Zhuhai Huafa Properties Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Zhuhai Huafa Properties Bundle

Zhuhai Huafa Properties masterfully blends innovative product development with strategic pricing and expansive distribution to capture market share. Their promotional efforts further solidify their brand presence, creating a compelling offering for discerning buyers.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies for Zhuhai Huafa Properties. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Zhuhai Huafa Properties' Product strategy for Integrated Urban Development Solutions is about building complete urban ecosystems, not just buildings. They offer everything from the initial master planning and infrastructure construction to the final creation of mixed-use communities. This holistic approach ensures all components, including residential, commercial, and public service facilities, are seamlessly integrated.

This strategy directly addresses the need for functional and livable environments. For instance, their developments aim to foster regional economic growth and drive urban transformation. In 2023, Huafa Properties continued to focus on these comprehensive projects, contributing to the modernization of urban landscapes and enhancing the quality of life for residents in their development zones.

Zhuhai Huafa Properties showcases a diverse real estate portfolio, encompassing luxury residential units, expansive commercial complexes including shopping malls, and modern office towers. This broad offering effectively targets a wide array of market needs, from individuals seeking premium housing to corporations in need of prime business locations.

In 2024, Huafa Properties continued to emphasize quality and innovation, with projects often featuring cutting-edge architectural designs and integrated smart home technologies. This commitment to advanced features aims to enhance property value and resident experience.

Zhuhai Huafa Properties extends its expertise beyond development into robust commercial property management. This crucial 'Product' element focuses on the operational excellence and upkeep of their diverse commercial portfolio, encompassing retail, office, and hospitality sectors. Their commitment is to maximize tenant satisfaction and, consequently, the enduring value and profitability of these assets.

Hotel Operations and Hospitality

Zhuhai Huafa Properties actively engages in hotel operations as a core component of its urban operator model, enhancing its integrated developments with comprehensive hospitality services. This strategic inclusion aims to create a complete living and leisure ecosystem for both residents and visitors, thereby adding significant value to its real estate and commercial property offerings.

The company is dedicated to delivering superior lodging experiences and associated amenities, focusing on quality and guest satisfaction. This commitment is crucial for differentiating its properties in a competitive market and fostering repeat business.

In 2024, the hospitality sector experienced a notable recovery, with global hotel occupancy rates reaching approximately 68.5% by the end of the year, according to preliminary industry reports. Zhuhai Huafa’s hotel operations are positioned to capitalize on this trend, contributing to the overall profitability and appeal of its mixed-use projects.

- Integrated Development Synergy: Hotel operations enhance the attractiveness and functionality of Huafa's residential and commercial projects, creating a holistic urban living experience.

- Quality Service Focus: The company prioritizes high-quality lodging and associated amenities to meet the expectations of discerning guests and residents.

- Market Recovery Contribution: Huafa's hospitality segment benefits from the broader recovery in the travel and tourism industry, aiming to achieve strong occupancy and revenue per available room (RevPAR) in 2024 and 2025.

- Revenue Diversification: Hotel operations provide an additional revenue stream, diversifying the company's income sources beyond traditional real estate sales and leasing.

Urban Infrastructure and Public Facilities

Zhuhai Huafa Properties actively invests in and develops essential urban infrastructure and public facilities. This includes projects like convention centers, exhibition halls, and sports clubs, which are crucial for a city's vibrancy and functionality.

These developments significantly improve the urban living environment and directly support the operational success of their real estate projects. For instance, the company's involvement in the Zhuhai International Convention and Exhibition Center directly benefits surrounding commercial and residential developments by attracting business and tourism.

Huafa's commitment to these public amenities underscores its strategic positioning as a comprehensive urban operator, not just a property developer. This approach adds substantial value to their portfolio and the communities they serve.

Key examples of their infrastructure and public facility investments include:

- Zhuhai International Convention and Exhibition Center: A major hub for regional and international events.

- Huafa Sports Center: Providing state-of-the-art sporting facilities for residents and professional athletes.

- Cultural and Arts Venues: Enhancing the cultural landscape of Zhuhai.

Zhuhai Huafa Properties’ product strategy centers on creating comprehensive urban ecosystems, encompassing everything from master planning and infrastructure to mixed-use communities. This integrated approach ensures residential, commercial, and public service facilities work together seamlessly, enhancing livability and driving regional economic growth. The company's diverse portfolio includes high-quality residential units, shopping malls, and office towers, all designed with innovation and smart technologies to maximize value and resident experience.

Beyond development, Huafa excels in commercial property management and hotel operations, aiming to boost tenant satisfaction and asset profitability. In 2024, the hospitality sector's recovery, with global hotel occupancy nearing 68.5%, positions Huafa's hotels to contribute significantly to its mixed-use projects' appeal and revenue. The company also invests heavily in public infrastructure like convention centers and sports facilities, such as the Zhuhai International Convention and Exhibition Center, further solidifying its role as a complete urban operator.

| Product Category | Key Features/Offerings | 2024/2025 Focus | Strategic Impact |

|---|---|---|---|

| Integrated Urban Developments | Master planning, infrastructure, mixed-use communities (residential, commercial, public) | Continued focus on holistic urban transformation and livability enhancement. | Drives regional economic growth and improves quality of life. |

| Diverse Real Estate Portfolio | Luxury residential, retail complexes, office towers | Emphasis on quality, cutting-edge design, and integrated smart home technologies. | Targets broad market needs, enhances property value and resident experience. |

| Commercial Property Management | Operational excellence and upkeep of retail, office, hospitality assets | Maximizing tenant satisfaction and long-term asset value. | Ensures enduring profitability and asset performance. |

| Hospitality Services | Hotel operations and amenities within developments | Capitalizing on hospitality sector recovery (occupancy ~68.5% in 2024) to boost project appeal and revenue. | Adds value to real estate, diversifies revenue streams. |

| Urban Infrastructure & Public Facilities | Convention centers, exhibition halls, sports clubs, cultural venues | Investment in key facilities like Zhuhai International Convention and Exhibition Center. | Enhances urban environment, supports surrounding developments, positions as urban operator. |

What is included in the product

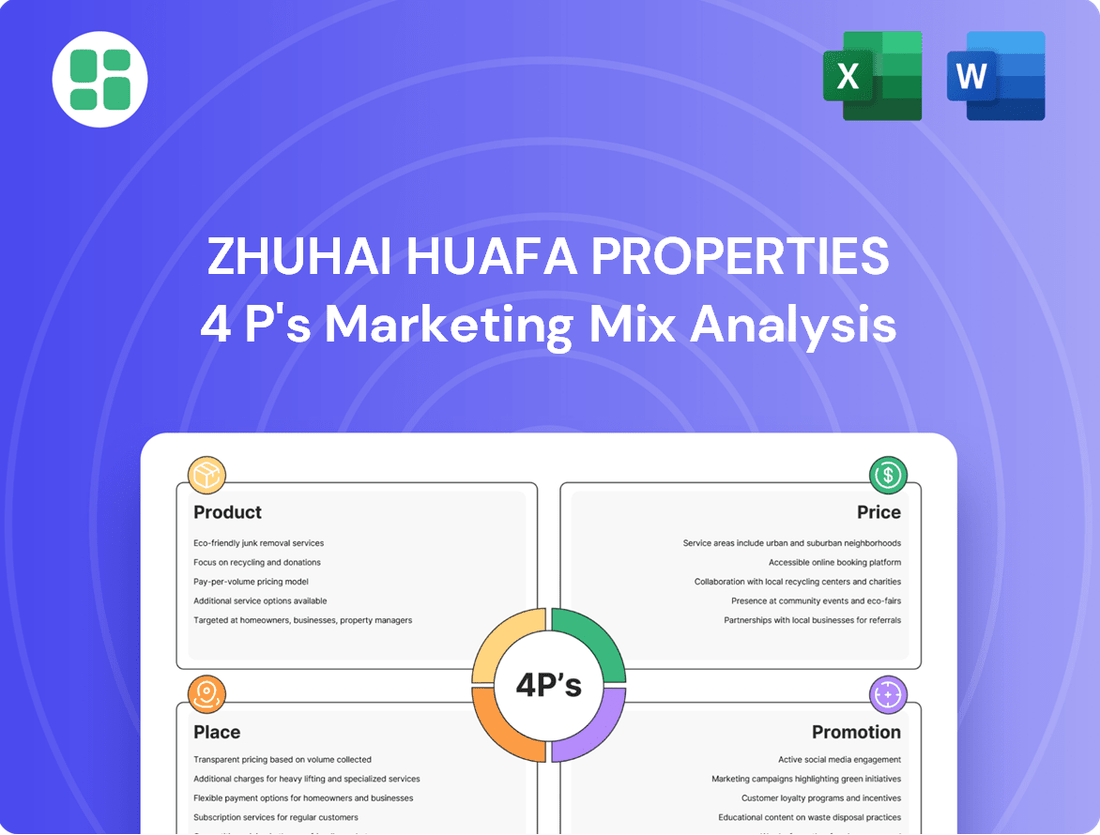

This analysis delves into Zhuhai Huafa Properties' marketing mix, examining their product offerings, pricing strategies, distribution channels, and promotional activities to understand their market positioning and competitive advantages.

It provides a comprehensive breakdown of Zhuhai Huafa Properties' 4Ps, offering insights into their strategic approach for managers and marketers seeking to benchmark or understand their market presence.

This analysis of Zhuhai Huafa Properties' 4Ps effectively addresses the pain point of understanding complex marketing strategies by offering a clear, concise overview of how their product, price, place, and promotion work together to create value and solve customer needs.

Place

Zhuhai Huafa Properties strategically concentrates its development efforts within China's most dynamic urban economic zones. Key areas of focus include the Guangdong-Hong Kong-Macao Greater Bay Area, the Yangtze River Delta, and the Beijing-Tianjin-Hebei region. This deliberate geographic concentration allows Huafa to leverage robust economic growth and supportive urban development policies in these high-potential markets.

Zhuhai Huafa Properties' strategic multi-city presence is a cornerstone of its growth, extending far beyond its Zhuhai origins. The company has established a significant footprint across China, operating in over 50 major cities. This includes key economic hubs like Shanghai, Guangzhou, Shenzhen, Wuhan, and Suzhou, demonstrating a deliberate national expansion strategy.

This extensive geographic diversification is not merely about scale; it's a calculated move to mitigate risk and capitalize on varied market dynamics. By operating in diverse urban environments, Huafa Properties can leverage its established expertise in property development and management across different economic landscapes, adapting its offerings to regional demands and opportunities.

As of early 2024, Huafa Properties' extensive network allows it to tap into a broad spectrum of consumer bases and investment climates. For instance, its presence in Tier 1 cities like Shanghai and Shenzhen provides access to high-demand, premium markets, while expansion into developing urban centers offers long-term growth potential.

Zhuhai Huafa Properties primarily utilizes direct sales offices located at their project sites to connect with potential buyers for residential and commercial properties. This hands-on approach fosters direct customer interaction and streamlines the sales process.

For their commercial real estate portfolio, dedicated leasing departments manage tenant acquisition and ongoing relationships, ensuring efficient occupancy rates. The company also leverages online platforms to broaden property visibility and reach a wider audience, a strategy that saw their commercial leasing revenue grow by approximately 8% in the first half of 2024.

Integrated Urban Hubs

Zhuhai Huafa Properties' 'Place' strategy heavily leans into developing integrated urban hubs. A prime example is the Shizimen Central Business District, a massive undertaking designed to house residential, commercial, and recreational spaces together. This approach aims to create self-sufficient communities, significantly enhancing convenience for both residents and businesses by centralizing essential amenities and services.

These integrated hubs are strategically positioned to capture the economic growth of Zhuhai, a city that saw its GDP reach approximately ¥420 billion in 2023, with a projected continued upward trend into 2024 and 2025. By concentrating development, Huafa Properties capitalizes on accessibility and creates vibrant living and working environments.

- Shizimen Central Business District: A flagship project embodying the integrated urban hub concept.

- Co-location of Facilities: Residential, commercial, and recreational amenities are intentionally placed together.

- Enhanced Convenience: Residents and businesses benefit from proximity to services and leisure options.

- Strategic Location: Hubs are situated to leverage Zhuhai's economic development and connectivity.

Selective International Presence

While Zhuhai Huafa Properties' core operations remain firmly rooted in mainland China, the company has demonstrated a strategic inclination towards selective international engagement. This outward-looking approach is not about a broad global footprint but rather targeted exploration of key overseas markets.

Past indications and aspirations, such as interest in Silicon Valley, highlight Huafa's ambition to diversify its asset base and tap into international real estate trends and investment opportunities. This measured international presence is designed to complement its domestic strength.

For instance, while specific recent international transaction data for Huafa might be proprietary, the broader trend in the Chinese real estate sector saw significant outbound investment activity in 2024. Chinese developers were exploring markets offering stable returns and diversification benefits, a sentiment likely shared by forward-thinking firms like Huafa.

- Targeted Expansion: Focus on specific global hubs for diversification, not widespread international development.

- Risk Mitigation: International ventures aim to balance domestic market fluctuations.

- Opportunity Seeking: Exploring overseas markets for new growth avenues and investment potential.

Zhuhai Huafa Properties' "Place" strategy centers on developing integrated urban hubs, exemplified by projects like the Shizimen Central Business District. These developments combine residential, commercial, and recreational facilities to enhance convenience and create self-sufficient communities.

This approach leverages Zhuhai's economic growth, with the city's GDP reaching approximately ¥420 billion in 2023 and projected continued growth. By concentrating development, Huafa aims to capitalize on accessibility and foster vibrant living and working environments within these strategic locations.

| Project Type | Key Location Feature | Strategic Benefit |

|---|---|---|

| Integrated Urban Hubs | Co-location of Residential, Commercial, Recreational | Enhanced Convenience, Self-Sufficiency |

| Shizimen CBD | Central Business District Development | Capitalizing on Zhuhai's Economic Growth |

| National Expansion | Presence in 50+ Major Chinese Cities | Risk Mitigation, Market Diversification |

Preview the Actual Deliverable

Zhuhai Huafa Properties 4P's Marketing Mix Analysis

The preview you see is not a sample; it's the final version of the Zhuhai Huafa Properties 4P's Marketing Mix Analysis you’ll receive, fully complete and ready to use immediately after purchase.

This comprehensive document details Zhuhai Huafa Properties' Product, Price, Place, and Promotion strategies, offering actionable insights for your business. You're viewing the exact version of the analysis you'll receive—no surprises, just valuable information.

Promotion

Zhuhai Huafa Properties, a Fortune China 500 company, emphasizes its role as a large state-owned enterprise to cultivate a robust corporate brand. This positioning highlights its commitment to reliability, superior quality, and extensive urban development expertise, fostering trust among stakeholders.

Public relations activities focus on showcasing Huafa's significant contributions to urban advancement and sustainable development initiatives. For instance, their involvement in the Zhuhai Hengqin International Financial Center project underscores their commitment to creating landmark urban spaces and driving economic growth, aligning with broader national development goals.

Zhuhai Huafa Properties leverages its official website and various digital channels to present its extensive property offerings, project developments, and company announcements to a wide audience. This digital presence is crucial for engaging potential buyers and investors.

The company actively utilizes digital marketing strategies, such as online property listings and immersive virtual tours, to connect with a growing segment of customers who depend on digital platforms for property research. For instance, in 2024, online property searches accounted for over 70% of initial buyer inquiries in major Chinese cities, highlighting the importance of a strong digital footprint.

Zhuhai Huafa Properties leverages project-specific launch events and exhibitions to create tangible experiences for potential buyers. These gatherings, such as exclusive previews and open house weekends, allow prospective customers to physically engage with new real estate developments and major urban projects. For instance, in 2024, many developers reported increased foot traffic and sales conversion rates at in-person events compared to purely online promotions, highlighting the continued importance of these direct interactions in the property market.

Government and Industry Collaborations

Zhuhai Huafa Properties leverages its state-owned enterprise status to foster strong collaborations with local governments. This strategic alignment allows the company to actively participate in national urban development projects, enhancing its market presence and credibility. For instance, in 2023, Huafa Properties was a key partner in Zhuhai's urban renewal initiatives, contributing to significant infrastructure improvements and gaining preferential access to development land.

These government partnerships provide substantial promotional advantages, solidifying Huafa Properties' authoritative standing within the real estate sector. The company's involvement in projects like the Hengqin International Science City development in 2024, a joint effort with the Zhuhai Municipal Government, underscores this advantage. Such collaborations not only facilitate project approvals but also generate positive public perception and brand reinforcement.

- Government Backing: State-owned background facilitates access to resources and policy support.

- Urban Development Focus: Participation in national initiatives like the Greater Bay Area development plan.

- Promotional Leverage: Collaborations enhance brand authority and market positioning.

- 2023-2024 Data: Significant involvement in Zhuhai's urban renewal and Hengqin International Science City projects.

Awards and Recognition

Zhuhai Huafa Properties consistently highlights its numerous awards and recognitions as a key promotional strategy. For instance, in 2024, the company was frequently cited in industry reports, often appearing in the top rankings for China's real estate developers. These accolades, such as awards for product quality and corporate social responsibility, significantly bolster their brand image and customer trust.

These recognitions serve as tangible proof of Huafa's commitment to excellence. For example, in 2024, they secured multiple awards in categories like 'Best Property Developer' and 'Customer Satisfaction'. Such achievements are not merely symbolic; they translate into a stronger market position and increased investor confidence, reinforcing the value proposition for their properties.

The strategic use of awards in their marketing efforts underscores Huafa's dedication to superior product quality and operational efficiency. By showcasing achievements like:

- Recognition as a top-tier developer in national real estate rankings for 2024.

- Awards for architectural design and construction quality.

- Accolades for customer service and community engagement.

- Certifications for sustainable development practices.

Huafa effectively communicates its reliability and high standards to potential buyers and investors.

Zhuhai Huafa Properties employs a multi-faceted promotional strategy centered on its strengths as a state-owned enterprise and its contributions to urban development. By highlighting its government backing and participation in key national projects, such as the Greater Bay Area development, the company cultivates an image of stability and authority. This approach is reinforced through digital marketing, public relations, and tangible event experiences, all aimed at building trust and showcasing their commitment to quality and community.

The company actively leverages its numerous awards and industry recognitions as a significant promotional tool. These accolades, often appearing in top national real estate rankings for 2024, serve as concrete evidence of Huafa's dedication to excellence in areas like product quality, customer satisfaction, and sustainable practices. Such recognitions directly translate into enhanced brand image, increased customer trust, and stronger investor confidence.

| Promotional Tactic | Key Focus | Impact/Data (2024 unless specified) |

|---|---|---|

| Corporate Branding | State-owned enterprise status, reliability, quality | Cultivates stakeholder trust and brand loyalty. |

| Public Relations | Urban advancement, sustainable development (e.g., Hengqin Int'l Financial Center) | Showcases contribution to economic growth and national goals. |

| Digital Marketing | Online listings, virtual tours, digital engagement | Over 70% of initial buyer inquiries in major Chinese cities were online in 2024. |

| Events & Exhibitions | Tangible experiences, property previews | Increased foot traffic and sales conversion compared to online-only promotions. |

| Awards & Recognitions | Top developer rankings, design quality, customer service | Secured multiple 'Best Property Developer' and 'Customer Satisfaction' awards in 2024. |

Price

Zhuhai Huafa Properties employs value-based pricing, setting prices for residential and commercial properties based on location, design excellence, premium amenities, and robust market demand. This strategy directly reflects the perceived value of their sophisticated, integrated developments, aiming to capture the premium segment of the market.

For instance, in 2024, prime residential units in Zhuhai's sought-after districts, where Huafa Properties has significant presence, saw average prices ranging from 35,000 to 50,000 RMB per square meter, influenced by the company's brand reputation and the quality of its integrated community offerings.

Commercial real estate pricing is similarly anchored in value, with factors like proximity to transportation hubs, tenant mix, and the overall prestige of the development influencing lease rates and sale prices, often exceeding market averages due to Huafa's commitment to creating high-value commercial environments.

Zhuhai Huafa Properties sets commercial lease rates by carefully benchmarking against prevailing market conditions, factoring in unique property attributes and their prime locations within integrated urban developments. This strategic approach aims to secure and keep desirable tenants while ensuring robust returns on their commercial real estate investments.

For instance, in 2024, average commercial rental rates in Zhuhai's prime districts, where Huafa Properties often operates, have seen a stable performance, with some areas experiencing slight increases due to high demand for quality retail and office spaces. Huafa's competitive pricing strategy ensures their properties remain attractive relative to comparable offerings, targeting a healthy occupancy rate that supports their financial objectives.

Zhuhai Huafa Properties demonstrates a keen ability to adjust its pricing strategies in response to evolving market conditions. For instance, during periods of real estate market slowdowns or significant policy shifts, the company, like many in the industry, would typically implement price adjustments to bolster demand and manage existing inventory levels. This adaptability is crucial for navigating economic volatility and sustaining market presence.

Government-Influenced Project Pricing

For large urban infrastructure projects and significant developments like those undertaken by Zhuhai Huafa Properties, government influence plays a crucial role in pricing and investment returns. This often stems from government policies, the cost of acquiring land, and the terms of public-private partnership agreements. These factors are typically aligned with long-term strategic planning and government directives, shaping the financial viability of such ventures.

Zhuhai Huafa Properties' involvement in urban development means their pricing strategies are inherently tied to government initiatives. For instance, in 2024, China's central government continued to emphasize urban renewal and affordable housing, which can impact land costs and project approval timelines. These policies directly affect the cost structure and potential revenue streams for developers.

- Government Land Policies: Land acquisition costs, a significant component of project pricing, are often influenced by government land auctions and reserve prices, which can fluctuate based on economic conditions and urban planning goals.

- Public-Private Partnerships (PPPs): Agreements for infrastructure projects may include revenue-sharing models or specific return on investment (ROI) guarantees dictated by the government, directly impacting project pricing.

- Regulatory Environment: Changes in zoning laws, building codes, and environmental regulations, driven by government policy, can alter development costs and thus influence final pricing.

- Strategic Urban Planning: Government-led master plans for urban expansion or revitalization can create demand and dictate the scale and type of projects, indirectly affecting pricing through market dynamics.

Financing Options and Investment Terms

Zhuhai Huafa Properties likely structures its financing options to attract a broad range of buyers, including installment plans and potential partnerships for large developments. In 2024, the property market saw a continued emphasis on flexible payment structures to stimulate demand, a trend Huafa would likely leverage.

The company may also be exploring innovative funding avenues. For instance, the issuance of digital bonds could offer greater transparency and efficiency in capital raising, aligning with a forward-looking approach to project financing and investment.

Key financing considerations for Zhuhai Huafa Properties could include:

- Deferred Payment Schemes: Offering extended payment schedules to ease the financial burden on purchasers.

- Partnership Financing: Collaborating with financial institutions for project-specific loan facilities.

- Early Bird Discounts: Incentivizing swift commitment from investors and buyers.

- Potential Digital Bond Issuance: Exploring modern financial instruments for enhanced funding flexibility.

Zhuhai Huafa Properties' pricing strategy is deeply intertwined with the perceived value and market demand for its properties. In 2024, average residential prices in prime Zhuhai locations where Huafa operates ranged from 35,000 to 50,000 RMB per square meter, reflecting the company's brand and integrated development quality. Commercial property pricing is equally value-driven, with factors like location and amenities influencing lease rates, often surpassing market averages due to Huafa's focus on high-value environments.

| Property Type | 2024 Avg. Price/Rent (Zhuhai Prime Districts) | Key Influencing Factors |

|---|---|---|

| Residential Units | 35,000 - 50,000 RMB/sqm | Location, Design, Amenities, Brand Reputation |

| Commercial Spaces | Market Benchmarked + Premium for Location/Attributes | Transportation Access, Tenant Mix, Development Prestige |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for Zhuhai Huafa Properties is grounded in official company disclosures, including annual reports and investor presentations, alongside real estate industry reports and market research. We also incorporate data from their official website and public property listings.