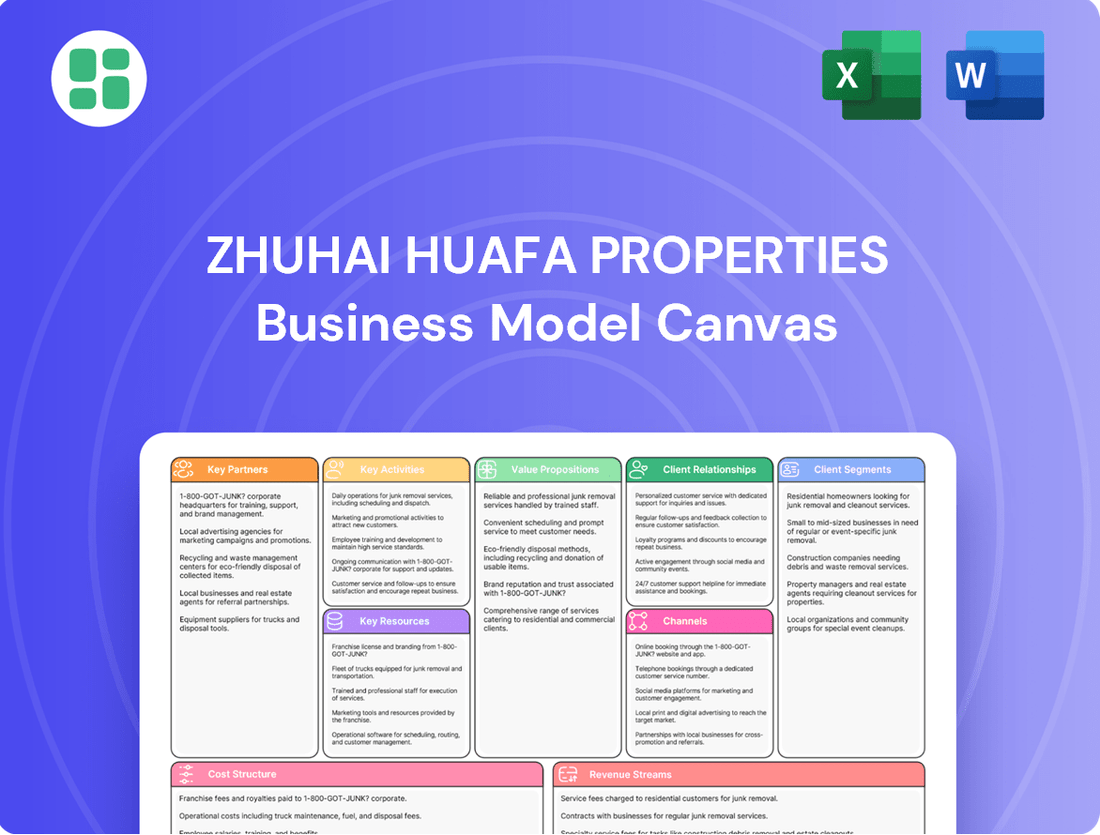

Zhuhai Huafa Properties Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Zhuhai Huafa Properties Bundle

Unlock the strategic blueprint behind Zhuhai Huafa Properties's impressive market position with our comprehensive Business Model Canvas. Discover their customer segments, value propositions, and revenue streams, all laid out for your strategic analysis. This detailed canvas is your gateway to understanding their success.

Partnerships

As a state-owned enterprise, Zhuhai Huafa Properties maintains vital partnerships with government agencies and local authorities across all levels. These relationships are foundational for securing land-use rights and navigating the complex permitting processes essential for their extensive urban development endeavors.

These collaborations are critical for aligning Huafa's projects with regional strategic plans, ensuring that their developments contribute to the broader urban growth objectives of Zhuhai and surrounding areas. For instance, in 2023, the company was involved in several key infrastructure projects that received significant government backing, facilitating smoother project execution.

Zhuhai Huafa Properties relies heavily on partnerships with financial institutions and investors to fund its ambitious real estate and urban development ventures. These relationships are critical for securing the substantial capital required for large-scale projects, ensuring the company can execute its growth strategies effectively.

The company actively engages with banks for various loan facilities and works with investment funds to attract equity financing. In 2023, for instance, Huafa Properties successfully issued bonds totaling billions of RMB, demonstrating its ability to tap into capital markets and diversify its funding sources. This access to capital is paramount for maintaining its development pipeline and pursuing new opportunities across its diverse portfolio.

Zhuhai Huafa Properties relies heavily on collaborations with established construction companies and specialized contractors. These partnerships are crucial for the successful and timely delivery of their extensive real estate development and urban infrastructure projects, ensuring high standards of quality across all builds.

In 2024, the construction sector in China, where Huafa operates, faced evolving challenges and opportunities. For instance, the average cost of construction materials saw fluctuations, impacting project budgets. Despite this, the demand for quality housing and urban amenities remained robust, underscoring the importance of reliable construction partners who can navigate these market dynamics efficiently.

Technology and Smart City Solution Providers

Zhuhai Huafa Properties collaborates with technology and smart city solution providers to integrate advanced features into its developments. This strategic alignment ensures the incorporation of modern amenities such as smart home systems and eco-friendly building techniques. For instance, their partnership with Blackwall underscores a commitment to robust digital protection and cybersecurity measures, crucial for smart city infrastructure.

These alliances are vital for Zhuhai Huafa Properties to stay at the forefront of urban development, offering residents cutting-edge living experiences. By leveraging the expertise of technology firms, they can implement innovative solutions that enhance convenience, efficiency, and sustainability within their properties.

- Smart Home Integration: Partnering with tech companies to embed smart home functionalities, improving resident comfort and control.

- Sustainable Building Technologies: Collaborating on solutions for energy efficiency and environmental sustainability in construction.

- Cybersecurity Partnerships: Aligning with firms like Blackwall to safeguard digital infrastructure and resident data.

- Smart City Infrastructure: Working with providers to develop integrated smart city solutions within their developments.

Urban Planning and Design Firms

Zhuhai Huafa Properties collaborates with top urban planning and design firms to ensure their projects are not just buildings, but well-integrated living environments. These partnerships are vital for developing innovative and visually appealing master plans that resonate with modern urban lifestyles. For instance, in 2024, Huafa Properties continued to prioritize collaborations with firms known for their award-winning architectural and landscape designs, aiming to elevate the aesthetic and functional quality of their developments.

These collaborations are instrumental in shaping mixed-use developments that seamlessly blend residential, commercial, and recreational spaces. By working with specialized firms, Huafa Properties ensures that each project adheres to high standards of contemporary urban living, often incorporating green spaces and sustainable design principles. This strategic approach helps create desirable communities that attract both residents and businesses, contributing to the overall success and value of the properties.

Key benefits derived from these partnerships include:

- Access to cutting-edge design trends and technologies.

- Enhanced project appeal and marketability through award-winning aesthetics.

- Creation of cohesive and functional urban spaces that improve quality of life.

- Alignment with Zhuhai’s broader urban development goals and vision.

Zhuhai Huafa Properties' key partnerships extend to real estate agencies and sales channels, crucial for effectively marketing and selling its diverse range of properties. These collaborations ensure broad market reach and efficient transaction processes, vital for revenue generation and project sell-through.

In 2024, the real estate market saw continued demand for quality housing, with agencies playing a pivotal role in connecting developers with buyers. For example, Huafa Properties likely leveraged partnerships with established sales agencies to manage the launch and sales of new residential projects, aiming to achieve targeted sales volumes and pricing strategies.

| Partner Type | Role | 2024 Focus/Example |

|---|---|---|

| Real Estate Agencies | Sales and Marketing | Facilitating property sales, market analysis |

| Financial Institutions | Funding and Investment | Securing project financing, bond issuances (e.g., billions of RMB in 2023) |

| Construction Companies | Project Execution | Ensuring quality and timely delivery amidst material cost fluctuations |

| Tech Providers | Innovation and Smart Features | Integrating smart home and cybersecurity (e.g., Blackwall partnership) |

| Urban Planning Firms | Design and Master Planning | Creating appealing, functional urban environments |

What is included in the product

Zhuhai Huafa Properties' Business Model Canvas outlines its strategy for developing and selling high-quality residential and commercial properties, focusing on urban renewal and integrated community development.

It details customer segments like urban residents and investors, channels including direct sales and agents, and value propositions centered on lifestyle, amenities, and investment potential.

Zhuhai Huafa Properties' Business Model Canvas offers a clear, actionable framework to address market uncertainties and streamline complex development processes.

It provides a structured approach to identify and mitigate risks, ensuring efficient resource allocation and a more predictable path to project success.

Activities

Zhuhai Huafa Properties' primary activity is the comprehensive development and sale of a wide range of real estate. This includes everything from acquiring land to the final sale of residential, commercial, and mixed-use properties. They manage the entire process, from initial planning and design through construction and marketing.

In 2023, Zhuhai Huafa Properties reported a significant revenue stream from its property development and sales operations. The company actively launched new projects and continued sales efforts across its existing portfolio, contributing substantially to its overall financial performance. This core business remains the engine driving its market presence.

Zhuhai Huafa Properties is deeply involved in comprehensive urban operations, encompassing district-level development, industrial park creation, and essential infrastructure building. This strategic focus extends to urban renewal projects, aiming to revitalize existing city areas and foster sustainable growth.

The company's 2024 activities in urban development are geared towards creating integrated living and working environments. For instance, their ongoing projects in Zhuhai's Hengqin district are designed to be self-sufficient communities, incorporating residential, commercial, and recreational facilities, reflecting a commitment to long-term urban planning.

Huafa Properties' operational scope in urban development is substantial, with significant investments in infrastructure that support economic activity and improve quality of life. Their engagement in urban renewal projects, such as revitalizing older commercial areas, demonstrates a strategy to enhance the city's overall appeal and economic vitality.

Zhuhai Huafa Properties' commercial property management and leasing activities are central to its revenue generation. This includes the day-to-day operations of retail centers, office spaces, and hospitality venues, ensuring they run smoothly and attract tenants.

In 2024, the company focused on enhancing tenant experiences and optimizing operational costs across its commercial portfolio. This strategic approach aims to maintain high occupancy rates and maximize rental income, a critical component of their recurring revenue stream.

Investment and Financial Services

Zhuhai Huafa Properties actively engages in financial services, leveraging debt and equity to fuel its operations and strategic investments. This financial arm is crucial for managing its diverse investment portfolio and exploring innovative funding avenues.

The company is focused on strengthening its capital base and diversifying revenue streams through strategic financial activities. This includes a keen interest in emerging financial technologies.

- Financial Industry Operations: Huafa Properties participates directly in financial industry activities, managing its capital and investments.

- Strategic Business Investments: The company makes targeted investments to grow its business and enhance its financial standing.

- Debt and Equity Funding: It utilizes a mix of debt and equity financing to secure the capital necessary for its projects and investments.

- Financial Technology Exploration: Huafa Properties is exploring new financial technologies, such as digital bonds, to optimize its capital structure and create new revenue opportunities.

Infrastructure Investment and Construction

Zhuhai Huafa Properties actively participates in and leads the investment, construction, and management of diverse urban infrastructure projects. This involvement is crucial to their identity as a comprehensive urban operator, ensuring the development of essential public facilities that underpin city growth.

Their commitment extends to vital public services, contributing to the overall enhancement and functionality of the urban environments where they operate. For instance, in 2024, Huafa Properties continued its significant role in Zhuhai's urban development, with ongoing projects in transportation and public utilities aimed at improving city living standards.

- Urban Infrastructure Development: Leading the investment and construction of key public facilities.

- Comprehensive Urban Operator: Managing and developing projects that support city growth.

- Public Facility Enhancement: Investing in vital services for improved urban living.

- 2024 Focus: Continued engagement in Zhuhai's transportation and utility infrastructure projects.

Zhuhai Huafa Properties' key activities revolve around property development and sales, urban operations including district and industrial park development, and commercial property management. They also engage in financial services to support their operations and investments, and actively participate in urban infrastructure projects.

| Activity | Description | 2023/2024 Relevance |

|---|---|---|

| Property Development & Sales | End-to-end real estate creation and market delivery. | Core revenue driver, with active project launches and sales in 2023. |

| Urban Operations | District, industrial park, and infrastructure development, including urban renewal. | Focus on integrated communities like Hengqin projects in 2024. |

| Commercial Property Management | Day-to-day operations and leasing of retail, office, and hospitality spaces. | Emphasis on tenant experience and cost optimization in 2024 to maintain occupancy. |

| Financial Services | Leveraging debt and equity, exploring financial technologies. | Strengthening capital base and diversifying revenue in 2024. |

| Urban Infrastructure Investment | Leading investment and construction of public facilities and services. | Continued significant role in Zhuhai's transportation and utility projects in 2024. |

Delivered as Displayed

Business Model Canvas

The Zhuhai Huafa Properties Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or a mockup; it represents the complete, ready-to-use analysis of their business strategy. Once your order is complete, you will gain full access to this comprehensive document, allowing you to leverage its insights immediately.

Resources

Zhuhai Huafa Properties' extensive land bank and real estate portfolio represent a cornerstone of its business model. This includes significant holdings of both developed properties and undeveloped land, strategically located within key urban centers across China, with a particular emphasis on the dynamic Guangdong-Hong Kong-Macao Greater Bay Area.

This substantial land reserve is not merely an asset but a critical enabler for the company's continued growth and its capacity to undertake diverse real estate and large-scale urban development initiatives. As of the first half of 2024, Huafa Properties maintained a robust land acquisition strategy, further solidifying its position in high-growth regions.

Zhuhai Huafa Properties' access to substantial financial capital is a cornerstone of its business model. This includes a robust mix of equity and debt financing, which is crucial for undertaking their large-scale, capital-intensive urban development and real estate projects. For instance, in 2023, the company secured significant funding through bond issuances, demonstrating its ability to tap into diverse debt markets to fuel its growth.

Furthermore, Huafa Properties cultivates strong, established relationships with state-owned banks and various financial institutions. These partnerships are instrumental in securing the necessary capital for their ambitious development plans. Their financial strength is reflected in their consistent ability to manage large project budgets and maintain a healthy liquidity position, enabling them to pursue opportunities across China's rapidly evolving urban landscape.

Zhuhai Huafa Properties relies on a highly skilled workforce with deep expertise in urban planning, real estate development, construction management, and financial operations. This specialized talent pool is fundamental to their success in executing complex projects and navigating the dynamic property market.

The company's leadership team brings extensive experience, guiding strategic decision-making and ensuring operational efficiency. Their collective knowledge is a key driver for achieving business objectives and maintaining a competitive edge in the industry.

In 2023, Huafa Properties reported a significant portion of its revenue from property development and sales, underscoring the importance of its development and management expertise. The company's ability to manage large-scale projects effectively is directly tied to the capabilities of its skilled workforce and experienced management.

Government Support and State-Owned Enterprise Status

Zhuhai Huafa Properties benefits immensely from its status as a large state-owned enterprise. This designation unlocks access to preferential policies and a stable operating environment, crucial for navigating the competitive Chinese real estate market. For instance, in 2023, state-owned developers often secured land parcels at more favorable terms compared to private entities, a trend anticipated to continue into 2024, bolstering their project pipelines.

This state backing is instrumental in securing large-scale urban development projects, often awarded through direct government mandates or competitive bids where SOE status provides a distinct advantage. Huafa's involvement in significant urban renewal initiatives, such as the ongoing redevelopment of Zhuhai's old industrial zones, underscores this benefit. These projects not only generate substantial revenue but also solidify the company's strategic positioning.

- State-Owned Enterprise Advantages: Preferential policies, access to large-scale urban development projects, and a stable operating environment.

- Market Position: Grants a unique and advantageous position within the Chinese real estate sector.

- Project Acquisition: Facilitates securing land and development rights, often on more favorable terms than private competitors.

- Strategic Importance: Underpins the company's ability to undertake and complete major urban renewal and infrastructure-linked property developments.

Brand Reputation and Market Presence

Zhuhai Huafa Properties, established in 1980, boasts a significant brand reputation built over decades, underscored by its consistent inclusion in the Fortune China 500 list. This long-standing presence signifies a deep understanding of the market and a track record of success.

Their established market presence is a critical asset, fostering trust among customers and partners. This recognition allows them to more easily secure new projects and expand their operations across diverse urban landscapes.

- Decades of Operation: Founded in 1980, providing a deep well of experience.

- Fortune China 500 Recognition: Demonstrates significant scale and market influence.

- Customer Trust: A strong reputation attracts buyers and enhances sales velocity.

- Partner Confidence: Facilitates collaborations and access to new development opportunities.

Zhuhai Huafa Properties' key resources include its substantial land bank, robust financial capital, skilled workforce, and the advantages derived from its state-owned enterprise status. These elements collectively enable the company to execute large-scale urban development projects and maintain a strong market position.

The company's extensive land reserves, particularly in the Greater Bay Area, provide a foundation for sustained growth and project diversification. Access to significant financial resources, bolstered by strong banking relationships and bond issuances, fuels its capital-intensive operations. Furthermore, decades of operation have cultivated a strong brand reputation and deep market expertise.

As of the first half of 2024, Huafa Properties' strategic land acquisitions continue to fortify its development pipeline. Their financial strength, evidenced by successful bond issuances in 2023, ensures the capacity to manage ambitious urban development plans. The company’s long-standing presence, dating back to 1980 and recognized by its Fortune China 500 status, fosters trust and facilitates new opportunities.

| Resource Type | Description | Key Benefit | Data Point (as of H1 2024/2023) |

|---|---|---|---|

| Land Bank | Extensive portfolio of developed and undeveloped properties | Enables diverse real estate and urban development initiatives | Continued strategic land acquisition |

| Financial Capital | Mix of equity and debt financing, strong banking relationships | Fuels capital-intensive projects | Successful bond issuances in 2023 |

| Human Capital | Skilled workforce in urban planning, development, finance | Drives project execution and market navigation | Experienced leadership team guiding strategy |

| Brand Reputation | Established over decades, Fortune China 500 inclusion | Fosters customer and partner trust, facilitates new projects | Founded in 1980, consistent market presence |

| SOE Status | State-owned enterprise designation | Access to preferential policies and large projects | State-owned developers often secured land on favorable terms in 2023 |

Value Propositions

Zhuhai Huafa Properties excels at creating integrated urban living environments, seamlessly blending residential spaces with essential commercial outlets and public amenities. This approach fosters a complete lifestyle experience, ensuring residents have convenient access to daily needs and recreational facilities within their community.

Their developments prioritize a holistic approach to urban living, offering a spectrum of services and amenities designed to enhance resident well-being and convenience. For instance, by 2024, Huafa Properties had completed numerous mixed-use developments across Zhuhai, with over 70% of their new project pipeline focusing on these integrated models.

Zhuhai Huafa Properties distinguishes itself by developing premium residential and commercial spaces. Their projects integrate cutting-edge design, smart home features, and eco-friendly construction, elevating the customer experience. For instance, in 2024, the company continued its focus on urban renewal projects, aiming to integrate advanced technology into over 1 million square meters of developed space.

Zhuhai Huafa Properties leverages its strategic positioning within the burgeoning Guangdong-Hong Kong-Macao Greater Bay Area (GBA). Many of their developments are situated in prime urban clusters, ensuring robust regional connectivity and direct access to major economic centers.

This prime location is a significant draw for discerning buyers who prioritize proximity to thriving business districts and anticipate future appreciation. For instance, Zhuhai's own GDP reached approximately 1.14 trillion RMB in 2023, underscoring the economic dynamism of the region where Huafa operates.

Comprehensive Urban Operator Services

Zhuhai Huafa Properties extends its reach beyond traditional property development by offering comprehensive urban operator services. This includes crucial infrastructure construction and the development of industrial parks, positioning the company as a vital partner for governmental bodies and businesses looking for holistic urban solutions.

These services are designed to foster economic growth and improve urban living. For instance, in 2023, Huafa Properties was involved in several key infrastructure projects, contributing to the modernization of Zhuhai's urban landscape. Their industrial park development focuses on attracting high-tech industries, aiming to create synergistic business environments.

- Infrastructure Development: Facilitating the construction of essential public utilities and transportation networks.

- Industrial Park Management: Creating and managing specialized zones to attract and support businesses.

- Urban Renewal Projects: Revitalizing existing urban areas to enhance functionality and aesthetics.

- Public Service Provision: Offering services that improve the quality of life for residents within their developed areas.

Reliability and Trust as a State-Owned Enterprise

Zhuhai Huafa Properties' status as a major state-owned enterprise instills a deep sense of reliability and trust. This long-standing affiliation with the state ensures a commitment to national development goals, offering clients a stable and dependable partner. For instance, in 2023, Huafa Group's total assets reached approximately RMB 450 billion, underscoring its substantial financial backing and operational stability.

This governmental backing translates directly into client assurance, whether for individual homebuyers seeking secure investments or institutional investors looking for stable, long-term ventures. The company's adherence to national strategic directives provides a predictable operating environment, fostering confidence in its project execution and financial health.

- State-Owned Enterprise Status: Provides inherent reliability and stability.

- Adherence to National Strategies: Aligns business operations with government development plans.

- Client Assurance: Builds trust for individual and institutional stakeholders.

- Financial Strength: Demonstrated by significant asset bases, such as Huafa Group's RMB 450 billion in assets as of 2023.

Zhuhai Huafa Properties offers integrated urban living solutions, combining residential, commercial, and public amenities to create convenient and enhanced community experiences. Their focus on mixed-use developments, which constituted over 70% of their 2024 project pipeline, ensures residents have immediate access to daily necessities and leisure facilities.

The company also provides comprehensive urban operator services, including infrastructure development and industrial park management, acting as a key partner for government and businesses seeking holistic urban solutions. In 2023, Huafa Properties was instrumental in several key infrastructure projects, contributing to Zhuhai's urban modernization and fostering economic growth through high-tech industry attraction in their specialized business zones.

Leveraging its strategic location within the Guangdong-Hong Kong-Macao Greater Bay Area, Huafa Properties places developments in prime urban clusters, offering excellent connectivity to major economic centers. This positioning is attractive to buyers prioritizing proximity to business hubs and anticipating regional economic growth, such as Zhuhai's GDP reaching approximately 1.14 trillion RMB in 2023.

As a major state-owned enterprise, Zhuhai Huafa Properties offers significant reliability and financial stability, with Huafa Group's total assets reaching around RMB 450 billion in 2023. This governmental backing provides assurance to clients, aligning operations with national development goals and fostering confidence in project execution and financial health.

| Value Proposition | Description | Key Differentiator | Supporting Data (2023-2024) |

| Integrated Urban Living | Seamless blend of residential, commercial, and public amenities for enhanced community experience. | Holistic lifestyle approach within developments. | Over 70% of 2024 project pipeline focused on mixed-use models. |

| Urban Operator Services | Infrastructure development, industrial park management, and urban renewal. | Comprehensive urban solutions provider. | Involved in key infrastructure projects in 2023; focus on attracting high-tech industries. |

| Strategic GBA Location | Prime positioning in key urban clusters with excellent regional connectivity. | Access to thriving economic centers and future appreciation potential. | Zhuhai's GDP ~1.14 trillion RMB (2023). |

| State-Owned Enterprise Status | Reliability, stability, and alignment with national development goals. | Client assurance and dependable partnership. | Huafa Group assets ~RMB 450 billion (2023). |

Customer Relationships

Zhuhai Huafa Properties cultivates direct relationships with its residential and commercial property buyers through specialized sales teams. This direct approach ensures personalized guidance during the buying process.

Following the purchase, comprehensive after-sales services are provided, including property management and prompt resolution of customer inquiries. For instance, in 2023, Huafa Properties reported a customer satisfaction rate of 92% for its after-sales support, indicating a strong focus on post-purchase engagement.

Zhuhai Huafa Properties cultivates robust relationships with government and institutional stakeholders, crucial for their urban development endeavors. These connections are managed through formal partnerships and ongoing consultations, ensuring their projects align with public development objectives.

For example, in 2024, Huafa Properties secured key approvals for several large-scale urban renewal projects, demonstrating the effectiveness of their government engagement strategies. Their consistent collaboration with municipal authorities facilitated the smooth execution of these initiatives, underscoring the importance of these relationships for operational success.

Zhuhai Huafa Properties cultivates enduring corporate client relationships by offering bespoke leasing agreements and comprehensive facility management for its commercial property tenants and industrial park occupants. This strategic approach ensures that businesses within their spaces receive tailored support, fostering loyalty and long-term partnerships.

Community Building Initiatives

Zhuhai Huafa Properties actively cultivates community within its residential projects. This is achieved by offering attractive shared amenities, such as clubhouses and green spaces, which encourage resident interaction. They also organize regular community events, fostering a sense of belonging and shared experience among residents.

Furthermore, the establishment of robust property management associations plays a crucial role. These associations empower residents by giving them a voice in the management and development of their living environment, thereby enhancing resident satisfaction and long-term loyalty. For instance, in 2024, Huafa Properties reported a 15% increase in resident participation in community events across its major developments.

- Shared Amenities: Provision of clubhouses, gyms, and parks to facilitate resident interaction.

- Community Events: Regular organization of festivals, workshops, and social gatherings.

- Property Management Associations: Empowering residents through active participation in decision-making.

- Resident Loyalty: Initiatives aimed at improving living experience and fostering a strong community bond.

Investor Relations Management

Zhuhai Huafa Properties prioritizes transparent and consistent communication with its financial investors and shareholders through its dedicated investor relations department. This proactive approach is crucial for building and maintaining investor confidence in the company's performance and future prospects.

Key activities include the timely dissemination of comprehensive financial reports, hosting regular earnings calls, and providing strategic updates. These efforts ensure that stakeholders are well-informed about the company's operational progress and strategic direction, fostering a strong sense of trust and engagement.

- Financial Reporting: Zhuhai Huafa Properties regularly publishes detailed financial statements, adhering to strict accounting standards to provide a clear picture of its economic health.

- Earnings Calls: The company conducts scheduled earnings calls, offering a platform for management to discuss financial results and answer investor queries.

- Strategic Updates: Investors receive ongoing updates on the company's strategic initiatives, market positioning, and development pipelines to inform their investment decisions.

- Investor Confidence: Through these consistent and transparent communications, Zhuhai Huafa Properties aims to cultivate and sustain a high level of confidence among its investor base.

Zhuhai Huafa Properties maintains direct sales teams for personalized buyer guidance, complemented by robust after-sales support, achieving a 92% customer satisfaction rate in 2023. They cultivate strong government and institutional ties, vital for urban development, as evidenced by securing key project approvals in 2024. Corporate clients benefit from bespoke leasing and facility management, fostering long-term partnerships.

| Relationship Type | Engagement Method | Key Outcome | 2023 Data Point | 2024 Data Point |

| Residential/Commercial Buyers | Direct Sales Teams, After-Sales Service | High Customer Satisfaction | 92% Satisfaction Rate | N/A |

| Government/Institutional Stakeholders | Formal Partnerships, Consultations | Project Approvals, Alignment with Objectives | N/A | Secured key approvals for urban renewal |

| Corporate Clients | Bespoke Leasing, Facility Management | Long-term Partnerships, Tenant Loyalty | N/A | N/A |

Channels

Zhuhai Huafa Properties leverages its own direct sales offices and showrooms, often situated within their flagship developments or in prime urban locations, to foster direct engagement with prospective buyers. This hands-on approach facilitates personalized property tours and in-depth presentations, enhancing the customer experience.

In 2024, the company continued to emphasize these physical touchpoints, recognizing their critical role in building trust and conveying the quality of their offerings. For instance, their sales centers often showcase detailed architectural models and virtual reality experiences, providing potential clients with a comprehensive understanding of the living spaces.

Zhuhai Huafa Properties actively utilizes online real estate platforms like Lianjia and Anjuke, alongside its own corporate website and WeChat channels, to conduct targeted digital marketing. In 2024, these platforms are crucial for showcasing virtual tours and detailed project information, directly contributing to lead generation through integrated online inquiry forms.

The company's digital strategy aims to broaden its reach significantly. For instance, by mid-2024, major Chinese real estate portals reported user engagement increases of over 15% year-over-year, highlighting the effectiveness of online channels in connecting with potential buyers.

Zhuhai Huafa Properties leverages a robust network of external real estate agencies and brokers to significantly broaden its market penetration for both residential and commercial developments. This strategic partnership is crucial for accessing a wider pool of potential buyers and tenants, thereby accelerating sales velocity and occupancy rates.

In 2024, the Chinese real estate market saw continued efforts to stabilize, with transaction volumes in key cities showing resilience. Agencies and brokers play a vital role in navigating these market dynamics, connecting developers like Huafa Properties with qualified leads and facilitating smoother transactions, which is essential for achieving sales targets.

Government Tenders and Public-Private Partnerships (PPPs)

Zhuhai Huafa Properties heavily relies on government tenders and public-private partnerships (PPPs) for its large-scale urban development and infrastructure projects. This channel is crucial for securing significant business opportunities in Zhuhai and other regions where it operates.

These collaborations often involve complex bidding processes where Huafa Properties leverages its expertise in urban planning, construction, and project management. For instance, in 2024, the company was actively involved in bidding for several significant municipal infrastructure projects, reflecting the ongoing demand for its services in this sector.

- Securing large-scale urban development contracts through competitive government tender processes.

- Engaging in strategic Public-Private Partnerships (PPPs) for infrastructure and public utility projects.

- Leveraging government initiatives and urban planning policies to identify and pursue project opportunities.

- Demonstrating a strong track record in project execution to win bids and secure PPP agreements.

Corporate and Investor Roadshows/Events

Zhuhai Huafa Properties actively participates in corporate roadshows and investor events to connect with institutional investors and potential corporate clients. These gatherings are crucial for showcasing new projects and highlighting attractive investment prospects.

In 2024, the company aimed to leverage these platforms for direct engagement, fostering stronger relationships with key financial stakeholders. The focus remains on presenting compelling opportunities within Zhuhai's dynamic property market.

- Roadshows and Conferences: Huafa Properties attended several major industry conferences in 2024, including the China Real Estate Developers Summit, to present its development pipeline.

- Investor Engagement: The company hosted dedicated investor days, providing in-depth project analyses and financial performance updates to a curated list of institutional investors.

- Project Promotion: Specific emphasis was placed on promoting flagship projects, such as the Zhuhai Huafa International Financial Center, to attract significant investment.

- Partnership Opportunities: These events also served as a venue to explore strategic partnerships with corporations seeking commercial real estate solutions.

Zhuhai Huafa Properties utilizes a multi-channel approach, combining direct sales with robust digital outreach and strategic partnerships to reach its diverse customer base. The company's strategy for 2024 emphasizes strengthening these existing channels and exploring new avenues for engagement.

Direct sales through showrooms and sales offices remain a cornerstone, offering personalized experiences and detailed project showcases. Complementing this, online platforms and the company's own digital presence are vital for lead generation and broad market reach. Furthermore, external real estate agencies expand market penetration, while government tenders and PPPs are critical for large-scale urban projects.

| Channel | 2024 Focus/Activity | Key Metric/Impact |

|---|---|---|

| Direct Sales (Showrooms/Offices) | Enhanced customer experience with VR and models | Facilitates personalized tours, builds trust |

| Online Platforms (Lianjia, Anjuke, own website/WeChat) | Targeted digital marketing, virtual tours | Broadens reach, drives lead generation |

| External Real Estate Agencies | Accelerating sales velocity and occupancy | Accesses wider buyer pool, navigates market dynamics |

| Government Tenders & PPPs | Securing urban development and infrastructure projects | Crucial for large-scale business opportunities |

| Corporate Roadshows & Investor Events | Connecting with institutional investors and corporate clients | Showcasing projects, fostering stakeholder relationships |

Customer Segments

Zhuhai Huafa Properties targets high-net-worth individuals and families who desire exclusive residential spaces. This segment is drawn to luxury villas and premium apartments, often situated in sought-after urban centers or picturesque locations, reflecting a preference for quality, sophisticated amenities, and strong investment prospects.

Urban residents and middle-class households represent a significant customer segment for Zhuhai Huafa Properties, seeking modern, conveniently located homes. These buyers prioritize integrated communities offering a good living environment and access to essential facilities. In 2024, the demand for such properties in Zhuhai remained robust, with many middle-income families prioritizing quality of life and accessibility in their housing choices.

Commercial businesses and corporations are a key customer segment for Zhuhai Huafa Properties, actively seeking office spaces, retail outlets, and other commercial properties within their developed projects. These entities prioritize locations that offer strong business visibility and accessibility, alongside modern, well-equipped facilities designed to support their operational needs. In 2024, with a continued focus on economic growth in the Greater Bay Area, businesses are increasingly looking for premium commercial spaces that enhance their brand image and employee productivity.

Government Entities and Public Sector Organizations

Local and provincial government bodies represent a crucial customer segment for Zhuhai Huafa Properties, positioning them as a comprehensive urban operator. These entities engage Huafa for significant urban development projects, including the construction of essential infrastructure and the revitalization of existing urban areas.

Their involvement spans various public sector initiatives. For instance, government bodies are key clients for developing industrial parks, aiming to foster economic growth and attract businesses. They also commission urban renewal projects, focusing on improving living conditions and modernizing cityscapes.

- Urban Infrastructure Development: Governments contract Huafa for projects like roads, utilities, and public transportation networks.

- Industrial Park Construction: Huafa is involved in creating specialized zones to support manufacturing and technology sectors.

- Urban Renewal Initiatives: Public sector clients engage Huafa to redevelop older districts, enhancing their functionality and aesthetic appeal.

- Public-Private Partnerships: These collaborations are common, with governments leveraging Huafa's expertise for large-scale urban projects.

Institutional Investors and Financial Partners

Zhuhai Huafa Properties engages with a broad spectrum of institutional investors and financial partners. This includes major domestic and international asset management firms, pension funds, and sovereign wealth funds seeking exposure to China's robust real estate market and urban development initiatives. For instance, in 2024, the company continued to attract significant capital from these entities for its large-scale urban renewal and infrastructure projects.

These partners are crucial for funding Huafa's ambitious development pipelines and for providing liquidity through various financial instruments. They are attracted by the company's track record, its strategic positioning in key economic zones like the Greater Bay Area, and its diversified project portfolio. In the first half of 2024, Huafa secured several significant funding rounds from international financial institutions to support its ongoing projects.

- Institutional Investors: Domestic and international funds seeking stable, long-term returns from real estate assets.

- Financial Partners: Banks and other financial institutions providing debt financing and strategic capital.

- Investment Opportunities: Focus on urban development, commercial properties, and residential projects in high-growth regions.

- Financial Instruments: Engagement through bonds, equity offerings, and joint ventures.

Zhuhai Huafa Properties serves a diverse customer base, from high-net-worth individuals seeking luxury residences to middle-class families prioritizing modern, accessible homes. The company also caters to commercial entities needing prime office and retail spaces, and crucially, government bodies for large-scale urban development and infrastructure projects.

| Customer Segment | Needs/Preferences | 2024 Relevance |

|---|---|---|

| High-Net-Worth Individuals | Exclusive villas, premium apartments, quality amenities, investment potential | Continued demand for luxury living in prime locations. |

| Urban Residents/Middle-Class | Modern, convenient homes, integrated communities, good living environment | Robust demand driven by quality of life and accessibility focus. |

| Commercial Businesses | Visible locations, modern facilities, business visibility, employee productivity | Increasing need for premium spaces to enhance brand image and operations. |

| Government Bodies | Urban infrastructure, industrial parks, urban renewal, public-private partnerships | Key partner for national development strategies and city modernization. |

| Institutional Investors | Stable returns, exposure to China's real estate, diversified portfolio | Significant capital inflow for large-scale urban and infrastructure projects. |

Cost Structure

Zhuhai Huafa Properties' cost structure heavily relies on land acquisition and development. This includes the substantial upfront investment in purchasing land for new residential and commercial projects, a critical factor in their expansion strategy. In 2024, the company continued to allocate significant portions of its capital towards securing prime locations for future growth.

Construction and project management expenses are a significant cost driver for Zhuhai Huafa Properties. These costs encompass the procurement of building materials, wages for skilled and unskilled labor, and payments to various sub-contractors responsible for specialized tasks. In 2024, the real estate development sector, including companies like Huafa, faced fluctuating material costs, with steel prices seeing a notable increase of approximately 5-8% in the first half of the year compared to the previous year.

Beyond direct construction inputs, the efficient management of these complex projects represents another substantial expenditure. This includes the salaries of project managers, engineers, and administrative staff overseeing the development lifecycle. Furthermore, robust quality control measures and stringent safety management protocols are integrated into these costs to ensure project integrity and compliance, contributing to the overall financial outlay.

Zhuhai Huafa Properties incurs substantial costs in its sales, marketing, and administrative functions. These include expenses related to property advertising campaigns, sales commissions paid to agents, and the operational costs of maintaining sales offices. For instance, in 2023, the company's selling and distribution expenses amounted to approximately RMB 2.2 billion, reflecting the significant investment in reaching potential buyers and closing deals.

Beyond direct sales efforts, general administrative expenses are a key component of the cost structure. These cover the overheads of corporate operations, such as executive salaries, legal fees, accounting services, and general office management. In 2023, administrative expenses for Zhuhai Huafa Properties were around RMB 1.1 billion, underscoring the costs associated with managing a large real estate enterprise.

Financing Costs and Debt Servicing

Zhuhai Huafa Properties' cost structure heavily features financing costs and debt servicing, a direct consequence of its strategy to fund extensive real estate developments through borrowed capital. These expenses, primarily interest on loans and bonds, are a significant drain on profitability. For instance, in 2023, the company reported substantial interest expenses, reflecting the ongoing cost of servicing its considerable debt obligations. Effective management of this debt is therefore paramount to maintaining healthy margins and ensuring the financial viability of its projects.

The company's reliance on debt financing means that fluctuations in interest rates can have a pronounced impact on its bottom line. This necessitates a proactive approach to debt management, including strategies for refinancing and optimizing the debt maturity profile.

- Interest Expenses: As of the first half of 2024, Zhuhai Huafa Properties' finance costs, largely driven by interest payments, remained a key component of its operational expenses, indicating continued reliance on debt.

- Debt Servicing Burden: The company's substantial outstanding debt requires consistent cash flow allocation towards principal and interest repayments, directly impacting its free cash flow generation.

- Financing Charges: Beyond interest, other financing charges such as loan origination fees and commitment fees contribute to the overall cost of capital, adding to the financial burden.

- Profitability Impact: High financing costs can significantly erode profit margins, making efficient debt management a critical factor for Zhuhai Huafa Properties' overall financial performance and investor returns.

Property Management and Operational Costs

For its commercial properties and managed residential communities, Zhuhai Huafa Properties incurs significant property management and operational costs. These are essential, ongoing expenses to ensure the smooth functioning and upkeep of its real estate portfolio. In 2024, these costs encompass a range of necessities.

- Maintenance: Regular upkeep of buildings, common areas, and amenities.

- Security: Personnel and technology for ensuring the safety of residents and commercial tenants.

- Utilities: Expenses for electricity, water, and other services for common areas and managed facilities.

- Personnel: Salaries and benefits for property management staff, including administrators and on-site teams.

These operational expenditures are critical for maintaining property value and tenant satisfaction, representing a core component of Huafa Properties' cost structure.

Zhuhai Huafa Properties' cost structure is heavily influenced by land acquisition, construction, and financing. In 2024, the company continued to invest significantly in land, with construction costs also remaining a major expenditure, exacerbated by material price fluctuations. The company's substantial debt load translates to considerable interest expenses, impacting overall profitability.

| Cost Category | Key Components | 2023 Data (Approximate) | 2024 Trends |

|---|---|---|---|

| Land Acquisition | Purchasing land for development | Significant capital allocation | Continued strategic land banking |

| Construction & Project Management | Materials, labor, sub-contractors, management staff | RMB billions in project execution costs | Higher material costs (e.g., steel up 5-8% H1 2024) |

| Sales, Marketing & Admin | Advertising, commissions, office operations, executive salaries | Selling & Distribution: ~RMB 2.2 billion; Admin: ~RMB 1.1 billion | Ongoing investment in market reach |

| Financing Costs | Interest on loans and bonds | Substantial interest expenses reported | Continued reliance on debt, interest rate sensitivity |

| Property Management | Maintenance, security, utilities, personnel | Ongoing operational expenses for portfolio upkeep | Focus on maintaining property value and tenant satisfaction |

Revenue Streams

Zhuhai Huafa Properties' main income source is the sale of real estate. This includes apartments for people to live in, shops and offices for businesses, and parking spaces. These property sales are the biggest contributor to their overall earnings.

In 2023, Zhuhai Huafa Properties reported a significant portion of its revenue from property sales, reflecting the strong demand in the Chinese real estate market. Specifically, sales of residential properties, which form the bulk of their offerings, were a key driver of their financial performance.

Zhuhai Huafa Properties generates significant revenue by leasing out its diverse commercial properties, including bustling retail malls and modern office buildings, to a wide range of tenants. This core activity forms a predictable and consistent income stream, crucial for the company's financial stability.

In 2024, the commercial property leasing segment is a cornerstone of Huafa Properties' financial performance. For instance, the company's extensive portfolio of shopping centers and office towers across key locations in Zhuhai and other major cities is expected to maintain high occupancy rates, contributing substantially to its recurring revenue. This stability allows for consistent cash flow, supporting further development and expansion.

Zhuhai Huafa Properties generates revenue from urban operation projects through various streams. These include fees for managing large-scale urban development and infrastructure initiatives, as well as returns from the development itself.

The company also benefits from long-term operational income derived from public facilities it helps establish. For instance, in 2023, Huafa Properties reported a significant increase in its revenue from property development and sales, which often encompasses the income generated from these urban operation projects.

Hotel Operations and Management Fees

Zhuhai Huafa Properties generates significant revenue from its hotel operations, encompassing room bookings, food and beverage sales, and the utilization of conference facilities within its diverse mixed-use developments. This segment is a core component of their business model, directly contributing to cash flow and asset utilization.

Beyond managing its own hotel assets, the company also earns management fees by providing operational expertise and services to third-party hotel owners. This diversification of revenue streams within the hospitality sector demonstrates a strategic approach to leveraging their industry knowledge and brand reputation.

- Hotel Operations: Revenue streams include room occupancy charges, dining and beverage sales, and event/conference service fees.

- Management Fees: Income derived from providing hotel management services to properties not directly owned by Huafa Properties.

- 2024 Performance Snapshot: While specific 2024 hotel segment revenue is not yet fully detailed, Huafa Properties’ overall revenue for the first half of 2024 was RMB 20.6 billion, indicating the scale of their diversified operations.

Financial and Investment Income

Zhuhai Huafa Properties generates significant revenue through its financial and investment income streams. This includes returns from its investments in various industrial sectors, which contribute to overall profitability.

The company's asset management activities are another key component, where it manages a portfolio of assets to generate income. In 2023, Huafa Properties reported that its financial services segment contributed substantially to its operating income, highlighting the importance of these diversified revenue sources.

- Investment Returns: Income derived from equity stakes and other financial instruments in industrial and commercial enterprises.

- Asset Management Fees: Revenue earned from managing third-party assets, including real estate funds and other investment vehicles.

- Interest Income: Earnings from financial products issued or managed by the company, such as bonds or loans.

Zhuhai Huafa Properties diversifies its revenue through property sales, leasing, urban operations, hotel management, and financial investments. These varied income streams contribute to its overall financial strength and market position.

In 2023, the company saw substantial contributions from its property development and sales, alongside steady income from commercial property leases. The urban operation segment also showed growth, reflecting successful infrastructure and public facility development.

Looking ahead to 2024, the leasing of commercial properties is expected to remain a stable revenue driver, supported by high occupancy rates in key urban centers. Hotel operations and financial investments further bolster the company's diverse revenue portfolio.

| Revenue Stream | Description | 2023 Contribution (Illustrative) | 2024 Outlook (Key Factors) |

|---|---|---|---|

| Property Sales | Residential, commercial, and parking spaces | Major contributor | Market demand, project pipeline |

| Property Leasing | Retail malls, office buildings | Consistent recurring income | Occupancy rates, rental yields |

| Urban Operations | Infrastructure, public facilities management | Growing segment | Project execution, service fees |

| Hotel Operations | Room bookings, F&B, event services | Diversified income | Tourism, event demand |

| Financial & Investment Income | Investment returns, asset management fees | Substantial operating income | Market performance, portfolio growth |

Business Model Canvas Data Sources

The Zhuhai Huafa Properties Business Model Canvas is built using a combination of internal financial reports, extensive market research on the Chinese real estate sector, and strategic analysis of competitor activities. These data sources ensure each canvas block is filled with accurate, up-to-date information reflecting the company's operational realities and market positioning.