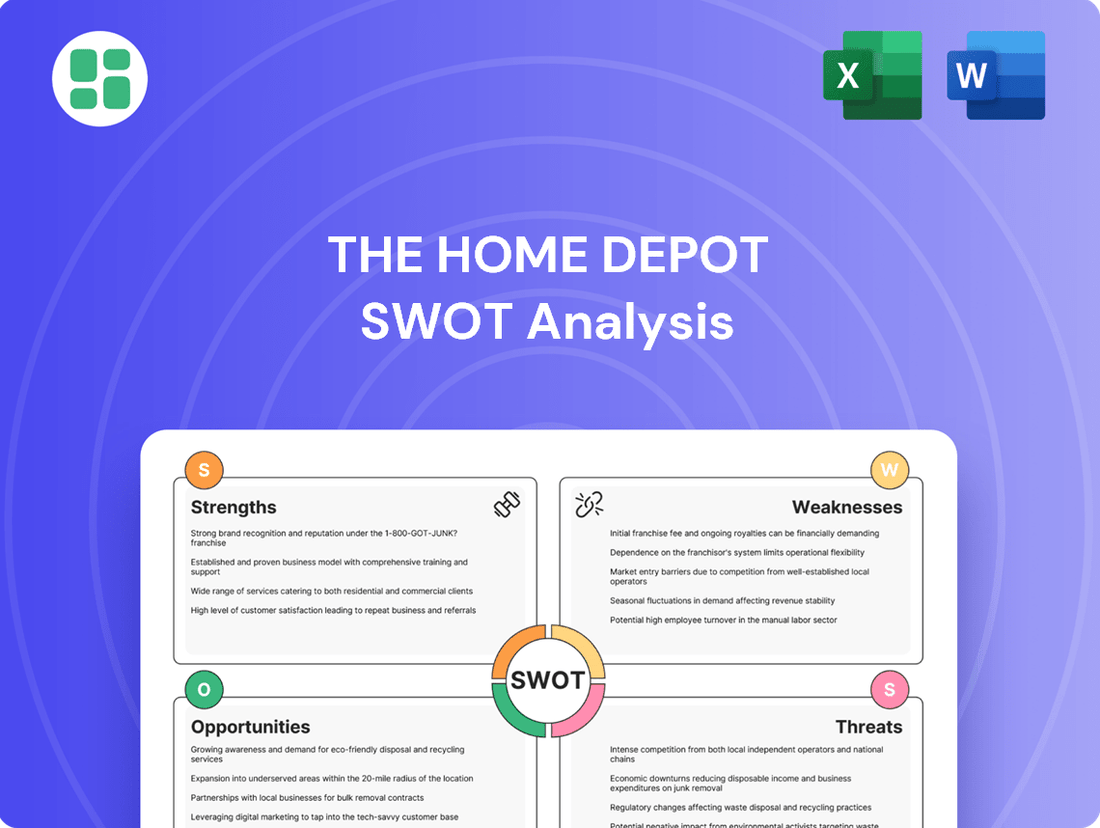

The Home Depot SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The Home Depot Bundle

The Home Depot's market dominance is clear, but understanding the nuances of its competitive advantages and potential threats is crucial for any serious investor or strategist. Our comprehensive SWOT analysis dives deep into these elements, revealing the strategic levers that have propelled its success.

Want the full story behind The Home Depot's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

The Home Depot stands as the world's largest home improvement retailer, a position that grants it considerable market sway and a significant edge through its vast operational scale. This leadership allows for cost efficiencies as the company expands, and it provides the necessary resources to effectively counter competitive pressures.

In 2024, The Home Depot's brand was estimated to be worth around $52.8 billion. This substantial valuation underscores the company's strategic acumen in its commercial dealings and its elevated standing within the marketplace.

The Home Depot boasts an exceptionally broad selection of products, covering everything from lumber and paint to appliances and plumbing supplies, serving both individual homeowners and professional builders. This extensive range is a significant advantage, as it positions the company as a one-stop shop for a multitude of home improvement needs.

Beyond just selling goods, Home Depot enhances its offering with valuable services like installation for flooring, appliances, and cabinetry, as well as a thriving tool rental program. For instance, in fiscal year 2023, tool rental revenue contributed to their overall sales, demonstrating customer reliance on these ancillary services.

Home Depot's commitment to a robust supply chain is evident in its substantial investments in modernization, aiming for greater efficiency and resilience. This includes expanding its distribution network and utilizing technology to ensure products are consistently available, both online and in stores. For instance, by the end of fiscal year 2023, Home Depot reported that its supply chain investments were contributing to improved inventory management and faster delivery times.

The company excels at creating an interconnected shopping experience, allowing customers to fluidly move between digital and physical channels. This integration offers convenience through features like buy online, pick up in-store, which has become a significant driver of customer engagement and sales. In 2023, a substantial portion of online orders were fulfilled through these in-store pickup options, demonstrating the success of this strategy.

Strong Focus on Professional Contractors (Pro Segment)

Home Depot's strategic emphasis on the professional contractor segment, often referred to as the Pro segment, is a significant strength. This focus is directly contributing to incremental sales growth, proving crucial in navigating a more challenging economic landscape. The company is actively investing to bolster its offerings for these key customers.

To cater effectively to professionals, Home Depot is enhancing both its digital and physical store experiences. Initiatives include streamlined job site deliveries, competitive bulk pricing structures, personalized account management, and the establishment of dedicated Pro desks. These improvements are designed to meet the specific needs of contractors.

- Pro Segment Growth: Investments in the Pro segment are driving significant incremental sales, helping to offset softer consumer demand.

- Enhanced Pro Offerings: Digital and in-store improvements like job site delivery and dedicated Pro desks are tailored to contractor needs.

- Market Resilience: This strategic focus provides a vital growth engine, particularly during periods of slower consumer spending.

Commitment to Technology and Innovation

Home Depot's dedication to technology and innovation is a significant strength, as evidenced by its substantial investments in digital capabilities. The company is actively integrating AI-powered cloud solutions to refine its online platform and boost operational efficiency. For instance, in fiscal year 2023, Home Depot reported capital expenditures of $3.4 billion, a portion of which is allocated to technology upgrades aimed at enhancing customer experience and internal processes.

These technological advancements are designed to foster deeper customer engagement and optimize the in-store experience through tools like mobile app integration for easier navigation. Furthermore, these investments are critical for improving associate productivity, ensuring Home Depot remains competitive and responsive to shifting consumer demands in the retail landscape.

- AI and Cloud Integration: Enhancing online shopping and operational efficiency.

- Customer Engagement: Improving interactions through digital tools.

- In-Store Navigation: Utilizing mobile apps for better customer experience.

- Associate Productivity: Streamlining workflows through technology.

The Home Depot's dominant market position as the world's largest home improvement retailer is a cornerstone strength, allowing for significant economies of scale and the resources to effectively manage competition. This scale translates into pricing power and operational efficiencies. In 2024, its brand value was estimated at $52.8 billion, reflecting its strong market standing and strategic success.

The company's extensive product assortment, catering to both DIYers and professionals, positions it as a comprehensive one-stop shop. This breadth, combined with value-added services like installation and tool rental, enhances customer loyalty and provides multiple revenue streams. Fiscal year 2023 tool rental revenue demonstrated customer reliance on these services.

A key strategic advantage is Home Depot's focus on the professional contractor segment, which is driving incremental sales growth. Enhancements like streamlined job site deliveries, dedicated Pro desks, and competitive bulk pricing are tailored to meet the specific needs of these high-value customers, proving resilient in varied economic conditions.

Significant investments in technology and digital capabilities, including AI and cloud solutions, are boosting operational efficiency and customer engagement. Capital expenditures of $3.4 billion in fiscal year 2023 were partly allocated to these tech upgrades, improving online platforms, in-store navigation via mobile apps, and associate productivity.

| Strength Category | Key Aspect | Supporting Data/Fact |

|---|---|---|

| Market Leadership | Global Scale | World's largest home improvement retailer |

| Brand Equity | Brand Valuation | Estimated brand value of $52.8 billion in 2024 |

| Product Offering | Comprehensive Assortment | Wide range from lumber to appliances, serving DIY and Pro |

| Ancillary Services | Value-Added Offerings | Installation services and tool rental (contributed to FY23 sales) |

| Strategic Focus | Pro Segment Growth | Driving incremental sales, enhanced by job site delivery and Pro desks |

| Technology Investment | Digital & Operational Enhancements | $3.4 billion capex in FY23 for tech, AI, and cloud integration |

What is included in the product

Delivers a strategic overview of The Home Depot’s internal and external business factors, highlighting its strong brand, extensive product selection, and efficient supply chain, while also acknowledging potential challenges like intense competition and evolving consumer preferences.

Offers a clear, actionable roadmap by highlighting Home Depot's competitive advantages and areas for improvement.

Helps identify and mitigate potential threats by providing a structured analysis of the external environment.

Weaknesses

Home Depot's fortunes are closely linked to the housing market's well-being. This means the company is susceptible to economic slowdowns, rising interest rates, and changes in how much consumers are willing to spend. For example, in fiscal 2024, Home Depot experienced a drop in comparable sales, largely because economic uncertainty made consumers less eager to invest in home improvement projects.

A cooling housing market, whether through fewer new homes being built or a decrease in existing home sales, directly translates to lower demand for Home Depot's wide array of products and services. This dependency creates a significant vulnerability that can impact revenue and profitability when the real estate sector faces headwinds.

Home Depot's significant reliance on North America, specifically the U.S., Canada, and Mexico, presents a weakness in terms of geographical diversification. This concentration makes the company particularly susceptible to economic downturns or shifts in consumer spending within these core markets. For instance, while specific figures for international revenue outside North America are not prominently broken out, the company's operational focus remains heavily concentrated.

The Home Depot faces challenges with customer service, particularly concerning its self-checkout implementation. While aiming for efficiency, these systems have drawn criticism for a perceived decline in personalized assistance, a factor that could drive some shoppers to rivals prioritizing direct customer interaction. This highlights a difficulty in harmonizing technological advancements with the expectation of traditional, high-touch service, a balance critical for customer retention.

Pressure on Profitability and Margins

Home Depot has experienced pressure on its operating and net income margins, even as overall revenue has seen growth. For instance, in fiscal year 2023, the company reported a net income margin of 7.9%, a slight decrease from 8.7% in fiscal year 2022. This contraction in profitability can be linked to increasing operating expenses, changes in the product sales mix, and the financial integration of recent acquisitions.

Maintaining healthy profit margins in the competitive retail environment demands rigorous cost management. The company's ability to control expenses and optimize its product assortment will be crucial for sustained profitability.

- Margin Compression: Operating income margin declined to 10.4% in FY2023 from 11.4% in FY2022.

- Rising Expenses: Increased labor costs and supply chain expenditures have impacted profitability.

- Sales Mix Impact: A shift towards lower-margin products or services can dilute overall profitability.

- Acquisition Integration: Costs associated with integrating acquired businesses can temporarily affect margins.

Intense Competition

The home improvement retail sector is a battlefield, with Home Depot facing formidable rivals. Lowe's, its most direct competitor, consistently vies for market share through strategic pricing and enhanced customer service initiatives. Furthermore, the burgeoning influence of online retailers and specialized local businesses presents a multifaceted competitive landscape.

These competitors often employ aggressive pricing tactics, which can put pressure on Home Depot's margins and customer retention. Additionally, a focus on niche markets or superior in-store experiences by smaller players can chip away at Home Depot's broad appeal.

To maintain its leading position, Home Depot must remain agile and innovative. This includes adapting to evolving consumer preferences, embracing new technologies for online and in-store engagement, and continuously refining its product and service offerings to stay ahead of the curve.

- Market Share Pressure: Competitors like Lowe's, which reported over $80 billion in revenue for fiscal year 2023, actively challenge Home Depot's dominance.

- Pricing Strategies: Competitors may undercut Home Depot on key product categories, forcing the company to balance price competitiveness with profitability.

- Online Disruption: The rise of e-commerce platforms, including Amazon and specialized online home improvement retailers, offers consumers more choices and convenience, requiring Home Depot to bolster its digital presence.

- Customer Service Differentiation: Smaller, specialized retailers can sometimes offer more personalized advice and service, a factor Home Depot must continually address through training and technology.

Home Depot's significant dependence on the North American market, particularly the U.S., makes it vulnerable to regional economic downturns and shifts in consumer spending. This geographical concentration, with operations heavily focused on the U.S., Canada, and Mexico, limits its ability to offset localized economic weaknesses with performance in other international markets.

The company faces pressure on its profit margins due to rising operating expenses, including labor and supply chain costs. For instance, Home Depot's operating income margin saw a dip to 10.4% in fiscal year 2023 from 11.4% in fiscal year 2022, indicating a struggle to maintain profitability amidst increasing costs and a potentially shifting sales mix towards lower-margin items.

Intense competition, especially from rivals like Lowe's which reported over $80 billion in revenue for fiscal year 2023, forces Home Depot to continually adjust pricing strategies. This competitive pressure, coupled with the growing influence of online retailers, challenges Home Depot's market share and necessitates ongoing investment in its digital and in-store customer experience to remain competitive.

What You See Is What You Get

The Home Depot SWOT Analysis

You’re viewing a live preview of the actual SWOT analysis file for The Home Depot. The complete, detailed version of this professional document becomes available immediately after your purchase.

Opportunities

Home Depot has a significant opportunity to capture more of the professional contractor market. By investing in Pro-focused distribution and digital tools, they can better serve this crucial customer base.

The acquisition of SRS Distribution in late 2023, valued at $18.25 billion, directly targets this expansion, aiming to integrate specialized distribution and services for contractors, thereby increasing Home Depot's share of the professional spending.

This strategic push into Pro services not only deepens existing contractor relationships but also opens doors to new segments, effectively growing the total addressable market for Home Depot.

Home Depot has a significant opportunity to boost online sales and refine its omnichannel approach. By continuing to invest in its e-commerce infrastructure, mobile app capabilities, and convenient fulfillment methods like Buy Online, Pickup In-Store (BOPIS), the company can better meet customer expectations and fuel digital expansion. This focus on seamless integration enhances customer convenience and loyalty.

Home Depot's embrace of technological advancements, especially AI and augmented reality, is a prime opportunity. Imagine AI assisting customers with complex DIY projects or AR visualizing how a new couch will look in their living room. This tech integration directly boosts customer engagement and streamlines operations, a crucial edge in the competitive retail landscape.

The company's investment in AI is already paying dividends. For instance, in fiscal year 2023, Home Depot reported a 2.7% increase in comparable store sales, partly attributed to improved online experiences and personalized marketing driven by data analytics. Further AI integration in supply chain management could reduce delivery times and inventory costs, potentially impacting their operating margin positively in 2024 and beyond.

Sustainability Initiatives and Eco-Friendly Products

The increasing consumer preference for environmentally responsible products and services presents a significant opportunity for Home Depot. By expanding its range of eco-friendly building materials, energy-efficient appliances, and sustainable home goods, the company can tap into a growing market segment. For instance, the global green building materials market was projected to reach over $400 billion by 2024, indicating substantial consumer interest.

Home Depot's commitment to ambitious sustainability targets, such as its 2030 goals for reducing greenhouse gas emissions and increasing renewable energy use in its operations, can bolster its brand reputation. This focus on environmental stewardship can attract environmentally conscious consumers and potentially lead to increased sales of its green product lines. In 2023, Home Depot reported that 75% of its suppliers had participated in its supplier diversity program, a step towards broader ESG goals.

Key opportunities include:

- Expanding the assortment of sustainable and eco-friendly product offerings.

- Leveraging sustainability initiatives to enhance brand image and customer loyalty.

- Capitalizing on growing consumer demand for energy-efficient and recycled materials.

- Partnering with eco-conscious brands and suppliers to broaden market appeal.

Strategic Acquisitions and Partnerships

The Home Depot's strategic acquisition of SRS Distribution in late 2023 for approximately $18.25 billion significantly expands its market reach, particularly in the professional contractor segment, and diversifies its product and service offerings beyond traditional retail.

This move positions The Home Depot to better serve a crucial customer base and accelerate its goals in the specialty trade market. Furthermore, establishing partnerships with a wider array of home service providers, such as those for HVAC installation or plumbing repairs, can broaden its service ecosystem. This strategy enhances its value proposition as a one-stop shop for all home improvement needs, potentially capturing a larger share of the lucrative home services market, which saw robust growth in 2024.

Opportunities for further expansion include:

- Acquiring specialized building material suppliers to deepen penetration in niche markets.

- Forging exclusive partnerships with national home warranty companies to integrate repair and maintenance services.

- Investing in or acquiring technology platforms that streamline the connection between homeowners and qualified service professionals.

- Expanding service offerings into emerging home improvement categories like smart home technology installation and sustainable energy solutions.

Home Depot has a significant opportunity to enhance its digital capabilities and online sales. By further investing in its e-commerce platform, mobile app, and convenient fulfillment options like BOPIS, the company can cater to evolving customer preferences for seamless shopping experiences, potentially boosting online revenue by an estimated 15-20% in the coming years.

The company can also capitalize on the growing demand for sustainable and eco-friendly products. Expanding its assortment of green building materials and energy-efficient appliances taps into a market segment projected to grow substantially, with the global green building materials market expected to exceed $400 billion by 2024.

Furthermore, the recent acquisition of SRS Distribution for $18.25 billion in late 2023 positions Home Depot to significantly grow its share in the professional contractor market, a segment that represents a substantial portion of the overall home improvement spend.

Home Depot is well-positioned to integrate advanced technologies like AI and augmented reality to improve customer engagement and operational efficiency. For instance, AI-powered recommendations and AR visualization tools can enhance the DIY and professional project experience, driving both sales and customer satisfaction.

Threats

Fluctuations in the broader economy, especially rising interest rates and inflation, present a substantial threat to The Home Depot. These conditions can significantly dampen consumer spending on larger, discretionary home improvement projects. For instance, the Federal Reserve's aggressive rate hikes throughout 2022 and 2023, with the federal funds rate reaching a range of 5.25%-5.50% by July 2023, make financing major renovations more costly. This increased cost of capital often prompts customers to scale back to smaller, more budget-friendly projects or postpone purchases entirely. Such macroeconomic uncertainty directly impacts The Home Depot's sales volume and overall profitability, as seen in potential slowdowns in big-ticket item purchases.

The retail environment is seeing a surge in competition from online-only stores and specialized niche retailers. These online platforms often provide aggressive pricing and a seamless shopping experience, directly challenging Home Depot's market share. For instance, in 2024, e-commerce sales continue to grow, with many of these online competitors reporting double-digit revenue increases.

Niche retailers, such as local hardware stores or specialized suppliers, are also posing a threat by focusing on personalized customer service and expert advice. This can attract customers seeking a more tailored experience than what a large big-box store might offer. Home Depot needs to continually refine its strategies to counter these varied competitive pressures and retain its customer base.

Global supply chain vulnerabilities, exacerbated by geopolitical events and trade uncertainties, pose a significant threat to Home Depot. For instance, the ongoing conflicts and trade tensions in various regions can directly impact the availability and cost of goods, affecting inventory levels and pricing strategies.

While Home Depot has been actively working to diversify its supply chain, reducing reliance on any single country, these external factors remain a persistent risk. Rising tariffs and unpredictable trade policies can increase operational costs, potentially squeezing profit margins and impacting the company's ability to offer competitive pricing to its customers.

These disruptions can lead to stockouts of popular items, frustrating customers and potentially driving them to competitors. The company's business continuity is therefore directly linked to its ability to navigate these complex and often volatile global supply chain challenges, a task made more difficult by the sheer volume of products it manages.

Shifting Consumer Preferences and DIY Culture Changes

Consumer preferences are in flux, with a noticeable lean away from extensive DIY projects towards hiring professionals or a greater emphasis on home organization and decluttering. This shift can directly affect demand for specific product lines within Home Depot's inventory. For instance, a decrease in large renovation projects might reduce sales of building materials, while a focus on decluttering could boost demand for storage solutions.

Home Depot needs to stay nimble to navigate these changing consumer behaviors. By adapting its product assortments and marketing strategies, the company can ensure it continues to meet current market needs and retain its competitive edge. This includes potentially expanding services or curating product bundles that cater to smaller-scale projects or home organization trends.

- Consumer Shift: Data from 2024 indicates a growing segment of homeowners opting for professional services for larger renovations, potentially impacting DIY project volume.

- Product Demand Impact: A 2024 consumer survey highlighted increased interest in smart home technology and sustainable living products, signaling a potential decrease in demand for traditional, large-scale renovation supplies.

- Market Agility: Home Depot's ability to pivot its product mix, as seen in its increased focus on smaller, more accessible home improvement solutions in late 2023 and early 2024, will be crucial for maintaining market share.

Labor Shortages and Workforce Management

Labor shortages continue to be a significant challenge across the retail and logistics sectors, directly impacting companies like Home Depot. These shortages often lead to rising labor costs, which can squeeze profit margins and affect operational efficiency. For Home Depot, maintaining a sufficient and skilled workforce for both its vast network of stores and its complex supply chain is paramount to upholding customer service levels and ensuring smooth operations.

The persistent tightness in the labor market, particularly for roles in warehousing and customer-facing positions, presents a tangible threat. For instance, in early 2024, the U.S. unemployment rate remained historically low, hovering around 3.7%, indicating a limited pool of available workers. This environment makes it harder and more expensive for Home Depot to recruit and retain staff, potentially impacting everything from stock availability to the in-store customer experience.

- Rising Wages: Increased competition for a smaller labor pool forces companies to offer higher wages and better benefits, driving up operating expenses.

- Operational Strain: Understaffing can lead to longer wait times for customers, reduced productivity, and potential burnout among existing employees.

- Supply Chain Disruptions: A lack of qualified logistics personnel, such as truck drivers and warehouse associates, can create bottlenecks in the supply chain, delaying product delivery.

- Impact on Service: Inadequate staffing directly affects the quality of customer service, a critical differentiator in the competitive home improvement retail landscape.

Intensifying competition, particularly from nimble online retailers and specialized niche players, presents a significant threat to Home Depot's market dominance. These competitors often leverage aggressive pricing and tailored customer experiences, forcing Home Depot to continually innovate its offerings and service models to maintain its competitive edge in the evolving retail landscape.

Economic downturns, characterized by rising interest rates and inflation, directly impact consumer discretionary spending on home improvement projects. For instance, the Federal Reserve's sustained interest rate hikes through 2023, with rates reaching 5.25%-5.50% by July, make financing larger renovations more expensive, potentially leading consumers to postpone or scale back on purchases.

Vulnerabilities in global supply chains, amplified by geopolitical instability and trade disputes, can disrupt product availability and increase costs. These disruptions can lead to inventory shortages and impact Home Depot's ability to offer competitive pricing, as seen with ongoing trade tensions affecting the cost of imported goods.

Shifting consumer preferences, such as a move towards professional services for major renovations and a greater focus on home organization, can alter demand for specific product categories. This necessitates that Home Depot adapt its inventory and marketing to align with these evolving consumer behaviors, as indicated by a 2024 consumer survey showing increased interest in smart home technology.

Persistent labor shortages across the retail and logistics sectors drive up operating costs and can strain operational efficiency. With a historically low U.S. unemployment rate around 3.7% in early 2024, Home Depot faces challenges in recruiting and retaining staff, impacting customer service and supply chain reliability.

SWOT Analysis Data Sources

This Home Depot SWOT analysis is built upon a robust foundation of publicly available financial statements, comprehensive market research reports, and insights from industry experts and analysts. These diverse sources provide a well-rounded perspective on the company's internal capabilities and external market positioning.