Himax Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Himax Bundle

Discover how Himax leverages its product innovation, strategic pricing, widespread distribution, and targeted promotions to dominate the display driver IC market.

This comprehensive 4Ps analysis goes beyond surface-level observations, offering actionable insights into Himax's marketing blueprint.

Unlock the full potential of this analysis—get instant access to an editable, presentation-ready report that details Himax's winning strategies, perfect for business professionals and students alike.

Product

Himax Technologies boasts a diverse portfolio of display driver integrated circuits (DDICs) and controllers, catering to everything from massive TV screens and monitors to the compact displays found in smartphones and e-paper devices. This breadth ensures they can meet a wide spectrum of market demands.

Their technological prowess is particularly evident in solutions like TDDI and LTDI, which are essential for the seamless integration of touch functionality into modern displays. These advancements are critical for devices where touch interaction is a primary user interface.

For instance, Himax's DDIC shipments in 2024 are projected to remain robust, particularly in the large-panel segment, driven by continued demand for high-resolution TVs and monitors. Their focus on integrated touch solutions also positions them well for the growing tablet and automotive display markets.

Himax Technologies is a powerhouse in automotive display integrated circuits (ICs), boasting a commanding global market share across various technologies. This includes traditional display driver ICs (DDICs), touch and display driver integration (TDDI), and advanced local dimming timing controller (Tcon) solutions. Their technology is fundamental to the trend of larger, more numerous, and sophisticated displays found in modern vehicles.

The widespread adoption of TDDI by major automotive manufacturers is a key growth driver for Himax, underscoring their leadership. Furthermore, the company is actively pushing the boundaries in automotive OLED display solutions, forging crucial partnerships with leading panel manufacturers to shape the future of in-car visual experiences.

Himax Technologies is a pivotal supplier of display and sensing solutions crucial for the burgeoning AR/VR/HMD market. Their advanced LCoS microdisplays, Wafer Level Optics (WLO), and 3D sensing technologies are foundational for creating the immersive and interactive experiences consumers and professionals demand.

At CES 2025, Himax showcased significant advancements, including groundbreaking 3D naked-eye display technology and integrated AR display modules. These innovations, often developed in collaboration with industry leaders like Vuzix, underscore Himax's commitment to pushing the boundaries of visual technology for next-generation wearables.

The AR/VR market is projected for substantial growth, with IDC forecasting worldwide spending on AR/VR to reach $120.7 billion in 2024, an increase of 42.4% over 2023. Himax's role in providing these essential components positions them to capitalize on this expansion, particularly as the demand for higher resolution, lower latency, and more compact display solutions intensifies.

Advanced AI Sensing Solutions (WiseEye)

Himax's WiseEye brand represents a significant product diversification beyond traditional display drivers, focusing on ultralow-power AI sensing solutions. These integrated modules combine AI processors, always-on image sensors, and AI algorithms, enabling intelligent features in edge devices. This strategic move into AIoT applications showcases Himax's commitment to innovation and expanding its market reach.

WiseEye solutions are being deployed across a range of innovative applications, demonstrating their versatility and Himax's growing influence in the AIoT space. Recent developments highlight their integration into smart door locks, palm vein authentication systems, and even notebooks, offering enhanced security and user experience. The plug-and-play design of these modules further accelerates adoption by simplifying integration for various multi-scenario use cases.

The market for AI-powered edge devices is experiencing robust growth, with Himax's WiseEye poised to capitalize on this trend. For instance, the smart home market, a key area for AI sensing, is projected to reach over $100 billion by 2026, with AI-enabled security features being a major driver. Himax's focus on ultralow power consumption is a critical differentiator in this battery-dependent sector.

- Product Focus: Ultralow-power AI sensing solutions (WiseEye) integrating AI processors, always-on image sensors, and AI algorithms.

- Key Applications: Endpoint AI devices, smart door locks, palm vein authentication, and notebooks.

- Market Position: Expansion into the growing AIoT sector, offering plug-and-play modules for diverse multi-scenario applications.

- Growth Driver: Capitalizing on the increasing demand for AI-enabled features in edge devices, particularly in security and smart home markets.

Co-Packaged Optics (CPO) for AI/HPC

Himax is making significant strides in the high-speed AI computing sector, leveraging its unique Wafer Level Optics (WLO) technology. This proprietary tech is absolutely essential for the development of Co-Packaged Optics (CPO), a key component for next-generation AI infrastructure.

In collaboration with FOCI, Himax has introduced groundbreaking CPO technology. This innovation seamlessly integrates silicon photonic chips with optical connectors, promising a substantial boost in bandwidth and a notable reduction in power consumption for AI multi-chip modules. While initially targeting cloud applications, future expansion into automotive and robotics is on the horizon.

The market is keenly awaiting the mass production of CPO, which is currently slated to begin in 2026. This timeline suggests a significant ramp-up in the adoption of CPO solutions within the AI and High-Performance Computing (HPC) ecosystems.

- Strategic Importance: Himax's WLO technology is a cornerstone for CPO, directly addressing the increasing demand for higher bandwidth and lower power in AI/HPC.

- Partnership Advantage: The collaboration with FOCI highlights a strong industry partnership, accelerating the development and deployment of leading CPO solutions.

- Market Potential: CPO is poised to revolutionize AI multi-chip modules, with potential applications extending beyond cloud computing into emerging sectors like automotive and robotics.

- Production Outlook: Anticipated mass production in 2026 indicates a clear pathway for Himax's CPO technology to enter the mainstream market.

Himax Technologies offers a comprehensive suite of display driver ICs (DDICs) and controllers, essential for a vast array of electronic devices. Their product strategy emphasizes technological integration, such as TDDI and LTDI, which are crucial for modern touch-enabled displays. Shipments in 2024 are expected to remain strong, particularly in large-panel displays for TVs and monitors, with a growing contribution from automotive and tablet segments.

Himax's product portfolio is deeply embedded in the automotive sector, providing advanced display driver ICs, TDDI, and Tcon solutions that enable the sophisticated visual interfaces in contemporary vehicles. Their leadership is further solidified by a focus on emerging technologies like automotive OLED displays, cultivated through strategic alliances with key panel manufacturers.

| Product Category | Key Technologies | Target Markets | 2024/2025 Focus | Market Significance |

|---|---|---|---|---|

| Display Drivers & Controllers | DDIC, TDDI, LTDI | Smartphones, Tablets, TVs, Monitors, Automotive | Robust shipments in large panels; growth in automotive and tablets | Core business, enabling touch functionality and advanced visuals |

| Automotive Displays | DDIC, TDDI, Tcon, OLED | Automotive Infotainment, Instrument Clusters | Expanding market share; developing OLED solutions | Dominant global supplier, critical for in-car displays |

| AR/VR/HMD | LCoS Microdisplays, WLO, 3D Sensing | Augmented Reality, Virtual Reality, Head-Mounted Displays | Advancements in naked-eye 3D displays and AR modules | Foundational components for immersive experiences; capitalizing on market growth |

| AI Sensing (WiseEye) | AI Processors, Image Sensors, AI Algorithms | Endpoint AI Devices, Smart Home, Security | Ultralow-power AI sensing for edge devices | Diversification into AIoT, enabling intelligent features with low power |

| High-Speed AI Computing | Wafer Level Optics (WLO) for CPO | AI/HPC Infrastructure, Cloud Computing | Enabling Co-Packaged Optics (CPO) for next-gen AI | Critical technology for future AI infrastructure, with mass production anticipated in 2026 |

What is included in the product

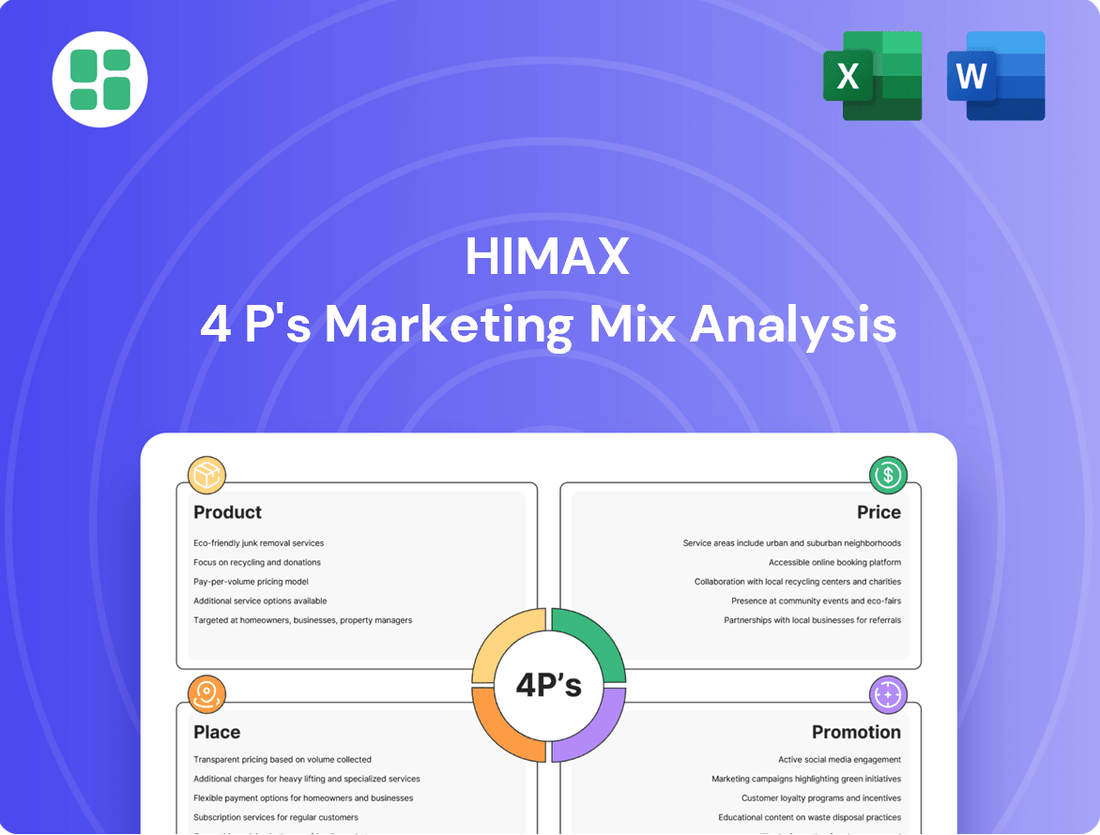

This analysis provides a comprehensive examination of Himax's marketing strategies, detailing their Product offerings, Pricing tactics, Place (distribution) channels, and Promotion efforts.

It offers actionable insights into Himax's market positioning and competitive advantages, serving as a valuable resource for strategic decision-making.

Provides a clear, actionable framework to address marketing challenges, transforming complex strategies into easily manageable components.

Simplifies the identification and resolution of marketing roadblocks, offering a structured approach to optimize Himax's product, price, place, and promotion strategies.

Place

Himax Technologies primarily utilizes a direct sales strategy, fostering deep relationships with Original Equipment Manufacturers (OEMs) and Original Design Manufacturers (ODMs) across the globe. This direct engagement, particularly with major panel manufacturers and mobile device makers, is crucial for aligning product development with customer needs. In 2023, Himax reported that over 90% of its revenue was generated through direct sales channels, highlighting the effectiveness of this approach in securing large-volume orders.

Himax Technologies, headquartered in Tainan, Taiwan, boasts a robust global operational footprint. This strategic positioning is further enhanced by significant offices in Hsinchu and Taipei, underscoring its deep roots in the semiconductor hub of Taiwan.

The company extends its reach through country offices in crucial markets such as China, South Korea, Japan, Germany, and the United States. This international network is vital for Himax, enabling it to effectively serve a broad and diverse customer base spanning multiple continents.

This widespread geographical presence is not merely about scale; it's a cornerstone of Himax's strategy to provide localized support and foster closer engagement with its clients. For instance, Himax reported a revenue of $1.33 billion for the fiscal year 2023, demonstrating the scale of operations supported by its global network.

Himax Technologies (HIMX) fosters deep technical collaboration, with its engineers working hand-in-hand with customer teams. This ensures Himax's integrated circuit (IC) solutions are precisely tailored to meet unique specifications and deliver optimal performance across diverse applications, from consumer gadgets to advanced automotive systems.

This partnership-driven development is crucial for successfully integrating complex ICs into end products and solidifying Himax's market position. For instance, in the automotive sector, this close collaboration is key to meeting stringent safety and performance requirements for advanced driver-assistance systems (ADAS), a market Himax has been actively expanding into.

Efficient Supply Chain Management

Himax Technologies, as a fabless semiconductor company, depends heavily on its external foundry partners for production. Their success hinges on maintaining robust relationships with these manufacturers to ensure consistent output and quality. This reliance means Himax's operational prowess is directly tied to the efficiency and reliability of its manufacturing partners.

The company's supply chain demonstrates remarkable agility, allowing them to effectively manage inventory and react quickly to fluctuating market demands. This adaptability is crucial, especially when fulfilling rush orders, showcasing their capacity to navigate the fast-paced semiconductor industry. For instance, in Q1 2024, Himax reported a days sales in inventory of 106 days, indicating a focus on managing stock levels efficiently while meeting customer needs.

- Inventory Management: Himax's ability to balance inventory levels against demand is key to avoiding stockouts and excess.

- Responsiveness: Their swift response to market shifts and urgent customer requests highlights a well-tuned supply chain.

- Foundry Partnerships: Strong collaborations with foundries are fundamental to Himax's manufacturing strategy and product availability.

- Market Navigation: Operational efficiency enables them to thrive in the volatile semiconductor landscape.

Diverse Application Market Reach

Himax Technologies' diverse application market reach is a significant strength, extending far beyond traditional display technology. Their advanced semiconductor solutions are integral to a wide array of end-use applications, demonstrating a strategic penetration across multiple high-growth sectors. This broad integration ensures Himax products are accessible to a vast consumer base through numerous original equipment manufacturers (OEMs) and system integrators.

The company's components are found in critical systems such as automotive displays and advanced driver-assistance systems (ADAS), AIoT devices powering smart cities and industrial automation, and sophisticated smart home and office solutions. Furthermore, Himax is making inroads into the medical device sector with its high-performance imaging and sensing technologies, as well as supporting the burgeoning robotics industry.

This expansive market coverage is underpinned by Himax's ability to adapt its core technologies to meet the specific demands of each sector. For instance, in the automotive sector, where reliability and safety are paramount, Himax's solutions are designed to meet stringent industry standards. In the rapidly evolving AIoT space, their low-power, high-performance chips are crucial for enabling intelligent, connected devices.

- Automotive: Himax's automotive solutions are crucial for in-car displays and ADAS, a market projected to reach over $60 billion by 2027, with Himax playing a key role in enabling advanced visual interfaces and sensor fusion.

- AIoT: The AIoT market is expanding rapidly, with Himax chips powering everything from smart cameras to industrial sensors, contributing to a sector expected to exceed $100 billion in the coming years.

- Smart Home/Office: Himax technology enhances user experiences in smart speakers, security systems, and interactive whiteboards, tapping into a market segment that saw significant growth in 2023 and is projected to continue its upward trajectory.

- Medical & Robotics: The integration of Himax's high-resolution imaging and sensing technology into medical devices and robotic systems highlights their commitment to innovation in critical, high-value applications.

Himax Technologies' place strategy centers on its global operational footprint and deep customer relationships. Headquartered in Taiwan, the company maintains a strong presence in key markets like China, South Korea, Japan, Germany, and the United States, facilitating localized support and engagement with its diverse clientele.

This strategic geographical positioning allows Himax to effectively serve a broad customer base, from major panel manufacturers to automotive system integrators. Their direct sales approach, emphasizing technical collaboration, ensures tailored IC solutions for applications ranging from consumer electronics to advanced automotive systems.

The company's ability to deliver billions in revenue, such as the $1.33 billion reported for fiscal year 2023, is a testament to the effectiveness of its widespread network and its commitment to being close to its customers.

| Region | Key Offices/Presence | Strategic Importance |

|---|---|---|

| Taiwan | Headquarters (Tainan), Hsinchu, Taipei | Semiconductor hub, R&D, core operations |

| Asia | China, South Korea, Japan | Major manufacturing and consumer markets, key customer base |

| North America | United States | Access to advanced technology sectors, automotive, AIoT |

| Europe | Germany | Automotive industry focus, industrial automation |

Full Version Awaits

Himax 4P's Marketing Mix Analysis

The preview you see here is not a sample; it's the final version of the Himax 4P's Marketing Mix Analysis you’ll receive. This comprehensive document is ready for immediate download and use upon purchase. You can be confident that the detailed insights into Himax's product, price, place, and promotion strategies are exactly what you will get.

Promotion

Himax Technologies actively engages in key industry events, demonstrating its commitment to showcasing innovation. For instance, their presence at major exhibitions like CES and Display Week in 2024 provided a vital stage for unveiling advanced technologies. These events are critical for generating buzz and attracting new business opportunities.

At these gatherings, Himax often highlights groundbreaking products, such as their latest 3D naked-eye display solutions and integrated AR display modules. This strategic participation not only reinforces their standing as a technology leader but also significantly boosts awareness among potential customers, partners, and investors within the global tech landscape.

Himax actively cultivates strategic partnerships with major players across the technology landscape. Collaborations with leading panel makers, AI platform providers, and device manufacturers such as Vuzix, FOCI, Dell, and DESMAN are central to their strategy.

These alliances are crucial for Himax to co-develop advanced, integrated solutions, thereby speeding up the adoption of their technologies. This ecosystem engagement also significantly expands Himax's market presence, particularly in burgeoning sectors like AIoT and high-speed computing.

Joint product announcements and collaborative launch events serve as powerful promotional tools, amplifying Himax's market visibility and reinforcing the value proposition of their integrated offerings to a wider audience.

Himax Technologies (HIMX) actively engages its investor base through a robust investor relations program. This includes quarterly earnings calls, detailed financial reports, and investor presentations that offer insights into their performance and strategic vision. For instance, their Q1 2024 earnings call highlighted progress in AI-driven applications and automotive display solutions, key growth areas for the company.

These communications are designed to inform a broad audience, from individual investors to financial professionals, about Himax's operational updates and technological advancements. By providing transparency on factors like their market share in LCoS microdisplays and their progress in AI-enabled sensing solutions, Himax aims to foster investor confidence and support their valuation.

Technical Publications and Whitepapers

Himax Technologies, a leader in display and semiconductor solutions, leverages technical publications and whitepapers as a key component of its promotional strategy. These documents are crucial for detailing the advanced capabilities of their integrated circuits (ICs) and innovative solutions.

These materials serve to educate a sophisticated audience, including engineers, potential clients, and industry analysts, on the specific advantages and technical differentiators of Himax's offerings. This approach solidifies their position as a technical authority and a thought leader in the semiconductor space.

- Technical Deep Dives: Himax's whitepapers likely explore the intricacies of their AI-enabled vision processors and display driver ICs, providing detailed performance metrics and application examples.

- Industry Education: By publishing research articles, Himax contributes to the broader understanding of advancements in areas like low-power AI and advanced display technologies, fostering industry-wide knowledge.

- Product Differentiation: Whitepapers clearly outline the unique selling propositions of their products, such as the energy efficiency of their WiseEye™ AI-IoT platform, crucial for informed purchasing decisions.

Focus on Automotive Market Leadership

Himax Technologies, a key player in the semiconductor industry, consistently emphasizes its strong position within the automotive sector, particularly in display integrated circuit (IC) technologies. Their promotional efforts highlight a dominant market share and technological prowess in areas like Touch Display Driver Integrated Circuits (TDDI) and local dimming timing controller (Tcon) solutions for automotive displays.

This strategic focus is supported by Himax's consistent communication about its pioneering solutions and a proven history of successful collaborations with major automotive manufacturers. These messages aim to solidify their leadership in a market segment that is experiencing significant growth and offers substantial value.

For instance, Himax reported that its automotive revenue represented approximately 24% of its total revenue in the first quarter of 2024, showcasing the increasing importance of this segment. The company's Tcon solutions are integral to advanced automotive displays, enabling features like local dimming for enhanced contrast and energy efficiency, which are increasingly sought after by carmakers.

- Market Share: Himax leads in automotive TDDI and Tcon technologies, crucial for modern vehicle displays.

- Technological Leadership: The company promotes its innovative solutions, including local dimming for improved display quality.

- Partnerships: Himax collaborates with leading automotive brands, reinforcing its credibility and market penetration.

- Revenue Contribution: Automotive revenue accounted for roughly 24% of Himax's total revenue in Q1 2024, indicating strong market traction.

Himax's promotional strategy is multi-faceted, encompassing industry events, investor relations, technical publications, and sector-specific marketing. Their participation in events like CES 2024 and Display Week 2024 showcased innovations in AR and 3D displays. Investor communications, including Q1 2024 earnings calls, highlight progress in AI and automotive sectors, aiming to build confidence.

Technical publications and whitepapers serve to educate industry professionals on their advanced ICs and AI-IoT platforms, reinforcing their technical authority. Furthermore, Himax actively promotes its leading position in automotive display technologies, with automotive revenue reaching approximately 24% of total revenue in Q1 2024, underscoring their market strength.

| Promotional Focus Area | Key Activities/Channels | 2024/2025 Data/Examples |

|---|---|---|

| Industry Events & Exhibitions | Showcasing new technologies, networking | Presence at CES 2024, Display Week 2024; unveiling 3D naked-eye displays, AR modules |

| Investor Relations | Earnings calls, financial reports, presentations | Q1 2024 earnings call highlighting AI and automotive progress |

| Technical Publications & Thought Leadership | Whitepapers, research articles | Detailing capabilities of AI vision processors, display driver ICs, WiseEye™ platform efficiency |

| Sector-Specific Marketing (Automotive) | Highlighting market share, partnerships, product benefits | ~24% of Q1 2024 revenue from automotive; promotion of TDDI and Tcon solutions |

Price

Himax Technologies utilizes a value-based pricing approach for its advanced IC solutions, reflecting the substantial innovation and performance delivered to sectors like automotive and AI sensing. This strategy acknowledges the high technological barriers and significant R&D investment, allowing for premium pricing that captures the inherent value of their specialized offerings.

For instance, Himax's AI sensing solutions, crucial for autonomous driving and smart devices, are priced to reflect their cutting-edge capabilities and the competitive advantage they provide to customers. This pricing aligns with the superior performance and unique intellectual property embedded within these complex integrated circuits, ensuring profitability commensurate with the advanced nature of the technology.

Himax operates in a fiercely competitive semiconductor landscape where competitor pricing and market demand heavily shape its own pricing strategies. The company aims for high-value segments but needs to maintain competitive pricing, particularly for established products like traditional display drivers.

While Himax enjoys significant market share in specific areas, granting it some pricing leverage, the ever-changing market necessitates continuous strategic pricing adjustments to stay ahead.

Himax's gross margin is directly tied to its product mix. For instance, in Q1 2024, Himax reported a gross margin of 27.1%, a figure bolstered by the increasing contribution of higher-margin non-driver products and advanced automotive solutions.

The company's strategy actively targets a pivot towards these more profitable, value-added segments. This focus implies that pricing decisions for certain product lines might prioritize overall profit optimization over sheer sales volume.

Volume-Based Pricing and Long-Term Contracts

Himax likely employs volume-based pricing for its large-volume customers, such as panel manufacturers and major original equipment manufacturers (OEMs). This strategy involves offering tiered discounts based on the quantity of chips purchased, making their advanced display driver ICs and other semiconductor solutions more cost-effective for high-volume clients. For instance, a customer committing to a significant annual volume could secure a lower per-unit price compared to smaller orders.

Furthermore, Himax probably utilizes long-term supply agreements to solidify relationships with its key partners. These contracts provide Himax with predictable revenue streams and ensure consistent demand for its products, while offering clients price stability and guaranteed supply. Such arrangements are crucial in the semiconductor industry, where production planning and component availability are paramount.

These volume-based pricing and long-term contract strategies are critical for Himax's market position. They not only incentivize larger purchases but also foster loyalty and reduce the risk of customer churn. For example, Himax's focus on the automotive and industrial sectors, which often require substantial and consistent chip supplies, makes these pricing models particularly relevant.

- Volume Discounts: Himax likely offers tiered pricing structures, reducing the per-unit cost for customers who purchase in larger quantities, a common practice for semiconductor suppliers.

- Long-Term Contracts: Securing multi-year supply agreements with major clients like smartphone manufacturers or automotive suppliers provides Himax with revenue visibility and operational stability.

- Customer Retention: These strategies are designed to lock in key customers, ensuring consistent demand and reducing the impact of market fluctuations on Himax's sales performance.

- Cost Efficiency for Clients: By offering volume-based incentives, Himax helps its largest customers manage their bill of materials (BOM) costs, strengthening the partnership.

Consideration of Economic Factors and Inventory

Himax Technologies (HIMX) considers broader economic factors when setting prices. This includes navigating supply chain cost volatility, which has been a significant concern globally through 2024 and into 2025, impacting semiconductor manufacturing. Currency exchange rate fluctuations also play a role, as Himax operates internationally.

The company's pricing decisions are further informed by overall market demand for its display driver ICs and other semiconductor solutions. Himax's demonstrated ability to manage inventory effectively and respond quickly to market shifts is crucial. This agility allows them to adjust pricing strategically, particularly when facing imbalances between supply and demand or when fulfilling urgent customer orders.

- Supply Chain Costs: Ongoing global logistics challenges and raw material price pressures in 2024-2025 necessitate flexible pricing models.

- Currency Exchange Rates: Fluctuations in the US Dollar against Asian currencies can impact Himax's cost structure and competitive pricing.

- Market Demand: Pricing is responsive to demand cycles for consumer electronics, automotive displays, and other key Himax markets.

- Inventory Management: Efficient inventory control enables Himax to capitalize on short-term demand surges and manage price adjustments effectively.

Himax's pricing strategy is a dynamic blend of value-based premiums for its advanced AI and automotive solutions and competitive pricing for its high-volume display driver ICs. This dual approach allows them to capture maximum value from innovation while maintaining market share in established segments.

The company's pricing is heavily influenced by market competition and the need to offer cost-effective solutions to large OEMs, particularly in the display driver market. For instance, in Q1 2024, Himax reported a gross margin of 27.1%, reflecting the profitability mix between these different product categories.

Volume discounts and long-term contracts are key tactics to secure business with major clients, ensuring predictable revenue and customer loyalty. This is especially relevant in the automotive sector, where consistent supply and stable pricing are critical.

Himax must also navigate external economic factors such as supply chain costs and currency fluctuations, which directly impact its pricing flexibility and competitiveness through 2024 and into 2025.

| Pricing Strategy Element | Description | Impact on Himax | Example/Data Point |

|---|---|---|---|

| Value-Based Pricing | Pricing based on the perceived value and performance of advanced ICs. | Maximizes revenue from high-margin products. | AI sensing solutions for automotive. |

| Competitive Pricing | Pricing aligned with market rates for high-volume products. | Maintains market share in display drivers. | Display driver ICs for consumer electronics. |

| Volume Discounts | Tiered pricing for larger purchase volumes. | Incentivizes large orders, fosters customer loyalty. | Discounts for major panel manufacturers. |

| Long-Term Contracts | Multi-year supply agreements. | Ensures revenue visibility and operational stability. | Agreements with smartphone OEMs. |

| Economic Factors | Consideration of supply chain costs and currency rates. | Requires pricing adjustments to maintain competitiveness. | Gross margin of 27.1% in Q1 2024 influenced by cost pressures. |

4P's Marketing Mix Analysis Data Sources

Our Himax 4P's Marketing Mix Analysis is grounded in comprehensive data, including official company reports, investor relations materials, and direct observations of their product offerings and pricing strategies. We also leverage industry-specific market research and competitive intelligence to ensure a thorough understanding of their market positioning.