Holy Stone Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Holy Stone Bundle

Holy Stone's competitive landscape is shaped by several key forces, including the bargaining power of buyers and the threat of new entrants. Understanding these dynamics is crucial for any stakeholder looking to navigate this market effectively.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Holy Stone’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The availability of critical raw materials, such as the ceramic powders like barium titanate and precious metals used in electrodes, can be quite limited. This scarcity directly empowers specialized suppliers, giving them significant leverage over manufacturers like Holy Stone.

As a manufacturer of MLCCs (Multi-Layer Ceramic Capacitors), Holy Stone's production capacity and costs are directly influenced by any disruptions or scarcity in these unique inputs. This reliance means suppliers can often dictate terms or pricing because their materials are absolutely essential for production.

For instance, in 2024, the global supply chain for rare earth elements, crucial for various electronic components, experienced price volatility due to geopolitical factors. This type of event underscores how specialized raw material scarcity can translate into substantial bargaining power for suppliers in the MLCC industry.

High switching costs for materials significantly bolster the bargaining power of Holy Stone's suppliers. The MLCC industry demands rigorous qualification processes for new raw material providers, often involving extensive testing and potential re-tooling of manufacturing equipment. This inertia means Holy Stone faces considerable hurdles and expenses when attempting to change suppliers.

Consequently, Holy Stone's flexibility to source materials from alternative vendors is diminished, granting existing, approved suppliers greater leverage. The time and financial investment required to establish new supply chain relationships further entrench this reliance, making it difficult for Holy Stone to negotiate more favorable terms or readily switch to competitors.

Major MLCC manufacturers are increasingly pursuing vertical integration. For instance, Murata has entered a joint venture for barium titanate production, a key raw material, while Taiyo Yuden is constructing a new facility for material development. This strategic move allows suppliers to either integrate forward into component manufacturing or secure their own supply chains for critical inputs.

Proprietary Material Technology

Suppliers who own unique technologies or patents for advanced ceramic formulations or electrode materials wield considerable influence. These specialized inputs are vital for Holy Stone to produce high-performance, miniaturized MLCCs, which are critical for their competitive edge in the market. In 2024, the demand for advanced MLCCs used in 5G infrastructure and electric vehicles continued to rise, further solidifying the bargaining power of these technology-holding suppliers. The intellectual property protection surrounding these materials restricts Holy Stone's ability to source alternatives, thereby increasing their dependence on these key suppliers.

- Proprietary Technology: Suppliers with patented material science for ceramics and electrodes have a distinct advantage.

- Critical Components: These advanced materials are indispensable for the miniaturization and performance of MLCCs.

- Limited Alternatives: Holy Stone faces restricted options when seeking substitutes for these patented materials.

- Supplier Dependence: The reliance on these suppliers is heightened due to the unique nature of their offerings.

Concentration of Key Suppliers

The concentration of key suppliers for critical MLCC raw materials significantly impacts Holy Stone's bargaining power. If only a few large companies dominate the supply of these essential components, their ability to dictate terms to Holy Stone intensifies. This limited supplier base reduces competition among sellers, giving them leverage over pricing, delivery schedules, and the quality of materials provided. For instance, in 2023, the global market for key ceramic powders used in MLCCs saw major players like Murata Manufacturing and TDK maintaining substantial market shares, potentially limiting Holy Stone's options for sourcing these critical inputs.

This concentration can translate directly into higher input costs for Holy Stone. When suppliers face little competition, they can often command higher prices for their products, squeezing Holy Stone's profit margins. Furthermore, these dominant suppliers may also have more influence in setting delivery timelines and quality specifications, potentially impacting Holy Stone's production efficiency and product consistency.

- Supplier Concentration: A market dominated by a few major raw material producers for MLCCs grants them increased leverage.

- Pricing Power: Limited supplier options allow these key players to potentially increase prices for Holy Stone.

- Influence on Terms: Concentrated suppliers can dictate delivery schedules and quality standards, affecting Holy Stone's operations.

The bargaining power of suppliers for Holy Stone is substantial due to the limited availability and specialized nature of critical raw materials like ceramic powders and precious metals. High switching costs, driven by rigorous qualification processes, further entrench this power, making it difficult for Holy Stone to change suppliers. In 2024, geopolitical factors impacting rare earth elements highlighted the price volatility suppliers can exert.

Suppliers with proprietary technology for advanced ceramic formulations or electrode materials hold significant leverage, especially as demand for high-performance MLCCs used in 5G and EVs increased in 2024. The concentration of key suppliers, such as Murata Manufacturing and TDK, in the market for essential ceramic powders also grants them pricing power and influence over delivery and quality terms for Holy Stone.

| Factor | Impact on Holy Stone | 2024 Relevance |

|---|---|---|

| Raw Material Scarcity | Limited availability of ceramic powders and precious metals empowers specialized suppliers. | Geopolitical volatility in rare earth elements increased supplier leverage. |

| High Switching Costs | Extensive qualification processes for new materials increase dependence on existing suppliers. | Re-tooling and testing requirements make supplier changes costly and time-consuming. |

| Proprietary Technology | Suppliers with patented materials for advanced MLCCs have significant influence. | Rising demand for 5G and EV components amplified the value of these specialized inputs. |

| Supplier Concentration | A few dominant suppliers for critical powders can dictate pricing and terms. | Major players like Murata and TDK maintained substantial market shares, limiting Holy Stone's sourcing options. |

What is included in the product

This analysis meticulously examines the five competitive forces impacting Holy Stone, providing a strategic roadmap to understand and navigate its market environment.

Visualize competitive intensity with a dynamic, interactive diagram that highlights key industry pressures.

Customers Bargaining Power

Holy Stone's customer landscape presents a dual dynamic: while the company serves a wide array of industries like automotive, industrial, consumer electronics, and telecommunications, the actual demand for its core products, such as MLCCs, is often consolidated among a few major players. This means that even with many individual customers, the real power often lies with large original equipment manufacturers (OEMs) and original design manufacturers (ODMs).

These significant buyers, especially those in high-growth sectors like automotive and smartphone production, frequently place substantial orders. Their sheer volume of purchases allows them to negotiate aggressively on price, directly impacting Holy Stone's profitability and bargaining power.

Holy Stone's customers, particularly in the fast-moving consumer electronics sector, face intense competition and are highly attuned to pricing. This sensitivity means they wield significant influence when placing large orders for Multilayer Ceramic Capacitors (MLCCs), directly impacting Holy Stone's profitability through demands for lower prices.

The relentless pursuit of cost optimization in finished electronic goods creates a ripple effect, placing considerable pressure on component manufacturers like Holy Stone. For instance, in 2024, the average selling price for many consumer electronics components saw a decline of 5-10% year-over-year due to market saturation and aggressive competition among brands.

Customer switching costs for MLCCs can be a significant factor. While MLCCs are vital, businesses often encounter moderate expenses and time investments when moving from one supplier to another, especially for critical applications.

For automotive manufacturers, the hurdle is particularly high. The rigorous qualification process for automotive-grade MLCCs can extend beyond two years, effectively locking in suppliers and substantially increasing switching costs for these customers.

This lengthy accreditation period grants considerable leverage to MLCC manufacturers in the automotive sector, diminishing the bargaining power of buyers. However, in more standardized, commoditized MLCC markets, where components are less specialized and qualification processes are simpler, customer switching costs are generally lower, leading to a more balanced power dynamic.

Backward Integration Potential

The potential for large customers, such as major electronics manufacturers or automotive original equipment manufacturers (OEMs), to backward integrate into MLCC production presents a significant bargaining chip. While building MLCC manufacturing capabilities is highly capital-intensive, the mere possibility, particularly for custom or high-volume components, can empower these customers to negotiate more favorable terms with suppliers like Holy Stone. This threat acts as a natural cap on the prices Holy Stone can command.

Consider the automotive sector, a key market for MLCCs. In 2024, the automotive industry continued its push for supply chain resilience and cost optimization. Major automotive players, already investing heavily in areas like battery production, might evaluate the strategic benefit of bringing critical component manufacturing, including certain types of MLCCs, in-house. For instance, a leading EV manufacturer could theoretically allocate billions towards establishing its own MLCC production lines if it perceived sufficient long-term cost savings or supply security advantages.

- Backward Integration Threat: Large customers can leverage the threat of producing MLCCs themselves to gain negotiation power.

- Capital Intensity Barrier: The high cost of establishing MLCC manufacturing facilities acts as a deterrent to actual backward integration.

- Strategic Advantage: Even a credible threat, especially for specialized or high-volume MLCCs, can significantly influence pricing discussions.

- Market Influence: Major players in sectors like automotive or consumer electronics wield substantial influence due to their purchasing volume and potential for vertical integration.

Product Standardization and Differentiation

While Holy Stone is known for its MLCCs, the market for standard MLCCs can be quite competitive, bordering on commoditization. This means customers who need basic components have more options and can often negotiate lower prices, giving them significant bargaining power. For instance, in 2024, the global MLCC market saw intense competition in the standard segment, with price pressures evident across many product lines.

However, Holy Stone has strategically positioned itself in higher-value segments. By focusing on MLCCs designed for demanding applications such as automotive electronics and industrial equipment, the company achieves a degree of product differentiation. These specialized components often require higher reliability and performance specifications, which reduces the direct substitutability and, consequently, the bargaining power of customers seeking these advanced solutions.

This differentiation is crucial. For example, MLCCs used in advanced driver-assistance systems (ADAS) or high-frequency communication modules are less likely to be treated as simple commodities. In 2024, the demand for high-reliability MLCCs in these sectors remained robust, with Holy Stone reporting strong order growth for its specialized product lines. The more niche and performance-driven the application, the less sensitive customers are to price alone, as the cost of failure or subpar performance in these critical systems far outweighs minor component price differences.

- Market Dynamics: Standard MLCCs face commoditization, empowering buyers.

- Holy Stone's Strategy: Focus on high-quality, specialized MLCCs for automotive and industrial sectors.

- Customer Sensitivity: Price sensitivity decreases for specialized, high-performance components.

- 2024 Data: Robust demand and order growth noted for Holy Stone's specialized MLCCs in demanding applications.

The bargaining power of customers for Holy Stone's products, particularly Multilayer Ceramic Capacitors (MLCCs), is shaped by several factors. While the company serves a broad market, large Original Equipment Manufacturers (OEMs) and Original Design Manufacturers (ODMs) often hold significant sway due to their substantial order volumes. This leverage allows them to negotiate aggressively on pricing, directly impacting Holy Stone's profit margins. For instance, in 2024, the consumer electronics sector experienced an average component price decline of 5-10% year-over-year, underscoring customer pricing pressure.

Switching costs for customers are a critical element. For standard MLCCs, these costs are generally moderate, giving customers more flexibility. However, in specialized sectors like automotive, the lengthy qualification processes for MLCCs, which can exceed two years, create high switching costs for buyers. This locks in suppliers and reduces customer bargaining power. Furthermore, the threat of backward integration, though capital-intensive, empowers large customers to negotiate more favorable terms, especially for custom or high-volume components.

| Factor | Impact on Customer Bargaining Power | Example/2024 Data |

|---|---|---|

| Purchasing Volume | High for large OEMs/ODMs | Major electronics brands' bulk orders |

| Price Sensitivity | High in consumer electronics | 5-10% average component price decline in 2024 |

| Switching Costs (Standard MLCCs) | Moderate | Easier to change suppliers for basic components |

| Switching Costs (Specialized MLCCs) | High (e.g., Automotive) | Over 2-year qualification for automotive-grade MLCCs |

| Threat of Backward Integration | Significant | Potential for EV manufacturers to produce MLCCs in-house |

What You See Is What You Get

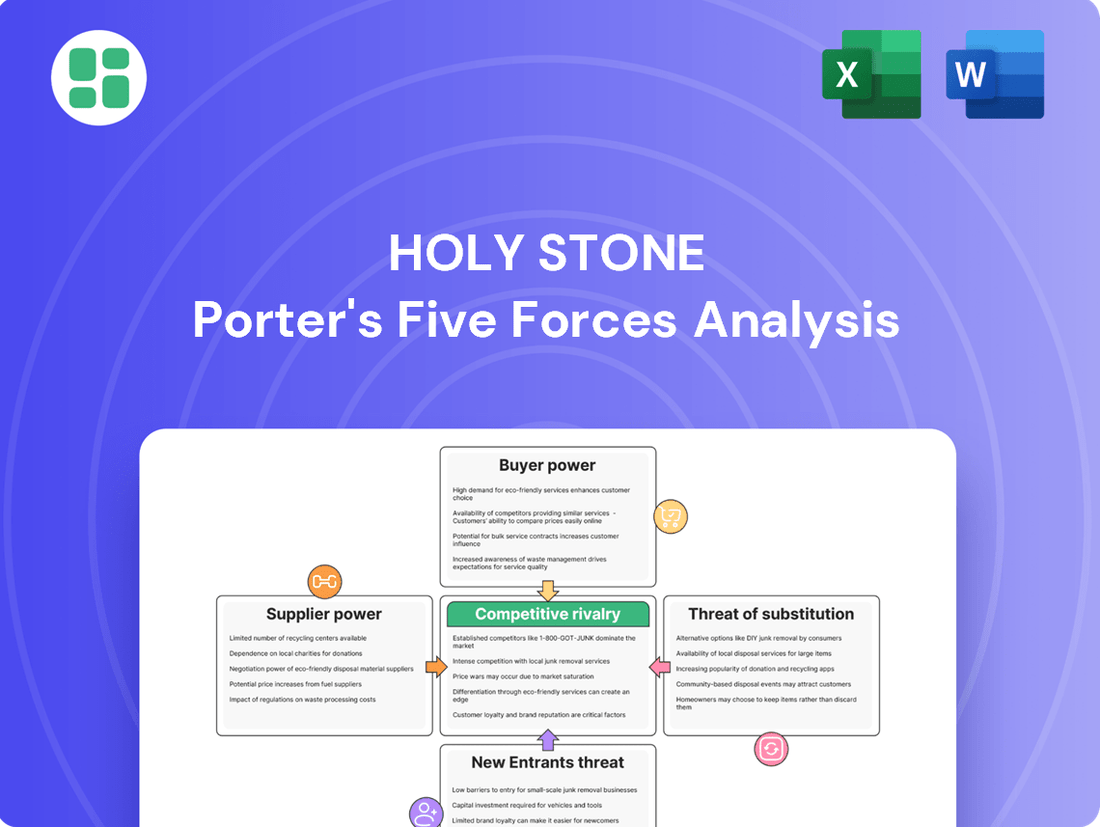

Holy Stone Porter's Five Forces Analysis

This preview showcases the complete Holy Stone Porter's Five Forces Analysis, offering a detailed examination of the competitive landscape for drone manufacturers. The document you see here is the exact, professionally formatted report you'll receive immediately after purchase, providing actionable insights without any placeholders or surprises.

Rivalry Among Competitors

The global MLCC market is a battlefield dominated by a handful of giants. Murata Manufacturing, Samsung Electro-Mechanics, TDK, and Taiyo Yuden are key players, with Japanese firms often leading in the high-performance segments. This concentration means Holy Stone is up against formidable competitors with deep technological expertise and established market presence.

Competitors are aggressively expanding production capacity and pouring resources into research and development. This focus is on creating smaller, more powerful, and dependable MLCCs crucial for burgeoning sectors such as 5G networks, electric vehicles, and the Internet of Things. For instance, Murata Manufacturing, a key rival, reported significant capital expenditures in 2023, signaling their commitment to scaling up and innovating.

This continuous drive for technological advancement and increased output from competitors establishes a highly competitive landscape for Holy Stone. To maintain its market position, the company must consistently allocate substantial capital towards its own innovation and production capabilities, a necessity underscored by the industry's rapid technological evolution.

The MLCC market is poised for significant expansion, with projected compound annual growth rates (CAGR) between 5.00% and 14.4% from 2025 onward. This growth is fueled by the escalating demand for electronic gadgets and the accelerating adoption of electric vehicles.

This attractive market growth acts as a magnet, compelling established players to aggressively pursue greater market share and enhance their operational capacities. Such a promising outlook naturally intensifies competitive rivalry as companies battle for dominance in an expanding sector.

Price Pressure and Inventory Management

Even with the MLCC market expanding, intense competition leads to significant price pressure, particularly from buyers in the consumer electronics sector. This dynamic forces manufacturers to constantly evaluate their pricing strategies to remain competitive.

Companies are adopting a more conservative approach to capacity expansion and inventory stockpiling. The focus is shifting towards fulfilling immediate or short-term customer demands, reflecting a cautious market sentiment and a desire to avoid excess stock.

- Price Sensitivity: Consumer-grade MLCCs face significant price pressure, impacting profit margins for suppliers.

- Inventory Strategy: Competitors are prioritizing short-term orders, indicating careful inventory management to avoid oversupply.

- Competitive Landscape: The industry's focus on urgent orders highlights a highly competitive environment where agility in production and pricing is key.

High Fixed Costs and Exit Barriers

The MLCC industry is characterized by high fixed costs, primarily due to the significant capital investment required for advanced manufacturing facilities and intricate production processes. These substantial upfront expenditures create a strong incentive for companies to operate at high capacity to spread costs, leading to intense competition.

These high fixed costs, combined with specialized, non-transferable assets, erect considerable exit barriers. Manufacturers find it economically challenging to leave the market, even when facing profitability issues, as they must recoup their initial investments. This situation forces companies to persist and compete vigorously, even during economic slowdowns, thereby intensifying the rivalry among existing players.

- Capital Intensity: MLCC production facilities can cost hundreds of millions of dollars to build and equip, with advanced automation and cleanroom environments being essential.

- Specialized Assets: The machinery and proprietary technology used in MLCC manufacturing are highly specific and have limited resale value outside the industry.

- Capacity Utilization: To achieve economies of scale and cover high fixed costs, manufacturers strive for high capacity utilization, which often leads to oversupply and price pressure when demand falters.

Competitive rivalry in the MLCC market is fierce, driven by major players like Murata Manufacturing and Samsung Electro-Mechanics. These companies are heavily investing in R&D and capacity expansion to meet demand from sectors like 5G and EVs. This intense competition results in price pressures, particularly for consumer-grade components, and necessitates efficient inventory management, with companies prioritizing short-term orders.

The high capital intensity of MLCC production, with facilities costing hundreds of millions of dollars, creates significant exit barriers. This means companies are compelled to compete vigorously to recoup investments, even during downturns, further intensifying rivalry.

| Key MLCC Market Competitors & Investment Focus (Illustrative Data) | ||

|---|---|---|

| Competitor | 2023 Capital Expenditure (Illustrative) | Key R&D Focus Areas |

| Murata Manufacturing | ~$1 Billion+ | Miniaturization, High-Frequency Performance |

| Samsung Electro-Mechanics | ~$800 Million+ | EV Components, 5G MLCCs |

| TDK | ~$600 Million+ | Automotive MLCCs, Advanced Materials |

| Taiyo Yuden | ~$500 Million+ | High-Capacitance MLCCs, Reliability |

SSubstitutes Threaten

The threat of direct functional substitutes for Multilayer Ceramic Capacitors (MLCCs) is notably low. This is primarily because no other readily available technology can perfectly replicate the MLCC's essential combination of miniaturization, high capacitance density, and consistent performance across diverse electronic systems.

MLCCs are deeply embedded as foundational components in virtually all modern electronic devices, from smartphones to automotive control units. Their critical role makes finding a simple drop-in replacement exceptionally challenging. For instance, in 2023, the global MLCC market was valued at approximately $12.5 billion, underscoring their widespread adoption and the difficulty in finding alternatives for such a pervasive technology.

The cost and complexity involved in switching from MLCCs to alternative capacitor technologies are substantial for electronic device manufacturers. This includes significant expenses related to redesigning circuits, extensive re-qualification processes for new components, and the potential for performance compromises, making widespread adoption of substitutes impractical for most customers.

These high switching costs act as a formidable barrier, effectively protecting Holy Stone's established market position in the MLCC sector. For instance, the automotive industry, a key market for MLCCs, requires rigorous testing and validation that can take years and cost millions, making a shift away from proven MLCC solutions highly undesirable.

Continuous technological advancements in Multilayer Ceramic Capacitors (MLCCs) are a significant factor in the threat of substitutes. Innovations such as increased capacitance density and miniaturization mean MLCCs can meet the ever-growing demands of compact and powerful electronic devices.

For instance, the ongoing development of MLCCs with ultra-high capacitance and smaller footprints directly addresses the need for more efficient energy storage in a reduced space. This persistent innovation makes it harder for alternative components to offer a comparable or superior performance-to-size ratio.

These improvements ensure MLCCs remain the go-to component for many applications, effectively pushing out potential substitutes by consistently enhancing their own capabilities. This strengthens the competitive position of MLCCs against emerging or existing alternatives.

Indispensability in Miniaturization Trends

The threat of substitutes for Multi-Layer Ceramic Capacitors (MLCCs) is significantly mitigated by their crucial role in the ongoing miniaturization trend. Across consumer electronics, automotive systems, and telecommunications, where every millimeter counts, MLCCs offer an unparalleled combination of high capacitance and compact size. This makes them virtually indispensable for many advanced applications.

Their unique ability to pack significant capacitance into minuscule packages is a key differentiator. For instance, in smartphones and wearable devices, the space saved by using MLCCs allows for more features or smaller overall dimensions. By 2024, the demand for smaller, more powerful electronic devices continues to drive the need for these highly efficient components, further solidifying their position against larger, less space-efficient alternatives.

- Indispensability in Miniaturization: MLCCs are critical enablers of the miniaturization trend in electronics, automotive, and telecommunications.

- Unmatched Space Efficiency: Their high capacitance-to-volume ratio is a key advantage over other capacitor types for many critical applications.

- Reduced Threat from Alternatives: This inherent advantage limits the viability of larger, less space-efficient substitute components.

Application-Specific Performance Requirements

In demanding sectors like automotive electronics, particularly for Advanced Driver-Assistance Systems (ADAS) and Electric Vehicles (EVs), and also in 5G infrastructure, MLCCs are essential. They must perform reliably under extreme conditions, offering stability, high-frequency capabilities, and resilience across a wide temperature range. For instance, MLCCs used in automotive applications often need to withstand operating temperatures from -55°C to +150°C, a benchmark few other capacitor technologies can consistently meet.

Alternative capacitor technologies, such as tantalum or aluminum electrolytic capacitors, generally fall short when these specific, high-performance criteria are paramount. Their inherent limitations in terms of high-frequency response, temperature stability, and miniaturization make them unsuitable substitutes for the critical functions MLCCs serve in these advanced applications. This performance gap significantly reduces the threat of substitution for Holy Stone's products in its core markets.

Holy Stone's strategic focus on these niche, high-performance applications creates a strong barrier against substitutes. The specialized nature of requirements, such as the need for low Equivalent Series Resistance (ESR) at high frequencies, which is crucial for signal integrity in 5G devices, further solidifies the position of MLCCs. For example, MLCCs can exhibit ESR values in the milliohm range at GHz frequencies, a performance level difficult for other capacitor types to achieve.

- Application Demands: Automotive ADAS/EVs and 5G infrastructure require capacitors with exceptional stability, high-frequency performance, and wide temperature tolerance.

- Performance Gaps: Other capacitor types like tantalum and aluminum electrolytic capacitors often lack the necessary high-frequency response and temperature resilience.

- Market Shielding: This niche performance advantage for MLCCs minimizes the viability of substitutes, protecting Holy Stone's market share in these critical sectors.

- Key Metrics: MLCCs in automotive settings must operate reliably from -55°C to +150°C, while 5G applications demand very low ESR (milliohms) at GHz frequencies.

The threat of substitutes for Multilayer Ceramic Capacitors (MLCCs) is significantly low due to their unique combination of miniaturization, high capacitance density, and consistent performance, making them indispensable in modern electronics. The substantial costs and complexity associated with redesigning circuits and re-qualifying new components for manufacturers act as a strong deterrent against adopting alternative capacitor technologies.

Furthermore, MLCCs' critical role in enabling miniaturization, particularly in space-constrained devices like smartphones and wearables, solidifies their position. Their ability to provide high capacitance in tiny packages is unmatched by many alternatives. For example, by 2024, the relentless demand for smaller, more powerful gadgets continues to favor MLCCs.

In demanding sectors like automotive electronics, especially for Advanced Driver-Assistance Systems (ADAS) and Electric Vehicles (EVs), and in 5G infrastructure, MLCCs are essential due to their reliability under extreme conditions, including a wide temperature range. For instance, automotive-grade MLCCs must reliably operate from -55°C to +150°C, a benchmark few other capacitor types can consistently meet.

Alternative capacitor technologies often fall short on key performance criteria such as high-frequency response, temperature stability, and miniaturization, making them unsuitable substitutes for critical functions. This performance gap, coupled with the specialized requirements like low Equivalent Series Resistance (ESR) at high frequencies crucial for 5G devices, significantly reduces the threat of substitution for MLCCs.

| Factor | Impact on Threat of Substitutes | Supporting Data/Examples |

|---|---|---|

| Technological Performance | Low | MLCCs offer superior miniaturization and capacitance density compared to alternatives. |

| Switching Costs | High | Redesigning circuits and re-qualification processes are costly and time-consuming for manufacturers. |

| Application Criticality | Low | MLCCs are indispensable in miniaturized devices and high-performance applications like automotive and 5G. |

| Performance Requirements | Low | MLCCs meet stringent demands for temperature stability (-55°C to +150°C) and low ESR (milliohms at GHz). |

Entrants Threaten

The threat of new entrants in the MLCC manufacturing industry is significantly mitigated by the substantial capital investment required. Establishing advanced production facilities, acquiring specialized machinery, and maintaining stringent cleanroom environments demands hundreds of millions of dollars. For instance, building a new, state-of-the-art MLCC plant can easily cost upwards of $500 million to $1 billion, depending on scale and technological sophistication.

This high upfront cost acts as a formidable barrier, deterring many potential new players from entering the market. Holy Stone, having already made these significant investments, benefits from this as it limits the ease with which new, competitive operations can be established, thereby protecting its market position.

The production of Multilayer Ceramic Capacitors (MLCCs) is incredibly complex. It involves very precise layering techniques, advanced material science, and high-temperature sintering, all of which demand significant technical expertise and unique, often proprietary, knowledge. This intricate manufacturing process, which includes analog elements that are hard to copy, presents a substantial barrier for any new companies trying to enter the market. The steep learning curve means new players struggle to reach the quality and efficiency levels that established companies have achieved.

Established brand loyalty and deep customer relationships represent a significant barrier for new entrants. Companies like Holy Stone have cultivated trust and integrated themselves into critical supply chains within the automotive, industrial, and electronics markets. For instance, in 2024, many automotive manufacturers continued to prioritize long-term supplier contracts, often renewing agreements with established partners due to proven reliability and quality. This loyalty makes it incredibly challenging for newcomers to penetrate these established networks and secure a foothold.

Economies of Scale and Cost Advantages

Incumbent MLCC manufacturers possess substantial economies of scale, translating into lower per-unit costs across production, procurement, and research and development. For example, major players like Murata Manufacturing, a leader in the MLCC market, have invested billions in advanced manufacturing facilities, enabling significant cost efficiencies.

New entrants would face a considerable challenge in matching these cost advantages. Operating at a smaller scale, they would likely incur higher per-unit expenses, making it difficult to compete on price with established giants. This cost disparity acts as a significant barrier to entry, deterring potential new competitors from entering the market.

- Economies of Scale: Incumbents leverage vast production volumes to reduce costs.

- Cost Disadvantage for New Entrants: Smaller-scale operations lead to higher per-unit costs.

- R&D Investment: Established firms benefit from ongoing R&D, further solidifying cost leadership.

- Procurement Power: Large manufacturers secure better pricing on raw materials due to bulk purchasing.

Intellectual Property and Patents

The MLCC industry, where companies like Holy Stone operate, is heavily protected by intellectual property. This includes a vast array of patents covering everything from the raw materials used to the intricate designs and manufacturing techniques. For instance, as of early 2024, major MLCC manufacturers hold thousands of active patents, creating a significant barrier for newcomers.

These patents act as a formidable shield for established players. New entrants attempting to enter the market face the daunting task of developing MLCCs that do not infringe upon these existing patents. This legal landscape makes it incredibly challenging and costly for new companies to innovate and bring competitive products to market without facing potential litigation.

- Extensive Patent Portfolio: Leading MLCC companies possess thousands of patents covering material compositions, electrode structures, and advanced manufacturing processes.

- Innovation Barrier: New entrants must navigate complex patent landscapes, requiring substantial investment in R&D to develop non-infringing technologies.

- Legal and Financial Risk: The threat of patent infringement lawsuits deters new companies, adding significant financial and legal risk to market entry.

The threat of new entrants in the MLCC market is low due to immense capital requirements, complex manufacturing processes, and established customer relationships. Holy Stone benefits from these barriers, as they make market entry extremely difficult and costly for potential competitors. The industry demands deep technical expertise and significant investment in advanced technology, creating a high hurdle for newcomers.

Intellectual property protection, particularly through extensive patent portfolios, further solidifies the position of established players like Holy Stone. Navigating this patent landscape requires substantial R&D investment and carries significant legal risk for any new company attempting to enter the market. This legal and technological complexity, combined with existing economies of scale, effectively deters new entrants.

| Barrier Type | Description | Impact on New Entrants | Example Data (as of 2024) |

|---|---|---|---|

| Capital Requirements | High cost of establishing advanced manufacturing facilities. | Deters entry due to significant upfront investment. | New MLCC plant costs can exceed $500 million. |

| Technical Expertise | Complex layering, material science, and sintering processes. | Requires specialized knowledge and a steep learning curve. | Proprietary analog elements are difficult to replicate. |

| Economies of Scale | Lower per-unit costs for established, high-volume producers. | New entrants face a cost disadvantage. | Major players invest billions for cost efficiencies. |

| Intellectual Property | Thousands of patents covering materials, designs, and processes. | Requires significant R&D and carries legal risk. | Major MLCC manufacturers hold thousands of active patents. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Holy Stone leverages data from company annual reports, industry-specific market research, and competitor financial statements to assess competitive intensity and strategic positioning.