flow. For instance, in 2023, HudBay's Snow Lake operations contributed significantly to its overall production, with the Lalor mine alone producing approximately 173,000 tonnes of zinc concentrate and 48,000 tonnes of copper concentrate.

Investments in these areas are strategically directed towards maintaining current productivity and further enhancing efficiency, rather than aggressive expansion or new market penetration. This approach aligns perfectly with the 'milking' strategy characteristic of cash cows, ensuring sustained profitability without substantial risk. The focus remains on maximizing returns from existing assets, leveraging their established position in the market.

By-product Silver Revenue

Silver, generated as a by-product from Hudbay's core mining activities, significantly boosts profitability through byproduct credits. This revenue stream enhances the economic viability of primary metal extraction without necessitating dedicated capital for silver-specific expansion.

The silver market shows positive momentum, but Hudbay's silver output is primarily a result of existing, efficient processes. This means it functions as a reliable cash generator, benefiting from established infrastructure rather than requiring substantial new investment for its continued contribution.

- By-product Silver Contribution: In 2023, Hudbay's byproduct credits, largely from silver, totaled $118.8 million, significantly offsetting production costs.

- Market Dynamics: Global silver demand in 2023 reached 1.02 billion ounces, driven by industrial applications and investment, indicating a robust market for Hudbay's silver output.

- Operational Efficiency: Hudbay's integrated operations, like the Constancia mine in Peru, efficiently recover silver, contributing to its status as a cash cow with minimal incremental capital expenditure.

Strong Balance Sheet Anchor

Hudbay's cash cow assets are a cornerstone of its financial strength, consistently generating robust cash flow. This reliable income stream has been instrumental in fortifying the company's balance sheet.

By the close of 2024, Hudbay had successfully reduced its net debt considerably, a direct result of the earnings from these mature, high-performing operations. This strategic financial management has positioned Hudbay with one of the lowest leverage ratios within its sector.

- Strong Cash Flow Generation: Cash cows provide a steady and predictable income stream.

- Debt Reduction: Profits from these assets have enabled significant deleveraging.

- Low Leverage Position: By the end of 2024, Hudbay achieved industry-leading low debt-to-equity ratios.

- Financial Stability: The consistent performance of cash cows underpins overall financial health.

Hudbay's cash cow assets, primarily the Constancia mine in Peru and its Snow Lake operations, are mature, highly productive units that consistently generate substantial free cash flow. These operations benefit from optimized processes and established infrastructure, ensuring high profit margins and efficient cash generation without requiring significant new investment.

In 2023, these cash cows played a crucial role in Hudbay's financial performance, with byproduct credits, largely from silver, totaling $118.8 million. This robust cash flow is vital for funding growth projects and managing debt, contributing to Hudbay's strong financial position.

By the close of 2024, Hudbay had significantly reduced its net debt, a direct outcome of the earnings from these reliable operations, resulting in one of the lowest leverage ratios in the sector.

The consistent performance of these assets underpins Hudbay's overall financial stability and provides strategic flexibility for future endeavors.

| Asset | Primary Metals | 2023 Byproduct Credits (USD Million) | Mine Life Extension |

| Constancia (Peru) | Copper, Gold | N/A (part of overall credits) | To 2041 |

| Snow Lake (Canada) | Zinc, Copper | N/A (part of overall credits) | Ongoing |

| Overall Byproduct Credits | Silver (primary driver) | 118.8 | N/A |

What You See Is What You Get

HudBay BCG Matrix

The HudBay BCG Matrix document you are currently previewing is the exact, final version you will receive upon purchase. This comprehensive analysis, designed to illuminate strategic growth opportunities and resource allocation, will be delivered to you without any watermarks or demo content. You can confidently expect a fully formatted and ready-to-use report, perfect for immediate application in your business planning and decision-making processes.

Dogs

The global zinc market faces headwinds heading into 2025, with projections suggesting a potential surplus and downward pressure on prices. This outlook signals a challenging environment for zinc producers, impacting growth and profitability.

Increased supply is a key driver of this anticipated softening. For instance, new mine projects and expanded operations are expected to contribute to a higher overall output, potentially exceeding demand. This oversupply scenario limits upside for zinc prices, making it a less attractive investment compared to commodities with tighter supply-demand balances.

Hudbay's zinc output, mainly from its Manitoba mines, is a by-product of extracting gold and copper. This means its production volume is directly linked to the success and mining schedules of these primary metals, capping its independent expansion prospects.

For instance, in 2024, Hudbay's zinc production was intrinsically tied to its copper and gold extraction rates, not driven by dedicated zinc market strategies. This by-product status means it typically doesn't attract substantial, standalone investment for growth.

Hudbay's zinc production guidance, projected to remain stable rather than showing significant growth, signals a reduced strategic focus on expanding its market share in this metal. This aligns with the company's capital allocation strategy, which prioritizes opportunities offering higher growth and returns. Consequently, investment in the zinc segment is expected to be minimal.

Modest Revenue Contribution

While zinc plays a role in Hudbay's overall revenue stream, its contribution is notably modest when stacked against the more significant impact of copper and gold. This means that while zinc isn't a drain on company finances, it's not the primary engine driving substantial growth or profits.

The market outlook for zinc in recent periods, including 2024, has been less robust than for other base metals. This less favorable environment further solidifies zinc's position as a "cash cow" or even a "question mark" rather than a "star" in Hudbay's portfolio, according to the BCG matrix framework.

- Modest Revenue Share: Zinc's revenue contribution is smaller compared to copper and gold.

- Neutral Profitability: It generally doesn't incur losses but also doesn't generate exceptional profits.

- Market Outlook: The zinc market has experienced a less favorable outlook, impacting its growth potential.

- BCG Classification: This positions zinc as a product that requires careful management rather than aggressive expansion.

Exposure to Market Volatility

Hudbay's zinc operations are positioned in a challenging market environment, characterized by anticipated surpluses and significant price fluctuations. This exposure to volatility means the segment could face downside risks, especially without the strong growth potential observed in Hudbay's other commodity segments.

- Market Outlook: The global zinc market in 2024 is projected to experience a surplus, which typically puts downward pressure on prices. For instance, the International Lead and Zinc Study Group (ILZSG) has forecast a surplus for refined zinc in the coming periods.

- Risk Factors: This surplus, coupled with inherent price volatility, creates a risk profile for Hudbay's zinc segment, potentially impacting profitability and cash flow generation.

- Strategic Rationale: The continued operation of these zinc assets may be strategically driven by the need to leverage existing infrastructure and to realize value from polymetallic ore bodies where zinc is a co-product, rather than solely by the standalone economics of zinc production.

Hudbay's zinc operations can be viewed as a "Dog" within the BCG matrix framework. This classification stems from its modest market share in a low-growth industry, characterized by a challenging global outlook for zinc prices. The company's zinc production is primarily a byproduct, limiting its strategic growth potential and investment focus. This positions zinc as a segment that requires careful management to extract value without significant capital allocation.

| BCG Classification | Market Growth | Relative Market Share | Hudbay Zinc Status |

|---|---|---|---|

| Dog | Low | Low | Byproduct, limited growth potential |

| Key Considerations | Global zinc market surplus projected for 2024, impacting prices. | Hudbay's zinc production is linked to copper and gold extraction. | Minimal investment for standalone growth. |

Question Marks

The Copper World project in Arizona is a classic example of a Question Mark in Hudbay's portfolio. It promises a substantial boost to copper production, potentially increasing it by over 50%, tapping into a market with strong demand.

However, this significant growth opportunity is still in its early stages, focused on de-risking and feasibility studies. This means it requires considerable capital investment for development but isn't yet generating revenue or contributing to market share.

Hudbay is strategically investing in early-stage exploration, focusing on areas like Snow Lake in Manitoba, and promising targets such as Talbot and Rail. These initiatives are designed to uncover and define new mineral resources in regions with high geological potential.

These exploration programs represent a significant capital outlay for Hudbay. For instance, in 2024, the company allocated a substantial portion of its exploration budget to these nascent projects, aiming to build its future resource pipeline.

The commercial success of these early-stage ventures remains uncertain, positioning them as high-risk, high-reward opportunities. Their contribution to Hudbay's future market share is yet to be determined, reflecting the inherent volatility of mineral exploration.

Beyond its flagship Copper World project, Hudbay is actively developing other significant pipeline copper assets, notably Mason in Nevada and Llaguen in Peru. These projects are currently in the preliminary stages of evaluation and development, positioning them as crucial future growth avenues within the strong global copper market.

The Mason and Llaguen projects are in earlier phases, necessitating substantial investment for crucial technical studies and permitting processes. As such, they represent a cash outflow for Hudbay without contributing any immediate production revenue or market share, fitting the profile of question marks in the BCG matrix.

Significant Growth Capital Expenditure

Hudbay is strategically investing significant capital into its question mark assets, aiming to cultivate future growth. For 2025, the company has earmarked $205 million for growth projects and an additional $40 million for exploration activities. This substantial allocation reflects a deliberate strategy to nurture ventures with limited current market presence but considerable future potential.

This capital expenditure is specifically targeted at transforming these question marks into potential stars within Hudbay's portfolio. By funding these high-potential, low-market-share assets, Hudbay is positioning itself for future profitability and market leadership in these emerging areas.

- 2025 Growth Capital Expenditure: $205 million

- 2025 Exploration Budget: $40 million

- Investment Focus: Projects with low/no current market share but high future growth potential

- Strategic Goal: Convert question marks into future stars

High Potential for Transformation into Stars

Hudbay's 'Question Marks,' notably the Copper World project, represent significant future growth opportunities. These assets are crucial for expanding the company's presence in burgeoning commodity sectors, with the potential to transition into 'Stars' within the BCG matrix if development proceeds as planned. The company's strategic focus is on advancing these projects, aiming to unlock their substantial market potential and contribute meaningfully to future revenue streams.

- Copper World's Strategic Importance: Copper World is positioned as a key driver for Hudbay's long-term growth, with a projected mine life of approximately 16 years based on initial resource estimates.

- Market Share Expansion: Successful development of these 'Question Marks' could substantially boost Hudbay's market share in copper and other high-demand commodities, reflecting the global shift towards electrification and green technologies.

- Investment in De-risking: Hudbay is actively investing capital to mitigate risks and advance the development phases of these promising projects, underscoring their strategic value.

- Potential for 'Star' Status: The successful transition of these assets from 'Question Marks' to operational 'Stars' would mark a significant achievement, demonstrating Hudbay's ability to identify and capitalize on high-growth opportunities.

Hudbay's 'Question Marks' are projects with high growth potential but currently low market share, requiring significant investment to develop. These include the Copper World project in Arizona, which could increase copper production by over 50%, and other early-stage assets like Mason in Nevada and Llaguen in Peru.

The company is channeling substantial capital into these ventures; for 2025, Hudbay has allocated $205 million for growth projects and an additional $40 million for exploration, aiming to transform these question marks into future stars.

These investments are crucial for building Hudbay's future resource pipeline and capitalizing on strong market demand for commodities like copper, essential for electrification and green technologies.

The success of these question marks hinges on effective de-risking and development, with Copper World having a projected mine life of approximately 16 years.

| Project | Location | Status | Potential Impact | 2025 Capital Allocation Focus |

|---|---|---|---|---|

| Copper World | Arizona, USA | Early Stage Development | >50% Copper Production Increase | De-risking, Feasibility Studies |

| Mason | Nevada, USA | Early Stage Evaluation | Future Copper Growth | Technical Studies, Permitting |

| Llaguen | Peru | Early Stage Evaluation | Future Copper Growth | Technical Studies, Permitting |

| Snow Lake Exploration (Talbot, Rail) | Manitoba, Canada | Exploration | New Mineral Resources | Exploration Budget |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including HudBay's financial reports, industry growth rates, and competitor analysis, to accurately position each business unit.