The Home Depot Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The Home Depot Bundle

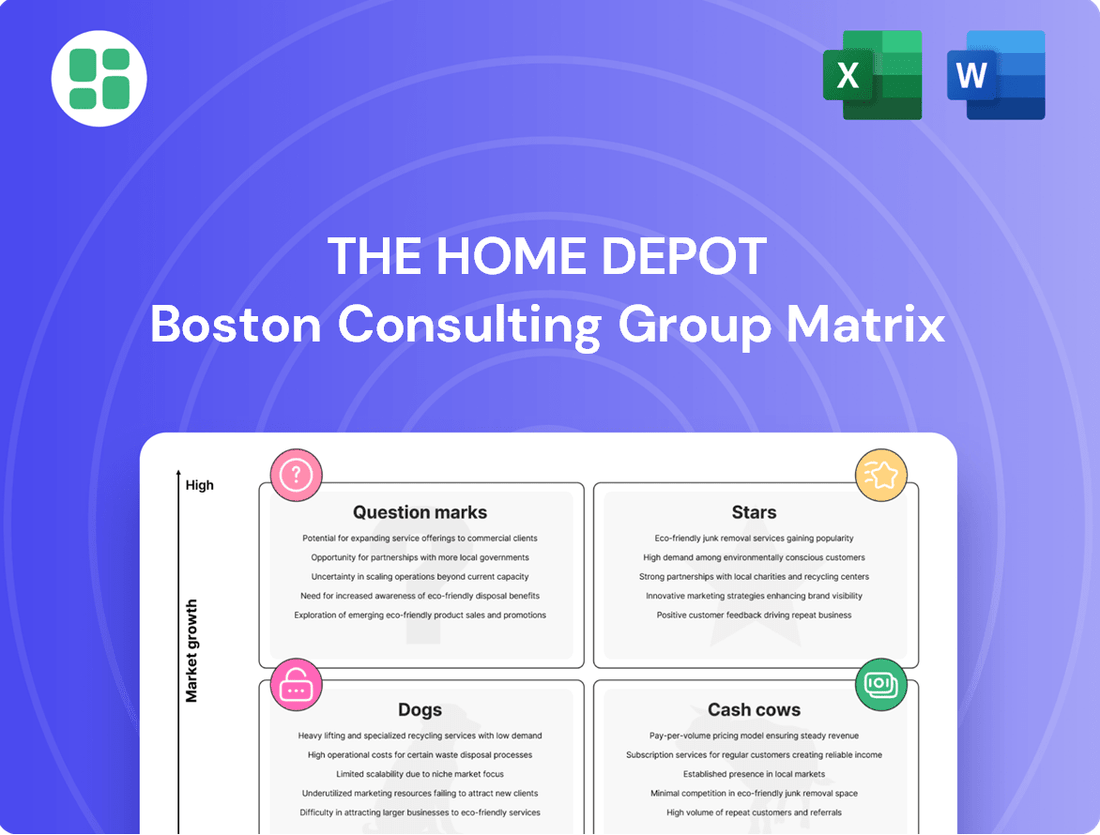

Curious about The Home Depot's product portfolio performance? Our BCG Matrix analysis reveals which categories are market leaders (Stars), which are reliable profit generators (Cash Cows), which are underperforming (Dogs), and which hold future potential (Question Marks).

Gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Home Depot's robust e-commerce platform, deeply integrated with its vast network of physical stores, is a key driver of its success. This omnichannel approach allows customers to seamlessly shop online and pick up items in-store, a strategy that has proven highly effective in the evolving retail landscape. For instance, in the first quarter of 2024, Home Depot reported that its online sales continued to grow, contributing significantly to its overall revenue. This integration not only captures market share in the expanding digital home improvement sector but also enhances customer loyalty through convenience.

The professional contractor segment is a star for Home Depot, showing strong growth. In 2024, Home Depot continued to invest in this area, building on strategic acquisitions like HD Supply to broaden its services and customer base. This segment is crucial for future expansion due to its consistent demand and Home Depot's commitment to offering specialized support and products.

Home Depot's commitment to supply chain modernization is a cornerstone of its strategy, with significant investments poured into infrastructure and technology. These upgrades are crucial for meeting the increasing complexity of omnichannel fulfillment, ensuring products reach customers faster and more reliably.

This enhanced efficiency directly translates to better product availability and reduced lead times, which are critical drivers of customer satisfaction and loyalty. In 2023, Home Depot reported a 4.2% increase in sales, partly attributed to these operational improvements that bolster market share.

By optimizing its supply chain, Home Depot solidifies its competitive advantage in a dynamic retail environment. The company's ability to swiftly and accurately deliver a wide range of products, from lumber to appliances, underscores the success of its strategic investments in logistical capabilities.

Smart Home & Connected Home Technology

Smart Home & Connected Home Technology is a burgeoning market where Home Depot is making significant strides. The company's commitment to this sector is evident in its extensive product selection, catering to the increasing consumer demand for integrated living solutions. This category is a key growth driver for Home Depot, reflecting its strategic focus on innovative and in-demand technologies.

The smart home market is projected to reach over $150 billion globally by 2024, with connected devices becoming increasingly mainstream. Home Depot's robust online and in-store presence allows it to effectively reach a broad customer base interested in these advancements. By stocking a diverse range of smart thermostats, lighting, security systems, and entertainment devices, Home Depot is well-positioned to capitalize on this expanding market segment.

- Market Growth: The global smart home market is expected to see substantial growth, reaching an estimated $151.3 billion in 2024.

- Home Depot's Role: Home Depot is a key retailer, offering a wide array of smart devices from leading brands.

- Product Assortment: The company provides smart thermostats, lighting, security systems, speakers, and other connected home essentials.

- Strategic Focus: This segment represents a high-growth area where Home Depot is investing to maintain a strong retail presence and capture market share.

Installation Services Expansion

Home Depot's Installation Services are a significant growth area, capitalizing on the rising consumer demand for convenient, professional home improvement solutions. This strategic expansion allows the company to capture a larger share of the lucrative services market, moving beyond just product sales.

By offering reliable installation, Home Depot not only enhances customer satisfaction and loyalty but also diversifies its revenue streams. In 2023, Home Depot reported that its installation services contributed significantly to its overall sales, with a notable increase in demand for kitchen and bath remodels, reflecting the 'done-for-you' trend.

- Growing Demand: Consumer preference for professional installation services continues to rise across various home improvement categories.

- Revenue Diversification: Expansion into installation services creates new, recurring revenue opportunities beyond product sales.

- Customer Loyalty: Providing a seamless, end-to-end solution from product purchase to installation fosters stronger customer relationships.

- Market Capture: Home Depot is strategically positioning itself to lead in the high-growth home installation market.

The professional contractor segment is a star for Home Depot, showing strong growth. In 2024, Home Depot continued to invest in this area, building on strategic acquisitions to broaden its services and customer base. This segment is crucial for future expansion due to its consistent demand and Home Depot's commitment to offering specialized support and products.

Smart Home & Connected Home Technology is a burgeoning market where Home Depot is making significant strides. The company's commitment to this sector is evident in its extensive product selection, catering to the increasing consumer demand for integrated living solutions. This category is a key growth driver for Home Depot, reflecting its strategic focus on innovative and in-demand technologies.

Home Depot's Installation Services are a significant growth area, capitalizing on the rising consumer demand for convenient, professional home improvement solutions. By offering reliable installation, Home Depot not only enhances customer satisfaction and loyalty but also diversifies its revenue streams.

| Category | BCG Status | Key Drivers | 2024 Outlook |

| Professional Contractor Segment | Star | Strategic acquisitions, specialized support, consistent demand | Continued investment and growth |

| Smart Home & Connected Home Technology | Star | Growing consumer demand, extensive product selection, innovation focus | High growth potential, market expansion |

| Installation Services | Star | Rising demand for professional solutions, revenue diversification, customer loyalty | Significant contribution to sales, increasing demand |

What is included in the product

The Home Depot BCG Matrix analyzes its product categories, identifying Stars (e.g., appliances), Cash Cows (e.g., paint), Question Marks (e.g., smart home tech), and Dogs (e.g., legacy tools).

The Home Depot BCG Matrix simplifies complex business unit performance, offering a clear, actionable overview for strategic decision-making.

Cash Cows

Core Building Materials & Lumber is a classic Cash Cow for Home Depot. As the largest home improvement retailer, Home Depot commands a significant market share in these essential products. This segment enjoys consistent demand, fueling high sales volume and predictable cash flow.

The demand for lumber and core building materials is stable, driven by both everyday homeowners and professional contractors. In 2023, Home Depot reported net sales of $152.7 billion, with a substantial portion attributed to these foundational product categories, underscoring their role as a reliable revenue generator.

The extensive range of tools and hardware, from power tools to hand tools and fasteners, is a foundational element of Home Depot's offerings. With a vast selection and established brand recognition, the company commands a significant market share in this crucial product segment.

These items consistently generate predictable revenue streams, characterized by relatively low growth but enduring, steady demand. In 2024, the tools and hardware category continued to be a substantial cash cow for Home Depot, reflecting its role as a reliable revenue engine.

Appliances represent a significant cash cow for The Home Depot. This segment operates in a mature market, driven by consistent replacement needs and the demand from new homeowners.

The company's established partnerships with top appliance manufacturers, coupled with its comprehensive delivery and installation network, solidify its substantial market share in this category.

In 2023, Home Depot's appliance sales were a key contributor to its overall revenue, reflecting the segment's role in generating consistent, high-value transactions and bolstering the company's cash flow.

Garden & Outdoor Living Products

The Garden & Outdoor Living Products segment at Home Depot is a classic cash cow. This category, encompassing everything from vibrant plants and essential gardening tools to stylish outdoor furniture and landscaping materials, consistently demonstrates robust sales, particularly as warmer weather arrives. Home Depot's vast product selection and strategic in-store placement solidify its dominant position in this market.

This segment's strength lies in its predictable, albeit seasonal, revenue generation. Despite its cyclical nature, the demand for these products is well-established, driven by consistent consumer interest in enhancing outdoor spaces. For instance, in fiscal year 2023, Home Depot reported that its Outdoor Living category was a significant contributor to overall sales, with gardening and lawn care products showing particular resilience.

- Strong Seasonal Demand: Peak seasons for gardening and outdoor living products drive substantial revenue.

- Market Leadership: Home Depot's extensive inventory and prominent displays ensure a leading market share.

- Consistent Cash Generation: Despite seasonality, the segment reliably produces significant cash flow due to established consumer habits.

- FY2023 Performance Highlight: The Outdoor Living category, including gardening, was a key sales driver for Home Depot.

Established Store Network & Brand Recognition

Home Depot's extensive network of over 2,300 physical stores across North America, a key component of its established store network, acts as a significant cash cow. This vast footprint, combined with strong brand recognition, drives consistent, high-volume sales across its diverse product offerings.

The brand's established customer loyalty and trust mean that these operations require relatively modest reinvestment for maintenance while generating substantial cash flow. In fiscal year 2023, Home Depot reported net sales of $152.9 billion, underscoring the immense revenue generated by this established infrastructure.

- Vast Store Network: Over 2,300 locations across North America.

- Brand Recognition: High customer trust and loyalty.

- Consistent Sales: Drives high-volume transactions across all categories.

- Low Reinvestment Needs: Significant cash generation with minimal new investment.

The Tools and Hardware segment at Home Depot is a prime example of a cash cow. This category, offering everything from power drills to essential fasteners, benefits from a vast product selection and strong brand recognition, securing a significant market share.

These items consistently deliver predictable revenue streams with relatively low growth but enduring, steady demand. In 2024, the tools and hardware category continued to be a substantial cash cow for Home Depot, reflecting its role as a reliable revenue engine.

Home Depot's Appliances segment also functions as a cash cow within a mature market, driven by consistent replacement needs and new homeowner purchases. Established manufacturer partnerships and a comprehensive delivery network solidify its market leadership.

In fiscal year 2023, Home Depot's appliance sales were a key contributor to its overall revenue, demonstrating the segment's ability to generate consistent, high-value transactions and bolster the company's cash flow.

| Category | Description | Revenue Contribution (FY2023 Est.) | Growth Outlook | Cash Flow Generation |

| Tools & Hardware | Essential tools, power tools, fasteners | High | Stable | Strong & Predictable |

| Appliances | Major home appliances | High | Moderate | Consistent |

Delivered as Shown

The Home Depot BCG Matrix

The Home Depot BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after your purchase. This means no watermarks or demo content, just a professionally designed, analysis-ready report ready for your strategic planning. You can trust that the comprehensive insights and clear presentation you see now will be yours to use without any alterations or additional steps.

Dogs

Obsolete niche product lines, like specialized gardening tools no longer in vogue or older model electronics, often land in the Dogs quadrant of The Home Depot's BCG Matrix. These items typically possess a low market share and face minimal growth, as seen with the declining sales of physical media players in favor of streaming services.

For instance, if a particular line of legacy smart home devices experiences a sales drop of over 15% year-over-year, as some older Z-Wave products might have in 2024, it signals a move towards the Dogs category. Such products consume valuable shelf space and capital without contributing meaningfully to overall revenue, impacting inventory turnover rates negatively.

Underperforming Basic Consumables represent a challenging area for Home Depot. These are largely commoditized products, like basic cleaning supplies or fasteners, where the company faces fierce price competition. Smaller retailers and online-only sellers often have lower overhead, allowing them to undercut prices, squeezing Home Depot’s margins on these items.

The low-margin nature of these consumables means they offer limited growth potential. Differentiation is minimal, making it difficult for Home Depot to command premium pricing or attract significant market share gains. In 2024, the consumer staples sector, which includes many of these basic consumables, saw an average operating margin of around 5%, significantly lower than other retail categories.

These products can become cash traps if not managed efficiently. While they generate sales, the low profitability and stagnant growth mean capital invested in inventory and marketing might be better deployed elsewhere. Home Depot must carefully monitor inventory turnover and promotional effectiveness to prevent these items from draining resources without providing a substantial return.

Very Specific, Low-Volume Seasonal Items with Poor Sell-Through are the Dogs in Home Depot's BCG Matrix. These are products like niche holiday decorations or specialized gardening tools that see a sharp spike in demand for a very short period but then languish. For example, in 2024, Home Depot might have stocked a particular line of artisanal Christmas ornaments that, despite initial interest, only achieved a 40% sell-through rate by the end of the season, leaving significant unsold inventory.

Legacy IT Systems for Minor Functions

Internal legacy IT systems supporting minor functions, such as outdated inventory tracking for non-core items or legacy HR payroll modules, can be viewed as Dogs in The Home Depot's BCG Matrix. These systems are expensive to maintain, with IT maintenance costs often representing a significant portion of departmental budgets, yet they offer little to no competitive advantage or operational efficiency. For instance, a 2024 report indicated that companies spend, on average, 70-80% of their IT budget on maintaining existing systems, a substantial portion of which can be attributed to legacy infrastructure.

These systems consume valuable resources, including IT staff time and financial investment, without contributing to innovation or core business growth. The Home Depot, like many large retailers, likely has numerous such systems that are costly to update or replace but are still functional for their limited purpose. Divesting or minimizing investment in these areas frees up capital and resources for more strategic initiatives.

- Costly Maintenance: Legacy systems can incur high maintenance fees, often exceeding the cost of modern alternatives.

- Lack of Competitive Edge: They do not offer new functionalities or improve customer experience.

- Resource Drain: Divert IT talent and budget from growth-oriented projects.

- Risk of Obsolescence: Increased vulnerability to security threats and integration challenges.

Select Niche Tool Rental Categories with Declining Usage

Within Home Depot's rental services, certain niche tool categories are experiencing a downturn in usage. These are typically highly specialized tools that have become less relevant due to shifts in construction techniques or the emergence of new technologies. For instance, specialized demolition tools designed for older building materials might see reduced demand as modern construction favors lighter, more modular components.

When usage rates for these specialized items are consistently low, and the costs associated with their maintenance and storage remain significant, they can become a drain on resources. These categories often contribute little to overall revenue and possess limited prospects for future growth, making them candidates for strategic review within a BCG matrix framework.

Consider these examples of niche tool rental categories that might fall into this declining usage segment:

- Specialized Masonry Cutting Saws for Obsolete Materials: Tools designed for cutting specific types of historical brick or stone may see declining demand as new construction rarely uses these materials, and renovation projects requiring them are niche.

- Certain types of Industrial-grade Wallpaper Strippers: While wallpaper removal remains a task, advancements in paint technology and the trend towards feature walls have reduced the prevalence of large-scale wallpaper installations, impacting demand for heavy-duty stripping equipment.

- Older Model Concrete Grinders with Specific Attachments: As newer, more efficient, and versatile concrete surface preparation tools enter the market, older models with limited functionality might experience a decline in rental frequency.

Dogs in Home Depot's BCG Matrix represent products or services with low market share and low growth potential. These are often items that are becoming obsolete, facing intense competition, or are highly specialized with declining demand. For example, legacy smart home devices with sales drops exceeding 15% year-over-year in 2024, or niche seasonal decorations with low sell-through rates, like artisanal Christmas ornaments achieving only 40% sell-through, exemplify these categories.

Internally, outdated IT systems supporting minor functions, which consume a significant portion of IT budgets (potentially 70-80% of the total budget on maintenance in 2024), also fall into the Dog quadrant. These systems offer little competitive advantage and drain resources that could be better allocated to growth initiatives.

Furthermore, certain niche tool rental categories, such as specialized masonry cutting saws for obsolete materials or older model concrete grinders, exhibit declining usage rates and high maintenance costs. These underperforming assets contribute minimally to revenue and have limited future growth prospects, necessitating careful strategic evaluation.

| Category Example | Market Share | Market Growth | Home Depot Relevance | Strategic Consideration |

|---|---|---|---|---|

| Legacy Smart Home Devices | Low | Low | Declining demand, obsolescence | Phase out or reposition |

| Niche Seasonal Decorations | Low | Low | Poor sell-through, inventory risk | Reduce stock, optimize purchasing |

| Outdated IT Systems | N/A (Internal) | N/A (Internal) | High maintenance, low ROI | Modernize or decommission |

| Specialized Rental Tools | Low | Low | Decreasing usage, high upkeep | Retire or repurpose |

Question Marks

Home Depot's DIY workshops, while popular, represent a potential "Question Mark" in the BCG matrix. Expanding these into advanced, certification-level programs for home maintenance and specialized DIY skills could tap into a lucrative, underserved market. This strategic move could significantly boost customer loyalty and create new revenue streams.

Subscription-based home maintenance services, like regular HVAC filter replacements or seasonal yard work, represent a promising area for Home Depot. These recurring services could build a steady income stream and attract customers looking for convenience. However, the success of such an offering hinges on how quickly people embrace it and how easily Home Depot can scale up operations to meet demand, suggesting it’s a nascent venture.

Augmented Reality and Virtual Reality are transforming how homeowners visualize renovations and product placement, representing a significant growth area. Home Depot's current use of these technologies in customer experience is nascent, indicating a low market share in this specific retail application.

The company is investing in these immersive tools to enhance customer engagement, though widespread adoption still requires substantial development and investment. For instance, the global AR/VR market for retail is projected to reach $13 billion by 2028, highlighting the potential for early adopters like Home Depot.

Hyper-Personalized Product Curation & AI-Driven Recommendations

Home Depot's hyper-personalized product curation, fueled by AI and data analytics, is a key area for future growth. By tailoring recommendations and project guidance, they aim to enhance customer experience and drive sales. This strategy taps into the growing demand for individualized shopping journeys.

While Home Depot already utilizes data for personalization, deepening this capability to create a distinct, revenue-generating offering is an ongoing evolution. The company's investment in technology and data science is crucial for unlocking the full potential of this strategy. As of 2024, retailers are increasingly focusing on AI to understand customer behavior and preferences.

- AI-driven personalization: Home Depot's focus on AI allows for more precise product recommendations, potentially increasing conversion rates.

- Growth potential: This area represents a significant opportunity for market share expansion, though it requires ongoing investment in research and development.

- Customer adoption: Success hinges on customers actively engaging with and trusting the personalized experiences offered.

- Competitive landscape: Many retailers are investing heavily in AI for personalization, making it a crucial differentiator in the 2024 market.

Specialized Pro Services & Project Management Platforms

The Home Depot's foray into specialized pro services and project management platforms for small to medium-sized contractors presents a classic Question Mark in the BCG matrix. While the company already has a strong relationship with professionals, a dedicated, comprehensive digital platform for project management is a relatively untapped market for them. This initiative requires substantial investment to build out features and gain traction against existing, albeit fragmented, solutions.

The potential here is significant, as contractors often juggle multiple projects and could benefit from integrated tools for scheduling, budgeting, and client communication. Home Depot's existing Pro Xtra loyalty program, which boasted over 1.6 million members as of early 2024, provides a solid base for introducing such services. However, capturing a meaningful share of the project management software market, where competitors like Procore and Buildertrend already operate, demands a strategic and well-funded approach.

- Market Opportunity: Developing a specialized digital project management platform for contractors taps into a need for streamlined workflow management within the construction and renovation sectors.

- Investment Required: Significant capital will be necessary for software development, marketing, and integration with existing Home Depot Pro services to establish a strong market presence.

- Competitive Landscape: While Home Depot has a strong brand, the project management platform space is occupied by established players, necessitating a differentiated offering to gain market share.

- Growth Potential: Success in this area could lead to increased loyalty and spending from professional customers, positioning Home Depot as a more comprehensive partner beyond just material supply.

Home Depot's exploration into advanced DIY workshops and subscription-based home maintenance services are prime examples of "Question Marks." These ventures hold significant growth potential but require substantial investment and customer adoption to move towards becoming Stars. The company's current market share in these specific niches is likely low, making them areas of strategic focus.

The integration of Augmented Reality and Virtual Reality for enhanced customer visualization, alongside hyper-personalized product curation driven by AI, also fall into the Question Mark category. While these technologies are rapidly evolving, their widespread adoption and profitability for Home Depot are still being determined. As of 2024, the retail AR/VR market is expanding, with projections indicating substantial growth.

Developing specialized project management platforms for contractors represents another key Question Mark. Home Depot's existing strong relationships with professionals, evidenced by its Pro Xtra loyalty program with over 1.6 million members in early 2024, provides a foundation. However, competing with established project management software requires significant strategic investment and feature development.

| Initiative | BCG Category | Key Considerations | Market Potential | Investment Need |

|---|---|---|---|---|

| Advanced DIY Workshops | Question Mark | Customer adoption, scaling advanced programs | High (specialized skills market) | Moderate to High |

| Subscription Home Maintenance | Question Mark | Service reliability, operational efficiency | High (convenience-driven) | Moderate to High |

| AR/VR for Visualization | Question Mark | Technology development, customer integration | High (transformative retail experience) | High |

| AI-Driven Personalization | Question Mark | Data analytics sophistication, customer trust | High (enhanced customer journey) | Moderate |

| Contractor Project Management Platform | Question Mark | Feature set, competitive differentiation | High (streamlined contractor workflow) | High |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.