Himax Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Himax Bundle

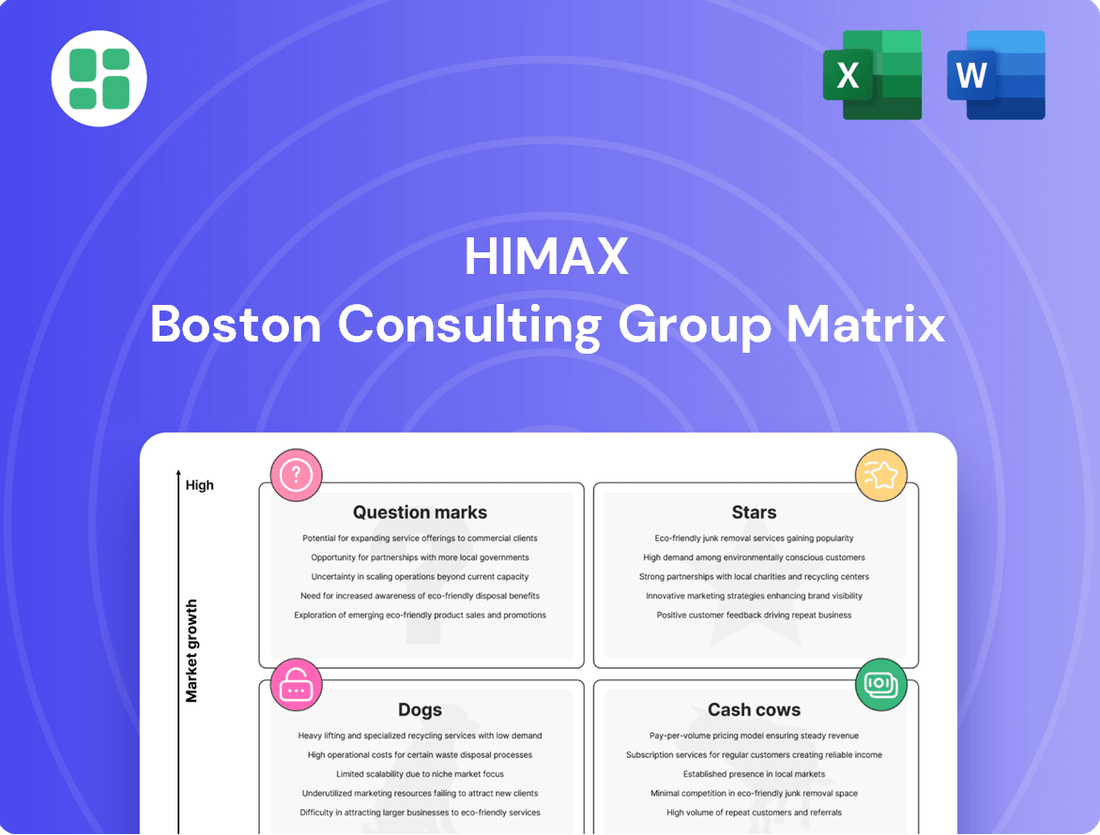

Curious about Himax's strategic product positioning? This glimpse into their BCG Matrix reveals key insights into their market performance, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Don't miss the opportunity to unlock the full picture and drive smarter investment decisions.

Gain a comprehensive understanding of Himax's product portfolio by purchasing the complete BCG Matrix. This detailed report provides the strategic clarity needed to identify growth opportunities and optimize resource allocation for maximum impact.

Stars

Himax Technologies holds a commanding position in the automotive display market, particularly with its Touch and Display Driver Integration (TDDI) and local dimming Tcon (Timing Controller) solutions. The company boasts a market share exceeding 50% in automotive TDDI, showcasing its significant influence. This segment, along with its even stronger presence in local dimming Tcon, is experiencing robust growth, fueled by the automotive industry's trend towards larger and more advanced in-car displays across both premium and mainstream vehicles.

The company's strategic focus on these high-growth areas is evident in the mass production of its third-generation automotive TDDI IC, the HX83195 series, and its Tcon Embedded Driver IC (TED). These products are poised to be significant contributors to Himax's revenue and market expansion in the coming periods.

Himax is making significant strides in automotive OLED display integrated circuits, collaborating with top panel manufacturers across Korea, China, and Japan on multiple projects. This burgeoning sector is poised to become a major growth engine as OLED technology becomes more prevalent in vehicles beyond just high-end models.

The company's established expertise and strong reputation in automotive LCD displays provide a solid foundation for its expansion into the OLED market. By 2024, the automotive display market, including OLED, was projected to reach over $15 billion, highlighting the substantial opportunity Himax is targeting.

Himax's LCoS microdisplays and WLO waveguide technologies are foundational for the burgeoning AR and VR markets, positioning them as key growth drivers. These components are essential for creating smaller, more power-efficient, and visually impressive headsets and glasses. For instance, the company's 2024 product pipeline focuses on enhancing brightness and reducing size, crucial for consumer adoption.

The global AR/VR market is experiencing rapid expansion, with projections indicating significant growth through 2030. Himax's advancements, such as their ultra-luminous miniature dual-edge front-lit LCoS microdisplay, directly tackle critical challenges like device bulkiness and energy demands. This innovation, demonstrated at SID Display Week 2025, underscores their commitment to enabling sleeker and more practical AR hardware.

These advanced microdisplay and optical solutions are anticipated to become indispensable for future AR devices, presenting a substantial opportunity for revenue and profit. Himax's strategic focus on these high-potential technologies places them in a strong position to capitalize on the increasing demand for immersive visual experiences.

Co-Packaged Optics (CPO) for AI/HPC

Himax's proprietary Wafer-Level Optics (WLO) technology is a cornerstone for Co-Packaged Optics (CPO) in AI and High-Performance Computing (HPC). It provides the crucial optical coupling needed for AI multi-chip modules (MCMs), directly impacting bandwidth and data transfer speeds within AI data centers.

This advanced optical coupling significantly boosts performance metrics, enabling higher data transmission rates and improved power efficiency for both server-to-server and chip-to-chip communications. This is vital for the demanding workloads of AI applications.

The company has commenced small-scale production for its first-generation CPO solutions. Himax is actively collaborating with AI customers to accelerate the development and deployment of future generations, signaling a robust growth path for this technology.

- Himax WLO Technology: Enables critical optical coupling for AI MCMs.

- Performance Enhancement: Drives higher bandwidth, data rates, and power efficiency.

- Market Traction: Small-scale production of Gen 1 CPO is active, with future generations under development with AI clients.

WiseEye AI Sensing Solutions

Himax's WiseEye AI Sensing Solutions are positioned as a significant growth driver, likely representing a Star in the BCG matrix. The company anticipates robust expansion for WiseEye, projecting continued success with major notebook manufacturers and expanding into new markets like smart door locks, palm vein authentication, and smart home devices. This strategic focus on ultralow power AI sensing for endpoint devices highlights a strong market opportunity, demonstrating resilience against broader economic downturns.

The WiseEye business is a key pillar of Himax's strategy, targeting the burgeoning market for AI-powered edge devices. This segment is expected to benefit from increasing demand for intelligent, always-on sensing capabilities in consumer electronics and smart home applications. Himax's technological advancements in ultralow power consumption are crucial for enabling these always-on features without compromising battery life.

- Projected Growth: Himax anticipates strong growth for WiseEye in 2025 and beyond.

- Market Penetration: Successes include partnerships with leading notebook brands and entry into smart door locks, palm vein authentication, and smart home sectors.

- Technology Focus: WiseEye utilizes ultralow power AI sensing technology, aligning with the trend towards endpoint AI devices.

- Market Resilience: This segment offers significant growth opportunities that are less susceptible to macroeconomic volatility.

Himax's WiseEye AI Sensing Solutions are poised to be a Star in their BCG Matrix. The company is projecting significant expansion for WiseEye, with continued success in notebooks and expansion into new markets like smart door locks and palm vein authentication. This focus on ultralow power AI sensing for endpoint devices represents a substantial market opportunity, demonstrating resilience against broader economic fluctuations.

WiseEye is a cornerstone of Himax's strategy, targeting the rapidly growing market for AI-powered edge devices. The demand for intelligent, always-on sensing in consumer electronics and smart home applications is increasing, and Himax's ultralow power consumption technology is key to enabling these features without impacting battery life.

Himax anticipates strong growth for WiseEye, projecting continued success with major notebook manufacturers and expanding into new markets such as smart door locks, palm vein authentication, and smart home devices. This segment offers significant growth opportunities that are less susceptible to macroeconomic volatility.

The WiseEye business is a key pillar of Himax's strategy, targeting the burgeoning market for AI-powered edge devices, expected to benefit from increasing demand for intelligent, always-on sensing capabilities in consumer electronics and smart home applications. Himax's technological advancements in ultralow power consumption are crucial for enabling these always-on features without compromising battery life.

| Business Segment | Himax's Position | Market Growth | BCG Classification |

| Automotive Displays (TDDI, Tcon) | Market Leader (>50% share in TDDI) | High | Star |

| AR/VR Microdisplays & Optics (LCoS, WLO) | Key Enabler, Emerging Leader | High | Question Mark/Star |

| AI & HPC (WLO for CPO) | Emerging Technology Provider | High | Question Mark |

| WiseEye AI Sensing Solutions | Strong Growth Driver, Expanding | High | Star |

What is included in the product

Himax BCG Matrix: Strategic insights for Stars, Cash Cows, Question Marks, and Dogs.

A visual Himax BCG Matrix simplifies complex portfolio analysis, relieving the pain of data overload for strategic decision-making.

Cash Cows

Himax's traditional large panel display drivers for TVs and monitors, though seeing some decline in 2024, remain a critical revenue generator. This segment contributed 13.9% to Himax's total sales in 2024, underscoring its enduring importance.

Despite being a mature market, this segment generates stable cash flow, a testament to Himax's strong market presence and extensive customer relationships. The company's strategy here is to maintain its existing market share with minimal investment, focusing on operational efficiency.

Traditional small and medium-sized display drivers, primarily for mobile phones and tablets, represented a significant 69% of Himax's revenue in 2024. Despite some sequential dips attributed to seasonality and market dynamics, this segment remains Himax's core business.

Operating within a mature market, Himax leverages its established position and strong customer ties in these traditional DDIC products. This segment consistently generates robust cash flow, underscoring its role as a reliable revenue generator for the company.

Himax Technologies, a dominant force in TFT-LCD display timing controller ICs, leverages its established legacy Tcon products for mature LCD segments as significant cash cows. These foundational products, while not experiencing explosive growth, provide a steady and reliable stream of revenue for the company.

Despite the emergence of newer technologies like local dimming Tcons, which are positioned as Stars, the enduring demand for traditional Tcon solutions in established LCD markets ensures their continued profitability. This stability allows Himax to maintain its market leadership without the need for substantial reinvestment, unlike its more dynamic product lines.

In 2024, Himax's legacy Tcon business is expected to contribute significantly to its overall financial health, capitalizing on consistent demand from a well-established market. This segment exemplifies a classic cash cow strategy, generating ample cash flow to fund other growth initiatives within the company.

General Display Driver IC Portfolio

Himax's General Display Driver IC (DDIC) portfolio is a cornerstone of its business, functioning as a cash cow within its BCG matrix. As a significant player in the display technology sector, Himax holds an estimated 8% of the global display driver market share. This broad range of DDICs, catering to various applications beyond the fastest-growing segments, generates consistent and substantial revenue.

These widely adopted components are crucial for Himax's financial stability. Their established market presence allows for high profit margins, ensuring consistent cash generation for the company. This steady income stream supports Himax's investments in research and development for its high-growth product lines.

- Global Display Driver Market Share: Approximately 8%.

- Portfolio Strength: Broad range of DDICs for diverse applications.

- Financial Contribution: Steady revenue streams and significant profitability.

- Profitability Driver: High profit margins due to established product nature.

Power Management ICs for Mature Displays

Himax Technologies' power management ICs (PMICs) for mature display applications represent a classic cash cow within their business portfolio. These components, part of the non-driver product segment, are designed for established display technologies where market growth has plateaued. Their primary contribution is generating steady, predictable revenue streams.

These PMICs are characterized by their high reliability and consistent performance, ensuring stable income for Himax. While the growth prospects for mature displays are limited, the demand for these reliable power solutions remains robust. This stability allows Himax to leverage existing manufacturing and design expertise without significant new research and development outlays.

The cash generated from these mature display PMICs plays a crucial role in funding Himax's investments in more innovative and high-growth areas. For instance, Himax has been actively developing advanced ICs for AI-enabled sensing, automotive displays, and other emerging technologies. The consistent cash flow from their established product lines, like these PMICs, provides the financial backbone for these future-oriented initiatives.

- Stable Revenue: Himax's PMICs for mature displays offer a dependable income source, contributing to overall financial stability.

- Low Growth, High Reliability: These products operate in established markets, prioritizing consistent performance and reliability over rapid expansion.

- Cash Generation: They generate significant cash flow, which is vital for funding R&D in newer, high-growth business segments.

- Strategic Support: The financial contribution from these cash cows enables Himax to allocate resources towards innovation and market leadership in emerging display technologies.

Himax's traditional large panel display drivers, while seeing some decline in 2024, still represent a significant revenue contributor, accounting for 13.9% of total sales. This segment, despite its maturity, generates stable cash flow due to Himax's strong market position and customer relationships.

The company's strategy for these mature products is to maintain existing market share with minimal investment, focusing on operational efficiency to ensure continued profitability. This approach solidifies their role as a reliable cash generator for Himax.

Himax's legacy Tcon products for mature LCD segments are significant cash cows, providing a steady and reliable revenue stream. Despite the growth of newer technologies, the enduring demand for traditional Tcons ensures their continued profitability, allowing Himax to maintain market leadership without substantial reinvestment.

These foundational products exemplify a classic cash cow strategy, generating ample cash flow to fund other growth initiatives within the company, underscoring their crucial role in Himax's financial health.

| Product Segment | 2024 Revenue Contribution | Market Status | Cash Flow Generation | Strategic Focus |

|---|---|---|---|---|

| Traditional Large Panel DDICs | 13.9% | Mature, Slight Decline | Stable | Maintain Market Share, Operational Efficiency |

| Legacy Tcons | Significant | Mature, Enduring Demand | Robust | Fund Growth Initiatives |

Full Transparency, Always

Himax BCG Matrix

The Himax BCG Matrix preview you are currently viewing is the identical, fully completed document you will receive immediately after completing your purchase. This means no watermarks, no placeholder text, and no hidden surprises – just the comprehensive, professionally formatted BCG Matrix ready for your strategic decision-making. You can confidently use this preview as a direct representation of the valuable analysis you'll gain.

Dogs

Very low-margin, highly commoditized display driver ICs (DDICs) represent a challenging segment. These are basic chips for older or very low-end applications, facing intense price competition from Chinese manufacturers, which severely compresses profit margins. In 2024, the average gross margin for such commoditized DDICs was estimated to be in the single digits, often below 5%, making them a significant drag on profitability.

Himax Technologies has been strategically phasing out older generations of integrated circuits (ICs) that are becoming technologically obsolete. These legacy products, often found in older consumer electronics, now represent a low market share and face declining demand as newer, more advanced solutions emerge. For instance, certain display driver ICs designed for older mobile phone displays are being discontinued.

These phasing-out product lines are characteristic of the Dogs quadrant in the BCG matrix. They have low growth prospects and a small share of the current market. If not managed carefully, they could become cash traps, consuming resources without generating significant returns. Himax's approach involves a controlled divestiture or a managed decline to free up capital and resources for more promising product categories.

Niche products with limited adoption and stagnant growth, fitting into the Dogs category of the BCG Matrix, represent a challenging segment for Himax. These are typically specialized items that haven't captured significant market share, often due to a lack of broad appeal or intense competition within their small target markets. For instance, Himax might have a line of highly specialized display drivers for a particular industrial application where market demand has plateaued, leading to minimal sales growth.

These products often exhibit low market share coupled with low market growth rates. This means they are not generating substantial revenue and are unlikely to become major profit drivers in the future. Consider a scenario where Himax developed advanced driver ICs for a niche segment of augmented reality glasses that, while innovative, failed to gain widespread consumer adoption in 2024. The market for these specific AR glasses remained small, and Himax's share within it was also limited, resulting in a product that consumes resources without a clear path to significant returns.

Products with Declining Market Share in Mature Segments

Himax Technologies (HIMX) has observed a consistent erosion of its market share in certain mature segments, a clear indicator of its 'dog' status within the BCG matrix. This decline, evident even as these markets stabilize, points to significant competitive pressures and evolving customer demands that Himax has struggled to meet.

The company's performance in areas like traditional display driver integrated circuits (DDICs) for smartphones, where competition from Chinese manufacturers has intensified, exemplifies this trend. For instance, while the overall smartphone market may be mature, Himax's share within this specific DDIC sub-segment has been shrinking. This situation necessitates a critical review of resource allocation and potential divestment strategies.

- Declining Market Share: Himax's share in mature segments like standard DDICs for smartphones has been steadily decreasing, facing aggressive competition.

- Intense Competition: The rise of domestic players in key Asian markets has put significant pricing and innovation pressure on Himax's offerings.

- Shifting Preferences: A move towards more advanced display technologies or alternative solutions in certain consumer electronics has also impacted demand for Himax's established products.

- Strategic Re-evaluation: The 'dog' status suggests Himax needs to consider reducing investment or exploring exit strategies for these underperforming product lines to focus on growth areas.

Unsuccessful R&D Projects that Entered Limited Production

Himax Technologies has encountered R&D projects that, despite reaching limited production, failed to gain commercial traction. These ventures represent significant capital outlays with minimal returns, essentially becoming cash drains. For instance, while specific project names are often proprietary, Himax's history includes endeavors in niche display technologies that did not scale due to market acceptance or competitive pressures.

These "dogs" in the BCG matrix context are characterized by low growth and low relative market share. They consume resources without contributing meaningfully to revenue or profit.

- Past R&D failures in specialized display segments that didn't achieve widespread adoption.

- Investments in technologies that were quickly superseded by more advanced or cost-effective alternatives.

- Projects that incurred substantial development costs but yielded negligible market penetration.

- Such initiatives tie up capital that could be reinvested in more promising areas of Himax's portfolio.

Products in the Dogs quadrant, like Himax's commoditized display driver ICs, are characterized by low market share and low growth. These segments, often facing intense price competition, especially from Chinese manufacturers, saw gross margins dip below 5% in 2024, making them a drag on overall profitability.

Himax is strategically exiting or reducing investment in these legacy product lines, which have limited market appeal and declining demand. This controlled divestiture aims to free up capital for more promising growth areas.

The company's historical R&D projects that failed to gain commercial traction also fall into this category, representing significant costs with negligible returns.

These "dogs" consume resources without contributing meaningfully to revenue, highlighting the need for careful resource allocation and potential exit strategies.

| Product Segment | BCG Category | Market Growth | Market Share | Estimated 2024 Gross Margin |

| Commoditized DDICs (Low-end/Older Apps) | Dogs | Low | Low | < 5% |

| Legacy Integrated Circuits (Obsolete) | Dogs | Declining | Low | N/A (Phased Out) |

| Niche Display Drivers (Stagnant Growth) | Dogs | Stagnant | Low | Low |

| Certain Specialized AR Display Drivers | Dogs | Low | Low | Low |

Question Marks

Himax Technologies is making a significant push into the tablet and notebook OLED display driver market, offering a full suite of solutions including DDIC, Tcon, and touch controllers. This expansion is fueled by strategic partnerships with major OLED panel manufacturers.

The company anticipates several new projects to commence mass production with prominent brands by the end of 2025. This suggests a strong future growth trajectory, though Himax's current market share in this specific segment is still developing.

Himax is strategically positioned to benefit from the increasing adoption of OLED displays and advanced touch functionalities in premium notebooks, a trend amplified by the emergence of AI PCs. This segment represents a significant growth opportunity, with Himax actively developing enhanced features such as active stylus support and dedicated gaming models to capture market share in these high-demand areas.

Head-up displays (HUDs) are a significant growth frontier in automotive displays, and Himax is seeing increased adoption of its local dimming Tcon solutions in this space. While Himax already holds a robust position in the broader Tcon market, its specific share within the rapidly expanding HUD segment is still in its growth phase.

New Generation of Smartphone OLED Display Drivers

Himax Technologies is targeting the burgeoning smartphone OLED display driver market, anticipating mass production to commence in late 2025. This strategic move involves deepening collaborations with key players in Korea and China.

The company views this as a significant growth opportunity, aiming to capture a larger share in a market segment where its current presence is relatively modest. Himax's focus is on leveraging its technological advancements to compete effectively.

- Market Growth: The global smartphone OLED display market is projected to continue its robust expansion, driven by increasing consumer demand for premium display technology.

- Himax's Strategy: Himax is actively investing in R&D and forging partnerships to enhance its product offerings and market penetration in this competitive landscape.

- Production Timeline: The planned mass production in late 2025 signifies Himax's readiness to scale its operations and meet anticipated market demand.

Endpoint AI Sensing Systems (beyond WiseEye's current success)

Himax Technologies, a leader in display and semiconductor solutions, is expanding its AI sensing capabilities beyond its established WiseEye platform. This strategic move positions Himax to capture emerging opportunities in the rapidly growing AI sector.

The recent collaboration with Rabboni to launch a scalable multi-scenario endpoint AI sensing system is a key indicator of this expansion. This system allows for real-time AI inference directly on wearable devices, opening doors to new high-growth applications.

- New Market Entry: Himax is pushing into new AI application areas where market share is still developing, indicating a focus on future growth.

- Wearable AI Focus: The Rabboni partnership specifically targets AI inference on wearable devices, a segment expected to see significant expansion.

- Scalability: The emphasis on a scalable system suggests Himax is building solutions designed for widespread adoption and diverse use cases.

- Beyond WiseEye: This initiative represents a diversification of Himax's AI sensing portfolio, leveraging its expertise into adjacent, high-potential markets.

Question Marks represent emerging product categories where Himax is investing but has not yet established a significant market presence. These are areas with high growth potential but also considerable uncertainty regarding market adoption and competitive landscape. Himax's strategy here is to be an early mover, leveraging its technological capabilities to define and capture future market share.

| Product Category | Current Market Position | Growth Potential | Himax Strategy | Key Considerations |

|---|---|---|---|---|

| Smartphone OLED DDIC | Developing/Modest | High | Targeting late 2025 mass production, deepening collaborations | Intense competition, need for differentiation |

| AI Sensing (beyond WiseEye) | New Entrant | Very High | Expanding capabilities, partnerships (e.g., Rabboni) for wearables | Rapidly evolving AI landscape, ecosystem development |

| Automotive HUD Tcon | Growing | High | Increased adoption of local dimming solutions | Long design cycles, automotive qualification |

BCG Matrix Data Sources

Our Himax BCG Matrix leverages comprehensive market data, including financial statements, industry growth rates, and competitive intelligence, to accurately position products and inform strategic decisions.