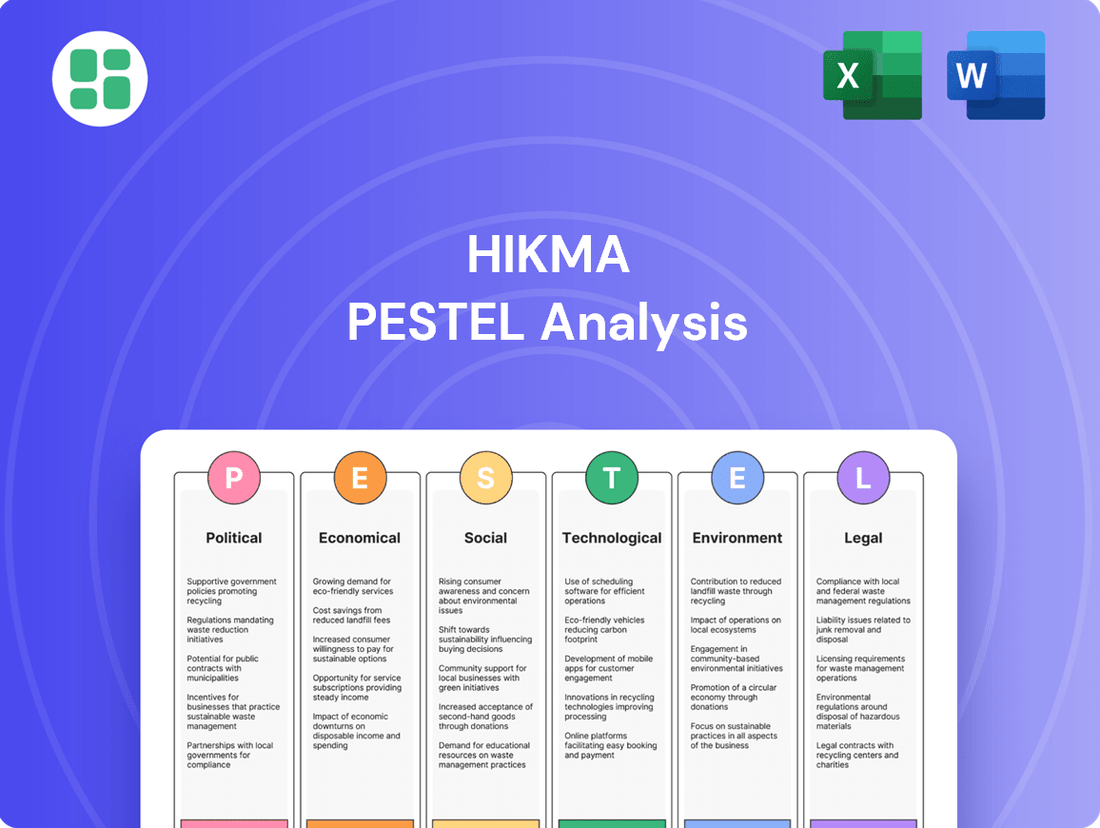

Hikma PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hikma Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Hikma's trajectory. Our expertly crafted PESTLE analysis provides the essential context for understanding the company's strategic landscape. Download the full version now to gain actionable intelligence and make informed decisions.

Political factors

Government healthcare policies are a major force shaping the pharmaceutical landscape. Regulations around drug pricing, how companies get paid back for their products (reimbursement), and how easily drugs can reach patients (market access) all directly impact companies like Hikma.

In the United States, the Inflation Reduction Act (IRA) is a prime example. It's changing how drug prices are negotiated, with the first set of negotiated prices for Medicare Part D drugs set to be implemented in 2026. This will undoubtedly affect Hikma's revenue streams, especially given its substantial operations in the US market.

Hikma's global footprint, spanning the US, Europe, and the MENA region, means it must constantly adapt to diverse policy environments. These varying regulations can significantly influence profitability across its different business segments, including its generics and injectable products.

Hikma's operations span the MENA region, US, and Europe, making it susceptible to geopolitical shifts and evolving trade dynamics. Political instability in key MENA markets, for instance, could disrupt supply chains and impact demand for Hikma's pharmaceutical products. In 2023, global geopolitical tensions, including ongoing conflicts and trade disputes, remained a significant factor influencing international business environments.

Changes in trade agreements, such as potential tariffs or new regulatory barriers, directly affect Hikma's cost of goods and market access. The company proactively monitors the tariff landscape, as noted in its 2023 annual report, and aims to adapt swiftly. This agility is crucial for maintaining competitiveness in a globalized pharmaceutical market.

Hikma leverages its diversified manufacturing base, with facilities across multiple continents, to build resilience against regional disruptions. This strategic footprint allows the company to mitigate risks associated with localized political instability or adverse trade policy changes, ensuring continuity of supply and operations.

Governments globally are tightening their grip on healthcare expenses, implementing tougher rules for drug pricing and how they are paid back. This trend directly impacts pharmaceutical companies like Hikma.

A significant development is the US Medicare drug price negotiation program, which started with 10 drugs in 2023 and could extend to private insurance markets. This creates substantial pricing challenges for drug manufacturers.

Hikma's focus on generic and branded generic drugs makes it especially vulnerable to these pricing pressures. The company must constantly adjust its sales and marketing approaches to navigate this evolving landscape.

Regulatory Environment Stability

The stability and predictability of the regulatory landscape are paramount for pharmaceutical companies like Hikma. Fluctuations in drug approval processes, such as those managed by the FDA in the US and the EMA in Europe, can significantly alter product development timelines and market entry strategies. For instance, in 2024, the FDA continued to refine its accelerated approval pathways, introducing new requirements for confirmatory trials, which could impact the speed of market access for certain innovative therapies.

Hikma's success hinges on its ability to navigate these evolving regulatory frameworks. Changes in post-market surveillance requirements or pricing regulations, which can vary considerably by region, directly affect operational costs and revenue streams. The company's investment in robust regulatory affairs capabilities is therefore essential for ensuring ongoing compliance and facilitating the timely introduction of its diverse product portfolio across its global markets.

Key aspects of the regulatory environment impacting Hikma include:

- Drug Approval Timelines: The efficiency and consistency of regulatory bodies like the FDA and EMA directly influence how quickly Hikma can bring new generics and branded products to market.

- Post-Market Surveillance: Evolving requirements for monitoring drug safety and efficacy after launch necessitate continuous investment in pharmacovigilance systems.

- Pricing and Reimbursement Policies: Government policies on drug pricing and reimbursement, which are subject to political and economic pressures, can significantly impact Hikma's profitability in key markets.

- Intellectual Property Protection: The strength and enforcement of patent laws are critical for protecting Hikma's investments in product development and maintaining market exclusivity.

Government Investment in Healthcare Infrastructure

Government investment in healthcare infrastructure and public health initiatives presents significant opportunities for pharmaceutical companies like Hikma. For instance, in 2024, Saudi Arabia announced plans to invest over SAR 100 billion in its healthcare sector to develop infrastructure and expand services, a move that directly benefits companies supplying essential medicines.

Enhanced healthcare access, especially in emerging markets within the MENA region, fuels demand for a wider range of pharmaceuticals. In 2024, the UAE's healthcare spending was projected to reach $20.5 billion, indicating a growing market for Hikma's products.

Hikma's strategic focus on addressing unmet medical needs aligns perfectly with these government-led initiatives. This alignment is crucial for expanding its patient base and market reach, particularly as governments prioritize accessible and affordable healthcare solutions.

- Increased Demand: Government spending on healthcare infrastructure directly translates to higher demand for pharmaceuticals, especially essential medicines.

- Market Expansion: Enhanced healthcare access in emerging MENA markets, supported by government investment, provides Hikma with avenues for significant market penetration.

- Strategic Alignment: Hikma's commitment to addressing unmet medical needs positions it favorably to benefit from government-backed public health programs and infrastructure development.

Government policies on drug pricing and reimbursement, like the US Inflation Reduction Act's negotiation provisions set for 2026, directly impact Hikma's revenue. Geopolitical shifts and trade dynamics in regions like MENA can disrupt supply chains and demand, as seen with global tensions in 2023.

Changes in trade agreements, including tariffs, affect Hikma's costs and market access; the company actively monitors this, as noted in its 2023 report. Regulatory stability, including drug approval timelines from bodies like the FDA and EMA, is crucial for Hikma's product launches and market strategies.

Government investment in healthcare, such as Saudi Arabia's SAR 100 billion healthcare sector development announced in 2024, fuels demand for pharmaceuticals. For example, projected UAE healthcare spending of $20.5 billion in 2024 highlights growing market opportunities for Hikma.

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting Hikma, examining the Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of Hikma's external environment to streamline strategic discussions.

Economic factors

Global economic growth is projected to be around 2.7% in 2024, with a slight uptick to 2.8% in 2025, according to the IMF's April 2024 World Economic Outlook. However, persistent inflationary pressures, while easing from 2023 peaks, continue to impact consumer purchasing power and operational costs for pharmaceutical companies like Hikma. For instance, elevated energy and logistics costs can directly translate to higher manufacturing expenses.

While the pharmaceutical sector often demonstrates resilience during economic downturns, significant global slowdowns can still affect healthcare budgets and demand for certain treatments. In 2024, inflation rates are expected to average 4.5% globally, a notable decrease from previous years but still a factor that can squeeze margins if not managed effectively through pricing strategies and cost controls.

Global healthcare spending is on an upward trajectory, with projections indicating continued high growth rates through 2025. This surge is fueled by innovative medical technologies and pharmaceuticals, coupled with rising demand for healthcare services. For instance, the global healthcare market was valued at approximately $12.5 trillion in 2023 and is expected to reach over $15 trillion by 2025, reflecting these trends.

While this expanding market presents opportunities for pharmaceutical companies like Hikma, it also places considerable pressure on healthcare systems and insurers to manage expenses. The increasing cost of new treatments and therapies necessitates a focus on cost-effectiveness and value-based care models.

Hikma's strategic emphasis on providing affordable medicines is a key advantage in this environment. By offering cost-effective alternatives, the company is well-positioned to capture market share while simultaneously addressing the cost-containment measures implemented by payers worldwide.

As a global pharmaceutical company with significant operations in the US, Europe, and the MENA region, Hikma Pharmaceuticals is inherently exposed to currency exchange rate fluctuations. For instance, a strengthening US dollar against the Euro could reduce the reported value of Hikma's European sales when translated back into dollars, impacting its consolidated financial results.

These currency movements directly affect Hikma's top-line revenue and bottom-line profitability. A significant depreciation of currencies in its key operating markets against the company's reporting currency (GBP) would negatively impact reported earnings. Conversely, favorable movements could boost reported figures.

Managing this foreign exchange exposure is a constant strategic imperative for Hikma. For example, hedging strategies or natural hedging through matching revenues and costs in the same currency are employed to mitigate the financial impact of volatile exchange rates, ensuring greater predictability in its financial performance.

Disposable Income and Affordability of Medicines

Disposable income is a critical factor affecting medicine affordability. In key markets, including the MENA region, patients' capacity to pay for prescribed drugs is directly tied to their available funds after essential expenses. For instance, in 2024, several MENA countries experienced inflation rates that impacted consumer spending power, making essential goods, including healthcare, a greater concern for households.

Economic downturns and persistent inflation can significantly shrink purchasing power. This economic pressure often leads consumers to seek out more cost-effective alternatives. Consequently, demand may pivot towards generic medications, which are typically priced lower than branded equivalents.

Hikma Pharmaceuticals is well-positioned to address this market trend. The company's robust portfolio of generic medicines, coupled with its stated commitment to providing affordable healthcare solutions, allows it to effectively serve patient populations facing economic constraints. This strategic alignment with affordability needs is a key differentiator.

- MENA Inflation Impact: Reports from 2024 indicated that inflation in key MENA markets put pressure on household budgets, affecting discretionary spending on items like non-essential medications.

- Generic Demand Growth: Global trends show a consistent rise in the market share of generic drugs, driven by both patient cost-consciousness and healthcare system initiatives to control spending.

- Hikma's Generics Strength: Hikma's extensive range of generic products, covering various therapeutic areas, directly caters to the growing demand for affordable treatment options.

Interest Rate Environment and Capital Access

Changes in the interest rate environment directly impact Hikma's cost of capital. For instance, if central banks like the US Federal Reserve or the Bank of England raise benchmark rates, Hikma's expenses for borrowing money for crucial activities such as research and development, strategic acquisitions, or expanding its manufacturing facilities will likely increase. This can put pressure on profitability and potentially make growth initiatives more challenging to finance.

A sustained period of higher interest rates, as seen with continued rate hikes in 2023 and potential stabilization or further adjustments in 2024 and 2025, could make accessing capital more expensive and perhaps more restricted. This is a critical consideration for a pharmaceutical company like Hikma, which often requires significant investment to bring new products to market and maintain its competitive edge.

However, Hikma's financial strength offers a degree of insulation. The company's robust balance sheet and strong credit ratings, which are typically reviewed by agencies like Moody's or S&P, provide a buffer against adverse interest rate movements. This financial resilience means Hikma is better positioned to manage increased borrowing costs compared to companies with weaker financial profiles, allowing for continued access to necessary funding even in a tighter credit market.

- Increased Borrowing Costs: Higher interest rates in 2024-2025 directly increase the cost of debt financing for Hikma's R&D, acquisitions, and expansion projects.

- Capital Access Constraints: A challenging interest rate environment can limit the availability and increase the cost of capital for growth initiatives.

- Balance Sheet Resilience: Hikma's strong financial position and credit ratings (e.g., investment-grade ratings from major agencies) help mitigate the impact of fluctuating interest rates.

- Strategic Investment Funding: Despite potential headwinds, Hikma's financial stability supports its ability to fund ongoing and future strategic investments.

Global economic growth is projected to be around 2.7% in 2024, with a slight uptick to 2.8% in 2025, according to the IMF's April 2024 World Economic Outlook. Persistent inflation, though easing, continues to impact consumer purchasing power and Hikma's operational costs, with global inflation expected to average 4.5% in 2024. The pharmaceutical sector, while resilient, faces potential demand shifts during economic slowdowns, making Hikma's focus on affordable medicines a strategic advantage.

Hikma's profitability is sensitive to currency fluctuations, as seen with a strengthening US dollar potentially reducing the value of its European sales when reported in GBP. For instance, a 5% adverse movement in key exchange rates could impact reported earnings. The company employs hedging strategies to mitigate these risks, aiming for greater financial predictability.

Disposable income directly influences medicine affordability, especially in regions like MENA where inflation in 2024 affected household budgets. This economic pressure often drives demand towards generic medications. Hikma's strong portfolio of generics positions it to effectively cater to this growing need for cost-effective treatments.

Rising interest rates in 2024-2025 increase Hikma's cost of capital for R&D and expansion, potentially impacting profitability. However, the company's strong balance sheet and investment-grade credit ratings provide resilience against these borrowing cost increases, ensuring continued access to capital for strategic investments.

| Economic Factor | 2024 Projection/Data | Impact on Hikma | Mitigation/Opportunity |

|---|---|---|---|

| Global GDP Growth | 2.7% (IMF April 2024) | Influences overall market demand and healthcare spending. | Resilience in essential medicines; focus on emerging markets. |

| Global Inflation Rate | 4.5% average (IMF April 2024) | Increases operational costs (energy, logistics) and impacts consumer purchasing power. | Cost control measures; strategic pricing; strong generic portfolio. |

| Interest Rates | Varies by region; potential for continued adjustments in 2024-2025. | Increases cost of borrowing for R&D, acquisitions, and expansion. | Strong balance sheet and credit ratings provide access to capital. |

| Currency Exchange Rates | Volatile; e.g., USD strength vs. EUR impacts reported European sales. | Affects reported revenue and profitability due to international operations. | Hedging strategies and natural hedging to manage exposure. |

| Disposable Income | Pressured by inflation in key markets (e.g., MENA in 2024). | Reduces affordability of non-essential or higher-cost medications. | Strong demand for Hikma's affordable generic product range. |

Preview Before You Purchase

Hikma PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Hikma PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain actionable insights into the strategic landscape for Hikma Pharmaceuticals.

Sociological factors

Developed nations, including the United States and Europe, are experiencing a significant increase in their aging populations. This demographic trend directly translates to a higher incidence of chronic diseases, which in turn fuels a robust demand for pharmaceutical products. Hikma's strategic positioning with a broad and diversified product portfolio across numerous therapeutic areas enables it to effectively address the escalating healthcare requirements of this expanding older demographic.

The aging population phenomenon is a consistent driver for the pharmaceutical industry, ensuring sustained demand for both branded and generic medications. For instance, in 2024, it's projected that over 20% of the US population will be aged 65 and older, a demographic segment that typically requires ongoing medical treatment for conditions such as cardiovascular disease and diabetes, key areas for Hikma.

Growing global health consciousness and the increasing prevalence of lifestyle diseases like diabetes and heart conditions are significantly boosting the pharmaceutical market. This trend directly benefits companies like Hikma, whose strategic focus on chronic disease medications, including those for oncology and cardiovascular health, positions them well to meet this rising demand.

For instance, the World Health Organization reported in 2024 that non-communicable diseases, largely lifestyle-related, accounted for an estimated 74% of all deaths globally. Hikma's portfolio, with a strong emphasis on generics and branded products for managing these very conditions, is therefore well-aligned with these critical public health challenges, driving consistent sales growth.

Societal expectations are increasingly pushing for wider and more equitable access to essential medicines. This trend is amplified by government initiatives worldwide, all aiming to ensure that quality healthcare, including access to necessary medications, is within reach for more people, especially in developing markets. For instance, by the end of 2024, global health organizations reported significant progress in expanding access to essential medicines in low- and middle-income countries, though disparities persist.

Hikma Pharmaceuticals, with its stated mission to make its essential medicines available to patients worldwide, particularly in emerging markets, is well-positioned to benefit from these evolving societal demands. The company's focus on providing affordable, high-quality generic and branded generic products directly addresses the growing need for accessible treatments. This alignment can bolster Hikma's brand reputation and facilitate deeper market penetration as it continues to serve populations with unmet medical needs.

Cultural Acceptance of Generic Medicines

Cultural acceptance of generic medicines significantly impacts Hikma Pharmaceuticals' market penetration. In regions with high trust in generics, such as the United States and Europe, Hikma's generics business benefits from established market share and strong demand. For instance, in 2023, the US FDA reported that generics accounted for approximately 90% of all prescriptions dispensed, highlighting a deeply ingrained acceptance.

Conversely, in some emerging markets, there can be a lingering perception that generics are inferior in quality or efficacy compared to branded drugs. This cultural hesitancy can slow the adoption of Hikma's generic offerings. However, ongoing public health initiatives and educational campaigns are actively working to bridge this gap. For example, the Indian government's Jan Aushadhi scheme, aimed at promoting affordable generic medicines, has seen substantial growth, with over 10,000 Jan Aushadhi Kendras operational by early 2024, demonstrating a positive shift in consumer perception.

Hikma's strategy often involves tailoring its market approach based on these cultural nuances. By partnering with local healthcare providers and participating in awareness programs, the company aims to build confidence in its generic products. The success of these efforts is reflected in the growing market share of generics globally, which is projected to reach $430 billion by 2027, up from approximately $320 billion in 2022, indicating a favorable trend for companies like Hikma.

Key factors influencing cultural acceptance include:

- Perceived Efficacy: Belief that generics are as effective as originator brands.

- Affordability: Recognition of generics as a cost-saving alternative.

- Regulatory Trust: Confidence in the regulatory bodies that approve generic drugs.

- Healthcare Professional Endorsement: Recommendations from doctors and pharmacists.

Healthcare Professional and Patient Preferences

Healthcare professionals' preferences for specific brands and formulations significantly shape prescribing patterns. Hikma's commitment to quality and reliability, evidenced by its robust product portfolio, directly addresses these professional preferences. For instance, the company's focus on generics and biosimilars offers cost-effective alternatives that are increasingly favored in many markets.

Patient adherence to treatment regimens is another crucial sociological element. Hikma's development of user-friendly delivery systems, such as pre-filled syringes for certain injectable medications, aims to improve patient compliance and convenience. This focus on patient experience can lead to greater trust and loyalty towards Hikma's offerings.

In 2024, the global pharmaceutical market continued to see a strong demand for accessible and effective treatments. Hikma's strategy to provide high-quality, affordable medicines, particularly in emerging markets, aligns with growing patient expectations for value. The company's investment in developing a diverse range of therapeutic areas, from cardiovascular to central nervous system disorders, further caters to a broad spectrum of patient needs and healthcare provider choices.

- Brand Loyalty Drivers: Healthcare professionals often favor brands with a proven track record of efficacy and consistent quality, which Hikma strives to deliver across its product lines.

- Patient Adherence Initiatives: Innovative drug delivery systems, like those Hikma develops, can reduce administration errors and improve patient comfort, fostering better adherence.

- Market Access and Affordability: Societal pressure for more affordable healthcare solutions makes Hikma's generic and biosimilar offerings particularly appealing to both prescribers and patients.

Societal shifts towards preventative healthcare and wellness are increasingly influencing pharmaceutical demand, with consumers actively seeking solutions for both treatment and proactive health management. Hikma's broad product portfolio, encompassing treatments for chronic conditions, directly addresses this growing awareness, positioning the company to capitalize on this trend.

The emphasis on patient-centric care is reshaping how pharmaceutical companies engage with consumers and healthcare providers. Hikma's focus on improving drug delivery systems and ensuring medication affordability aligns with these patient-centric expectations, fostering loyalty and positive brand perception.

The global push for greater healthcare access, particularly in emerging economies, presents a significant opportunity for Hikma. By providing affordable, high-quality generic and branded generic medicines, the company is well-aligned with these societal goals, potentially driving market share growth.

Cultural attitudes towards generics continue to evolve, with increasing acceptance driven by regulatory confidence and proven efficacy. Hikma's strong presence in markets with high generic penetration, such as the US and Europe, benefits from this trend, which is projected to see continued expansion globally.

Technological factors

Technological factors are rapidly reshaping the pharmaceutical landscape. Breakthroughs in biotechnology, genomics, and computational drug discovery, notably the integration of Artificial Intelligence (AI), are revolutionizing research and development. By 2025, AI is expected to spearhead a substantial portion of new drug discoveries, significantly shortening development cycles and lowering associated expenses.

Hikma Pharmaceuticals is actively investing in its R&D capabilities and forging strategic alliances to capitalize on these technological advancements. This focus is vital for enhancing its product pipeline and introducing novel treatments to the market. For instance, in 2023, Hikma reported a 10% increase in R&D spending, reflecting a commitment to innovation in a fast-evolving scientific environment.

Hikma Pharmaceuticals is actively integrating advanced manufacturing technologies, including automation and continuous manufacturing. This strategic move aims to boost operational efficiency, lower production costs, and elevate product quality standards across its global facilities. For instance, their investment in automated filling and packaging lines in 2024 is projected to increase throughput by 15% while reducing manual error rates.

These technological advancements are also pivotal for strengthening Hikma's supply chain resilience. By enabling more flexible production schedules and quicker adaptation to shifting market demands, Hikma can ensure a more consistent supply of its essential medicines. The company's focus on local manufacturing enhancements, coupled with stringent quality control, directly leverages these technologies to meet patient needs reliably.

The healthcare landscape is rapidly evolving with the increasing adoption of digital health and telemedicine. By the end of 2024, it's estimated that over 80% of healthcare providers will be offering some form of virtual care, a significant jump from pre-pandemic levels.

This shift presents Hikma with opportunities to enhance patient monitoring and medication adherence through integrated digital platforms. For instance, wearable devices and remote patient monitoring systems, which saw a 25% market growth in 2023, can provide valuable data for chronic disease management, a key area for Hikma's therapeutic focus.

Furthermore, telemedicine opens new avenues for pharmaceutical companies to engage with healthcare professionals and patients, offering direct support and information. Hikma can leverage these digital channels to complement its existing product portfolio, potentially improving patient outcomes and expanding its market reach.

Data Analytics and AI in Operations

Hikma's operations are increasingly benefiting from big data analytics and artificial intelligence, extending beyond research and development. These advanced tools are crucial for optimizing supply chains, improving demand forecasting accuracy, and enabling personalized medicine approaches. For instance, AI-driven predictive analytics can help Hikma anticipate market shifts and manage inventory more effectively, potentially reducing waste and improving delivery times. This strategic adoption of technology directly enhances operational efficiency and strengthens risk management capabilities.

The integration of AI and data analytics provides Hikma with a significant competitive edge by informing more robust strategic decisions. By leveraging these capabilities, the company can gain deeper insights into market trends, customer behavior, and operational bottlenecks. This data-driven approach allows for more agile responses to market dynamics and a proactive stance on potential challenges. Investing in these technological advancements is therefore paramount for maintaining and growing Hikma's market position.

Specific applications of these technologies for Hikma include:

- Supply Chain Optimization: AI algorithms can analyze vast datasets to identify the most efficient routes, manage warehouse logistics, and predict potential disruptions, ensuring timely delivery of pharmaceuticals.

- Demand Forecasting: Advanced analytics improve the accuracy of predicting product demand, allowing Hikma to better manage production schedules and inventory levels, thereby minimizing stockouts and overstocking.

- Personalized Medicine: While R&D focused, data analytics also supports the operational aspects of delivering personalized treatments by managing patient data and treatment protocols efficiently.

- Risk Management: Predictive modeling can identify operational risks, such as quality control issues or regulatory compliance challenges, enabling proactive mitigation strategies.

Intellectual Property and Patent Expirations

Technological advancements in drug discovery and development are intrinsically linked to intellectual property (IP) rights, particularly patents. These patents grant exclusivity for a period, incentivizing innovation by allowing companies to recoup R&D investments. For Hikma, a key player in the generic and branded generics market, the expiration of these patents is a critical driver of opportunity.

When a blockbuster drug's patent expires, it opens the door for generic manufacturers to produce and market bioequivalent versions. This significantly increases market competition, leading to lower prices for consumers and healthcare systems. For instance, the period around 2024 and 2025 has seen, and will continue to see, the expiration of patents for several high-value medications, creating a fertile ground for generic entry.

However, the landscape is evolving. The development of new chemical entities (NCEs) and biologics, which are complex biological products, presents significant hurdles for generic development. These complexities can lead to extended patent litigation and challenges in demonstrating bioequivalence, requiring substantial technological expertise and investment from companies like Hikma.

Key considerations for Hikma regarding IP and patent expirations include:

- Patent Cliff Opportunities: Monitoring and strategically targeting drugs with upcoming patent expiries to launch affordable generic alternatives.

- Biologics and Biosimilars: Investing in the advanced technological capabilities required to develop and manufacture biosimilars, a growing segment of the pharmaceutical market.

- IP Litigation and Defense: Navigating the complexities of patent law and potential litigation, which can impact market entry timelines and profitability.

Technological advancements are fundamentally altering pharmaceutical R&D, with AI projected to drive a significant portion of new drug discoveries by 2025, shortening development timelines. Hikma's increased R&D spending, up 10% in 2023, reflects its commitment to leveraging these innovations.

Hikma is also adopting advanced manufacturing technologies like automation, with investments in automated filling lines in 2024 expected to boost throughput by 15% and reduce errors. Digital health and telemedicine are also growing, with over 80% of healthcare providers expected to offer virtual care by the end of 2024, presenting opportunities for Hikma in patient monitoring.

The company is utilizing big data analytics and AI to optimize its supply chain, improve demand forecasting, and enable personalized medicine. These technologies are crucial for enhancing operational efficiency and risk management, giving Hikma a competitive edge in strategic decision-making.

The expiration of drug patents, particularly around 2024-2025, creates significant opportunities for generic manufacturers like Hikma to launch bioequivalent versions, increasing market competition and lowering prices.

Legal factors

The pharmaceutical sector operates under stringent regulatory oversight, demanding strict adherence to Good Manufacturing Practices (GMP) and Good Distribution Practices (GDP). These quality standards are enforced by agencies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA). Failure to comply can result in severe consequences, including warning letters, product recalls, and substantial financial penalties, impacting a company's reputation and market access.

Hikma Pharmaceuticals, like all players in this arena, places immense importance on quality and regulatory compliance. This focus is essential for maintaining its global operational integrity and market standing. For instance, in 2023, Hikma reported that its manufacturing sites underwent numerous inspections by regulatory authorities, with a high pass rate, underscoring its dedication to these critical standards.

Intellectual property laws, particularly patents and data exclusivity, are cornerstones of the pharmaceutical industry, directly impacting Hikma's ability to introduce affordable generic and branded generic medications. The company actively manages a complex web of patent challenges and litigation, a critical process for bringing cost-effective treatments to patients.

Hikma's strategy involves meticulously tracking patent expiry dates for originator drugs. This allows for timely preparation and submission of abbreviated new drug applications (ANDAs) or equivalent filings, aiming to be among the first to market with a generic version, thereby capitalizing on the period immediately following patent expiration.

In 2023, Hikma reported that its Generics segment revenue was approximately $1.6 billion, highlighting the significant contribution of its generic product portfolio, which is heavily influenced by its success in navigating patent landscapes and launching products efficiently post-patent expiry.

Legislation focused on drug price control, like the US Inflation Reduction Act (IRA) enacted in 2022, directly influences pharmaceutical revenue. The IRA's provisions for Medicare drug price negotiation and inflation rebates, which began impacting some drugs in 2023 and will expand, place pressure on companies like Hikma, particularly within its generics business.

These policies, designed to curb healthcare spending, introduce complex compliance requirements and could alter market dynamics for established and new pharmaceutical products. Hikma's financial performance, especially in the US market where a significant portion of its generics revenue is generated, is susceptible to these evolving pricing regulations.

Antitrust and Competition Laws

Antitrust and competition laws are crucial in the pharmaceutical sector, aiming to prevent monopolies and foster a level playing field for all players. These regulations directly impact how companies like Hikma can grow through mergers and acquisitions, enter new markets, and set prices for their products. For instance, in 2024, the European Commission continued its scrutiny of pharmaceutical mergers, emphasizing the need for robust competition assessments to protect patient access and affordability.

Hikma's strategic decisions regarding acquisitions and partnerships are therefore heavily influenced by these legal frameworks. Ensuring compliance with antitrust regulations is paramount to avoid penalties and maintain fair market conduct. The company's ability to expand its portfolio or geographic reach often hinges on demonstrating that such moves will not unduly stifle competition. For example, in 2025, regulatory bodies globally are expected to maintain a close watch on consolidation trends within the generics and biosimil markets, requiring detailed justifications for any significant M&A activity.

Key considerations for Hikma under these laws include:

- Merger Control: Ensuring that any proposed acquisitions or joint ventures are reviewed and approved by competition authorities, demonstrating no adverse impact on market competition.

- Abuse of Dominance: Avoiding practices that could be construed as exploiting a dominant market position, such as excessive pricing or exclusionary conduct.

- Pricing Regulations: Navigating the complex landscape of pharmaceutical pricing, which can be influenced by competition law and government oversight in various markets.

Product Liability and Consumer Protection Laws

Product liability and consumer protection laws are critical for pharmaceutical companies like Hikma. These regulations ensure that medicines are safe, effective, and that consumers are well-informed about their use. Failure to comply can lead to substantial legal penalties and reputational damage. In 2023, the global pharmaceutical market saw significant regulatory scrutiny, with numerous product recalls and fines issued for non-compliance with quality standards, highlighting the high stakes involved.

Hikma's commitment to rigorous quality control and patient safety is therefore paramount. This focus directly addresses the stringent requirements of product liability and consumer protection legislation. By maintaining high standards in manufacturing and information dissemination, Hikma aims to minimize the risks associated with these legal frameworks.

- Product Liability: Pharmaceutical firms face substantial legal exposure if their products cause harm due to defects in design, manufacturing, or marketing.

- Consumer Protection: Laws mandate transparency, fair practices, and the provision of accurate information to patients regarding medication efficacy and side effects.

- Hikma's Mitigation Strategy: The company's investment in quality assurance and patient safety programs is designed to align with and exceed regulatory expectations, thereby reducing legal liabilities.

- Market Context: Regulatory bodies worldwide, including the FDA and EMA, actively enforce these laws, with significant financial penalties for violations, underscoring the importance of compliance for companies like Hikma.

Legal and regulatory frameworks significantly shape Hikma's operations, from product approval to pricing. Stringent adherence to Good Manufacturing Practices (GMP) and Good Distribution Practices (GDP) is mandated by bodies like the FDA and EMA, with non-compliance leading to severe penalties. Hikma's robust quality control systems, evidenced by high inspection pass rates in 2023, are crucial for maintaining market access and reputation.

Intellectual property laws, especially patents, are vital for Hikma's generics business. The company strategically navigates patent expiries to launch affordable alternatives, a strategy that contributed to approximately $1.6 billion in Generics segment revenue in 2023. Legislation like the US Inflation Reduction Act (IRA), with its drug price negotiation provisions, directly impacts Hikma's revenue potential, particularly in the US market.

Antitrust and competition laws influence Hikma's growth strategies, including mergers and acquisitions, requiring careful assessment to ensure fair market practices. Product liability and consumer protection laws necessitate a strong focus on patient safety and transparent information dissemination. Hikma's investments in quality assurance are designed to mitigate legal risks and comply with global regulatory expectations, as highlighted by ongoing scrutiny of pharmaceutical mergers in 2024 and 2025.

Environmental factors

The pharmaceutical sector, including companies like Hikma, faces growing scrutiny over its environmental footprint. The industry's contribution to carbon emissions is significant, prompting a stronger push for decarbonization strategies. This environmental pressure is a key factor influencing operational and strategic decisions across the sector.

Hikma Pharmaceuticals has proactively addressed these concerns by setting ambitious climate targets. Specifically, the company aims for a 25% reduction in Scope 1 and 2 emissions by 2030, using 2020 as its baseline. Furthermore, linking these emission reduction goals to senior executive bonuses underscores the seriousness of this commitment and aligns financial incentives with environmental performance, reflecting a broader industry trend towards sustainability.

Water scarcity poses a significant environmental challenge, especially for industries like pharmaceuticals that often require substantial water resources. Hikma is actively addressing this by intensifying its focus on responsible water usage, particularly in regions facing water stress, such as the Middle East and North Africa (MENA).

The company is implementing specific strategies to reduce its water footprint and manage associated risks. This involves improving water monitoring systems to better understand consumption patterns and pinpoint areas for increased efficiency.

Pharmaceutical manufacturing, by its nature, produces diverse waste streams, including hazardous materials. This necessitates stringent waste management protocols and effective pollution control systems. Companies like Hikma are under increasing pressure to adopt greener manufacturing processes, such as substituting harmful solvents with environmentally friendly alternatives and utilizing closed-loop production systems to minimize waste generation.

Hikma's commitment to environmental stewardship is evident in its ongoing initiatives to enhance waste data collection and actively reduce its overall environmental footprint. For instance, in 2023, Hikma reported a reduction in hazardous waste generation per unit of production, a testament to their implemented pollution control measures and process optimizations.

Sustainable Supply Chain Practices

The pharmaceutical industry faces increasing scrutiny regarding its environmental impact, pushing companies like Hikma to adopt sustainable supply chain practices. This means looking at everything from how raw materials are obtained to how finished products reach patients, with a focus on reducing environmental harm. For instance, in 2024, many pharmaceutical firms are prioritizing partnerships with suppliers who demonstrate strong environmental credentials, aiming to cut down on carbon emissions throughout their operations.

Hikma is actively working to improve its supply chain's sustainability by collaborating with its suppliers. A key objective is to reduce its Scope 3 greenhouse gas emissions, which are indirect emissions occurring in the value chain. This initiative is crucial for building a more resilient supply chain, better equipped to withstand environmental challenges such as extreme weather events that can disrupt logistics and production.

Key areas of focus for Hikma and the broader industry in 2024-2025 include:

- Supplier Engagement: Actively working with suppliers to adopt greener manufacturing processes and reduce waste.

- Logistics Optimization: Implementing low-emission transportation methods, such as electric vehicles for last-mile delivery and optimizing shipping routes to minimize fuel consumption.

- Traceability and Transparency: Enhancing the ability to track materials and products throughout the supply chain to identify and address environmental risks and improve accountability.

- Circular Economy Principles: Exploring opportunities for recycling and reusing materials within the supply chain to reduce reliance on virgin resources.

Environmental Regulations and ESG Reporting

The pharmaceutical industry faces increasingly stringent environmental regulations and mandatory ESG reporting, influencing operational strategies. For instance, the EU's Corporate Sustainability Reporting Directive (CSRD) necessitates detailed disclosures on environmental impacts, affecting companies like Hikma. This directive, which came into full effect for large listed companies in 2024, requires comprehensive reporting on a wide range of sustainability matters.

Hikma's proactive approach is evident in its 2024 Sustainability Report, which details its efforts to align with evolving global reporting standards. This commitment underscores the growing importance of transparency and accountability in environmental stewardship within the sector. The company's focus on reducing greenhouse gas emissions, for example, is a key component of its ESG strategy.

- CSRD Mandates: The Corporate Sustainability Reporting Directive (CSRD) requires extensive environmental impact reporting from 2024 onwards for many European companies.

- Hikma's 2024 Report: Hikma's latest sustainability report showcases its adherence to these growing ESG reporting demands.

- Focus on Emissions: Pharmaceutical companies are increasingly prioritizing the reduction of their carbon footprint and operational waste.

Environmental factors are increasingly shaping the pharmaceutical landscape, pushing companies like Hikma to prioritize sustainability. Growing concerns over carbon emissions are driving decarbonization efforts, with Hikma targeting a 25% reduction in Scope 1 and 2 emissions by 2030 against a 2020 baseline. Water scarcity is another critical issue, prompting Hikma to enhance water monitoring and efficiency, particularly in water-stressed regions.

Waste management and the adoption of greener manufacturing processes are paramount, with Hikma reporting a reduction in hazardous waste generation per unit of production in 2023. The company is also focused on supply chain sustainability, aiming to reduce Scope 3 emissions by engaging with suppliers on environmental practices and optimizing logistics for lower emissions. Enhanced traceability and the adoption of circular economy principles are also key focus areas for 2024-2025.

Stricter environmental regulations, such as the EU's CSRD, are mandating comprehensive ESG reporting from 2024, requiring companies like Hikma to disclose detailed environmental impacts. Hikma's 2024 Sustainability Report demonstrates its commitment to these evolving standards, highlighting its focus on emission reduction and overall environmental stewardship.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Hikma is built on a robust foundation of data, drawing from official reports by international organizations like the WHO and IMF, as well as regulatory updates from key markets and reputable pharmaceutical industry publications. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting Hikma's operations.