The Home Depot PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The Home Depot Bundle

Uncover the critical political, economic, social, technological, environmental, and legal factors shaping The Home Depot's trajectory. Our comprehensive PESTLE analysis provides actionable intelligence to anticipate market shifts and identify strategic opportunities. Don't just react to change; lead it. Download the full report now to gain a decisive competitive advantage.

Political factors

Home Depot navigates a complex web of government regulations, from product safety standards to environmental mandates. Compliance with federal, state, and local laws is paramount for its continued operation and brand integrity, including adherence to Environmental Protection Agency (EPA) guidelines.

Global trade policies, including tariffs such as Section 301 and Section 232, significantly affect Home Depot's supply chain and the cost of its products. For instance, in early 2024, the ongoing review of Section 301 tariffs on Chinese goods continued to influence import costs for a wide range of consumer and building products.

To counter these impacts, Home Depot is actively diversifying its global sourcing strategies. This diversification aims to reduce reliance on any single country, thereby mitigating potential disruptions and cost increases stemming from trade disputes or policy changes. This strategic move is crucial for maintaining competitive pricing and ensuring consistent product availability for its customers.

The Home Depot actively participates in lobbying, investing significant resources to shape legislation impacting its operations. For instance, in 2023, the company reported spending $6.8 million on lobbying efforts, focusing on areas like energy efficiency tax credits within the Inflation Reduction Act and corporate tax structures.

Beyond direct legislative influence, Home Depot also engages in advocacy concerning critical supply chain issues, such as mitigating port congestion and enhancing global supply chain security. The company also champions initiatives to promote skilled trades and support career transitions for veterans, aligning its political engagement with broader economic and social objectives.

Labor Laws and Workforce Policy

Changes in labor laws, such as ongoing discussions around potential legislation like the PRO Act, present a significant factor for Home Depot. These developments can directly influence the company's workforce management strategies and potentially increase operational costs through mandates on wages, benefits, and unionization rights. Home Depot actively monitors proposed legislation impacting labor relations and worker protections, understanding the direct correlation to employee morale and operational adaptability.

The company's approach to compliance with evolving labor standards is a constant priority. For instance, as of early 2024, the national unemployment rate remained relatively low, hovering around 3.9%, which can empower workers and increase the likelihood of unionization efforts. This economic backdrop necessitates careful attention to labor policies to maintain a stable and productive workforce.

Key considerations for Home Depot regarding labor laws include:

- Unionization Trends: Monitoring the national sentiment and specific campaigns that could impact retail and construction sectors, where Home Depot operates.

- Wage and Hour Regulations: Adapting to potential changes in minimum wage laws and overtime rules, which directly affect labor expenses.

- Worker Safety and Benefits: Ensuring adherence to updated standards for workplace safety and employee benefits, which can influence recruitment and retention efforts.

Organized Retail Crime Legislation

The Home Depot is significantly impacted by the escalating issue of organized retail crime (ORC). The company actively champions legislative measures designed to curb these illicit activities, including enhancements to the INFORM Consumers Act. This legislation aims to increase transparency in online marketplaces, making it harder for criminals to sell stolen goods.

The company's proactive stance involves robust lobbying efforts. Home Depot advocates for more stringent laws and increased funding to combat ORC. These efforts are crucial as ORC directly affects inventory levels, employee and customer safety, and ultimately, the company's profitability. For instance, the National Retail Federation reported that ORC cost the retail industry an estimated $112 billion in losses in 2022, a figure that underscores the severity of the problem.

- Legislation Support: Home Depot backs laws like the INFORM Consumers Act to combat organized retail crime.

- Lobbying Efforts: The company actively lobbies for stronger anti-ORC measures and increased appropriations.

- Economic Impact: Organized retail crime leads to inventory loss, safety concerns, and reduced profitability for retailers.

- Industry Data: The NRF estimated $112 billion in ORC losses for the retail sector in 2022, highlighting the scale of the issue.

Government regulations significantly shape Home Depot's operational landscape, from product safety standards to environmental compliance. The company also actively lobbies policymakers, investing millions annually to influence legislation, as evidenced by its $6.8 million expenditure in 2023 on lobbying efforts related to energy efficiency tax credits and corporate tax structures.

Trade policies, including tariffs on imported goods, directly impact Home Depot's supply chain costs and product pricing. For instance, ongoing reviews of tariffs on Chinese goods in early 2024 continued to affect import expenses for a broad array of consumer and building products.

Home Depot's engagement extends to advocating for supply chain improvements and supporting initiatives that promote skilled trades and veteran employment, demonstrating a commitment to broader economic and social objectives.

Labor laws present a dynamic challenge, with potential changes to minimum wage, overtime, and unionization rights directly influencing operational costs and workforce management strategies. The company closely monitors these developments, especially in a 2024 economic climate with a low national unemployment rate around 3.9%, which can embolden unionization efforts.

| Political Factor | Impact on Home Depot | 2023/2024 Data/Trend |

|---|---|---|

| Lobbying & Legislation | Influences tax credits, corporate tax, and labor laws. | $6.8 million spent on lobbying in 2023. |

| Trade Policies & Tariffs | Affects supply chain costs and product pricing. | Ongoing review of Section 301 tariffs on Chinese goods impacting import costs in early 2024. |

| Labor Laws & Unionization | Impacts wages, benefits, and workforce management. | Low national unemployment (approx. 3.9% in early 2024) may increase unionization potential. |

| Organized Retail Crime (ORC) Legislation | Drives need for enhanced transparency and security measures. | Support for INFORM Consumers Act; ORC cost retailers $112 billion in 2022 (NRF). |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing The Home Depot across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying key opportunities and threats shaped by current market and regulatory dynamics.

A concise PESTLE analysis for Home Depot that highlights key external factors, acting as a pain point reliever by offering clarity on potential market shifts and strategic opportunities.

Economic factors

Elevated interest rates, a significant economic factor, directly influence consumer behavior, particularly for large purchases like home renovations and new homes. For Home Depot, this means customers are more likely to postpone major projects when borrowing costs are high.

The company has noted that as interest rates climb, there's a noticeable shift in demand. Shoppers tend to favor smaller, more manageable DIY projects that require less upfront investment, rather than undertaking extensive renovations. This macroeconomic trend directly impacts the sales volume of Home Depot's higher-priced, big-ticket items.

For instance, the Federal Reserve's benchmark interest rate remained at 5.25%-5.50% through much of 2024, a level not seen in over two decades. This sustained period of higher rates has contributed to a slowdown in the housing market, consequently affecting the demand for substantial home improvement supplies.

Persistent inflation throughout 2024 continued to squeeze household budgets, significantly impacting consumer disposable income. For instance, the U.S. Consumer Price Index (CPI) saw an annualized increase of 3.4% as of April 2024, meaning everyday goods cost more, leaving less for non-essentials.

This economic pressure directly translates to more cautious spending, particularly on discretionary items like home improvement projects. Consumers are increasingly prioritizing essential repairs and maintenance over larger, more aspirational upgrades, which directly affects Home Depot's sales of higher-ticket items.

The company has noted a discernible pullback in spending on these larger purchases, as evidenced by a slowdown in sales growth for categories such as appliances and outdoor living during recent quarters, reflecting this shift in consumer priorities.

The housing market's vitality directly impacts Home Depot. Factors like home sales volume, new construction rates, and prevailing mortgage interest rates are key economic indicators. For instance, in early 2024, rising mortgage rates contributed to a slowdown in housing transactions, affecting demand for home improvement goods.

Looking ahead to 2025, there are encouraging signals, with projections suggesting an uptick in both home sales and available housing inventory. This trend is beneficial for Home Depot, as increased homeownership and subsequent renovation projects typically correlate with higher sales for the company.

Consumer Spending Patterns

Home Depot is navigating a significant change in how consumers are spending, with a noticeable move away from big, discretionary home renovation projects towards smaller, more cost-aware tasks like painting and gardening. This shift, influenced by economic uncertainties, means the company must adapt its product selection, advertising, and sales promotions to better match what customers want right now.

For instance, in the first quarter of 2024, Home Depot reported a 2.1% decrease in comparable sales, indicating that consumers are indeed tightening their belts on larger purchases. This trend underscores the need for strategic adjustments.

- Shift to Smaller Projects: Consumers are prioritizing smaller, less expensive home maintenance and improvement tasks.

- Budget Consciousness: Economic uncertainty is driving a more cautious approach to discretionary spending on home goods.

- Strategic Adaptation: Home Depot is adjusting its inventory and marketing to cater to these evolving, budget-friendly consumer preferences.

Sales Outlook and Growth Projections

Home Depot's sales outlook for fiscal 2025 indicates a cautiously optimistic trajectory following a dip in 2024. The company is projecting modest overall growth, with expectations for total sales to increase by approximately 2.8%.

Comparable sales are also anticipated to see a slight uptick, with projections around 1.0% growth. These figures are shaped by current economic conditions and the company's strategic initiatives designed to foster long-term expansion.

- Fiscal 2024 Comparable Sales Decline: Home Depot experienced a decrease in comparable sales during fiscal year 2024.

- Fiscal 2025 Total Sales Projection: The company forecasts total sales growth of approximately 2.8% for fiscal 2025.

- Fiscal 2025 Comparable Sales Projection: Comparable sales are expected to grow by around 1.0% in fiscal 2025.

- Influencing Factors: Projections are influenced by ongoing macroeconomic challenges and strategic investments.

Economic factors, particularly elevated interest rates and persistent inflation, significantly shaped consumer spending in 2024. This led to a noticeable shift from large renovation projects to smaller, more budget-conscious DIY tasks, impacting Home Depot's sales of big-ticket items.

For fiscal year 2024, Home Depot reported a decrease in comparable sales. Looking ahead to fiscal 2025, the company projects modest growth, with total sales expected to increase by approximately 2.8% and comparable sales by around 1.0%, reflecting a cautiously optimistic outlook amid ongoing economic conditions.

| Metric | Fiscal Year 2024 (Actual) | Fiscal Year 2025 (Projection) |

|---|---|---|

| Comparable Sales | Decrease | ~1.0% Growth |

| Total Sales | (Not Specified) | ~2.8% Growth |

What You See Is What You Get

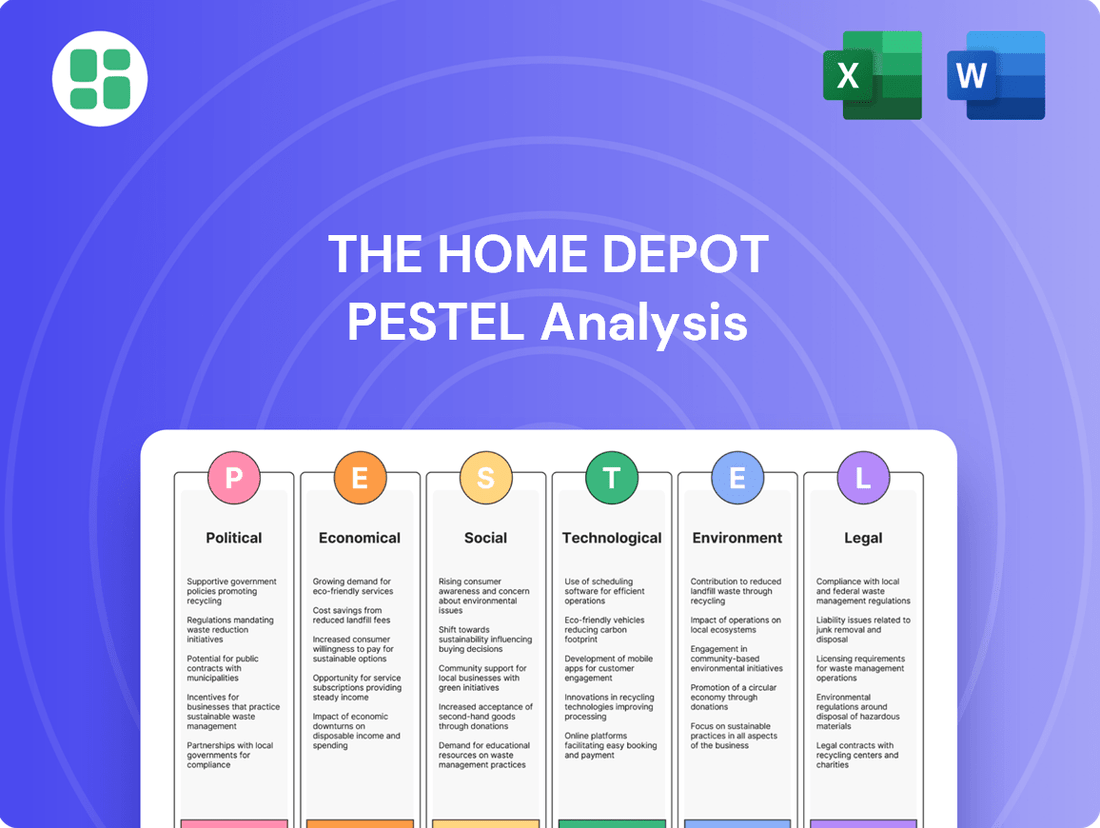

The Home Depot PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of The Home Depot.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting The Home Depot.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights into the strategic landscape for The Home Depot.

Sociological factors

Consumer behavior is a fascinating area, especially when we look at home improvement. There's a constant dance between people tackling projects themselves (DIY) and those hiring professionals. Right now, we're seeing DIYers leaning towards smaller, more manageable tasks. This is a key trend to watch.

Home Depot, however, is strategically placing a big bet on the professional contractor segment. They're pouring resources into building out their Pro customer program. This includes enhanced services, dedicated support, and bulk purchasing options. The company sees significant long-term growth potential and market share capture by catering to these professionals.

For instance, in fiscal year 2023, Home Depot reported that its Pro customers represented a substantial portion of its sales, though specific percentages are often embedded within broader reporting. The company's investment in its Pro Xtra loyalty program, which offers tiered benefits and exclusive pricing, underscores this focus. This ecosystem aims to foster loyalty and increase the average spend per professional customer.

Demographic shifts are significantly reshaping housing demands. For instance, the aging population in the U.S., with a projected 20% of the population aged 65 and over by 2030, is driving demand for accessibility modifications and aging-in-place renovations. This trend encourages a greater need for 'do-it-for-me' services and specialized products, influencing Home Depot’s strategic focus on installation services and a broader range of adaptive home solutions.

Societal trends highlight a persistent and growing emphasis on home-centric lifestyles, even amidst economic fluctuations. This enduring value placed on personal living spaces underpins robust demand for home improvement, a trend The Home Depot is well-positioned to capitalize on.

The Home Depot actively supports this home-centricity by offering an extensive selection of products and services designed for both the upkeep and beautification of homes. For instance, in fiscal year 2023, The Home Depot reported net sales of $108.5 billion, demonstrating the significant market engagement with home enhancement activities.

Sustainability and Ethical Consumerism

Growing consumer awareness regarding sustainability and ethical sourcing significantly impacts Home Depot's product selection and corporate practices. Shoppers are increasingly prioritizing items that minimize environmental harm, driving demand for eco-friendly options.

This trend is evident in the rising popularity of energy-efficient appliances and water-saving fixtures, prompting Home Depot to expand its assortment of green products. For instance, in fiscal year 2023, Home Depot reported a continued emphasis on its sustainability initiatives, including efforts to reduce its operational carbon footprint by 30% by 2030, aligning with evolving consumer expectations.

- Consumer Demand: A significant percentage of consumers, often exceeding 60% in recent surveys, express a willingness to pay more for products from sustainable brands.

- Product Mix: Home Depot's investment in expanding its eco-friendly product lines reflects this demand, with growth observed in categories like LED lighting and low-VOC paints.

- Corporate Responsibility: The company's commitment to ethical sourcing and environmental stewardship is becoming a key differentiator, influencing brand perception and customer loyalty.

Workforce Development and Skilled Trades Shortage

The shortage of skilled trades professionals presents a significant societal challenge, directly impacting the availability of labor for crucial home improvement projects, especially for those relying on professional contractors. This gap affects not only individual homeowners but also the broader construction and renovation industry.

Home Depot is actively addressing this by investing in its own workforce through comprehensive training programs for its associates. This initiative aims to equip employees with the necessary skills to better serve customers and potentially fill some of the labor void.

Furthermore, Home Depot supports external initiatives focused on educating and training individuals in skilled trades. By fostering these educational pathways, the company contributes to bolstering the overall industry workforce, hoping to alleviate the skilled trades shortage in the long term.

- Skilled Trades Gap: A 2024 report indicated a projected shortfall of 3 million skilled trade workers by 2026 in the U.S., highlighting the urgency of this issue.

- Home Depot Training: The company's "Path to Zero" initiative, for example, focuses on developing associates' skills, with significant investment in their professional growth.

- Industry Support: Home Depot partners with organizations like SkillsUSA, which aims to prepare students for careers in trade, craft, and technical services, underscoring its commitment to workforce development.

- Economic Impact: The lack of skilled labor can lead to project delays and increased costs for consumers, impacting the home improvement market's overall health.

Societal values are shifting, with a growing emphasis on home as a sanctuary and a space for personal expression. This trend fuels continued investment in home improvement, benefiting retailers like Home Depot. The company's strong brand recognition and broad product assortment cater directly to this desire for enhanced living spaces.

Technological factors

Home Depot is significantly boosting its investment in artificial intelligence to transform both customer interactions and internal efficiency. A prime example is its 'Magic Apron' generative AI, currently active on its website and mobile app, which helps shoppers with product queries, DIY guidance, and tailored suggestions.

This AI initiative is slated for expansion to serve B2B Pro customers, broadening its reach. Beyond customer-facing applications, AI is also being deployed to refine inventory management and optimize workforce scheduling, aiming for smoother operations across the board.

The Home Depot is significantly investing in its digital infrastructure, aiming to provide a seamless omnichannel experience. This focus on e-commerce and digital platform enhancement is crucial, as customer preferences increasingly lean towards online purchasing and convenient options like curbside pickup.

In 2023, The Home Depot reported that its digital channels accounted for approximately 8% of its total sales, a testament to the growing importance of its online presence. The company's strategy includes enhancing its interconnected shopping experience, which involves faster delivery options and better integration between its online and physical store operations.

Advanced technologies like AI are revolutionizing Home Depot's supply chain. In 2024, the company continued to invest in AI-powered demand forecasting, aiming to reduce stockouts and overstock situations. This technology helps predict customer needs with greater accuracy, ensuring products are available when and where they are needed.

Optimizing inventory management is a key benefit. By leveraging AI, Home Depot can better track millions of SKUs across its vast network. This not only minimizes carrying costs but also enhances the customer experience by ensuring product availability, a critical factor in retail success.

These technological advancements also support strategic sourcing. Home Depot's focus on diversifying suppliers and improving efficiency globally is bolstered by AI's ability to analyze complex data sets, identify potential risks, and optimize logistics for a more resilient supply chain.

Smart Home Technology Adoption

Home Depot is actively integrating smart home technology, leveraging AI to offer customers enhanced energy efficiency, security, and convenience. This strategic push positions the company as a key player in the growing smart home market, which saw global revenue reach an estimated $138.4 billion in 2024, with projections indicating continued strong growth through 2025.

The company's focus on smart home solutions aligns with increasing consumer demand for connected living experiences. For instance, the smart thermostat market alone is expected to grow significantly, with sales of smart thermostats projected to reach $5.8 billion by 2025, up from approximately $4.1 billion in 2022.

- AI-powered recommendations: Home Depot uses AI to suggest compatible smart home devices, simplifying the customer's purchasing journey.

- Energy efficiency solutions: The company offers smart lighting and thermostat options that help consumers reduce energy consumption, a key driver in today's market.

- Enhanced home security: Smart locks, cameras, and alarm systems are increasingly popular, with Home Depot expanding its range in this category.

- Convenience and automation: Voice-activated assistants and integrated systems that automate home functions are central to their smart home strategy.

Data Analytics for Personalized Customer Experience

Home Depot is significantly leveraging data analytics and machine learning to craft personalized customer experiences. By analyzing vast amounts of customer data, the company can offer highly tailored product recommendations and solutions. This strategic use of technology is designed to boost sales, enhance customer satisfaction, and cultivate stronger brand loyalty through relevant and timely suggestions.

This data-driven approach is crucial in today's competitive retail landscape. For instance, in fiscal year 2024, Home Depot reported a 3.1% increase in comparable store sales, partly attributed to improved customer engagement driven by personalized marketing efforts. The company's investment in advanced analytics platforms allows them to understand individual customer preferences and purchasing behaviors more deeply.

- Personalized Recommendations: Home Depot utilizes AI to suggest products based on past purchases, browsing history, and demographic information, increasing the likelihood of conversion.

- Targeted Marketing: Data analytics enables the creation of more effective marketing campaigns, reaching the right customers with the right offers at the right time.

- Improved Customer Service: By understanding customer needs through data, Home Depot can offer more proactive and relevant support, enhancing the overall service experience.

- Inventory Management: Analyzing purchasing trends helps optimize stock levels, ensuring popular items are readily available, which directly impacts customer satisfaction.

The Home Depot's technological strategy is heavily focused on artificial intelligence and digital transformation. Their AI initiatives, like 'Magic Apron,' aim to enhance customer interactions and internal operations, with AI-powered demand forecasting a key component for 2024 inventory management.

The company is also prioritizing its digital infrastructure to deliver a seamless omnichannel experience, recognizing the growing importance of e-commerce, which accounted for approximately 8% of total sales in 2023.

Furthermore, Home Depot is integrating smart home technology, leveraging AI to offer solutions for energy efficiency and security, tapping into a market projected for continued strong growth through 2025.

Data analytics and machine learning are central to crafting personalized customer experiences, with investments in advanced analytics platforms supporting improved customer engagement and targeted marketing efforts.

| Technology Focus | Key Initiatives/Applications | Impact/Data Point |

|---|---|---|

| Artificial Intelligence | 'Magic Apron' generative AI, AI-powered demand forecasting, workforce scheduling optimization | Enhancing customer interaction, improving inventory accuracy, streamlining operations |

| Digital Infrastructure | Omnichannel experience enhancement, e-commerce platform development | Digital channels represented ~8% of total sales in 2023 |

| Smart Home Technology | AI-driven recommendations for smart devices, energy efficiency solutions, smart security systems | Smart home market projected for strong growth through 2025; smart thermostat market to reach $5.8 billion by 2025 |

| Data Analytics & Machine Learning | Personalized customer recommendations, targeted marketing, improved customer service | Fiscal year 2024 comparable store sales increased 3.1%, partly due to improved customer engagement |

Legal factors

Home Depot navigates a complex web of product safety and quality regulations, primarily overseen by federal bodies such as the Consumer Product Safety Commission (CPSC). This means every item, particularly those bearing Home Depot's private labels like HDX or Simpli Home, must meet rigorous safety benchmarks and proper labeling mandates. Failure to comply can lead to significant fines and damage to consumer confidence. For instance, in 2023, the CPSC recalled thousands of products across various retailers due to safety concerns, highlighting the critical nature of these regulations for companies like Home Depot.

The Home Depot navigates a complex landscape of consumer protection laws that dictate everything from how it advertises its products to how it handles pricing and sales. These regulations are crucial for safeguarding customer rights and ensuring fair business practices across the board.

Compliance is paramount, especially concerning online transactions. For instance, adherence to regulations governing online marketplace payments and robust credit card security measures directly impacts consumer trust and The Home Depot's brand reputation. In 2023, the U.S. Federal Trade Commission (FTC) reported over 1.1 million fraud reports, highlighting the continued importance of these protective measures.

Home Depot must navigate a complex web of environmental laws, covering everything from how it handles waste and manages emissions to the safe disposal of hazardous materials. For instance, the Resource Conservation and Recovery Act (RCRA) dictates strict guidelines for hazardous waste management, impacting how the company disposes of certain products or byproducts from its operations and customer returns.

The company actively pursues sustainability goals, such as reducing its carbon footprint, which directly supports regulatory compliance and demonstrates proactive environmental responsibility. In 2023, Home Depot reported a 12% reduction in its Scope 1 and 2 greenhouse gas emissions compared to its 2019 baseline, a move that not only aligns with global climate directives but also enhances its operational efficiency and public image.

Labor and Employment Laws

Home Depot, as a significant employer, navigates a landscape of intricate labor and employment legislation. These laws cover critical areas such as minimum wage requirements, overtime pay, and adherence to workplace safety standards like those enforced by OSHA. Furthermore, the company is bound by anti-discrimination statutes that prohibit unfair treatment based on protected characteristics.

The company actively tracks evolving legislative proposals that could reshape its operational framework. For instance, potential changes stemming from legislation like the PRO Act, which aims to strengthen collective bargaining rights, could significantly influence Home Depot's approach to labor relations and employee representation. As of early 2024, discussions around such labor reforms remain a key consideration for large retailers.

- Wage and Hour Compliance: Home Depot must ensure compliance with federal and state minimum wage laws, as well as overtime regulations for eligible employees.

- Workplace Safety: Adherence to Occupational Safety and Health Administration (OSHA) standards is paramount to maintaining a safe working environment for all associates.

- Anti-Discrimination Laws: The company is subject to laws like Title VII of the Civil Rights Act, prohibiting discrimination in employment practices.

- Labor Relations Monitoring: Home Depot keeps a close watch on legislative developments impacting unionization and collective bargaining, such as proposed federal legislation.

International Trade and Customs Laws

Home Depot's global operations mean it must meticulously adhere to international trade and customs laws, a complex web of regulations governing import and export activities. These laws dictate everything from product labeling to duties and tariffs, directly impacting the cost and efficiency of sourcing goods. For instance, in 2024, the ongoing adjustments to trade policies between major economies continue to create a dynamic landscape for retailers like Home Depot.

The company's strategic push for supply chain diversification is significantly influenced by these legal factors. By spreading its sourcing across multiple countries, Home Depot aims to mitigate risks stemming from fluctuating trade agreements, such as potential tariffs or import restrictions. This proactive approach helps ensure a more stable flow of merchandise, even as international trade policies evolve, reflecting the ongoing challenges in global commerce.

Navigating these regulations requires significant investment in compliance and expertise. For example, the Harmonized System (HS) codes used for classifying traded products are subject to updates, and failure to comply can result in penalties, delays, or even seizure of goods. Home Depot's commitment to international trade compliance is therefore crucial for its operational integrity.

- Global Sourcing Compliance: Home Depot must comply with a multitude of international trade laws and customs regulations across all the countries it operates in or sources from.

- Tariff and Duty Management: Fluctuations in tariffs and duties, as seen in ongoing trade discussions between major economic blocs in 2024, directly impact the cost of goods and require constant monitoring and strategic adjustment.

- Supply Chain Risk Mitigation: Diversifying its supply chain is a direct response to the legal risks associated with evolving trade agreements and potential protectionist measures implemented by various nations.

- Import/Export Requirements: Adherence to specific import and export documentation, licensing, and product standards is essential to avoid disruptions in the flow of inventory.

Home Depot's operations are significantly shaped by legal and regulatory frameworks, particularly concerning product safety and consumer protection. Adherence to standards set by bodies like the Consumer Product Safety Commission (CPSC) is vital, as non-compliance can lead to substantial fines and reputational damage. For instance, in 2023, numerous product recalls across the retail sector underscored the critical importance of these safety mandates.

The company must also navigate a complex array of consumer protection laws governing advertising, pricing, and sales practices. Ensuring compliance with regulations for online transactions, including payment processing and credit card security, is paramount for maintaining customer trust. The Federal Trade Commission's (FTC) 2023 report on fraud, detailing over 1.1 million reports, highlights the ongoing need for robust consumer protection measures.

Environmental laws, such as the Resource Conservation and Recovery Act (RCRA), dictate strict guidelines for waste management and hazardous material disposal, impacting Home Depot's operational procedures. The company's commitment to sustainability, evidenced by a reported 12% reduction in Scope 1 and 2 greenhouse gas emissions by 2023 compared to its 2019 baseline, aligns with regulatory expectations and enhances its corporate image.

Labor and employment laws, including minimum wage, overtime, and workplace safety standards enforced by OSHA, are critical for Home Depot as a major employer. The company also monitors legislative developments, such as potential impacts of the PRO Act on labor relations, which could influence its approach to employee representation. As of early 2024, these labor reforms remain a key consideration.

International trade and customs laws significantly influence Home Depot's global sourcing and supply chain strategies. Compliance with import/export regulations, tariffs, and product classifications, like Harmonized System (HS) codes, is essential to avoid penalties and operational disruptions. Evolving trade policies between major economies in 2024 necessitate continuous monitoring and adaptation to mitigate risks associated with tariffs and import restrictions.

| Legal Factor | Description | Impact on Home Depot | Relevant Data/Trends (2023-2024) |

| Product Safety & Quality | Compliance with CPSC regulations and safety standards for all products sold. | Avoids fines, recalls, and reputational damage; ensures consumer trust. | Thousands of product recalls across retail in 2023 due to safety concerns. |

| Consumer Protection | Adherence to laws on advertising, pricing, online transactions, and data security. | Maintains customer confidence; prevents legal action and financial penalties. | FTC reported over 1.1 million fraud reports in 2023; emphasis on online transaction security. |

| Environmental Regulations | Compliance with laws like RCRA for waste and hazardous material management. | Ensures responsible operations; supports sustainability initiatives and public image. | Home Depot reported a 12% reduction in Scope 1 & 2 GHG emissions by 2023 (vs. 2019 baseline). |

| Labor & Employment Laws | Adherence to minimum wage, overtime, OSHA safety standards, and anti-discrimination laws. | Ensures fair labor practices; avoids litigation and maintains employee morale. | Ongoing legislative discussions (e.g., PRO Act) impacting labor relations and collective bargaining. |

| International Trade & Customs | Compliance with import/export laws, tariffs, and product classification (HS Codes). | Facilitates smooth global sourcing and supply chain operations; manages costs. | Dynamic trade policy adjustments between major economies in 2024 impacting tariffs and import restrictions. |

Environmental factors

The Home Depot has set significant greenhouse gas emissions reduction targets, validated by the Science Based Targets initiative (SBTi). These goals include a 42% decrease in absolute Scope 1 and Scope 2 emissions by 2030, measured against a 2020 baseline.

Furthermore, the company aims to achieve a 25% reduction in Scope 3 emissions specifically related to the use of products sold by 2030. These commitments underscore a strategic focus on environmental sustainability within its operational framework.

The Home Depot is actively promoting energy efficiency, with its product offerings helping customers save an estimated $300 million annually on energy costs through the purchase of ENERGY STAR certified products. This focus extends to their own operations, as the company aims to source 100% of its corporate office electricity from renewable sources by 2025, demonstrating a commitment to reducing its environmental footprint.

Home Depot actively promotes water conservation, guiding customers toward reducing their water usage. This involves championing products certified by WaterSense®, a U.S. Environmental Protection Agency program, and offering other water-saving solutions.

Through these efforts, Home Depot helps customers achieve notable savings on their water bills. For example, by installing WaterSense® labeled fixtures, consumers can save an average of 20% on indoor water use, translating to significant financial benefits and environmental impact.

Waste Reduction and Circular Economy Practices

The Home Depot is actively pursuing waste reduction and circular economy practices, viewing waste as a resource for new opportunities. This commitment is evident in their efforts to innovate packaging, notably by phasing out materials like EPS foam and PVC film. In 2023, they reported a 20% reduction in packaging waste compared to their 2021 baseline, demonstrating tangible progress.

Their strategy also involves a significant focus on reducing plastic usage and implementing robust recycling programs, particularly for materials that are typically challenging to recycle. By the end of 2024, The Home Depot aims to divert 75% of its operational waste from landfills, a goal supported by investments in advanced sorting and processing technologies.

- Packaging Innovation: Eliminating EPS foam and PVC film from packaging to reduce harmful materials.

- Plastic Reduction: Actively working to decrease the overall amount of plastic used in their products and operations.

- Recycling Programs: Expanding initiatives to recycle difficult-to-process materials, enhancing resource recovery.

- Waste Diversion Goals: Targeting a 75% diversion of operational waste from landfills by the end of 2024.

Sustainable Sourcing and Supply Chain Engagement

Home Depot is actively cultivating a more environmentally conscious supply chain. A key initiative involves encouraging its most important suppliers to establish and publicly announce their sustainability objectives by the year 2025. This strategic push aims to align the company's partners with its own environmental commitments.

The company's commitment extends to prioritizing the sourcing of sustainable materials. Furthermore, Home Depot is making a significant push towards battery-powered technology in its outdoor power equipment. The goal is to transition a substantial portion of these sales to battery-powered options by 2028, a move that directly influences supplier product development and manufacturing practices.

- Supplier Sustainability Goals: Top-tier strategic suppliers are being motivated to adopt publicly stated sustainability goals by 2025.

- Sustainable Material Sourcing: Home Depot prioritizes sourcing materials with a lower environmental impact.

- Battery-Powered Equipment Transition: A significant shift towards battery-powered outdoor power equipment is targeted by 2028, influencing supplier innovation.

Home Depot's commitment to environmental stewardship is evident in its ambitious emissions reduction targets, aiming for a 42% cut in Scope 1 and 2 emissions by 2030 from a 2020 baseline. The company is also driving customer energy savings, with ENERGY STAR products helping consumers save an estimated $300 million annually.

Water conservation is another key focus, with WaterSense® certified fixtures enabling consumers to reduce indoor water use by an average of 20%. This proactive approach to sustainability is integrated across operations and product offerings, aiming to minimize environmental impact.

The company is making strides in waste reduction, targeting a 75% operational waste diversion from landfills by the end of 2024, supported by packaging innovations like the phasing out of EPS foam. Furthermore, Home Depot is encouraging its key suppliers to set public sustainability goals by 2025, fostering a greener supply chain.

| Environmental Initiative | Target/Goal | Year | Impact/Metric |

|---|---|---|---|

| Scope 1 & 2 Emissions Reduction | 42% decrease | 2030 | vs. 2020 baseline |

| Scope 3 Emissions Reduction (Product Use) | 25% decrease | 2030 | |

| Renewable Electricity Sourcing (Corporate Offices) | 100% | 2025 | |

| Operational Waste Diversion | 75% | End of 2024 | from landfills |

| Supplier Sustainability Goals | Publicly announced | 2025 | for top-tier suppliers |

PESTLE Analysis Data Sources

Our PESTLE Analysis for The Home Depot is built on a comprehensive review of data from government agencies, industry associations, and reputable market research firms. This includes economic indicators, regulatory updates, technological advancements, and social trend reports.