Himax Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Himax Bundle

Himax Technologies operates in a dynamic semiconductor landscape, where the bargaining power of buyers and the threat of substitutes significantly shape its competitive environment. Understanding these forces is crucial for navigating its market.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Himax’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Himax Technologies, operating as a fabless semiconductor company, is inherently dependent on external foundries for its manufacturing. This reliance places a significant portion of its production capabilities in the hands of a select group of advanced semiconductor manufacturers.

The semiconductor foundry sector is characterized by high concentration. For instance, TSMC (Taiwan Semiconductor Manufacturing Company) alone held an estimated 58% of the global foundry market share in 2023, with its share in advanced nodes being even higher. This dominance translates into substantial bargaining power for these foundries, particularly when it comes to accessing the most advanced manufacturing processes essential for Himax's cutting-edge display driver ICs and other specialized chips.

Switching foundries or key material suppliers in the semiconductor industry, like Himax, can be incredibly costly. These expenses often include significant investments in redesigning components, undergoing rigorous re-qualification processes, and facing potential delays in bringing new products to market. For instance, a typical semiconductor re-qualification can take anywhere from six to eighteen months and cost millions of dollars.

This inherent expense creates a notable dependency for Himax on its established supplier relationships. Consequently, it strengthens the bargaining power of these suppliers, as the financial and operational ramifications of Himax switching providers are substantial, giving suppliers leverage in negotiations.

Himax Technologies' reliance on specialized, high-performance semiconductor fabrication processes and unique input materials for its advanced display drivers and AR/VR/AI chips can grant significant bargaining power to its key suppliers. If the specific materials or manufacturing technologies required are not readily available from multiple sources, Himax faces a greater risk of supplier leverage.

Threat of Forward Integration

The threat of forward integration by suppliers, particularly foundries, poses a potential challenge to fabless semiconductor companies like Himax. While foundries typically focus on manufacturing, there's a theoretical risk they could move into designing and selling end products, directly competing with their fabless clients. However, the immense capital investment required for chip manufacturing, estimated to be billions of dollars for advanced fabrication plants, generally discourages foundries from diversifying into the highly competitive and design-intensive fabless space. For instance, TSMC, a leading foundry, invests tens of billions annually in its manufacturing capabilities, reinforcing its commitment to its core business.

Integrated Device Manufacturers (IDMs) represent a more nuanced threat. These companies, which handle both chip design and manufacturing, could potentially increase their in-house component production, thereby reducing their reliance on external suppliers and indirectly impacting the supplier landscape for fabless firms. This strategy might be pursued if an IDM sees a significant market opportunity for a specific component or wishes to secure its supply chain. However, the specialization and efficiency of dedicated foundries often make it more cost-effective for IDMs to outsource manufacturing for many of their component needs.

While direct forward integration by foundries into end-product design is rare due to the specialized skills and market knowledge required, the broader trend of consolidation and strategic shifts within the semiconductor industry warrants attention. For example, in 2024, the global semiconductor manufacturing equipment market was valued at approximately $100 billion, highlighting the scale of investment and focus within this sector. This capital intensity reinforces the likelihood that most foundries will continue to prioritize their manufacturing expertise over venturing into direct competition with their fabless partners.

- Foundries' focus on capital-intensive manufacturing

- IDMs' potential for increased internal component production

- High barrier to entry for foundries in end-product design

Supplier Importance to Himax

Himax Technologies relies heavily on its suppliers, particularly foundries, for manufacturing its display driver ICs and other semiconductor products. The company's operational agility and ability to meet market demands are directly linked to the reliability and capacity of these key partners. In 2023, Himax reported that its top five suppliers accounted for a significant portion of its total purchases, highlighting the concentration of supplier relationships.

Strategic partnerships with foundries and other essential component providers are paramount for Himax to maintain its competitive edge. These collaborations are crucial for securing production capacity, ensuring quality, and managing inventory effectively within the often volatile semiconductor market. For instance, Himax's ability to scale production for new product launches, such as its AI-enabled sensing solutions, hinges on the foundry's willingness and capability to allocate sufficient wafer starts.

- Supplier Dependence: Himax's operational efficiency is intrinsically tied to the consistent supply of critical components, especially from its foundry partners.

- Strategic Alliances: Cultivating strong relationships with foundries is vital for Himax to guarantee production capacity and maintain its market responsiveness.

- Market Volatility Management: Effective inventory management and the ability to adapt to fluctuating demand are directly influenced by the strength and flexibility of supplier agreements.

Himax's bargaining power with suppliers is limited due to the high concentration in the semiconductor foundry market, where companies like TSMC dominate advanced manufacturing. This concentration means Himax has fewer options for its critical fabrication needs, giving suppliers significant leverage.

The cost and time involved in switching foundries are substantial, creating a strong dependency for Himax on its existing supplier relationships. This switching cost, which can include millions of dollars and 6-18 months for re-qualification, further empowers suppliers in negotiations.

The specialized nature of Himax's advanced display driver ICs and AR/VR/AI chips means that if specific materials or manufacturing technologies are not widely available, suppliers can exert even more influence.

While forward integration by foundries into end-product design is rare due to the capital and expertise required, the ongoing consolidation and strategic focus within the industry, with massive investments in manufacturing like the $100 billion semiconductor manufacturing equipment market in 2024, reinforce their commitment to their core business, indirectly benefiting Himax by maintaining specialized foundry services.

What is included in the product

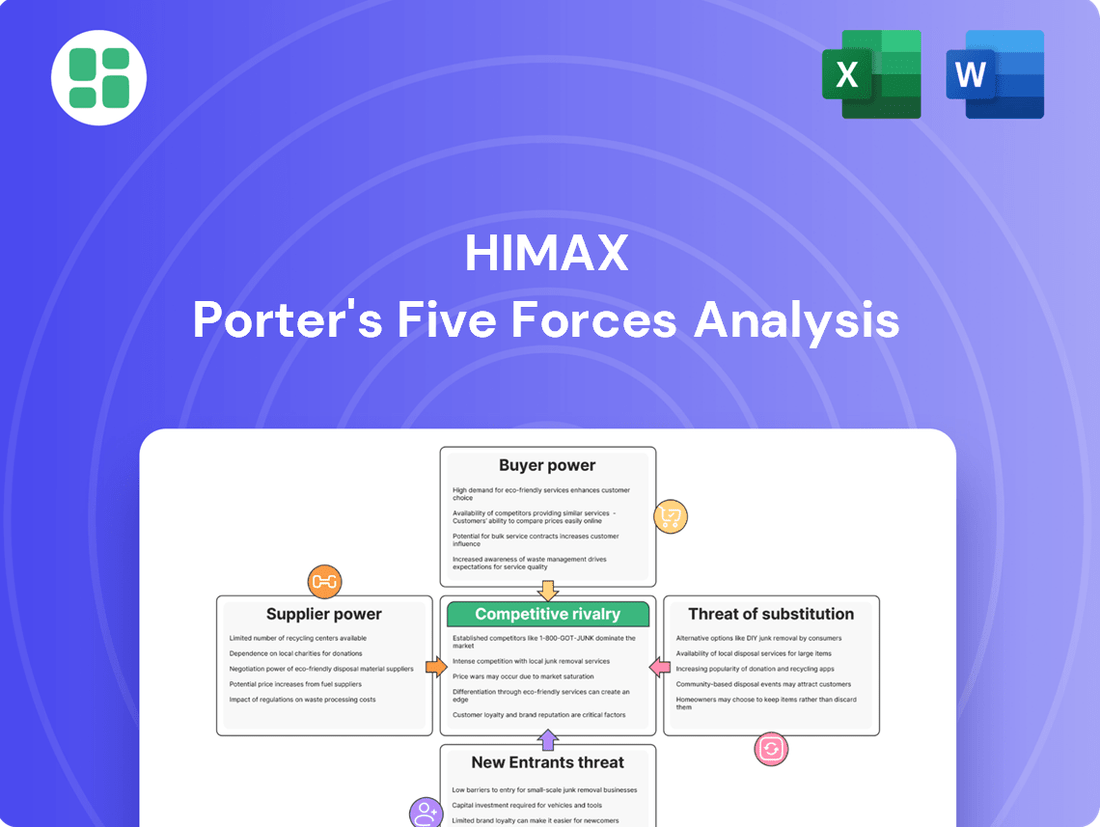

This Porter's Five Forces analysis for Himax thoroughly examines the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitutes on Himax's semiconductor business.

Effortlessly identify and mitigate competitive threats with a dynamic visual representation of all five forces, streamlining strategic planning.

Customers Bargaining Power

Himax Technologies serves a wide array of electronics manufacturers, spanning sectors like televisions, laptops, mobile phones, tablets, and automotive displays. This broad customer base generally dilutes individual customer bargaining power.

However, Himax acknowledges that reliance on a few key customers presents a significant risk. Such concentration can amplify the bargaining power of these principal buyers, potentially leading to pricing pressures or unfavorable contract terms.

Customers in consumer electronics, especially for high-volume items like smartphones and televisions, are frequently quite sensitive to price. This is driven by the fierce competition within their own markets, which naturally pushes them to seek the lowest possible costs for components like Himax's display drivers.

This intense price sensitivity among buyers can directly translate into downward pressure on Himax's average selling prices (ASPs) for its display driver integrated circuits. For instance, in 2024, the global smartphone market experienced a slight decline in shipments, intensifying the need for component suppliers to offer competitive pricing to secure orders.

The availability of substitute products significantly impacts Himax's bargaining power with its customers. Customers can readily turn to competitors like Novatek Microelectronics and LG Display for display driver ICs and other semiconductor solutions. This ease of switching suppliers means customers have considerable leverage to negotiate better pricing and terms, as Himax must remain competitive to retain their business.

Customer's Purchase Volume

Large-volume customers, like major electronics manufacturers, hold considerable sway over Himax. Their substantial purchase volumes grant them leverage to negotiate for lower prices, bespoke product configurations, and more accommodating payment or delivery schedules. This is particularly evident in Himax's expanding automotive sector, where dealings with prominent global automotive brands necessitate a keen understanding of their volume-driven demands.

For instance, in 2023, Himax reported that its top ten customers accounted for a significant portion of its revenue, underscoring the concentrated purchasing power within its client base. This concentration means that losing even one major client could have a material impact on Himax's financial performance.

- Significant Customer Concentration: Himax's reliance on a few large customers amplifies their bargaining power.

- Automotive Sector Influence: Major global automotive brands in Himax's growing automotive segment exert strong pricing and customization pressures.

- Negotiation Leverage: High purchase volumes allow these customers to demand better terms, impacting Himax's profit margins.

- Strategic Importance of Key Accounts: Maintaining strong relationships with these large clients is crucial for Himax's sustained growth and market position.

Customer Switching Costs

Customer switching costs for display driver and controller ICs, while present, are not insurmountable for Himax’s clients. While re-design and validation are necessary steps, these efforts are manageable, particularly when alternative suppliers offer compelling price points or enhanced technological capabilities. This dynamic grants customers a degree of leverage in their supplier relationships.

The ability for customers to switch suppliers, even with some effort, directly influences their bargaining power. In 2024, the semiconductor industry saw continued intense competition, pushing manufacturers to innovate and maintain competitive pricing to retain clients. For instance, a customer might face a few months of re-engineering time, but if a competitor offers a 5% cost reduction or a performance improvement, the switch becomes economically viable.

- Manageable Re-design Effort: While some engineering resources are required for integration, the complexity is often within the scope of typical product development cycles.

- Price Sensitivity: Customers are highly attuned to cost savings, making price a significant factor in their sourcing decisions.

- Technological Parity: If competitors offer comparable or superior performance, the barrier to switching is significantly lowered.

- Supplier Competition: A robust competitive landscape for display driver ICs empowers customers to negotiate more favorable terms.

Himax's customers, particularly large electronics manufacturers, wield significant bargaining power due to their substantial order volumes. This leverage allows them to negotiate for lower prices and more favorable contract terms, directly impacting Himax's profitability. For example, in 2023, Himax's top ten customers represented a substantial portion of its revenue, highlighting their concentrated purchasing influence.

The intense competition within the consumer electronics market in 2024 further empowers customers. They are highly sensitive to component costs, readily seeking out suppliers offering the most competitive pricing for display driver ICs. This price sensitivity means Himax must constantly balance cost reduction with maintaining product quality to retain these crucial accounts.

While switching costs exist for customers integrating Himax's components, they are not prohibitive. The availability of alternative suppliers like Novatek Microelectronics, coupled with manageable re-design efforts, provides customers with the leverage to demand better terms or switch if a competitor offers a compelling price or performance advantage.

| Customer Segment | Bargaining Power Drivers | Impact on Himax | 2024 Market Context |

|---|---|---|---|

| Large Volume Manufacturers | High purchase volume, concentration of buyers | Price pressure, demand for favorable terms | Slight decline in global smartphone shipments intensified price competition |

| Price-Sensitive Consumer Electronics | Intense market competition, focus on cost reduction | Downward pressure on ASPs | Component cost efficiency became a key differentiator for device manufacturers |

| Automotive Sector Clients | Growing importance, dealings with major brands | Demand for customization and volume-based pricing | Automotive display market continued to grow, increasing the strategic importance of these accounts |

Same Document Delivered

Himax Porter's Five Forces Analysis

This preview showcases the complete Himax Porter's Five Forces Analysis, offering an in-depth examination of competitive forces within its industry. The document you see here is precisely what you will receive immediately after purchase, ensuring transparency and immediate utility for your strategic planning.

Rivalry Among Competitors

Himax Technologies operates within the highly competitive semiconductor market, specifically for display drivers and imaging integrated circuits. The field is populated by numerous players, contributing to a fragmented yet intensely contested environment. This means Himax faces significant rivalry from a range of companies.

Key competitors that directly challenge Himax include Allegro MicroSystems, Tower Semiconductor, SiTime, LG Display, Impinj, and Silicon Motion Technology. The presence of these established entities, each with their own market share and technological advancements, intensifies the pressure on Himax to innovate and maintain its competitive edge. For instance, in the first quarter of 2024, the semiconductor industry saw a notable resurgence, with companies like TSMC, a key foundry partner for many, reporting strong revenue growth, indicating the overall health and competitive activity within the sector.

The global semiconductor industry is poised for significant expansion, with worldwide sales anticipated to climb by 11.2% in 2025. This robust growth trajectory presents broad opportunities across various market segments.

However, not all areas are experiencing uniform growth. Traditional large panel display driver segments, for instance, have seen declines, intensifying competition within these more mature markets. Companies operating in these areas face pressure to innovate and differentiate.

Himax Technologies distinguishes itself through significant technological innovation, particularly in its automotive TDDI and Tcon solutions, and its proprietary WiseEye AI sensing technology. The company's LCoS microdisplays are also a key differentiator for the growing AR/VR market.

This dedication to advanced, often patented, technologies allows Himax to command premium pricing and secure leading positions in specialized market segments. For instance, in 2023, Himax reported substantial growth in its automotive segment, a testament to the demand for its differentiated offerings.

Exit Barriers

The semiconductor industry, including companies like Himax, faces substantial exit barriers. These are driven by the massive capital outlays required for research and development, securing crucial intellectual property, and maintaining specialized manufacturing partnerships, even for fabless firms. For instance, the average R&D spending for leading semiconductor companies in 2023 often exceeded billions of dollars, reflecting the ongoing need for innovation and advanced technology.

These high costs mean that once a company has invested heavily, it is very difficult and costly to simply walk away from the market. This situation often forces competitors to persist even during downturns, thereby intensifying the competitive rivalry as players strive to recover their investments.

Key factors contributing to these high exit barriers include:

- Significant sunk costs: Investments in specialized manufacturing equipment, chip design software, and patent portfolios represent substantial, unrecoverable expenses.

- Interconnected supply chains: Long-term relationships with foundries and equipment suppliers create dependencies that are hard to sever without significant penalties or loss of access.

- Brand reputation and customer loyalty: Building trust and a strong brand in the semiconductor space takes years, and exiting can mean forfeiting this established goodwill.

Market Share and Leadership

Himax Technologies demonstrates a commanding global market share in automotive display integrated circuits (ICs), notably within the TDDI (Touch and Display Driver Integration) and local dimming Tcon segments. This leadership is further solidified by its position as a key supplier for TDDI solutions in the non-iOS tablet market.

This strong market presence suggests a substantial competitive advantage in these specific niches. However, the competitive landscape for Himax is not uniform across all its product lines; other segments likely experience more vigorous rivalry from established and emerging players.

For instance, in the rapidly evolving automotive sector, Himax’s dominance in TDDI is a critical factor. In 2023, the global automotive display market was valued at approximately $14.7 billion, with Himax securing a significant portion of the TDDI segment, particularly for in-car infotainment systems.

- Himax's leading market share in automotive TDDI and local dimming Tcon highlights its strong competitive position.

- The company is a primary supplier for TDDI in non-iOS tablets, indicating broad market penetration.

- While dominant in certain areas, Himax faces intense competition in other product segments.

- The automotive display market, a key area for Himax, was valued at around $14.7 billion in 2023.

Himax operates in a highly competitive semiconductor market, facing numerous rivals in display drivers and imaging ICs. This intense rivalry is fueled by significant innovation and the presence of established players like Allegro MicroSystems and Silicon Motion Technology. The overall semiconductor market is projected to grow, with global sales expected to increase by 11.2% in 2025, but competition is fiercer in mature segments like traditional large panel display drivers.

Himax differentiates itself through advanced technologies like WiseEye AI and LCoS microdisplays, securing strong positions in automotive TDDI and non-iOS tablets. For instance, the automotive display market was valued at approximately $14.7 billion in 2023, a key segment where Himax holds significant market share.

| Competitor | Key Product Areas | 2023/2024 Relevance |

|---|---|---|

| Allegro MicroSystems | Automotive ICs, Power Management | Strong presence in automotive, a key Himax market. |

| Silicon Motion Technology | SSD Controllers, Display ICs | Direct competitor in display driver ICs. |

| LG Display | Displays (OLED, LCD) | Major customer and potential competitor in display technology integration. |

| Tower Semiconductor | Foundry Services | Key manufacturing partner for many fabless semiconductor companies, indirectly influencing competition. |

SSubstitutes Threaten

The primary threat to Himax Technologies stems from alternative display technologies that could diminish the need for its traditional display driver integrated circuits. While Liquid Crystal Displays (LCD) and Organic Light-Emitting Diodes (OLED) currently hold significant market share, the landscape is evolving.

Emerging technologies such as microLED and Quantum Dot LED (QLED) present a potential long-term challenge. For instance, the microLED market is projected for substantial growth, with some analysts forecasting it to reach billions of dollars in the coming years, indicating a shift in display manufacturing preferences.

Software-based solutions present a moderate threat to Himax's display driver ICs. For certain display processing tasks, advancements in software or integrated System-on-Chip (SoC) designs could potentially replicate the functions of discrete driver or controller ICs. For instance, in mid-range smartphones, software optimizations and more powerful integrated graphics processing units (GPUs) are increasingly handling visual processing that previously required dedicated display ICs.

However, the need for specialized hardware remains significant, particularly for high-performance display imaging. Technologies like high refresh rates, advanced color accuracy, and low latency, crucial for gaming or professional displays, still heavily rely on the specialized capabilities of dedicated display driver ICs. Himax’s focus on advanced display technologies, such as their AI-driven display solutions, positions them to mitigate this threat by offering integrated hardware and software capabilities that surpass purely software-based alternatives.

Large original equipment manufacturers (OEMs) and panel makers possess the potential to develop more display driver and timing controller capabilities internally, thereby lessening their dependence on external providers like Himax. This vertical integration, while theoretically possible, necessitates substantial capital outlay and specialized technical acumen.

Evolution of End-Use Applications

The threat of substitutes for Himax's display driver ICs is influenced by evolving end-use applications. For instance, a significant shift in consumer preferences towards technologies like holographic projections or direct retinal displays could reduce the demand for traditional screen-based display drivers.

Himax is actively addressing this by investing in emerging display technologies such as augmented reality (AR) and virtual reality (VR), as well as Liquid Crystal on Silicon (LCoS) displays. These investments aim to capture new market segments and mitigate the risk posed by potential substitutes in conventional display markets.

While the exact market share of emerging display technologies is still developing, the growth trajectory for AR/VR headsets is substantial. For example, the global AR/VR market was valued at approximately $25 billion in 2023 and is projected to grow significantly in the coming years, indicating a potential shift in display technology adoption.

The success of these new applications and Himax's ability to adapt its product offerings will be crucial in navigating the threat of substitutes. The company's strategic focus on these forward-looking technologies demonstrates an awareness of potential disruptions and a proactive approach to maintaining its competitive position.

Cost-Performance Trade-offs

The threat of substitutes for Himax's display technologies is closely tied to the cost-performance trade-offs available to consumers and businesses. If alternative display solutions emerge that offer comparable or superior visual quality and functionality at a lower price point, they pose a significant risk.

For instance, advancements in microLED or advanced LCD technologies that drastically reduce manufacturing costs while maintaining or improving pixel density and brightness could lure customers away from Himax's offerings. Consider the ongoing competition in the smartphone market; a new display innovation that provides a better viewing experience for less money would quickly disrupt market share. In 2023, the global display market was valued at approximately $130 billion, with significant investment flowing into next-generation technologies, indicating the potential for disruptive shifts.

- Cost-Performance Ratio: Substitutes become compelling when they offer a superior balance of price and performance, potentially eroding demand for existing solutions.

- Technological Advancements: Emerging technologies like microLED, if they achieve cost parity or advantage, could directly challenge current display standards.

- Market Dynamics: The highly competitive consumer electronics sector, where price sensitivity is high, makes it susceptible to substitutes offering better value propositions.

- System-Level Cost: The overall cost of integrating a display technology into a final product is crucial; cheaper alternatives, even with slightly lower performance, can be attractive.

The threat of substitutes for Himax's display driver ICs is primarily driven by the emergence of new display technologies and evolving end-user applications. While current alternatives like advanced LCD and OLED are established, emerging technologies such as microLED and Quantum Dot LED (QLED) are gaining traction, with the microLED market projected for significant growth in the coming years.

Software-based solutions and internal development by large OEMs also present a moderate threat, especially for less demanding applications. However, the demand for specialized hardware for high-performance displays, like those requiring high refresh rates and advanced color accuracy, remains strong. Himax’s strategic investments in AR/VR and LCoS technologies, coupled with their AI-driven display solutions, are proactive measures to address these evolving market dynamics and mitigate the impact of substitutes.

| Technology | Potential Impact on Himax | Key Drivers/Concerns | Market Data/Projections (Illustrative) |

|---|---|---|---|

| MicroLED | High | Superior brightness, contrast, energy efficiency; High manufacturing cost | Global MicroLED market projected to grow significantly, potentially reaching billions in the coming years. |

| QLED | Moderate | Enhanced color gamut, brightness; Often relies on LED backlighting | Continued competition with OLED in premium TV segments. |

| Software/SoC Integration | Moderate | Cost reduction, simplified design; Limited by processing power for high-end features | Increasing use in mid-range smartphones for visual processing. |

| AR/VR Displays | Low (Opportunity) | New market segment; Requires specialized, high-performance drivers | Global AR/VR market valued around $25 billion in 2023, with strong growth prospects. |

| Holographic/Retinal Displays | Low (Long-term) | Radical shift in display paradigm; Nascent technology | Currently in early research and development stages. |

Entrants Threaten

High capital requirements pose a significant threat in the fabless semiconductor sector, especially for niche markets like display driver ICs. New companies need immense funding for advanced research and development, securing crucial intellectual property, and building reliable relationships with wafer fabrication foundries. For instance, establishing a cutting-edge R&D facility and securing foundry capacity can easily run into hundreds of millions of dollars, making it a formidable barrier for aspiring competitors.

Himax Technologies boasts an extensive intellectual property portfolio, holding over 2,600 granted patents and hundreds more in the pipeline. This deep well of innovation presents a significant hurdle for potential new entrants.

To compete effectively, new companies would need to make substantial investments in research and development to create comparable technologies. Furthermore, they would face the challenge of navigating Himax's intricate and well-established patent landscape, making market entry considerably more difficult and costly.

Established players like Himax leverage significant economies of scale in their operations, from chip design to securing favorable terms with foundries and managing global distribution networks. For instance, Himax’s substantial production volumes in 2024 allow for lower per-unit manufacturing costs, a hurdle new entrants would find difficult to overcome quickly.

The experience curve further solidifies this advantage; as Himax has refined its processes over years of production, it has achieved greater efficiency and lower costs. A new entrant would lack this accumulated learning, making it challenging to match Himax's cost-competitiveness and achieve profitability without substantial initial investment and market penetration.

Customer Relationships and Brand Loyalty

Himax Technologies has cultivated deep, enduring relationships with prominent global electronics and automotive manufacturers. These partnerships are founded on a proven track record of performance and unwavering reliability, making it exceptionally difficult for new entrants to replicate this level of trust and secure crucial design wins.

The barriers to entry are significantly heightened by the time and investment required to gain the confidence of these established players. For instance, Himax's long-standing collaborations, often spanning years of product development cycles, create a formidable moat that new competitors would struggle to overcome.

- Established Trust: Himax's history of delivering consistent quality and technological innovation has fostered strong, long-term partnerships with key industry leaders.

- High Switching Costs: For major manufacturers, changing a critical component supplier like Himax involves extensive re-qualification, design modifications, and supply chain adjustments, leading to high switching costs.

- Brand Reputation: Himax's brand is synonymous with reliable display driver ICs and other semiconductor solutions, a reputation that new entrants would need years to build.

- Design Wins: Securing design wins with major OEMs is a lengthy and rigorous process, often requiring prior successful collaborations and proven product performance, which new entrants lack.

Regulatory and Certification Hurdles

The semiconductor industry, particularly for applications in critical sectors like automotive, presents significant regulatory and certification hurdles for new entrants. These requirements involve extensive testing, validation, and adherence to stringent standards, which can be both time-consuming and capital-intensive. For instance, achieving certifications like IATF 16949 for automotive semiconductors involves a complex and lengthy process, often taking over a year and requiring substantial investment in quality management systems and documentation.

Overcoming these regulatory barriers is a substantial challenge for any new company aiming to enter the semiconductor market. The need for rigorous compliance, such as meeting safety standards for automotive components or specific governmental approvals for defense applications, adds a considerable layer of difficulty. This complexity directly increases the cost and time associated with market entry, thereby acting as a significant deterrent to potential new competitors.

The financial implications are substantial. For example, the cost of obtaining necessary certifications can range from tens of thousands to hundreds of thousands of dollars, depending on the specific standards and the complexity of the product. This financial commitment, coupled with the extended timelines for approval, creates a formidable barrier, protecting established players who have already navigated these processes and built the necessary infrastructure and expertise.

- Rigorous Testing: Semiconductor products for automotive use undergo extensive reliability and performance testing, often exceeding 1,000 hours of stress testing for critical components.

- Certification Costs: Obtaining certifications like AEC-Q100 can cost upwards of $50,000 to $100,000 per product family.

- Validation Time: The validation and qualification process for new semiconductor designs in the automotive sector can take 12-24 months.

- Market Access: Failure to meet these regulatory and certification requirements can prevent a new entrant from accessing key markets, especially in safety-critical industries.

The threat of new entrants in the fabless semiconductor market, particularly for specialized areas like Himax's display driver ICs, is significantly mitigated by substantial barriers. High capital requirements for R&D, intellectual property acquisition, and foundry access present a formidable financial hurdle, easily running into hundreds of millions of dollars. Furthermore, Himax's extensive patent portfolio, exceeding 2,600 granted patents, necessitates costly and time-consuming efforts for new players to develop comparable technologies and navigate existing intellectual property rights.

Established economies of scale and experience curve advantages also deter new entrants. Himax's substantial production volumes in 2024 translate to lower per-unit costs, a competitive edge that newcomers would struggle to match. Deeply ingrained relationships with major electronics and automotive manufacturers, built on years of proven performance and reliability, create high switching costs and require lengthy validation periods, often 12-24 months, for any potential competitor to replicate.

Regulatory and certification hurdles, especially for sectors like automotive, add another layer of difficulty. Obtaining certifications such as IATF 16949 can cost upwards of $50,000 to $100,000 per product family and take over a year, demanding significant investment in quality management systems. These rigorous compliance requirements, including extensive testing and adherence to stringent safety standards, act as a powerful deterrent, protecting incumbent players like Himax.

| Barrier Type | Description | Estimated Cost/Time for New Entrant |

|---|---|---|

| Capital Requirements | R&D, IP, Foundry Access | Hundreds of millions of dollars |

| Intellectual Property | Himax's 2,600+ patents | Significant R&D investment, legal costs |

| Economies of Scale | Lower per-unit costs due to volume | Difficult to match without substantial market share |

| Customer Relationships | Established trust with OEMs | 12-24 months for design wins and validation |

| Regulatory Compliance | Automotive certifications (e.g., IATF 16949) | $50,000-$100,000+ per product family, 12+ months |

Porter's Five Forces Analysis Data Sources

Our Himax Porter's Five Forces analysis is built upon a foundation of robust data, drawing from Himax Technologies' annual reports, investor presentations, and SEC filings. We supplement this with industry-specific market research reports and competitor analysis to gain a comprehensive understanding of the competitive landscape.