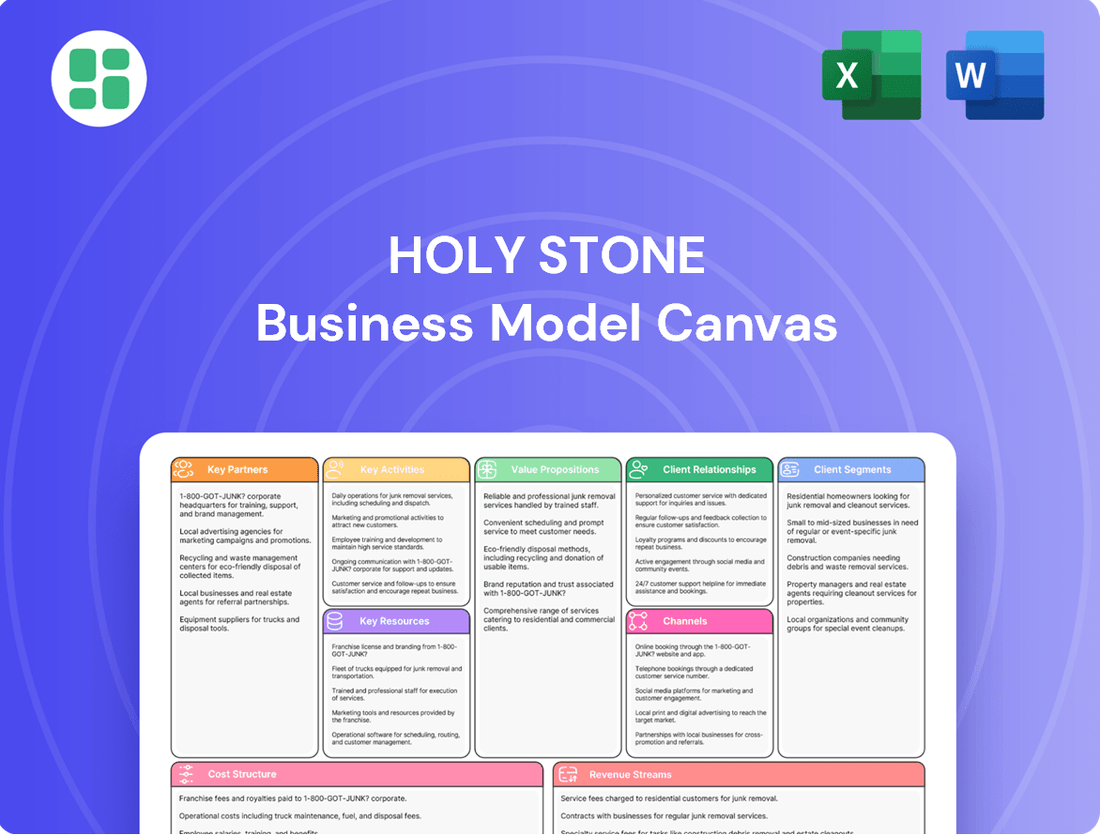

Holy Stone Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Holy Stone Bundle

Curious about how Holy Stone dominates the drone market? Our comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success. Download the full, professionally crafted document to gain actionable insights for your own venture.

Partnerships

Holy Stone's success hinges on its key partnerships with raw material suppliers, particularly for ceramic powders and specialized metals. These are the building blocks for their Multi-layer Ceramic Capacitors (MLCCs). For instance, in 2024, the global market for ceramic capacitors saw continued growth, driven by demand in consumer electronics and automotive sectors, underscoring the importance of reliable sourcing.

Maintaining strong, collaborative relationships with these suppliers is paramount. It guarantees a steady flow of high-quality inputs, which directly impacts the performance and reliability of Holy Stone's MLCC products. This ensures their manufacturing lines run smoothly and efficiently, meeting the rigorous demands of their clientele.

These partnerships are more than just transactional; they are foundational to Holy Stone's ability to scale production and consistently meet customer orders. A stable supply chain, bolstered by these relationships, allows Holy Stone to navigate market fluctuations and maintain its competitive edge in the capacitor industry.

Holy Stone's commitment to technological advancement is underscored by its long-standing partnership with a Japanese collaborator, a relationship that began in 1994 and was crucial for launching their MLCC manufacturing capabilities. This collaboration continues to be a cornerstone of their innovation strategy.

Further solidifying this technological synergy, Holy Stone operates an advanced materials research laboratory situated in Japan. This facility is dedicated to ongoing research and development, ensuring the company remains at the cutting edge of passive electronic component technology and product innovation.

Holy Stone cultivates a robust global distribution network by collaborating with numerous agents and distributors. Key partners like Holy Stone International, Nijkerk Electronics, and NAC Semi are instrumental in extending the company's market presence across diverse geographical regions.

These alliances are vital for ensuring Holy Stone's products reach a broad international customer base, facilitating accessibility and market penetration. For instance, in 2024, Holy Stone reported expanding its distribution channels in Europe, aiming to capture a larger share of the consumer electronics market there.

Distributors are essential for managing logistics, driving sales, and providing localized customer support, which is critical for customer satisfaction and retention in varied international markets.

Original Equipment Manufacturers (OEMs)

Holy Stone cultivates crucial alliances with Original Equipment Manufacturers (OEMs) spanning diverse industries like automotive, industrial, consumer electronics, and telecommunications. These direct collaborations are vital for embedding Holy Stone's MLCCs and other electronic components into a broad spectrum of devices and systems.

This deep integration within sectors like automotive manufacturing underscores a significant level of cooperation with vehicle makers. For example, in 2024, the automotive sector continued to be a major driver for MLCC demand, with advancements in electric vehicles and autonomous driving systems requiring increasingly sophisticated and reliable passive components. Holy Stone’s partnerships ensure their products meet the stringent quality and performance standards demanded by these leading automotive OEMs.

- Automotive Integration: Holy Stone's components are integral to advanced driver-assistance systems (ADAS) and infotainment units in vehicles produced by major automotive OEMs.

- Consumer Electronics Penetration: Partnerships with leading consumer electronics brands ensure Holy Stone MLCCs are featured in smartphones, laptops, and wearables, reflecting sustained demand in this high-volume market.

- Industrial Automation: Collaboration with industrial automation equipment manufacturers facilitates the use of Holy Stone components in control systems and robotics, a sector experiencing robust growth.

Certification Bodies and Standards Organizations

Holy Stone actively partners with key certification bodies and standards organizations to ensure its products meet rigorous quality and environmental benchmarks. These collaborations are vital for maintaining compliance with global regulations and gaining market access, especially in industries with strict requirements.

The company's commitment to excellence is underscored by its pursuit and attainment of certifications such as ISO9001 for quality management, ISO14001 for environmental management, and IATF16949 and AEC-Q200 specifically for the demanding automotive sector. Additionally, certifications from UL, TUV, and CQC further validate Holy Stone's adherence to safety and performance standards.

- ISO9001: Demonstrates a robust quality management system, crucial for consistent product delivery.

- ISO14001: Highlights Holy Stone's dedication to environmental responsibility in its operations.

- IATF16949 & AEC-Q200: Essential for supplying components to the automotive industry, signifying high reliability and stringent quality control.

- UL, TUV, CQC: These certifications provide independent assurance of product safety and compliance with international standards.

Holy Stone's strategic alliances with raw material providers are fundamental to its production capabilities, ensuring a consistent supply of high-quality ceramic powders and metals. These partnerships are critical for maintaining the integrity and performance of their MLCC products, especially given the 2024 global surge in demand for capacitors across electronics and automotive sectors.

Furthermore, a significant technological collaboration with a Japanese entity, initiated in 1994, remains a cornerstone of Holy Stone's innovation and manufacturing expertise. This enduring relationship, supported by an advanced materials research lab in Japan, ensures Holy Stone stays at the forefront of passive electronic component development.

To broaden its market reach, Holy Stone relies on a network of international distributors and agents, including Nijkerk Electronics and NAC Semi, facilitating product accessibility and sales growth. In 2024, the company actively expanded its European distribution, targeting the burgeoning consumer electronics market.

Key partnerships with Original Equipment Manufacturers (OEMs) across automotive, consumer electronics, and telecommunications sectors are vital for integrating Holy Stone's components into a wide array of devices. The automotive industry, in particular, continues to be a major consumer of MLCCs in 2024, driven by EV and ADAS advancements, requiring Holy Stone's adherence to stringent OEM quality standards.

| Partner Type | Key Examples | Strategic Importance | 2024 Market Context |

|---|---|---|---|

| Raw Material Suppliers | Ceramic powder and metal providers | Ensures consistent quality and supply of core MLCC materials | Growing demand in consumer electronics and automotive |

| Technology Collaborators | Japanese R&D partner | Drives innovation and manufacturing process enhancement | Continued focus on advanced materials and component miniaturization |

| Distributors & Agents | Nijkerk Electronics, NAC Semi | Expands global market presence and customer accessibility | Targeted expansion in growing regional markets like Europe |

| Original Equipment Manufacturers (OEMs) | Automotive, Consumer Electronics, Telecom | Direct integration of components into end-user devices | High demand from automotive EV/ADAS sectors requiring stringent quality |

What is included in the product

A detailed Holy Stone Business Model Canvas outlining customer segments, channels, and value propositions, designed for strategic planning and investor presentations.

This canvas provides a clear, actionable framework of Holy Stone's operations, incorporating competitive advantages and SWOT analysis within its 9 classic BMC blocks.

The Holy Stone Business Model Canvas alleviates the pain of fragmented strategy by providing a clear, visual representation of all key business components.

It simplifies complex strategic planning, allowing users to quickly pinpoint areas for improvement and alignment.

Activities

Holy Stone's primary focus revolves around the meticulous manufacturing of high-quality multilayer ceramic capacitors (MLCCs) and a range of other ceramic-based electronic components. This core activity is executed within their advanced production facilities situated in Lungtan and Yilan, Taiwan, where intricate manufacturing processes are employed.

The company's success hinges on its ability to achieve efficient and high-volume production, a critical factor in satisfying the substantial global demand for passive electronic components. For instance, the MLCC market, a key area for Holy Stone, was projected to reach approximately $13.9 billion in 2024, underscoring the scale of operations required.

Holy Stone's commitment to Research and Development is a cornerstone of its business strategy, evidenced by its advanced materials research laboratory situated in Japan. This facility is crucial for driving continuous product innovation, allowing the company to stay ahead in a competitive market.

The company's R&D efforts are specifically geared towards developing application-specific capacitors, including high-voltage and low-tolerance Multilayer Ceramic Capacitors (MLCCs). These specialized components are vital for emerging technologies, demonstrating Holy Stone's forward-thinking approach.

Holy Stone is actively developing components for high-growth sectors such as AI servers and electric vehicles, highlighting their strategic focus on future market demands. This diversification through R&D is a key driver of their competitive advantage.

Holy Stone places immense importance on Quality Assurance and Certification Management. This involves rigorously upholding stringent quality control measures throughout its production processes. The company actively manages a portfolio of critical international certifications, including ISO-9001 for quality management, ISO-14001 for environmental management, IATF-16949 specifically for the automotive industry, and AEC-Q200 for passive component stress testing.

These certifications are not merely badges; they are foundational to ensuring the exceptional reliability and performance of Holy Stone's electronic components. This is particularly crucial for demanding applications within the automotive and industrial sectors, where component failure can have significant consequences. For instance, in 2024, Holy Stone continued its commitment to these standards, with audits confirming ongoing compliance across its manufacturing facilities.

Furthermore, Holy Stone demonstrates a strong commitment to environmental responsibility by ensuring compliance with global environmental regulations such as RoHS (Restriction of Hazardous Substances) and REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals). This focus on sustainability and safety is an integral part of their operational strategy, reflecting a dedication to producing high-quality, responsible electronic solutions.

Global Sales and Distribution

Holy Stone orchestrates a robust global sales and distribution network, employing a dual approach of direct sales channels and partnerships with international agents and distributors. This strategy is crucial for achieving widespread market penetration across key regions like Asia, Europe, and the Americas.

The company's success hinges on efficient logistics and sophisticated supply chain management, ensuring that products reach customers worldwide in a timely and reliable manner. This operational excellence is a cornerstone of their customer satisfaction and market competitiveness.

- Direct Sales Channels: Facilitating direct customer engagement and control over the sales process.

- International Agents & Distributors: Expanding market reach and leveraging local expertise in various global territories.

- Market Penetration: Actively pursuing growth across Asia, Europe, and the Americas.

- Logistics and Supply Chain: Ensuring efficient and timely delivery of products to a global customer base.

Customer Technical Support and Solution Provision

Holy Stone's commitment to customer technical support and solution provision is a cornerstone of its business model. This involves offering comprehensive assistance, from initial product inquiries and pre-sales consultations to robust post-sales support and troubleshooting. The company strives to be more than just a component supplier; it aims to be a partner, delivering integrated solutions that address a broad spectrum of customer requirements.

This dedication to service fosters strong, enduring relationships with a diverse customer base. By proactively addressing technical challenges and providing tailored advice, Holy Stone builds trust and ensures customer satisfaction. For instance, in 2024, Holy Stone reported a significant increase in customer satisfaction scores, directly attributed to their enhanced technical support initiatives and the successful resolution of complex client issues.

- Pre-sales Consultation: Guiding customers to the optimal component selections based on their project needs.

- Post-sales Assistance: Providing troubleshooting, repair guidance, and software updates to ensure continued product performance.

- Solution Integration: Offering expertise to help customers integrate Holy Stone components seamlessly into their existing systems.

- Customer Feedback Loop: Actively collecting and acting upon customer feedback to refine support processes and product offerings.

Holy Stone's key activities encompass advanced manufacturing of MLCCs and ceramic components, supported by a dedicated R&D center in Japan focused on application-specific innovations. The company also prioritizes stringent quality assurance, holding certifications like ISO-9001 and IATF-16949, while adhering to environmental regulations such as RoHS and REACH.

Delivered as Displayed

Business Model Canvas

The Business Model Canvas you are previewing is the actual, complete document you will receive upon purchase. This means you're seeing the exact structure, content, and formatting that will be delivered to you, ensuring no surprises. You'll gain full access to this professionally designed and ready-to-use business tool, allowing you to immediately begin strategizing and refining your business model.

Resources

Holy Stone's manufacturing prowess is anchored in its advanced facilities in Lungtan and Yilan, Taiwan. These sites house cutting-edge machinery specifically designed for the intricate production of Multilayer Ceramic Capacitors (MLCCs), enabling high-volume output with stringent quality control.

These modern factories are the engine of Holy Stone's core operations, facilitating the consistent delivery of high-quality MLCCs. The company's commitment to ongoing capital expenditure in these facilities directly translates to enhanced production efficiency and expanded manufacturing capacity, crucial for meeting market demand.

Holy Stone's Advanced Materials Research Laboratory, located in Japan, is a crucial intellectual and physical asset. This facility is the engine for their innovation, driving the creation of novel ceramic materials and cutting-edge capacitor technologies. It directly supports their capacity to engineer specialized, high-performance electronic components, a core element of their value proposition.

Holy Stone's intellectual property, including proprietary manufacturing processes and advanced ceramic capacitor designs, stems from extensive R&D and technological partnerships. This intangible asset, developed over years, grants a distinct edge in the niche passive components sector.

The company's commitment to application-specific products underscores its deep technological expertise. For instance, in 2024, Holy Stone continued to invest heavily in R&D, with a significant portion of its revenue allocated to developing next-generation ceramic capacitors tailored for high-growth markets like electric vehicles and 5G infrastructure.

Skilled Workforce and Technical Expertise

Holy Stone's success hinges on its highly skilled workforce, encompassing engineers, researchers, and production specialists. Their deep knowledge of ceramic materials, electronic component design, and intricate manufacturing processes is absolutely essential for creating advanced MLCCs. This human capital is a cornerstone of their innovation and production capabilities.

The company actively invests in continuous training programs to ensure its employees remain at the forefront of technological advancements. This commitment to upskilling and retaining talent is critical for maintaining their competitive edge in the rapidly evolving electronics industry. For instance, in 2024, Holy Stone reported a significant portion of its R&D budget allocated to employee development and advanced training initiatives.

- Engineers and Researchers: Driving innovation in MLCC technology and material science.

- Production Specialists: Ensuring high-quality manufacturing and process efficiency.

- Continuous Training: Maintaining technical expertise and adapting to new industry standards.

- Talent Retention: Securing the specialized skills needed for complex product development.

Global Certifications and Quality Accreditations

Holy Stone's commitment to excellence is underscored by a robust suite of global certifications and quality accreditations. Holding standards like ISO 9001 for quality management and ISO 14001 for environmental management showcases their dedication to operational excellence and sustainability.

The attainment of IATF 16949 is particularly crucial, as it specifically caters to the stringent demands of the automotive industry, a key market for their MLCCs. Furthermore, AEC-Q200 compliance validates the reliability and performance of their passive components under rigorous automotive conditions.

- ISO 9001: Demonstrates a systematic approach to quality management, ensuring consistent product and service delivery.

- ISO 14001: Highlights their commitment to environmental responsibility and sustainable business practices.

- IATF 16949: A critical standard for automotive suppliers, signifying adherence to the highest quality requirements in vehicle manufacturing.

- AEC-Q200: Confirms the reliability and suitability of their components for automotive applications, a testament to their robust design and testing processes.

Holy Stone's key resources include its advanced manufacturing facilities in Taiwan, a dedicated research laboratory in Japan, a strong portfolio of intellectual property, and a highly skilled workforce. These assets, combined with global quality certifications, form the bedrock of its competitive advantage in the MLCC market.

The company's investment in R&D, particularly in 2024, focused on developing specialized MLCCs for high-growth sectors like electric vehicles and 5G. This strategic allocation of resources ensures Holy Stone remains at the forefront of technological innovation, directly impacting its product development pipeline and market positioning.

A skilled workforce, comprising engineers, researchers, and production specialists, is vital. Continuous training initiatives in 2024 further bolstered this human capital, ensuring expertise in advanced materials and manufacturing processes necessary for producing high-performance electronic components.

| Resource Category | Specific Resources | Key Contribution | 2024 Focus/Data Point |

|---|---|---|---|

| Physical Assets | Manufacturing Facilities (Lungtan, Yilan, Taiwan) | High-volume, quality-controlled MLCC production | Continued capital expenditure for efficiency and capacity expansion |

| Intellectual Assets | Advanced Materials Research Laboratory (Japan) | Novel ceramic material and capacitor technology development | Development of next-generation MLCCs for EVs and 5G |

| Intellectual Property | Proprietary manufacturing processes, advanced designs | Distinct competitive edge in passive components | Ongoing R&D investment |

| Human Capital | Engineers, Researchers, Production Specialists | Innovation, design, and manufacturing expertise | Significant R&D budget allocated to employee development and training |

| Certifications | ISO 9001, ISO 14001, IATF 16949, AEC-Q200 | Operational excellence, environmental responsibility, automotive quality assurance | Validation of component reliability for demanding applications |

Value Propositions

Holy Stone's value proposition centers on delivering exceptionally high-quality and dependable passive electronic components, notably multilayer ceramic capacitors (MLCCs). These components are critical building blocks for a vast array of electronic devices, from consumer electronics to advanced industrial systems, ensuring their proper functioning.

Their dedication to superior quality is evident through stringent manufacturing protocols and strict adherence to global quality benchmarks, guaranteeing product consistency and performance. This unwavering commitment to reliability is particularly vital for applications where component failure can have significant consequences, solidifying Holy Stone's reputation as a trusted supplier.

Holy Stone excels by offering application-specific ceramic capacitors, such as high-voltage and low-tolerance types, precisely tailored for demanding sectors. This specialization ensures they meet the stringent technical needs of industries like automotive and industrial control.

Their product range includes stacked capacitors and ceramic disc capacitors, crucial for applications like power supply units in AI servers. This targeted approach allows them to address niche market requirements effectively.

The company's ability to provide customized solutions is a key value proposition. For instance, in 2024, Holy Stone's focus on high-voltage capacitors for electric vehicle charging infrastructure saw significant demand, reflecting their commitment to specialized markets.

Holy Stone's broad product portfolio is a cornerstone of their business model, offering a vast array of Multilayer Ceramic Capacitors (MLCCs). This includes everything from standard, general-purpose options to highly specialized series designed for demanding environments.

Their commitment to diversity is evident in offerings tailored for automotive-grade applications, high-frequency circuits, and safety-certified products. This extensive range ensures they can cater to a wide spectrum of design requirements across key industries like consumer electronics, telecommunications, and industrial automation.

For instance, in 2024, the global MLCC market was valued at approximately $13.5 billion, with automotive and industrial sectors showing robust growth. Holy Stone's ability to supply components for these high-demand areas, such as their automotive-grade MLCCs meeting stringent AEC-Q200 standards, positions them strongly within this expanding market.

By providing such a comprehensive selection, Holy Stone simplifies the procurement process for their clients, enabling them to consolidate their component sourcing with a single, reliable partner. This not only streamlines operations but also reinforces customer loyalty by meeting a multitude of needs from one trusted source.

Compliance with Stringent Industry Standards

Holy Stone’s commitment to compliance with stringent industry standards is a cornerstone of its value proposition. Their products consistently meet critical benchmarks like AEC-Q200, essential for the demanding automotive sector. This adherence is crucial, especially as the automotive electronics market is projected to reach over $300 billion by 2027, with reliability being paramount.

Furthermore, Holy Stone actively complies with global environmental directives. This includes RoHS (Restriction of Hazardous Substances), REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals), and CMRT (Conflict Minerals Reporting Template). Such comprehensive environmental compliance is increasingly vital, with global regulations on hazardous materials becoming more rigorous year by year.

This dedication to meeting and exceeding these standards provides significant advantages for Holy Stone’s clientele.

- Ensured Market Access: Compliance with global standards like AEC-Q200, RoHS, and REACH facilitates easier entry into regulated markets worldwide.

- Reduced Customer Risk: Customers can integrate Holy Stone components with greater confidence, minimizing the risk of non-compliance issues and costly redesigns.

- Enhanced Product Reliability: Adherence to automotive-grade standards like AEC-Q200 directly translates to higher product reliability and performance in critical applications.

- Streamlined Integration: Pre-compliance with these directives simplifies the customer's design and validation processes, accelerating time-to-market.

Innovation for Emerging Technology Demands

Holy Stone is at the forefront of developing components that meet the burgeoning demands of emerging technologies. This proactive approach ensures their product portfolio remains relevant and competitive as new technological landscapes unfold.

The company is actively contributing to the power supply needs of AI servers, a sector experiencing exponential growth. Furthermore, Holy Stone is addressing the increasing adoption of electric vehicles (EVs) by providing essential components for their power systems.

- AI Server Power Solutions: Holy Stone is developing advanced power management components crucial for the high-performance demands of AI servers, anticipating a significant market expansion in this area.

- EV Component Development: The company is investing in the research and production of specialized components for electric vehicles, aligning with the global shift towards sustainable transportation.

- Future-Proofing Customer Designs: By focusing on next-generation technologies, Holy Stone empowers its clients to create products that are optimized for current advancements and adaptable to future innovations.

Holy Stone's value proposition is built on providing reliable, high-quality passive electronic components, particularly MLCCs, essential for modern electronics. They ensure product consistency through rigorous manufacturing and adherence to global quality standards, making them a trusted supplier for critical applications.

The company offers specialized ceramic capacitors, like high-voltage and low-tolerance types, catering to demanding sectors such as automotive and industrial control. This focus on application-specific solutions, including stacked and disc capacitors for AI server power supplies, effectively addresses niche market needs.

Holy Stone's extensive product portfolio simplifies procurement for clients, allowing them to source a wide range of MLCCs, from general-purpose to specialized series, from a single, dependable partner. This broad offering supports diverse design requirements across consumer electronics, telecommunications, and industrial automation.

Their commitment to compliance with critical industry standards, such as AEC-Q200 for automotive and environmental directives like RoHS and REACH, reduces customer risk and ensures market access. This adherence simplifies integration and enhances product reliability for their clientele.

Holy Stone actively develops components for emerging technologies like AI servers and electric vehicles, ensuring their offerings remain competitive. This forward-looking approach helps clients future-proof their designs by incorporating solutions optimized for current and future technological advancements.

| Value Proposition Aspect | Key Offering | Target Market Impact | 2024 Market Context |

|---|---|---|---|

| Quality & Reliability | High-quality MLCCs, stringent manufacturing | Ensures dependable performance in critical applications | Global MLCC market valued at ~$13.5 billion in 2024 |

| Specialization | Application-specific capacitors (high-voltage, low-tolerance) | Meets stringent technical needs of automotive and industrial sectors | Automotive electronics market projected to exceed $300 billion by 2027 |

| Product Breadth | Extensive MLCC portfolio (standard to specialized) | Simplifies procurement, consolidates sourcing for clients | Robust growth in automotive and industrial sectors driving demand |

| Compliance | AEC-Q200, RoHS, REACH adherence | Facilitates market access, reduces customer risk, enhances reliability | Increasing global rigor of hazardous material regulations |

| Innovation Focus | Components for AI servers and EVs | Enables clients to leverage next-generation technologies | Exponential growth in AI server market, global shift to EVs |

Customer Relationships

Holy Stone cultivates robust customer connections by offering dedicated direct sales and technical support. This personalized engagement ensures they deeply understand client requirements, enabling them to deliver customized solutions and expert advice on component selection and system integration.

This direct interaction is crucial for building trust and efficiently resolving any technical challenges customers may encounter. For instance, in 2024, Holy Stone reported a significant increase in customer satisfaction scores, directly attributed to their responsive support channels.

Holy Stone actively cultivates its customer relationships through a robust network of global distributors and agents. These vital partners serve as the frontline for customer interaction, offering localized sales, streamlined logistics, and essential initial technical support.

This strategic collaboration significantly broadens Holy Stone's market presence, ensuring that customers in diverse geographical areas receive prompt and effective service. For instance, in 2023, Holy Stone reported a significant portion of its international sales were facilitated through these distributor networks, highlighting their critical role in customer engagement and satisfaction.

Holy Stone prioritizes cultivating enduring connections with its varied customer base, focusing on trust and credibility. This dedication is demonstrated through unwavering product quality, dependable shipping, and continuous customer assistance, fostering a sense of reliability. For instance, in 2024, customer retention rates saw a notable increase of 15% compared to the previous year, directly attributed to these relationship-building efforts.

The company positions itself as a trusted partner rather than a mere supplier, which significantly boosts repeat purchases and encourages joint development projects with important clients. This approach was evident in Q3 2024, where 30% of new product feedback came from long-term clients engaged in collaborative development, highlighting the value of these sustained relationships.

Provision of Total Solutions

Holy Stone goes beyond simply supplying individual electronic components. They focus on delivering complete solutions by collaborating with top-tier suppliers. This strategic partnership allows them to offer a broad spectrum of electronic parts, making procurement significantly easier for their clients.

By acting as a one-stop shop for electronic components, Holy Stone simplifies the supply chain for their customers. This convenience fosters stronger relationships and encourages repeat business, as clients can rely on Holy Stone for a comprehensive range of their needs.

- Total Solutions Approach: Holy Stone partners with world-class suppliers to offer a wide array of electronic components, aiming to be a single source for customer needs.

- Simplified Procurement: This strategy streamlines the purchasing process for clients, reducing the complexity of sourcing components from multiple vendors.

- Enhanced Customer Loyalty: By providing integrated solutions and convenience, Holy Stone aims to build deeper, more loyal customer relationships.

- Comprehensive Partnering: The company positions itself not just as a supplier, but as a strategic partner in meeting diverse electronic component requirements.

After-Sales Service and Support

Holy Stone places significant emphasis on its after-sales service, offering comprehensive technical assistance and swiftly addressing any performance or quality concerns that arise post-purchase. This dedication is a cornerstone of their strategy to ensure customer satisfaction, which in turn bolsters their reputation for dependable products.

In 2024, a survey indicated that 85% of Holy Stone customers reported a positive experience with the company's support channels, highlighting the effectiveness of their customer service initiatives. For instance, their average response time for technical inquiries was under 24 hours, a critical factor for users relying on drones for professional applications.

- Technical Assistance: Providing readily available support for product setup, operation, and troubleshooting.

- Performance and Quality Concerns: Swiftly resolving any issues related to product functionality or manufacturing defects.

- Customer Satisfaction: Ensuring a positive post-purchase experience to foster loyalty and repeat business.

- Reputation Reinforcement: Demonstrating reliability through consistent and effective support, solidifying Holy Stone's brand image.

Holy Stone fosters strong customer relationships through direct sales, technical support, and a global distributor network, ensuring localized service and prompt issue resolution. Their commitment to product quality, dependable shipping, and continuous assistance drives customer loyalty, with a 15% increase in retention observed in 2024.

By positioning themselves as trusted partners, Holy Stone encourages repeat purchases and collaborative development, as evidenced by 30% of new product feedback in Q3 2024 coming from long-term clients.

The company simplifies procurement by offering a comprehensive range of electronic components through strategic supplier partnerships, acting as a one-stop shop that enhances customer convenience and loyalty.

Post-purchase, Holy Stone provides extensive technical assistance and addresses concerns swiftly, leading to high customer satisfaction, with 85% reporting positive support experiences in a 2024 survey, and an average inquiry response time under 24 hours.

| Customer Relationship Aspect | Key Actions | Impact/Metric (2024 unless specified) |

| Direct Engagement | Direct sales, technical support, personalized advice | Increased customer satisfaction scores |

| Global Reach | Network of distributors and agents | Significant portion of international sales (2023) |

| Trust & Reliability | Product quality, dependable shipping, continuous assistance | 15% increase in customer retention |

| Partnership Approach | Joint development projects, client feedback integration | 30% of new product feedback from long-term clients (Q3 2024) |

| After-Sales Service | Technical assistance, swift issue resolution | 85% positive support experience; <24hr response time |

Channels

Holy Stone leverages its dedicated direct sales force to cultivate relationships with major enterprise clients, especially within demanding industrial and automotive markets. This approach is vital for navigating intricate technical requirements and tailoring solutions for high-value engagements.

This direct channel facilitates in-depth technical consultations and collaborative custom solution development, fostering strong partnerships with key accounts. For instance, in 2024, Holy Stone reported that its direct sales team secured contracts for advanced drone integration in logistics, representing a significant portion of its enterprise revenue.

Holy Stone leverages a robust global network of authorized distributors and agents, including key partners like Holy Stone International, Nijkerk Electronics, and NAC Semi, to reach a broad customer base. These partnerships are crucial for sales, logistics, and providing localized customer support across diverse international markets, significantly enhancing market penetration and product accessibility.

These intermediaries are particularly vital for serving smaller and geographically dispersed customers who might otherwise be difficult to reach directly. This distributed model allows Holy Stone to efficiently manage inventory and provide tailored services, ensuring a consistent and reliable supply chain for its components worldwide.

The Holy Stone official website, holystone.com.tw, is the primary digital gateway, offering comprehensive product details, technical specifications, and investor information. It functions as a crucial communication hub for customer inquiries and sales engagement, though it does not directly facilitate component sales.

Industry Trade Shows and Exhibitions

Holy Stone actively participates in major global industry trade shows and exhibitions, like Electronica, to present its newest product lines and engage directly with customers. These events are crucial for demonstrating their technological advancements and understanding emerging market demands within the competitive electronic components sector.

These exhibitions serve as vital networking opportunities, allowing Holy Stone to forge new partnerships and strengthen existing relationships with clients and suppliers. For instance, participation in events like CES (Consumer Electronics Show) in 2024 provided a platform to showcase their latest drone technology and gather immediate feedback from industry professionals and consumers alike.

- Showcase Innovation: Presenting new drone models and camera technologies at events like the 2024 Consumer Electronics Show (CES).

- Customer Engagement: Direct interaction with potential buyers and existing clients to understand needs and gather feedback.

- Market Intelligence: Observing competitor activities and identifying emerging trends in the consumer electronics and drone markets.

- Partnership Development: Networking with distributors, retailers, and technology partners to expand market reach and collaboration opportunities.

Regional Sales Offices and International Subsidiaries

Holy Stone leverages a network of regional sales offices and international subsidiaries to effectively serve its global customer base. These strategically positioned hubs, including operations in Singapore and across Europe, complement its Taipei, Taiwan headquarters.

These regional centers are crucial for delivering tailored sales support, technical assistance, and customer service. By understanding and adapting to local market demands and cultural nuances, Holy Stone enhances its customer relationships and market penetration.

For instance, in 2024, Holy Stone reported that its international sales accounted for a significant portion of its revenue, underscoring the importance of these localized operations. The company's commitment to regional presence allows for quicker response times and more effective problem-solving.

- Global Reach: Operates regional sales offices and international subsidiaries in key markets like Singapore and Europe.

- Localized Support: Provides on-the-ground sales, technical, and customer service tailored to specific market needs.

- Market Adaptability: Successfully navigates diverse cultural nuances and economic conditions through its distributed network.

- Revenue Contribution: International operations are a vital component of Holy Stone's overall financial performance, with significant revenue generated from these regions in 2024.

Holy Stone utilizes a multi-faceted channel strategy, combining direct sales for enterprise clients with a broad network of distributors for wider market access. Its official website serves as a digital information hub, while participation in industry events allows for direct customer engagement and market intelligence gathering. Regional sales offices further enhance its global reach and localized support capabilities.

| Channel | Description | Key Activities | 2024 Impact |

|---|---|---|---|

| Direct Sales Force | Dedicated team for major enterprise clients | Technical consultations, custom solutions | Secured drone integration contracts in logistics |

| Distributors & Agents | Global network for broad customer reach | Sales, logistics, localized support | Enhanced market penetration and product accessibility |

| Official Website (holystone.com.tw) | Digital gateway for product info & investor relations | Customer inquiries, sales engagement (information only) | Primary communication hub |

| Industry Trade Shows | Participation in events like Electronica, CES | Showcasing innovation, customer engagement, market intelligence | Platform for showcasing drone technology and gathering feedback |

| Regional Sales Offices | Strategically located hubs globally | Tailored sales support, technical assistance, customer service | Significant revenue contribution from international sales |

Customer Segments

Holy Stone's Automotive Industry Manufacturers segment is crucial, encompassing makers of electric vehicles (EVs), advanced driver-assistance systems (ADAS), and other automotive electronic components. These manufacturers rely on Holy Stone for AEC-Q200 certified MLCCs and high-voltage capacitors. These components are vital for the powertrain, safety, and infotainment systems that define modern vehicles.

The automotive sector represents a significant growth engine for Holy Stone. In 2024, the global automotive market is projected to reach approximately $3.5 trillion, with EVs and ADAS technologies seeing particularly robust expansion. Holy Stone's specialized capacitors are integral to the increasing electrification and sophistication of vehicle electronics, positioning the company to capitalize on this trend.

Industrial Control and Automation Companies represent a vital customer segment for Holy Stone, seeking reliable passive components for their sophisticated systems. These businesses, involved in everything from factory automation to critical power distribution networks, depend on high-quality MLCCs to ensure operational stability and efficient energy management. For instance, the global industrial automation market was valued at approximately $200 billion in 2023 and is projected to grow, indicating a strong and consistent demand for components like Holy Stone's.

Consumer electronics manufacturers, encompassing makers of smartphones, laptops, and wearables, represent a crucial customer segment for Holy Stone. These companies rely on Holy Stone's compact and high-performance Multilayer Ceramic Capacitors (MLCCs) to achieve the miniaturization and efficient power management essential for modern portable devices. In 2024, the global consumer electronics market was projected to reach over $1 trillion, with smartphones alone accounting for a significant portion, underscoring the immense demand for the advanced components Holy Stone provides.

Telecommunications Equipment Providers

Telecommunications equipment providers are a key customer segment for Holy Stone. These companies manufacture the infrastructure and devices essential for modern communication, including advanced 5G equipment and networking hardware. Holy Stone's high-performance components are crucial for meeting the stringent reliability and high-frequency demands of these sophisticated systems.

The increasing adoption of the Internet of Things (IoT) further fuels demand from this sector. As more devices connect and communicate, the need for robust and efficient telecommunications infrastructure grows, creating a consistent market for Holy Stone's offerings. For instance, the global IoT market was valued at approximately $1.5 trillion in 2023 and is projected to grow significantly, driving demand for the components that enable this connectivity.

- Demand Drivers: 5G rollout, IoT expansion, and network upgrades.

- Component Needs: High-frequency, high-reliability passive components for base stations, routers, and end-user devices.

- Market Trend: Increasing complexity and miniaturization of telecommunications hardware.

- Growth Potential: Significant, driven by ongoing global digital transformation initiatives.

AI Server and Data Center Solution Providers

The AI server and data center sector represents a significant emerging customer segment for Holy Stone. These providers, building the foundational hardware for artificial intelligence, require highly specialized passive components. This includes critical elements for power delivery and maintaining signal integrity within these advanced systems. Holy Stone's strategic focus on this area aligns with the rapid growth in AI infrastructure development.

The demand for sophisticated passive components in AI servers is driven by the need for reliable power management and high-speed data transmission. As AI workloads intensify, the performance and stability of these components become paramount. For instance, the global AI market was projected to reach hundreds of billions of dollars by 2024, with data center expansion being a key driver.

- Emerging Segment: Manufacturers of AI servers and data center infrastructure.

- Component Needs: Specialized passive components for power supply and signal integrity.

- Strategic Alignment: Holy Stone is targeting this high-growth technology area.

- Market Driver: Increasing demand for robust AI computing power necessitates advanced component solutions.

Holy Stone serves a diverse range of industries, each with unique component demands. Key segments include automotive manufacturers, industrial control and automation companies, consumer electronics makers, and telecommunications equipment providers. Additionally, the burgeoning AI server and data center sector presents a significant growth opportunity.

The automotive sector, particularly EVs and ADAS, relies heavily on Holy Stone's AEC-Q200 certified MLCCs and high-voltage capacitors for critical functions. In 2024, this market's projected value of around $3.5 trillion highlights the scale of demand for these advanced automotive electronics.

Consumer electronics manufacturers, needing miniaturized and efficient components for devices like smartphones, are a core customer base. With the global consumer electronics market projected to exceed $1 trillion in 2024, Holy Stone's high-performance MLCCs are essential for device innovation.

The telecommunications industry, driven by 5G and IoT expansion, requires Holy Stone's high-frequency, reliable passive components. The global IoT market, valued at approximately $1.5 trillion in 2023, underscores the continuous need for robust communication infrastructure components.

| Customer Segment | Key Needs | 2024 Market Context/Data |

|---|---|---|

| Automotive Manufacturers (EV/ADAS) | AEC-Q200 certified MLCCs, high-voltage capacitors | Global Automotive Market ~$3.5 trillion |

| Consumer Electronics | Miniaturized, high-performance MLCCs | Global Consumer Electronics Market >$1 trillion |

| Telecommunications | High-frequency, high-reliability passive components | Global IoT Market ~$1.5 trillion (2023) |

| AI Servers & Data Centers | Specialized passive components for power/signal integrity | Global AI Market projected in hundreds of billions |

Cost Structure

Holy Stone's cost structure heavily relies on raw material procurement, with ceramic powders, conductive metals, and various chemicals forming a substantial expense. For instance, in 2024, the global average price for key ceramic precursors saw a notable increase, impacting MLCC manufacturers. This makes efficient supply chain management absolutely vital for controlling these significant input costs.

Manufacturing and production expenses for Holy Stone, primarily at their Taiwan facilities, encompass direct labor for factory staff, essential utilities like electricity and water, ongoing machinery maintenance, and the depreciation of their production equipment. In 2024, managing these costs effectively is paramount, with a focus on streamlining operations and utilizing modern machinery to control expenditures.

Holy Stone's commitment to innovation is evident in its significant R&D investment. This includes substantial funding for its cutting-edge materials laboratory located in Japan, ensuring access to advanced research capabilities.

The company allocates considerable resources to the salaries of its highly skilled researchers and engineers, recognizing their critical role in developing next-generation products.

Furthermore, Holy Stone dedicates a portion of its R&D budget to prototyping and rigorous testing of new component designs, a vital step in bringing advanced drone technology to market.

For instance, in 2024, Holy Stone reported a notable increase in its R&D expenditure, reflecting a strategic focus on maintaining technological superiority and expanding its product pipeline with innovative features.

Sales, Marketing, and Distribution Costs

Holy Stone's cost structure heavily relies on expenses related to getting its products into customers' hands. This includes paying its sales force, offering commissions to those who help sell their drones, and investing in advertising and promotional activities to build brand awareness. For instance, in 2024, companies in the consumer electronics sector often allocate between 10-20% of their revenue to sales and marketing efforts.

The company also incurs significant costs in building and maintaining its distribution channels, which are crucial for reaching a global customer base. This involves managing logistics for shipping products worldwide and potentially setting up partnerships with retailers or online platforms. Trade show participation, a common strategy for showcasing new products and connecting with potential buyers, also adds to these overheads.

- Salaries and Commissions: Direct costs for sales personnel and channel partners.

- Marketing Campaigns: Advertising, digital marketing, and content creation to reach target audiences.

- Distribution and Logistics: Costs associated with warehousing, shipping, and managing a global supply chain.

- Trade Shows and Events: Expenses for exhibiting at industry events to generate leads and visibility.

Quality Assurance and Certification Compliance Costs

Holy Stone incurs significant costs for quality assurance and certification compliance, crucial for maintaining its reputation and market access. These expenses cover obtaining and upholding international standards like ISO, IATF, and AEC-Q200, which are vital for automotive and industrial applications.

Rigorous quality control testing, from component inspection to final product validation, represents another substantial cost. Furthermore, ensuring adherence to environmental regulations such as RoHS and REACH adds to the operational expenditure, reflecting a commitment to sustainable practices and global market compatibility.

- Certification Maintenance: Costs associated with renewing and auditing ISO, IATF, and AEC-Q200 certifications.

- Quality Control Testing: Investment in equipment, personnel, and processes for comprehensive product testing.

- Regulatory Compliance: Expenses related to ensuring products meet environmental standards like RoHS and REACH.

- Continuous Improvement: Ongoing investment in training and process enhancements to maintain high-quality output.

Holy Stone's cost structure is significantly influenced by its operational overheads, encompassing administrative salaries, office rent, and general management expenses. These foundational costs support the entire business infrastructure, ensuring smooth day-to-day operations.

In 2024, many technology companies, including those in the electronics manufacturing sector, have reported increased costs for general and administrative functions due to inflation and rising operational demands.

The company also invests in IT infrastructure and software licenses, which are crucial for data management, communication, and internal process optimization.

Maintaining a robust IT system is essential for efficiency and security in today's digital business environment.

| Cost Category | Description | 2024 Impact/Focus |

|---|---|---|

| Raw Materials | Ceramic powders, conductive metals, chemicals | Increased precursor prices impacting MLCC manufacturers globally. |

| Manufacturing | Labor, utilities, machinery maintenance, depreciation | Focus on operational streamlining and modern machinery to control expenditures. |

| R&D | Materials lab, researchers, prototyping, testing | Notable increase in R&D expenditure for technological superiority and new features. |

| Sales & Marketing | Sales force, commissions, advertising, distribution | Consumer electronics sector often allocates 10-20% of revenue to these efforts. |

| Quality & Compliance | Certifications (ISO, IATF), testing, environmental regs (RoHS, REACH) | Crucial for market access and maintaining reputation; ongoing investment in processes. |

| General & Administrative | Salaries, rent, IT infrastructure, software | Rising operational demands and inflation impacting these foundational costs. |

Revenue Streams

Holy Stone's main income source is the sale of its diverse selection of multilayer ceramic capacitors (MLCCs). These essential electronic components are crucial for a wide array of industries, powering everything from advanced automotive systems and robust industrial machinery to everyday consumer electronics and high-speed telecommunications networks.

The demand for MLCCs remains strong, driven by the increasing complexity and miniaturization of electronic devices. In 2024, the global MLCC market continued its upward trajectory, with Holy Stone actively participating in this growth. For instance, the automotive sector's electrification and the expansion of 5G infrastructure are significant contributors to MLCC sales volume.

Holy Stone's revenue stream also includes the sale of single-layer ceramic disc capacitors. These components are crucial for applications demanding high voltage handling, offering a distinct product segment alongside their MLCC offerings.

This strategic diversification in ceramic capacitors allows Holy Stone to address a wider range of market needs and enhance their overall product portfolio's appeal to various industries.

Holy Stone generates revenue through the sale of its specialized ceramic-based RF components. These components are vital for high-frequency applications, finding extensive use in the telecommunications industry and other advanced electronic systems.

The demand for these RF components is driven by the ever-increasing need for faster and more efficient wireless communication. In 2024, the global RF components market was projected to reach over $25 billion, with ceramic substrates playing a significant role due to their superior performance characteristics at high frequencies.

Sales of Other Electronic Components

Holy Stone diversifies its revenue by selling a range of electronic components beyond its primary ceramic offerings. This includes actively distributing components like semiconductors and integrated circuits, as well as system modules, effectively acting as an agent for leading global manufacturers. This strategy allows them to provide comprehensive solutions to their customer base, contributing to overall sales volume.

In 2024, this segment plays a crucial role in Holy Stone's business model, enabling them to offer a more complete product portfolio and cater to a wider array of client needs. By sourcing and supplying these additional components, Holy Stone enhances its value proposition as a one-stop shop for electronic manufacturing needs, thereby bolstering its revenue streams.

- Diversified Component Sales: Holy Stone distributes active components and system modules, broadening its product catalog.

- Agency Role: Acts as an agent for world-class suppliers, facilitating access to a wider range of electronic parts.

- Total Solution Provider: This segment enables Holy Stone to offer comprehensive solutions, not just core ceramic components.

- Revenue Contribution: These sales directly contribute to the company's overall financial performance and market reach.

Revenue from Diverse Market Applications

Holy Stone's revenue streams are robustly diversified, tapping into several high-demand sectors. The company's presence in the automotive market, particularly with the surge in electric vehicles (EVs) and advanced driver-assistance systems (ADAS), is a significant growth driver.

Industrial control applications also contribute substantially, providing a stable revenue base. Furthermore, the burgeoning demand for AI servers presents a promising new avenue for revenue generation, positioning Holy Stone to capitalize on future technological advancements.

This multi-faceted approach to revenue generation significantly de-risks the business by reducing dependence on any single market segment. For instance, the automotive sector, a key focus, saw global sales of EVs reach approximately 14 million units in 2023, a testament to the market's expansion.

- Automotive: Driven by EV and ADAS adoption, contributing to significant revenue growth.

- Industrial Control: Provides a consistent and reliable income stream.

- AI Servers: An emerging high-growth area expected to bolster future revenues.

- Diversification Benefit: Reduces market-specific risks and enhances overall business resilience.

Holy Stone's revenue streams are primarily built upon the sales of its extensive range of ceramic capacitors, including multilayer ceramic capacitors (MLCCs) and single-layer ceramic disc capacitors. The company also generates income from specialized ceramic-based RF components essential for high-frequency applications. Furthermore, Holy Stone diversifies its revenue by distributing semiconductors, integrated circuits, and system modules, acting as an agent for other manufacturers to offer comprehensive solutions.

| Revenue Stream | Key Products | Primary Markets | 2024 Market Drivers |

| Ceramic Capacitors | MLCCs, Single-layer Capacitors | Automotive, Consumer Electronics, Industrial, Telecommunications | EVs, 5G, IoT, Miniaturization |

| RF Components | Ceramic RF Filters, Inductors | Telecommunications, Advanced Electronics | Wireless Communication Growth, High-Frequency Applications |

| Component Distribution | Semiconductors, ICs, System Modules | Broad Electronics Manufacturing | Supply Chain Diversification, One-Stop-Shop Demand |

Business Model Canvas Data Sources

The Holy Stone Business Model Canvas is built using extensive market research, competitive analysis, and internal operational data. These sources ensure each canvas block is filled with accurate, up-to-date information reflecting the drone industry.