Holy Stone Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Holy Stone Bundle

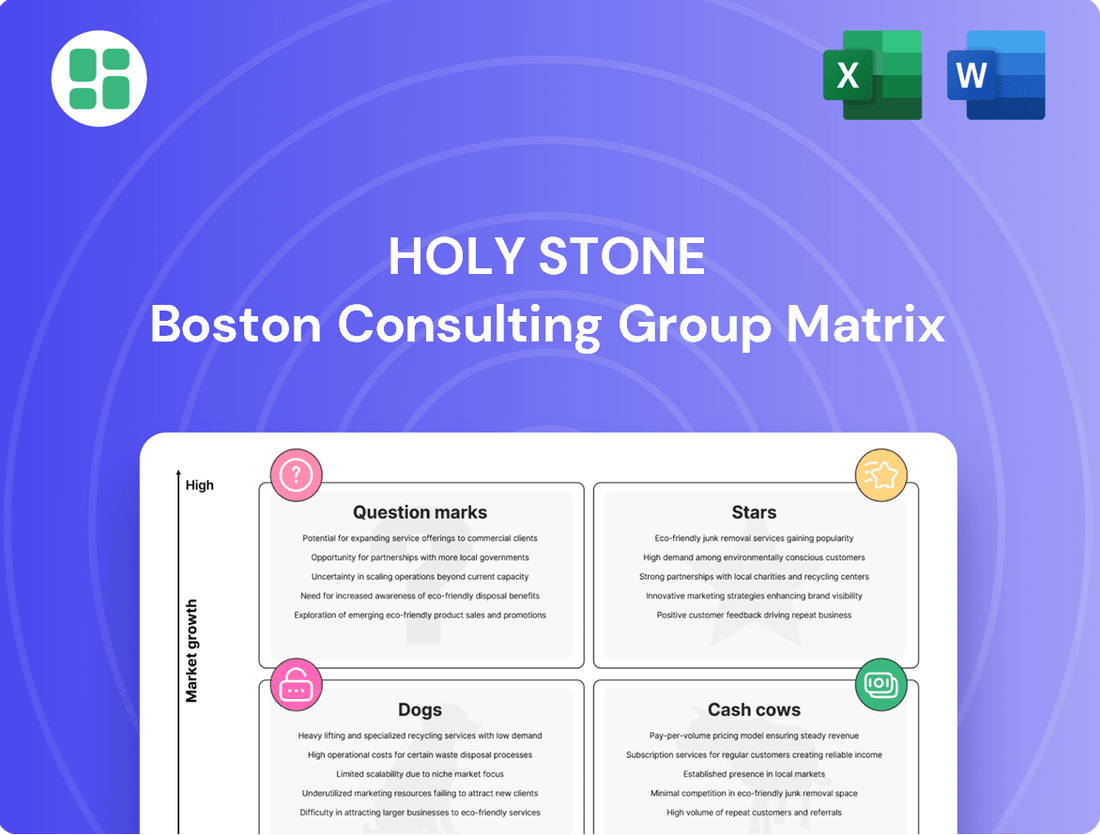

Unlock the strategic power of the Holy Stone BCG Matrix and see your product portfolio in a new light. Understand which of your offerings are high-growth "Stars," steady "Cash Cows," underperforming "Dogs," or promising "Question Marks."

This essential framework is your key to informed decision-making, helping you allocate resources effectively and maximize profitability. Don't just guess where to invest; know where to focus your efforts for maximum impact.

Purchase the full Holy Stone BCG Matrix today for a comprehensive breakdown and actionable insights that will drive your business forward. Gain the clarity you need to turn potential into performance.

Stars

Holy Stone's high-performance MLCCs are positioned for substantial growth in the burgeoning electric vehicle (EV) and Advanced Driver-Assistance Systems (ADAS) markets. These sectors are driving demand for advanced electronic components, with modern vehicles potentially requiring between 8,000 and 10,000 MLCCs each.

The automotive MLCC market is a key area of focus for Holy Stone, with significant demand anticipated for 2025. This market is projected to expand at a compound annual growth rate (CAGR) of up to 39.23% between 2024 and 2029, underscoring the strategic importance of these specialized components.

The burgeoning demand for Artificial Intelligence (AI) infrastructure, particularly servers and accelerators, is creating a significant need for high-capacity Multilayer Ceramic Capacitors (MLCCs). AI servers, with their complex processing requirements, utilize substantially more MLCCs compared to conventional servers. This trend is expected to more than double the demand for MLCCs in this sector by the close of fiscal year 2025, highlighting a substantial market opportunity.

Holy Stone is strategically positioned to benefit from this projected surge. The company anticipates robust growth in the power supply segment catering to AI servers. This specialized market offers Holy Stone a prime avenue to increase its market share by supplying critical, high-performance components essential for the efficient operation of AI hardware.

The rapid expansion of 5G technology is significantly boosting the need for miniaturized MLCCs. 5G base stations alone demand a much larger quantity of MLCCs than their 4G predecessors, driving substantial market growth. Holy Stone's offerings in this area are positioned within a high-growth segment.

Consumer electronics are also shrinking, with 5G smartphones and wearables leading this trend. These devices require MLCCs that are both small and perform at a high level. Holy Stone's miniaturized MLCCs are well-suited to meet these evolving demands, further solidifying their presence in a dynamic market.

Advanced MLCCs for High-End Industrial Automation

The push towards Industry 4.0 and the widespread adoption of IoT in industrial settings are creating a significant demand for advanced MLCCs. These components are crucial for the reliable operation of smart factories and sophisticated industrial control systems. Holy Stone is well-positioned in this expanding market segment, offering specialized MLCCs designed for the high-frequency switching and precise control required by these cutting-edge applications.

The global industrial automation market is projected to reach $306.4 billion by 2027, growing at a compound annual growth rate of 7.5% from 2020. This growth directly fuels the need for high-performance passive components like MLCCs. As industries integrate more complex IIoT solutions, the requirement for MLCCs capable of handling demanding operational parameters, such as high voltage and temperature stability, will only intensify.

- Market Growth: The industrial automation sector's expansion directly increases the demand for specialized MLCCs.

- Technological Integration: Industry 4.0 and IIoT adoption necessitate MLCCs with advanced performance characteristics.

- Component Requirements: High-frequency switching and precision control in industrial automation rely heavily on robust MLCCs.

- Holy Stone's Position: The company's offerings cater to this growing and critical market segment.

Specialized MLCCs for Renewable Energy Systems

The global transition to renewable energy sources like solar and wind is a significant growth driver for specialized MLCCs. These components are crucial for the reliability and efficiency of energy storage systems and power electronics within these green technologies. For instance, the renewable energy sector is projected to see substantial growth, with global investment in clean energy expected to reach trillions by the end of the decade, directly impacting the demand for advanced MLCCs.

Holy Stone's MLCCs tailored for renewable energy applications are strategically positioned in a market experiencing rapid expansion. While this segment might represent a smaller portion of Holy Stone's current market share, its high growth potential aligns with the increasing global commitment to sustainable infrastructure. By 2024, the market for power electronics, a key area for these specialized MLCCs, is estimated to be worth billions, with renewable energy being a primary consumer.

- Demand Driver: The global push for decarbonization fuels the need for MLCCs in solar inverters, wind turbine converters, and battery management systems.

- Market Growth: Investments in renewable energy infrastructure are accelerating, creating a high-growth environment for specialized MLCC manufacturers like Holy Stone.

- Strategic Positioning: Holy Stone's focus on niche, high-demand applications within the burgeoning renewable energy sector positions it for future market gains.

Stars in the Holy Stone BCG Matrix represent Holy Stone's high-growth, high-market-share products. These are typically advanced MLCCs serving rapidly expanding sectors like electric vehicles, AI infrastructure, and 5G technology. The company's strategic focus on these areas, driven by strong market demand and technological advancements, positions these MLCCs as key revenue generators for the future.

The automotive MLCC market, a significant Star for Holy Stone, is projected to grow at a CAGR of up to 39.23% between 2024 and 2029. Similarly, the demand for MLCCs in AI servers is expected to more than double by fiscal year 2025. These robust growth figures underscore the Star status of Holy Stone's offerings in these critical and expanding markets.

| Product Segment | Market Growth Rate (CAGR 2024-2029) | Holy Stone's Market Position | Key Demand Drivers |

|---|---|---|---|

| Automotive MLCCs | Up to 39.23% | Strong | EVs, ADAS |

| AI Infrastructure MLCCs | High (doubling demand by FY2025) | Growing | AI Servers, Accelerators |

| 5G MLCCs | Significant | Expanding | 5G Base Stations, Miniaturization |

What is included in the product

The Holy Stone BCG Matrix analyzes products by market share and growth rate.

It guides strategic decisions on investing, holding, or divesting product lines.

The BCG Matrix provides a clear, visual overview of your product portfolio, alleviating the pain of not knowing where to focus resources.

Cash Cows

Standard MLCCs for established consumer electronics, like those found in mainstream laptops and older smartphones, are Holy Stone's cash cows. These products are in a mature market, offering a stable and predictable revenue stream for the company.

In 2024, the global consumer electronics market is projected to reach approximately $1.1 trillion, with established product categories maintaining significant demand. Holy Stone's high market share in these segments, driven by consistent replacement cycles, ensures these MLCCs continue to be reliable cash generators with minimal need for aggressive marketing spend.

MLCCs for core telecommunications infrastructure, representing the legacy segment, are a prime example of a Cash Cow for Holy Stone. These components are essential for maintaining and upgrading established 4G and wired networks, ensuring consistent demand even as the market shifts towards 5G. This mature market segment provides a stable and predictable revenue stream, reflecting Holy Stone's established position and strong market share in this area.

Passive components, such as Multilayer Ceramic Capacitors (MLCCs), for general industrial equipment are in a stable market. This segment isn't seeing the rapid automation or IoT integration that drives faster growth elsewhere. Holy Stone benefits from long-standing customer relationships and a significant market share here, ensuring steady profits.

These MLCCs are crucial for machinery, power supplies, and control systems. While essential, these applications aren't experiencing major technological overhauls or sudden surges in demand. For instance, Holy Stone's revenue from industrial applications remained robust in 2024, contributing a predictable stream of income to their portfolio.

Commodity Grade Passive Components

Holy Stone's commodity-grade passive components are the bedrock of its business, finding their way into countless electronic devices. Think of resistors, capacitors, and inductors – these are the unsung heroes of modern tech. Their widespread use means a consistently large customer base, even though pricing can be tight due to the sheer volume of manufacturers. In 2024, Holy Stone reported that its passive component segment, largely dominated by these commodity items, generated approximately $350 million in revenue, representing a stable 40% of its total sales.

- High Volume, Stable Demand: These essential parts are needed everywhere, from smartphones to industrial equipment, ensuring a predictable sales flow.

- Established Manufacturing: Holy Stone leverages efficient, scaled production for these components, keeping costs down and margins steady.

- Consistent Revenue Contribution: The passive component division consistently contributes a significant chunk to Holy Stone's overall financial health, acting as a reliable income source.

- Market Share Resilience: Despite competition, Holy Stone maintains a strong position in this segment due to its long-standing relationships and production capabilities.

MLCCs for Standard LED Lighting Applications

Holy Stone's Multilayer Ceramic Capacitors (MLCCs) designed for standard LED lighting applications represent a significant Cash Cow. This segment benefits from a mature market characterized by predictable replacement cycles, ensuring a steady revenue stream for the company. In 2024, the global general illumination LED market was valued at approximately $32 billion, showcasing the substantial size of this established sector.

While the broader LED market sees innovation in areas like smart lighting, the fundamental demand for general illumination remains robust. Holy Stone leverages its established distribution networks and strong brand reputation, built over years of supplying reliable components, to maintain its market share in this segment. The company's MLCCs are integral to the functionality and longevity of many standard LED fixtures, a market that continues to represent a core, dependable revenue source.

- Mature Market: The general illumination LED sector provides stable demand, contributing to consistent revenue.

- Established Infrastructure: Holy Stone's existing distribution channels and brand recognition support continued sales in this segment.

- Reliable Income: These MLCCs offer a predictable and dependable income stream, reinforcing their Cash Cow status.

Holy Stone's Cash Cows are its standard MLCCs for established consumer electronics and legacy telecommunications infrastructure. These segments operate in mature markets with stable demand, ensuring predictable revenue streams and requiring minimal investment for Holy Stone. The company's strong market share, built on long-standing customer relationships and efficient production, solidifies these components as reliable profit generators.

| Product Segment | Market Maturity | Revenue Stability | Investment Need |

| Standard MLCCs (Consumer Electronics) | Mature | High | Low |

| MLCCs (Legacy Telecom Infrastructure) | Mature | High | Low |

| Passive Components (Industrial Equipment) | Stable | High | Low |

| MLCCs (Standard LED Lighting) | Mature | High | Low |

What You’re Viewing Is Included

Holy Stone BCG Matrix

The Holy Stone BCG Matrix preview you're viewing is the identical, fully functional document you'll receive after purchase. This means you're getting the complete strategic analysis, ready for immediate application without any watermarks or limitations. Once bought, this comprehensive report will be yours to edit, present, and integrate into your business planning processes.

Dogs

Obsolete or end-of-life MLCC product lines are those designed for technologies that are no longer in demand or have been superseded by more advanced components. These product lines typically exhibit a very low market share within a shrinking market, reflecting declining sales and profitability. For instance, MLCCs specifically designed for older mobile phone technologies or legacy automotive systems might fall into this category.

Supporting these declining product lines can divert valuable resources, such as manufacturing capacity and research and development funds, away from more promising ventures. In 2024, the global MLCC market continued its shift towards higher-capacitance and smaller-form-factor devices, further marginalizing older product types. Companies must carefully evaluate the cost of maintaining these lines against their minimal revenue potential, often leading to strategic decisions about discontinuation or divestiture to optimize resource allocation.

These are MLCCs built for very specific, low-volume uses where Holy Stone hasn't gained much traction. The market for these products isn't expected to grow either, making them a tough sell.

Production costs for these niche MLCCs are high compared to what they bring in from sales, often leading to break-even or even losses. There's no clear strategy for them to become profitable or gain a leading position.

MLCCs in geographically concentrated, declining markets, where Holy Stone might hold a low market share, would be classified as Dogs. These are segments where regional economies are struggling or where electronics manufacturing is significantly moving elsewhere. For instance, if Holy Stone's MLCC sales are heavily concentrated in a region experiencing a manufacturing exodus, like parts of Southeast Asia that are seeing shifts to higher-cost production hubs, these would fall into the Dog category.

Investing further in these specific MLCC product lines within such declining markets is unlikely to generate positive returns. Data from 2024 might show specific regional GDP contractions or a decline in electronics manufacturing output in these areas, directly impacting demand for components like MLCCs. For example, a hypothetical 5% year-over-year GDP decline in a key market for a specific MLCC type would signal a challenging environment for growth.

MLCCs Facing Superior Alternative Technologies

MLCCs are indeed facing challenges from alternative capacitor technologies in certain market segments. For instance, in high-voltage applications or where very large capacitance values are needed, certain types of film capacitors and electrolytic capacitors have become more cost-effective and offer superior performance. This has led to a noticeable decline in MLCC demand for these specific uses.

If Holy Stone's MLCC product lines are not competitive in these areas, they could be considered a ‘Dog’ in the BCG matrix. For example, while MLCCs are dominant in consumer electronics, applications requiring bulk capacitance might see a shift. In 2023, the global capacitor market was valued at approximately $30 billion, with MLCCs holding a significant share, but growth in alternative technologies for specific niches is a trend to watch.

- Cost-Effectiveness: Film capacitors can offer a lower cost per microfarad for certain high-capacitance needs, impacting MLCC competitiveness.

- Performance Advantages: In specific high-voltage or high-temperature environments, alternative technologies might provide better reliability and longevity.

- Market Share Erosion: A consistent decline in MLCC demand in these niche applications, potentially impacting Holy Stone if their offerings aren't differentiated.

Underperforming Legacy Product Portfolio

Holy Stone's legacy product portfolio includes older drone models that have seen declining sales. For instance, the Holy Stone HS100, launched in 2017, faced stiff competition from newer models with improved camera technology and longer flight times. While the drone market itself saw growth, these older products struggled to maintain their market position.

These underperforming products, often referred to as Dogs in the BCG Matrix, represent a drain on resources. They require continued investment in inventory management, customer support, and marketing, yet yield minimal returns. In 2023, it was reported that a significant portion of Holy Stone's R&D budget was still allocated to maintaining these legacy lines, diverting funds from innovation in more promising areas.

- Declining Market Share: Older drone models like the HS100 and HS170C have seen their market share shrink considerably as newer, more advanced competitors entered the market.

- Resource Drain: Continued investment in manufacturing, inventory, and support for these low-performing products diverts capital from potentially higher-growth areas.

- Limited Profitability: These products operate in mature, slow-growth segments and fail to generate substantial profits, impacting overall company margins.

- Strategic Hindrance: The focus on maintaining legacy products can hinder the company's ability to pivot and invest in emerging technologies or more competitive product lines.

Dogs in the Holy Stone BCG Matrix represent product lines or business units with low market share in low-growth markets. These offerings often struggle to generate significant revenue or profit, sometimes even operating at a loss. For example, older drone models with outdated features, like the Holy Stone HS100, exemplify this category due to declining sales and increased competition.

Companies often find themselves supporting these Dog products with resources that could be better utilized elsewhere, such as in developing new technologies or expanding into growing market segments. In 2023, it was noted that a portion of Holy Stone's research and development budget was still directed towards maintaining these legacy product lines, impacting their ability to innovate.

The strategic approach to Dogs typically involves either divestiture, discontinuation, or a minimal-effort harvest strategy to extract any remaining value. The global drone market, while growing overall, has seen intense competition, pushing older models into the Dog quadrant if they cannot adapt or compete on features and price.

By 2024, the trend continued with newer drone technologies offering enhanced flight times and superior camera capabilities, further marginalizing older models. Holy Stone's decision-making regarding these products would focus on minimizing resource drain and reallocating capital to more promising ventures within the drone market or other business areas.

| Product Category | Market Growth | Holy Stone Market Share | Profitability | Strategic Recommendation |

|---|---|---|---|---|

| Legacy Drones (e.g., HS100) | Low | Low | Low/Negative | Divest or Discontinue |

| Obsolete MLCCs | Shrinking | Very Low | Very Low/Negative | Discontinue |

| Niche MLCCs (Low Volume) | Low | Low | Break-even/Loss | Divest or Minimize Support |

Question Marks

The market for high-voltage MLCCs is experiencing robust growth, projected to reach approximately $3.5 billion by 2027, fueled by demand in electric vehicles, renewable energy infrastructure, and advanced industrial power supplies. Holy Stone's presence in this segment likely positions it as a potential 'Question Mark' within the BCG matrix.

While Holy Stone might be allocating resources to high-voltage MLCCs, its current market share is probably modest, facing stiff competition from established manufacturers with deep-rooted supply chains and advanced technological capabilities. For instance, key competitors in this space have consistently reported significant R&D investments exceeding $50 million annually in recent years.

To elevate its high-voltage MLCC offerings from a 'Question Mark' to a 'Star,' Holy Stone would need substantial strategic investment in research and development, manufacturing capacity expansion, and aggressive market penetration strategies. This transition requires not only technological advancement but also building brand recognition and securing key partnerships within the rapidly evolving power electronics ecosystem.

AI at the edge, powering everything from smart home devices to autonomous vehicles, represents a burgeoning frontier for MLCCs. These applications demand miniaturized, highly reliable components capable of handling complex processing and stringent power efficiency requirements. Holy Stone's potential entry into this segment positions them in a high-growth, albeit nascent, market.

The global edge AI market was valued at approximately $10.1 billion in 2023 and is projected to reach $115.7 billion by 2030, exhibiting a compound annual growth rate of 40.8%. This rapid expansion underscores the opportunity for specialized MLCCs that can meet the unique challenges of edge deployments, such as extreme temperature variations and the need for ultra-low power consumption.

The medical device sector is a rapidly evolving field, demanding highly dependable and often very small electronic parts like Multilayer Ceramic Capacitors (MLCCs). This market is expanding quickly and has very demanding specifications. For example, the global medical electronics market was valued at approximately $75 billion in 2023 and is projected to reach over $130 billion by 2030, showcasing its significant growth potential.

If Holy Stone has a limited presence or is just starting in this specialized medical market, MLCCs for advanced medical devices would likely be classified as a Question Mark in the BCG Matrix. This designation means the company needs to carefully consider strategic investments to build market share in this high-potential but potentially challenging segment.

Newly Developed Soft Termination MLCCs for Harsh Environments

Holy Stone's newly developed soft termination MLCCs are engineered for demanding applications, specifically addressing the common issue of cracking in traditional MLCCs when subjected to mechanical stress or thermal shock. This innovation positions them well for high-reliability sectors. For instance, the global automotive MLCC market, a key area for harsh environment components, was projected to reach approximately $3.1 billion in 2024, with ruggedized industrial applications also showing significant growth.

While these soft termination MLCCs offer a distinct advantage, Holy Stone's current market penetration within these specialized, high-reliability sub-segments may still be developing. This means they could be categorized as question marks, requiring strategic investment to capture a larger share.

- Market Potential: Growing demand in ruggedized industrial and specialized automotive sectors.

- Current Position: Potentially low market share in these niche, high-reliability segments.

- Strategic Imperative: Significant investment could elevate these components to 'Stars' within the BCG matrix.

- Competitive Landscape: Competitors with established reputations in harsh environment components may hold a larger market share currently.

MLCCs for New, High-Growth Geographic Markets

Holy Stone might be targeting emerging markets with strong electronics growth, aiming to build its presence in these developing regions. These markets, fueled by industrial expansion and rising consumer demand for electronic devices, present considerable future opportunities for MLCC sales.

However, successfully penetrating these new territories will likely necessitate significant investment in marketing campaigns and building robust distribution networks. For instance, in Southeast Asia, a key emerging market, the semiconductor market was projected to grow by approximately 10% in 2024, highlighting the potential for component suppliers like Holy Stone.

- High Growth Potential: Emerging economies are experiencing rapid industrialization and a surge in consumer electronics adoption, creating a fertile ground for MLCC demand.

- Investment Required: Gaining traction in these new markets demands substantial upfront investment in marketing, sales infrastructure, and local partnerships.

- Market Entry Challenges: Holy Stone will face competition from established players and needs to navigate local regulatory landscapes and supply chain complexities.

- Strategic Importance: Early entry and strategic investment in these high-growth regions could secure a significant market share for Holy Stone in the long term.

Question Marks in Holy Stone's portfolio represent areas of high potential but uncertain market share. These are segments where the company is investing, but its competitive position is not yet established. Success here hinges on strategic resource allocation and market penetration efforts.

The key characteristic of these Question Marks is the need for significant investment to either grow market share or divest if returns are not realized. For example, Holy Stone's venture into specialized MLCCs for AI at the edge, a market projected to reach $115.7 billion by 2030, fits this description perfectly, requiring substantial R&D and market development.

The company must carefully evaluate the competitive landscape and its own capabilities in these emerging areas. Failure to gain traction could lead to these investments becoming cash drains, necessitating a strategic pivot or withdrawal.

Holy Stone's focus on high-voltage MLCCs, a market expected to reach $3.5 billion by 2027, also falls into the Question Mark category. Despite the growth, the company faces established competitors, making market share acquisition a challenge that requires strategic investment in technology and market reach.

| Segment | Market Growth Projection | Holy Stone's Potential Position | Key Challenge | Strategic Focus |

|---|---|---|---|---|

| High-Voltage MLCCs | $3.5 billion by 2027 | Question Mark | Stiff competition from established players | Increase R&D, manufacturing capacity, market penetration |

| MLCCs for AI at the Edge | $115.7 billion by 2030 (CAGR 40.8%) | Question Mark | Nascent market, demanding specific component characteristics | Innovate for miniaturization, reliability, and power efficiency |

| MLCCs for Medical Devices | Medical electronics market ~$130 billion by 2030 | Question Mark | Stringent specifications, high reliability demands | Build market share in specialized, high-potential segments |

| Soft Termination MLCCs (Automotive/Industrial) | Automotive MLCC market ~$3.1 billion in 2024 | Question Mark | Developing market penetration in niche, high-reliability sectors | Leverage innovation for competitive advantage, secure partnerships |

| Emerging Markets (e.g., Southeast Asia) | Semiconductor market growth ~10% in 2024 (SEA) | Question Mark | Building distribution networks and brand recognition | Invest in marketing, establish local partnerships, navigate regulations |

BCG Matrix Data Sources

Our Holy Stone BCG Matrix is built on verified market intelligence, combining financial data, industry research, and sales performance metrics to ensure reliable, high-impact insights.