Hikma Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hikma Bundle

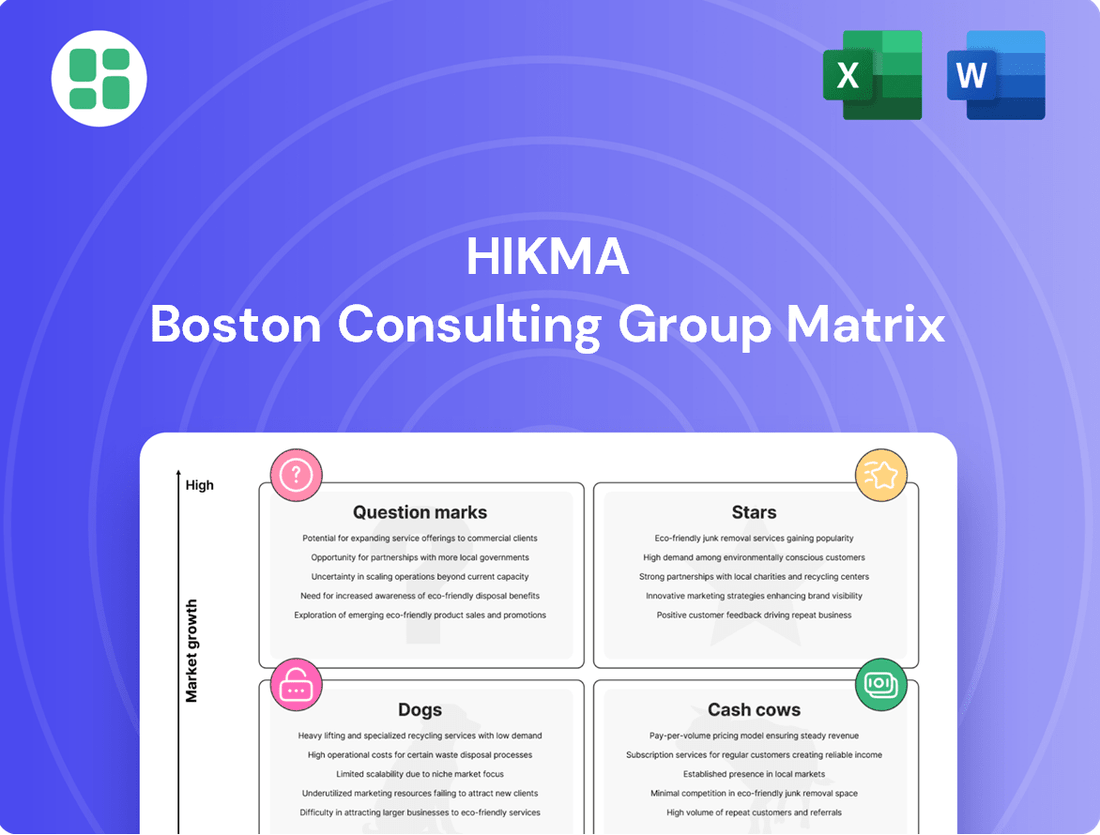

Explore the strategic positioning of key products within the company using the BCG Matrix framework. Understand which are your Stars, Cash Cows, Dogs, and Question Marks to make informed decisions.

This preview offers a glimpse into how the company's portfolio is structured. To unlock actionable strategies and a comprehensive understanding of market share and growth potential for each product, purchase the full BCG Matrix report.

Don't miss out on the complete strategic roadmap. Get the full BCG Matrix to gain detailed quadrant analysis and data-driven insights that will empower your investment and product development decisions.

Stars

Hikma's Injectables segment is a star performer, experiencing robust revenue growth of 10% in 2024. This segment is projected to continue its upward trajectory with an estimated 7% to 9% growth in 2025, highlighting its position in a high-growth market.

The company's significant market presence, ranking as the third-largest supplier of generic injectable products by volume in the United States, underpins this success. Strong demand is also evident across key regions like Europe and the Middle East and North Africa (MENA).

Strategic moves, such as the acquisition of Xellia Pharmaceuticals' US finished dosage form business, are further bolstering Hikma's injectables portfolio and manufacturing capabilities. This expansion solidifies its leadership in a complex and expanding product category.

Hikma's entry into the GLP-1 market with liraglutide injection in December 2024 marks a strategic move into a rapidly expanding therapeutic segment. This launch, Hikma's first in this category, targets the significant and growing diabetes and obesity management markets.

While the current market share for liraglutide within the competitive GLP-1 landscape is still developing, the substantial investment and the inherent growth trajectory of this product class point towards considerable future potential. Hikma's strategy of focusing on differentiated products positions liraglutide as a key contributor to its future growth initiatives.

Hikma's European injectables business demonstrated robust expansion, with its own products achieving a 20% growth in 2024. This outpaced the broader market, signaling a significant increase in Hikma's market share within this expanding sector.

The company's strategic market entries in France, the UK, and Spain, combined with an expanding product range, have been instrumental in capitalizing on market supply disruptions. This has effectively allowed Hikma to broaden its footprint across key European territories.

US Injectables Portfolio Expansion (Post-Xellia Acquisition)

Hikma's acquisition of Xellia Pharmaceuticals' US finished dosage form business in 2024 was a strategic move that significantly bolstered its injectables portfolio and pipeline within the United States. This expansion not only broadened the range of products but also integrated advanced manufacturing capabilities and complex technologies, crucial for sustained growth in the vital US sterile injectables sector.

The US market for sterile injectables is currently experiencing significant shortages, presenting a substantial high-growth opportunity for companies like Hikma that have expanded their capacity and technological expertise. This situation underscores the strategic importance of Hikma's investment in strengthening its position to address these market demands.

- Diversification: The Xellia acquisition broadened Hikma's US injectables offerings, adding new therapeutic areas and product lines.

- Capacity Enhancement: It increased Hikma's manufacturing footprint and technological capabilities in the US, vital for meeting demand.

- Market Opportunity: The ongoing shortages in the US sterile injectables market create a favorable environment for Hikma's expanded portfolio.

- Pipeline Enrichment: The deal brought a richer pipeline of complex injectables, promising future growth and market penetration.

Oncology & Lifestyle Disease Products (Branded Segment)

Hikma's Branded business is strategically expanding its presence in oncology and lifestyle disease products, recognizing these as key growth sectors. The company is actively cultivating a diverse portfolio to capture opportunities in these critical therapeutic areas.

A prime example of this strategy is the exclusive licensing agreement for rucaparib in the Middle East and North Africa (MENA) region. This move underscores Hikma's ambition to establish itself as a frontrunner in specialized and expanding markets.

These targeted investments in high-demand therapeutic segments are designed to drive substantial future market share growth for Hikma's branded offerings.

- Focus Areas: Oncology and lifestyle diseases are central to Hikma's branded portfolio expansion.

- Strategic Partnerships: Exclusive licensing deals, like the one for rucaparib in MENA, highlight a commitment to specialized markets.

- Growth Potential: Investments in these high-demand areas are positioned for significant future market share gains.

- Market Position: Hikma aims to become a leading provider in these specialized, growing therapeutic segments.

Hikma's Injectables segment is a clear star, demonstrating strong revenue growth of 10% in 2024, with projections for 7% to 9% growth in 2025. This segment benefits from Hikma's position as the third-largest supplier of generic injectables by volume in the US and strong demand in Europe and MENA. The acquisition of Xellia Pharmaceuticals' US business in 2024 further solidified this star status by enhancing its portfolio and manufacturing capabilities in a market experiencing significant sterile injectable shortages.

The strategic entry into the GLP-1 market with liraglutide in late 2024 also positions Hikma's Injectables as a star. Despite its nascent market share in this competitive space, the substantial investment and the inherent growth of the GLP-1 market, particularly for diabetes and obesity, signal significant future potential. This focus on differentiated products like liraglutide is a key driver for the segment's continued star performance.

Hikma's European Injectables business is also shining, with its own products achieving 20% growth in 2024, outperforming the market. This success is attributed to strategic market entries in France, the UK, and Spain, along with an expanded product range that capitalized on market supply disruptions.

| Segment | 2024 Revenue Growth | 2025 Projected Growth | Key Strengths | Strategic Initiatives |

| Injectables (US) | 10% | 7-9% | #3 US generic injectable supplier by volume; addressing market shortages | Xellia acquisition; GLP-1 (liraglutide) launch |

| Injectables (Europe) | N/A (Own products grew 20%) | N/A | Outperforming market; capitalizing on supply disruptions | Expansion in France, UK, Spain; product range growth |

What is included in the product

This BCG Matrix analysis provides a tailored overview of Hikma's product portfolio, categorizing each unit to guide strategic investment decisions.

The Hikma BCG Matrix offers a clear, visual snapshot of business unit performance, alleviating the pain of strategic uncertainty.

Cash Cows

Hikma's Branded business in the MENA region demonstrated impressive strength in 2024, achieving 8% revenue growth. This performance, coupled with a solid core operating margin of 24.6%, underscores its significant market share within a mature yet stable environment.

The company solidified its standing as the second-largest pharmaceutical player in MENA, a testament to its deep understanding and tailored approach to local market demands. This segment's consistent ability to generate substantial cash flow is crucial for funding other strategic initiatives within Hikma.

Hikma stands as the third-largest supplier of generic injectable products by volume in the United States, a testament to its extensive portfolio and deep-rooted market presence. This mature segment, while facing typical price pressures, provides a stable cash flow for Hikma due to its leading position and commitment to high-quality manufacturing. For instance, in 2023, Hikma’s US Generics segment reported strong performance, contributing significantly to the company's overall revenue, underscoring the reliability of these established products.

Hikma's nasal spray franchise, a key player in its Generics segment, demonstrated robust performance throughout 2024. This sustained success underscores its established market leadership and significant share within the respiratory generics category.

The nasal spray line is a substantial contributor to the Generics business, which achieved a notable milestone by exceeding $1 billion in revenue for the first time in 2024. This financial achievement highlights the overall strength and growth of Hikma's generic offerings.

With its consistent demand and reliable revenue generation, the nasal spray franchise functions as a dependable cash cow for Hikma. Its mature market position means it requires minimal aggressive marketing or promotional capital, allowing it to efficiently generate profits.

Sodium Oxybate (Authorized Generic)

Hikma's authorized generic for sodium oxybate has solidified its standing as a Cash Cow within the Generics segment. In 2024, the company successfully boosted its market share for this complex generic, underscoring its dominant presence in the market.

Despite the royalty payments on this authorized generic impacting the core operating profit for the Generics division, its substantial market share positions it as a key revenue driver. This product's market leadership ensures it remains a stable and significant contributor to Hikma's overall generics portfolio, even with specific cost considerations.

- Market Share Growth: Hikma's market share in sodium oxybate (authorized generic) increased in 2024.

- Revenue Contribution: The product is a significant revenue contributor due to its high market share.

- Profitability Impact: Royalties affected core operating profit but market leadership remains key.

- Portfolio Stability: Represents a substantial and stable part of the generics portfolio.

Contract Manufacturing Organization (CMO) Business

Hikma's Contract Manufacturing Organization (CMO) business demonstrated solid performance in 2024, with growth particularly noted in the latter half of the year. This segment consistently generates revenue by effectively utilizing its established manufacturing infrastructure and core capabilities.

A key development in 2024 was the signing of a substantial agreement with a major global pharmaceutical firm. This partnership is projected to significantly boost revenue starting in 2027, underscoring the CMO business's potential for sustained and predictable cash flow through its specialized manufacturing services.

- 2024 Performance: Steady revenue generation, accelerating in H2.

- Long-Term Growth Driver: Significant 2024 agreement with a global pharma company, expected to contribute from 2027.

- Core Strength: Leverages existing infrastructure and manufacturing expertise for consistent income.

Hikma's established MENA Branded business, with its 8% revenue growth in 2024 and a 24.6% core operating margin, functions as a stable cash cow. Its significant market share in a mature region ensures consistent cash generation with minimal need for aggressive investment.

The US Generics segment, particularly the nasal spray franchise which surpassed $1 billion in revenue for the business in 2024, acts as another key cash cow. This segment benefits from established market leadership and requires limited capital expenditure for growth, allowing it to efficiently produce profits.

The authorized generic for sodium oxybate is a prime example of a cash cow within Hikma's Generics portfolio. Despite royalty payments, its dominant market share in 2024 ensures it remains a stable and substantial revenue contributor, generating reliable cash flow for the company.

Preview = Final Product

Hikma BCG Matrix

The Hikma BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks or placeholder content, only a professionally structured analysis ready for your strategic planning. You can confidently use this preview as a direct representation of the high-quality, actionable report that will be yours to download and implement. This ensures transparency and provides you with a clear understanding of the value and detail contained within the complete Hikma BCG Matrix analysis.

Dogs

Within Hikma's Generics segment, older, undifferentiated oral products are likely positioned as Dogs in the BCG matrix. While the Generics business overall shows strength, Hikma has noted price erosion impacting its base business. This indicates that these mature, less specialized oral generics, facing crowded markets and numerous competitors, may be struggling with low market share and minimal growth.

These products often operate in highly competitive environments where aggressive pricing is the norm, significantly dampening profit margins and future expansion opportunities. For instance, in 2024, the generic oral segment faced continued pressure from increased competition and reimbursement challenges across various therapeutic areas, impacting the profitability of these legacy products.

Within Hikma's BCG Matrix, non-strategic or divested Takeda brands would likely be categorized as Dogs. This is because these brands, if not part of the 17 Takeda brands Hikma acquired to boost future profitability, might have low market share in slow-growing therapeutic areas. For instance, if a Takeda brand previously licensed to Hikma underperformed or faced declining demand, it would fit this profile.

Certain segments within Hikma's Generics portfolio are characterized by highly fragmented markets. In these areas, price competition is exceptionally fierce, leading to persistently squeezed profit margins.

While Hikma focuses on differentiated generics, a portion of its broader generic offerings likely contends with these pressures. This can result in a low market share and minimal profitability for these specific products.

For instance, in 2024, the global generics market, while growing, saw intense price erosion in many therapeutic areas. Companies like Hikma must carefully manage these products to prevent them from becoming significant drains on resources, often requiring a lean operational approach to maintain any level of profitability.

Underperforming Legacy Products in Europe/ROW

While Hikma's European operations generally demonstrated robust growth, certain legacy products within this region, and indeed across the Rest of the World (ROW), may be experiencing challenges. These products, especially those not recently introduced or benefiting from supply disruptions elsewhere, could exhibit both a low market share and sluggish growth.

Such underperformers, if they lack strategic alignment with current market drivers or face intense local competition, might be categorized as Dogs in the BCG Matrix. These products contribute minimally to the overall portfolio's health and require careful evaluation. For instance, in 2024, Hikma's Generics segment in Europe saw varied performance, with some mature products in specific markets like Germany or Italy potentially falling into this category if their market share remained below 10% and growth rates were flat or negative.

- Low Market Share: Products with a market share below the industry average in their respective European or ROW markets.

- Stagnant Growth: Exhibits minimal to no revenue growth year-over-year.

- Limited Strategic Fit: Not aligned with Hikma's current innovation pipeline or key therapeutic areas.

- Competitive Pressure: Faces significant pricing or product competition from local players.

Products with Declining Demand or Obsolete Technologies

Products with declining demand or obsolete technologies in Hikma's portfolio would fall into the Dogs category of the BCG Matrix. These are typically items linked to shrinking therapeutic areas or those relying on older manufacturing processes. For instance, if Hikma had a significant product line in a therapeutic area that has seen a sharp decline in patient numbers due to new treatment alternatives, it would likely be a Dog.

Such products would possess a low market share within a contracting market, offering minimal to no potential for future growth. For example, a generic injectable antibiotic whose efficacy has been surpassed by newer, more potent formulations, and which is produced using older batch manufacturing methods, would fit this description.

These "Dogs" can consume capital and management attention without generating substantial returns. Hikma's 2024 financial reports might reveal specific product segments showing negative revenue growth or significant year-over-year declines in volume, which could indicate potential Dogs.

- Declining Therapeutic Areas: Products targeting conditions with reduced prevalence or where newer, more effective treatments have emerged.

- Obsolete Manufacturing Technologies: Products manufactured using older, less efficient, or environmentally less friendly processes compared to industry advancements.

- Low Market Share in Shrinking Markets: Products that are losing ground to competitors or alternative solutions in a market that is itself contracting.

- Resource Drain: These products often require ongoing investment for maintenance or regulatory compliance without yielding commensurate profits, diverting resources from more promising ventures.

Dogs in Hikma's portfolio represent products with low market share in slow-growing markets, often characterized by intense price competition and limited strategic value. These segments, particularly within the mature Generics oral products, face significant price erosion and are unlikely to drive future growth.

For example, in 2024, the continued pricing pressure in the generic oral segment, as noted by Hikma, likely impacted the profitability of these legacy products, making them prime candidates for the Dog classification. These products often require careful management to minimize resource drain.

Hikma's strategy of focusing on differentiated generics means that older, undifferentiated products, especially those in highly fragmented markets, are more prone to becoming Dogs. These products contribute minimally to overall portfolio health and may not align with current market drivers.

These products require ongoing evaluation to determine if divestment or minimal investment is the most prudent approach, rather than attempting to revitalize them in markets with little growth potential.

Question Marks

Hikma Pharmaceuticals is significantly boosting its R&D spending, planning a roughly 20% increase in 2025 to fuel its global pipeline. This strategic move underscores a commitment to nurturing new product candidates that, while currently holding low market share, represent substantial future growth opportunities. These emerging R&D projects are considered speculative, demanding considerable investment to assess their potential to evolve into market-leading 'Stars'.

Kloxxado®, with its 8mg naloxone HCl formulation, is positioned as a potential Star in Hikma's BCG Matrix, given the high-demand and rapid growth of the opioid overdose reversal market. The partnership with Emergent BioSolutions, initiated in January 2025, is a strategic move to boost patient access to this critical medication.

Despite the favorable market dynamics, Hikma's current market share for Kloxxado® in the US is notably low. This necessitates substantial investment in marketing and distribution to build brand recognition and secure a significant competitive position within this growing sector.

Hikma is strategically prioritizing growth within its Generics segment by focusing on more complex products. These advanced generics, often characterized by intricate manufacturing processes or novel delivery systems, represent a significant opportunity for differentiation and market leadership.

Newly launched complex generics, while possessing high growth potential due to their specialized nature and limited competition, typically begin with a modest market share as they establish their presence. For instance, in 2024, Hikma observed that several of its recently introduced complex generics captured less than 5% of their respective market shares within the first year of launch.

These products necessitate ongoing investment in commercialization efforts to build awareness, secure formulary acceptance, and demonstrate their value proposition to healthcare providers and patients. Such sustained support is crucial for these nascent offerings to mature into future Stars within Hikma's product portfolio.

Emerging Market Expansion (New Entrants)

Emerging market expansion for Hikma, particularly into new territories beyond its established MENA base, would classify as a 'Question Mark' in the BCG Matrix. These ventures represent significant opportunities due to potentially high growth rates, but also carry substantial risk given Hikma's likely low initial market share.

For instance, if Hikma were to enter the burgeoning Southeast Asian pharmaceutical market, a region experiencing robust economic growth and increasing healthcare spending, it would face established local and international competitors. This necessitates considerable investment in building distribution networks, navigating diverse regulatory landscapes, and establishing brand recognition. As of early 2024, many emerging markets in Asia and Africa show projected pharmaceutical market growth rates exceeding 8-10% annually, presenting a compelling case for expansion but also highlighting the investment required to gain traction.

- High Growth Potential: Emerging economies often exhibit faster GDP and healthcare sector growth than developed markets.

- Low Market Share: New entrants typically start with a minimal footprint, requiring substantial effort to build market share.

- Significant Investment Needs: Entering new markets demands investment in R&D, manufacturing, distribution, marketing, and regulatory compliance.

- Strategic Importance: Successful expansion into these markets can diversify revenue streams and tap into future growth engines for Hikma.

Products from the 17 Acquired Takeda Brands

The acquisition of 17 Takeda brands by Hikma is poised to bolster future profitability within its Branded segment. These newly integrated brands are expected to initially fall into the 'Question Marks' category within the BCG Matrix for Hikma. This classification signifies their potential for high growth but also their current low market share under Hikma's direct management, requiring strategic investment to cultivate.

These brands, especially those entering new therapeutic areas or those with less established positions within Hikma's existing portfolio, will need focused marketing and sales efforts. For example, if a brand is in a rapidly expanding market but Hikma's current market share is minimal, it represents a classic Question Mark. The goal is to invest in these brands to increase their market share, potentially moving them to the 'Stars' category in the future.

- Potential for High Growth: The 17 acquired Takeda brands are entering markets with significant growth prospects.

- Low Market Share: Initially, these brands will likely possess a low market share under Hikma's direct management.

- Strategic Investment Required: Significant investment in marketing, sales, and potentially R&D will be necessary to grow their market presence.

- Future Star Potential: Successful investment and market penetration could elevate these brands to 'Stars' in Hikma's portfolio.

Question Marks in Hikma's BCG Matrix represent products or ventures in high-growth markets where the company currently holds a low market share. These require significant investment to increase market penetration and potentially become future Stars. For instance, expansion into new emerging markets or the integration of newly acquired brands often falls into this category, demanding strategic resource allocation to unlock their full potential.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.