Himax PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Himax Bundle

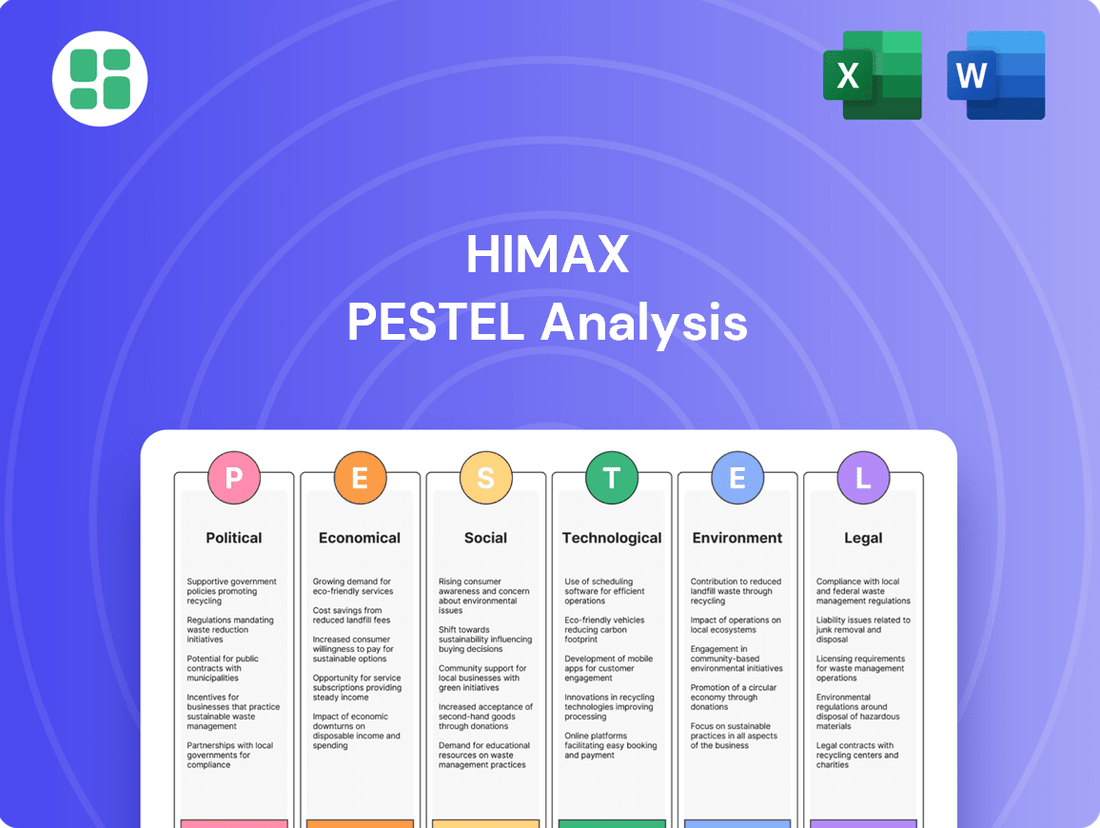

Navigate the complex external forces impacting Himax with our expert PESTLE Analysis. Understand the political, economic, social, technological, legal, and environmental factors that are shaping its trajectory and uncover hidden opportunities. Equip yourself with actionable intelligence to refine your strategy and gain a competitive edge. Download the full version now for immediate, in-depth insights.

Political factors

Himax Technologies, a Taiwanese semiconductor company, operates within a complex geopolitical landscape. The ongoing US-China trade tensions and the potential for cross-strait issues present significant risks to its global operations and supply chains. These tensions can disrupt the flow of essential components and finished goods, impacting production schedules and cost structures.

To navigate these challenges, Himax is actively working to enhance its supply chain resilience. This involves diversifying its manufacturing and sourcing locations to reduce reliance on any single region. The company is strategically strengthening its presence in key markets such as China, Korea, and Singapore, aiming to ensure greater flexibility and maintain cost competitiveness amidst global uncertainties.

Government initiatives, such as China's past subsidies for consumer electronics, have historically boosted demand for display components, a key segment for Himax Technologies. For instance, in 2023, China's efforts to stimulate its economy included measures that indirectly supported the consumer electronics market, benefiting suppliers like Himax.

National semiconductor strategies, like Taiwan's focus on advanced manufacturing and the US CHIPS and Science Act, aim to strengthen domestic chip production and innovation. These policies, with significant funding allocated through 2024-2025, could provide Himax with R&D grants or incentives for advanced packaging, potentially lowering operational costs and enhancing its competitive position in the global market.

The strength of intellectual property (IP) protection laws in Himax's key markets directly impacts its competitive standing. As a fabless semiconductor company, Himax's value is intrinsically tied to its innovative designs and patented technologies.

Himax's commitment to innovation is underscored by its substantial IP portfolio, which included 2,609 granted patents and 370 pending applications as of June 30, 2025. Strong legal frameworks for IP enforcement are vital to safeguarding these assets, deterring unauthorized use, and preserving Himax's market advantage in areas like advanced display drivers and AI-powered processors.

Trade Regulations and Tariffs

Changes in international trade agreements and tariffs significantly impact Himax's global operations. For instance, evolving export regulations like the Export Administration Regulations (EAR) can alter how Himax sells its products internationally. These shifts can necessitate costly adjustments to supply chains and affect the final price of their display driver ICs and wafer-level optics, potentially influencing customer demand in key markets.

Himax actively monitors these trade dynamics, recognizing their potential to create pricing pressures and affect market access. The company's financial reports often reflect concerns regarding ongoing tariff negotiations, underscoring the direct link between geopolitical trade policies and Himax's financial performance. For example, in their 2024 outlook, Himax cited trade uncertainties as a factor influencing their revenue projections.

- Trade Agreements: Himax must adapt to evolving trade pacts that can open or close markets for their semiconductor products.

- Tariffs: Imposed tariffs directly increase the cost of goods, impacting Himax's competitive pricing strategies and profit margins.

- Export Controls: Regulations such as EAR can restrict the sale of advanced technology to certain countries, limiting Himax's market reach.

- Supply Chain Impact: Trade policy shifts can force Himax to reconfigure its global manufacturing and sourcing, potentially leading to increased operational costs.

Regulatory Approvals for Investments

Himax Technologies' strategic growth, including investments in new technologies and subsidiary expansion, hinges on securing regulatory approvals across numerous global markets. These approvals can significantly influence the speed of international market entry, mergers and acquisitions, and substantial research and development funding. For instance, the semiconductor industry often faces scrutiny regarding intellectual property, national security implications, and fair competition, which can prolong or complicate approval processes.

Navigating this complex web of international regulations presents an ongoing challenge for a company like Himax, operating within the highly interconnected semiconductor sector. Different countries have varying requirements for foreign investment, technology transfer, and market access, demanding a proactive and adaptable approach to compliance. The ability to anticipate and address these regulatory hurdles is crucial for maintaining a competitive edge and achieving long-term expansion goals.

- Global Expansion Challenges: Himax's plans to establish new facilities or acquire companies in regions like the US, Europe, or Asia require adherence to local foreign direct investment (FDI) regulations and antitrust laws.

- Technology Transfer Scrutiny: Advanced semiconductor technologies are often subject to export controls and national security reviews, potentially impacting collaborations or sales to certain countries.

- M&A Approval Timelines: Acquisitions, such as potential strategic partnerships or outright purchases of smaller tech firms, can face lengthy antitrust reviews by bodies like the US Federal Trade Commission (FTC) or the European Commission, impacting deal closure dates.

- R&D Investment Hurdles: Significant investments in cutting-edge research, particularly in areas with dual-use potential, may attract governmental oversight or require specific licensing agreements to proceed.

Geopolitical tensions, particularly US-China trade friction, directly impact Himax's supply chain and market access, with ongoing negotiations in 2024-2025 potentially altering tariff structures. Government incentives, like Taiwan's semiconductor support initiatives and the US CHIPS Act, aim to bolster domestic production, offering Himax opportunities for R&D grants and advanced packaging incentives through 2025. Evolving trade agreements and export controls, such as the EAR, necessitate strategic adjustments to sales and pricing, as highlighted in Himax's 2024 revenue outlook which factored in trade uncertainties. Strong IP protection laws are critical for Himax, which held 2,609 granted patents and 370 pending applications as of June 30, 2025, to safeguard its technological advantage.

| Factor | Impact on Himax | 2024-2025 Relevance |

|---|---|---|

| US-China Trade Tensions | Supply chain disruption, market access limitations | Ongoing negotiations influencing tariffs and export regulations |

| Government Semiconductor Strategies (e.g., CHIPS Act) | Potential for R&D grants, manufacturing incentives | Funding allocated through 2025 for advanced manufacturing and innovation |

| Intellectual Property (IP) Protection | Safeguarding competitive advantage, deterring infringement | Himax's portfolio of 2,609 granted patents (as of June 30, 2025) relies on robust legal frameworks |

| Export Controls (e.g., EAR) | Restrictions on technology sales, market reach limitation | Constant monitoring and adaptation required for international sales strategies |

What is included in the product

This Himax PESTLE Analysis provides a comprehensive examination of the external macro-environmental factors influencing the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to empower strategic decision-making and identify potential opportunities and threats in the dynamic market landscape.

A clear, actionable summary of Himax's PESTLE analysis, presented in an easily digestible format, alleviates the pain of information overload during strategic planning.

Economic factors

Himax Technologies' financial performance is closely linked to the health of the global economy and how much consumers are spending on electronics. When the world economy is doing well, people tend to buy more gadgets like smartphones, laptops, and televisions, which directly boosts Himax's sales.

For instance, in 2023, global GDP growth was around 3.1%, providing a generally supportive environment for consumer electronics demand. However, if economic conditions become uncertain, customers might become more hesitant, leading to careful inventory decisions that can affect Himax's order volumes.

Looking ahead to 2024 and 2025, projections suggest continued, albeit potentially moderating, global economic growth. This trend is expected to support demand for Himax's display driver ICs and other semiconductor solutions, though geopolitical factors and inflation rates will remain key variables influencing consumer confidence and spending patterns.

Inflationary pressures directly impact Himax's operational costs, from sourcing essential raw materials to manufacturing processes and labor. These rising expenses can put a squeeze on the company's gross margins if not effectively managed.

Himax has proactively implemented rigorous expense controls and cost optimization strategies to counter these economic headwinds. This focus is crucial for maintaining profitability amidst a challenging macroeconomic landscape.

A testament to this strategy, Himax achieved a notable 5.6% reduction in its operating expenses for the entirety of 2024. This financial discipline demonstrates the company's commitment to navigating inflationary challenges and preserving its financial health.

Himax Technologies, with its global footprint and sales across various regions, is significantly exposed to currency exchange rate fluctuations, especially between its base currency, the Taiwanese Dollar (TWD), and the widely used US Dollar (USD). For instance, in the first quarter of 2024, Himax reported that foreign currency translation adjustments had a negative impact on its financial results, highlighting the real-time effect of these shifts.

When the TWD strengthens against the USD, Himax's reported revenues from sales denominated in USD can decrease when converted back to TWD, potentially impacting profitability. Conversely, a weaker TWD can boost reported revenues but also increase the cost of imported components if those are priced in USD.

These currency movements are a continuous risk for international semiconductor companies like Himax. For example, the TWD experienced periods of appreciation against the USD throughout 2023 and into early 2024, creating headwinds for companies with substantial dollar-denominated earnings.

Supply Chain Stability and Component Availability

Disruptions in the semiconductor supply chain, particularly shortages of essential components, pose a direct threat to Himax Technologies' manufacturing capacity and its ability to fulfill customer orders. For instance, the global semiconductor shortage that extended through much of 2022 and into 2023 significantly impacted lead times and production volumes across the industry.

In response to these macroeconomic volatilities, Himax has strategically prioritized enhancing its supply chain resilience and maintaining cautious inventory levels. This proactive approach is crucial for navigating unpredictable market conditions and ensuring consistent product delivery.

Key initiatives to bolster its supply chain include diversifying its partnerships for both foundry services and backend packaging and testing operations. This diversification reduces reliance on single suppliers, mitigating the risk of concentrated disruptions.

- Semiconductor Shortage Impact: Global shortages experienced in 2022-2023 led to extended lead times for critical components, affecting production schedules for many tech companies, including those relying on Himax's display driver ICs.

- Supply Chain Diversification: Himax is actively broadening its foundry partners and backend testing facilities to reduce dependency and improve flexibility in sourcing.

- Inventory Management: The company employs a conservative inventory strategy to buffer against unforeseen supply chain interruptions and demand fluctuations.

Market Demand for Display Products

The market demand for display products is a critical economic factor for Himax Technologies. The company's sales are directly tied to the demand for both large panel drivers, used in TVs and monitors, and small and medium-sized drivers, essential for smartphones and automotive displays.

In 2024, Himax experienced a shift in its revenue streams. While revenue from large panel display drivers saw a decline, the automotive sector emerged as a significant growth engine. Automotive driver IC sales became the largest contributor to Himax's revenue, underscoring the increasing importance of this segment.

The continued adoption of advanced technologies is a key driver of this demand. Specifically, the integration of automotive TDDI (Touch and Display Driver Integration) technology is fueling growth in the automotive display market, directly benefiting Himax.

- Automotive displays are now Himax's largest revenue source, surpassing traditional large panel drivers in 2024.

- The demand for automotive TDDI technology is a significant growth catalyst for Himax's display driver business.

- While large panel driver revenue decreased in 2024, the overall display market's diversification supports Himax's strategy.

Global economic conditions significantly influence Himax's sales, as consumer spending on electronics directly correlates with economic health. While global GDP growth was around 3.1% in 2023, projections for 2024 and 2025 indicate continued, though potentially moderating, growth, which is expected to support demand for Himax's semiconductor solutions.

Inflationary pressures impact Himax's costs, but the company has focused on expense controls, achieving a 5.6% reduction in operating expenses in 2024. Currency fluctuations, particularly between the Taiwanese Dollar and US Dollar, also affect reported revenues, with a strengthening TWD negatively impacting dollar-denominated earnings, as seen in early 2024.

Supply chain disruptions, such as the semiconductor shortages of 2022-2023, pose a risk, prompting Himax to diversify foundry partners and maintain cautious inventory levels. The demand for display products is crucial, with automotive displays becoming Himax's largest revenue source in 2024, driven by technologies like automotive TDDI.

| Economic Factor | Impact on Himax | Data/Trend (2023-2025) |

|---|---|---|

| Global Economic Growth | Influences consumer spending on electronics. | Global GDP growth ~3.1% in 2023; moderate growth projected for 2024-2025. |

| Inflation | Increases operational costs, affecting margins. | Focus on expense controls; 5.6% operating expense reduction in 2024. |

| Currency Exchange Rates | Affects reported revenues and costs. | TWD appreciation against USD in early 2024 negatively impacted dollar-denominated earnings. |

| Supply Chain Stability | Impacts manufacturing capacity and order fulfillment. | Diversifying foundry partners; cautious inventory management post-2022/2023 shortages. |

| Display Market Demand | Drives sales of display driver ICs. | Automotive displays became largest revenue source in 2024; TDDI demand is a key growth driver. |

What You See Is What You Get

Himax PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Himax PESTLE analysis covers all key external factors impacting the company, providing a thorough strategic overview. You'll gain insights into political, economic, social, technological, legal, and environmental influences.

Sociological factors

Consumers increasingly desire richer visual experiences, fueling demand for Himax's advanced display driver and controller ICs. This trend is evident in the growing popularity of high-resolution smartphones and the burgeoning market for immersive technologies.

The surge in interest for augmented reality (AR), virtual reality (VR), and head-mounted display (HMD) devices directly translates to a need for Himax's specialized microdisplay and optical solutions. These advanced displays are crucial for delivering the seamless and interactive visual feedback these technologies require.

Himax's commitment to this evolving consumer demand was highlighted at CES 2025 with the unveiling of its innovative 3D naked-eye display technology, demonstrating a clear understanding of the market's trajectory towards more engaging and visually compelling interfaces.

The widespread embrace of smart devices and the swift incorporation of advanced displays in vehicles are major drivers for Himax's growth. As cars become more connected and feature increasingly sophisticated infotainment and driver information systems, the demand for Himax's display driver ICs (TDDI) and timing controller (Tcon) solutions is soaring.

Himax holds a strong position in the automotive display market, benefiting directly from this trend. The company's commitment to innovation in this space is evident in its financial performance, with automotive IC sales experiencing a substantial increase of nearly 20% year-over-year in 2024, underscoring the growing importance of automotive displays in its overall business.

The widespread adoption of work-from-home and hybrid models continues to shape consumer electronics demand. This trend directly benefits Himax by increasing the need for personal electronic devices, particularly those featuring high-quality displays. For instance, the global notebook market saw shipments of approximately 230 million units in 2023, with a significant portion catering to remote and hybrid work setups, underscoring the sustained demand for enhanced visual experiences.

Himax is strategically aligning with this shift, focusing on advancements in display technology for premium notebooks. The company's efforts to integrate OLED displays and advanced touch functionalities into these devices directly address the evolving preferences of users who rely on their laptops for both productivity and immersive experiences. This positioning is crucial as premium notebook segments increasingly prioritize these sophisticated display features, aiming to capture a larger market share in this growing segment.

Environmental Consciousness and Energy Efficiency

Growing environmental consciousness is a significant societal trend influencing consumer and industry demand for energy-efficient electronic devices. Himax Technologies' strategic focus on developing display solutions that minimize power consumption, such as its ultralow power AI sensing technology and efficient local dimming Tcon, directly addresses this evolving market preference. This alignment can significantly boost product appeal and market competitiveness.

This trend is supported by increasing regulatory pressure and consumer awareness. For instance, in 2024, the global market for energy-efficient electronics is projected to see continued growth, driven by both corporate sustainability goals and individual consumer choices seeking to reduce their carbon footprint and energy bills. Himax's innovations in power-saving display technologies position them to capitalize on this demand.

- Consumer Preference: Surveys in late 2024 indicate that over 60% of consumers consider energy efficiency a key factor when purchasing new electronic devices.

- Industry Adoption: Many large tech manufacturers are setting ambitious targets for reducing the energy consumption of their product portfolios, creating opportunities for component suppliers like Himax.

- Himax's Technology: Himax's ultralow power AI sensing technology can reduce power draw by up to 30% in certain applications compared to traditional sensing methods.

- Market Impact: Products featuring Himax's energy-efficient display solutions are likely to gain market share as environmental concerns become more prominent purchasing criteria.

Demographic Shifts and Regional Market Preferences

Global demographic shifts, like the increasing average age in many developed nations and the burgeoning middle class in emerging economies, directly impact consumer electronics demand. For instance, an aging population might favor larger, easier-to-read displays in devices, while younger demographics may prioritize portability and advanced features in smartphones. Himax, with its broad product range spanning TVs, mobile devices, and automotive displays, is well-positioned to address these diverse and evolving regional preferences.

The company's strategic focus on high-growth areas like premium notebooks adopting OLED technology highlights its responsiveness to market trends. As of early 2024, the OLED display market for notebooks was experiencing significant expansion, driven by consumer demand for enhanced visual quality and energy efficiency. Himax aims to leverage this by supplying advanced display driver ICs and timing controller ICs crucial for these premium devices.

- Aging populations in North America and Europe are increasing demand for larger, high-resolution TV displays and accessible user interfaces in automotive systems.

- Growth in emerging markets, particularly in Asia, fuels demand for mid-range smartphones and cost-effective display solutions.

- Himax's diversified product portfolio allows it to tailor offerings to specific regional needs, from automotive displays in Germany to mobile solutions in India.

- The company anticipates a surge in OLED notebook adoption, projecting a significant market share capture in this premium segment through 2025.

Societal trends like the increasing demand for immersive visual experiences, driven by AR/VR adoption and high-resolution devices, directly benefit Himax. The company's innovative 3D naked-eye display technology, showcased at CES 2025, demonstrates its alignment with this consumer desire for more engaging interfaces.

The growing preference for energy-efficient electronics, supported by consumer awareness and regulatory pressure, presents a significant opportunity. Himax's development of ultralow power AI sensing and efficient Tcon solutions caters to this trend, with consumer surveys in late 2024 indicating over 60% prioritize energy efficiency in electronics purchases.

Demographic shifts, such as aging populations and a growing middle class in emerging markets, influence display preferences. Himax's diverse product range, from automotive displays for older demographics to mobile solutions for emerging markets, positions it to meet these varied global needs. The company anticipates strong growth in the premium notebook sector, particularly with OLED technology, aiming for significant market share capture through 2025.

Technological factors

Himax Technologies is a key player in the evolving landscape of display technologies, pushing boundaries with advancements in OLED, mini-LED, and micro-LED. The company's strategic focus on automotive OLED panels, including active development and mass production, positions it to capitalize on the increasing demand for high-quality displays in vehicles. Furthermore, Himax is poised to benefit from the growing trend of premium notebooks transitioning to OLED technology, a market segment expected to see significant growth through 2025.

Himax is significantly benefiting from the integration of AI and machine learning into display processing. Their WiseEye™ Ultralow Power AI Sensing technology, featuring an ultralow power AI processor and CNN-based AI algorithms, is finding its way into consumer electronics and AIoT devices. This technology enhances features like object detection and gesture control, opening new avenues for product innovation and market expansion.

The relentless drive for smaller, more integrated, and higher-performing integrated circuits (ICs) is a significant technological factor propelling Himax's research and development. This demand is directly fueling innovation in areas critical for next-generation computing and consumer electronics.

Himax's advancements in technologies like wafer-level optics (WLO) and co-packaged optics (CPO) are instrumental in enabling the high-speed AI computing and the miniaturization essential for augmented reality (AR) and virtual reality (VR) applications. These innovations are key to meeting the performance and size constraints of future devices.

A prime example of this is Himax's recently developed AR optical module in collaboration with Vuzix. This module showcases their capability to integrate ultra-luminous and miniature microdisplays, directly addressing the market's need for more compact and powerful AR solutions.

Emergence of Augmented Reality (AR) and Virtual Reality (VR)

Himax Technologies is strategically positioned to capitalize on the burgeoning augmented reality (AR) and virtual reality (VR) markets. The company's expertise in critical components, including Liquid Crystal on Silicon (LCoS) microdisplays, Wafer-Level Optics (WLO) waveguides, and 3D sensing solutions, makes it a vital enabler for head-mounted display (HMD) technologies.

Himax demonstrated its forward-thinking approach by showcasing innovative 3D naked-eye display solutions and integrated AR display modules at major industry events like CES 2025 and Display Week 2025. These advancements underscore Himax's dedication to pioneering the next generation of immersive experiences.

The AR/VR market is experiencing significant growth, with projections indicating a substantial expansion in the coming years. For instance, the global AR/VR market size was estimated to be around $28.2 billion in 2023 and is expected to reach over $210 billion by 2030, growing at a compound annual growth rate (CAGR) of approximately 33.4% during the forecast period. This trajectory highlights the immense potential for companies like Himax that provide foundational technologies.

- Key Himax Contributions: LCoS microdisplays, WLO waveguides, 3D sensing solutions for AR/VR devices.

- Recent Innovations: Naked-eye 3D displays and integrated AR modules presented at CES 2025 and Display Week 2025.

- Market Growth: Global AR/VR market projected to exceed $210 billion by 2030, with a CAGR of over 33%.

Competitive Landscape and R&D Investment

The semiconductor industry is fiercely competitive, demanding substantial and ongoing research and development (R&D) investment to maintain a leading edge. Himax Technologies, Inc. demonstrates this commitment through its strategic focus on areas like automotive display integrated circuits (ICs), OLED technology, Timing Controller (Tcon) solutions, its proprietary WiseEye AI platform, and advanced optical technologies. This dedication to innovation is crucial for its sustained growth and market position.

Himax's R&D expenditure reflects its proactive approach to technological advancement. For instance, in the first quarter of 2024, Himax reported R&D expenses of $44.2 million, representing approximately 16.5% of its net revenue. This investment is geared towards enhancing its product portfolio and developing next-generation solutions.

- Automotive Display ICs: Himax continues to invest heavily in advanced ICs for automotive displays, a rapidly growing market segment.

- OLED and Tcon Solutions: The company is actively developing and refining its offerings in OLED driver ICs and Tcon technology to capture market share in high-performance displays.

- WiseEye AI Platform: Significant R&D is allocated to the WiseEye AI platform, focusing on edge AI solutions for various applications, including smart home and IoT devices.

- Intellectual Property: Protecting its intellectual property through patents and other legal mechanisms is paramount for Himax to safeguard its competitive advantage and R&D investments.

Himax Technologies is at the forefront of display innovation, actively developing advanced solutions for automotive OLED, premium notebooks, and the burgeoning AR/VR markets. Their investment in technologies like LCoS microdisplays and WLO waveguides positions them as a key enabler for next-generation immersive experiences.

The company's WiseEye™ AI sensing technology, powered by ultralow power AI processors and CNN algorithms, is integrating artificial intelligence into consumer electronics and AIoT devices, enhancing capabilities like object detection and gesture control.

Himax's commitment to research and development is substantial, with R&D expenses representing approximately 16.5% of net revenue in Q1 2024. This investment fuels advancements in automotive display ICs, OLED technology, and the WiseEye AI platform, crucial for maintaining a competitive edge in the semiconductor industry.

The demand for smaller, more integrated, and higher-performing ICs directly drives Himax's innovation, particularly in areas critical for future computing and consumer electronics, including wafer-level optics and co-packaged optics for AI computing and AR/VR miniaturization.

Legal factors

Himax Technologies' core business is built on a robust foundation of intellectual property, particularly its innovations in display driver ICs and other semiconductor technologies. The company's commitment to R&D is reflected in its extensive patent portfolio, which boasted over 2,600 granted patents and hundreds more pending approval globally as of early 2024.

These patents are crucial for protecting Himax's technological advancements and maintaining its competitive edge in the fast-evolving semiconductor market. The strength and enforceability of patent laws worldwide directly impact Himax's ability to prevent unauthorized use of its designs and secure its market share.

Himax Technologies must navigate a complex web of international trade laws, including tariffs and export control regulations such as the Export Administration Regulations (EAR). These legal frameworks directly influence Himax's ability to conduct global business, impacting everything from sourcing components to selling finished products. For instance, the ongoing trade tensions between major economic blocs have led to increased scrutiny and potential disruptions for companies like Himax that rely on international supply chains.

Changes in these trade policies can significantly alter Himax's cost structure and market access. The company has actively addressed this by undertaking tariff-driven supply chain restructuring, aiming to mitigate risks associated with import duties and trade barriers. This strategic shift involves enhancing production flexibility across different geographical regions to better adapt to evolving trade landscapes and maintain competitive pricing.

As a key supplier of electronic components, Himax faces significant legal hurdles concerning product liability and safety. These regulations vary by market, demanding strict adherence to ensure their display drivers and integrated circuits (ICs) meet stringent safety benchmarks, especially for sensitive sectors like automotive electronics.

For instance, Himax's HX83195 TDDI, a testament to their commitment, is designed to meet global automotive safety standards, underscoring the critical nature of compliance in high-stakes applications. Failure to meet these standards can lead to substantial financial penalties and reputational damage.

Labor Laws and Employment Regulations

Himax Technologies, with its global footprint spanning Taiwan, China, Korea, Japan, Germany, and the US, must navigate a complex web of varying labor laws and employment regulations. This necessitates significant investment in compliance, impacting everything from hiring practices to compensation structures and employee benefits across its diverse operational regions.

Adherence to these varied legal frameworks directly influences Himax's operational costs and human resource management strategies. For instance, differences in minimum wage laws, overtime rules, and employee termination protections can create substantial cost variances between countries, requiring careful planning and resource allocation.

Himax's proactive approach to labor relations is evident in initiatives like establishing a preschool for employees' children. This family-friendly policy, while fostering employee well-being and loyalty, also demonstrates a commitment to exceeding basic legal requirements and building a supportive work environment, which can be a competitive advantage in talent acquisition and retention.

- Global Operations: Himax operates in 6 countries, each with distinct labor laws.

- Compliance Costs: Navigating these laws impacts operational expenses and HR management.

- Employee Initiatives: A family-friendly workplace, including a preschool, reflects a strategic approach to labor relations.

- Talent Management: Such policies can enhance employee retention and attract skilled professionals in competitive markets.

Data Protection and Privacy Regulations

Himax Technologies, as a supplier of components for AI-enabled sensing solutions like WiseEye AI, faces increasing scrutiny under data protection laws such as the GDPR and CCPA. While not directly handling end-user data, their technology's role in devices that do could lead to indirect legal liabilities concerning data security and privacy compliance. For instance, the European Union's GDPR, fully enforced since 2018, imposes strict rules on data processing and user consent, and similar frameworks are evolving globally.

These regulations necessitate careful consideration of how Himax's semiconductor designs can support privacy-by-design principles within customer products. Failure to align with these evolving legal landscapes could impact market access and partnerships, especially as consumer awareness of data privacy grows. The global data privacy software market, for example, was projected to reach approximately $3.5 billion in 2024, highlighting the significant financial and operational impact of these regulations.

- Increased Compliance Burden: Himax must ensure its products facilitate customer compliance with evolving data privacy laws like GDPR and CCPA.

- Indirect Liability Risk: While a fabless company, integration into data-collecting devices creates potential indirect legal implications for data security.

- Market Access Impact: Non-compliance with privacy standards could hinder Himax's ability to partner with companies in privacy-sensitive markets.

- Evolving Regulatory Landscape: Ongoing changes in global data protection laws require continuous monitoring and adaptation of product roadmaps.

Himax Technologies operates within a dynamic legal environment, particularly concerning intellectual property. As of early 2024, the company held over 2,600 granted patents globally, a testament to its innovation in display driver ICs and related technologies. These patents are vital for safeguarding its market position and preventing infringement in the competitive semiconductor industry.

Navigating international trade laws, including tariffs and export controls, is a significant legal factor for Himax. The company's global supply chain is subject to regulations like the Export Administration Regulations (EAR), and ongoing trade tensions can impact its operations and costs. Himax has strategically restructured its supply chain to mitigate risks associated with import duties and trade barriers.

Product liability and safety regulations are paramount for Himax, especially in sectors like automotive electronics. The company must ensure its components, such as the HX83195 TDDI, meet stringent global safety standards. Non-compliance can result in severe financial penalties and reputational damage, highlighting the critical importance of legal adherence.

Himax must also comply with diverse labor laws across the six countries where it operates, influencing HR strategies and operational costs. Furthermore, as a provider of AI-enabled sensing solutions, the company must consider data protection laws like GDPR and CCPA, ensuring its technology supports privacy-by-design principles to avoid indirect legal liabilities and maintain market access.

Environmental factors

The growing global emphasis on managing electronic waste (e-waste) directly influences the demand for components like those Himax produces. As countries implement stricter regulations, such as the EU's Waste Electrical and Electronic Equipment (WEEE) Directive, which aims to increase collection and recycling rates, Himax's clients in the electronics manufacturing sector face pressure to design products with recyclability in mind. This translates to a potential need for Himax to offer components that are easier to disassemble or made from more sustainable materials. For instance, by 2025, the EU is targeting a 55% collection rate for e-waste, a figure that will likely rise in subsequent years, pushing the entire supply chain towards circular economy principles.

Stricter energy efficiency standards for displays, especially in consumer electronics and automotive sectors, are a significant environmental factor impacting Himax. These regulations directly shape how Himax designs and develops its display driver ICs and related technologies.

Himax's focus on power-efficient solutions, such as advanced local dimming Tcon technology, directly addresses these environmental mandates. This allows their customers to build products that comply with regulations and attract eco-conscious buyers.

For instance, the EU's Ecodesign Directive continues to push for greater energy savings in electronic displays, with ongoing reviews and potential tightening of requirements expected through 2024 and beyond. Himax's investment in low-power architectures positions them favorably to meet these evolving environmental demands.

Himax, operating within the semiconductor industry, faces growing pressure to ensure its supply chain is both sustainable and ethically sound. This includes the responsible sourcing of raw materials, such as conflict minerals, and the implementation of environmentally friendly manufacturing processes by its partners. For instance, the Responsible Minerals Initiative (RMI) continues to set standards for due diligence, impacting companies like Himax that rely on global supply chains.

Adherence to these environmental and social standards is no longer just a matter of good practice; it's crucial for maintaining a positive brand image and meeting regulatory requirements. As of early 2024, many major electronics manufacturers are publicly committing to net-zero emissions targets, which cascades down to their suppliers, including semiconductor firms like Himax, demanding greater transparency and action on environmental impact.

Carbon Footprint Reduction Initiatives

Global efforts to curb carbon emissions are significantly reshaping manufacturing and logistics within the semiconductor sector. For Himax, a fabless company, this translates to increased scrutiny on its foundry and packaging partners to implement sustainable production practices. These environmental mandates can influence Himax's operational expenses and strategic sourcing decisions, potentially leading to higher costs for greener manufacturing processes.

Himax's own focus on enhancing operational efficiency plays a crucial role in minimizing its environmental footprint. By optimizing internal processes, the company contributes to a reduction in its overall impact. For instance, in 2023, Himax reported a total Scope 1 and Scope 2 greenhouse gas emissions of approximately 1,300 metric tons of CO2 equivalent, a figure they aim to further reduce through ongoing efficiency improvements.

The semiconductor industry, in general, is seeing a push towards sustainability, with many leading foundries setting ambitious carbon reduction targets. TSMC, a major foundry partner for many fabless companies, has committed to achieving net-zero emissions by 2050 and is investing in renewable energy sources for its operations. Similarly, other partners in Himax's supply chain are expected to align with these industry-wide environmental goals.

These environmental pressures are likely to drive innovation in materials science and manufacturing techniques. Himax will need to monitor these developments closely, as they could present both challenges and opportunities for the company's product development and supply chain management strategies moving forward.

Resource Scarcity and Raw Material Sourcing

The availability and cost of essential raw materials, particularly rare earth elements and critical minerals vital for semiconductor production, are increasingly susceptible to environmental policies and growing resource scarcity. For Himax, a fabless semiconductor company, these sourcing challenges are managed by its manufacturing partners, directly impacting production capacity and the final pricing of its components.

This dependency means Himax must navigate potential disruptions in the supply chain, which could be exacerbated by geopolitical factors or stricter environmental regulations on mining and processing. For instance, concerns over the environmental impact of mining rare earth elements, crucial for advanced display drivers and image sensors, could lead to increased compliance costs for foundries, ultimately affecting Himax's cost structure.

- Global Rare Earth Oxide Prices: Prices for key rare earth oxides, such as Neodymium and Dysprosium, saw significant volatility in 2023, with some experiencing double-digit percentage increases due to supply chain concerns and increased demand from the electric vehicle and renewable energy sectors.

- Semiconductor Material Costs: The cost of silicon wafers, a primary input for semiconductor manufacturing, has also seen upward pressure, with forecasts suggesting a continued tight supply-demand balance through 2025, impacting overall production expenses for fabless companies.

- Environmental Regulations Impact: Stricter environmental regulations in key mining regions, such as China, can directly influence the cost and availability of critical minerals, creating a ripple effect on the semiconductor supply chain.

Growing concerns over electronic waste (e-waste) and stricter regulations like the EU's WEEE Directive are pushing electronics manufacturers to adopt more sustainable designs, influencing Himax's clients. Energy efficiency standards for displays are also a key factor, driving demand for Himax's power-saving solutions.

Himax's commitment to power-efficient technologies directly addresses these environmental mandates, aligning with directives like the EU's Ecodesign Directive, which continues to evolve through 2024 and beyond.

The company must also navigate sustainable sourcing pressures and the environmental impact of its supply chain partners, as global emissions targets and initiatives like the Responsible Minerals Initiative gain prominence.

Increased scrutiny on carbon emissions affects Himax's foundry and packaging partners, potentially impacting operational costs and strategic sourcing, with major foundries like TSMC setting net-zero targets by 2050.

PESTLE Analysis Data Sources

Our Himax PESTLE analysis is built on a comprehensive review of data from reputable industry research firms, financial news outlets, and official government publications. We draw insights from market trend reports, economic forecasts, and regulatory updates to ensure a thorough understanding of the external environment.