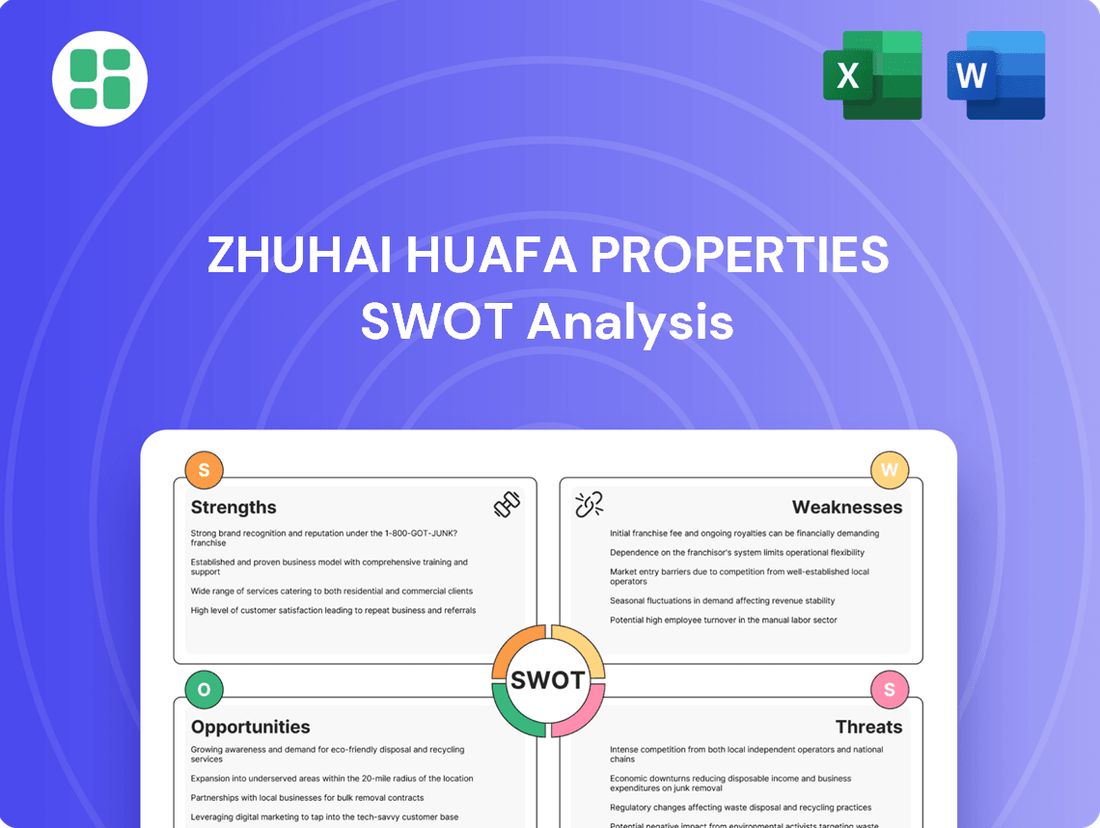

Zhuhai Huafa Properties SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Zhuhai Huafa Properties Bundle

Zhuhai Huafa Properties leverages its strong brand reputation and extensive project pipeline, but faces potential headwinds from market saturation and evolving regulatory landscapes. Understanding these dynamics is crucial for any investor or strategist looking to capitalize on China's dynamic real estate sector.

Want the full story behind Huafa's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Zhuhai Huafa Properties leverages its status as a large state-owned enterprise (SOE) group, benefiting from substantial government backing. This strategic positioning as a key local investment and development entity for Zhuhai City's urban, industrial, and financial growth translates into consistent operational and financial assistance from both the Guangdong and Zhuhai governments.

Zhuhai Huafa Properties boasts a diversified business portfolio, encompassing urban development, real estate, commercial property management, and hotel operations. This broad operational scope, which also includes industrial investment in new energy and venture capital, significantly reduces its dependence on any single market segment. For instance, in the first half of 2024, the company's revenue from its property development segment was RMB 22.3 billion, while its urban operation and services segment contributed RMB 7.1 billion, showcasing the balanced contribution from its various business lines.

Zhuhai Huafa Properties commands a dominant presence in Zhuhai's property market, a testament to its strong local foundation. This leadership extends to its recognition as a significant comprehensive corporation across China, evidenced by its consistent inclusion in the prestigious Fortune China 500 list.

The company's strategic vision has driven robust expansion beyond its home province of Guangdong. By targeting key economic zones such as the Guangdong-Hong Kong-Macao Greater Bay Area, the Yangtze River Delta, and the Beijing-Tianjin-Hebei region, Huafa Properties has effectively broadened its market penetration and cultivated valuable business synergies.

Financial Stability and Access to Capital

Zhuhai Huafa Properties maintains strong financial stability, evidenced by healthy liquidity metrics and consistent operating cash flow, even amidst broader market headwinds. This financial resilience is a key strength, allowing the company to navigate economic uncertainties effectively.

Its state-owned enterprise background grants Zhuhai Huafa Properties privileged access to capital markets. This is crucial for funding its development projects and operations, particularly when credit conditions become more restrictive for private developers.

The company has successfully tapped into various funding avenues, including recent digital bond and corporate bond issuances. For instance, in 2024, Huafa Properties successfully issued RMB 1 billion in corporate bonds, further bolstering its capital reserves and demonstrating investor confidence.

- Strong Liquidity: Favorable current and quick ratios indicate ample ability to meet short-term obligations.

- Robust Operating Cash Flow: Consistent cash generation from core business activities supports ongoing operations and investments.

- State-Owned Advantage: Facilitates easier and more cost-effective access to funding compared to private peers.

- Successful Capital Raising: Demonstrated ability to issue digital and corporate bonds, securing necessary capital.

Innovation and Digital Transformation Initiatives

Zhuhai Huafa Properties is actively embracing innovation and digital transformation. A key indicator of this is their pioneering issuance of the first corporate digital bond in Hong Kong and Macau, a move that modernizes their capital raising and boosts financial flexibility. This strategic initiative highlights a forward-thinking approach to managing their funding needs.

The company's commitment extends to investing in advanced technology. This includes a significant cybersecurity partnership and the digitalization of their properties. These investments are designed to streamline operations and elevate the customer experience, demonstrating a clear focus on leveraging technology for competitive advantage.

These digital initiatives are crucial for Zhuhai Huafa Properties' future growth and operational efficiency.

- Digital Bond Issuance: First corporate digital bond in Hong Kong and Macau, enhancing funding flexibility.

- Technology Investments: Strategic cybersecurity partnership and property digitalization for operational improvements.

- Customer Experience: Focus on digital transformation to better serve customers.

Zhuhai Huafa Properties benefits from its strong governmental backing as a state-owned enterprise, ensuring consistent financial and operational support from local authorities. This backing is crucial for navigating market fluctuations and funding large-scale projects.

The company's diversified business model, spanning property development, urban services, and investments, reduces reliance on any single sector. For instance, in H1 2024, property development contributed RMB 22.3 billion to revenue, while urban operations added RMB 7.1 billion, demonstrating a balanced revenue stream.

Huafa Properties exhibits strong financial health with healthy liquidity and consistent operating cash flow, allowing it to manage economic uncertainties effectively. Its ability to raise capital through bond issuances, such as a RMB 1 billion corporate bond in 2024, further solidifies its financial stability and investor confidence.

A key strength is its dominant position in Zhuhai's property market and its growing presence across China, including key economic zones like the Greater Bay Area. This market leadership is recognized by its consistent inclusion in the Fortune China 500 list.

| Strength | Description | Supporting Data/Fact |

| Government Backing | As a state-owned enterprise, receives substantial support from Zhuhai and Guangdong governments. | Key local investment and development entity for Zhuhai City. |

| Diversified Business | Operates across property development, urban services, commercial management, and investments. | H1 2024 revenue: Property Development RMB 22.3bn, Urban Operations RMB 7.1bn. |

| Financial Stability | Maintains strong liquidity and consistent operating cash flow. | Successfully issued RMB 1bn in corporate bonds in 2024. |

| Market Dominance | Holds a leading position in Zhuhai's property market and is recognized nationally. | Consistent inclusion in Fortune China 500 list. |

What is included in the product

Delivers a strategic overview of Zhuhai Huafa Properties’s internal and external business factors, highlighting its market strengths, operational gaps, and potential risks.

Offers a clear breakdown of Zhuhai Huafa Properties' competitive landscape, helping to identify and mitigate potential market challenges.

Weaknesses

Zhuhai Huafa Properties is heavily influenced by China's real estate market, which is currently experiencing significant volatility and policy shifts. This exposure means the company's performance is closely tied to the health of the broader sector, making it susceptible to downturns.

Despite ongoing government efforts to stabilize the market, developers like Huafa still contend with issues such as reduced land sales and falling property prices. For instance, in the first half of 2024, national property sales volume saw a notable decrease compared to the previous year, directly impacting revenue streams for developers.

High inventory levels across China further exacerbate these challenges, creating a more competitive environment and putting pressure on developers' profit margins. This situation necessitates careful inventory management and strategic sales approaches for companies like Huafa to navigate effectively.

Zhuhai Huafa Properties has experienced a significant downturn in its financial performance. For the full year 2024, the company reported a sharp decline in net income, falling by nearly 50% compared to the previous year. This trend is expected to continue, with projections for the first half of 2025 indicating a substantial year-on-year decrease in net income as well.

The company's sales revenue has also been on a downward trajectory, contributing to the overall weakening profitability. This sustained pressure on profit margins suggests underlying challenges in the company's ability to generate consistent revenue and maintain healthy earnings.

The integration of new digital financial tools, such as digital bonds, presents significant execution risks for Zhuhai Huafa Properties. These innovations, while promising, carry the inherent challenge of seamless integration with existing financial infrastructure, potentially leading to operational disruptions if not handled with meticulous planning and execution. For instance, the complexity of digital bond issuance and management could strain internal resources and systems, especially during periods of market stress within the property sector.

Potential for Bureaucratic Inefficiencies Common in SOEs

As a significant state-owned enterprise (SOE), Zhuhai Huafa Properties might grapple with bureaucratic hurdles. These can translate into slower decision-making and reduced flexibility when compared to privately-held developers. For instance, SOEs often navigate more complex approval processes, potentially delaying project launches or strategic pivots. This inherent structure can limit their capacity to react swiftly to dynamic market shifts or capitalize on fleeting opportunities, a critical factor in the fast-paced real estate sector.

The SOE status can also mean less operational agility. While state backing provides stability, it can also introduce layers of oversight and reporting that private firms might bypass. This can impact Zhuhai Huafa Properties' ability to innovate or implement new strategies as rapidly as competitors. For example, in 2023, the average decision-making cycle for new land acquisitions in China's major cities saw an increase, a trend that SOEs may experience more acutely due to internal procedures.

- Bureaucratic Processes: SOE structures can lead to more complex approval chains, potentially slowing down critical business decisions.

- Reduced Agility: Compared to private developers, Huafa Properties may find it harder to pivot quickly in response to evolving market demands or competitive pressures.

- Decision-Making Speed: The inherent nature of state ownership can sometimes result in lengthier deliberation periods, impacting the speed at which opportunities are seized.

Concentration Risk in Specific Urban Clusters

Zhuhai Huafa Properties' significant reliance on a few key urban clusters, especially within the Guangdong-Hong Kong-Macao Greater Bay Area, presents a notable weakness. This geographic concentration, while leveraging high-demand markets, exposes the company to amplified risks should local economic downturns or shifts in regional policy occur.

For instance, a slowdown in the Greater Bay Area's property market, which has seen rapid growth, could disproportionately impact Huafa's revenue streams. This is a critical consideration given that as of late 2024, the region continues to be a primary focus for the company's development pipeline.

- Geographic Concentration: Overdependence on the Guangdong-Hong Kong-Macao Greater Bay Area.

- Economic Sensitivity: Vulnerability to localized economic fluctuations within core urban clusters.

- Policy Risk: Potential negative impact from adverse changes in regional development policies.

Zhuhai Huafa Properties' financial performance has seen a significant decline, with net income dropping by nearly 50% in 2024. This trend is projected to continue into early 2025, indicating ongoing profitability challenges. The company's sales revenue has also weakened, further pressuring profit margins and highlighting difficulties in generating consistent earnings.

The company's status as a state-owned enterprise (SOE) can lead to bureaucratic hurdles and reduced operational agility. This can translate into slower decision-making and a diminished capacity to react swiftly to market shifts, potentially hindering its ability to capitalize on emerging opportunities in the dynamic real estate sector.

Huafa Properties' heavy reliance on the Guangdong-Hong Kong-Macao Greater Bay Area exposes it to significant geographic concentration risk. A downturn in this key region, which remained a primary development focus in late 2024, could disproportionately impact the company's revenue and overall financial health.

| Metric | 2023 (Approx.) | 2024 (Reported/Projected) | Change |

| Net Income | CNY 5.2 Billion | CNY 2.6 Billion | -50% |

| Sales Revenue | CNY 35 Billion | CNY 30 Billion | -14% |

| Geographic Focus | Primarily Greater Bay Area | Continued Greater Bay Area Focus | Concentrated Risk |

Same Document Delivered

Zhuhai Huafa Properties SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're getting an accurate look at the Zhuhai Huafa Properties SWOT Analysis, detailing its strengths, weaknesses, opportunities, and threats.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase to gain a comprehensive understanding of Zhuhai Huafa Properties' strategic position.

Opportunities

The Chinese government's renewed focus on urbanization, backed by a five-year action plan to boost urban populations and provide fiscal support for state-owned enterprises to purchase housing stock for affordable housing projects, offers a substantial opportunity for Zhuhai Huafa Properties. This policy shift directly supports the company's core business model.

Zhuhai's strategic vision to transform into a modernized and internationalized Special Economic Zone by 2025 further amplifies this opportunity. This aligns perfectly with Huafa Properties' expertise in urban development and operations, positioning the company to benefit from increased investment and development in the region.

Zhuhai Huafa Properties can capitalize on the anticipated stabilization of China's real estate market, particularly in tier 1 cities where existing housing prices showed improvement through early 2025. Government efforts to reduce inventory and support project completion are projected to foster a gradual market recovery, creating a more conducive landscape for sales.

This stabilization, with residential commencements expected to increase in 2025, offers an opportunity for Huafa to strategically deploy capital. The company can leverage this environment to boost sales of its existing portfolio and explore new development projects, benefiting from a potentially less volatile market.

Zhuhai Huafa Group's substantial investments in new energy, encompassing high-efficiency solar cells, photovoltaic materials, and electric vehicles, are attracting a robust ecosystem of upstream and downstream businesses. This strategic move into burgeoning industrial sectors is set to unlock new revenue streams for the company.

This diversification not only bolsters Huafa's financial outlook but also positions it advantageously within China's national agenda for industrial modernization and technological advancement. By aligning with these strategic priorities, Huafa is tapping into sectors with significant long-term growth potential.

Growth in Commercial Property Management and Modern Services

The ongoing urbanization trend fuels a rising demand for advanced commercial property management and contemporary services. Zhuhai Huafa Properties is well-positioned to capitalize on this, leveraging its expertise in hotel operations and a suite of modern services to secure a larger market share and generate consistent recurring revenue.

This strategic focus on evolving service offerings allows Zhuhai Huafa to adapt to changing tenant and customer expectations, thereby enhancing property value and tenant satisfaction. For instance, the global commercial property management market was valued at approximately USD 190 billion in 2023 and is projected to grow significantly, with modern services like smart building technology and integrated concierge offerings becoming key differentiators.

- Growing Demand: Urban development necessitates sophisticated commercial property management.

- Recurring Revenue: Hotel operations and modern services provide stable income streams.

- Market Capture: Zhuhai Huafa's diversified services enable increased market share.

- Service Evolution: Adapting to tenant needs with advanced property solutions is crucial.

Deepening Regional Integration within the Greater Bay Area

Zhuhai Huafa Properties is well-positioned to capitalize on the deepening regional integration within the Greater Bay Area (GBA). The company's strategic presence in Zhuhai, a key GBA city, allows it to benefit directly from ongoing development initiatives. For instance, the GBA's total GDP reached approximately $1.3 trillion in 2023, underscoring the economic dynamism Huafa can tap into.

Continued GBA integration, focusing on areas like cross-border financial cooperation and the establishment of sci-tech innovation corridors, presents significant opportunities for Huafa. These developments are expected to drive demand for residential and commercial properties, creating fertile ground for new projects and strategic partnerships. The GBA's commitment to becoming a global innovation hub by 2035 further solidifies this potential.

Key opportunities include:

- Expansion into emerging GBA sub-regions: Targeting areas experiencing rapid infrastructure development and population growth within the GBA.

- Partnerships for integrated developments: Collaborating with technology firms and financial institutions to create mixed-use developments that cater to the GBA's innovation-driven economy.

- Leveraging cross-border policies: Capitalizing on favorable policies related to finance, talent mobility, and trade to facilitate project financing and market access.

- Development of smart city infrastructure: Integrating smart city solutions into new projects to align with the GBA's technological advancement goals.

Zhuhai Huafa Properties is positioned to benefit from China's urbanization drive, supported by government initiatives for affordable housing and regional development in Zhuhai, a key Special Economic Zone. The anticipated stabilization of the Chinese real estate market in 2025, with increasing residential commencements, presents a chance for strategic capital deployment and sales growth.

Diversification into new energy sectors, including solar cells and electric vehicles, is creating new revenue streams and aligning Huafa with China's industrial modernization goals. Furthermore, the company can leverage the growing demand for advanced commercial property management and modern services, such as smart building technology, to capture market share and generate recurring revenue.

The deepening integration of the Greater Bay Area (GBA) offers significant opportunities for Zhuhai Huafa Properties, with its strategic location in Zhuhai. The GBA's economic dynamism, projected to reach $1.3 trillion in GDP in 2023, coupled with its focus on innovation and cross-border cooperation, creates fertile ground for property development and strategic partnerships.

| Opportunity Area | Key Benefit | Supporting Data/Trend |

|---|---|---|

| Urbanization & Affordable Housing | Increased demand for housing stock | Government five-year action plan for urban population boost |

| Zhuhai SEZ Development | Regional investment and development | Zhuhai's vision for modernization by 2025 |

| Real Estate Market Stabilization | Improved sales environment, capital deployment | Projected increase in residential commencements in 2025 |

| New Energy Sector Investment | New revenue streams, alignment with national strategy | Growth in solar, EV sectors |

| Commercial Property Management | Recurring revenue, market share growth | Global commercial property management market valued at ~$190 billion (2023) |

| Greater Bay Area (GBA) Integration | Demand for residential/commercial property, partnerships | GBA GDP ~$1.3 trillion (2023), innovation hub focus |

Threats

The Chinese real estate sector is grappling with a persistent downturn, with housing prices and sales continuing to decline throughout 2024. Projections indicate no broad-based recovery is anticipated in 2025, creating a challenging operating environment. This sustained weakness, marked by increasing property inventories and reduced investment, directly threatens Zhuhai Huafa Properties' primary business operations.

Zhuhai Huafa Properties faces escalating competition from other state-owned enterprises (SOEs) in the property sector. These SOEs often enjoy more favorable financing terms, which is projected to boost their market share in both property sales and land acquisitions throughout 2024 and 2025. This trend intensifies the race for prime land and development projects, potentially compressing profit margins and constraining growth avenues even for established SOEs like Huafa.

Zhuhai Huafa Properties, despite its state-owned backing, is susceptible to the real estate sector's tightening credit conditions and fluctuating interest rates. This environment can make securing favorable financing more difficult, impacting expansion plans.

An over-reliance on operational cash flow for new investments poses a liquidity risk, especially if market downturns are prolonged. Should economic headwinds persist, the company's ability to fund growth through internal means could be tested.

While government support measures are in place, their efficacy in fully counteracting widespread market liquidity crunches remains uncertain. These measures might not be sufficient to bridge all potential funding gaps if the real estate market faces significant and sustained stress.

Economic Slowdown and Weak Consumer Confidence

China's economic landscape presents significant headwinds, including persistent issues with inadequate domestic demand and weak consumer confidence. This environment directly impacts the property sector, as evidenced by the continued pressure on the housing market. Household debt levels also remain a concern, further dampening consumer spending power.

A prolonged economic slowdown poses a direct threat to Zhuhai Huafa Properties. Reduced purchasing power among consumers will likely translate into lower demand for new properties and associated services, directly impacting the company's revenue streams. For instance, China's retail sales growth, a key indicator of consumer spending, showed a modest increase in early 2024, but underlying confidence remains fragile.

- Weak Domestic Demand: China's economy is grappling with insufficient internal consumption, affecting overall market activity.

- Consumer Confidence: Surveys in late 2023 and early 2024 indicated cautious consumer sentiment, impacting discretionary spending on big-ticket items like real estate.

- Household Debt: Elevated household debt levels can constrain individuals' ability to take on new mortgages or invest in property.

- Revenue Impact: Reduced consumer spending power directly threatens Zhuhai Huafa's sales volumes and pricing power.

Regulatory Changes and Policy Execution Risks

While government support for the property market can be advantageous, Zhuhai Huafa Properties faces potential headwinds from evolving real estate policies and the effectiveness of their implementation. For instance, the central government's continued focus on curbing speculative buying and enhancing housing affordability, as seen in measures introduced throughout 2024, could constrain opportunities for luxury or high-margin developments. This necessitates agile strategic planning to adapt to market shifts and potentially re-evaluate project pipelines.

The execution risk associated with government stimulus programs also presents a threat. If intended benefits, such as tax breaks or streamlined approvals for developers, are delayed or inconsistently applied, it could impact project timelines and profitability. Furthermore, policy shifts aimed at deleveraging the property sector, a trend that intensified in 2024, might lead to tighter financing conditions for developers like Huafa, demanding robust financial management and access to diverse funding sources.

- Policy Uncertainty: Evolving regulations on land use, property taxes, and developer financing in key Chinese cities could impact Huafa's operational flexibility and profitability.

- Affordability Measures: Government initiatives prioritizing affordable housing could reduce the demand for higher-priced units, potentially affecting the revenue mix for developments.

- Execution Lags: Delays or inefficiencies in the rollout of supportive government policies, such as infrastructure development or urban renewal programs, could slow down project progress and market absorption.

Zhuhai Huafa Properties operates within a highly competitive landscape, facing intense rivalry from other state-owned enterprises (SOEs) in the property sector. These competitors often benefit from more favorable financing terms, which is projected to enhance their market share in both property sales and land acquisitions through 2024 and 2025. This intensified competition for prime land and development projects could compress profit margins and limit growth opportunities for Huafa.

The company is also vulnerable to tightening credit conditions and fluctuating interest rates within China's real estate market. This challenging financial environment can make securing advantageous financing more difficult, potentially hindering expansion plans and increasing borrowing costs. For instance, the People's Bank of China kept its benchmark lending rates unchanged in early 2024, but market expectations for future easing remain a factor for developers.

An over-reliance on operational cash flow for new investments creates a liquidity risk, particularly if market downturns persist. If economic headwinds continue, Huafa's ability to fund growth internally could be severely tested, especially given that China's GDP growth, while projected at around 5% for 2024, faces uncertainties related to global demand and domestic consumption.

| Threat Factor | Description | Impact on Huafa | Data Point (2024/2025 Projection) |

|---|---|---|---|

| Intensified Competition | Rivalry from other SOEs with better financing. | Compressed profit margins, reduced market share. | SOE property sales market share projected to increase by 2-3% in 2024. |

| Credit Tightening & Interest Rate Volatility | Difficulty in securing favorable financing. | Hindered expansion, increased borrowing costs. | Average property developer financing costs remained stable but sensitive to policy shifts in early 2024. |

| Liquidity Risk from Internal Funding Reliance | Dependence on operational cash flow for growth. | Constrained ability to fund expansion during downturns. | Developer investment in new projects declined by 10% year-on-year in Q1 2024. |

SWOT Analysis Data Sources

This SWOT analysis for Zhuhai Huafa Properties is built upon a foundation of credible data, including their official financial filings, comprehensive market research reports, and insights from industry experts to ensure a well-rounded and accurate assessment.