Hikma SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hikma Bundle

Hikma's strategic positioning in generics and specialty pharmaceuticals presents significant growth opportunities, but understanding the nuances of its competitive landscape and potential regulatory hurdles is crucial. Our comprehensive SWOT analysis delves into these critical areas, offering actionable insights for informed decision-making.

Want to fully grasp Hikma's market strengths, potential weaknesses, and the opportunities and threats shaping its future? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment research.

Strengths

Hikma's diversified portfolio is a significant strength, encompassing Injectables, Generics, and Branded products. This broad market reach ensures revenue stability and resilience, mitigating risks associated with any single product category or geographic market. The company's ability to consistently grow across these segments, as seen in its 2024 performance, highlights the effectiveness of this strategic diversification.

Hikma Pharmaceuticals boasts a commanding market presence across vital geographies, notably North America, the Middle East and North Africa (MENA), and Europe. This strong footing is a testament to its strategic expansion and deep operational understanding in these key markets.

In the United States, Hikma stands as the seventh-largest supplier of generic medicines, a significant achievement reflecting its competitive edge and extensive product portfolio in one of the world's largest pharmaceutical markets. This position underscores its ability to navigate complex regulatory landscapes and meet substantial demand.

Furthermore, Hikma's dominance in the MENA region is undeniable, where it ranks as the second-largest pharmaceutical company by sales. This leadership highlights its robust commercial capabilities and established brand recognition within these rapidly developing economies.

Hikma Pharmaceuticals demonstrates significant strength through its ongoing commitment to research and development, coupled with substantial investments in its manufacturing infrastructure. This dual focus allows the company to consistently bring high-quality, complex generic and specialty medicines to market.

The company's strategic capital allocation is evident in its planned $1 billion investment in US generic drug capabilities by 2030, a move designed to bolster its market presence and product pipeline. Furthermore, the establishment of a new R&D center in Zagreb underscores Hikma's dedication to innovation and operational enhancement, positioning it for future growth.

Strategic Acquisitions and Partnerships

Hikma has a proven history of successfully integrating strategic acquisitions, like the 2023 acquisition of Xellia Pharmaceuticals' US finished dosage form business, which significantly bolstered its injectables portfolio. These moves, alongside new partnerships, are crucial for expanding its market presence and product offerings.

These inorganic growth strategies directly enhance Hikma's competitive edge, especially within high-demand segments such as injectables and oncology. For instance, the Xellia deal aimed to strengthen its position in these specialized therapeutic areas, contributing to sustained revenue growth.

- Xellia Pharmaceuticals Acquisition (2023): Expanded injectables portfolio and market access in the US.

- Partnership Expansion: Broadened therapeutic reach and diversified revenue streams.

- Competitive Enhancement: Strengthened position in specialized markets like oncology.

- Revenue Growth Driver: Inorganic growth contributing to overall financial performance.

Commitment to Affordability and Access to Medicines

Hikma's dedication to making high-quality medicines affordable and accessible is a significant strength, particularly as global healthcare needs continue to grow. This focus directly addresses a critical market demand, positioning the company favorably.

The company's purpose-driven approach, as emphasized in its 2024 Sustainability Report, strengthens its brand reputation and builds trust. This commitment fosters robust relationships with healthcare providers and the communities they serve, creating a loyal customer base.

- Global Reach: Hikma's ability to provide affordable medicines extends its reach into underserved markets, aligning with global health initiatives.

- Purpose-Driven Brand: The company's commitment to affordability and access enhances its image as a socially responsible organization.

- Stakeholder Relationships: Strong ties with healthcare systems and communities are cultivated through its mission-oriented business practices.

Hikma's diversified business model, spanning Injectables, Generics, and Branded products, provides significant revenue stability and resilience. This broad market approach, evident in its consistent growth across segments, effectively mitigates risks tied to any single area.

The company holds a strong market position in key regions, notably being the seventh-largest generic medicine supplier in the US and the second-largest pharmaceutical company in the MENA region by sales. This extensive geographic footprint, supported by strategic expansion, highlights its operational depth and market understanding.

Hikma's commitment to R&D and manufacturing infrastructure, including a planned $1 billion investment in US generic capabilities by 2030 and a new R&D center in Zagreb, positions it for sustained innovation and market competitiveness. Its strategic acquisitions, such as the 2023 Xellia Pharmaceuticals deal, further bolster its high-demand injectables and oncology portfolios.

The company’s core strength lies in its purpose-driven mission to provide affordable and accessible high-quality medicines, enhancing its brand reputation and fostering strong stakeholder relationships globally.

| Segment | 2024 Performance Highlight | Key Strength |

|---|---|---|

| Injectables | Bolstered by Xellia acquisition, strong growth in US market. | Expanding portfolio in high-demand therapeutic areas. |

| Generics | Seventh-largest supplier in the US. | Extensive product portfolio and competitive pricing. |

| Branded | Dominant presence in MENA region. | Established brand recognition and robust commercial capabilities. |

What is included in the product

Maps out Hikma’s market strengths, operational gaps, and risks, providing a comprehensive view of its strategic landscape.

Offers a structured framework to identify and address Hikma's strategic challenges, alleviating the pain of uncertainty.

Weaknesses

Hikma's reliance on its Generics segment presents a notable weakness. In 2024, this segment, encompassing both injectable and oral generics, still represented a substantial portion of the company's revenue. Specifically, generic injectables accounted for 41.8% and oral generics for 32.8% of the total. This concentration exposes Hikma to the significant pricing pressures and fierce competition typical of the generic pharmaceutical market.

While the company aims for overall growth, the Generics segment's outlook for 2025 is projected to be relatively flat. This is largely due to anticipated price erosion impacting its established products. Although Hikma plans to counter this with differentiated products, the underlying vulnerability to market dynamics within the generics space remains a key concern.

Hikma's substantial operations within the Middle East and North Africa (MENA) region, while a source of growth, also present a significant vulnerability. The inherent geopolitical instability in many MENA countries can disrupt supply chains, impact demand, and lead to unexpected regulatory changes, all of which can directly affect Hikma's financial performance. For instance, ongoing regional conflicts or political unrest can hinder market access and increase operational costs.

Economic volatility and currency fluctuations are persistent challenges in the MENA markets. For 2024 and into 2025, several MENA currencies have experienced significant depreciation against major global currencies, which can erode the value of repatriated earnings and increase the cost of imported raw materials for Hikma. This exposure to fluctuating exchange rates directly impacts the company's profitability and requires robust hedging strategies.

Hikma Pharmaceuticals is planning a substantial increase in its Research and Development (R&D) spending, projecting a rise of around 20% in 2025. This strategic move aims to bolster its global product pipeline, which is vital for future expansion. However, this increased investment carries significant financial burdens and the inherent risks associated with drug development, where success is never guaranteed.

The substantial financial commitment required for R&D means that returns are not assured, potentially impacting Hikma's financial flexibility in the near term. For instance, if key pipeline projects face setbacks or fail to gain regulatory approval, the company could experience a considerable strain on its resources without the anticipated revenue generation.

Potential for Increased Competition and Pricing Pressure

The generics and injectables markets, where Hikma operates, are intensely competitive. This environment naturally leads to ongoing price erosion for products, which can squeeze profit margins, particularly for those offerings that are not highly differentiated. Hikma must therefore prioritize continuous innovation and pursue cost efficiencies to maintain profitability.

For instance, in the first half of 2024, Hikma reported a 10% increase in revenue for its Generics segment, reaching $1.2 billion. However, this growth was achieved amidst a challenging pricing landscape, underscoring the constant pressure faced by the company.

- Intense Market Competition: The pharmaceutical sector, especially generics and injectables, faces fierce competition, driving down prices.

- Margin Compression: Continuous pricing pressure can significantly reduce profit margins, particularly for less distinct products.

- Need for Innovation: Hikma must consistently invest in R&D and product development to stay ahead and mitigate pricing pressures.

- Operational Efficiency: Achieving cost efficiencies across its operations is crucial for maintaining competitiveness and profitability in this dynamic market.

Impact of Regulatory Changes and Compliance Costs

Hikma's diverse operational footprint across the US, Europe, and MENA regions exposes it to a complex web of evolving regulatory environments. This necessitates significant investment in compliance measures, which can directly impact profitability and operational efficiency.

The company's 2023 financial performance was notably affected by a specific provision for opioid-related cases in North America, highlighting the financial risks associated with navigating stringent regulations in key markets. This underscores the ongoing challenge of managing compliance costs and potential liabilities.

- Navigating Diverse Regulations: Operating in multiple geographies requires adherence to differing and frequently changing rules, increasing compliance burdens.

- Increased Compliance Costs: Meeting varied regulatory standards across markets leads to higher operational expenses.

- Product Approval Delays: Regulatory hurdles can slow down the launch of new products, affecting revenue streams.

- Risk of Penalties: Non-compliance can result in significant fines and legal repercussions, as seen with the opioid-related provision in 2023.

Hikma's significant reliance on its Generics segment, which accounted for a substantial portion of its revenue in 2024, makes it vulnerable to intense price competition and market pressures inherent in this sector. The projected flat growth for this segment in 2025 due to anticipated price erosion highlights a key weakness.

Geopolitical instability and economic volatility in the MENA region, where Hikma has substantial operations, pose significant risks to its supply chains, market access, and profitability due to currency fluctuations and potential regulatory shifts.

The planned 20% increase in R&D spending for 2025, while crucial for pipeline development, introduces financial strain and the inherent risk of development setbacks or regulatory approval failures, impacting near-term financial flexibility.

Hikma's diverse regulatory landscape across the US, Europe, and MENA necessitates substantial compliance investments and carries the risk of penalties, as evidenced by the 2023 provision for opioid-related cases.

Full Version Awaits

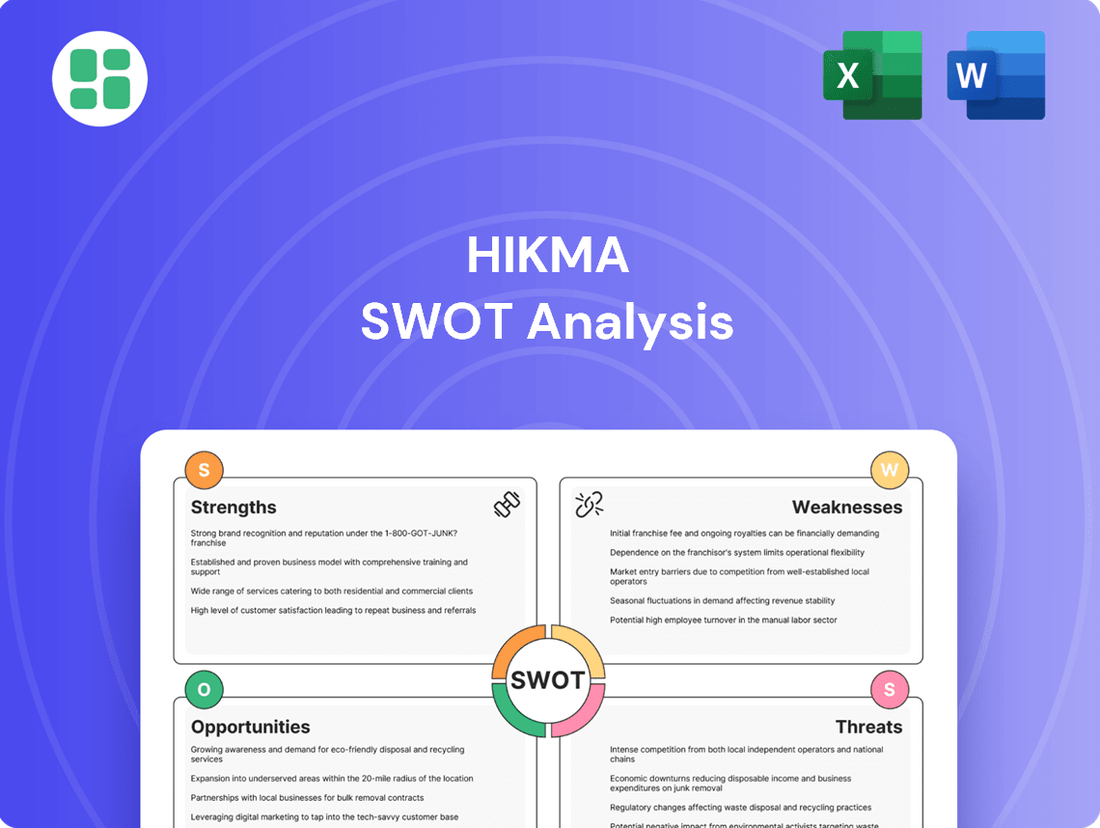

Hikma SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive overview of Hikma's strategic position.

This is a real excerpt from the complete document, showcasing the meticulous detail within the Hikma SWOT analysis. Once purchased, you’ll receive the full, editable version for your strategic planning needs.

Opportunities

Hikma can seize opportunities by expanding into emerging markets where its established reputation for affordable, quality generics provides a competitive edge. This strategic move could tap into new customer bases and revenue streams, particularly in regions with growing healthcare needs.

Furthermore, investing in novel therapeutic areas, like the burgeoning GLP-1 market or expanding its oncology portfolio, presents a significant growth avenue. For instance, the global oncology drug market alone was valued at approximately $180 billion in 2023 and is projected to grow substantially, offering Hikma a chance to capture market share with specialized treatments.

Hikma's contract manufacturing organization (CMO) services are experiencing robust growth, offering a significant opportunity to broaden its reach to other pharmaceutical firms. This expansion capitalizes on Hikma's established high-quality manufacturing infrastructure, creating a valuable supplementary revenue stream and enhancing the profitability and utilization of its facilities.

Hikma can significantly boost its operations by embracing digital transformation. For instance, implementing advanced data analytics in R&D could accelerate the development of new pharmaceuticals, a critical factor in the competitive landscape. In 2024, the pharmaceutical industry saw significant investment in AI for drug discovery, with some estimates suggesting it could reduce early-stage research costs by up to 25%.

Optimizing manufacturing and supply chain processes through digital technologies presents another key opportunity. This could lead to substantial cost reductions and improved product availability. For example, companies adopting digital twin technology in manufacturing have reported efficiency gains of 15-20% by simulating and optimizing production lines before physical implementation.

Strategic Partnerships and In-Licensing Agreements

Hikma's strategy of forging strategic partnerships and in-licensing agreements continues to be a significant growth driver. For instance, the acquisition of 17 Takeda brands in 2023 significantly bolstered its branded portfolio, adding established products and revenue streams. This approach allows Hikma to expand its market reach and product offerings efficiently, bypassing the substantial costs and risks associated with in-house research and development.

These collaborations are crucial for accessing innovative therapies and expanding into new therapeutic areas. A prime example is Hikma's exclusive agreement in 2024 to market and distribute rucaparib, an oncology drug, in key European markets. This type of deal not only brings a promising new product into their pipeline but also strengthens their presence in the high-growth oncology segment.

- Enhanced Product Portfolio: Partnerships provide access to a wider range of established and pipeline drugs, diversifying revenue sources.

- Reduced R&D Expenditure: In-licensing agreements mitigate the financial burden and timeline associated with developing new pharmaceuticals internally.

- Market Expansion: Collaborations offer opportunities to enter new geographical regions or therapeutic areas with proven products.

- Strategic Growth: These agreements are key to building a robust and profitable branded business, as seen with the Takeda brand acquisition.

Addressing Unmet Medical Needs with Differentiated Products

Hikma's strategic focus on research and development for unmet medical needs allows them to develop complex, differentiated products. This approach enables better pricing power and mitigates the impact of generic competition. For instance, their commitment to launching first-to-market products tailored to specific regional requirements underscores this opportunity.

This strategy is particularly relevant in markets where generic erosion is a significant challenge. By offering unique formulations or delivery systems, Hikma can secure a stronger market position.

- Targeting Unmet Needs: Development of novel therapies for diseases with limited treatment options.

- Differentiated Products: Focus on complex generics, biosimilars, and value-added medicines.

- Pricing Power: Ability to command premium pricing for innovative and specialized treatments.

- Reduced Generic Pressure: Less vulnerability to price declines typically seen with standard generics.

Hikma can capitalize on the growing demand for affordable healthcare in emerging markets, leveraging its established reputation. Expanding its Generics business into new territories, particularly in Asia and Africa, presents a significant avenue for revenue growth. The global generics market was projected to reach over $450 billion by 2025, offering substantial opportunity.

Investing in specialized and differentiated products, such as complex generics and biosimilars, is another key opportunity. This strategy allows Hikma to command higher margins and reduce direct competition. For example, the biosimilars market alone is expected to exceed $100 billion by 2027, a lucrative area for expansion.

Furthermore, strengthening its contract manufacturing organization (CMO) services by attracting new clients and expanding capacity offers a stable revenue stream. The global CMO market is anticipated to grow to over $200 billion by 2027, reflecting strong demand for outsourced manufacturing.

Hikma's strategic partnerships and in-licensing agreements continue to be a powerful engine for growth, enabling access to new therapies and markets. The company's 2024 agreement to market rucaparib in Europe exemplifies this, bolstering its oncology portfolio.

| Opportunity Area | Market Size (Est. 2025) | Hikma's Potential |

|---|---|---|

| Emerging Markets (Generics) | $450+ Billion (Global Generics) | Leverage brand for new customer bases |

| Specialized Products (Biosimilars) | $100+ Billion (Biosimilars) | Higher margins, reduced competition |

| CMO Services | $200+ Billion (Global CMO) | Attract new clients, expand capacity |

| Strategic Partnerships | N/A (Deal-dependent) | Access new therapies and markets |

Threats

The global pharmaceutical arena is a battleground, teeming with both established giants and nimble newcomers, especially in the generics and biosimilars sectors. This fierce rivalry often translates into aggressive pricing, which can chip away at market share and squeeze Hikma's profitability across its various business units.

In 2024, the generics market, a key area for Hikma, saw continued price erosion, with some reports indicating average price declines of 5-10% for established products. Biosimilars, while offering growth potential, also face intense competition from multiple manufacturers entering the market, driving down prices and requiring significant R&D and manufacturing investment to remain competitive.

Governmental price controls and healthcare reforms represent a significant threat to Hikma. Increasing pressure from governments and payers globally to manage drug costs directly impacts pharmaceutical companies. In 2024, many developed markets continued to implement stricter pricing regulations and reimbursement policies, potentially squeezing margins on Hikma's generic and branded generic products.

Geopolitical instability, especially in the Middle East and North Africa (MENA) region where Hikma holds significant market share, poses a direct threat. For instance, ongoing conflicts or political shifts in key MENA markets could disrupt supply chains and impact sales volumes. Hikma's 2023 annual report noted that its MENA segment, a crucial contributor to its overall revenue, faced localized challenges due to regional dynamics.

Broader macroeconomic uncertainties are also a concern. Rising inflation and fluctuating interest rates globally can increase operating costs and affect consumer spending on pharmaceuticals. Hikma is actively monitoring how these factors, alongside persistent supply chain disruptions, might influence demand and profitability across its diverse markets. The company also remains vigilant regarding evolving tariff landscapes, which could add complexity to international trade operations.

Regulatory Scrutiny and Increased Compliance Burden

The pharmaceutical sector, including companies like Hikma, operates under a microscope of strict and ever-changing regulations. These govern everything from how medicines are made and ensure their safety to how they are priced. For example, in 2024, ongoing investigations into past opioid settlements continued to cast a shadow, with potential financial implications for companies involved in that market.

This heightened regulatory attention translates directly into a heavier compliance burden. Meeting these demands can significantly increase operating costs. Furthermore, failure to comply can result in severe consequences, including product recalls, which disrupt supply chains and damage reputation, or substantial legal liabilities. Hikma has previously factored in provisions for legal matters, highlighting the financial impact of such regulatory challenges.

- Increased Operating Costs: Adhering to evolving Good Manufacturing Practices (GMP) and data integrity standards necessitates ongoing investment in quality control and validation processes.

- Potential for Product Recalls: Manufacturing deviations or quality issues identified during inspections can lead to costly product recalls, impacting revenue and market confidence.

- Legal and Financial Penalties: Non-compliance with regulations, particularly concerning product safety or marketing practices, can result in significant fines and legal settlements, as seen in past industry-wide actions.

- Impact on Product Approvals: Delays or rejections in regulatory submissions due to compliance concerns can hinder market access and revenue generation for new and existing products.

Patent Expirations and Pipeline Challenges

Patent expirations pose a significant threat to Hikma Pharmaceuticals. For instance, the loss of exclusivity on key products can open the door for intense competition from lower-cost generic alternatives, directly impacting sales and profitability. This is a recurring challenge in the pharmaceutical industry, where a substantial portion of revenue can be tied to a few blockbuster drugs.

The company's reliance on its product pipeline also presents a risk. Pharmaceutical R&D is inherently uncertain, and setbacks in clinical trials or regulatory approvals can lead to substantial financial losses and delays in bringing new revenue streams to market. A robust pipeline is essential to offset the decline in revenue from off-patent products.

- Patent Cliff Impact: The expiration of patents on Hikma's branded or differentiated generic products, such as those in its Generics segment, can lead to rapid price erosion and market share loss.

- Pipeline Development Risks: Failures in the R&D pipeline, particularly for late-stage clinical candidates, represent a significant financial and strategic threat, potentially costing hundreds of millions and delaying future growth.

- Competitive Generic Entry: Following patent expiry, multiple generic manufacturers can enter the market, fragmenting the customer base and driving down prices, a scenario Hikma must actively manage.

Intense competition, particularly in the generics and biosimilars markets, is a persistent threat, leading to price erosion and impacting Hikma's margins. For example, the generics market in 2024 continued to experience price declines, with some reports suggesting an average of 5-10% for established products. This competitive landscape necessitates continuous innovation and cost management to maintain market share.

Governmental price controls and healthcare reforms globally exert significant pressure on pharmaceutical pricing, directly affecting Hikma's profitability. Many developed markets in 2024 continued to implement stricter pricing regulations and reimbursement policies, potentially squeezing margins on the company's generic and branded generic offerings. This trend requires strategic adaptation to navigate evolving cost-containment measures.

Geopolitical instability, especially in the Middle East and North Africa (MENA) region, where Hikma has a strong presence, poses a direct threat to its operations and sales. Political shifts or conflicts in key MENA markets can disrupt supply chains and negatively impact sales volumes. Hikma's 2023 annual report highlighted localized challenges in its crucial MENA segment due to regional dynamics.

The pharmaceutical industry's stringent and evolving regulatory environment presents a significant challenge, increasing compliance burdens and operational costs. For instance, ongoing investigations into past opioid settlements in 2024 continued to cast a shadow, with potential financial implications for companies operating in that space. Failure to comply can lead to costly product recalls or legal liabilities.

SWOT Analysis Data Sources

This Hikma SWOT analysis is built upon a foundation of verified financial reports, comprehensive market intelligence, and expert industry commentary to ensure a robust and insightful assessment.