Hikma Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hikma Bundle

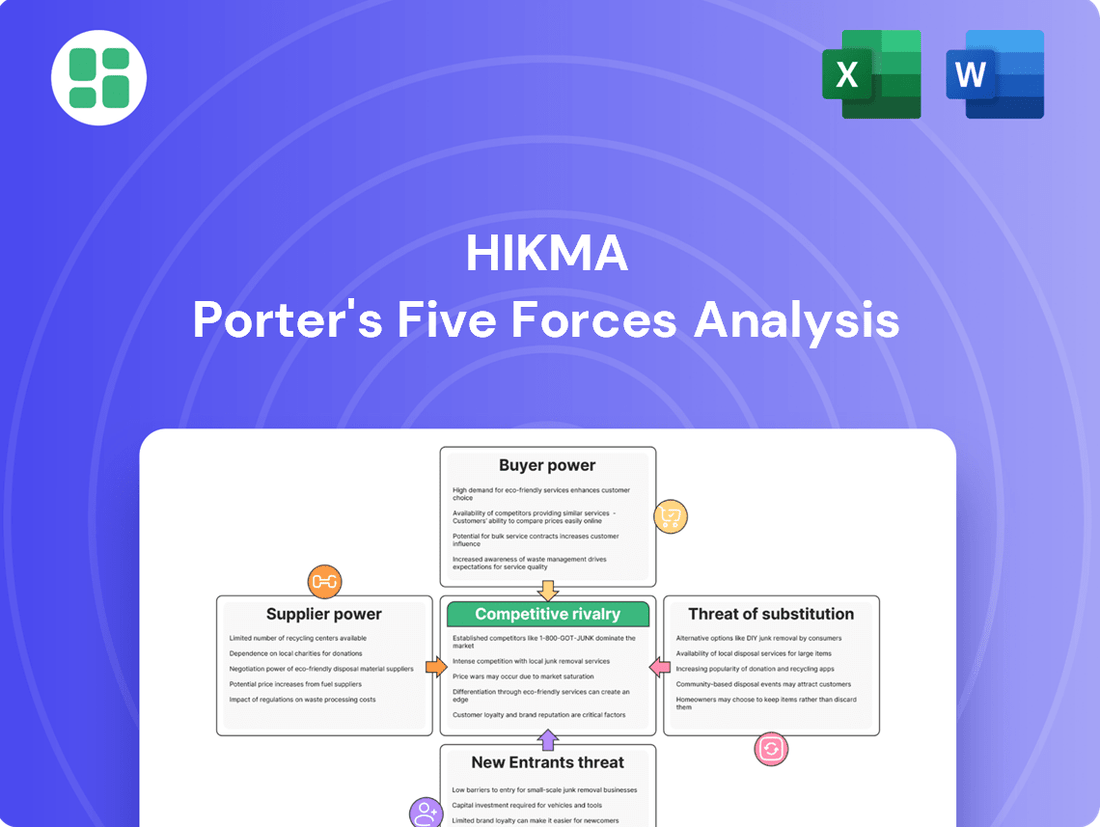

Hikma's competitive landscape is shaped by the interplay of five key forces, revealing significant pressures from rivals and the constant threat of substitutes. Understanding these dynamics is crucial for navigating its market effectively.

The complete report reveals the real forces shaping Hikma’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The pharmaceutical sector's reliance on Active Pharmaceutical Ingredients (APIs) from a concentrated group of manufacturers, especially in China and India, grants these suppliers considerable bargaining power. Hikma, while sourcing globally, faces this reality, particularly for specialized APIs where supplier options are limited.

The global API market is expected to expand, reaching an estimated USD 269.5 billion by 2027, underscoring the ongoing dependence on these key suppliers.

Switching raw material suppliers in the pharmaceutical industry, especially for Active Pharmaceutical Ingredients (APIs), presents substantial challenges for companies like Hikma. These challenges stem from the rigorous regulatory landscape. For instance, gaining approval from bodies like the U.S. Food and Drug Administration (FDA) for a new API supplier can be a lengthy and costly undertaking, often taking years and millions of dollars.

The need to revalidate quality control processes and ensure compliance with current Good Manufacturing Practices (cGMP) adds further complexity and expense. These stringent requirements mean that pharmaceutical manufacturers have to invest heavily in testing and documentation for each new supplier. This process is not just about meeting standards; it's about ensuring the safety and efficacy of the final drug product.

Consequently, existing, approved API suppliers hold significant bargaining power. Pharmaceutical companies like Hikma are often locked into using these suppliers due to the high switching costs and the inherent risks associated with disrupting a validated supply chain. This reliance strengthens the suppliers' position, allowing them to potentially command higher prices or dictate terms, impacting Hikma's cost of goods sold.

The uniqueness of inputs, particularly patented Active Pharmaceutical Ingredients (APIs), can significantly impact Hikma Pharmaceuticals' bargaining power with its suppliers. While Hikma's portfolio leans towards generics, certain branded generics or in-licensed products rely on specialized APIs. These patented APIs are often controlled by a limited number of suppliers, giving them considerable leverage.

This reliance on a few suppliers for critical, patented components means Hikma may face higher input costs and reduced negotiation power for these specific materials. For instance, if a key patented API for a high-margin branded generic is only available from one or two manufacturers, those suppliers can dictate terms, potentially squeezing Hikma's profitability on that product line.

Forward Integration Threat by Suppliers

While not a common occurrence, there's a theoretical threat of large Active Pharmaceutical Ingredient (API) manufacturers integrating forward into the production of generic drugs. This would position them as direct competitors to companies like Hikma Pharmaceuticals. This potential, even if rarely acted upon, grants API suppliers a certain underlying leverage.

However, this threat is significantly diminished by the substantial capital investment and complex regulatory approvals required to enter the finished dosage form manufacturing market. For instance, establishing a new drug manufacturing facility often involves billions of dollars and years of navigating stringent FDA or EMA guidelines.

- Forward Integration Threat: Large API manufacturers could theoretically enter generic drug production, becoming direct competitors.

- Supplier Leverage: This potential, even if unrealized, provides API suppliers with latent bargaining power.

- Mitigating Factors: Significant capital requirements and regulatory hurdles substantially reduce this threat for API suppliers.

Impact of Supply Chain Disruptions

Geopolitical events and global health crises, such as the COVID-19 pandemic, have significantly highlighted the fragilities within pharmaceutical supply chains. This increased vulnerability often translates to a stronger bargaining position for established and dependable suppliers of Active Pharmaceutical Ingredients (APIs) and other critical components. For instance, during the pandemic, lead times for certain APIs extended, and prices saw upward pressure, directly impacting drug manufacturers like Hikma.

Hikma's strategic initiatives to bolster its US manufacturing capabilities and diversify its supplier base are crucial in navigating these challenges. By reducing reliance on single-source or geographically concentrated suppliers, Hikma aims to build resilience. However, the fundamental global nature of API sourcing means that Hikma, like many in the industry, must continually manage the inherent risks associated with international supply chains.

The bargaining power of suppliers can manifest in several ways:

- Increased Input Costs: Suppliers can command higher prices for raw materials or APIs, especially when demand outstrips supply or when their own production is disrupted.

- Extended Lead Times: Reliable suppliers may prioritize certain customers or face production bottlenecks, leading to longer delivery times for others.

- Reduced Quality or Service: In a tight market, some suppliers might compromise on quality or customer service, leaving manufacturers with fewer viable alternatives.

- Control over Innovation: Suppliers of novel or patented APIs can exert significant influence over the terms of their products, affecting the development and availability of new medications.

Suppliers of Active Pharmaceutical Ingredients (APIs) hold significant sway over Hikma due to the pharmaceutical industry's reliance on specialized, regulated inputs. The global API market's projected growth to USD 269.5 billion by 2027 underscores this dependence.

High switching costs, driven by stringent regulatory approvals like those from the FDA, lock pharmaceutical companies into existing API suppliers. This lengthy validation process, often costing millions, means companies like Hikma face substantial barriers to changing suppliers, strengthening the suppliers' negotiating position.

The limited number of suppliers for patented or specialized APIs further amplifies their bargaining power. This concentration can lead to increased input costs for Hikma, particularly for branded generics relying on these unique components, impacting overall profitability.

Geopolitical instability and health crises, as seen during the COVID-19 pandemic, have exposed supply chain vulnerabilities, further empowering established API suppliers. This has led to extended lead times and price increases, directly affecting manufacturers like Hikma.

| Factor | Impact on Hikma | Example/Data Point |

|---|---|---|

| Regulatory Hurdles | High switching costs for API suppliers | FDA approval for new API suppliers can take years and cost millions. |

| Supplier Concentration | Increased input costs for specialized APIs | Patented APIs often sourced from a few manufacturers. |

| Market Dynamics | Price volatility and extended lead times | COVID-19 pandemic saw increased API prices and longer delivery times. |

What is included in the product

This analysis unpacks the competitive forces impacting Hikma, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the pharmaceutical industry.

Instantly identify and address competitive threats with a visual breakdown of each Porter's Five Force.

Streamline strategic planning by clearly mapping out the competitive landscape and potential challenges.

Customers Bargaining Power

Government and institutional buyers, like national healthcare systems and large hospital networks, exert considerable bargaining power. Their sheer volume of purchases, especially for generic pharmaceuticals, allows them to negotiate aggressively for lower prices. This is a significant factor for Hikma, particularly given its substantial market share in regions like the US and MENA, where these entities are key customers constantly seeking cost efficiencies.

In the generic drug market, customers exhibit high price sensitivity. Since generic drugs are essentially identical to their branded counterparts in terms of active ingredients and efficacy, buyers naturally gravitate towards the most cost-effective options. This intense price competition is a defining characteristic of the sector.

Hikma's Generics segment, therefore, contends with ongoing price erosion on its established products. To counteract this, the company must concentrate on developing and marketing differentiated generics, perhaps those with unique delivery systems or formulations, and ensuring consistent, reliable supply to its customers.

For instance, in 2024, the average price decline for generic drugs in the US market continued to be a significant factor, with some mature products experiencing double-digit annual decreases, underscoring the need for Hikma to innovate beyond basic bioequivalence to protect its margins.

Customers, notably insurance companies and Pharmacy Benefit Managers (PBMs), wield substantial influence through their formulary inclusion and reimbursement decisions. These policies directly determine which pharmaceuticals are covered and at what price points, impacting a manufacturer's market penetration. For instance, exclusion from a preferred formulary can drastically curtail sales volume, as seen with many generic drug manufacturers facing intense pricing pressure from large PBMs in 2024.

Patient and Physician Influence

While individual patients typically have limited direct bargaining power, their collective demand for accessible and affordable medications significantly shapes the market. This is particularly evident in the growing acceptance and uptake of biosimilars and generic drugs, driven by cost-consciousness. For instance, in 2024, the US market for biosimilars continued its expansion, with several new approvals and increasing physician adoption, reflecting this patient-driven cost sensitivity.

Physicians act as a crucial intermediary, influencing patient choices through their prescribing habits. Their decisions are increasingly informed by the cost-effectiveness of treatments, especially in systems where patients bear a portion of the drug costs or where formularies prioritize value. In 2024, discussions around value-based pricing and outcomes-based contracts for pharmaceuticals gained further traction, underscoring the importance of demonstrating cost-effectiveness to gain physician acceptance.

- Patient Demand for Affordability: Growing patient awareness and out-of-pocket costs in 2024 fueled a stronger demand for lower-priced prescription drugs.

- Physician Prescribing Patterns: Physicians, influenced by cost-effectiveness data and insurance formularies, increasingly steer patients towards more affordable options.

- Biosimilar Adoption: The increasing availability and physician familiarity with biosimilars in 2024 provided a tangible avenue for cost reduction, enhancing customer power.

- Value-Based Healthcare Trends: The broader shift towards value-based care in 2024 incentivized healthcare providers and payers to favor treatments demonstrating superior cost-effectiveness, indirectly empowering patients.

Availability of Multiple Generic Options

The availability of numerous generic drug options significantly strengthens customer bargaining power. When multiple manufacturers produce the same generic medication, buyers can easily switch suppliers to secure lower prices, putting pressure on individual companies to remain competitive.

Hikma's market position highlights this dynamic. As the seventh largest supplier of generic medicines in the U.S. and third largest for generic injectables by volume, the company operates within a crowded marketplace. This means customers, whether they are pharmacies, wholesalers, or healthcare systems, have a wide array of choices when sourcing their medications.

- Numerous Generic Competitors: The presence of many manufacturers for common generic drugs allows buyers to compare prices and terms easily.

- Price Sensitivity: Customers can leverage competition to negotiate better pricing, impacting Hikma's profit margins.

- Hikma's Market Share: Being a significant player (7th in US generics, 3rd in US generic injectables by volume) means Hikma is directly exposed to this customer power.

The bargaining power of customers for Hikma is substantial, driven by price sensitivity in the generics market and the influence of large institutional buyers like healthcare systems and PBMs. In 2024, continued price erosion in the US generics market, with some products seeing double-digit annual decreases, exemplifies this pressure. Hikma's position as a major supplier means it directly faces intense competition, forcing a focus on differentiated products and reliable supply to maintain margins.

| Customer Type | Bargaining Power Driver | Impact on Hikma | 2024 Trend Example |

|---|---|---|---|

| Government/Healthcare Systems | High Volume Purchases, Price Negotiation | Pressure on pricing for generics | Continued focus on cost efficiencies by these entities |

| Insurance Companies/PBMs | Formulary Inclusion, Reimbursement Decisions | Dictates market access and pricing | Intense pricing pressure from large PBMs |

| Individual Patients | Demand for Affordability, Biosimilar Uptake | Drives market towards lower-cost options | Expansion of biosimilar market in the US |

| Physicians | Prescribing Habits, Cost-Effectiveness Focus | Influences adoption of cost-effective treatments | Increased discussion of value-based pricing |

Same Document Delivered

Hikma Porter's Five Forces Analysis

This preview showcases the comprehensive Hikma Porter's Five Forces Analysis, detailing the competitive landscape of the pharmaceutical industry. The document you see here is the exact, fully formatted analysis you will receive immediately after purchase, providing actionable insights without any placeholders or surprises. Gain a deep understanding of Hikma's strategic position by acquiring this ready-to-use report.

Rivalry Among Competitors

The pharmaceutical sector, particularly the generics market where Hikma is a major player, is teeming with competition. Companies like Teva Pharmaceutical Industries, Sandoz (part of Novartis), and Viatris are significant global and regional competitors, making the landscape intensely crowded.

This sheer volume of players, especially those focusing on off-patent, undifferentiated generic drugs, significantly escalates competitive rivalry. For instance, in 2024, the global generics market was valued at over $400 billion, with hundreds of companies vying for market share, often on price alone.

The global pharmaceutical market is indeed experiencing growth, but the generics sector presents a more nuanced picture. While new product introductions offer some uplift, this is often counteracted by price erosion in established product lines.

For Hikma, this translates to an expectation of broadly flat Generics revenue. This signals a mature and intensely competitive landscape where achieving meaningful growth requires a deliberate strategy focused on differentiation rather than simply volume.

Hikma Pharmaceuticals actively differentiates itself by focusing on high-quality manufacturing, particularly in complex injectables and branded products, which sets it apart from competitors often relying on similar generic offerings. This strategic emphasis on quality and specialized product lines is key in a crowded market. For instance, in 2023, Hikma reported a 7% increase in revenue to $2.0 billion, with its Injectables segment showing particular strength, underscoring the value of its differentiated approach.

Innovation and securing first-to-file opportunities are vital for Hikma to maintain its competitive edge. The pharmaceutical landscape demands continuous development of new formulations and delivery systems. Hikma's robust pipeline and its ability to bring complex generics to market first provide a significant advantage, allowing it to capture market share before broader competition emerges.

Exit Barriers and Fixed Costs

The pharmaceutical sector, including companies like Hikma, faces significant competitive rivalry driven by substantial exit barriers. These barriers are largely due to the immense fixed costs involved in research and development (R&D), the establishment and maintenance of specialized manufacturing facilities, and the stringent regulatory compliance required for drug approval and production.

These high fixed costs mean that once a company has invested heavily, it is very difficult and expensive to exit the market. Consequently, even when profitability is low, pharmaceutical firms are often compelled to remain operational and continue competing. This persistence, even in challenging economic conditions, naturally intensifies the rivalry among existing players as they strive to maintain market share and recover their substantial investments.

For instance, in 2024, the global pharmaceutical industry continues to see substantial R&D spending. Companies are investing billions annually, with many major players dedicating over 15% of their revenue to R&D. This ongoing commitment to innovation, coupled with the capital-intensive nature of drug manufacturing and the complex regulatory pathways, creates a scenario where exiting is often financially unviable, thereby locking companies into sustained competition.

- High R&D Investment: Pharmaceutical companies regularly invest billions in drug discovery and development, with many allocating over 15% of their revenue to R&D in 2024.

- Specialized Manufacturing: The cost of building and maintaining Good Manufacturing Practice (GMP) compliant facilities is exceptionally high, often running into hundreds of millions of dollars.

- Regulatory Hurdles: Compliance with agencies like the FDA and EMA involves extensive testing and documentation, adding significant ongoing costs and making market exit costly.

- Asset Specificity: Specialized manufacturing equipment and intellectual property are often specific to the pharmaceutical industry, limiting resale value and increasing the cost of exiting.

Strategic Acquisitions and Partnerships

Competitive rivalry within the pharmaceutical industry, including for companies like Hikma, is significantly influenced by strategic acquisitions and partnerships. These moves are crucial for expanding product portfolios, capturing greater market share, and integrating innovative technologies. For instance, Hikma's acquisition of Xellia's US business in 2020, valued at $325 million, was a strategic step to bolster its sterile injectables segment.

Such activities directly intensify competition by consolidating market power and introducing new capabilities. By acquiring or partnering, companies can gain access to a wider range of therapeutic areas and distribution networks, thereby challenging established players. Hikma's ongoing pursuit of strategic alliances and acquisitions demonstrates a proactive approach to navigating this competitive landscape and strengthening its overall market position.

These strategic maneuvers allow companies to:

- Expand product portfolios

- Gain market share

- Leverage new technologies

- Strengthen pipeline

The competitive rivalry in the pharmaceutical sector, particularly for generics, is fierce due to a large number of players and price-based competition. Companies like Hikma face intense pressure from global giants as well as smaller regional manufacturers.

This rivalry is further fueled by significant exit barriers, including massive R&D investments, specialized manufacturing costs, and stringent regulatory requirements, which keep companies engaged even in low-profitability scenarios.

Strategic moves like acquisitions and partnerships, such as Hikma's acquisition of Xellia's US business for $325 million in 2020, are common strategies to gain market share and technological advantages, thereby intensifying competition.

In 2024, the global generics market, valued at over $400 billion, exemplifies this intense rivalry, with hundreds of companies competing primarily on price, leading to an expectation of flat revenue growth in this segment for players like Hikma unless differentiation is achieved.

| Company | 2023 Revenue (approx.) | Key Focus Area | Competitive Characteristic |

|---|---|---|---|

| Hikma Pharmaceuticals | $2.0 billion | Injectables, Generics, Branded | Quality manufacturing, complex generics |

| Teva Pharmaceutical Industries | $15.0 billion (2023) | Generics, Specialty Medicines | Global scale, broad product portfolio |

| Viatris | $13.3 billion (2023) | Generics, Biosimilars, Specialty | Extensive global reach, diverse offerings |

SSubstitutes Threaten

The threat of generic drugs and biosimilars is a significant factor for Hikma's branded and in-licensed portfolio. Once patents expire, the market opens up to lower-cost alternatives, directly impacting the revenue streams of the original, higher-priced products. For instance, the U.S. market for branded drugs often sees substantial price erosion, sometimes exceeding 80%, following generic entry.

This substitution pressure forces Hikma to adapt its strategies, potentially by focusing on product differentiation, lifecycle management, or by developing its own generic and biosimilar offerings. The increasing sophistication and acceptance of biosimilars, particularly in therapeutic areas like oncology and autoimmune diseases, amplify this threat. By 2024, the global biosimilar market is projected to reach tens of billions of dollars, underscoring the competitive landscape Hikma navigates.

Beyond direct drug substitutes, alternative medical treatments like traditional Chinese medicine, physiotherapy, and even robust lifestyle interventions such as specialized diets and comprehensive exercise programs can significantly reduce the demand for certain pharmaceutical products. For instance, the global market for complementary and alternative medicine was valued at approximately $128 billion in 2023, indicating a substantial consumer shift towards non-pharmaceutical solutions.

While this threat is typically moderate for life-saving or essential medicines where pharmaceutical intervention is critical, it can notably impact sales for treatments addressing non-critical conditions or those with strong lifestyle-related components. The growing awareness and accessibility of these alternatives mean that pharmaceutical companies must consider how these options might erode market share for specific drug classes.

The availability of over-the-counter (OTC) medications presents a significant threat of substitution for prescription drugs. As more pharmaceuticals transition from prescription-only to OTC status, consumers gain access to readily available and often more affordable alternatives for managing certain health conditions. This trend directly impacts the market for prescription drugs, as patients may opt for OTC options when clinically appropriate.

For instance, the U.S. Food and Drug Administration (FDA) has approved numerous prescription drugs for OTC availability in recent years, expanding consumer choice and potentially reducing reliance on doctor-prescribed medications. This shift can lead to a decline in prescription volumes for those specific therapeutic areas, thereby affecting the revenue streams of pharmaceutical companies that primarily rely on prescription sales.

Technological Advancements and New Treatment Modalities

Emerging technologies such as gene therapies and personalized medicine present a significant threat of substitution for traditional pharmaceuticals. These advanced treatments can offer entirely new ways to address diseases, potentially making existing drug-based therapies obsolete. For instance, by 2024, the global gene therapy market was projected to reach approximately $13.4 billion, indicating substantial investment and growth in these alternative modalities.

The increasing sophistication of diagnostic tools also contributes to this threat. Advanced diagnostics can identify disease markers or genetic predispositions, enabling earlier and more targeted interventions that might bypass the need for conventional drug treatments. This shift towards precision medicine, while often starting with high-cost, niche applications, has the long-term potential to disrupt established pharmaceutical markets.

Consider these key aspects of technological substitution:

- Disruptive Treatment Paradigms: Gene therapies and personalized medicine offer fundamentally different approaches to disease management, potentially rendering current drug regimens less effective or even unnecessary.

- Market Penetration Potential: While currently specialized, the scalability and cost reduction of these technologies over time pose a direct threat to the market share of traditional pharmaceuticals.

- R&D Investment Trends: Significant global investment in biotech and advanced therapies, with billions poured into research and development annually, underscores the growing viability and competitive threat of these substitutes.

Patent Expirations of Competitors' Products

The expiration of patents for competitor blockbuster drugs directly impacts Hikma's Generics segment, opening doors for increased market penetration. However, this same phenomenon poses a constant threat of new generic entrants targeting Hikma's own branded or differentiated products. This cyclical nature of innovation and competition is a defining characteristic of the pharmaceutical landscape.

For instance, in 2024, the pharmaceutical industry continued to see significant patent cliffs. According to industry reports, several major blockbuster drugs lost patent protection in the preceding years, paving the way for a surge in generic versions. This trend intensifies the competitive pressure on companies like Hikma, particularly in markets where their differentiated products may face direct generic competition.

- Increased Generic Competition: Patent expirations allow other companies to produce and sell generic versions of previously protected drugs, lowering prices and capturing market share.

- Pressure on Branded Products: Hikma's own branded or differentiated products face a heightened risk of generic substitution upon patent expiry.

- Opportunity for Generics Segment: Conversely, Hikma's Generics business can capitalize on these expirations by launching its own affordable generic alternatives.

- Constant Innovation Cycle: The industry necessitates continuous investment in R&D to develop new, patent-protected products to offset the erosion of revenue from expiring patents.

The threat of substitutes for Hikma is multifaceted, encompassing generic and biosimilar drugs, alternative medical treatments, and over-the-counter (OTC) medications. The U.S. market, for example, often experiences over 80% price erosion for branded drugs post-generic entry, a trend amplified by the projected global biosimilar market reaching tens of billions by 2024. Furthermore, the complementary and alternative medicine market was valued at approximately $128 billion in 2023, highlighting a significant consumer pivot towards non-pharmaceutical solutions.

Emerging technologies like gene therapies, with a projected global market of $13.4 billion by 2024, also present a substantial substitution threat by offering novel disease management approaches that could render traditional drugs obsolete. The constant cycle of patent expirations, while creating opportunities for Hikma's Generics segment, also intensifies competition for its branded products, necessitating continuous R&D investment to counter market share erosion.

| Substitute Category | Impact on Hikma | Key Data Point (2023-2024) |

|---|---|---|

| Generic & Biosimilar Drugs | Price erosion, market share loss for branded products | Global biosimilar market projected to reach tens of billions by 2024 |

| Alternative Medical Treatments | Reduced demand for specific drug classes | Global complementary and alternative medicine market valued at ~$128 billion (2023) |

| Over-the-Counter (OTC) Medications | Shift from prescription to OTC reduces reliance on doctor-prescribed drugs | Increased FDA approvals for prescription-to-OTC transitions |

| Advanced Therapies (e.g., Gene Therapy) | Potential obsolescence of traditional pharmaceuticals | Global gene therapy market projected at ~$13.4 billion (2024) |

Entrants Threaten

The pharmaceutical sector demands substantial upfront capital for research and development, extensive clinical trials, sophisticated manufacturing infrastructure, and navigating stringent regulatory pathways. For instance, bringing a new drug to market can cost upwards of $2.6 billion, a figure that deters many potential new players. Hikma Pharmaceuticals, as a major player, allocates significant resources to its R&D pipeline to ensure continued innovation and market competitiveness.

New entrants into the pharmaceutical industry, like Hikma, are confronted with exceptionally stringent regulatory requirements and lengthy approval processes. For instance, obtaining approval from bodies such as the U.S. Food and Drug Administration (FDA) or the European Medicines Agency (EMA) can span several years and involve significant financial investment, creating a substantial barrier to entry.

Established players, including Hikma, have already invested heavily in navigating these complex pathways for their existing product lines, giving them a significant advantage. In 2023, the FDA approved over 50 novel drugs, a testament to the rigorous vetting process that newcomers must endure.

Established pharmaceutical giants, including Hikma, leverage significant economies of scale in their operations. This means they can produce drugs at a lower per-unit cost due to high-volume manufacturing, bulk purchasing of raw materials, and optimized distribution networks. For instance, in 2023, Hikma reported revenues of $2.1 billion, underscoring its substantial market presence and operational efficiency.

New entrants face a considerable hurdle in matching these cost efficiencies. Without the established volume and infrastructure, they often operate at a higher cost base, making it difficult to compete on price. This cost disadvantage is a primary barrier, as achieving comparable scale requires massive upfront investment in facilities and market penetration, which is a significant deterrent.

Brand Loyalty and Established Distribution Channels

Brand loyalty, particularly for established pharmaceutical brands, presents a significant barrier. While less impactful in the generics market, physician and patient trust in established brands can sway prescribing habits, making it harder for new entrants to gain traction. For instance, in 2024, the global pharmaceutical market saw continued strong performance from patented drugs with high patient adherence.

Established companies also leverage deeply entrenched distribution channels. Their long-standing relationships with hospitals, pharmacies, and healthcare providers form a robust network that new entrants struggle to replicate. This access ensures product availability and visibility, crucial factors in market penetration. In 2023, major pharmaceutical distributors reported stable volumes, indicating the strength of these existing networks.

- Brand Loyalty: Physicians and patients often exhibit loyalty to established pharmaceutical brands, influencing prescription choices and making it difficult for new entrants to capture market share.

- Distribution Networks: Companies with extensive and trusted distribution channels, including relationships with hospitals and pharmacies, create a significant hurdle for new competitors seeking market access.

- Market Access: Replicating the established relationships and logistical infrastructure of incumbent firms is a time-consuming and capital-intensive process for new entrants.

- Switching Costs: For patients, switching from a familiar and trusted medication can involve perceived risks and require physician intervention, increasing switching costs and deterring new market entrants.

Intellectual Property and Patent Protection

The threat of new entrants in the pharmaceutical sector, particularly concerning intellectual property, is significantly shaped by existing patent protection. Established pharmaceutical companies, like Hikma, possess vast patent portfolios covering their innovative drugs. This creates a substantial barrier for new players aiming to introduce similar novel treatments, often necessitating lengthy and costly licensing agreements or facing potential patent infringement litigation.

For instance, the pharmaceutical industry heavily relies on patents to safeguard R&D investments. In 2024, the average patent life for a new drug can be around 20 years from filing, but the effective market exclusivity is often much shorter due to the lengthy approval processes. This means that by the time a drug is launched, a significant portion of its patent life may have already expired, limiting the window for recouping development costs and creating a challenging environment for new entrants trying to bypass these protections.

- Patent Portfolios as Barriers: Established firms hold extensive patents on innovative drugs, deterring new entrants from launching similar products without licensing or facing legal challenges.

- R&D Investment Protection: Patents are crucial for recouping the substantial investments made in drug discovery and development, a process that can cost billions of dollars per successful drug.

- Market Exclusivity Window: While patents last 20 years, the effective market exclusivity period is often less due to regulatory review times, intensifying competition once patents expire.

- Licensing Costs: New entrants may need to secure costly licenses for patented technologies or drug formulations, adding significant financial burden and reducing profitability.

The threat of new entrants for Hikma Pharmaceuticals is generally considered moderate. The pharmaceutical industry requires immense capital for research, development, and regulatory approvals, creating significant upfront barriers. For instance, the average cost to develop a new drug exceeded $2.6 billion as of recent estimates, a sum that naturally limits the number of potential new players.

Established companies like Hikma benefit from economies of scale, efficient supply chains, and strong brand recognition, making it difficult for newcomers to compete on cost and market access. In 2023, Hikma reported revenues of $2.1 billion, illustrating its substantial operational footprint and market presence.

Furthermore, intellectual property rights, particularly patents, protect innovative drugs and create a substantial hurdle for new entrants. The lengthy regulatory approval processes, often taking several years, also act as a deterrent, with bodies like the FDA scrutinizing new submissions rigorously.

| Barrier to Entry | Description | Impact on New Entrants | Example Data (2023-2024) |

| Capital Requirements | High costs for R&D, clinical trials, and manufacturing. | Significant financial barrier. | Drug development costs ~$2.6 billion. |

| Regulatory Hurdles | Lengthy and complex approval processes (FDA, EMA). | Time-consuming and costly market entry. | FDA approvals for novel drugs show rigorous vetting. |

| Economies of Scale | Lower per-unit costs for established, high-volume producers. | Difficulty competing on price. | Hikma's 2023 revenue of $2.1 billion indicates scale. |

| Intellectual Property | Patents protect drug innovations. | Requires licensing or faces legal challenges. | Effective market exclusivity often < 20 years due to approval delays. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Hikma Pharmaceuticals is built upon a robust foundation of data, drawing from company annual reports, investor presentations, and regulatory filings (e.g., SEC filings). We also incorporate insights from reputable industry analysis firms and market research reports that track the pharmaceutical sector.