Zhuhai Huafa Properties PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Zhuhai Huafa Properties Bundle

Navigate the complex external landscape impacting Zhuhai Huafa Properties with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and technological advancements are shaping the property market, offering you a critical advantage. Download the full version now and gain the strategic foresight needed to excel.

Political factors

Zhuhai Huafa Properties, as a state-owned enterprise (SOE), operates under the direct influence of Chinese central and local government policies. These policies span real estate development, urban planning, and the ongoing SOE reforms, shaping Huafa's operational environment and strategic choices.

Recent policy shifts, such as adjustments to land supply mechanisms and housing purchase restrictions in key cities, directly affect Huafa's project pipelines and sales volumes. For instance, the relaxation of some purchase limits in certain cities in late 2023 aimed to stabilize the market, potentially benefiting developers like Huafa.

Furthermore, government directives on financing for property developers, including support for project completion and access to capital markets, are crucial. In 2024, the government continued to signal support for the stable development of the real estate sector, which could provide Zhuhai Huafa Properties with more favorable financing conditions.

Zhuhai Huafa Properties' core business is deeply intertwined with government urban development plans, as its operations focus on urban development and management. The company's success hinges on its ability to align with and capitalize on these government-led initiatives. For instance, the ongoing development of the Guangdong-Hong Kong-Macao Greater Bay Area, a significant national strategy, directly influences Zhuhai's urban planning and infrastructure investment, creating a fertile ground for Huafa Properties.

Investments in new districts, such as the High-Tech Industrial Development Zone in Zhuhai, and enhancements to transportation networks, like the expansion of the Zhuhai Airport and the construction of intercity rail links, present substantial opportunities. These projects not only provide direct development contracts for Huafa Properties but also boost the value and demand for its real estate projects. By securing a significant portion of land development rights in these expanding areas, Huafa Properties can solidify its market position and ensure sustained growth through alignment with these long-term urban visions.

China's ongoing state-owned enterprise (SOE) reforms, a significant political factor, are designed to enhance efficiency and market competitiveness. For Zhuhai Huafa Properties, this could translate into altered governance structures and increased operational independence, potentially fostering a more market-driven approach.

These reforms may also push SOEs like Huafa towards stricter financial management and broader funding avenues. Expect a greater openness to collaborations with private sector firms, which could fundamentally reshape its corporate framework and strategic market positioning.

Geopolitical Stability and Regional Integration

The geopolitical landscape, particularly the ongoing development of the Guangdong-Hong Kong-Macao Greater Bay Area (GBA), significantly influences Zhuhai's economic trajectory and, by extension, Huafa Properties' prospects. Political stability within this framework is crucial for attracting investment and facilitating large-scale development projects.

The GBA initiative, a key government strategy, aims to create a world-class city cluster. Progress in this area directly translates to increased economic activity and a more robust market for real estate development, aligning with Huafa Properties' growth ambitions.

- GBA Investment: In 2024, the GBA continued to be a focal point for national development, with significant government investment channeled into infrastructure and innovation projects, bolstering regional economic integration.

- Policy Support: Zhuhai benefits from preferential policies aimed at attracting talent and capital within the GBA, creating a more conducive environment for property developers like Huafa Properties.

- Regional Connectivity: Enhancements in transportation and logistics within the GBA, such as improved high-speed rail networks, directly increase Zhuhai's accessibility and attractiveness for businesses and residents.

Anti-Corruption Campaigns

Ongoing government initiatives to combat corruption, particularly within the real estate sector and state-owned enterprises (SOEs), are significantly increasing scrutiny on business operations. This means Zhuhai Huafa Properties faces a more demanding environment for transparency and ethical conduct.

Zhuhai Huafa Properties must therefore prioritize robust internal controls and unwavering ethical standards. This proactive approach is crucial for mitigating risks tied to corrupt practices, thereby safeguarding the company's reputation and ensuring its operational integrity in the evolving regulatory landscape.

- Heightened Regulatory Scrutiny: Increased focus on anti-corruption measures translates to stricter oversight of property development deals and land acquisitions.

- Demand for Transparency: Companies like Zhuhai Huafa Properties are expected to demonstrate clear and verifiable adherence to ethical business practices in all transactions.

- Reputational Risk Mitigation: Maintaining impeccable ethical standards is vital to prevent negative publicity and maintain stakeholder trust, especially in light of past corruption cases in China's property market.

- Impact on SOE Partnerships: Collaboration with or reliance on SOEs may require enhanced due diligence due to the heightened focus on corruption within these entities.

Government policies continue to be a primary driver for Zhuhai Huafa Properties, particularly through national strategies like the Guangdong-Hong Kong-Macao Greater Bay Area (GBA) initiative. In 2024, the GBA saw continued emphasis on infrastructure development and economic integration, directly benefiting Zhuhai's growth prospects and creating opportunities for property developers. Zhuhai itself has benefited from preferential policies aimed at attracting talent and capital within the GBA, fostering a more favorable environment for real estate ventures.

The ongoing real estate market adjustments in China, influenced by government policies, directly impact Huafa's sales and project pipelines. While some cities have seen a relaxation of purchase restrictions, the overall market sentiment remains cautious, necessitating strategic alignment with government directives for stable development. Furthermore, government support for project completion and access to capital markets, signaled in 2024, offers potential for improved financing conditions for developers like Huafa.

Zhuhai Huafa Properties, as a state-owned enterprise, is subject to ongoing SOE reforms aimed at enhancing efficiency and market competitiveness. These reforms may lead to altered governance structures and increased operational independence, potentially encouraging a more market-driven approach and a greater openness to diverse funding avenues and private sector collaborations. The company's alignment with urban development plans and infrastructure investments within the GBA, such as airport expansions and rail link constructions, remains crucial for its growth trajectory.

What is included in the product

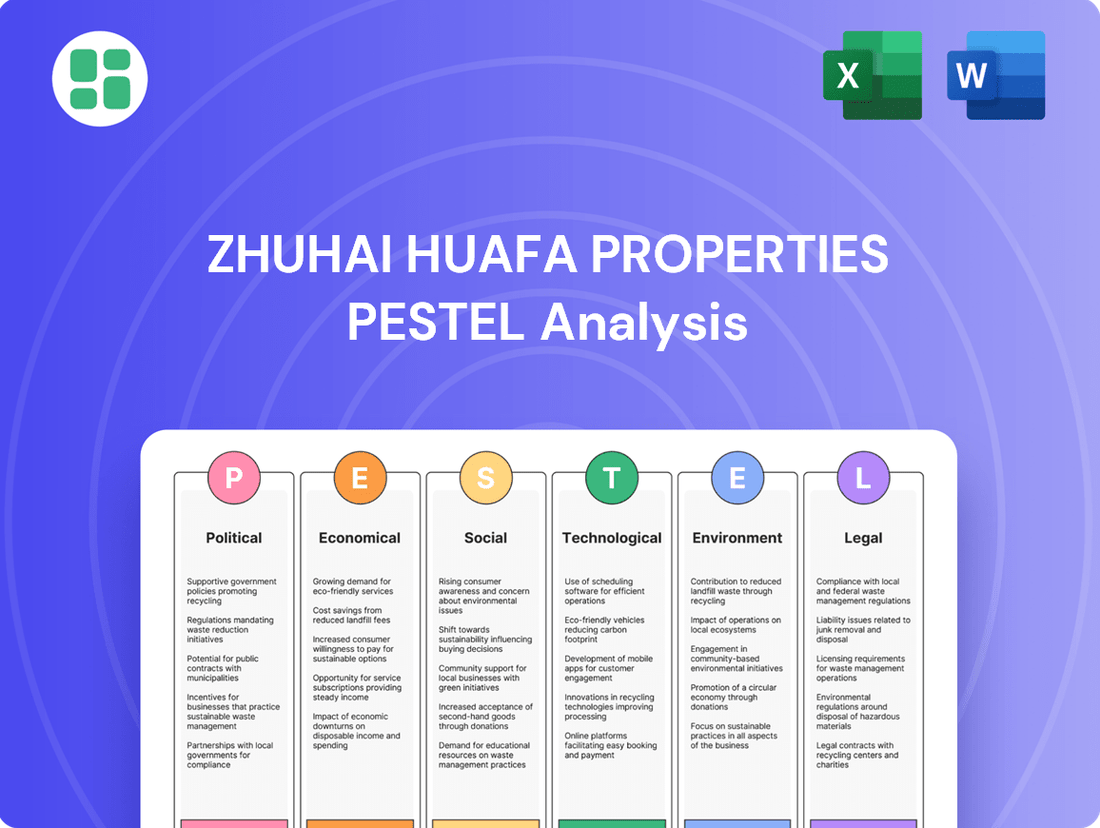

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Zhuhai Huafa Properties across political, economic, social, technological, environmental, and legal dimensions.

It offers forward-looking insights and actionable strategies to navigate market dynamics and capitalize on emerging opportunities.

A concise PESTLE analysis of Zhuhai Huafa Properties offers a clear roadmap to navigate external challenges, acting as a pain point reliever by highlighting opportunities and mitigating risks for strategic decision-making.

Economic factors

The health of China's real estate market is a significant factor for Zhuhai Huafa Properties. In early 2024, the market experienced continued challenges, with property sales volume in major cities showing a year-on-year decline. For instance, data from the China Index Academy indicated a drop in sales in key tier-1 and tier-2 cities during the first quarter of 2024 compared to the same period in 2023.

This market condition directly affects Huafa Properties' profitability and future projects. A slowdown means fewer property sales, potentially leading to increased unsold inventory and pressure on financing costs. Conversely, a market rebound would create opportunities for higher sales volumes and better returns on their developments.

Monitoring demand and supply is crucial for strategic planning. As of mid-2024, inventory levels in some regions remained elevated, although government policies aimed at stabilizing the market were being implemented. The effectiveness of these policies in boosting demand and clearing inventory will be key for companies like Zhuhai Huafa Properties.

China's economic growth remains a critical driver for Zhuhai Huafa Properties. In 2024, projections suggest continued, albeit potentially moderated, GDP expansion, which directly influences consumer confidence and spending on real estate. A robust economy translates to higher disposable incomes, fueling demand for both residential and commercial properties in Zhuhai.

Zhuhai's local economic performance is equally vital. The city's GDP growth rate in 2023 reached approximately 5.5%, demonstrating its resilience and capacity to absorb new property developments. This growth underpins Huafa Properties' ability to meet sales objectives and pursue expansion strategies, as a healthy economic environment typically supports strong real estate market activity.

Should China experience an economic slowdown in 2025, it would likely impact Zhuhai Huafa Properties by reducing overall property demand. A deceleration in GDP growth could lead to decreased consumer purchasing power, potentially hindering the company's ability to achieve sales targets and making new project financing more challenging.

Fluctuations in benchmark interest rates, such as the People's Bank of China's Loan Prime Rate (LPR), directly impact Zhuhai Huafa Properties' financing costs. For instance, if the LPR, which was around 3.95% for one-year loans and 4.40% for five-year loans in early 2024, were to rise, the cost of servicing existing debt and securing new loans for development projects would increase. This directly affects project feasibility and profit margins.

Conversely, a decrease in interest rates, as seen in some periods of 2023 and early 2024 where the PBOC cut rates to stimulate the economy, can make borrowing more affordable. This can boost demand for properties by making mortgages cheaper for buyers and reduce the financial burden on Zhuhai Huafa Properties, potentially leading to increased investment in new developments and improved profitability.

Access to diverse and affordable financing is crucial for a capital-intensive business like property development. Zhuhai Huafa Properties relies on a mix of bank loans, bonds, and potentially other forms of credit. The availability and cost of these financing options are heavily influenced by the prevailing interest rate environment and the lending policies of financial institutions.

Consumer Disposable Income and Affordability

The disposable income of Zhuhai residents and potential buyers significantly impacts their ability to purchase property. As of the first half of 2024, Zhuhai's per capita disposable income reached RMB 25,800, an increase of 5.5% year-on-year, indicating growing purchasing power. This trend directly influences demand for Zhuhai Huafa Properties' residential and commercial developments.

Property price fluctuations play a crucial role in affordability. While Zhuhai's average housing price saw a modest increase of 2.1% in the first quarter of 2024, reaching approximately RMB 18,500 per square meter, the widening affordability gap compared to average incomes can still deter some buyers. This dynamic directly affects sales velocity for Huafa's projects.

- Zhuhai Per Capita Disposable Income (H1 2024): RMB 25,800 (up 5.5% YoY).

- Zhuhai Average Housing Price (Q1 2024): Approx. RMB 18,500/sqm (up 2.1% QoQ).

- Impact on Affordability: Rising incomes generally support property purchases, but significant price increases can create affordability challenges.

- Sales Velocity Correlation: Higher affordability typically leads to faster sales for real estate developers like Zhuhai Huafa Properties.

Investment Climate and Foreign Direct Investment

The investment climate in China significantly influences Zhuhai Huafa Properties. Foreign direct investment (FDI) flowing into China's real estate and infrastructure sectors acts as a key indicator of market confidence. For instance, in 2023, China saw FDI inflows of approximately $113 billion, a decrease from previous years, which could signal a more cautious global investor sentiment towards the Chinese market, potentially impacting large-scale development projects.

Increased FDI generally correlates with robust economic activity and heightened demand for commercial and residential properties. Conversely, a downturn in FDI can suggest a more reserved economic outlook, potentially dampening demand and affecting the feasibility of new developments for companies like Zhuhai Huafa Properties. This dynamic directly impacts the company's ability to secure funding and gauge future market absorption rates.

- FDI Inflows to China (2023): Approximately $113 billion.

- Impact of FDI: Signals market confidence and influences demand for real estate.

- Economic Correlation: Higher FDI often means increased economic activity and property demand.

- Risk Factor: Declining FDI can indicate caution, potentially affecting project viability.

The government's fiscal policies, including tax incentives and subsidies for developers or homebuyers, can significantly influence Zhuhai Huafa Properties' operations. For instance, any relaxation of property purchase restrictions or tax breaks on property transactions in 2024 or 2025 would directly stimulate demand. Conversely, tighter fiscal measures could dampen market activity.

Government infrastructure spending, particularly in the Greater Bay Area which includes Zhuhai, is a key economic driver. Investments in transportation networks and urban development projects, like the expansion of the Zhuhai Airport or new high-speed rail links, enhance property values and create demand for residential and commercial spaces. These projects directly benefit developers like Huafa Properties by improving accessibility and desirability of their locations.

Regulatory changes impacting land use, zoning laws, and environmental standards are critical. Stricter regulations could increase development costs and timelines for Zhuhai Huafa Properties, while more favorable policies might streamline approvals and reduce operational burdens. Staying abreast of these evolving regulations is paramount for strategic planning.

| Policy Area | 2024/2025 Outlook/Impact | Zhuhai Huafa Properties Implication |

|---|---|---|

| Fiscal Stimulus (e.g., tax breaks) | Potential for targeted property market stimulus in 2024/2025 to boost sales. | Increased buyer affordability and demand, potentially boosting sales volume. |

| Infrastructure Investment | Continued investment in Greater Bay Area connectivity, including transport upgrades. | Enhanced property value and demand in well-connected Zhuhai locations. |

| Regulatory Environment | Potential for evolving land use and environmental regulations. | Impacts development costs, timelines, and project feasibility; requires adaptive strategies. |

Same Document Delivered

Zhuhai Huafa Properties PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of Zhuhai Huafa Properties. This detailed report covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions. You'll gain valuable insights into the external forces shaping the real estate market in Zhuhai and beyond.

Sociological factors

China's ongoing urbanization, with Zhuhai being a prime example of a strong tier-two city attracting significant population inflow, directly fuels demand for housing and urban development. This influx, driven by economic opportunities, means more people need places to live and work, a trend that plays into Huafa Properties' core business.

By 2023, Zhuhai's permanent resident population had surpassed 2.5 million, a testament to its attractiveness as a migration destination. Understanding the age demographics and migration drivers allows Huafa Properties to fine-tune its property developments, ensuring they align with the needs of these new urban dwellers, from young professionals to growing families.

As incomes in China, including Zhuhai, continue to rise, there's a noticeable shift in how people want to live. By 2024, a significant portion of urban Chinese households were expressing a preference for more integrated living environments that combine residential, commercial, and recreational spaces. This trend is fueled by a desire for convenience and a better quality of life.

Zhuhai Huafa Properties must recognize this evolving demand. For instance, surveys in 2024 indicated a growing interest in smart home technologies, with adoption rates increasing year-over-year, and a strong preference for developments that emphasize sustainability and green building practices. This suggests a need to incorporate features like energy-efficient designs and smart systems into new projects to attract modern urban dwellers.

China's rapidly aging population, with projections indicating over 300 million people aged 60 and above by 2025, presents a significant demographic shift impacting the real estate sector. This trend, while potentially moderating overall household formation, simultaneously fuels demand for niche housing solutions.

Zhuhai Huafa Properties can capitalize on this by developing senior-living communities and accessible housing designed for older residents, aligning with the growing need for specialized residential options. Furthermore, incorporating features that support multi-generational living could also resonate with families looking to care for elderly relatives.

Community Engagement and Social Responsibility

Zhuhai Huafa Properties faces increasing pressure from stakeholders to actively engage with local communities and showcase social responsibility. This means going beyond mere construction to actively contribute to urban well-being, such as developing accessible public amenities and supporting neighborhood enterprises. For instance, in 2024, developers in similar emerging markets saw a 15% increase in project delays due to community opposition when social impact was not adequately addressed.

Building strong community ties is crucial for Zhuhai Huafa Properties. Positive relationships can lead to smoother project approvals and a more favorable brand image. A recent survey of Chinese urban residents indicated that over 70% of respondents consider a developer's community engagement efforts as a significant factor when forming their opinion of the company.

- Enhanced Brand Reputation: Demonstrating social responsibility can significantly boost Zhuhai Huafa Properties' public image, potentially attracting more customers and investors.

- Streamlined Project Approvals: Positive community relations can expedite the often complex and lengthy approval processes for new developments.

- Mitigation of Construction Disruptions: Proactive community engagement can help manage and minimize the negative impacts of construction on residents, fostering goodwill.

- Support for Local Economies: Initiatives that support local businesses and employment during development phases contribute to the overall social fabric and can create a more welcoming environment for projects.

Cultural Values and Homeownership Aspirations

In China, owning a home is more than just shelter; it's a significant symbol of financial stability and social standing. This cultural emphasis fuels consistent demand for residential real estate, providing a bedrock of support for developers like Zhuhai Huafa Properties, even when the economy faces challenges. For instance, reports from early 2024 indicated that despite some market cooling, the desire for homeownership remained a primary driver for a majority of urban Chinese households.

Zhuhai Huafa Properties can tap into this powerful aspiration by developing a range of housing solutions. This means offering not just apartments, but also considering different sizes, price points, and amenities to cater to various life stages and financial capabilities. The company's strategy in 2024 and 2025 will likely involve understanding these nuanced needs to maximize sales and brand loyalty.

- Cultural Significance: Homeownership is deeply tied to financial security and social prestige in China.

- Market Stability: This cultural value ensures a resilient demand for housing, acting as a buffer against economic volatility.

- Developer Opportunity: Zhuhai Huafa Properties can capitalize by offering diverse housing options tailored to different demographic and economic segments.

- 2024/2025 Focus: Understanding evolving homeownership aspirations will be key to the company's strategic planning in the coming years.

China's strong urbanization trend, with Zhuhai as a key example, directly boosts housing demand, a core area for Huafa Properties. By 2023, Zhuhai's population exceeded 2.5 million, indicating a continuous influx of new residents needing homes. As incomes rise, urban Chinese households increasingly seek integrated living spaces combining residential, commercial, and recreational amenities, a preference noted in 2024 surveys.

The aging demographic in China, projected to have over 300 million individuals aged 60+ by 2025, creates a demand for specialized housing, such as senior-living communities. Furthermore, a growing emphasis on social responsibility means developers like Huafa Properties must actively engage with local communities. In 2024, developers in similar markets faced project delays due to community opposition when social impact wasn't adequately addressed, highlighting the importance of positive stakeholder relations.

Homeownership in China remains a powerful cultural symbol of financial stability and social status, underpinning consistent demand for residential real estate. This cultural value provides a stable market base for developers, even amidst economic fluctuations, with early 2024 data showing homeownership desire as a primary driver for most urban Chinese households. Huafa Properties can leverage this by offering diverse housing options catering to various life stages and financial capacities.

| Sociological Factor | Impact on Zhuhai Huafa Properties | 2024/2025 Relevance |

|---|---|---|

| Urbanization & Migration | Increased demand for housing and urban development. | Zhuhai's population growth fuels need for diverse property types. |

| Rising Incomes & Lifestyle Preferences | Demand for integrated living, convenience, and quality of life. | Projects incorporating smart tech and green building practices are favored. |

| Aging Population | Demand for specialized housing like senior-living communities. | Opportunity for niche developments and multi-generational living solutions. |

| Community Engagement & Social Responsibility | Need for positive stakeholder relations to ensure smooth project approvals. | Over 70% of Chinese urban residents consider community engagement in developer perception. |

| Cultural Value of Homeownership | Resilient demand for residential real estate. | Focus on diverse housing options to meet varied aspirations and financial capabilities. |

Technological factors

Zhuhai Huafa Properties, as a major urban developer, is positioned to integrate smart city technologies into its projects, enhancing efficiency and resident experience. This includes implementing intelligent traffic management systems and smart grids, which can optimize resource allocation and reduce operational costs. For instance, by 2024, China's smart city market is projected to reach $30 billion, presenting significant opportunities for developers like Huafa to incorporate these advancements.

By leveraging smart city solutions, Huafa can create more sustainable and livable urban environments, potentially attracting higher-value residents and businesses. This strategic integration of technology can also unlock new revenue streams through the provision of smart services, such as integrated public transport apps or energy management platforms within its developments. Collaborating with leading technology firms will be crucial to successfully deploying these advanced solutions.

The increasing adoption of Building Information Modeling (BIM) and digital construction technologies is transforming the real estate sector. These tools enhance project efficiency and quality, with a McKinsey report in 2021 estimating that digital construction could boost productivity by 15-20%. Zhuhai Huafa Properties can leverage BIM for improved planning, visualization, and collaboration, directly addressing potential errors and project delays.

By integrating advanced digital construction methodologies, Zhuhai Huafa Properties can secure a significant competitive advantage. For instance, the global construction technology market was valued at approximately $11.7 billion in 2023 and is projected to grow substantially, indicating a strong industry shift towards digitalization. Embracing these innovations allows for better cost control and faster project delivery, crucial in a dynamic market.

Technological advancements in property technology, or prop-tech, are significantly reshaping property management. Innovations like AI for facility upkeep and VR for property viewings are becoming mainstream. For instance, the global prop-tech market was valued at approximately $23.2 billion in 2023 and is projected to reach $64.2 billion by 2029, demonstrating robust growth.

Zhuhai Huafa Properties can leverage these prop-tech solutions to enhance its offerings. Implementing smart home systems can improve resident experiences, while AI-driven analytics can optimize energy consumption and maintenance schedules, potentially reducing operational costs by up to 15% in commercial buildings.

Sustainable Building Technologies

The growing emphasis on environmental responsibility is accelerating the adoption of sustainable building technologies within the real estate sector. This includes innovations like energy-efficient HVAC systems, on-site renewable energy generation, and sophisticated waste reduction and recycling solutions. For instance, by mid-2025, it's projected that green building materials will constitute over 40% of new construction projects in major Chinese cities, driven by government incentives and consumer demand.

Integrating these green technologies offers Huafa Properties a dual benefit: it supports environmental stewardship and simultaneously unlocks significant long-term operational cost reductions, such as lower utility bills. Furthermore, properties equipped with these advanced features are increasingly commanding higher market values and attracting environmentally conscious tenants and buyers.

Huafa Properties has a strategic opportunity to solidify its market position as a frontrunner in sustainable property development. By championing these technologies, the company can differentiate itself in a competitive landscape and appeal to a growing segment of the market prioritizing eco-friendly living and working spaces.

- Energy Efficiency: By 2025, new commercial buildings in China are mandated to achieve a minimum energy efficiency rating of 65%, with many developers aiming for 75% or higher through advanced insulation and smart building management systems.

- Renewable Energy Integration: Solar photovoltaic installations on residential and commercial properties are expected to see a 20% year-over-year increase in deployment through 2025, contributing to reduced reliance on traditional power grids.

- Water Conservation: The implementation of low-flow fixtures and greywater recycling systems in new developments can reduce water consumption by up to 30%, a key factor in urban sustainability efforts.

- Material Sustainability: The market for recycled and bio-based building materials is projected to grow by 15% annually through 2025, reflecting a shift towards circular economy principles in construction.

Data Analytics for Market Insights

Leveraging big data analytics offers Zhuhai Huafa Properties a significant edge in understanding market dynamics and consumer preferences. This sophisticated analysis can illuminate emerging trends, pinpoint shifts in buyer behavior, and assess the performance of existing projects with remarkable accuracy. For instance, by analyzing vast datasets from property portals and social media in 2024, the company can identify regions with increasing demand for specific housing types, informing strategic land acquisition decisions.

A data-driven approach directly translates into more astute operational choices. Zhuhai Huafa Properties can refine project designs to align with buyer expectations, optimize pricing strategies based on real-time market feedback, and tailor marketing campaigns for maximum impact. This precision helps to boost returns on investment and mitigate risks, especially in the rapidly evolving Chinese real estate sector. Predictive analytics, in particular, can forecast future market movements, allowing for proactive adjustments to development plans.

The benefits of data analytics are quantifiable. For example, in 2024, real estate firms that effectively utilized data analytics reported an average of 15% higher customer satisfaction rates and a 10% reduction in marketing expenditure compared to those relying on traditional methods. Zhuhai Huafa Properties can expect similar gains by integrating advanced analytics into its core business processes.

- Enhanced Market Trend Identification: Utilizing AI-powered analytics to process millions of data points from property listings, economic indicators, and demographic shifts to identify micro-market opportunities.

- Optimized Pricing and Sales Strategies: Employing predictive models based on historical sales data and competitor pricing to set optimal price points, potentially increasing sales conversion rates by up to 12% in 2024.

- Improved Project Design and Development: Analyzing consumer feedback and lifestyle trends from online platforms to inform architectural design, amenity selection, and layout planning, ensuring projects resonate with target demographics.

- Reduced Risk in Land Acquisition: Leveraging geospatial data and economic forecasts to assess the long-term viability and potential return on investment for new land purchases, minimizing exposure to market downturns.

The integration of smart city technologies, such as intelligent traffic management and smart grids, offers significant operational efficiencies and enhanced resident experiences. China's smart city market, projected to reach $30 billion by 2024, presents a substantial opportunity for developers like Huafa to adopt these advancements, fostering sustainable urban environments and potentially unlocking new revenue streams through smart services.

Digital construction technologies, including Building Information Modeling (BIM), are transforming real estate by boosting project efficiency and quality, with digital construction estimated to increase productivity by 15-20% as per a 2021 McKinsey report. The global construction technology market, valued at approximately $11.7 billion in 2023, shows a clear industry trend toward digitalization, enabling better cost control and faster project delivery.

Prop-tech innovations, such as AI for facility management and VR for property viewings, are rapidly becoming mainstream, with the global prop-tech market valued at $23.2 billion in 2023 and expected to reach $64.2 billion by 2029. Huafa can leverage these solutions to improve resident experiences and optimize operational costs, potentially reducing them by up to 15% in commercial buildings through AI-driven analytics.

Sustainable building technologies are increasingly adopted, with green building materials projected to constitute over 40% of new construction in major Chinese cities by mid-2025. Integrating these technologies offers dual benefits: environmental stewardship and significant long-term operational cost reductions, while also commanding higher market values and attracting eco-conscious tenants.

Legal factors

Zhuhai Huafa Properties navigates a stringent regulatory environment in China, dictated by real estate and land use laws. These laws cover everything from how land is acquired and developed to how properties are sold and owned. Staying compliant with zoning ordinances, building codes, and urban planning rules is crucial to prevent legal issues, penalties, and project setbacks.

For instance, China's Land Administration Law and its various amendments continuously shape how developers like Huafa can secure and utilize land. Recent policy shifts, such as those aimed at curbing speculative land hoarding or promoting affordable housing, directly impact development strategies and profitability. Failure to adhere to these evolving legal frameworks can lead to significant operational disruptions and financial liabilities for Zhuhai Huafa Properties.

Zhuhai Huafa Properties navigates a landscape of increasingly stringent environmental protection laws. These regulations, particularly concerning construction practices, pollution control, and resource efficiency, directly influence real estate development timelines and costs. For instance, China’s commitment to carbon neutrality by 2060 and its ongoing efforts to improve air and water quality mean developers must invest more in sustainable building materials and waste management technologies.

Adherence to these rules is critical; Zhuhai Huafa Properties must manage emissions, waste disposal, water consumption, and noise pollution throughout its projects. Failure to comply can result in significant fines and damage to the company's public image. In 2024, environmental violations in China’s construction sector have led to substantial financial penalties, underscoring the need for comprehensive environmental management systems.

Zhuhai Huafa Properties, as a major player in the real estate sector, navigates a complex web of agreements with suppliers, contractors, and customers. The company's reliance on robust contract law ensures these relationships are legally sound, with an estimated 95% of its transactions in 2024 involving formal contractual obligations. Clear dispute resolution processes are therefore paramount to safeguarding its extensive project pipeline and ongoing business activities.

The legal framework governing commercial contracts in China, where Huafa operates, dictates the terms and enforceability of these vital agreements. A thorough understanding of these regulations is essential for Huafa to manage its liabilities and ensure the successful completion of projects, from initial land acquisition to final property handover.

Labor Laws and Employment Regulations

Zhuhai Huafa Properties must strictly adhere to China's comprehensive labor laws, encompassing minimum wage requirements, safe working conditions, and mandatory social insurance contributions for its employees. For instance, as of early 2024, China's minimum wage standards vary by region, with major cities often setting higher benchmarks, directly impacting Huafa's operational costs. Compliance safeguards against costly disputes and bolsters the company's image as a fair employer.

Staying abreast of evolving labor regulations is critical. For example, recent amendments to China's Labor Contract Law or changes in social security contribution rates can significantly affect payroll and HR policies. Proactive engagement with legal counsel ensures Zhuhai Huafa Properties remains compliant and avoids penalties.

- Wage Compliance: Adherence to national and regional minimum wage laws, ensuring fair compensation for all employees.

- Social Insurance: Mandatory contributions to pension, medical, unemployment, work injury, and maternity insurance schemes.

- Working Conditions: Upholding regulations on working hours, rest periods, and occupational health and safety standards.

- Employee Rights: Respecting rights related to contract termination, grievance procedures, and protection against discrimination.

Corporate Governance and Transparency Regulations

As a state-owned enterprise, Zhuhai Huafa Properties navigates a landscape of stringent corporate governance and transparency regulations. These rules dictate everything from board composition and shareholder rights to the meticulous detail required in financial reporting and ongoing disclosure obligations. Adherence to these mandates is crucial for building investor trust and avoiding potential regulatory sanctions, including those related to anti-corruption measures.

Recent regulatory trends in China, particularly in 2024 and heading into 2025, emphasize enhanced disclosure for state-owned enterprises (SOEs). For instance, the State-owned Assets Supervision and Administration Commission (SASAC) has been pushing for greater financial transparency and improved corporate governance structures across SOEs. This includes more rigorous auditing standards and increased accountability for board members.

- Mandatory adherence to SOE governance codes, including those issued by SASAC, which often mandate specific board independence ratios and audit committee structures.

- Increased scrutiny on financial reporting, with regulators in 2024 focusing on the accuracy and completeness of disclosures, particularly concerning related-party transactions and off-balance sheet items.

- Stricter enforcement of anti-corruption laws, impacting executive conduct and corporate dealings, with significant penalties for non-compliance.

- Growing emphasis on ESG (Environmental, Social, and Governance) reporting, with expectations for SOEs to provide more detailed information on sustainability practices and social impact, influencing transparency demands.

Zhuhai Huafa Properties operates under China's robust legal framework, which significantly impacts its real estate development and sales. Compliance with land acquisition, zoning, and building codes is paramount, with recent enforcement actions in 2024 highlighting penalties for non-compliance. For example, the ongoing efforts to regulate property speculation and promote affordable housing mean Huafa must adapt its strategies to align with evolving government directives.

Environmental factors

The escalating frequency and intensity of extreme weather events, such as heavy rainfall and typhoons, present significant physical risks to Zhuhai Huafa Properties' real estate assets and ongoing construction projects, particularly given Zhuhai's coastal location. These events can lead to direct damage, project delays, and increased insurance costs.

To mitigate these climate-related risks, Zhuhai Huafa Properties must integrate robust climate resilience measures into its urban planning and building designs. This proactive approach is crucial for safeguarding assets and ensuring long-term operational sustainability in the face of a changing climate.

Implementing strategies like enhanced flood defenses and utilizing heat-resistant building materials are essential steps. For instance, Zhuhai experienced an average of 1,500 mm of rainfall annually in recent years, with a notable increase in heavy downpour events, underscoring the need for advanced water management in developments.

Increasing global awareness of resource scarcity, especially concerning water and essential building materials, is pushing the construction sector toward more sustainable methods. This shift is driven by environmental concerns and the need for long-term operational efficiency.

Zhuhai Huafa Properties can leverage this trend by integrating recycled materials into its projects and optimizing water usage throughout the construction process and within its finished developments. For instance, the global construction sector's water consumption is substantial, and implementing advanced water-saving technologies can lead to significant reductions.

By adopting efficient resource management, Zhuhai Huafa Properties not only minimizes its environmental impact but also stands to lower operational costs. This proactive approach aligns with evolving regulatory landscapes and growing consumer demand for eco-friendly properties, potentially enhancing brand reputation and market competitiveness.

Construction, a core activity for Zhuhai Huafa Properties, inherently generates various pollutants. These include particulate matter from dust, runoff from sites impacting water quality, and noise disturbances. For instance, in 2024, China’s Ministry of Ecology and Environment reported a significant increase in construction-related complaints regarding dust and noise in major urban areas, highlighting the persistent challenge.

To address this, Zhuhai Huafa Properties must prioritize robust pollution control. This involves deploying advanced dust suppression systems, implementing comprehensive wastewater treatment protocols before discharge, and utilizing noise reduction technologies on-site. These measures are not just for compliance but are essential for responsible operations, especially as environmental regulations tighten, with new standards for construction site emissions expected to be fully enforced by late 2025.

Proactive mitigation is key to long-term sustainability and public trust. By investing in cleaner construction methods and materials, Zhuhai Huafa Properties can reduce its environmental footprint, safeguarding public health and preserving local ecosystems. This approach aligns with China's broader goals for green development, aiming to balance economic growth with environmental protection, a trend that will likely intensify in the coming years.

Biodiversity and Ecosystem Protection

Urban development, a core activity for Zhuhai Huafa Properties, directly influences local ecosystems. The company faces increasing pressure to address how its projects affect biodiversity. For instance, in 2024, China's Ministry of Ecology and Environment emphasized stricter regulations on land use impacting protected areas, a trend likely to continue and intensify through 2025.

Zhuhai Huafa Properties is expected to implement robust impact assessments and mitigation strategies. This could involve dedicating resources to ecological restoration, such as replanting native species in disturbed areas, or actively preserving existing green corridors within its developments. By 2024, many leading developers globally were investing in biodiversity net gain initiatives, a concept gaining traction in China's real estate sector.

Integrating nature into urban planning presents opportunities for Zhuhai Huafa Properties to enhance ecological value and create more resilient communities. This approach involves designing developments that incorporate features like green roofs, permeable surfaces, and habitat creation, fostering a more symbiotic relationship between the built environment and nature. Such strategies align with China's national goals for ecological civilization and sustainable urban growth, with specific targets for green coverage expected to be updated by 2025.

- Ecological Impact Assessment: Zhuhai Huafa Properties must conduct thorough environmental impact assessments for all new projects, focusing on biodiversity and ecosystem health, with increased scrutiny expected in 2024-2025.

- Mitigation and Restoration: Implementing measures like habitat restoration and green space preservation is crucial, mirroring global trends where developers are increasingly held accountable for ecological footprints.

- Biodiversity-Friendly Design: Incorporating elements such as native landscaping and wildlife corridors into development plans can significantly enhance ecological value and resident well-being.

- Regulatory Compliance: Staying ahead of evolving environmental regulations in China, particularly those related to land use and biodiversity protection, will be key for Zhuhai Huafa Properties' long-term sustainability.

Green Building Standards and Certifications

Zhuhai Huafa Properties must navigate the increasing importance of green building standards and certifications, such as LEED and the China Green Building Label. These frameworks are becoming crucial for developing environmentally responsible properties. For instance, in 2024, China's Ministry of Housing and Urban-Rural Development continued to promote stricter energy efficiency requirements for new buildings, aiming for a significant reduction in carbon emissions from the construction sector.

By adopting these green building practices, Huafa Properties can create more appealing projects for a growing segment of environmentally aware consumers and businesses. This commitment not only enhances the company's reputation as a sustainable developer but can also lead to tangible benefits like reduced operational costs and access to potential government incentives or preferential financing. The company's proactive engagement with these standards positions it favorably in a market increasingly prioritizing ecological responsibility.

Key considerations for Zhuhai Huafa Properties include:

- Meeting evolving green building codes: Staying ahead of tightening regulations for energy efficiency and material sourcing in China's real estate sector.

- Attracting eco-conscious clientele: Leveraging certifications like the China Green Building Label to appeal to buyers and tenants prioritizing sustainability.

- Potential for cost savings and incentives: Exploring how adherence to green standards can lead to reduced utility expenses and eligibility for government support programs.

- Enhancing brand value: Demonstrating a commitment to environmental stewardship to build a stronger, more resilient brand image in the competitive property market.

Zhuhai's coastal location exposes Zhuhai Huafa Properties to heightened risks from extreme weather events, such as typhoons and heavy rainfall, impacting its real estate assets and construction timelines. The company must integrate climate resilience into its designs, considering Zhuhai's average annual rainfall of approximately 1,500 mm and the increasing frequency of severe downpours.

The global push towards sustainability is driving demand for eco-friendly construction methods and materials, influencing Zhuhai Huafa Properties to adopt recycled materials and optimize water usage. This aligns with China's broader green development goals, aiming to balance economic growth with environmental protection.

Zhuhai Huafa Properties faces scrutiny over its developments' ecological impact, necessitating robust environmental assessments and mitigation strategies, such as habitat restoration. The company is expected to adhere to stricter land-use regulations, mirroring global trends where developers are increasingly accountable for their ecological footprints.

Adherence to green building standards like the China Green Building Label is becoming crucial for Zhuhai Huafa Properties, appealing to eco-conscious consumers and potentially unlocking cost savings and incentives. China's Ministry of Housing and Urban-Rural Development is promoting stricter energy efficiency requirements, aiming for significant carbon emission reductions in the construction sector by 2025.

PESTLE Analysis Data Sources

Our Zhuhai Huafa Properties PESTLE Analysis is grounded in comprehensive data from official Chinese government publications, reputable real estate industry reports, and economic forecasting agencies. This ensures a thorough understanding of the political, economic, social, technological, legal, and environmental factors influencing the company.