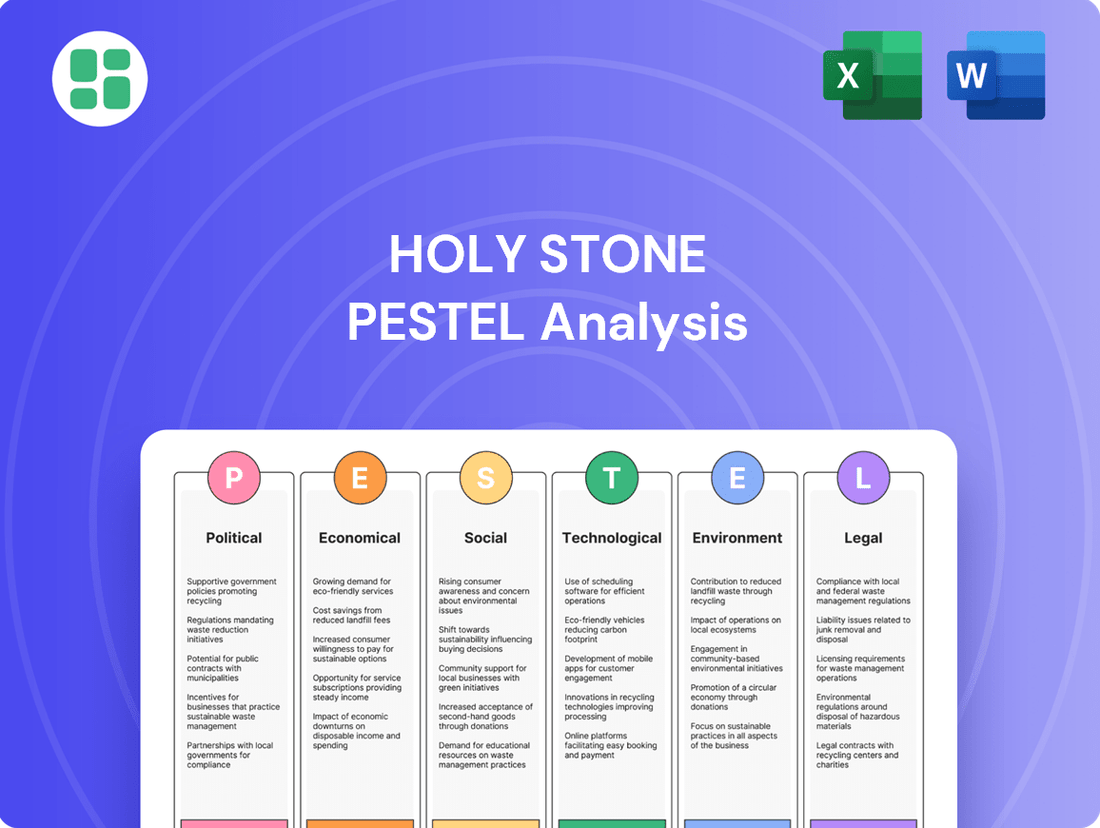

Holy Stone PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Holy Stone Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Holy Stone's trajectory. This comprehensive PESTLE analysis provides the essential market intelligence you need to anticipate challenges and seize opportunities. Download the full version to gain a strategic advantage and make informed decisions for Holy Stone's future.

Political factors

Government policies directly shape Holy Stone's operating environment. For instance, initiatives like the US CHIPS and Science Act of 2022, allocating over $52 billion to boost domestic semiconductor manufacturing, could create both opportunities and challenges. This legislation aims to reshore critical technology production, potentially impacting Holy Stone's supply chain costs and market access depending on its manufacturing locations and sourcing strategies.

Trade tariffs and import/export regulations imposed by various governments can significantly alter Holy Stone's production costs and the competitiveness of its products. For example, a 25% tariff on certain electronic components entering the US, if applied, would directly increase Holy Stone's input expenses, necessitating strategic adjustments to pricing or sourcing to maintain market share.

Incentives for domestic manufacturing, such as tax breaks or R&D grants offered by governments looking to strengthen local supply chains, could influence Holy Stone's decisions regarding capital investment and facility expansion. These programs are designed to encourage companies to build or expand operations within a specific country, potentially offering a competitive edge for those who can leverage them effectively.

Ongoing geopolitical tensions, especially between the United States and China, significantly impact the global electronics supply chain. For Holy Stone, this means potential disruptions from tariffs, export controls, and technology transfer restrictions. These factors could affect the procurement of raw materials, manufacturing processes, and sales in critical markets, pushing the company to diversify its supply chain and implement robust risk mitigation strategies.

The political stability in Taiwan, a key manufacturing hub for Holy Stone, remains a critical factor. While Taiwan has a robust democratic system, ongoing geopolitical tensions in the region could potentially disrupt operations or supply chains. For instance, any significant escalation in cross-strait relations could impact logistics and investor confidence.

International Trade Agreements and Regulations

International trade agreements significantly impact Holy Stone's ability to source components and distribute its drones globally. For instance, the USMCA (United States-Mexico-Canada Agreement), which replaced NAFTA, continues to shape trade dynamics in North America, potentially influencing tariffs and sourcing strategies for components used in drones assembled or sold in these regions. The ongoing evolution of trade policies, including potential adjustments to tariffs on electronic goods, directly affects the cost of goods sold and the competitiveness of Holy Stone's products in key international markets.

Changes in regulations, such as those pertaining to data privacy and drone usage in different countries, also present challenges and opportunities. For example, the European Union's General Data Protection Regulation (GDPR) can influence how drone data is collected and processed, potentially requiring Holy Stone to adapt its software and operational protocols. Similarly, evolving national drone regulations, like those being updated by the FAA in the United States for 2024 and beyond, dictate where and how Holy Stone's products can be legally operated, impacting market access and product development roadmaps.

- Impact of Tariffs: Fluctuations in import/export duties on electronic components, driven by trade disputes or new agreements, can directly alter Holy Stone's manufacturing costs and pricing strategies.

- Intellectual Property Protection: The strength of IP protection within trade agreements influences Holy Stone's ability to safeguard its drone technology and manufacturing processes in foreign markets.

- Compliance Standards: Adherence to evolving international standards for drone safety, emissions, and data security, often codified in trade regulations, is crucial for market entry and continued sales.

- Market Access: Favorable trade agreements can open new markets or reduce barriers to entry, while protectionist measures can restrict Holy Stone's global reach and sales potential.

Cybersecurity and Data Privacy Policies

Governments globally are intensifying their focus on cybersecurity and data privacy, a trend that directly impacts companies like Holy Stone. New regulations, such as the EU's Digital Services Act and the ongoing evolution of the US Cybersecurity Improvement Act of 2023, are creating stricter compliance requirements for connected devices. This means Holy Stone must ensure its components, particularly those integrated into IoT systems and sensitive applications like automotive electronics, adhere to these evolving data protection standards.

The increased regulatory scrutiny translates into potential compliance burdens and added costs for Holy Stone. For instance, the European Union's AI Act, expected to be fully implemented by mid-2025, will place significant obligations on the cybersecurity of AI-enabled systems, which could include components manufactured by Holy Stone. Failure to comply can result in substantial fines, impacting profitability and market access.

- Increased Compliance Costs: Adhering to new data privacy laws like GDPR or CCPA may necessitate investments in enhanced security features and auditing processes for Holy Stone's products.

- Stricter Enforcement: Regulatory bodies are demonstrating a greater willingness to enforce data privacy and cybersecurity rules, with significant penalties for non-compliance.

- Impact on Sensitive Applications: Components used in automotive or industrial control systems face even more stringent cybersecurity requirements, potentially increasing development and testing expenses for Holy Stone.

- Market Access Implications: Non-compliance with cybersecurity standards in key markets could restrict Holy Stone's ability to sell its products in those regions.

Government policies significantly influence Holy Stone's operational landscape, from trade agreements to domestic manufacturing incentives. For instance, the US CHIPS and Science Act of 2022, with its over $52 billion allocation for semiconductor manufacturing, could reshape supply chains and market dynamics for component suppliers like Holy Stone.

Trade tariffs and import/export regulations directly impact Holy Stone's cost structure and product competitiveness. For example, a potential 25% tariff on specific electronic components entering the US would increase input expenses, necessitating strategic pricing or sourcing adjustments.

Geopolitical tensions, particularly between the US and China, create supply chain vulnerabilities for Holy Stone, potentially leading to disruptions from tariffs and export controls, pushing for diversification and risk mitigation strategies.

Evolving regulations on data privacy and drone usage, such as the EU's GDPR and updated FAA rules for 2024, directly affect Holy Stone's product development and market access, requiring adaptation in software and operational protocols.

What is included in the product

This PESTLE analysis offers a comprehensive examination of the external macro-environmental factors influencing Holy Stone, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights and forward-looking perspectives to inform strategic decision-making and identify potential opportunities and threats for Holy Stone.

Provides a clear, actionable framework that simplifies complex external factors, enabling businesses to proactively identify and mitigate potential risks before they become major issues.

Economic factors

Global economic growth significantly impacts Holy Stone's revenue by influencing consumer spending on electronics and automotive components. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight slowdown from 3.1% in 2023, indicating a cautious consumer environment. This slowdown can directly translate to reduced demand for new devices, affecting Holy Stone's order volumes.

Consumer spending power is a critical driver for Holy Stone's sales. In 2024, inflation concerns and interest rate hikes in major economies like the US and Europe continued to pressure household budgets. This reduced disposable income can lead consumers to postpone purchases of discretionary items, including the electronic gadgets that utilize Holy Stone’s advanced semiconductor solutions.

The price and availability of key raw materials like ceramic powders and precious metals are crucial for Holy Stone's MLCC production. These costs can be quite volatile, directly affecting manufacturing expenses and, consequently, profit margins.

For instance, the price of palladium, a critical component in MLCCs, saw significant fluctuations in 2024, with spot prices ranging from approximately $900 to $1,300 per ounce, influenced by global supply dynamics and industrial demand.

Supply chain stability for these materials is also a concern, as disruptions, whether from geopolitical events or natural disasters, can lead to shortages and further price hikes, impacting Holy Stone's ability to meet production targets.

Currency exchange rate fluctuations significantly impact Holy Stone's global operations. As a company engaged in international trade, shifts in exchange rates can alter the cost of raw materials sourced from abroad and the pricing of its products in foreign markets. For instance, a stronger US dollar could make Holy Stone's drones more expensive for overseas buyers, potentially reducing export volumes.

In 2024, the US dollar experienced volatility against major currencies. If Holy Stone sources a significant portion of its components from regions with weakening currencies, it could see a reduction in its cost of goods sold. Conversely, if its primary export markets see their currencies depreciate against the US dollar, this could negatively affect its revenue when translated back into its reporting currency, impacting overall profitability.

Industry-Specific Market Demand (Automotive, Telecom, Consumer Electronics)

Holy Stone's performance is closely tied to the health of its key customer industries. The automotive sector, particularly the burgeoning electric vehicle (EV) market, is a significant driver. Global EV sales are projected to reach approximately 17 million units in 2024, a substantial increase from previous years, directly boosting demand for automotive-grade MLCCs.

The telecommunications industry, with its ongoing 5G network build-outs, also presents strong growth opportunities. As of early 2024, 5G network coverage continues to expand globally, requiring vast quantities of passive components for base stations and user equipment.

Consumer electronics, while mature, remains a foundational market. The demand for smartphones and the expanding Internet of Things (IoT) ecosystem, with billions of connected devices, ensures a consistent need for MLCCs. For instance, the global IoT market was valued at over $1 trillion in 2023 and is expected to grow significantly, further supporting Holy Stone's revenue streams.

- Automotive: EV sales growth is a primary demand driver, with global EV sales expected to hit around 17 million units in 2024.

- Telecommunications: Continued 5G infrastructure deployment fuels demand for passive components.

- Consumer Electronics: The expanding IoT market, valued over $1 trillion in 2023, and smartphone sales provide consistent demand.

Inventory Levels and Supply-Demand Balance

Inventory levels in the passive electronic components market are a critical indicator of the supply-demand balance. In late 2024 and early 2025, the industry has seen a general easing of supply chain pressures compared to the peak disruptions of previous years, though specific component categories can still experience tightness. This shift impacts Holy Stone by potentially reducing lead times but also necessitates careful inventory management to avoid carrying excess stock if demand softens unexpectedly.

Periods of oversupply can indeed lead to price erosion for components like capacitors and resistors, directly affecting Holy Stone's cost of goods sold and profit margins. Conversely, unexpected surges in demand or production issues can create shortages, leading to increased component costs and longer lead times. For instance, a global shortage of certain advanced ceramic materials in early 2025 could significantly impact the production of high-performance capacitors, a key product category for many drone manufacturers like Holy Stone, potentially leading to lost sales opportunities if they cannot secure sufficient supply.

- Supply Chain Normalization: Global supply chains for passive components showed signs of normalization through 2024, with lead times generally improving for many standard parts.

- Demand Fluctuations: However, demand remains dynamic, influenced by consumer electronics cycles and industrial automation growth, creating localized shortages for specific, high-demand components.

- Inventory Management Challenges: Companies like Holy Stone must balance carrying sufficient inventory to meet potential demand spikes against the risk of obsolescence or price drops due to oversupply.

- Price Sensitivity: The passive component market remains highly price-sensitive; significant shifts in inventory levels directly translate to price volatility, impacting Holy Stone's pricing strategies and competitiveness.

Interest rate trends significantly influence Holy Stone's cost of capital and investment decisions. Higher rates in 2024 and projected into 2025 increase borrowing costs for expansion or R&D, potentially slowing growth. Conversely, lower rates could stimulate investment in new technologies and manufacturing capabilities.

Inflationary pressures, particularly in energy and labor costs, directly impact Holy Stone's manufacturing expenses. While global inflation showed signs of moderating in 2024, persistent price increases in certain input materials could squeeze profit margins if not passed on to customers. This necessitates efficient cost management and strategic sourcing.

The overall economic outlook, including GDP growth forecasts for major markets like North America and Asia, shapes consumer and business confidence. A robust economic environment generally translates to higher demand for electronics and automotive components, benefiting Holy Stone. For instance, the OECD projected global GDP growth to be 2.7% in 2024, a slight uptick from 2.7% in 2023, suggesting a stable but not booming economic backdrop.

Full Version Awaits

Holy Stone PESTLE Analysis

The preview you see here is the exact Holy Stone PESTLE Analysis document you’ll receive after purchase. It's fully formatted and ready to use, providing a comprehensive overview of the external factors impacting Holy Stone. You can trust that the detailed analysis of Political, Economic, Social, Technological, Legal, and Environmental aspects is precisely what you'll be working with.

Sociological factors

Societal preferences are increasingly leaning towards sleeker, more compact electronic gadgets that pack a serious punch in terms of functionality. This persistent demand for miniaturization and enhanced performance directly fuels the need for advanced, high-density electronic components like multilayer ceramic capacitors (MLCCs), which are critical for enabling these sophisticated devices.

For a company like Holy Stone, this trend means a significant focus on research and development to produce MLCCs that are not only smaller but also deliver superior electrical characteristics and reliability. The market for MLCCs in consumer electronics, particularly in smartphones and wearables, is projected to see continued growth, with global shipments expected to reach over 5 trillion units by 2025, underscoring the importance of this miniaturization drive for Holy Stone's product strategy.

Workforce availability and the presence of skill gaps are crucial considerations for Holy Stone in the advanced electronics manufacturing and R&D sectors. A significant challenge in 2024 and projected into 2025 is the persistent shortage of highly skilled engineers, specialized technicians, and experienced R&D personnel. This scarcity directly impacts Holy Stone's ability to scale production and drive innovation effectively.

These labor shortages can constrain Holy Stone's production capacity and slow down the development of new technologies. Furthermore, increased competition for a limited pool of talent in 2024 has driven up labor costs, impacting operational efficiency and potentially squeezing profit margins for companies like Holy Stone.

The shift towards remote and hybrid work models significantly impacts demand for Holy Stone's products, particularly laptops and networking components. In 2024, a significant portion of the workforce continues to embrace flexible arrangements, driving sustained demand for reliable personal computing and connectivity solutions.

This evolving work culture also affects Holy Stone's internal operations, influencing recruitment strategies and the need for robust IT infrastructure to support a distributed workforce. Companies are increasingly prioritizing employee well-being and flexibility, which can enhance talent acquisition and retention in the competitive tech sector.

Ethical Consumerism and Corporate Social Responsibility (CSR) Expectations

Consumers and investors are increasingly scrutinizing companies for their ethical conduct and commitment to social responsibility. Holy Stone must align with these expectations by showcasing responsible sourcing and fair labor practices. For instance, a 2024 survey indicated that 68% of consumers consider a company's ethical stance when making purchasing decisions, a figure that continues to rise.

This heightened awareness translates into direct pressure on Holy Stone to ensure transparency throughout its supply chain. Failing to meet these standards can impact brand reputation and market acceptance, as demonstrated by industry trends where companies with strong CSR initiatives often see improved customer loyalty and investor confidence. In 2025, expect further growth in demand for verifiable ethical production.

- Consumer Demand: A significant majority of consumers now prioritize ethical sourcing and production methods when choosing products.

- Investor Scrutiny: Investors are increasingly integrating Environmental, Social, and Governance (ESG) factors into their decision-making, impacting capital availability for companies with poor ethical records.

- Brand Reputation: Demonstrating a commitment to corporate social responsibility is crucial for maintaining and enhancing brand image in a competitive market.

- Supply Chain Transparency: Consumers and regulators expect clear visibility into how products are made, including labor conditions and environmental impact.

Global Digitalization and Connectivity Trends

The world is becoming increasingly digital, with more and more devices connecting to the internet. This trend, often called the Internet of Things (IoT), means there's a growing need for all sorts of electronic gadgets and systems. Holy Stone's passive components, like resistors and capacitors, are essential building blocks for these connected devices, ensuring a steady demand for their products.

Consider these key aspects of global digitalization:

- Growing IoT Penetration: By the end of 2024, it's estimated that over 20 billion IoT devices will be in use worldwide, a figure projected to climb significantly by 2025.

- Increased Data Traffic: Global mobile data traffic is expected to reach nearly 300 exabytes per month by 2025, highlighting the infrastructure demands that rely on robust electronic components.

- Consumer Electronics Demand: The global consumer electronics market was valued at over $1 trillion in 2023 and is expected to see continued growth, driven by the demand for smart home devices, wearables, and advanced entertainment systems.

Societal trends emphasize miniaturization and enhanced functionality in electronics, driving demand for advanced components like MLCCs. This miniaturization trend is critical for Holy Stone, as the global MLCC market is projected to exceed 5 trillion units by 2025.

The increasing adoption of remote and hybrid work models in 2024 and 2025 sustains demand for Holy Stone's computing and networking products. This shift also influences internal operations, necessitating adaptable recruitment and IT strategies to support a distributed workforce and prioritize employee well-being.

Heightened consumer and investor scrutiny on ethical conduct and social responsibility is paramount. In 2024, approximately 68% of consumers consider a company's ethics in purchasing decisions, a figure expected to rise by 2025, pressuring Holy Stone for supply chain transparency and responsible practices.

The ongoing digital transformation, particularly the expansion of the Internet of Things (IoT), fuels demand for Holy Stone's passive components. By the end of 2024, over 20 billion IoT devices are expected to be operational, with global mobile data traffic reaching nearly 300 exabytes per month by 2025.

| Sociological Factor | Impact on Holy Stone | Relevant Data (2024/2025) |

|---|---|---|

| Miniaturization & Performance Demand | Drives R&D for smaller, higher-performing components (e.g., MLCCs). | Global MLCC shipments projected to exceed 5 trillion units by 2025. |

| Remote/Hybrid Work Models | Sustains demand for computing/networking products; impacts recruitment and IT infrastructure. | Continued workforce embrace of flexible arrangements in 2024. |

| Ethical Consumerism & ESG Focus | Requires supply chain transparency and responsible practices to maintain brand reputation and investor confidence. | 68% of consumers consider ethics in purchasing (2024); rising trend for 2025. |

| Digitalization & IoT Growth | Increases demand for passive components as foundational elements for connected devices. | Over 20 billion IoT devices in use by end of 2024; global mobile data traffic nearing 300 exabytes/month by 2025. |

Technological factors

Continuous innovation in Multilayer Ceramic Capacitor (MLCC) technology, particularly in materials science and manufacturing, is a significant technological factor. These advancements are yielding higher capacitance densities, enabling smaller component sizes, and boosting overall reliability. For instance, advancements in dielectric materials like X7R and C0G are allowing for greater capacitance in the same or smaller footprints, a key trend observed throughout 2024.

Holy Stone's strategic investment in and rapid adoption of these cutting-edge MLCC technologies are paramount for its sustained competitive advantage. Keeping pace with these developments ensures the company can meet the increasingly sophisticated demands of its diverse customer base, from consumer electronics to automotive applications, which are constantly seeking more compact and higher-performing components.

The rapid advancement of technologies like AI, IoT, 5G, and EVs is a significant driver for passive components. These innovations require high-performance Multilayer Ceramic Capacitors (MLCCs) to handle increased data processing, connectivity, and power management. For instance, the global AI market was valued at approximately $150 billion in 2023 and is projected to surge past $1.3 trillion by 2030, indicating a substantial need for the specialized components that enable these systems.

The manufacturing sector is rapidly embracing automation and Industry 4.0 principles, integrating robotics, AI, and the Internet of Things (IoT) into production lines. This shift is significantly boosting efficiency and precision across the industry. For example, in 2024, the global industrial automation market was projected to reach over $200 billion, highlighting substantial investment in these technologies.

Holy Stone can capitalize on these advancements to streamline its electronics manufacturing processes. Implementing smart factory solutions can lead to reduced operational costs, enhanced product quality through advanced quality control systems, and greater agility in adapting to fluctuating consumer demand. This technological evolution allows for more responsive and competitive production cycles.

Development of Alternative Passive Component Technologies

The evolution of alternative passive component technologies presents a significant consideration for Holy Stone. Emerging materials and designs could offer enhanced performance metrics, such as higher capacitance density or improved temperature stability, potentially disrupting the market for traditional MLCCs. For instance, advancements in solid-state electrolytes for capacitors or novel dielectric materials could offer compelling advantages.

Holy Stone must actively track these technological shifts to maintain its competitive edge. Failing to adapt could lead to a decline in market share if competitors adopt superior alternatives. The global capacitor market, a key sector for MLCCs, was valued at approximately $39.5 billion in 2023 and is projected to reach $53.2 billion by 2028, growing at a CAGR of 6.1%, according to Mordor Intelligence. This growth underscores the importance of staying ahead of technological curves.

Monitoring these developments also opens avenues for diversification. Holy Stone could explore integrating or developing these alternative technologies to broaden its product portfolio and capture new market segments. Key areas to watch include:

- Advancements in ceramic dielectric materials: Innovations in barium titanate (BaTiO3) and other perovskite structures could lead to MLCCs with higher volumetric efficiency.

- Development of solid-state capacitors: These offer potential improvements in safety and energy density compared to traditional electrolytic capacitors, though they are not direct MLCC replacements, they compete in the broader passive component space.

- Exploration of film capacitors: Continued improvements in metallized film technologies could offer competitive solutions in certain high-voltage or high-frequency applications.

- Emergence of new conductive materials: Research into graphene or other advanced conductive materials could lead to novel capacitor designs with superior electrical properties.

Intellectual Property (IP) and Patent Landscape

In the fast-paced electronics components sector, intellectual property (IP) is a critical differentiator. Holy Stone's success hinges on its ability to secure and leverage its innovations through a robust patent portfolio. This protection is vital for maintaining a competitive edge and preventing rivals from replicating its technological advancements.

Navigating the complex IP landscape is paramount for Holy Stone. The company must actively monitor patent filings and potential infringement risks to safeguard its R&D investments. As of early 2024, the global electronics patent landscape saw continued growth, with significant filings in areas like advanced semiconductor design and drone technology, directly impacting Holy Stone's operational environment.

- Patent Portfolio Strength: Holy Stone's ability to secure patents for its drone technology and electronic components directly influences its market position.

- R&D Investment: Continued investment in research and development is essential to generate new IP and maintain a competitive advantage.

- Infringement Avoidance: Proactive IP management helps Holy Stone avoid costly legal disputes and potential product bans.

- Licensing Opportunities: A strong patent portfolio can also open avenues for lucrative licensing agreements, generating additional revenue streams.

Technological advancements in AI, IoT, and 5G are significantly increasing the demand for high-performance passive components like MLCCs, as these technologies require robust data processing and power management capabilities. The global AI market, valued at approximately $150 billion in 2023, is expected to exceed $1.3 trillion by 2030, highlighting the substantial growth and need for enabling components.

Automation and Industry 4.0 principles are transforming manufacturing, boosting efficiency and precision through robotics and AI integration, with the global industrial automation market projected to surpass $200 billion in 2024. Holy Stone can leverage these smart factory solutions to reduce costs and improve product quality.

Emerging alternative capacitor technologies, such as those using solid-state electrolytes or advanced dielectric materials, pose a potential disruption to the traditional MLCC market, necessitating continuous monitoring and adaptation by companies like Holy Stone to maintain their competitive edge.

Holy Stone's intellectual property (IP) portfolio is a critical differentiator in the competitive electronics sector, with ongoing R&D investment and patent protection essential for safeguarding innovations and preventing rivals from replicating advancements, especially given the dynamic global patent landscape in areas like advanced semiconductor design.

Legal factors

Holy Stone faces significant legal hurdles due to stringent environmental regulations like RoHS and REACH. These directives restrict the use of hazardous substances in electronic products, impacting Holy Stone's component sourcing and manufacturing. For instance, non-compliance with REACH could lead to product recalls and market access denial in the EU, a key market for drones.

Furthermore, evolving E-waste disposal laws globally, including those in the US and Europe, necessitate responsible product lifecycle management. Holy Stone must invest in sustainable design and recycling initiatives to meet these mandates, which aim to reduce electronic waste's environmental footprint. Failure to comply can result in substantial fines and reputational damage.

Legal requirements for product safety and quality are paramount for Holy Stone, especially given its involvement in the automotive sector. Meeting stringent standards like AEC-Q200, which specifies reliability for passive components in automotive environments, is crucial. Failure to comply can lead to significant penalties and reputational damage.

Adherence to these standards directly impacts Holy Stone's ability to secure contracts with major automotive manufacturers, who increasingly demand evidence of robust quality control and component reliability. For instance, in 2024, the global automotive industry saw a continued focus on supply chain resilience and component validation, making certifications like AEC-Q200 a non-negotiable prerequisite for suppliers.

Holy Stone must navigate a complex web of labor laws across its global operations. This includes complying with minimum wage requirements, such as the recent increases in many regions, and adhering to regulations on working hours and overtime pay. For example, in 2024, many European Union countries are seeing adjustments to their national minimum wages, impacting labor costs.

Maintaining safe and fair working conditions is paramount. This involves adhering to occupational health and safety standards, which can vary significantly by country and industry. Non-compliance can lead to substantial fines and reputational damage, as seen in past cases where companies faced penalties for violating workplace safety regulations.

Employment practices, including hiring, firing, and anti-discrimination policies, are also subject to legal scrutiny. Holy Stone's commitment to fair employment practices not only ensures legal compliance but also contributes to employee morale and retention, which is crucial for a stable workforce, especially as the global talent market tightens.

Anti-Trust and Competition Laws

Anti-trust and competition laws are crucial for Holy Stone, as they shape the market landscape by preventing monopolies and fostering fair play. The company must meticulously align its business strategies, including mergers, acquisitions, and pricing, with these regulations to sidestep potential legal disputes and penalties.

Failure to comply can result in significant financial repercussions. For instance, in 2024, the European Commission continued its rigorous enforcement of competition rules across various sectors, imposing substantial fines on companies found engaging in anti-competitive practices. Holy Stone's adherence to these laws ensures its long-term operational stability and market reputation.

- Market Dominance Scrutiny: Regulators closely monitor companies like Holy Stone for any signs of monopolistic behavior that could stifle innovation or harm consumers.

- Merger Control: Any proposed mergers or acquisitions by Holy Stone will undergo thorough review to ensure they do not create anti-competitive market structures.

- Pricing Practices: Holy Stone must ensure its pricing strategies are fair and do not involve predatory pricing or price-fixing, which are strictly prohibited.

- International Compliance: Given its global operations, Holy Stone must navigate and comply with the diverse anti-trust regulations of all countries in which it operates.

Import/Export Regulations and Customs Laws

Navigating import and export regulations is crucial for Holy Stone, especially concerning electronic components. These rules dictate tariffs, quotas, and documentation requirements, directly impacting the cost and speed of bringing products to market. For instance, in 2024, the World Trade Organization (WTO) reported that global trade facilitation measures, aimed at streamlining customs procedures, are still being implemented, with varying degrees of success across different regions.

Adherence to customs laws prevents costly delays and penalties. In 2025, the International Chamber of Commerce (ICC) highlighted that non-compliance with trade regulations can lead to seizure of goods, significant fines, and reputational damage. Holy Stone must stay updated on evolving trade agreements and sanctions, such as those impacting semiconductor supply chains, to ensure seamless international operations.

- Customs Duties: Tariffs on electronic components can significantly affect Holy Stone's cost of goods sold.

- Import Licenses: Certain electronic parts may require special licenses for import into specific countries.

- Export Controls: Regulations on exporting advanced technology components must be strictly followed to avoid legal issues.

- Trade Agreements: Understanding free trade agreements can offer preferential tariff treatment, reducing costs for Holy Stone.

Legal factors significantly shape Holy Stone's operational landscape, from product compliance to labor practices. Environmental regulations like REACH and RoHS demand careful material sourcing, impacting product design and market access, particularly in the EU. Evolving global e-waste laws also necessitate responsible product lifecycle management, with non-compliance risking fines and reputational damage.

Environmental factors

The electronics industry, including MLCC manufacturing, faces growing challenges from the scarcity of key raw materials like rare earth elements and specific metals. For instance, global demand for neodymium, a critical component in many electronic devices, is projected to significantly outpace supply in the coming years, with some estimates suggesting a deficit by 2030.

Holy Stone must prioritize sustainable sourcing to navigate these material constraints. This involves developing robust supplier relationships that emphasize ethical and environmentally sound extraction practices. The company's ability to secure a stable supply of these critical materials will directly impact its production capacity and cost structure.

Investing in material efficiency and exploring recycling initiatives are also crucial. By optimizing the use of raw materials in MLCC production and developing effective recycling processes for electronic waste, Holy Stone can reduce its reliance on virgin resources and mitigate supply chain risks. This proactive approach also aligns with increasing consumer and regulatory pressure for environmentally responsible manufacturing.

Holy Stone's manufacturing operations contribute to energy consumption and carbon emissions, a growing concern for the drone industry. As global demand for sustainability intensifies, companies like Holy Stone face increasing pressure to adopt carbon-neutral production methods and enhance energy efficiency. This will likely require significant investment in greener technologies and more sustainable operational strategies to meet evolving environmental regulations and consumer expectations.

The growing challenge of electronic waste (e-waste) presents a significant environmental factor for companies like Holy Stone. Globally, e-waste generation is projected to reach 74 million metric tons by 2030, a stark increase from 53.6 million metric tons in 2019. This necessitates a focus on waste management and the integration of circular economy principles into product design and lifecycle strategies.

Holy Stone can leverage opportunities by designing components for easier disassembly and recycling, thereby reducing the environmental burden of its products. Initiatives like product take-back programs and developing robust end-of-life management strategies are crucial for responsible stewardship, aligning with increasing regulatory pressures and consumer demand for sustainable practices.

Water Usage and Management in Production

Semiconductor manufacturing, a core area for Holy Stone, is incredibly water-intensive. Processes like wafer cleaning and etching demand vast quantities of ultrapure water. For instance, the semiconductor industry as a whole can consume millions of gallons of water per day per fabrication plant, highlighting the scale of this requirement.

Water scarcity is a growing concern in many of the regions where electronic components are manufactured. This presents a significant operational risk for Holy Stone. Regions like Taiwan, a major hub for semiconductor production, have faced periods of drought, impacting industrial water availability. This necessitates robust water management strategies.

To mitigate these risks, Holy Stone is compelled to implement highly efficient water management systems. This includes exploring advanced water recycling and reclamation technologies. Such initiatives not only reduce reliance on fresh water sources but also contribute to cost savings and environmental sustainability.

- High Water Consumption: Semiconductor fabrication plants can use millions of gallons of water daily for cleaning and cooling.

- Regional Scarcity Risks: Drought conditions in key manufacturing regions, like parts of Asia, can disrupt operations.

- Efficiency Investments: Companies like Holy Stone are investing in water recycling and conservation technologies to reduce their footprint.

- Operational Continuity: Effective water management is crucial for ensuring uninterrupted production and supply chains.

Climate Change Impacts on Supply Chain Resilience

Climate change presents significant risks to Holy Stone's global supply chain. Extreme weather events, such as intensified storms, floods, and droughts, can directly impact raw material sourcing and manufacturing operations. For instance, a severe drought in a key agricultural region could disrupt the supply of certain components or materials essential for Holy Stone's products.

The frequency and severity of these events are projected to increase, necessitating a proactive approach to resilience. According to the World Meteorological Organization's 2024 report, the economic damage from weather-related disasters globally reached an estimated $200 billion in 2023 alone, highlighting the tangible financial impact on businesses.

To mitigate these risks, Holy Stone must prioritize building a more resilient supply chain. This involves strategies like:

- Geographical Diversification: Spreading manufacturing and sourcing across different, less vulnerable regions can reduce the impact of localized climate disasters.

- Supplier Risk Assessment: Regularly evaluating suppliers' own climate resilience plans and their exposure to climate-related risks.

- Inventory Management: Maintaining strategic buffer stocks for critical components to weather short-term supply disruptions.

Environmental regulations are becoming increasingly stringent globally, impacting manufacturing processes and product lifecycles. For Holy Stone, this means adhering to standards concerning emissions, waste disposal, and the use of hazardous substances, with compliance costs likely to rise.

The company must also contend with growing consumer and investor demand for sustainability, pushing for greener products and transparent environmental reporting. Failure to meet these expectations could affect brand reputation and market share.

The push for a circular economy is also a significant environmental factor, encouraging businesses to design for longevity, repairability, and recyclability. Holy Stone needs to integrate these principles to minimize waste and maximize resource efficiency.

The electronics industry's environmental footprint is substantial, with e-waste projected to reach 74 million metric tons by 2030. Holy Stone's efforts in product design for recyclability and robust end-of-life management are critical for responsible stewardship.

| Environmental Factor | Impact on Holy Stone | Key Considerations |

|---|---|---|

| Regulatory Compliance | Increased operational costs, potential penalties for non-compliance. | Adherence to evolving emissions, waste, and substance regulations. |

| Consumer & Investor Pressure | Reputational risk, potential impact on sales and investment. | Demonstrating commitment to sustainability and transparent reporting. |

| Circular Economy Principles | Need for redesign, investment in recycling infrastructure. | Designing for durability, repairability, and recyclability. |

| E-waste Management | Supply chain complexity, potential liability. | Implementing take-back programs and end-of-life management strategies. |

PESTLE Analysis Data Sources

Our Holy Stone PESTLE Analysis is built upon a robust foundation of data from official government publications, reputable market research firms, and leading technology journals. This ensures that every assessment of political, economic, social, technological, legal, and environmental factors is grounded in factual, current information.