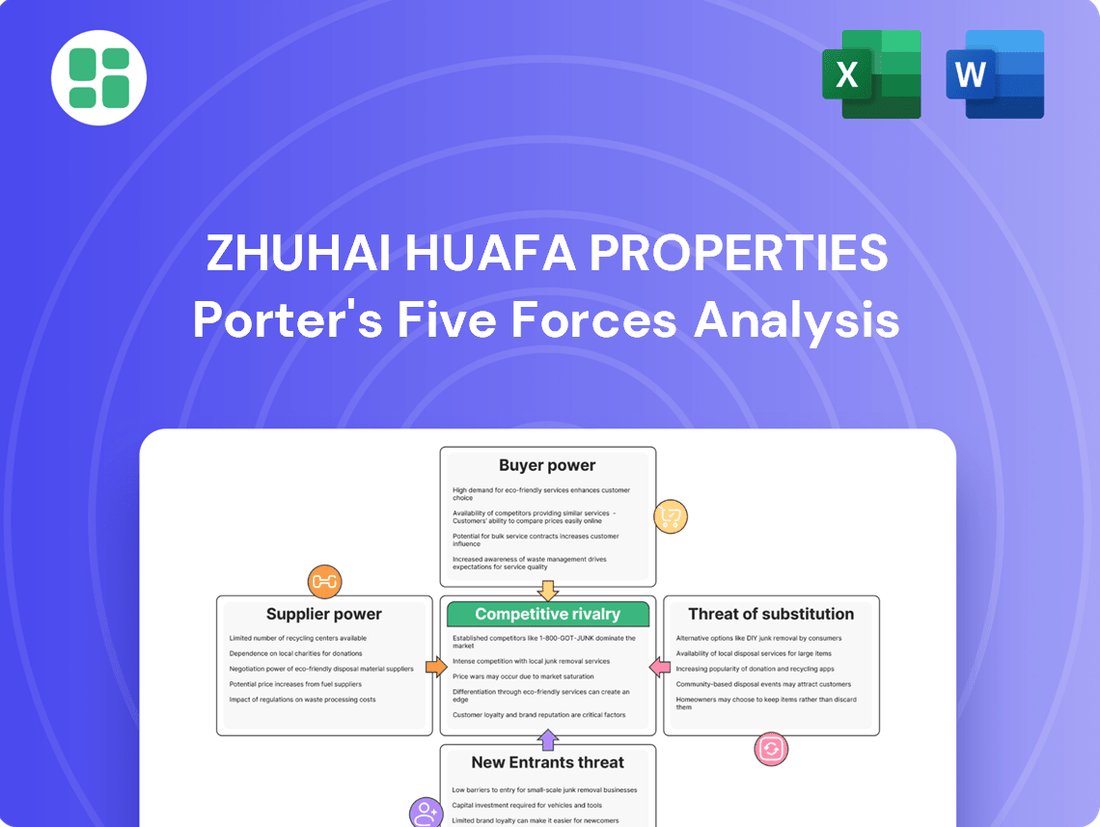

Zhuhai Huafa Properties Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Zhuhai Huafa Properties Bundle

Zhuhai Huafa Properties faces a dynamic competitive landscape, with moderate threats from new entrants and substitutes impacting its market position. Understanding the interplay of buyer power and supplier bargaining is crucial for navigating this environment.

The complete report reveals the real forces shaping Zhuhai Huafa Properties’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of land suppliers, predominantly local governments in China, is substantial given their exclusive authority over land allocation. This position grants them considerable leverage in negotiations.

However, the current real estate market slowdown has created fiscal pressures for local governments, as land sales revenue has declined. This financial strain might slightly diminish their bargaining power as they become more eager to sell existing land reserves.

As a state-owned enterprise, Zhuhai Huafa may benefit from preferential land acquisition terms or access from government entities, potentially mitigating some of the suppliers' power.

The bargaining power of construction material suppliers for Zhuhai Huafa Properties appears to be moderate to low. This is largely due to the vast number of suppliers operating within China and a noticeable slowdown in new construction projects, which can lead to increased competition among suppliers for business. For instance, China's construction output saw a slight contraction in early 2024 compared to the previous year, intensifying the need for suppliers to secure contracts.

Zhuhai Huafa, as a significant player in the property market, can effectively utilize its substantial purchasing volume to negotiate more favorable terms and pricing. The company also has the flexibility to source materials from different geographical regions, further enhancing its ability to manage costs and mitigate the risk of over-reliance on any single supplier. This strategic sourcing capability strengthens Huafa's position in its negotiations.

However, there's a subtle shift occurring. As developers like Zhuhai Huafa increasingly focus on building higher-quality homes and incorporating green infrastructure, the demand for specialized and often higher-cost materials is rising. This growing demand for niche products could slightly elevate the bargaining power of suppliers who can provide these specific, advanced materials, particularly those meeting stringent environmental standards.

The bargaining power of labor suppliers for Zhuhai Huafa Properties is likely moderate. While China has a vast labor force, the demand for skilled construction workers and experienced project managers for large-scale urban developments can give these workers some leverage, potentially driving up wages.

However, the broader economic climate and the real estate sector's performance play a significant role. In 2024, China's property market experienced a slowdown, which could lead to a surplus of available labor. This surplus would likely reduce the bargaining power of individual workers, as companies like Huafa Properties might find it easier to secure talent at more competitive rates, tempering wage increase pressures.

Financing Providers

The bargaining power of financing providers, such as banks and bond investors, is notably high for Chinese real estate developers, particularly private ones, given the persistent liquidity challenges within the sector. Zhuhai Huafa, being a state-backed entity, enjoys a degree of advantage, evidenced by its successful digital bond issuances. However, the prevailing financial strain across the industry compels lenders to exercise significant caution.

Despite government initiatives like the 'whitelist' policy designed to channel funds to viable projects, financial institutions remain hesitant to extend credit to developers with substantial leverage. This caution underscores the significant leverage lenders hold in dictating terms and access to capital for property firms.

- Lender Caution: Banks are scrutinizing loan applications more rigorously due to the sector's financial instability.

- State Backing Advantage: Zhuhai Huafa's state-owned status provides a buffer, potentially easing access to financing compared to private peers.

- Digital Bond Issuance: The successful issuance of digital bonds by Zhuhai Huafa demonstrates an ability to tap alternative financing channels, though overall market sentiment impacts these avenues.

Technology and Consultancy Service Providers

The bargaining power of technology and high-end consultancy service providers is on the rise for Zhuhai Huafa Properties. This is driven by an increasing demand for quality, efficiency, and smart city solutions in urban development. For instance, in 2024, the global smart city market was valued at approximately $510 billion, with projections showing significant growth, underscoring the value of these specialized services.

Zhuhai Huafa's strategic direction, emphasizing comprehensive urban operations and recent collaborations in areas like cybersecurity, highlights its dependence on these expert providers. The company's investment in advanced technologies and partnerships reflects a recognition of the critical role these services play in modern urban planning and execution.

These specialized providers, particularly those offering cutting-edge or environmentally conscious solutions, can negotiate higher prices. Their unique capabilities and the escalating need for sophisticated urban planning tools create a strong market position, allowing them to influence terms and pricing. In 2024, consultancy fees for specialized urban planning and technology integration often saw increases of 5-10% year-over-year due to high demand and limited supply of top-tier expertise.

- Rising Demand for Smart City Solutions: The global smart city market's growth signifies increasing reliance on advanced technology and consultancy.

- Zhuhai Huafa's Strategic Focus: The company's emphasis on urban operations and cybersecurity partnerships demonstrates a clear need for specialized external expertise.

- Provider Leverage: Technology and consultancy firms with innovative and sustainable offerings can command premium pricing due to their unique value proposition.

- Market Trends: Increased demand and a shortage of specialized talent in urban tech and planning empower service providers to negotiate favorable terms.

The bargaining power of land suppliers, predominantly local governments in China, is substantial given their exclusive authority over land allocation. However, the current real estate market slowdown has created fiscal pressures for local governments, as land sales revenue has declined, potentially diminishing their leverage. As a state-owned enterprise, Zhuhai Huafa may benefit from preferential land acquisition terms.

The bargaining power of construction material suppliers for Zhuhai Huafa Properties appears to be moderate to low due to a vast number of suppliers and a slowdown in new construction projects, intensifying competition. China's construction output saw a slight contraction in early 2024, increasing supplier eagerness for contracts. Huafa's substantial purchasing volume and flexible sourcing capabilities further strengthen its negotiating position.

The bargaining power of labor suppliers for Zhuhai Huafa Properties is likely moderate. While China has a vast labor force, demand for skilled workers can give them leverage. However, the 2024 property market slowdown might lead to a labor surplus, reducing individual worker bargaining power and tempering wage pressures.

The bargaining power of financing providers is notably high for Chinese real estate developers due to persistent liquidity challenges. Zhuhai Huafa's state-backed status provides an advantage, but lenders remain cautious due to sector instability, exercising significant leverage in dictating terms.

The bargaining power of technology and high-end consultancy service providers is on the rise for Zhuhai Huafa Properties, driven by demand for quality and smart city solutions. The global smart city market was valued at approximately $510 billion in 2024, highlighting the value of these specialized services. Providers of cutting-edge or environmentally conscious solutions can negotiate higher prices, with consultancy fees seeing increases of 5-10% year-over-year in 2024.

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Zhuhai Huafa Properties' position in the Chinese real estate market.

Zhuhai Huafa Properties' Porter's Five Forces analysis provides a clear, one-sheet summary of all five forces, perfect for quick decision-making and instantly understanding strategic pressure.

Customers Bargaining Power

Homebuyers in Zhuhai, like many in China, currently wield considerable bargaining power. This is largely driven by a substantial oversupply of housing units across the nation, coupled with a noticeable decline in property values and a general dip in consumer confidence concerning the real estate sector. Buyers are adopting a more discerning approach, prioritizing economic fundamentals and potential rental yields over speculative gains.

The Chinese government has implemented various measures to bolster demand and stabilize the market. However, a widespread recovery is not anticipated to fully materialize by 2025, suggesting that buyers will likely retain their leverage for the foreseeable future. This sustained buyer advantage puts pressure on developers like Zhuhai Huafa Properties to offer more attractive pricing and terms.

Commercial tenants, such as office and retail businesses, wield significant bargaining power. In 2024, many Chinese cities experienced a notable increase in office supply, leading to higher vacancy rates. This oversupply compels landlords to be more flexible with rental agreements and pricing to secure and retain tenants, creating a market that favors those looking to lease space.

This tenant-centric environment directly impacts property management firms like Zhuhai Huafa's commercial segment. The need to offer competitive rents and favorable lease terms to maintain occupancy means landlords have less leverage. Consequently, Zhuhai Huafa must focus on optimizing its commercial property portfolio and enhancing services to remain attractive and competitive in a market where tenant retention is paramount.

Government agencies are significant customers for infrastructure and urban development, wielding considerable bargaining power. Zhuhai Huafa, as a state-affiliated entity, often participates in government-driven initiatives, aligning with directives for enhanced quality and efficiency in urban planning. For instance, in 2024, government spending on infrastructure projects in China saw continued focus, with specific allocations for smart city development and transportation networks, areas where Huafa is actively involved.

Local Governments (for Housing Stock Acquisition)

Local governments are increasingly asserting their influence as major customers for housing stock, particularly through policies aimed at stabilizing property markets by acquiring unsold inventory. This trend significantly amplifies their bargaining power with developers. In 2024, several cities in China, including those in the Pearl River Delta where Zhuhai Huafa operates, have seen increased government intervention in the property sector, with local authorities actively purchasing unsold units. For instance, reports from early 2024 indicated significant government-backed purchases in key regions to alleviate developer debt and manage potential market downturns.

- Increased Government Intervention: Local governments are actively buying unsold housing to support developers and stabilize the market, a trend evident throughout 2024.

- Destocking Channel: These government purchases represent a vital avenue for developers to reduce excess inventory in an oversupplied market.

- Zhuhai Huafa's Experience: Zhuhai Huafa Properties has engaged in asset transfers to government-backed entities, demonstrating the direct impact of this buyer power.

Institutional Investors (for Commercial/Rental Assets)

Institutional investors looking to purchase commercial or rental properties are finding they have more sway in negotiations. This is largely because asset prices have become more appealing, and interest rates have remained low, making these acquisitions more attractive. For instance, in 2024, commercial property transaction volumes in major global cities saw a notable increase as investors capitalized on these favorable conditions.

As developers shift their focus to higher-quality housing projects and may look to divest certain existing assets, institutional buyers are in a stronger position to negotiate favorable terms. This dynamic allows them to secure better pricing and more advantageous contract conditions. The growing acceptance and expansion of Real Estate Investment Trusts (REITs) to encompass rental housing also opens up more investment channels for these large-scale investors, further bolstering their bargaining power.

- Increased Negotiation Leverage: Favorable asset prices and lower interest rates in 2024 empower institutional investors.

- Developer Diversification Impact: Developers diversifying into higher-quality housing may offload assets, creating opportunities for better terms.

- REIT Expansion: The inclusion of rental housing in REITs broadens investment options and strengthens investor negotiation power.

The bargaining power of customers for Zhuhai Huafa Properties is significant, particularly with homebuyers and commercial tenants. In 2024, a substantial oversupply of housing nationwide, coupled with declining property values and reduced consumer confidence, has shifted leverage heavily towards buyers. This trend is expected to persist, compelling developers to offer more attractive terms.

Commercial tenants also benefit from increased office supply and higher vacancy rates in many Chinese cities during 2024, granting them considerable negotiation power. Zhuhai Huafa's commercial segment must therefore focus on competitive pricing and service enhancement to retain tenants.

Government agencies and local governments are also powerful customers, especially in infrastructure and housing acquisition. In 2024, government initiatives to stabilize the property market led to increased purchases of unsold inventory, directly impacting developers like Zhuhai Huafa.

Institutional investors are also gaining leverage due to appealing asset prices and low interest rates in 2024, enabling them to negotiate more favorable terms for property acquisitions.

| Customer Segment | Bargaining Power Factors (2024) | Impact on Zhuhai Huafa |

|---|---|---|

| Homebuyers | Housing oversupply, declining property values, low consumer confidence | Pressure on pricing and sales terms |

| Commercial Tenants | Increased office supply, higher vacancy rates, tenant-centric market | Need for competitive rents and flexible lease agreements |

| Government (Agencies/Local) | Infrastructure spending focus, housing destocking policies | Opportunities in government projects, pressure on housing sales |

| Institutional Investors | Attractive asset prices, low interest rates, REIT expansion | Stronger negotiation position for property acquisitions |

Preview Before You Purchase

Zhuhai Huafa Properties Porter's Five Forces Analysis

This preview displays the complete Zhuhai Huafa Properties Porter's Five Forces Analysis, offering a comprehensive examination of the competitive landscape. You are looking at the actual document; once your purchase is complete, you’ll get instant access to this exact, professionally formatted file, ready for your strategic planning needs.

Rivalry Among Competitors

The Chinese real estate sector is characterized by a significant number of developers, fueling intense competitive rivalry. Despite recent defaults causing a market contraction, many companies continue to compete for development opportunities, particularly in major urban centers where demand remains relatively robust.

Zhuhai Huafa Properties strategically focuses on core urban areas, placing it directly in the path of fierce competition for desirable projects. For instance, in 2023, the sales volume of the top 100 Chinese developers decreased by 15.6% year-on-year, highlighting the challenging market conditions and consolidation pressures, yet prime locations still attract considerable developer interest.

The Chinese real estate market's downturn, marked by falling sales and prices, has significantly amplified competitive rivalry for Zhuhai Huafa Properties. In 2023, national property sales volume saw a substantial decrease, putting immense pressure on developers to offload inventory. This environment naturally leads to more aggressive pricing strategies as companies vie for a smaller buyer base, impacting profit margins across the sector.

State-owned enterprises (SOEs) like Zhuhai Huafa are increasingly dominating land acquisition in China. In 2023, SOEs secured a significant majority of residential land bids across major cities, often outbidding private developers. This trend intensifies competition for private firms, as SOEs may benefit from preferential financing and direct government support.

Zhuhai Huafa's position as a large SOE grants it a distinct advantage. This includes potentially more favorable loan terms and a stronger ability to weather market downturns compared to purely private competitors. The government's focus on market stabilization further empowers these state-backed entities, shaping the competitive landscape for all developers.

Diversification and Quality Focus

Competitive rivalry in the property development sector is evolving beyond mere scale. Developers are increasingly prioritizing quality, operational efficiency, and a broader spectrum of urban services. This shift is evident as companies expand into areas like construction management, commercial property management, and sustainable infrastructure development, opening up new competitive arenas.

Zhuhai Huafa Properties' strategy as a comprehensive urban operator directly addresses this trend. However, this diversification means the company now contends with specialized players in each of these new segments. For instance, in 2024, the global property management market was valued at approximately $1.1 trillion, with specialized firms often holding significant competitive advantages in efficiency and client service.

- Diversification into New Service Areas: Property developers are moving beyond residential construction to offer services like construction management, commercial property leasing, and facility management.

- Focus on Quality and Efficiency: The emphasis is shifting from rapid expansion to building higher-quality properties and operating them more efficiently.

- Competition with Specialists: Zhuhai Huafa's broad urban operator model necessitates competing against firms that specialize in specific service areas, potentially impacting market share in those niches.

- Market Trends in 2024: The real estate industry in 2024 saw increased investment in proptech solutions aimed at improving operational efficiency and customer experience, a key area for specialized competitors.

Regional Concentration and Policy Influence

Competitive rivalry in the property sector is frequently localized, with significant competition concentrated within specific urban clusters and regions. For Zhuhai Huafa Properties, its strong foothold in the Guangdong-Hong Kong-Macao Greater Bay Area (GBA) means it faces intense competition within this vital economic zone. The company's performance is directly tied to its ability to outmaneuver rivals in these key development areas.

Government policies play a crucial role in shaping project opportunities and influencing competitive dynamics. Initiatives such as urban village renovation and affordable housing programs can create new avenues for development but also intensify competition as developers vie for these government-backed projects. For instance, in 2024, the GBA continued to see substantial government investment in infrastructure and urban renewal, directly impacting the competitive landscape for developers like Huafa.

- Localized Competition: Rivalry is most acute within specific cities and development zones in the GBA, where multiple developers target similar customer segments and land parcels.

- Policy-Driven Opportunities: Government-backed urban regeneration projects and affordable housing mandates in areas like Shenzhen and Guangzhou are key battlegrounds for developers.

- GBA Strategic Focus: Zhuhai Huafa's significant exposure to the GBA means its competitive strategy must account for the region's unique market conditions and policy shifts impacting property development.

The Chinese real estate market's intense competition is further amplified by the ongoing market downturn, forcing developers like Zhuhai Huafa Properties to contend with falling sales and prices. This environment encourages more aggressive pricing, impacting profit margins across the sector.

State-owned enterprises, including Zhuhai Huafa, are increasingly winning land bids, particularly in major cities, as they often benefit from preferential financing and government backing. This trend intensifies competition for private developers, who may struggle to compete on acquisition costs.

Zhuhai Huafa's strategic expansion into broader urban services means it now faces specialized competitors in areas like property management and construction. For example, the global property management market was valued at approximately $1.1 trillion in 2024, with niche players often holding distinct advantages.

Localized competition within key economic zones like the Guangdong-Hong Kong-Macao Greater Bay Area (GBA) is a significant factor. Zhuhai Huafa's strong presence there means it must effectively navigate competition for prime development sites and government-backed projects in cities like Shenzhen and Guangzhou, which saw substantial government investment in urban renewal in 2024.

| Metric | 2023 Value | Trend | Competitive Implication |

|---|---|---|---|

| Top 100 Developers Sales Volume Change | -15.6% YoY | Decreasing | Intensified competition for market share |

| SOE Land Acquisition Share (Major Cities) | Significant Majority | Increasing | Disadvantage for private developers |

| Property Management Market Value (Global) | ~$1.1 Trillion | Growing | Competition from specialized service providers |

| GBA Infrastructure Investment | Substantial | Increasing | Opportunities and heightened competition for projects |

SSubstitutes Threaten

The burgeoning second-hand property market in Zhuhai presents a substantial threat of substitutes for Zhuhai Huafa Properties. In 2024, the resale market often provides quicker access to housing and can present more attractive price points, particularly when compared to the upfront costs and potential construction delays of new builds. This is especially true if market sentiment shifts unfavorably for new developments.

Buyers concerned about the risks of incomplete projects or developer financial stability might naturally gravitate towards established, pre-owned homes. This preference directly siphons potential demand away from Zhuhai Huafa's new property offerings, impacting their sales volume and market share.

The rental market poses a significant threat to Zhuhai Huafa Properties by offering a direct alternative to homeownership. For many, especially younger demographics grappling with affordability challenges and economic instability, renting becomes a more accessible option. This is particularly relevant in 2024, where rising property prices in many urban centers continue to make outright purchase a distant dream for a substantial portion of the population.

Government policies aimed at bolstering the rental sector further amplify this threat. Initiatives to increase the supply of affordable rental housing, often targeting new residents and migrant workers, create more appealing and practical living solutions. For instance, in many Chinese cities, there's been a concerted effort to develop more rental units, making them a more competitive choice against buying.

A robust rental market can effectively dampen the demand for new home purchases. When rental yields are attractive and rental availability is high, the perceived necessity to invest in property ownership diminishes. This can lead to a slowdown in sales for developers like Zhuhai Huafa Properties, as potential buyers opt for the flexibility and lower upfront costs associated with renting.

For investors looking beyond traditional real estate, a variety of alternative investment avenues exist. These include financial products like stocks and bonds, other asset classes such as commodities or cryptocurrencies, and even international property markets. The attractiveness of these substitutes is amplified by current conditions in China's real estate sector.

The prolonged downturn and significant inventory levels within China's property market, including areas like Zhuhai, make alternative investments appear more appealing. Investors are increasingly prioritizing opportunities that offer a better balance of higher potential returns and lower associated risks. This sentiment is particularly relevant in 2024 as investors reassess capital allocation strategies.

Self-Build or Rural Housing Options

While Zhuhai Huafa Properties primarily focuses on urban developments, the option of self-build or rural housing acts as a potential substitute, particularly for individuals less tethered to major metropolitan areas. China's ongoing rural revitalization initiatives are enhancing rural infrastructure, making these alternatives more attractive and potentially impacting demand for Zhuhai Huafa's entry-level and suburban projects.

- Rural Housing Appeal: China's rural revitalization efforts, including infrastructure upgrades, could see a greater number of individuals opting for self-built or renovated rural homes.

- Impact on Entry-Level Market: This trend primarily poses a threat to Zhuhai Huafa's offerings in the more affordable, entry-level, and suburban housing segments.

- Shifting Demand: As rural living becomes more viable and appealing, some potential buyers may divert their interest away from urban property developers like Zhuhai Huafa.

Delayed Homeownership or Smaller Units

Economic headwinds and rising household debt in China, which reached approximately 62% of GDP by the end of 2023, are influencing consumer choices. This financial pressure can push potential buyers towards delaying significant purchases like new homes or selecting smaller, more budget-friendly living spaces.

This trend acts as a substitute for acquiring larger, premium properties often offered by developers like Zhuhai Huafa. Consumers are increasingly prioritizing essential needs and cost-effectiveness over the aspirational purchase of a larger, newly constructed home.

- Economic Uncertainty: Global economic slowdowns and domestic policy shifts can create hesitancy in major purchasing decisions.

- Household Debt Levels: High debt burdens limit disposable income and borrowing capacity for potential homebuyers.

- Shift in Consumer Priorities: A greater emphasis on affordability and practical living spaces over luxury or size.

- Impact on Developers: Companies like Zhuhai Huafa may face reduced demand for their larger, higher-priced inventory.

The resale property market in Zhuhai presents a direct substitute for Zhuhai Huafa Properties' new developments. In 2024, these existing homes often offer immediate occupancy and potentially lower transaction costs, appealing to buyers seeking quicker entry or more budget-friendly options. This can divert demand from new builds, especially if market sentiment favors established properties.

The rental market also serves as a significant substitute, particularly for younger demographics or those facing economic uncertainty. With rising property prices, renting provides a more accessible and flexible housing solution. Government initiatives to expand affordable rental housing further bolster this alternative.

Alternative investments, such as stocks, bonds, or even international property, are increasingly attractive substitutes for real estate investment. The current downturn in China's property market, including Zhuhai, makes these other avenues appear more appealing due to perceived better risk-return profiles.

While less direct, rural housing and self-build options can substitute for urban developments, especially with China's rural revitalization efforts improving infrastructure. This trend might impact Zhuhai Huafa's offerings in the entry-level and suburban market segments.

| Substitute Type | 2024 Market Conditions/Trends | Impact on Zhuhai Huafa |

| Resale Property | Quicker access, potentially lower costs, established homes favored. | Siphons demand from new builds, impacting sales volume. |

| Rental Market | Affordability challenges, flexibility favored, government support for rentals. | Dampens demand for homeownership, impacting sales. |

| Alternative Investments | Property market downturn, search for better risk-return. | Reduces capital allocation to real estate, affecting demand. |

| Rural/Self-Build Housing | Rural revitalization, infrastructure improvements. | Threatens entry-level and suburban segments. |

Entrants Threaten

The real estate and urban development industries demand immense capital for everything from acquiring land to building and maintaining properties. This high financial threshold naturally discourages newcomers from entering the market, as they often lack the substantial funds needed to compete. For instance, major urban development projects can easily run into billions of dollars, a sum that many aspiring developers simply cannot raise.

Adding to this challenge, the current financing landscape for developers is particularly restrictive. Securing loans and investment has become more difficult, meaning new entrants struggle even more to obtain the crucial funding required to launch their ventures. This tight credit environment effectively acts as another significant barrier.

Zhuhai Huafa Properties, on the other hand, benefits immensely from its robust capital base and the backing of state-owned entities. This financial strength and governmental support provide a considerable competitive advantage, allowing it to undertake large-scale projects and weather market fluctuations more effectively than less capitalized competitors.

The threat of new entrants in China's real estate sector is significantly mitigated by a complex and evolving regulatory landscape. New players must contend with intricate government policies governing land use, development approvals, and sales processes. For instance, in 2024, the central government continued to emphasize stricter controls on property development and sales, impacting market access for less established firms.

The state's increasing influence over land and real estate markets, coupled with shifting urban planning objectives, presents a substantial hurdle. Entrants need to cultivate robust relationships with government bodies and remain agile to policy adjustments. Zhuhai Huafa's status as a state-owned enterprise provides a distinct advantage, leveraging its pre-existing connections with regulatory authorities.

Established brand recognition and extensive project portfolios held by large developers like Zhuhai Huafa present a significant barrier to new entrants. Building the necessary trust and a robust project pipeline in a competitive market demands considerable time and substantial investment, making it difficult for newcomers to gain traction. Zhuhai Huafa's consistent ranking among the top 10 real estate companies in China underscores its entrenched market position and the formidable challenge new players face.

Access to Land and Strategic Locations

The threat of new entrants concerning access to land and strategic locations for Zhuhai Huafa Properties is significant. Prime land parcels, particularly in sought-after first-tier cities and key development zones like the Greater Bay Area, are scarce and highly competitive. This scarcity is exacerbated by the inherent advantage state-owned enterprises often possess in securing these crucial development sites, making it difficult for new players to acquire the desirable plots necessary for profitable ventures.

New entrants face substantial hurdles in acquiring the land needed to compete effectively. For instance, in 2024, the average land auction price in major Chinese cities continued to reflect strong demand and limited supply. In Shenzhen, a key city within the Greater Bay Area, land premiums in auctions often exceeded initial expectations, demonstrating the high cost of entry. This makes it challenging for new developers to secure the foundational assets required for projects, directly impacting their ability to challenge established players like Huafa Properties.

- Limited Availability of Prime Land: Access to desirable land, especially in first-tier cities and the Greater Bay Area, is restricted.

- State-Owned Enterprise Advantage: SOEs often have preferential access to land, creating an uneven playing field.

- High Acquisition Costs: New entrants struggle with the elevated costs of acquiring suitable land parcels, hindering their ability to enter the market profitably.

- Competitive Land Auctions: In 2024, land auction prices in major Chinese cities remained high, with premiums often exceeding expectations, as seen in markets like Shenzhen.

Oversupply and Market Downturn

The current real estate market in many regions, including areas where Zhuhai Huafa Properties operates, is experiencing significant oversupply. For instance, in late 2023 and early 2024, several Chinese cities saw a substantial increase in unsold housing inventory, with some reporting vacancy rates exceeding 10%. This oversupply naturally drives down property prices, making it a less appealing environment for new developers to enter.

Declining property prices directly impact profitability. When developers can no longer command premium prices, their margins shrink considerably. In 2023, the average price decline in some major Chinese cities was reported to be around 5-8% year-on-year. This low profitability, coupled with the increased risk of further price drops, makes the industry a less attractive proposition for new capital investment.

The combination of oversupply and price erosion creates a challenging economic climate. This unfavorable environment significantly raises the barrier to entry for potential new competitors. New entrants would face immediate pressure to compete on price, likely at a loss, and would struggle to gain market share against established players who may have more favorable land acquisition costs or financing structures.

- Oversupply: Reports from early 2024 indicated a significant glut of residential properties in key Chinese urban centers.

- Price Declines: Property prices in several major cities saw year-on-year decreases of 5% to 8% through 2023.

- Reduced Profitability: Lower sales prices directly compress profit margins for developers.

- Increased Risk: The market downturn amplifies the financial risks for any new company entering the sector.

The threat of new entrants for Zhuhai Huafa Properties is considerably low due to substantial capital requirements, a challenging financing environment, and stringent regulations in China's real estate sector. Established players like Huafa benefit from existing relationships and financial strength, making it difficult for newcomers to compete. For instance, the high cost of land acquisition, exemplified by competitive auctions in cities like Shenzhen in 2024 where premiums often exceeded expectations, acts as a significant deterrent.

| Barrier to Entry | Description | Impact on New Entrants | Example Data (2024) |

| Capital Requirements | Immense funds needed for land, construction, and maintenance. | Newcomers struggle to raise sufficient capital. | Major urban development projects can cost billions. |

| Financing Difficulty | Restrictive lending and investment landscape. | Securing loans and investment is challenging. | Tight credit environment observed in early 2024. |

| Regulatory Hurdles | Complex government policies on land, development, and sales. | Navigating intricate rules requires expertise and time. | Continued emphasis on stricter property controls by the central government. |

| Land Access & Cost | Scarcity of prime land and high auction prices. | Acquiring desirable plots is expensive and competitive. | Land premiums in Shenzhen auctions often exceeded initial bids. |

Porter's Five Forces Analysis Data Sources

Our analysis of Zhuhai Huafa Properties leverages data from official company filings, including annual reports and investor presentations, alongside industry-specific market research from reputable firms and government statistics on the Chinese real estate sector.