Holy Stone SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Holy Stone Bundle

Holy Stone is a recognized player in the drone market, leveraging its brand recognition and established distribution channels. However, it faces intense competition and the need for continuous innovation to maintain its edge.

Want the full story behind Holy Stone's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Holy Stone Enterprise Co., Ltd. stands out as a premier manufacturer of passive electronic components, with a significant focus on Multilayer Ceramic Capacitors (MLCCs). This leadership position, built over years of operation, translates to robust brand recognition and deep technical expertise in a vital area of electronics. For instance, in 2023, the global MLCC market was valued at approximately $13.5 billion, a sector where Holy Stone has carved a substantial niche.

Holy Stone's diverse application portfolio is a significant strength, serving key sectors like automotive, industrial, consumer electronics, and telecommunications. This broad market reach mitigates risks associated with over-reliance on any single industry, ensuring a more stable revenue stream.

The company's presence in high-growth areas such as automotive and 5G telecommunications, where demand for its products like MLCCs is rapidly expanding, further solidifies its market position. For instance, the automotive sector's increasing electrification and advanced driver-assistance systems (ADAS) are major drivers for MLCC consumption, a trend expected to continue strongly through 2025.

Holy Stone's dedication to using high-quality, reliable components is a significant strength, particularly in the passive components sector where dependability is paramount. This focus ensures their products meet the stringent demands of critical industries like automotive and industrial systems, where failure is not an option.

Strong Financial Performance (Recent)

Holy Stone has showcased impressive financial strength, with accumulated revenue for the first half of 2025 reaching NT$6.68 billion. This represents a healthy 8.08% increase compared to the same period in the previous year, underscoring a period of sustained growth.

The company’s second quarter of 2025 saw consolidated revenue hit NT$3.27 billion. A significant portion of this revenue, 45%, was generated from passive components, highlighting the strength and stability of this core business segment.

- Robust Revenue Growth: Accumulated revenue for H1 2025 at NT$6.68 billion, up 8.08% year-over-year.

- Strong Q2 Performance: Q2 2025 consolidated revenue reached NT$3.27 billion.

- Passive Component Dominance: Passive components contributed 45% to Q2 2025 revenue.

Strategic Manufacturing and R&D Capabilities

Holy Stone's strategic manufacturing and R&D capabilities are a significant strength. They operate modern factories in Taiwan, ensuring efficient production of their MLCC products. This is complemented by an advanced materials research laboratory in Japan, fostering innovation.

This dual-location strategy allows Holy Stone to leverage specialized expertise and adapt quickly to market needs. Their focus on application-specific ceramic capacitors means they can tailor products for demanding technological sectors, maintaining a competitive edge.

- Manufacturing Hub: Modern factories in Taiwan for efficient MLCC production.

- Innovation Center: Advanced materials research laboratory in Japan driving product development.

- Specialization: Focus on application-specific ceramic capacitors to meet diverse industry needs.

- Adaptability: Strategic setup enables rapid response to evolving technological demands.

Holy Stone's financial performance in early 2025 demonstrates significant strength, with accumulated revenue for the first half reaching NT$6.68 billion, an 8.08% increase year-over-year. The company's core business in passive components remains a key driver, contributing 45% to the NT$3.27 billion consolidated revenue recorded in the second quarter of 2025. This consistent financial growth underscores the company's stability and market demand for its products.

| Financial Metric | H1 2025 (NT$) | Q2 2025 (NT$) | YoY Growth (H1) |

|---|---|---|---|

| Accumulated Revenue | 6.68 billion | - | 8.08% |

| Consolidated Revenue | - | 3.27 billion | - |

| Passive Component Contribution | - | 45% | - |

What is included in the product

Maps out Holy Stone’s market strengths, operational gaps, and external threats.

Offers a clear, actionable framework to identify and address strategic weaknesses, alleviating the pain of uncertainty.

Weaknesses

Holy Stone's reliance on various raw materials for MLCC manufacturing presents a significant vulnerability. For instance, the price of palladium, a key component in some MLCCs, saw considerable volatility in 2023, with prices fluctuating by as much as 20% within a single quarter due to supply concerns and demand shifts in other industries. This makes consistent cost management and predictable profit margins a persistent challenge for the company.

Holy Stone's reliance on a global supply chain for electronic components exposes it to significant vulnerabilities. Geopolitical events, evolving trade policies, and persistent logistics hurdles continue to create instability. For instance, in early 2024, ongoing shipping delays and increased freight costs impacted many electronics manufacturers, a trend that could affect Holy Stone's component availability and delivery timelines.

Holy Stone operates in the highly competitive MLCC market, facing established global giants like Murata Manufacturing, Samsung Electro-Mechanics, and Taiyo Yuden. This crowded landscape exerts significant pricing pressure, potentially impacting Holy Stone's profit margins. For instance, the MLCC market is projected to reach approximately $15 billion by 2025, with intense competition driving innovation and cost efficiency among all players.

Potential for Technological Obsolescence

The rapid pace of technological advancement in the electronics sector presents a significant weakness for Holy Stone. While MLCCs remain crucial, the emergence of novel technologies or alternative passive components could potentially diminish the demand for their core products. For instance, the market for advanced ceramic capacitors is constantly being challenged by innovations in materials science and component integration.

To mitigate this, substantial and continuous investment in research and development is imperative for Holy Stone to remain competitive. The global R&D spending in the semiconductor and passive components industry is projected to reach over $200 billion in 2024, highlighting the intense competition and the need for innovation to avoid obsolescence.

- Risk of New Component Technologies: The possibility of disruptive passive component innovations could reduce reliance on traditional MLCCs.

- High R&D Investment Needs: Staying ahead requires significant and ongoing financial commitment to research and development.

- Market Share Vulnerability: Competitors developing next-generation components could capture market share if Holy Stone lags in innovation.

- Evolving Consumer Electronics Demands: Shifts in consumer electronics design, such as miniaturization or new power management techniques, might favor different component types.

Reliance on Specific Product Category

Holy Stone's heavy dependence on a single product category presents a notable weakness. In the second quarter of 2025, passive components, primarily MLCCs, accounted for a substantial 45% of the company's revenue. This concentration makes Holy Stone particularly vulnerable to fluctuations in the MLCC market, including potential price drops or changes in customer demand for these specific components.

This over-reliance means that any downturn or disruption within the MLCC sector could disproportionately impact Holy Stone's overall financial performance. For instance, a slowdown in the automotive or consumer electronics industries, major consumers of MLCCs, could directly and significantly affect Holy Stone's sales and profitability. The company's revenue streams are thus heavily tied to the fortunes of this one product segment.

- Revenue Concentration: 45% of Q2 2025 revenue derived from passive components (MLCCs).

- Market Susceptibility: High vulnerability to downturns or shifts in demand within the MLCC market.

- Sectoral Risk: Potential for significant financial impact from slowdowns in key MLCC-consuming industries.

Holy Stone's dependency on specific raw materials, like palladium, exposes it to price volatility. In 2023, palladium prices saw swings of up to 20% per quarter, impacting cost management. This makes consistent profit margins a persistent challenge.

The company's reliance on a global supply chain creates vulnerabilities due to geopolitical events and logistics issues. Early 2024 saw ongoing shipping delays and increased freight costs, which could affect Holy Stone's component availability and delivery schedules.

Holy Stone faces intense competition from major players like Murata and Samsung Electro-Mechanics in the MLCC market, which is projected to reach $15 billion by 2025. This competition drives pricing pressure and necessitates continuous innovation.

The rapid pace of technological change in electronics poses a risk, as new component technologies could reduce demand for MLCCs. Staying competitive requires significant R&D investment, with the industry's R&D spending projected to exceed $200 billion in 2024.

A significant weakness is Holy Stone's heavy reliance on MLCCs, which accounted for 45% of its revenue in Q2 2025. This concentration makes the company highly susceptible to market fluctuations and downturns in key consuming industries like automotive and consumer electronics.

| Weakness | Description | Impact | Supporting Data |

| Raw Material Volatility | Dependence on key materials like palladium. | Inconsistent cost management and profit margins. | Palladium prices fluctuated up to 20% quarterly in 2023. |

| Supply Chain Vulnerability | Reliance on global logistics and component sourcing. | Potential disruptions to availability and delivery. | Ongoing shipping delays and increased freight costs in early 2024. |

| Intense Market Competition | Facing established global MLCC manufacturers. | Pricing pressure and reduced profit margins. | MLCC market projected at $15 billion by 2025. |

| Technological Obsolescence Risk | Emergence of new component technologies. | Potential decline in demand for MLCCs. | Industry R&D spending over $200 billion in 2024. |

| Revenue Concentration | Heavy reliance on MLCCs for revenue. | Disproportionate impact from MLCC market downturns. | MLCCs represented 45% of Q2 2025 revenue. |

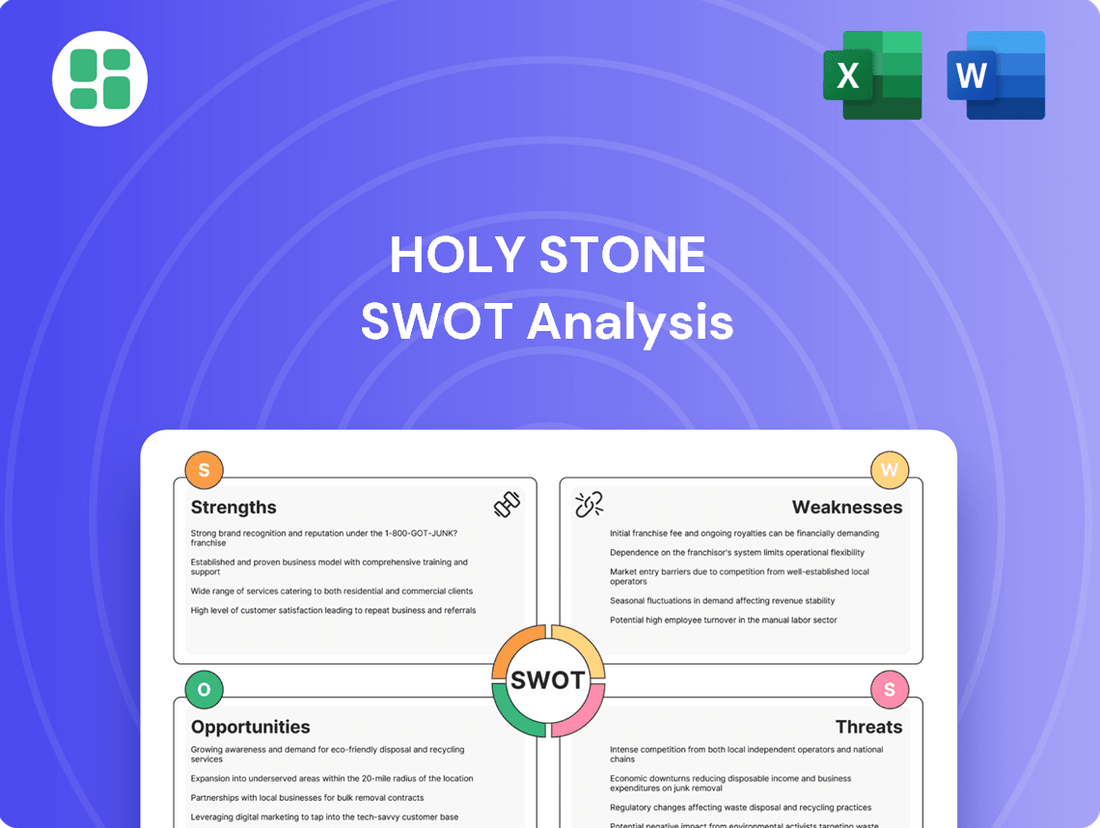

Preview the Actual Deliverable

Holy Stone SWOT Analysis

The preview you see is the actual Holy Stone SWOT analysis document you’ll receive upon purchase. This means you get exactly what you expect, a professionally crafted and comprehensive report. No hidden surprises, just the full, detailed analysis ready for your strategic planning.

Opportunities

The accelerating adoption of electric vehicles (EVs) and the increasing integration of advanced driver-assistance systems (ADAS) create a substantial growth avenue for Holy Stone. These sophisticated vehicles demand a significantly higher quantity of high-performance multilayer ceramic capacitors (MLCCs) to manage their complex electronic systems.

The automotive MLCC market is experiencing robust expansion, with projections indicating a compound annual growth rate (CAGR) of over 10% in the coming years, driven particularly by the EV segment. This trend directly translates into increased demand for Holy Stone's specialized MLCC products.

The global 5G infrastructure market is projected to reach $460.9 billion by 2026, according to Statista, creating a significant opportunity for Holy Stone. The increasing deployment of 5G networks worldwide fuels demand for advanced passive components, such as multilayer ceramic capacitors (MLCCs), where Holy Stone has established expertise.

The Internet of Things (IoT) sector is also experiencing rapid growth, with the number of connected IoT devices expected to exceed 29 billion by 2030. This expansion necessitates a robust supply of miniaturized and high-performance electronic components, directly aligning with Holy Stone's product offerings and strategic focus.

The burgeoning demand for industrial automation and AI integration presents a significant opportunity for Holy Stone. As smart factories and AI-driven systems become more prevalent, the need for advanced electronic components like MLCCs will surge. These technologies rely on high-precision control, efficient power management, and high-frequency switching, areas where Holy Stone's products excel.

The global industrial automation market was valued at approximately $215 billion in 2023 and is projected to reach over $370 billion by 2028, with AI integration being a key growth driver. This expansion directly translates to increased demand for the sophisticated MLCCs Holy Stone manufactures, particularly those designed for high-reliability applications in demanding industrial environments.

Miniaturization and High-Performance Trends

The ongoing push for smaller, more powerful electronic devices presents a significant opportunity for Holy Stone. As the industry increasingly demands miniaturization, Holy Stone can leverage this trend to develop advanced Multilayer Ceramic Capacitors (MLCCs) that offer higher capacitance within smaller footprints. This focus on innovation aligns perfectly with the market's need for compact, high-performance components.

This trend is supported by market data indicating robust growth in the passive components sector. For instance, the global MLCC market was valued at approximately $13.5 billion in 2023 and is projected to reach over $20 billion by 2029, showcasing a compound annual growth rate (CAGR) of around 7%. This expansion is driven by the increasing adoption of MLCCs in smartphones, wearables, automotive electronics, and 5G infrastructure, all areas where miniaturization and high performance are paramount.

- Innovation in MLCC Technology: Holy Stone can invest in research and development to create next-generation MLCCs that meet stringent miniaturization and performance requirements.

- Targeting High-Growth Sectors: Focusing on sectors like consumer electronics, automotive, and telecommunications where demand for compact, high-reliability components is surging.

- Strategic Partnerships: Collaborating with leading electronics manufacturers to co-develop tailored MLCC solutions for their evolving product designs.

- Capacity Expansion: Strategically increasing production capacity to meet the anticipated rise in demand for advanced, miniaturized MLCCs.

Strategic Partnerships and Market Diversification

Holy Stone can seize opportunities by forging strategic partnerships with key players in end-use industries, like the automotive and 5G sectors. This allows for the co-development of highly customized MLCC solutions tailored to specific, high-growth applications. For example, by collaborating with leading electric vehicle manufacturers, Holy Stone can ensure its MLCCs meet the stringent requirements for power management and thermal performance in next-generation EVs.

Expanding its reach into untapped geographic markets or focusing on niche applications presents another significant avenue for growth. Emerging markets in Southeast Asia and Latin America, with their rapidly growing electronics manufacturing sectors, offer substantial potential. Additionally, targeting niche markets such as medical devices or industrial automation, where reliability and miniaturization are paramount, can create new revenue streams.

Diversifying its product portfolio beyond traditional MLCCs is also a crucial opportunity. Exploring advanced materials for higher capacitance density or developing integrated passive solutions that combine multiple components into a single package can provide a competitive edge. This strategic move aligns with industry trends demanding greater integration and performance in smaller footprints, potentially capturing a larger share of the advanced electronics market.

- Strategic Collaborations: Partnering with automotive OEMs to develop specialized MLCCs for EV powertrains and infotainment systems.

- Market Expansion: Targeting the burgeoning Indian electronics market, which is projected to reach $300 billion by 2026.

- Product Diversification: Investing in R&D for next-generation MLCCs with enhanced temperature resistance and higher voltage ratings.

- Niche Application Focus: Developing MLCCs specifically designed for the stringent requirements of aerospace and defense applications.

Holy Stone is well-positioned to capitalize on the accelerating adoption of electric vehicles (EVs) and the increasing integration of advanced driver-assistance systems (ADAS). These technologies demand a higher volume of high-performance multilayer ceramic capacitors (MLCCs), a core product for Holy Stone. The automotive MLCC market is projected for robust growth, with the EV segment being a significant driver, indicating a direct increase in demand for Holy Stone's specialized offerings.

The expansion of global 5G infrastructure, projected to reach $460.9 billion by 2026, presents a substantial opportunity for Holy Stone. Similarly, the burgeoning Internet of Things (IoT) sector, expected to exceed 29 billion connected devices by 2030, fuels the need for miniaturized and high-performance electronic components, aligning perfectly with Holy Stone's product capabilities.

The growing trend towards industrial automation and AI integration also presents a significant growth avenue. As smart factories and AI systems become more prevalent, the demand for advanced electronic components like MLCCs, crucial for high-precision control and efficient power management, will surge. The industrial automation market, valued at approximately $215 billion in 2023 and projected to exceed $370 billion by 2028, highlights this trend.

Holy Stone can further leverage the industry's push for smaller, more powerful electronic devices by innovating in MLCC technology to achieve higher capacitance within smaller footprints. The global MLCC market, valued at around $13.5 billion in 2023 and expected to surpass $20 billion by 2029, with a CAGR of about 7%, underscores the demand for compact, high-performance components across various sectors like consumer electronics, automotive, and 5G infrastructure.

Threats

Escalating geopolitical tensions, particularly between the U.S. and China, pose a significant threat. Tariffs and trade restrictions can disrupt Holy Stone's access to critical electronic components, increasing manufacturing costs. For instance, the U.S. imposed tariffs on various goods from China in recent years, impacting the electronics sector.

A global economic slowdown, particularly evident in the projected 2.7% GDP growth for the OECD countries in 2024, poses a significant threat. Persistent inflationary pressures, which saw the US CPI at 3.4% year-over-year in April 2024, can further dampen consumer spending and business investment.

This economic climate directly impacts Holy Stone by potentially reducing demand for electronic devices, a core market for its passive components. Consequently, lower demand can lead to decreased sales volumes and put pressure on Holy Stone's revenue and profitability in the coming fiscal years.

The MLCC market is fiercely competitive, with many established companies vying for market share. This intense rivalry frequently leads to price erosion, a significant threat to Holy Stone's profitability. For instance, in 2023, the average selling price for certain MLCC categories saw a decline due to oversupply and aggressive market strategies by competitors, impacting margins for companies like Holy Stone, particularly on their more standardized product lines.

Supply Chain Instability and Component Shortages

Despite some easing in global supply chains, the electronic component market, crucial for drone manufacturing, can still experience periodic shortages of key raw materials or specific integrated circuits. These disruptions can directly impact Holy Stone's ability to maintain consistent production levels, potentially delaying product launches and impacting revenue targets. For instance, the semiconductor shortage that began in late 2020 continued to affect various industries through 2023, with some analysts forecasting lingering effects into early 2025 for certain specialized components.

Such instabilities pose a significant threat by hindering Holy Stone's production capabilities, leading to extended lead times for finished goods and potentially impacting sales volume. This can also result in increased manufacturing costs as the company may need to source components from alternative, potentially more expensive, suppliers. For example, in 2023, the average lead time for certain microcontrollers remained elevated compared to pre-pandemic levels, impacting manufacturers across sectors.

- Supply Chain Vulnerability: Reliance on a limited number of suppliers for critical electronic components creates a vulnerability to geopolitical events or natural disasters affecting those regions.

- Increased Lead Times: Shortages can extend manufacturing and delivery times, potentially causing Holy Stone to miss seasonal demand peaks or competitive product release windows.

- Cost Volatility: Fluctuations in component availability can lead to unpredictable pricing, impacting Holy Stone's cost of goods sold and profit margins.

- Customer Dissatisfaction: Production delays and stockouts stemming from supply chain issues can negatively affect customer experience and brand loyalty.

Rapid Technological Shifts and Disruptive Innovations

Rapid technological shifts pose a significant threat to Holy Stone if the company cannot adapt quickly enough to emerging material science advancements or alternative component technologies. A major disruptive innovation could quickly diminish the competitiveness or even make current MLCC technologies obsolete. For instance, the ongoing development in solid-state batteries, which bypass traditional lithium-ion components, highlights the potential for rapid obsolescence in related electronics manufacturing sectors.

The pace of innovation in areas like advanced semiconductor packaging and new dielectric materials could challenge Holy Stone's market position. Companies that invest heavily in R&D for next-generation MLCCs, perhaps incorporating novel materials offering higher capacitance density or improved thermal performance, could gain a substantial advantage. The global MLCC market, projected to reach approximately $15 billion by 2027, is highly sensitive to such technological leaps, with significant market share shifts possible if incumbents falter.

- Technological Obsolescence: Failure to integrate new material science breakthroughs could make Holy Stone's current MLCC offerings less desirable.

- Disruptive Innovation Risk: A competitor introducing a fundamentally superior MLCC technology could rapidly erode Holy Stone's market share.

- R&D Investment Gap: Competitors with greater R&D spending may outpace Holy Stone in developing next-generation components.

Intensified competition, particularly from Asian manufacturers, presents a significant threat. These competitors often benefit from lower labor costs and government subsidies, allowing them to offer products at more aggressive price points. This dynamic can lead to price wars, squeezing Holy Stone's profit margins, especially in high-volume, commoditized segments of the MLCC market.

The global economic outlook remains a concern, with projections indicating continued inflationary pressures and potential slowdowns in key markets. For instance, the IMF's forecast for global growth in 2024, while revised upwards, still suggests a cautious economic environment. This can translate into reduced consumer and industrial demand for electronic devices, directly impacting Holy Stone's sales volumes.

Supply chain disruptions, though showing signs of easing, continue to pose a risk. Shortages of critical raw materials or specialized components can lead to production delays and increased costs. The semiconductor shortage, which lingered through 2023, serves as a reminder of how fragile these supply chains can be, with potential impacts extending into 2025 for certain niche components.

Technological obsolescence is another substantial threat. The rapid pace of innovation in electronics means that current MLCC technologies could be superseded by newer, more advanced solutions. Companies that fail to invest adequately in research and development risk falling behind competitors who introduce next-generation components with superior performance characteristics.

| Threat Category | Specific Threat | Potential Impact on Holy Stone | Relevant Data/Example |

|---|---|---|---|

| Competition | Aggressive pricing from lower-cost competitors | Erosion of profit margins, loss of market share | Average selling price declines in certain MLCC categories observed in 2023 |

| Economic Factors | Global economic slowdown and inflation | Reduced demand for electronic devices, lower sales volumes | IMF forecast for global growth in 2024 suggests a cautious economic environment |

| Supply Chain | Persistent shortages of critical components | Production delays, increased manufacturing costs | Lingering effects of semiconductor shortages into early 2025 for niche components |

| Technology | Rapid technological advancements and obsolescence | Loss of competitiveness, diminished product desirability | Development of advanced semiconductor packaging and new dielectric materials |

SWOT Analysis Data Sources

This Holy Stone SWOT analysis is built upon a robust foundation of data, drawing from official company financial reports, comprehensive market research, and expert industry analysis to provide a clear and actionable strategic overview.