The Home Depot Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The Home Depot Bundle

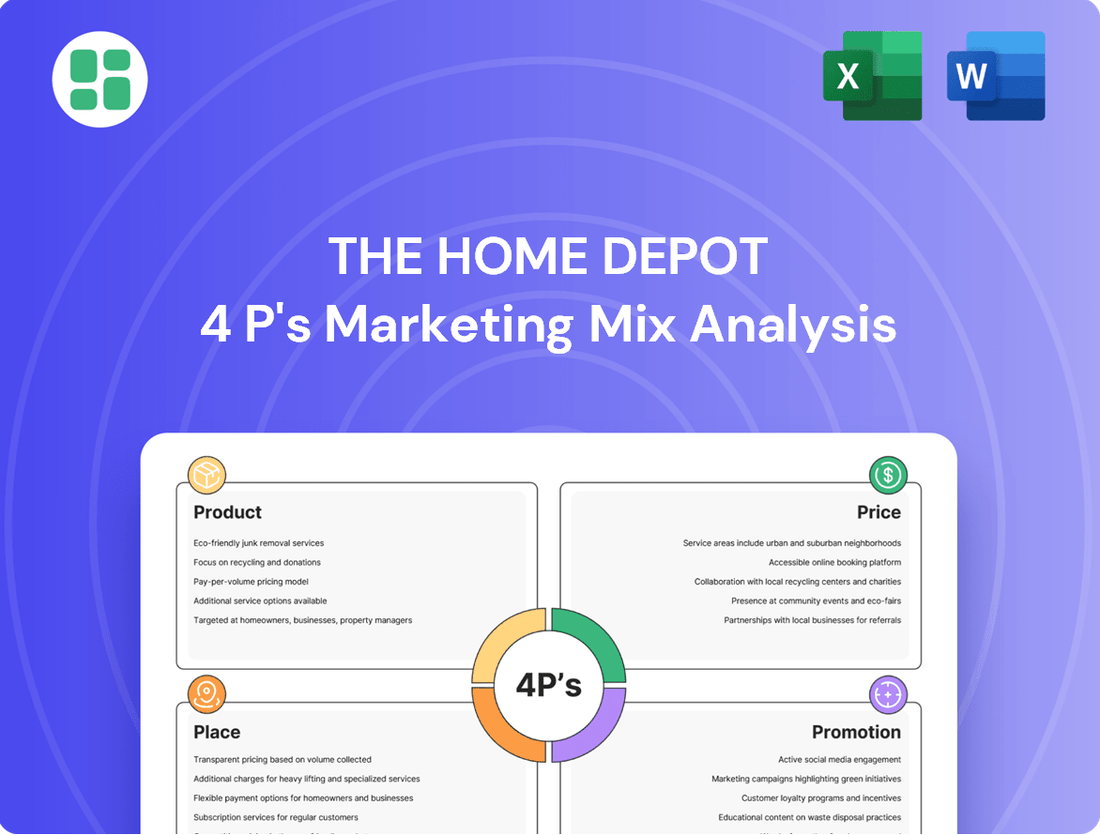

Discover how The Home Depot masterfully leverages its product assortment, competitive pricing, extensive distribution network, and impactful promotional campaigns to dominate the home improvement market. This analysis goes beyond the surface, revealing the strategic synergy of their 4Ps.

Unlock the complete, in-depth 4Ps Marketing Mix Analysis for The Home Depot, offering actionable insights into their product innovation, pricing strategies, unparalleled market reach, and compelling promotional activities. Ideal for students, professionals, and anyone seeking to understand retail success.

Gain immediate access to a comprehensive, editable report detailing The Home Depot's product offerings, pricing architecture, place (distribution) strategy, and promotion tactics. Elevate your understanding of effective marketing execution.

Product

The Home Depot's extensive home improvement assortment is a cornerstone of its product strategy, offering a comprehensive selection of physical goods. This vast array covers everything from foundational building materials like lumber and concrete to specialized tools, major appliances, and decorative items, serving both individual homeowners and professional contractors.

This broad product mix ensures customers can source all necessary components for any project, whether it's a weekend DIY update or a significant construction undertaking. For instance, in fiscal year 2023, The Home Depot reported net sales of $152.7 billion, a testament to the demand for their wide-ranging product categories.

Home Depot's service offerings extend far beyond simply selling products, creating a more comprehensive value proposition for customers. This includes installation services for major home improvement projects like flooring, kitchen renovations, and window replacements, simplifying the DIY process for many.

The company also boasts a significant tool and equipment rental business. In 2023, Home Depot's rental segment generated substantial revenue, with customers increasingly turning to rentals for specialized tools needed for one-off projects, making it a cost-effective alternative to purchasing.

Home Depot's product strategy brilliantly caters to both the do-it-yourself enthusiast and the professional tradesperson. This dual focus ensures a comprehensive market reach, understanding that each group has unique needs and purchasing behaviors.

For professionals, Home Depot is actively investing in services like localized product assortments and bulk job lot quantities, acknowledging their significant and consistent spending. In 2023, pro sales represented a substantial portion of their overall revenue, highlighting the importance of this segment.

The company also prioritizes the DIY customer by offering accessible product selections and valuable guidance for home improvement projects. This approach is particularly effective during peak seasons, where DIYers often drive increased demand for seasonal goods and project-specific supplies.

Private Brands and Exclusive s

Home Depot's private brands, like Behr paint and Hampton Bay outdoor furniture, are a cornerstone of its product strategy. These exclusive offerings provide customers with distinct quality and value propositions, setting Home Depot apart from rivals. This focus on proprietary brands not only drives sales but also fosters significant customer loyalty.

The company actively cultivates these exclusive lines, ensuring they represent innovation and quality. For instance, Behr paint is consistently recognized for its performance and wide color selection. This commitment to exclusive products allows Home Depot to control the narrative around quality and price, directly impacting customer perception and purchasing decisions.

- Private Brand Sales Contribution: While specific percentage breakdowns aren't always public, private label brands often represent a substantial portion of a retailer's overall sales, typically ranging from 15-25% for leading retailers in the home improvement sector.

- Customer Loyalty Impact: Exclusive brands like Behr are frequently cited in customer satisfaction surveys as a key reason for repeat business, contributing to Home Depot's strong customer retention rates.

- Supplier Collaboration: Home Depot partners with select suppliers to co-develop and exclusively offer products, ensuring a unique assortment that cannot be found elsewhere, thereby driving traffic and sales.

Digital Integration and Innovation

Home Depot’s commitment to digital integration is evident in its robust online presence and mobile application, designed for seamless product discovery and selection. For instance, in fiscal year 2023, Home Depot reported that its digital channels accounted for approximately 8% of its total sales, a figure that continues to grow. This highlights the increasing importance of their online platforms in driving revenue and customer engagement.

The company's website and app offer a wealth of detailed product information, customer reviews, and innovative features like in-store navigation. This digital infrastructure not only simplifies the shopping journey but also provides valuable data for personalized recommendations. By prioritizing user experience, Home Depot aims to replicate the helpfulness of its in-store associates online.

Further enhancing the customer experience, Home Depot is integrating advanced AI tools. The 'Magic Apron' initiative, for example, leverages artificial intelligence to assist customers with project planning, product selection, and even visualizing how products will look in their homes. This innovation is crucial for empowering customers to make confident purchasing decisions, particularly for complex home improvement projects.

- Digital Sales Growth: Home Depot's digital sales represented about 8% of total sales in fiscal year 2023, indicating a strong and growing online presence.

- Enhanced Product Discovery: The website and mobile app provide detailed product information, customer reviews, and in-store navigation to simplify the shopping process.

- AI-Powered Assistance: Tools like 'Magic Apron' use AI to help customers with project planning and product selection, improving purchasing confidence.

The Home Depot's product strategy centers on an expansive and diverse assortment, catering to both DIY enthusiasts and professional contractors. This includes everything from lumber and paint to appliances and tools, ensuring customers can find all necessary items for any project. In fiscal year 2023, the company achieved net sales of $152.7 billion, underscoring the broad appeal of its product categories.

Exclusive private brands, such as Behr paint and Hampton Bay furniture, are key differentiators, offering unique value and fostering customer loyalty. These proprietary lines are continually innovated to maintain quality and competitive pricing, directly influencing customer purchasing decisions and brand perception.

The company's digital product offerings are robust, with its website and mobile app designed for easy product discovery and selection. In fiscal year 2023, digital channels contributed approximately 8% to total sales, demonstrating a significant and growing online customer base. AI-powered tools like 'Magic Apron' further enhance the digital experience by assisting with project planning and product visualization.

| Product Category | Key Features | Fiscal Year 2023 Relevance |

|---|---|---|

| Building Materials | Lumber, concrete, drywall, roofing | Core offering for construction and renovation projects |

| Tools & Equipment | Hand tools, power tools, outdoor power equipment | Essential for both DIY and professional use; rental services available |

| Home Decor & Appliances | Furniture, lighting, major appliances, paint | Private brands like Behr and Hampton Bay drive significant sales |

| Digital & Services | Online sales, mobile app, installation, rental | 8% of total sales from digital in FY23; AI tools enhance customer experience |

What is included in the product

This analysis provides a comprehensive breakdown of The Home Depot's marketing mix, detailing its product assortment, pricing strategies, extensive distribution channels, and impactful promotional activities.

It's designed for professionals seeking to understand The Home Depot's market positioning through real-world brand practices and competitive insights.

This analysis distills Home Depot's 4Ps into actionable strategies, alleviating the pain of complex marketing planning by providing a clear, concise overview for efficient decision-making.

Place

The Home Depot's extensive physical store network is a cornerstone of its marketing strategy, boasting over 2,300 large-format retail locations across North America, including the U.S., Canada, and Mexico. These stores are more than just points of sale; they are crucial hubs for product availability and service delivery, with each typically offering around 105,000 square feet of indoor retail space.

This vast footprint ensures maximum accessibility for a diverse customer base, strategically positioned to serve both densely populated urban areas and sprawling suburban communities. The sheer scale of this physical presence allows Home Depot to effectively reach and serve millions of customers for their home improvement needs.

Home Depot's robust e-commerce platform is a cornerstone of its marketing strategy, complementing its extensive physical store network. In 2024, this digital channel generated over $20 billion in sales, showcasing its significant contribution to the company's revenue. The online presence offers unparalleled convenience, enabling customers to access a vast catalog of over one million products from any location.

Home Depot has masterfully woven its online and physical presences together, creating a truly seamless omnichannel experience that prioritizes customer convenience. This integration is evident in services like Buy Online, Pick Up In Store (BOPIS), readily available in-store pickup lockers, and efficient curbside pickup options.

The success of this strategy is quantifiable: in 2023, nearly half of Home Depot's e-commerce orders were fulfilled through in-store pickup. This high adoption rate underscores how effectively the company leverages its vast network of physical stores to complement its digital offerings, meeting customers wherever and however they prefer to shop.

Strategic Distribution Centers and Supply Chain

The Home Depot is strategically bolstering its supply chain and distribution network to meet evolving customer needs, particularly for its Pro segment. This involves substantial investment in new facilities designed to boost efficiency and accelerate delivery times.

In 2024, a key development was the opening of four new distribution centers. These facilities are purpose-built to cater to Pro customers, handling bulky items and facilitating direct deliveries to job sites.

This expansion directly addresses the need to alleviate in-store congestion. It ensures that essential products, especially those for large and complex projects, are readily available exactly when and where they are required by professional contractors.

- 2024 Expansion: Four new distribution centers opened to serve Pro customers.

- Focus: Stocking bulky merchandise and enabling direct job-site deliveries.

- Objective: Reduce in-store congestion and improve product availability for large projects.

Pro-Focused Fulfillment and Delivery

Home Depot's place strategy significantly caters to professional contractors through specialized fulfillment. The company is actively expanding its network of Flatbed Distribution Centers (FDCs) to facilitate same- and next-day delivery of large, project-critical orders directly to job sites.

This focus on pro customers is evident in their investments; for instance, Home Depot announced plans to invest approximately $1 billion in fiscal year 2024 to enhance its supply chain and delivery capabilities, with a significant portion aimed at improving pro fulfillment. These FDCs are crucial for handling bulky items like lumber and drywall, ensuring contractors receive materials efficiently, minimizing project delays.

Furthermore, Home Depot is bolstering its digital platforms to streamline order management for pros. This includes features like enhanced online inventory visibility and easier reordering, all designed to make the procurement process smoother and more reliable for their professional clientele.

- Expanded FDC Network: Home Depot's commitment to pro customers is underscored by its ongoing expansion of Flatbed Distribution Centers designed for rapid delivery of large-format materials.

- Same- and Next-Day Delivery: This specialized delivery service directly to job sites is a cornerstone of their pro-focused fulfillment strategy, directly addressing contractor needs for timely material access.

- Digital Tool Enhancement: Investments in digital tools improve order tracking, inventory management, and reordering for professional clients, aiming for greater efficiency and satisfaction.

Home Depot's place strategy is built on an expansive physical store network, complemented by robust digital channels and a sophisticated supply chain. This omnichannel approach ensures widespread accessibility and convenient fulfillment options for all customers, including a dedicated focus on professional contractors.

The company's physical footprint, with over 2,300 stores, acts as a critical distribution and service hub. In 2024, Home Depot continued to invest in its supply chain, opening four new distribution centers specifically to enhance service for its Pro segment, facilitating direct job-site deliveries for bulky items.

This strategic placement of distribution centers and the expansion of services like same- and next-day delivery for large orders underscore a commitment to meeting the time-sensitive needs of professional builders and remodelers, a key growth area for the company.

| Channel | Key Features | Customer Segment Focus | 2024/2025 Data/Initiatives |

|---|---|---|---|

| Physical Stores | Over 2,300 locations across North America; average 105,000 sq ft retail space | Broad consumer base, accessible for immediate needs | Continued optimization of store layouts for efficient shopping and BOPIS fulfillment. |

| E-commerce | Over 1 million products available online; over $20 billion in sales (2024) | Convenience-seeking consumers, online shoppers | Seamless integration with physical stores for BOPIS, curbside pickup, and locker availability. |

| Supply Chain & Distribution | Network of distribution centers, including new Flatbed Distribution Centers (FDCs) | Professional contractors, large project needs | Opened 4 new distribution centers in 2024; ~ $1 billion investment in supply chain enhancements for Pro fulfillment. |

Same Document Delivered

The Home Depot 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of The Home Depot's 4P's Marketing Mix is fully complete and ready for immediate use. You're viewing the exact version you'll download, providing full confidence in your purchase.

Promotion

Home Depot's advertising strategy is a cornerstone of its marketing mix, focusing on broad reach with targeted messaging. In 2024, the company continued to invest heavily in campaigns across television, digital channels, and print media to connect with both do-it-yourself enthusiasts and professional tradespeople. These efforts often showcase seasonal promotions, such as spring planting or fall cleanup, alongside new product introductions and competitive pricing strategies.

A key element of their promotional efforts is the utilization of their retail media network. This allows Home Depot to serve highly relevant product advertisements directly to customers browsing their website, using their mobile app, or engaging with email communications. This data-driven approach ensures that promotions are seen by the most interested consumers, maximizing campaign efficiency and driving sales for specific product categories.

Home Depot heavily utilizes seasonal and holiday sales events to drive customer engagement and sales. Promotions like their annual Spring Black Friday and Black Friday Savings events offer significant discounts across categories such as gardening, appliances, and tools. These events are strategically timed to coincide with periods of high consumer spending and demand for specific product categories, aiming to attract a large customer base and boost overall revenue.

Home Depot strategically leverages digital marketing, pouring resources into search engine marketing, targeted email campaigns, and robust social media engagement. Platforms like Facebook, Instagram, X (formerly Twitter), and Pinterest are key to their outreach.

The company actively cultivates an online community by sharing practical DIY project ideas, timely seasonal advice, and inspiring customer success stories. This consistent, valuable content is designed to resonate with their audience.

This interactive approach not only builds strong brand loyalty but also firmly establishes Home Depot as a go-to resource for inspiration and actionable solutions in the home improvement space. For instance, in Q1 2024, Home Depot reported a 3.2% increase in comparable store sales, partly fueled by their effective digital engagement strategies.

In-Store Workshops and Educational Content

The Home Depot leverages its physical store footprint as a powerful promotional tool, offering free in-store workshops and clinics. These educational sessions cater to do-it-yourself enthusiasts, covering a wide array of home improvement topics. By equipping customers with practical skills and knowledge, these workshops directly encourage product purchases for their upcoming projects.

This commitment to education extends online, where Home Depot provides a wealth of how-to guides and instructional videos. This digital content reinforces the company's position as a trusted expert resource, fostering deeper customer engagement and brand loyalty. In 2023, Home Depot reported over 1.5 million attendees across its in-store workshops, demonstrating the significant reach of this promotional strategy.

- In-Store Workshops: Free educational sessions held in physical stores.

- Online Content: Extensive how-to guides and videos available digitally.

- Customer Empowerment: Equipping customers with skills to encourage project completion and product sales.

- Engagement Driver: Fostering brand loyalty and positioning Home Depot as an expert resource.

Pro-Specific Marketing and Loyalty Programs

Home Depot actively courts professional contractors through targeted marketing and the Pro Xtra loyalty program. This initiative acknowledges the unique demands of trade professionals, offering them specialized benefits designed to enhance their business operations and foster repeat engagement.

The Pro Xtra program is a cornerstone of this strategy, providing members with advantages like tiered pricing, business management tools, and exclusive access to events. By catering directly to the needs of this high-value segment, Home Depot aims to secure a more significant portion of their spending.

For instance, Home Depot reported that its Pro segment continued to outperform its DIY segment in recent quarters. In the first quarter of 2024, sales to Pro customers grew by approximately 5.0%, while DIY sales saw a more modest increase. This highlights the effectiveness of their pro-specific strategies in driving growth within this crucial customer demographic.

- Pro Xtra Program: Offers tiered rewards, business tools, and exclusive pricing for professional customers.

- Targeted Marketing: Utilizes dedicated sales forces in key markets to engage directly with contractors.

- Segment Growth: Pro sales outpaced DIY sales in Q1 2024, demonstrating the success of pro-focused initiatives.

- Wallet Share: Efforts are concentrated on capturing a larger share of professional contractors' purchasing power.

Home Depot's promotional strategy is multi-faceted, leveraging digital, in-store, and loyalty programs to drive sales and customer engagement. Their retail media network allows for highly targeted advertising, while seasonal sales events like Spring Black Friday capture significant consumer interest. The company also focuses on empowering customers through educational workshops and online content, positioning itself as an expert resource.

The Pro Xtra program is a critical component, offering specialized benefits to professional contractors, which has proven effective in driving segment growth. In Q1 2024, Pro sales saw a notable increase of approximately 5.0%, outperforming DIY sales. This strategic focus on professional customers underscores the success of their targeted marketing efforts.

| Promotional Tactic | Description | Impact/Data Point |

|---|---|---|

| Digital Marketing | Targeted ads, email campaigns, social media engagement | Supports Q1 2024 comparable store sales increase of 3.2% |

| Seasonal Sales Events | Spring Black Friday, Black Friday Savings | Drives significant customer traffic and revenue during key periods |

| In-Store Workshops | Free educational sessions for DIY customers | Over 1.5 million attendees in 2023, fostering project engagement |

| Pro Xtra Program | Loyalty program for contractors | Pro segment sales grew ~5.0% in Q1 2024, outpacing DIY |

Price

Home Depot employs a competitive pricing strategy, focusing on an Everyday Low Price (EDLP) model for many of its core products. This approach is designed to make the company a consistently attractive option in the fiercely competitive home improvement sector.

By striving to offer the lowest prices on quality goods, Home Depot cultivates a perception of strong value among its customer base. This strategy is crucial for driving repeat business and fostering customer loyalty, ensuring they return for their project needs.

In fiscal year 2023, Home Depot reported net sales of $152.7 billion, underscoring the effectiveness of its pricing and overall marketing mix in a challenging economic environment.

Home Depot's pricing strategy is a cornerstone of its marketing mix, meticulously crafted to resonate with distinct customer needs. For the do-it-yourself (DIY) enthusiast, pricing often emphasizes accessible promotions and competitive pricing on popular items, making home improvement projects more attainable. This approach aims to capture a broad consumer base by offering clear value on individual purchases.

Professional contractors and businesses, however, are catered to with a different pricing structure designed to acknowledge their higher volume and specialized requirements. This includes tiered bulk discounts and exclusive pro pricing programs, reflecting the significant contribution of this segment to Home Depot's revenue. For instance, in fiscal year 2023, Home Depot reported that its Pro segment represented approximately 45% of its total sales, underscoring the importance of these tailored pricing strategies.

Beyond the sticker price, Home Depot embeds value into its pricing by integrating the cost of quality service and expert advice. This commitment to knowledgeable associates and readily available support enhances the overall customer experience, justifying the price point for many. This perceived added value, encompassing everything from project planning assistance to product demonstrations, differentiates Home Depot from competitors and fosters customer loyalty.

The Home Depot leverages promotional discounts to drive sales, with events like the 2024 Spring Black Friday sale offering substantial savings on appliances and home improvement essentials. These seasonal promotions, alongside ongoing 'Special Buys,' are crucial for inventory management and attracting price-sensitive customers.

To further enhance affordability, The Home Depot offers a range of financing options. Their Home Depot Consumer Credit Card, for instance, provides special financing periods on qualifying purchases, making significant investments in appliances or renovations more manageable for consumers throughout 2024 and into 2025.

Tiered Pricing and Trade Credit for Pros

Home Depot offers tiered pricing for its professional customers, rewarding higher volume or consistent purchases through its Pro Xtra loyalty program. This structure is designed to incentivize larger orders and foster long-term relationships. For example, in 2024, Pro Xtra members could access exclusive discounts and early access to sales, driving increased engagement among contractors and builders.

The company is also actively piloting trade credit programs, recognizing the critical need for flexible payment terms among contractors who manage project-based cash flows. These programs aim to ease financial burdens and facilitate smoother transactions, particularly for those undertaking larger renovation or construction projects. By offering these payment options, Home Depot strengthens its appeal to professionals who rely on predictable financial management.

These pricing and credit initiatives are instrumental in boosting Home Depot's wallet share within the professional segment. By providing tangible financial benefits, the company not only attracts new pro customers but also encourages existing ones to consolidate their purchasing with Home Depot, enhancing loyalty and overall sales performance in 2024 and beyond.

- Tiered Pricing: Better rates for higher purchase volumes via Pro Xtra.

- Trade Credit: Piloted programs offer flexible payment terms for contractors.

- Customer Retention: These benefits are key to strengthening relationships with pro clients.

- Market Impact: Aimed at increasing wallet share among professional buyers.

Stability Amidst Market Fluctuations

Stability Amidst Market Fluctuations

Despite external pressures like rising tariffs and inflation, Home Depot has largely maintained its current pricing. This commitment to price stability is a significant factor in solidifying customer loyalty and differentiating the company from competitors. For instance, in early 2024, while many retailers grappled with passing on increased costs, Home Depot's strategic approach allowed it to absorb some of these pressures.

This pricing stability is underpinned by several key strengths. Home Depot's immense scale of operations provides significant purchasing power, enabling them to negotiate favorable terms with suppliers. Furthermore, their robust supplier partnerships and a diversified supply chain, which minimizes reliance on any single country for imports, contribute to their ability to manage costs effectively. This resilience was particularly evident throughout 2024 as global supply chain disruptions continued to impact many industries.

- Price Stability: Home Depot aims to maintain current pricing levels despite inflation and tariffs.

- Customer Loyalty: This strategy helps retain customers and build stronger relationships.

- Competitive Advantage: Differentiates Home Depot from competitors who may increase prices.

- Operational Strengths: Scale, supplier partnerships, and supply chain diversification enable cost management.

Home Depot's pricing strategy is a dynamic blend of Everyday Low Price (EDLP) and targeted promotions, aiming to capture both DIY and professional segments. This approach is crucial for maintaining market leadership, especially as the company navigates economic shifts. In fiscal year 2023, Home Depot's net sales reached $152.7 billion, reflecting the success of its comprehensive marketing mix.

The company offers tiered pricing and trade credit programs for its professional clients, incentivizing higher purchase volumes and providing flexible payment terms. These initiatives, like the Pro Xtra loyalty program, are vital for customer retention and increasing wallet share within this key demographic. In 2024, these programs continued to drive engagement and loyalty among contractors.

Home Depot prioritizes price stability, absorbing some cost pressures from inflation and tariffs to maintain customer loyalty and a competitive edge. This is supported by its significant operational scale, strong supplier relationships, and a diversified supply chain, enhancing its ability to manage costs effectively through 2024.

| Pricing Strategy Component | Description | Fiscal Year 2023 Impact |

| Everyday Low Price (EDLP) | Consistent low prices on core products. | Drives customer perception of value and repeat business. |

| Promotional Discounts | Seasonal sales (e.g., Spring Black Friday) and Special Buys. | Aids inventory management and attracts price-sensitive customers. |

| Pro Pricing & Credit | Tiered pricing, Pro Xtra loyalty, trade credit pilot programs. | Targets professional segment, increasing wallet share; Pro segment represented ~45% of sales in FY23. |

| Financing Options | Consumer Credit Card with special financing periods. | Enhances affordability for larger purchases, supporting consumer spending. |

4P's Marketing Mix Analysis Data Sources

Our Home Depot 4P's Marketing Mix Analysis leverages a comprehensive blend of official company disclosures, including SEC filings and investor relations materials, alongside real-time e-commerce data and detailed industry reports. This ensures our insights into product assortment, pricing strategies, distribution network, and promotional activities are grounded in verifiable market actions and competitive positioning.