The Home Depot Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The Home Depot Bundle

The Home Depot navigates a landscape shaped by intense rivalry, significant buyer power, and the constant threat of new entrants. Understanding these forces is crucial for anyone looking to grasp their competitive edge.

This snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore The Home Depot’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Home Depot benefits from a broad and diversified supplier base, which limits the bargaining power of any single supplier. For instance, in 2024, the company sources millions of SKUs from thousands of vendors, ensuring that reliance on any one is minimal. This wide network allows Home Depot to negotiate favorable terms and switch suppliers if necessary, especially for commodity building materials.

Home Depot faces significant switching costs when changing suppliers for its vast array of products. These costs encompass not only the financial outlay for new contracts and potential termination fees but also the operational disruption involved in qualifying new vendors, reconfiguring supply chains, and updating inventory management systems. For instance, a shift in suppliers for a core product like lumber could necessitate extensive testing for quality consistency and impact delivery schedules, potentially delaying projects for contractors who rely on Home Depot.

The operational complexities are substantial. Home Depot would need to invest in retraining staff on new product specifications, handling procedures, and potentially new quality control protocols. Furthermore, a supplier change could lead to temporary gaps in product availability or even a perceived dip in quality, impacting customer satisfaction and sales. In 2023, Home Depot reported net sales of $110.1 billion, underscoring the sheer volume of goods that would be affected by such a transition, making the inertia to switch suppliers a powerful factor.

Home Depot's suppliers generally offer standardized building materials and home improvement products, meaning most items are not highly differentiated. This lack of uniqueness limits the bargaining power of individual suppliers, as Home Depot can often source similar products from multiple vendors. For instance, while some specialized tools or proprietary brands might exist, the bulk of Home Depot's inventory consists of widely available commodities.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into the retail market, effectively bypassing Home Depot, is generally considered low. This is primarily because the capital investment and operational complexities involved in running a large-scale retail business are significant barriers for most of Home Depot’s established suppliers.

For instance, while a large lumber supplier might have substantial assets, the intricate logistics of managing thousands of SKUs, customer service, and widespread store networks present a different challenge than their current manufacturing or distribution operations. Home Depot's scale and efficiency in retail make it a difficult market for suppliers to enter profitably and compete directly.

- Low Threat: Suppliers integrating forward into retail is a minimal concern for Home Depot.

- Barriers to Entry: The high capital requirements and operational complexity of retail deter most suppliers.

- Scale Advantage: Home Depot's established infrastructure and market presence create a significant competitive advantage.

- Supplier Focus: Most suppliers are focused on their core competencies in manufacturing and distribution rather than retail operations.

Importance of Home Depot to Suppliers

Home Depot's sheer scale makes it a critical customer for many of its suppliers. In 2023, Home Depot reported net sales of $152.9 billion, a significant portion of which flowed to its vast supplier network. This substantial revenue stream means that many manufacturers and distributors rely heavily on Home Depot for a large percentage of their business, thereby diminishing their individual bargaining power.

The retailer's dominant market position, holding a substantial share of the home improvement retail sector, further amplifies its influence. Suppliers often find that losing Home Depot as a client could have severe financial repercussions. This dependency allows Home Depot to negotiate favorable terms, pricing, and product specifications, effectively limiting the suppliers' ability to dictate terms.

- Home Depot's 2023 net sales: $152.9 billion.

- Impact of scale: Many suppliers are highly dependent on Home Depot for revenue.

- Market dominance: Home Depot's significant market share reduces supplier leverage.

- Negotiating advantage: Dependency allows Home Depot to secure favorable terms.

Home Depot's bargaining power with suppliers is strong due to its immense scale and diversified supplier base. In 2023, the company's net sales reached $152.9 billion, meaning many suppliers depend heavily on Home Depot for a significant portion of their revenue. This reliance limits individual suppliers' ability to dictate terms.

| Factor | Assessment | Impact on Suppliers |

|---|---|---|

| Supplier Concentration | Low. Home Depot sources from thousands of vendors. | Reduces individual supplier leverage. |

| Supplier Dependence | High. Many suppliers rely on Home Depot for substantial revenue. | Limits suppliers' ability to negotiate unfavorable terms. |

| Product Differentiation | Low for most items. Many products are standardized commodities. | Allows Home Depot to switch suppliers easily for similar goods. |

| Switching Costs for Home Depot | High due to operational complexity and volume. | Creates inertia for Home Depot to switch, but doesn't negate overall power. |

| Forward Integration Threat | Low. High barriers to entry for suppliers in retail. | Suppliers are unlikely to bypass Home Depot by entering retail. |

What is included in the product

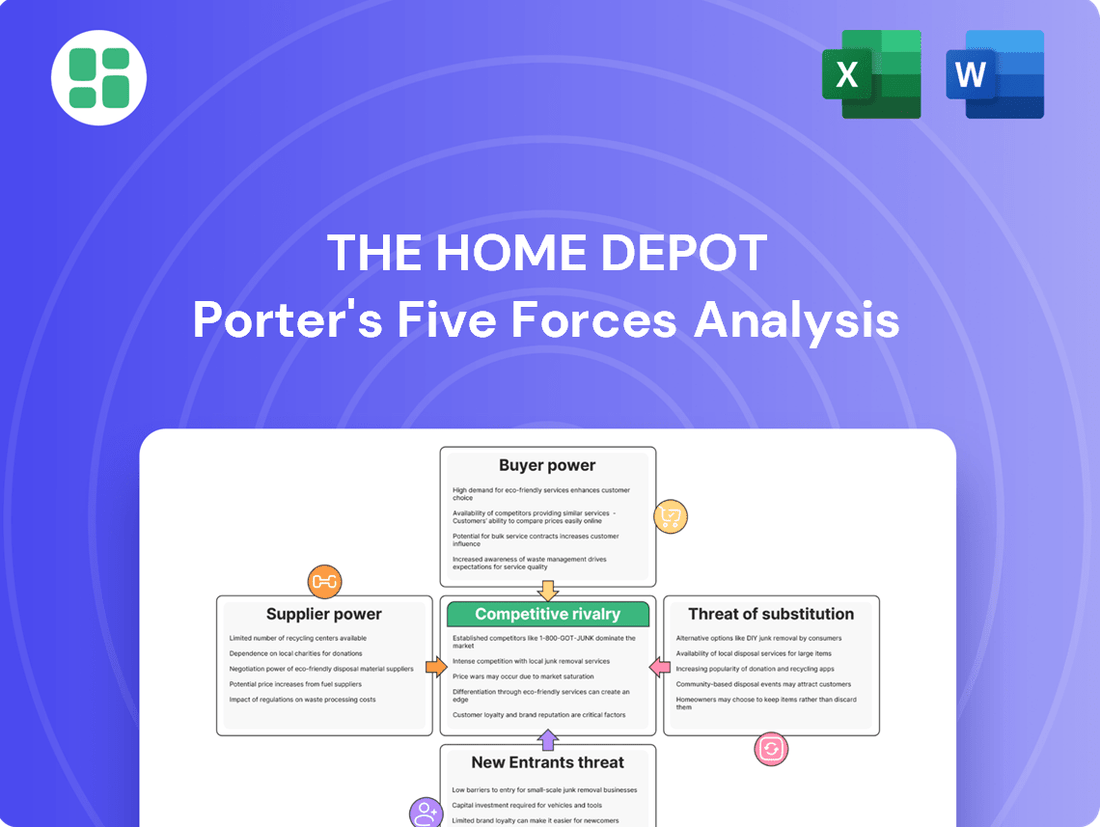

This analysis of The Home Depot dissects the competitive forces shaping its industry, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry among existing players.

Instantly identify and address competitive threats by visualizing the intensity of each of Porter's Five Forces impacting Home Depot.

Customers Bargaining Power

Home Depot's customers, both do-it-yourself (DIY) enthusiasts and professional contractors, exhibit significant price sensitivity. Many will actively compare prices between Home Depot and its competitors like Lowe's or smaller local hardware stores before making a purchase, especially for larger ticket items or bulk materials.

This sensitivity is evident in how readily customers seek out sales, discounts, and loyalty programs. For instance, during the peak home improvement season in 2024, promotions on lumber, paint, and appliances often drove significant foot traffic and online sales, demonstrating a direct correlation between price incentives and purchasing decisions.

The availability of alternative retailers significantly empowers customers in the home improvement sector. Customers can easily switch to competitors like Lowe's, or even explore options at general merchandise stores such as Walmart or Target, which increasingly offer home goods. Online retailers like Amazon also present a readily accessible alternative, providing a vast selection and competitive pricing.

Customer switching costs for Home Depot are generally quite low. Consumers can easily shift their purchases to a competitor like Lowe's or even online retailers such as Amazon for many home improvement products. This ease of transition means customers don't face significant financial penalties or major inconveniences when choosing an alternative provider.

Customer Information and Product Knowledge

Customers today are incredibly informed, especially when it comes to pricing and product quality. The internet has made it easy for them to research alternatives and compare offerings. This readily available information significantly boosts their bargaining power.

For instance, Home Depot customers can easily access detailed product specifications, read numerous reviews, and compare prices across different retailers, including online giants, before making a purchase. This transparency means customers can often negotiate better deals or choose competitors if they feel the price or quality doesn't align with market expectations.

- Informed Customer Base: Access to online reviews, price comparison tools, and product information empowers Home Depot's customers.

- Price Sensitivity: Customers can readily identify and act on price differences, increasing pressure on Home Depot to remain competitive.

- Product Knowledge: Detailed product information available online allows customers to assess quality and features, impacting their willingness to pay a premium.

Volume of Purchases by Different Customer Segments

The Home Depot serves a diverse customer base, notably distinguishing between do-it-yourself (DIY) shoppers and professional contractors. DIY customers, while numerous, typically make smaller, less frequent purchases, limiting their individual bargaining power.

Professional contractors, on the other hand, represent a segment with significantly higher bargaining power. These customers, including builders, remodelers, and property managers, often make substantial and recurring purchases. For instance, in 2023, Pro customers accounted for approximately 40% of The Home Depot's total sales, highlighting their economic importance.

This volume of business allows contractors to negotiate better pricing and terms. Their potential for long-term relationships and the ability to shift their business to competitors if pricing or service is not satisfactory further amplifies their leverage.

- DIY Customers: Smaller, individual purchases, lower bargaining power.

- Professional Contractors: Larger, frequent purchases, higher individual bargaining power due to volume.

- Pro Customer Sales: Represented about 40% of The Home Depot's total revenue in 2023, underscoring their significant economic impact.

- Relationship Leverage: Contractors can leverage their spending and potential for long-term commitment to negotiate favorable terms.

The bargaining power of Home Depot's customers is considerable, driven by easy access to information and a competitive market. Customers can readily compare prices and product quality online, making them less likely to accept higher prices without seeking alternatives. This informed consumer base exerts significant pressure on Home Depot to maintain competitive pricing and offer value.

| Customer Segment | Purchase Volume | Bargaining Power Factor | Impact on Home Depot |

|---|---|---|---|

| DIY Shoppers | Lower, individual | Price sensitivity, ease of switching | Moderate pressure on everyday pricing |

| Professional Contractors | Higher, recurring | Volume discounts, relationship leverage | Significant pressure on pricing and terms; ~40% of 2023 sales |

| Online Shoppers | Variable | Price transparency, wide availability of alternatives | Intensifies price competition across all product categories |

What You See Is What You Get

The Home Depot Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. You're looking at the actual, comprehensive Home Depot Porter's Five Forces Analysis, detailing competitive rivalry, buyer power, supplier power, threat of new entrants, and threat of substitutes. Once you complete your purchase, you’ll get instant access to this exact file, ready for your strategic planning needs.

Rivalry Among Competitors

The home improvement retail landscape is highly concentrated, with Home Depot and Lowe's standing as the two dominant giants. In 2023, Home Depot reported net sales of $152.9 billion, while Lowe's achieved $83.5 billion in net sales. This duopoly structure intensifies competitive rivalry, as both companies vie for market share through aggressive pricing, product assortment, and customer service strategies.

The home improvement industry generally experiences steady growth, often tied to housing market trends and consumer spending. In 2023, for instance, the U.S. home improvement market was valued at approximately $500 billion, demonstrating resilience. However, periods of slower economic expansion can heighten competitive rivalry as companies vie more aggressively for a larger share of a less rapidly expanding market.

Home Depot stands out through its extensive product selection, including exclusive private brands like HDX and Husky, which offer quality at competitive price points. The company also focuses on specialized services, such as in-home consultations and professional installation, providing a comprehensive solution for customers. This commitment to a superior customer experience, coupled with a vast inventory, creates significant differentiation.

Exit Barriers for Competitors

Competitors in the home improvement sector, including those directly challenging Home Depot, often face significant exit barriers. These arise from substantial investments in specialized assets and high fixed costs associated with large retail footprints, extensive supply chains, and sophisticated inventory management systems. For instance, maintaining a vast network of physical stores requires ongoing capital expenditure, making a quick or easy exit financially untenable for many players.

The capital-intensive nature of the industry means that exiting would likely result in substantial losses on the sale of specialized assets like distribution centers and store leases, which may not have readily available buyers or command their original value. This financial pressure often compels companies to persevere even in challenging market conditions, leading to sustained competitive rivalry as firms attempt to recoup their investments rather than abandon them.

- High Capital Investments: The home improvement retail sector demands significant upfront and ongoing capital for store development, logistics, and technology.

- Specialized Assets: Many assets, such as large format retail stores and distribution centers, are highly specialized for the industry, limiting their resale value upon exit.

- Brand and Reputation: Companies invest heavily in building brand loyalty and reputation, which are difficult to divest or monetize quickly if a decision to exit is made.

- Employee and Supplier Relationships: Severing long-standing relationships with employees and suppliers can incur significant severance costs and contractual penalties, increasing exit costs.

Market Share and Strategic Objectives of Rivals

The competitive rivalry in the home improvement sector is intense, with Home Depot facing significant pressure from key players like Lowe's and a growing number of smaller, specialized retailers. Lowe's, for instance, has been strategically focusing on the Pro customer segment, aiming to capture a larger share of professional contractor business, which directly challenges Home Depot’s established dominance in this area.

Furthermore, the pursuit of enhanced omnichannel capabilities by rivals, including robust online platforms and seamless in-store pickup options, escalates the competitive landscape. In 2024, Home Depot reported net sales of $110.4 billion, while Lowe's reported net sales of $86.3 billion, highlighting the scale of the competition.

- Lowe's Strategic Focus: Lowe's has been actively investing in its Pro customer offerings, including dedicated sales teams and expanded product assortments tailored to professional contractors.

- Omnichannel Investments: Both Home Depot and Lowe's are heavily investing in their digital platforms and supply chains to improve online order fulfillment and in-store pickup experiences.

- Market Share Dynamics: While Home Depot maintains a larger market share in the U.S. home improvement market, estimated to be around 35% in early 2024, Lowe's holds approximately 20%, indicating a substantial, though smaller, competitive presence.

- Emerging Competitors: The rise of online-only retailers and specialized home improvement chains adds further complexity, forcing established players to continually innovate.

Competitive rivalry in the home improvement sector is fierce, primarily between Home Depot and Lowe's, who dominate the market. In 2024, Home Depot reported net sales of $110.4 billion, while Lowe's achieved $86.3 billion, showcasing their significant market presence. This intense competition forces both companies to constantly innovate in pricing, product variety, and customer service to capture market share.

The strategic initiatives of rivals, such as Lowe's increased focus on the professional contractor segment, directly challenge Home Depot's market position. Additionally, significant investments in omnichannel capabilities by both major players, including enhanced online platforms and in-store pickup options, further intensify the competitive landscape.

The home improvement market, valued at approximately $500 billion in 2023, sees intense competition, especially during economic slowdowns. Home Depot, holding an estimated 35% market share in early 2024, faces strong competition from Lowe's, which commands around 20% of the market. This rivalry is further complicated by emerging online retailers and specialized chains, pushing established players towards continuous improvement.

SSubstitutes Threaten

Customers seeking home improvement solutions have several alternatives to directly purchasing from The Home Depot. They can bypass retailers altogether by hiring professional contractors who source their own materials, or opt for specialized repair services for specific needs like plumbing or electrical work.

Furthermore, general merchandise stores, while not their primary focus, offer a selection of basic home improvement items, providing a more convenient option for minor repairs or upgrades. In 2023, the home services market, encompassing these alternatives, was valued at over $1.5 trillion globally, indicating a significant portion of home improvement spending occurs outside traditional retail channels.

The threat of substitutes for Home Depot is significantly influenced by the price-performance trade-off. While Home Depot offers a vast selection of products and services, consumers can often find alternatives that meet their needs at a lower cost. For instance, smaller independent hardware stores or even online marketplaces can sometimes provide similar items for less, especially for basic commodities like fasteners or paint.

DIY enthusiasts might also opt for more specialized or niche retailers if they seek unique materials or expert advice not readily available at a big-box store. The perceived value Home Depot provides through convenience, selection, and brand recognition must consistently outweigh the cost savings offered by these substitutes. In 2024, with inflation impacting consumer spending, the price sensitivity towards substitute options is likely to be a key consideration for many shoppers.

Customers might switch to substitutes if they perceive a better value or convenience. For instance, a homeowner needing a quick fix for a leaky faucet might opt for a local hardware store over The Home Depot if it's closer and has the specific part readily available. The complexity of a DIY project also plays a role; a simple task might encourage a customer to explore alternatives, while a major renovation often solidifies the need for specialized products found at larger retailers.

Technological Advancements Enabling Substitutes

Technological advancements are a significant driver of substitute threats for The Home Depot. New online marketplaces and direct-to-consumer (DTC) models from manufacturers can offer alternatives to traditional retail, potentially bypassing established players like Home Depot. For instance, the rise of platforms connecting homeowners directly with specialized contractors or DIY product manufacturers selling directly online can siphon off demand. In 2024, the growth of e-commerce in home improvement continued, with online sales accounting for a notable portion of the market, indicating increasing customer comfort with alternative purchasing channels.

The accessibility of information and tools online also empowers consumers to undertake projects themselves or find alternative solutions. This can include readily available how-to guides, virtual design tools, and the sourcing of materials from a wider array of suppliers than previously possible. This trend was particularly evident in 2024 as consumers continued to invest in home improvement projects, often seeking cost-effective or unique solutions enabled by technology.

- Online Marketplaces: Platforms like Angi or Thumbtack offer alternatives for finding home services, potentially reducing reliance on Home Depot's contractor services or recommendations.

- Direct-to-Consumer (DTC) Brands: Manufacturers of flooring, paint, or smart home devices increasingly sell directly to consumers online, offering competitive pricing and specialized product lines.

- DIY Enablement: Advanced online tutorials and virtual reality design tools empower consumers to undertake more complex projects, potentially sourcing materials from various online vendors instead of a single retailer.

- Rental and Sharing Economy: For specialized tools or equipment, rental services or peer-to-peer sharing platforms can serve as substitutes for purchasing items outright from Home Depot.

Switching Costs to Substitutes

The threat of substitutes for The Home Depot is generally moderate. For many basic home improvement items like paint, fasteners, or basic tools, switching costs are quite low. Customers can easily find similar products at general merchandise retailers or specialty online stores.

However, for more specialized products or services, such as custom-cut lumber, specific plumbing fixtures, or installation services, the switching costs can increase. Home Depot's extensive product selection and in-store expertise can make it inconvenient to replicate the same experience elsewhere.

- Low Switching Costs for Basic Goods: For items like nails, screws, or standard paint, customers can readily find alternatives at competitors like Lowe's or even big-box retailers such as Walmart, with minimal effort or financial penalty.

- Moderate Switching Costs for Specialized Items: When it comes to custom-cut lumber, specific appliance brands, or unique tile selections, the effort to find and match these at a substitute retailer increases, making Home Depot a more convenient choice.

- Service-Based Substitutes: For services like plumbing or electrical work, customers might opt for independent contractors or specialized local businesses rather than purchasing materials from Home Depot and attempting DIY.

- Online Retailers as Substitutes: Pure online players like Amazon offer a vast array of home improvement products, presenting a significant substitute threat, especially for customers prioritizing convenience and price comparison, though immediate availability and in-person advice are lacking.

The threat of substitutes for The Home Depot is moderate, largely due to the ease with which consumers can find alternatives for many basic home improvement needs. Online marketplaces and general merchandise stores offer competitive pricing and convenience for items like paint or fasteners. However, for specialized products or comprehensive project support, Home Depot's vast selection and in-store expertise present a higher barrier to substitution.

In 2024, the continued growth of e-commerce and direct-to-consumer brands intensified this threat, offering consumers more choices and potentially lower prices. For instance, platforms specializing in flooring or smart home technology can directly compete with Home Depot's offerings, especially for price-sensitive customers or those seeking niche products.

The rise of service-based alternatives, such as hiring specialized contractors who source their own materials, also diverts spending away from traditional retail. This trend is supported by the significant global home services market, which was valued at over $1.5 trillion in 2023, highlighting that a substantial portion of home improvement expenditure occurs outside of big-box retailers.

| Substitute Category | Examples | Impact on Home Depot | 2024 Trend Relevance |

|---|---|---|---|

| Online Marketplaces | Amazon, Wayfair, Etsy | Low switching costs for many products; convenience focus | Continued growth in online home goods sales |

| Specialty Retailers | Local hardware stores, flooring specialists, lighting showrooms | Higher switching costs for unique or custom items; expertise | Niche markets remain resilient |

| Direct-to-Consumer (DTC) Brands | Manufacturer websites for paint, appliances, smart home devices | Competitive pricing, specialized product lines | Increasing market penetration |

| Service Providers | Independent contractors, specialized repair services | Bypass retail for materials; focus on labor | Growing home services market |

Entrants Threaten

Establishing a large-scale home improvement retail operation like Home Depot demands a substantial financial commitment. This includes acquiring prime real estate for massive warehouse stores, stocking a diverse and extensive inventory of building materials, tools, and home goods, and building a robust, efficient supply chain network. For instance, a single Home Depot store can span over 100,000 square feet, requiring millions in construction and land acquisition alone.

The sheer scale of these initial investments, often running into hundreds of millions of dollars for a new competitor to even approach Home Depot's market presence, creates a formidable barrier. This high capital requirement significantly deters potential new entrants from challenging established players in the home improvement retail sector.

Home Depot's immense scale creates significant cost advantages through economies of scale. For instance, in 2023, its revenue reached $152.8 billion, allowing it to negotiate bulk purchasing discounts that smaller competitors simply cannot access. This scale also fuels its experience curve, where accumulated knowledge in operations, supply chain management, and customer service further drives down costs per unit.

Home Depot benefits from strong brand recognition, making it difficult for new entrants to attract customers. While switching costs for basic purchases might be low, established customer preferences and the perception of quality and reliability create a significant hurdle for newcomers aiming to build trust.

In 2024, Home Depot's brand equity remains a formidable barrier. The company consistently invests in marketing and customer experience, fostering loyalty that new competitors must overcome. This loyalty is built on years of reliable service and a vast product selection, making it a significant challenge for any new entrant to replicate.

Access to Distribution Channels and Suppliers

New entrants into the home improvement retail sector face significant hurdles in securing advantageous relationships with suppliers. Home Depot's long-standing partnerships and massive purchasing power allow it to negotiate favorable terms, making it challenging for newcomers to access the same quality or volume of goods at competitive prices. For instance, in 2023, Home Depot's net sales reached $152.7 billion, underscoring its immense supplier leverage.

Establishing an efficient and cost-effective distribution network is another major barrier. Home Depot operates a vast network of distribution centers and utilizes sophisticated logistics to ensure timely product delivery to its stores and customers. A new entrant would need substantial capital investment to replicate this infrastructure, potentially facing higher per-unit shipping costs and slower delivery times, which could impact customer satisfaction and operational efficiency.

- Supplier Relationships: New entrants struggle to match Home Depot's established supplier agreements, which are built on volume and long-term commitment.

- Distribution Network: The high cost and complexity of building a comparable logistics and distribution system present a significant barrier.

- Economies of Scale: Home Depot’s sheer size allows for greater purchasing power and lower per-unit costs, a scale that is difficult for new competitors to achieve quickly.

Government Policy and Regulations

Government policy and regulations, while not typically a significant barrier to entry in the broad retail sector, can introduce complexities for new home improvement retailers. Zoning laws dictate where physical stores can be built, impacting site selection and development costs. For instance, in 2024, obtaining the necessary permits for large-format retail spaces often involves navigating local planning departments with varying requirements and timelines, potentially delaying market entry and increasing initial overhead.

Licensing requirements, though generally straightforward for general retail operations, can become more intricate if new entrants plan to offer specialized services, such as installation or custom design. These can necessitate specific certifications or adherence to industry standards. While the Home Depot operates with established compliance frameworks, a new competitor must invest in understanding and meeting these regulatory landscapes, adding an operational layer to their market entry strategy. For example, in 2023, California's stringent environmental regulations for building materials added compliance costs for retailers operating in that state.

- Zoning Laws: Local ordinances dictate where large retail stores can operate, influencing real estate acquisition and development costs.

- Licensing: While general retail licenses are common, specialized services may require additional certifications, increasing operational complexity.

- Environmental Regulations: Compliance with rules regarding building materials and waste disposal, as seen with California's 2023 regulations, can add significant costs.

The threat of new entrants in the home improvement retail sector is significantly mitigated by Home Depot's substantial barriers to entry. These include immense capital requirements for store development and inventory, estimated to be in the hundreds of millions for a comparable market presence. Furthermore, Home Depot's established economies of scale, evidenced by its 2023 revenue of $152.8 billion, grant it superior purchasing power and lower per-unit costs, making it difficult for newcomers to compete on price.

Strong brand loyalty, cultivated through years of reliable service and extensive product offerings, poses another considerable challenge for potential entrants. In 2024, Home Depot continues to invest heavily in marketing and customer experience, solidifying its market position. New competitors must also overcome Home Depot's deeply entrenched supplier relationships and its highly efficient, costly-to-replicate distribution network.

Regulatory hurdles, such as zoning laws and licensing for specialized services, can also add complexity and cost. For instance, navigating local permitting processes in 2024 can lead to project delays and increased overhead. Compliance with environmental regulations, like those in California in 2023, further contributes to the operational expenses for new entrants.

| Barrier to Entry | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Building large-format stores and stocking diverse inventory requires millions in investment. | Deters new entrants due to high upfront costs. |

| Economies of Scale | Home Depot's 2023 revenue of $152.8 billion allows for bulk purchasing and lower operating costs. | New entrants struggle to match competitive pricing and margins. |

| Brand Loyalty & Switching Costs | Established customer trust and preference for Home Depot's offerings. | Difficult for new players to attract and retain customers. |

| Supplier Relationships | Long-standing agreements and high purchasing volume provide favorable terms. | New entrants face challenges securing similar supplier deals and pricing. |

| Distribution Network | Extensive logistics infrastructure is costly and complex to replicate. | Higher shipping costs and slower delivery times for new competitors. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for The Home Depot is built upon a foundation of robust data, drawing from publicly available company filings, industry-specific market research reports, and reputable financial news outlets.