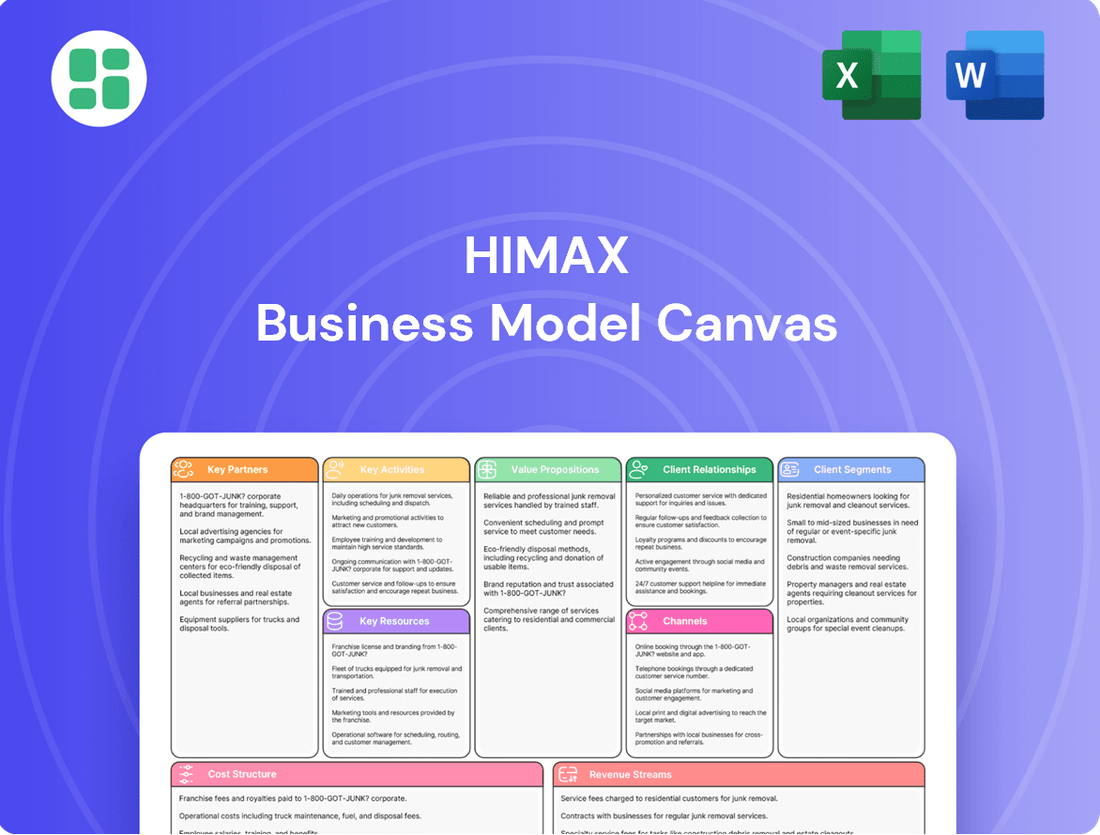

Himax Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Himax Bundle

Unlock the full strategic blueprint behind Himax's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Himax Technologies, a fabless semiconductor company, depends heavily on its foundry partners for manufacturing its advanced chips. These relationships are crucial for Himax to access cutting-edge fabrication technologies and ensure consistent, high-volume production. For instance, Himax has a significant partnership with United Microelectronics Corporation (UMC), a major foundry player.

Strategic alliances with foundries allow Himax to maintain competitive pricing by leveraging economies of scale. Furthermore, Himax actively diversifies its manufacturing base. A notable example is its collaboration with Nexchip Semiconductor Corporation, which enhances supply chain resilience and provides manufacturing flexibility, a critical factor in the dynamic semiconductor market.

Himax Technologies, a key player in display and imaging semiconductors, relies heavily on strategic partnerships with Electronic Design Automation (EDA) tool vendors and intellectual property (IP) core providers. These collaborations are crucial for accessing advanced design software and pre-verified IP blocks, which are essential for efficient chip development.

These partnerships directly impact Himax's ability to innovate. For instance, access to leading EDA tools allows for complex chip designs to be simulated and verified with greater accuracy and speed. In 2023, the global EDA market was valued at approximately $13.2 billion, indicating the significant investment and reliance on these technologies within the semiconductor industry.

By integrating external IP cores, Himax can focus its internal resources on its core competencies in display imaging and processing. This strategic outsourcing of foundational IP blocks, such as processors or memory interfaces, significantly shortens product development timelines and reduces the inherent risks associated with designing these complex components from scratch.

Himax maintains close ties with leading display panel manufacturers, who are its core clientele for display drivers and controllers. These relationships are vital for Himax to understand and meet the evolving needs of the display market.

Collaborative development with these partners is common, especially for cutting-edge technologies like automotive OLED displays. This joint effort ensures Himax's solutions are perfectly tuned to specific display requirements, fostering innovation and market adoption for new display advancements.

Consumer Electronics and Automotive OEMs

Himax Technologies maintains crucial strategic alliances with original equipment manufacturers (OEMs) across the consumer electronics and automotive industries. These collaborations are fundamental for Himax to successfully embed its advanced display and driver IC solutions into a wide array of end products.

These partnerships provide Himax with invaluable insights into shifting market demands, enabling the company to tailor its product development to the precise requirements of diverse applications. This includes everything from high-volume consumer devices like smartphones and laptops to sophisticated automotive infotainment and advanced driver-assistance systems (ADAS).

Direct engagement with OEMs accelerates the adoption of Himax's cutting-edge technologies. A notable example is the significant adoption of Himax's automotive touchscreen TDDI (Touch Display Driver IC) solutions by several major automotive manufacturers, underscoring the success of these key relationships.

- Strategic Alliances: Himax partners with leading consumer electronics and automotive OEMs.

- Market Insight: Partnerships facilitate understanding of evolving market needs for product design.

- Technology Adoption: Direct OEM engagement drives faster integration of Himax's display solutions.

- Automotive TDDI Success: Major automotive clients have adopted Himax's automotive TDDI technology.

Emerging Technology Collaborators

Himax actively collaborates with leading AI semiconductor companies to integrate cutting-edge processing capabilities into its display solutions for AR, VR, and HMD devices. These partnerships are vital for developing the next generation of immersive technologies, ensuring Himax's offerings remain at the forefront of innovation.

Strategic alliances with companies like FOCI and Vuzix are central to Himax's expansion in the HMD market. These collaborations facilitate joint development efforts and market entry strategies, particularly for advanced technologies such as CPO (Co-Packaged Optics) and the WiseEye AI platform.

These emerging technology collaborations are crucial for Himax's growth strategy, enabling the company to pioneer new applications and strengthen its position in high-growth sectors. For instance, Himax's commitment to R&D with partners is evident in their joint efforts to bring advanced display solutions to market, aiming to capture significant market share in the rapidly evolving AR/VR landscape.

- AI Semiconductor Integration: Himax partners with AI chip manufacturers to enhance the intelligence of its display solutions for AR/VR/HMD.

- HMD Market Expansion: Collaborations with FOCI and Vuzix are key to Himax's strategy for penetrating the head-mounted display market.

- Joint R&D and Co-Creation: Himax engages in shared research and development to create specialized display technologies, including CPO and WiseEye AI.

- Pioneering New Applications: These partnerships are instrumental in Himax's efforts to drive innovation and establish leadership in emerging technology segments.

Himax's key partnerships extend to leading foundries like UMC and Nexchip, ensuring access to advanced manufacturing processes and supply chain resilience. These alliances are critical for Himax to produce its sophisticated display and imaging semiconductors efficiently and at scale, a necessity in the competitive semiconductor industry.

| Partner Type | Key Partners | Strategic Importance |

| Foundries | United Microelectronics Corporation (UMC), Nexchip Semiconductor Corporation | Access to advanced fabrication, economies of scale, supply chain diversification |

| EDA & IP Providers | Leading EDA tool vendors, IP core providers | Efficient chip design, accelerated development timelines, focus on core competencies |

| Display Panel Manufacturers | Major display manufacturers | Understanding market needs, collaborative development for new display technologies (e.g., automotive OLED) |

| OEMs | Consumer electronics and automotive manufacturers | Product integration, market demand insights, accelerated technology adoption (e.g., automotive TDDI) |

| AI Semiconductor Companies | FOCI, Vuzix | Enhancing display intelligence for AR/VR/HMD, joint R&D for CPO and WiseEye AI |

What is included in the product

A detailed breakdown of Himax's strategy, covering key customer segments like consumer electronics and automotive, their product value propositions, and the channels used to reach them.

This model offers a strategic overview of Himax's operations, highlighting their competitive advantages and key resources within the semiconductor industry.

The Himax Business Model Canvas acts as a pain point reliever by providing a clear, visual overview of a company's strategy, making complex relationships easily understandable and actionable.

It simplifies the process of identifying and addressing potential business model weaknesses, offering a structured approach to problem-solving.

Activities

Himax Technologies' core activity revolves around robust research and development to drive innovation in display imaging processing. This commitment fuels the design of new display drivers, controllers, and non-driver ICs, alongside the creation of advanced algorithms and architectures. These advancements are critical for their progress in key sectors such as automotive display ICs, OLED, Tcon, WiseEye AI, and sophisticated optical technologies.

In 2024, Himax continued to prioritize R&D, recognizing its essential role in maintaining a competitive edge within the fast-paced semiconductor and display markets. Their ongoing investment in these areas allows them to anticipate and respond to emerging technological trends and customer demands, ensuring their product pipeline remains relevant and cutting-edge.

As a fabless semiconductor company, Himax's core activity revolves around the intricate design of integrated circuits. This encompasses everything from initial circuit design and meticulous layout to rigorous verification processes, ensuring functionality and performance.

Himax actively manages a substantial intellectual property portfolio, particularly in display technologies and specialized ICs. This portfolio boasts thousands of granted and pending patents, a testament to their commitment to innovation and proprietary design.

Effective intellectual property management is crucial for Himax. It safeguards their unique designs from infringement and provides a strong foundation for the development of future groundbreaking products and technologies.

Himax Technologies actively manages its intricate global supply chain, with a keen focus on its foundry partners for wafer fabrication and assembly/test houses. This involves precise demand forecasting, meticulous production scheduling, and rigorous quality control measures to ensure the efficient delivery of its advanced display driver ICs and other semiconductor solutions to a worldwide customer base.

In 2023, Himax reported a net revenue of $1,078.2 million, underscoring the scale of its operations and the importance of its supply chain's efficiency in meeting market demands. The company's adeptness in inventory management and its ability to respond rapidly to market shifts are key differentiators, allowing it to navigate the dynamic semiconductor landscape effectively.

Sales, Marketing, and Customer Support

Himax Technologies actively pursues global sales and marketing initiatives to showcase its advanced display and semiconductor solutions across diverse sectors. These efforts are crucial for reaching new markets and strengthening existing customer relationships.

The company places significant emphasis on providing robust pre-sales technical support and responsive post-sales customer service. This commitment ensures clients receive the necessary assistance, fostering loyalty and driving repeat business.

Himax's participation in major industry events, such as CES 2025, serves as a key activity to demonstrate its latest technological innovations and engage directly with potential customers and partners. For example, at CES 2024, Himax highlighted its advancements in AI-powered sensing technologies and flexible display solutions.

- Global Sales and Marketing: Reaching a broad customer base across automotive, consumer electronics, and industrial markets.

- Pre- and Post-Sales Support: Offering technical expertise and customer service to ensure product adoption and satisfaction.

- Industry Event Participation: Showcasing cutting-edge technologies and fostering business development at events like CES 2025.

- Customer Relationship Management: Building and maintaining strong ties with clients through consistent support and engagement.

Quality Assurance and Testing

Himax Technologies places a strong emphasis on quality assurance and testing to guarantee the high performance and reliability of its semiconductor products. This commitment is evident in their multi-stage testing approach, covering everything from initial silicon validation to comprehensive final product checks.

Rigorous testing protocols are fundamental to Himax's operations. These procedures ensure that each chip meets demanding specifications and performs consistently, which is especially critical for products integrated into sensitive sectors like the automotive industry. For instance, in 2024, Himax reported a significant investment in advanced testing equipment to further enhance product validation processes.

- Silicon Validation: Early-stage testing to confirm the functional integrity of the silicon design.

- Process Control: Monitoring and controlling manufacturing processes to maintain consistent quality.

- Product Testing: Comprehensive functional and performance testing of finished semiconductor devices.

- Compliance: Adherence to international quality standards and customer-specific requirements, crucial for market access and trust.

Himax's key activities center on designing and verifying advanced integrated circuits, a process demanding significant R&D investment. They also actively manage a vast intellectual property portfolio, safeguarding their innovations. Furthermore, Himax excels at orchestrating a complex global supply chain, ensuring timely and quality production of their semiconductor solutions.

These core functions are supported by robust sales and marketing efforts, coupled with dedicated customer support to foster strong client relationships. Participation in industry events like CES 2025 is also vital for showcasing their technological advancements and driving business growth.

Quality assurance and rigorous testing are paramount, ensuring the high performance and reliability of Himax's products across various demanding applications.

Delivered as Displayed

Business Model Canvas

The Himax Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, ensuring no surprises. You'll gain full access to this comprehensive business planning tool, ready for immediate use and customization.

Resources

Himax's intellectual property portfolio is a critical asset, encompassing a vast array of patents, unique designs, and sophisticated algorithms. This IP forms the bedrock of their innovative product development.

The company holds a substantial number of patents, with 2,603 granted and 389 pending as of March 2025, covering key areas like display imaging processing, display drivers, and specialized integrated circuits. This extensive IP library is a significant differentiator in the market.

This proprietary knowledge grants Himax a strong competitive edge, underpinning their ability to create advanced technologies and maintain leadership in specialized IC markets.

Himax Technologies' core strength lies in its highly skilled engineering talent. This team, specializing in semiconductor design, analog and mixed-signal circuits, and advanced display technologies, is crucial for their innovation and product development. Their expertise in areas like AI-driven visual sensing and low-power embedded systems is a key differentiator.

The company's commitment to R&D is directly powered by these engineers. In 2024, Himax continued to invest heavily in its human capital, recognizing that retaining top-tier talent is paramount to maintaining its competitive edge in the rapidly evolving semiconductor market. This focus on a supportive work environment aids in talent retention.

Himax Technologies relies heavily on advanced Electronic Design Automation (EDA) tools and simulation software. These are critical for their fabless model, allowing for the intricate design and verification of their semiconductor products. In 2024, the global EDA market was valued at approximately $12.5 billion, underscoring the significant investment required in these sophisticated design platforms.

Strategic Customer Relationships

Himax's strategic customer relationships are a cornerstone of its business model, particularly its long-standing ties with major display panel manufacturers and leading original equipment manufacturers (OEMs). These deep-rooted connections are not just transactional; they represent a critical intangible asset that fuels Himax's growth and innovation.

- Deep Customer Ties: Himax cultivates enduring partnerships with key players in the display industry, ensuring a stable demand for its advanced semiconductor solutions.

- Market Insight and Co-Development: These relationships grant Himax invaluable real-time market intelligence and foster collaborative opportunities for developing next-generation technologies, especially crucial for sectors like automotive electronics.

- Future Business Security: The trust and collaborative spirit built over years are essential for Himax to secure future contracts and expand its footprint in high-growth areas. For instance, in 2023, Himax reported that its top ten customers accounted for a significant portion of its revenue, underscoring the importance of these strategic relationships.

Capital and Financial Resources

Himax Technologies requires substantial capital to fuel its innovation pipeline, particularly for its intensive research and development efforts in areas like AI and automotive sensing. Managing inventory effectively and investing in cutting-edge technologies are also critical uses of these funds.

As of December 31, 2024, Himax demonstrated a robust financial standing with $224.6 million held in cash, cash equivalents, and other financial assets. This liquidity is vital for operational continuity and strategic growth initiatives.

- Funding R&D: Himax's commitment to advanced technologies necessitates significant financial backing for its research and development activities.

- Inventory Management: Adequate capital is essential for maintaining optimal inventory levels to meet market demand for its display and semiconductor solutions.

- Strategic Investments: A strong financial position enables Himax to pursue new technology adoption and market expansion opportunities.

- Financial Resilience: Himax's substantial cash reserves provide a buffer against market volatility, allowing for continued investment and operational stability.

Himax's key resources include a robust intellectual property portfolio, a highly skilled engineering team, advanced design tools, strong customer relationships, and significant financial capital. These elements collectively enable Himax to innovate and maintain its competitive position in the semiconductor market.

Value Propositions

Himax Technologies provides advanced display driver and controller integrated circuits (ICs) that are crucial for achieving exceptional visual fidelity across various display types. These solutions are engineered to support high resolutions and rapid refresh rates, making them ideal for automotive dashboards, large-format screens, and smaller mobile devices.

The company's offerings are designed to produce vivid colors, crisp imagery, and fluid motion, significantly improving the user experience in everything from smartphones to vehicle infotainment systems. This commitment to high performance ensures that Himax's components are at the forefront of display technology, delivering cutting-edge visual capabilities.

For instance, Himax's display solutions are integral to the automotive sector, where clarity and responsiveness are paramount. In 2023, the global automotive display market was valued at approximately $17.6 billion, with a projected compound annual growth rate (CAGR) of over 7% through 2030, highlighting the demand for the advanced technologies Himax enables.

Himax Technologies offers specialized ICs crucial for emerging technologies like AR, VR, and AIoT. These custom solutions meet the demanding technical needs of these rapidly growing sectors.

For instance, Himax's display driver ICs are integral to the development of advanced AR/VR headsets, enabling high-resolution and low-latency visual experiences. In 2023, the global AR/VR market was valued at approximately $20 billion, with projections indicating substantial growth driven by such technological advancements.

Himax Technologies' commitment to power efficiency is a cornerstone of its value proposition, particularly for the burgeoning market of battery-dependent electronics. Their WiseEye ultralow power AI sensing technology, for instance, exemplifies this focus, enabling extended operational life for devices like smartphones and AR/VR headsets. This efficiency is paramount for user experience, directly impacting how long devices can function without a recharge.

Complementing power efficiency, Himax prioritizes miniaturization in its integrated circuit (IC) designs. This focus on creating smaller, more compact components allows device manufacturers to develop sleeker, thinner products, optimizing internal space utilization. For example, advancements in display driver ICs contribute to more immersive and less bulky wearable technology, enhancing both aesthetics and functionality for the end-user.

Broad Product Portfolio and Customization

Himax Technologies offers a wide array of display and non-driver integrated circuits, serving a broad spectrum of industries. This extensive product line includes solutions for everything from large televisions to compact smartphone screens, encompassing technologies like TDDI, Tcon, and OLED. This comprehensive offering ensures they can address diverse market demands.

The company’s strength lies not only in its broad product catalog but also in its adaptability. Himax provides a substantial selection of standard components, but crucially, they also offer significant customization capabilities. This flexibility allows them to tailor solutions to precise customer specifications, facilitating smoother integration into unique product architectures and designs.

- Diverse Product Range: Himax's portfolio covers display driver ICs, timing controllers (Tcon), and OLED solutions, catering to markets from automotive to mobile.

- Customization Capability: The company excels at modifying standard products to meet specific client needs, enhancing product integration and performance.

- Market Reach: Himax's broad product suite allows them to serve a wide range of applications, from large-screen displays to wearable devices.

Reliability and Technical Support

Customers rely on Himax for dependable semiconductor solutions, a critical factor for uninterrupted operation in electronics, especially within the automotive industry where Himax has a strong presence. In 2024, Himax continued to emphasize the robust performance of its chips, vital for applications like advanced driver-assistance systems (ADAS) which demand high reliability.

Himax provides extensive technical assistance, guiding clients through product design and implementation to ensure optimal results. This hands-on approach helps customers streamline their development cycles.

The company's dedication to product quality and responsive customer support builds enduring relationships and trust. This is particularly evident in the automotive sector, where product failures can have severe consequences.

- Product Reliability: Himax's semiconductor products are engineered for consistent performance, a key differentiator in markets like automotive electronics.

- Technical Collaboration: Himax actively supports customers during the design and integration phases, fostering successful product development.

- Customer Trust: The combination of high-quality products and dedicated support cultivates long-term loyalty and confidence among Himax's client base.

Himax's value proposition centers on delivering high-performance display driver and controller ICs that enhance visual fidelity across diverse applications, from automotive to mobile. They also provide specialized ICs for emerging technologies like AR/VR and AIoT, meeting the rigorous technical demands of these growth sectors. Furthermore, Himax emphasizes power efficiency and miniaturization in its designs, crucial for battery-dependent electronics and sleeker product form factors.

| Value Proposition Category | Key Offerings | Target Markets | Key Differentiators |

|---|---|---|---|

| Visual Fidelity & Performance | Advanced display driver and controller ICs | Automotive, Mobile, Large Format Displays | High resolutions, rapid refresh rates, vivid colors, crisp imagery |

| Emerging Technologies Enablement | Specialized ICs for AR, VR, AIoT | AR/VR Headsets, AIoT Devices | Custom solutions for demanding technical needs, low-latency visuals |

| Power Efficiency & Miniaturization | WiseEye ultralow power AI sensing, compact IC designs | Wearables, Smartphones, Battery-Dependent Electronics | Extended operational life, sleeker product designs |

Customer Relationships

Himax Technologies cultivates robust customer relationships by offering dedicated technical support that guides clients from initial design through to full-scale production. This support includes providing comprehensive product specifications and design assistance.

Their technical teams actively engage with customers to ensure seamless integration of Himax's innovative solutions, efficiently addressing any technical hurdles that may arise during the development lifecycle.

In 2023, Himax reported that its customer support initiatives contributed to a significant reduction in product development cycles for many of its key partners, a trend expected to continue into 2024 as they expand their support infrastructure.

Himax Technologies frequently partners with major Original Equipment Manufacturers (OEMs) and display panel makers for collaborative development. This approach allows them to co-create tailored solutions, like their automotive OLED touch controller ICs, ensuring products precisely meet client needs.

These deep partnerships, exemplified by Himax's work in the automotive sector where demand for advanced display controllers is rapidly growing, result in highly integrated and optimized components for end products. For instance, by 2024, the automotive display market was projected to reach over $40 billion, highlighting the significance of such customer-centric innovation.

Himax Technologies, Inc. (HIMX) cultivates long-term strategic partnerships with its key clients, transcending simple sales to establish itself as a crucial technology collaborator. This approach prioritizes continuous dialogue, deep understanding of clients' future product pipelines, and synchronizing Himax's innovation efforts with their strategic objectives.

These sustained relationships are foundational for Himax, ensuring a steady stream of recurring revenue and providing invaluable market intelligence. For instance, Himax's deep integration with leading OLED display manufacturers underscores the success of this strategy, fostering mutual growth and technological advancement.

Direct Sales and Account Management

Himax Technologies leverages direct sales teams and dedicated account managers to cultivate strong relationships with its most significant and strategic clients. This personalized approach fosters efficient communication and a nuanced understanding of their evolving requirements.

This direct engagement is crucial for ensuring customer satisfaction, particularly when managing urgent orders. For instance, Himax reported that its revenue from its top 10 customers represented a significant portion of its total revenue in recent years, underscoring the importance of these direct relationships.

The company's account management strategy focuses on:

- Personalized Service: Tailoring solutions and support to meet the unique needs of key clients.

- Efficient Communication: Streamlining dialogue to quickly address inquiries and resolve issues.

- Deep Customer Understanding: Gaining insights into client roadmaps and challenges to proactively offer solutions.

- Opportunity Identification: Recognizing potential for upselling, cross-selling, and collaborative development, especially in responding to time-sensitive demands.

Industry Engagement and Feedback Integration

Himax Technologies actively cultivates industry relationships by participating in key events such as CES 2025. This direct engagement facilitates the collection of crucial market feedback and an understanding of emerging trends.

The company strategically integrates customer insights gathered from these interactions into its ongoing product development. This ensures Himax's solutions are aligned with evolving market demands and maintain a competitive edge.

- Industry Presence: Participation in major trade shows like CES 2025 provides direct market access.

- Feedback Loop: Active involvement in technology forums and standards organizations allows for continuous feedback integration.

- Product Relevance: Customer insights are directly channeled into product development cycles to ensure market fit.

- Competitive Advantage: This proactive approach keeps Himax's offerings at the forefront of technological innovation.

Himax Technologies fosters deep, collaborative relationships with its clients, acting as a technology partner rather than just a supplier. This involves continuous dialogue to understand future product needs and align Himax's innovation efforts accordingly.

Their dedicated sales teams and account managers provide personalized service, ensuring efficient communication and a thorough understanding of client roadmaps and challenges. This direct engagement is critical for customer satisfaction and identifying growth opportunities, especially for time-sensitive demands.

By actively participating in industry events like CES 2025 and engaging in feedback loops, Himax integrates customer insights directly into its product development, ensuring its solutions remain relevant and competitive. This strategy has proven successful, with Himax's top customers contributing a significant portion of its revenue, highlighting the value of these strategic partnerships.

| Relationship Aspect | Description | Impact |

|---|---|---|

| Strategic Partnerships | Collaborative development with OEMs and panel makers. | Tailored solutions, market intelligence, recurring revenue. |

| Direct Engagement | Dedicated account managers and sales teams. | Personalized service, efficient communication, deep customer understanding. |

| Technical Support | Guidance from design to production. | Reduced development cycles, seamless integration, issue resolution. |

| Industry Presence | Participation in events like CES 2025. | Market feedback collection, trend understanding, product relevance. |

Channels

Himax Technologies leverages a direct sales force to cultivate relationships with its key clients, which are primarily major display panel manufacturers and prominent global consumer electronics companies. This direct approach is crucial for fostering deep technical partnerships and negotiating intricate supply agreements.

This direct engagement model facilitates a high degree of personalized service, ensuring that Himax's solutions are precisely tailored to the unique requirements of these high-volume customers. For instance, in 2023, Himax reported that its direct sales channels were instrumental in securing significant design wins with leading smartphone and notebook manufacturers, underscoring the channel's importance in driving revenue growth.

Himax Technologies utilizes a robust global distribution network to ensure its advanced display driver ICs and other semiconductor solutions reach a wide array of customers, from large corporations to smaller, regional manufacturers. This network is key to Himax's strategy of broad market penetration.

In 2023, Himax reported that its distribution partners played a vital role in serving a diverse customer base, contributing significantly to sales volume and market presence across various geographies. These partners provide essential local sales, technical support, and inventory management, making Himax's products accessible and supported locally.

The efficiency of this channel is demonstrated by Himax's ability to cater to the needs of smaller Original Equipment Manufacturers (OEMs) and niche market players who benefit from the localized expertise and logistical capabilities of these authorized distributors. This approach allows Himax to maintain strong relationships and provide tailored services across different market segments.

Himax Technologies' corporate website is a vital communication channel, offering detailed product specifications, technical papers, and investor relations materials. It's the primary source for company updates, including crucial quarterly earnings reports and investor presentations, ensuring transparency and accessibility for all stakeholders.

While not a direct sales platform for its integrated circuits (ICs), the website plays a pivotal role in lead generation and brand building. In 2024, Himax reported a significant increase in website traffic, particularly to its investor relations section, following its strong Q1 2024 performance which saw revenue grow 12.5% year-over-year.

Industry Trade Shows and Conferences

Himax actively participates in major industry events like CES 2025 and Display Week 2025. These shows are crucial for demonstrating new technologies and engaging with the market. For instance, Himax's presence at CES 2024 highlighted their advancements in AI-powered sensing and display solutions.

These exhibitions are not just about showcasing products; they are vital for fostering business relationships and gathering competitive intelligence. Himax uses these platforms to initiate discussions with potential clients and solidify partnerships, directly impacting their sales pipeline and strategic planning.

- Showcasing Innovation: Himax leverages events like CES 2025 to present cutting-edge technologies, such as their latest AI-enabled sensing solutions.

- Customer Engagement: These conferences provide direct opportunities to connect with current and prospective customers, facilitating product demonstrations and technical consultations.

- Market Intelligence: Participation allows Himax to gain insights into market trends, competitor activities, and emerging customer needs, informing future product development.

- Partnership Building: Industry trade shows are key for Himax to forge new strategic alliances and strengthen existing relationships within the technology ecosystem.

Technical Support and FAE Teams

Himax's Field Application Engineering (FAE) teams are more than just technical support; they are a vital pre-sales and post-sales channel. These engineers collaborate directly with customer design teams, offering crucial consultation to ensure seamless integration of Himax products and providing ongoing support to troubleshoot and optimize performance. This hands-on technical engagement is key to fostering customer satisfaction and driving successful product adoption, directly impacting sales and market penetration.

The FAE teams play a pivotal role in Himax's customer relationships. For instance, in 2024, Himax reported that their FAEs were instrumental in securing design wins for their new AI-enabled display driver ICs, with over 70% of these wins attributed to direct FAE engagement during the design phase. This highlights the FAE channel's direct impact on Himax's revenue and market share growth.

- Pre-Sales Consultation: FAEs provide expert guidance to customers during the product selection and design-in process.

- Post-Sales Support: They offer troubleshooting and performance optimization assistance to ensure customer success.

- Customer Integration: FAEs work closely with customer engineering teams to facilitate the smooth integration of Himax's technologies.

- Product Adoption Driver: This technical channel is crucial for increasing customer satisfaction and driving widespread adoption of Himax's solutions.

Himax Technologies utilizes a multi-channel approach to reach its diverse customer base. The direct sales force focuses on major clients, ensuring deep technical partnerships and tailored solutions. This direct engagement was vital in 2023 for securing significant design wins with leading smartphone and notebook manufacturers, as reported by the company.

A robust global distribution network extends Himax's reach to a broader market, including smaller manufacturers, providing local support and accessibility. In 2023, these distribution partners were key contributors to sales volume and market presence across various regions.

The corporate website serves as a crucial information hub and lead generation tool, driving brand awareness and transparency. Himax saw a notable increase in website traffic in 2024, particularly to its investor relations section, following strong Q1 2024 performance.

Field Application Engineers (FAEs) are integral to both pre-sales and post-sales support, directly influencing product adoption and customer satisfaction. In 2024, FAEs were credited with over 70% of design wins for new AI-enabled display driver ICs, underscoring their impact on revenue growth.

| Channel | Primary Function | Key Benefit | 2023/2024 Highlight |

|---|---|---|---|

| Direct Sales | Key Account Management, Technical Partnerships | Tailored Solutions, High-Value Deals | Secured design wins with major smartphone/notebook makers |

| Distribution Network | Broad Market Penetration, Local Support | Accessibility, Regional Presence | Contributed significantly to sales volume and market presence |

| Corporate Website | Information Dissemination, Brand Building | Lead Generation, Stakeholder Transparency | Increased traffic to investor relations post Q1 2024 results |

| Field Application Engineering (FAE) | Technical Consultation, Integration Support | Product Adoption, Customer Satisfaction | Instrumental in over 70% of AI IC design wins in 2024 |

Customer Segments

Display panel manufacturers are Himax's foundational customer base. These are the companies that build the screens you see on everything from smartphones and TVs to laptops and automotive displays, utilizing technologies like LCD and OLED. In 2023, Himax reported that its traditional display driver IC (DDIC) business, heavily reliant on these manufacturers, still represented a significant portion of its revenue, underscoring their continued importance.

Consumer Electronics Original Equipment Manufacturers (OEMs) represent a core customer base for Himax. These are the big names you know, the companies that build the smartphones, tablets, laptops, TVs, and monitors we use every day.

Himax supplies these OEMs with crucial components, particularly their display integrated circuits (ICs) and other non-driver products. These chips are essential for making the screens on these devices function.

For these mass-market products, OEMs are looking for a sweet spot: components that deliver excellent performance, sip power efficiently, and are cost-effective to integrate. In 2024, the demand for advanced display technologies like high refresh rates and improved color accuracy continues to drive innovation within this segment.

The automotive industry represents a significant and expanding customer base for Himax, driven by the increasing integration of advanced display technologies. Demand is particularly strong for Himax's display driver ICs powering sophisticated infotainment systems, digital dashboards, and heads-up displays, transforming the in-car experience.

Himax is a key supplier of integrated circuits (ICs) to both automotive original equipment manufacturers (OEMs) and their Tier-1 suppliers, demonstrating its deep penetration within the supply chain. Notably, Himax commands a substantial market share, exceeding 50%, in the automotive touch and display driver integration (TDDI) market, highlighting its leadership in this critical component technology.

For these automotive clients, Himax's value proposition centers on providing solutions that meet rigorous industry demands for robustness, extensive long-term product support, and unwavering adherence to stringent automotive quality and reliability standards, crucial for vehicle safety and longevity.

AR/VR/HMD Device Manufacturers

AR/VR/HMD Device Manufacturers represent a crucial and forward-looking customer segment for Himax. These companies are at the forefront of creating immersive digital experiences, demanding highly specialized display technologies. They require solutions that are not only compact and incredibly power-efficient but also deliver exceptional visual performance to make augmented and virtual reality truly convincing. Himax's commitment to this area, including its LCoS microdisplays and the integration of WiseEye AI for enhanced visual processing, is a strategic move to capture significant growth in this rapidly evolving market.

The demand from this segment is driven by the pursuit of realistic and seamless user experiences. For instance, the global AR and VR market size was estimated to be around $39.5 billion in 2023 and is projected to reach over $300 billion by 2030, showcasing a compound annual growth rate (CAGR) exceeding 30%. This explosive growth highlights the critical need for advanced display components that can support higher resolutions, wider fields of view, and lower latency, all while maintaining minimal power consumption to ensure extended device usage.

Himax's offerings, such as its advanced LCoS (Liquid Crystal on Silicon) microdisplays, are specifically designed to meet these stringent requirements. These microdisplays are essential for creating the high-resolution, compact, and energy-efficient visual engines needed for next-generation AR/VR headsets. Furthermore, the integration of Himax's WiseEye AI technology into these devices can enable intelligent features like eye tracking and foveated rendering, which optimize performance and further reduce power draw by rendering only the area the user is looking at in high detail. This dual focus on display technology and AI integration positions Himax as a key enabler for the future of immersive computing.

- Emerging Strategic Segment: AR/VR/HMD device manufacturers are a key growth area, requiring specialized, compact, and ultra-low power display solutions.

- Market Growth: The AR/VR market is projected to grow significantly, with estimates suggesting it could surpass $300 billion by 2030, indicating substantial demand for advanced display components.

- Himax's Technological Edge: Himax's LCoS microdisplays and WiseEye AI technology are tailored to meet the high-performance, low-power demands of immersive AR/VR experiences.

- Enabling Immersive Experiences: These display solutions are critical for delivering the visual fidelity and efficiency necessary for the widespread adoption of AR and VR devices.

Industrial and Other Specialized Applications

Himax Technologies also serves industrial and specialized sectors that demand bespoke display solutions and unique driver ICs. This includes markets like medical equipment, industrial automation interfaces, and unique display technologies. These clients typically require customized products and extended product support, reflecting a need for reliability and longevity in their applications.

The company's WiseEye solutions are notably being integrated into smart home devices, enhancing features in products such as smart door locks. This demonstrates Himax's ability to adapt its core technologies for emerging consumer-facing industrial applications.

In 2023, Himax reported that its non-consumer electronics segment, which encompasses industrial and automotive applications, continued to be a significant contributor to its revenue. While specific figures for the industrial and specialized segment are often bundled, the overall growth in these areas highlights Himax's strategic diversification beyond traditional consumer markets.

- Customized Solutions: Himax provides tailored display driver ICs and integrated solutions for niche industrial and specialized markets.

- Long Product Lifecycles: These segments often require products with extended lifespans and consistent support, a capability Himax addresses.

- WiseEye Applications: The integration of Himax's WiseEye technology into smart home devices like smart door locks showcases its expansion into IoT and smart building solutions.

- Diversified Revenue Streams: Himax's focus on industrial and specialized applications contributes to a more balanced revenue profile, reducing reliance on any single market segment.

Himax Technologies caters to a diverse customer base, ranging from foundational display panel manufacturers and consumer electronics OEMs to the rapidly growing automotive and AR/VR/HMD sectors. Additionally, industrial and specialized markets seeking bespoke solutions form another key segment.

The company's strategy involves supplying essential display driver ICs and advanced technologies like LCoS microdisplays and WiseEye AI across these varied segments. This broad reach is supported by Himax's significant market share in areas such as automotive TDDI, exceeding 50%.

Financial performance in 2023 indicated that while traditional display driver ICs remain important, Himax is strategically diversifying into higher-growth areas like automotive and industrial applications, which contributed significantly to its revenue.

The AR/VR market, in particular, presents a substantial growth opportunity, with projections indicating a market size exceeding $300 billion by 2030, underscoring the demand for Himax's specialized display components.

Cost Structure

Research and Development (R&D) represents a substantial component of Himax's cost structure. This includes the significant investment in highly skilled engineering talent, the licensing of essential design software, and the costs associated with creating and testing new product prototypes.

Despite a 5.6% year-over-year decrease in operating expenses during 2024, partly influenced by reduced employee bonus payouts, Himax continues to prioritize R&D. This strategic allocation underscores the company's commitment to fostering innovation and maintaining a competitive edge in its target markets.

As a fabless semiconductor company, Himax Technologies relies heavily on external partners for its manufacturing. This means a significant portion of their expenses goes towards wafer fabrication, assembly, and testing, typically handled by foundries and OSAT providers. These costs are a major component of their cost of goods sold, fluctuating directly with how many chips they produce and the complexity of the technology used.

For instance, in the first quarter of 2024, Himax reported cost of revenue of $360.1 million. This figure directly reflects the substantial investment in outsourced manufacturing services required to produce their advanced display driver ICs and AI-powered sensing products. The company's strategy to diversify its foundry partners is crucial for managing these significant, volume-dependent expenses.

Himax Technologies' Sales, General, and Administrative (SG&A) expenses encompass the costs of running its sales force, marketing initiatives, and the essential functions of its corporate offices. This includes everything from sales team compensation and advertising campaigns to rent, utilities, and legal counsel. For instance, in the first quarter of 2024, Himax reported SG&A expenses of $45.2 million, reflecting their commitment to managing these operational costs effectively.

The company prioritizes rigorous expense control and ongoing cost optimization strategies to ensure SG&A remains efficient and supports its business objectives. This disciplined approach to overhead management is crucial for maintaining profitability and competitiveness in the dynamic semiconductor industry.

Intellectual Property (IP) Licensing and Royalties

Himax Technologies, operating within a fabless semiconductor model, acknowledges significant costs associated with intellectual property (IP) licensing and royalties. These expenses are crucial for integrating third-party foundational technologies and specialized IP blocks into their advanced display driver ICs and other semiconductor solutions, thereby accelerating product development and enhancing performance.

- IP Licensing Fees: Himax pays upfront or ongoing fees to license essential IP from other companies, enabling them to build upon existing technological frameworks.

- Royalty Payments: For each unit incorporating licensed IP, Himax may incur royalty charges, directly impacting the cost of goods sold.

- R&D Investment in IP: While licensing, Himax also invests heavily in its own IP development, which is a significant cost but vital for competitive differentiation.

- Strategic IP Acquisition: Costs may also arise from acquiring IP outright to secure exclusive rights or to bolster their patent portfolio, as seen in strategic acquisitions within the semiconductor industry.

In 2024, the semiconductor industry continued to see substantial investments in IP, with companies like Himax strategically managing these costs to maintain a competitive edge in areas like AI-enabled vision and display technologies. The exact figures for Himax's IP licensing and royalty expenses are typically detailed within their annual financial reports, reflecting the ongoing nature of these commitments in the fabless ecosystem.

Personnel Costs

Personnel costs are a significant fixed expense for Himax Technologies, encompassing salaries, benefits, and other related expenditures for its global workforce. A substantial portion of these costs is allocated to its highly skilled engineers and dedicated research and development teams, reflecting the company's commitment to innovation.

Attracting and retaining top-tier talent is paramount, necessitating competitive compensation packages. Annual bonuses represent a considerable component of employee remuneration, underscoring the value Himax places on its human capital. For instance, in 2023, Himax reported total employee compensation and benefits expenses amounting to approximately $398.7 million.

- Employee Salaries and Benefits: Covering the compensation of its global workforce, including specialized engineers.

- R&D Investment: A significant portion dedicated to highly skilled research and development personnel.

- Talent Retention: Competitive packages and annual bonuses are key to attracting and keeping top talent.

- 2023 Compensation: Himax's employee compensation and benefits totaled around $398.7 million in 2023.

Himax's cost structure is heavily influenced by its fabless model, necessitating significant spending on outsourced manufacturing. Research and Development (R&D) is another major cost driver, reflecting investments in skilled personnel and technological advancements.

Sales, General, and Administrative (SG&A) expenses, along with Intellectual Property (IP) licensing and royalty fees, also contribute substantially to overall costs. Personnel costs, particularly for R&D staff, represent a significant fixed expense.

| Cost Category | Q1 2024 (Millions USD) | 2023 (Millions USD) |

|---|---|---|

| Cost of Revenue | 360.1 | 1,498.6 |

| SG&A Expenses | 45.2 | 196.3 |

| Total Employee Compensation & Benefits | N/A | 398.7 |

Revenue Streams

Himax Technologies' core business revolves around the sale of Display Driver Integrated Circuits (DDICs). These are critical components for powering a wide array of displays, from traditional LCDs to advanced OLED panels. In 2024, this segment was particularly strong, contributing a significant 82.9% to Himax's total revenue.

The company holds a commanding position in this market, boasting a 40% global market share for DDICs. Himax supplies these essential driver ICs to major display panel manufacturers and also directly to Original Equipment Manufacturers (OEMs), solidifying its role as a key supplier in the display technology ecosystem.

Himax Technologies also generates revenue through the sale of Timing Controllers (TCONs). These components are essential for display panels, working alongside display drivers to ensure data signals are managed and synchronized correctly. TCONs are particularly important for displays that boast high resolutions and fast refresh rates, areas where Himax is seeing significant traction.

The demand for Himax's TCONs is robust, especially within the automotive sector. In 2024, the company experienced a substantial surge in automotive TCON sales, increasing by over 70%. This growth not only complements its existing Display Driver Integrated Circuit (DDIC) business but also highlights TCONs as a key strategic area for future expansion and revenue generation.

Himax Technologies is actively expanding its revenue beyond its traditional display driver ICs by offering a variety of non-driver products. This diversification includes crucial components like video processing ICs, essential for image enhancement, and power management ICs, vital for optimizing energy consumption in electronic devices. Furthermore, their touch and display driver integration (TDDI) solutions streamline the manufacturing process for touchscreens and displays.

In 2024, Himax reported significant growth in this segment, with non-driver product sales reaching $155.5 million. This represents a healthy 10.6% increase compared to the previous year and accounts for 17.1% of their total sales. This segment is a key focus for strategic growth, encompassing innovative areas such as their WiseEye AI solutions and advanced optical technologies.

Sales of ICs for Emerging Technologies (AR/VR/HMD)

Himax Technologies is seeing a significant uptick in revenue from its specialized integrated circuits (ICs) powering the burgeoning AR, VR, and HMD markets. These aren't just any chips; they are designed with Himax's proprietary WiseEye ultralow power AI sensing and wafer-level optics (WLO) technologies, which are crucial for the compact and power-efficient designs these devices demand.

As these advanced technology sectors continue to gain traction and mature, Himax anticipates these high-value, niche solutions will represent an increasingly substantial portion of its overall sales. For instance, Himax reported that its AI-enabled sensing products, which are key components for AR/VR applications, saw strong demand in 2023, contributing to its growth strategy.

- AR/VR/HMD IC Sales: Himax's specialized ICs are a growing revenue driver, targeting advanced display and sensing technologies.

- Key Technologies: WiseEye ultralow power AI sensing and WLO technologies are foundational to Himax's offerings in these emerging markets.

- Market Maturation: As AR/VR/HMD adoption increases, Himax expects these niche solutions to contribute more significantly to its financial performance.

- 2023 Performance: Strong demand for AI-enabled sensing products, vital for AR/VR, underscored the potential in these segments during 2023.

Licensing and Design Services

Himax Technologies, while primarily known for its display driver ICs, also explores revenue through intellectual property licensing and specialized design services for bespoke solutions. This often involves tailoring their advanced technologies for specific client needs, creating niche revenue opportunities.

The company is actively investing in next-generation product development, particularly in collaboration with leading AI semiconductor firms and foundry partners. This strategic focus is designed to unlock new revenue streams, with expectations that these initiatives will substantially boost overall revenue and profitability in the upcoming years. A key area of this development includes CPO (Co-Packaged Optics) solutions.

- Intellectual Property Licensing: Himax may generate revenue by licensing its patented technologies to other companies, enabling broader adoption and creating a recurring income stream.

- Design Services: Offering customized design solutions for clients requiring highly specialized integrated circuits or display technologies allows Himax to capture value beyond standard product sales.

- Future Technology Collaboration: Partnerships with AI semiconductor companies and foundries are aimed at developing cutting-edge products, such as CPO solutions, which are anticipated to become significant future revenue drivers.

- Strategic Investment in R&D: Himax's commitment to new technology development signals a forward-looking approach to revenue diversification and long-term growth, capitalizing on emerging market trends.

Himax Technologies' revenue streams are primarily driven by its dominance in Display Driver Integrated Circuits (DDICs), which accounted for 82.9% of its total revenue in 2024. The company also generates significant income from Timing Controllers (TCONs), experiencing over a 70% surge in automotive TCON sales in 2024. Additionally, Himax is diversifying with non-driver products, including video and power management ICs, and touch and display driver integration (TDDI) solutions, which saw a 10.6% increase in sales in 2024, reaching $155.5 million.

| Revenue Stream | 2024 Contribution | Key Products/Segments | Growth Drivers |

| Display Driver ICs (DDICs) | 82.9% | LCD, OLED displays | Market leadership, broad customer base |

| Timing Controllers (TCONs) | Significant | High-resolution, high-refresh-rate displays, Automotive | Automotive sector growth (over 70% increase in 2024) |

| Non-Driver Products | 17.1% ($155.5M) | Video ICs, Power Management ICs, TDDI | Diversification strategy, AI solutions (WiseEye), optical tech |

| AR/VR/HMD ICs | Emerging | AI sensing, WLO, specialized ICs | Growth in AR/VR markets, proprietary technologies |

Business Model Canvas Data Sources

The Himax Business Model Canvas is built upon a foundation of market intelligence, competitor analysis, and internal financial data. These sources provide a comprehensive view of industry trends and Himax's strategic positioning.