Hikma Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hikma Bundle

Uncover the strategic genius behind Hikma's success with our comprehensive Business Model Canvas. This in-depth analysis breaks down how Hikma effectively serves its diverse customer segments and leverages key partnerships to deliver essential medicines. Discover their unique value propositions and revenue streams.

Ready to gain a competitive edge by understanding Hikma's operational backbone? Download the full Business Model Canvas to explore their core activities, cost structures, and channels, providing actionable insights for your own strategic planning.

Elevate your business acumen by learning from Hikma's proven model. Our professionally crafted Business Model Canvas offers a clear, detailed roadmap of their entire strategy, empowering you to adapt and innovate. Get the full version today!

Partnerships

Hikma actively pursues in-licensing and collaboration agreements to broaden its product offerings, especially in branded and intricate generic pharmaceuticals. These strategic alliances enable Hikma to introduce novel treatments to its key markets swiftly, bypassing the need for substantial in-house research and development, thereby diversifying its product pipeline and accelerating market penetration.

A prime illustration of this strategy is Hikma's acquisition of rights to 17 Takeda brands in the Middle East and North Africa (MENA) region, a move that significantly bolstered the profitability of its branded segment. Furthermore, the company secured an exclusive licensing deal with pharmaand GmbH for an oncology drug targeting the MENA market, underscoring its commitment to expanding its therapeutic reach through external partnerships.

Hikma Pharmaceuticals actively engages with Contract Manufacturing Organizations (CMOs) as key partners, extending its own manufacturing expertise to other pharmaceutical firms. This strategic approach allows Hikma to optimize the use of its significant production capacity, including facilities like its Columbus, Ohio plant.

By offering contract manufacturing services, Hikma generates an additional revenue stream, enhancing its overall financial performance. The company actively seeks out and pursues these CMO opportunities, identifying them as valuable collaborations that benefit both Hikma and its strategic partners in the global pharmaceutical landscape.

Hikma cultivates vital partnerships with hospitals, clinics, and other healthcare institutions to ensure its injectable and branded medicines reach patients effectively. These collaborations are foundational for the widespread distribution and acceptance of Hikma's product portfolio.

The Injectables division, a cornerstone of Hikma's strategy, directly supplies generic injectable and specialized medicines to hospitals throughout key markets including North America, Europe, and the MENA region. This direct engagement with healthcare providers facilitates access to essential treatments.

For example, in 2023, Hikma's Injectables segment continued to be a significant contributor, with strong performance driven by its established relationships with hospital networks. This segment’s ability to consistently supply critical care medicines underscores the importance of these institutional partnerships.

Raw Material and API Suppliers

Hikma's manufacturing relies heavily on dependable sources for its raw materials and active pharmaceutical ingredients (APIs). These partnerships are the bedrock of their ability to produce a wide range of medicines consistently and affordably.

Strategic alliances with these suppliers are crucial for maintaining the high quality Hikma is known for, while also ensuring cost efficiency and a stable supply chain. This focus on supplier relationships is key to preventing disruptions that could impact production schedules and product availability.

- Supplier Reliability: Hikma prioritizes suppliers who can guarantee consistent quality and timely delivery of essential pharmaceutical components.

- Cost Management: Negotiating favorable terms with raw material and API suppliers directly impacts Hikma's overall cost of goods sold and profitability.

- Supply Chain Resilience: Diversifying and strengthening relationships with key suppliers enhances Hikma's ability to navigate global supply chain challenges, as seen in the pharmaceutical industry's ongoing efforts to secure critical ingredients.

Research and Development Collaborations

Hikma actively pursues research and development collaborations to bolster its unique product pipeline and accelerate the launch of more intricate therapies. These partnerships are crucial for developing biosimilars and other advanced treatments, effectively augmenting Hikma's in-house R&D capabilities and fostering sustainable, long-term expansion.

The company is strategically increasing its R&D expenditure, which stood at $240 million in 2023, to fuel its expanding global pipeline. This investment underscores Hikma's commitment to innovation and its focus on bringing complex, high-value products to market.

- Biosimilar Development Partnerships: Collaborations focused on creating biosimilar versions of existing biologic drugs, aiming to offer more affordable alternatives.

- Innovative Therapy Co-Development: Joint ventures with academic institutions or biotech firms to advance novel drug candidates through clinical trials.

- Technology Access Agreements: Partnerships that grant Hikma access to cutting-edge R&D technologies and platforms, enhancing its development capacity.

- Increased R&D Investment: A commitment to growing R&D spending, with a stated aim to support the development of a robust global product portfolio.

Hikma's key partnerships are diverse, spanning in-licensing agreements for new drugs, collaborations with Contract Manufacturing Organizations (CMOs), and essential relationships with healthcare institutions for product distribution. These alliances are fundamental to expanding its product portfolio, optimizing manufacturing, and ensuring patient access to its medicines.

The company actively partners with suppliers for raw materials and Active Pharmaceutical Ingredients (APIs), ensuring consistent quality and cost-effectiveness. Furthermore, Hikma invests in R&D collaborations to develop complex therapies and biosimilars, augmenting its internal capabilities and driving innovation.

| Partnership Type | Key Activities | Strategic Benefit |

|---|---|---|

| In-licensing & Collaboration Agreements | Acquiring rights to new drugs, co-development of therapies | Broadens product pipeline, accelerates market entry, diversifies revenue |

| Contract Manufacturing Organizations (CMOs) | Utilizing excess manufacturing capacity, offering manufacturing services | Generates additional revenue, optimizes asset utilization |

| Healthcare Institutions (Hospitals, Clinics) | Direct supply of injectables and branded medicines | Ensures patient access, strengthens market presence, drives sales in key segments |

| Suppliers (Raw Materials, APIs) | Ensuring consistent quality and timely delivery of essential components | Maintains product quality, manages costs, ensures supply chain resilience |

| R&D Collaborations | Developing biosimilars, co-developing innovative therapies | Augments in-house R&D, accelerates launch of complex treatments, fosters long-term growth |

What is included in the product

A detailed breakdown of Hikma's pharmaceutical business, outlining its focus on generic and branded generics, key customer segments like healthcare providers and patients, and its global manufacturing and distribution channels.

Provides a clear, actionable framework for identifying and addressing market gaps.

Helps to pinpoint and overcome operational inefficiencies by visualizing key business activities.

Activities

Hikma's Research and Development (R&D) is the engine driving its future growth, focusing on creating a unique product pipeline. This includes complex generics, biosimilars, and innovative branded products designed to meet critical medical needs.

The company is significantly boosting its R&D investment, with substantial plans for 2025, underscoring its commitment to innovation. This strategic investment aims to broaden Hikma's product range and improve its existing offerings across all its business segments.

Hikma's manufacturing and production activities are central to its mission, involving a global network of facilities that produce a diverse portfolio of pharmaceutical products. These operations span its Injectables, Generics, and Branded segments, ensuring a steady supply of quality, affordable medicines across its operating regions.

A significant strategic move is Hikma's commitment to bolstering its US manufacturing presence. The company plans a substantial $1 billion investment by 2030, aimed at significantly enhancing its domestic production capabilities and further securing its supply chain within the United States.

Navigating the intricate web of global regulatory requirements is a cornerstone of Hikma's operations. This involves meticulously preparing dossiers, conducting rigorous clinical trials, and upholding stringent quality standards to secure product approvals and ensure patient safety and efficacy.

Hikma demonstrated significant progress in regulatory affairs during 2024, achieving a robust pipeline of new product submissions and securing numerous approvals. This strategic advancement is crucial for bolstering the company's future growth trajectory and expanding its market reach.

Sales and Marketing

Hikma Pharmaceuticals actively drives sales and marketing for its diverse product range, encompassing generics, branded generics, and in-licensed medicines. Their strategy targets healthcare professionals, pharmacies, and various healthcare institutions, ensuring broad market penetration and product adoption.

The company utilizes a multi-faceted approach, including dedicated sales teams, targeted promotional campaigns, and sophisticated market access strategies. These efforts are crucial for maximizing the reach and impact of their pharmaceutical offerings.

- Sales Force: Hikma maintains a significant direct sales force, a key driver for product promotion and customer engagement in 2024.

- Promotional Campaigns: The company invests in varied promotional activities, including digital marketing and medical education, to enhance brand awareness and product understanding.

- Market Access: Hikma focuses on securing favorable reimbursement and formulary placement, critical for patient access and commercial success.

- Product Portfolio Maximization: Leveraging strong commercial platforms, Hikma aims to optimize the performance and market share of its entire product pipeline.

Supply Chain and Distribution

Hikma's supply chain and distribution are critical for getting its medicines to patients efficiently. This involves managing a complex global network, from sourcing raw materials to delivering finished products. In 2024, Hikma continued to invest in optimizing its logistics and inventory management systems to ensure a consistent supply across its key markets, including the MENA region, the US, and Europe.

The company's strategic warehousing approach is designed to meet the specific needs of different geographies, ensuring medicines are available when and where they are needed. This focus on reliability is paramount, especially given the diverse regulatory environments and patient populations Hikma serves.

- Global Logistics Optimization: Hikma actively works to streamline its international shipping and transportation processes to reduce lead times and costs.

- Inventory Management: The company employs sophisticated inventory control measures to prevent stockouts and minimize waste, ensuring product availability.

- Strategic Warehousing: Hikma maintains a network of strategically located warehouses to facilitate efficient distribution and responsiveness to market demands.

- MENA Focus: Particular attention is paid to the MENA region, where Hikma's distribution capabilities are crucial for reaching a broad patient base.

Hikma's key activities revolve around robust Research and Development to build a strong product pipeline, efficient global manufacturing to produce quality medicines, and navigating complex regulatory landscapes for product approvals. These are complemented by aggressive sales and marketing efforts to drive adoption and a sophisticated supply chain and distribution network ensuring product availability.

| Key Activity | Description | 2024 Focus/Data |

|---|---|---|

| Research & Development | Developing new pharmaceutical products, including generics and biosimilars. | Continued investment in pipeline expansion, with a focus on complex generics and biosimilars. |

| Manufacturing & Production | Producing a diverse portfolio of medicines across global facilities. | Enhancing US manufacturing presence with a $1 billion investment planned by 2030. |

| Regulatory Affairs | Securing product approvals and ensuring compliance with global standards. | Achieved a strong pipeline of new product submissions and numerous approvals in 2024. |

| Sales & Marketing | Promoting and distributing pharmaceutical products to healthcare providers and institutions. | Utilized dedicated sales teams and targeted promotional campaigns to maximize market reach. |

| Supply Chain & Distribution | Managing global logistics for efficient delivery of medicines. | Optimized logistics and inventory management to ensure consistent supply in key markets. |

Preview Before You Purchase

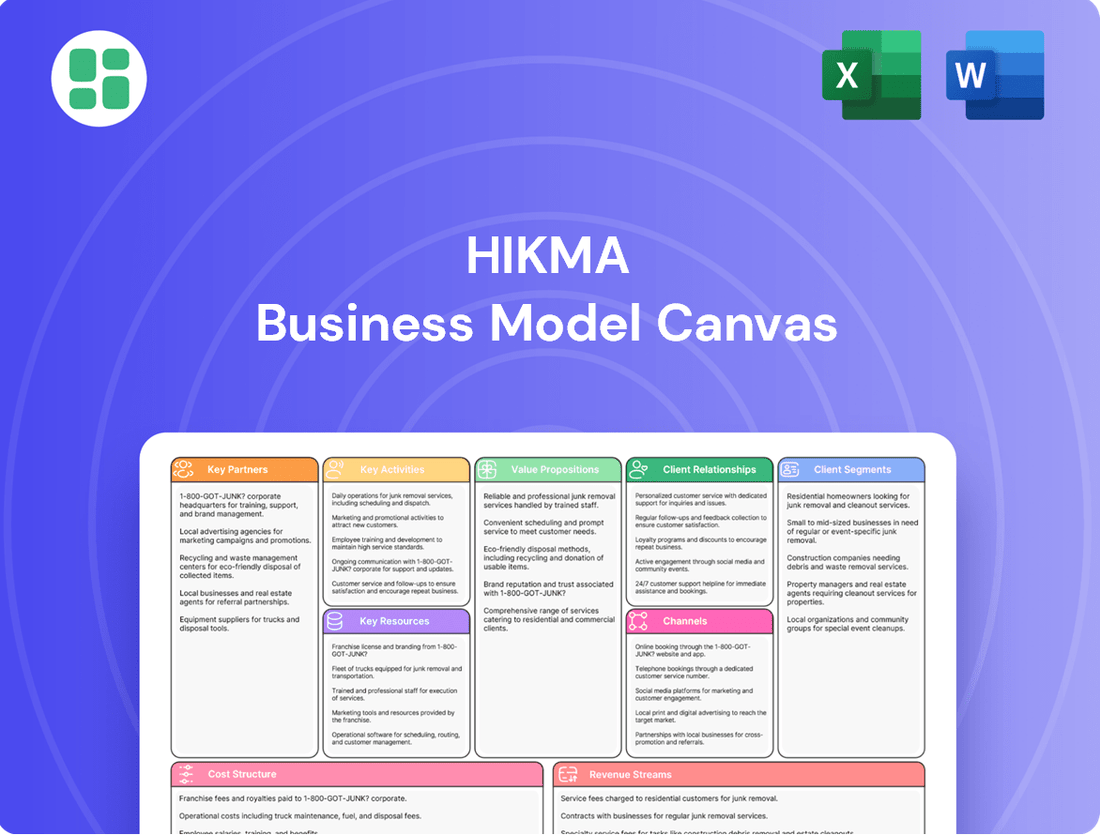

Business Model Canvas

The Business Model Canvas you see here is the actual, complete document you will receive upon purchase. This preview offers a direct glimpse into the comprehensive analysis and strategic framework that Hikma provides, ensuring no surprises, only the full, ready-to-use content.

Resources

Hikma's intellectual property and product portfolio are foundational to its business model, encompassing a vast array of generic, branded generic, and in-licensed medicines. This diverse offering, spanning over 800 distinct medicines including more than 180 injectable products, is a critical resource that fuels revenue generation and solidifies market presence across its key segments.

The company's strength lies in its comprehensive portfolio, fortified by patents and regulatory exclusivities that provide a competitive edge and protect its market share. This robust intellectual asset base is instrumental in driving Hikma's growth and maintaining its position as a key player in the global pharmaceutical market.

Hikma operates advanced manufacturing facilities across the globe, including significant operations in the United States. These sites are equipped with cutting-edge technology to handle the production of intricate pharmaceutical formulations, ensuring high-volume output and stringent quality control.

These state-of-the-art facilities are vital for Hikma's ability to meet international manufacturing standards and regulatory requirements. The company's commitment to maintaining these high standards underpins its reputation for reliable drug supply.

Further demonstrating its dedication to enhancing production capabilities, Hikma is making a substantial investment of $1 billion to expand its manufacturing and research and development infrastructure within the US. This investment is slated to boost its capacity for producing complex generics and biosimilars.

Hikma's operations rely heavily on its approximately 9,500-strong global workforce. This includes a diverse range of experts, from cutting-edge scientists and researchers to skilled manufacturing specialists and effective sales professionals.

The company's research and development capabilities are significantly bolstered by its R&D talent. This expertise is fundamental to Hikma's ability to innovate, develop new pharmaceutical products, and maintain a strong competitive position in the dynamic global market.

Regulatory Approvals and Licenses

Regulatory approvals and licenses are absolutely critical for Hikma. Holding these from major bodies like the U.S. Food and Drug Administration (FDA) and other international health authorities is what allows them to actually sell their medicines in different countries. These approvals aren't just paperwork; they're a stamp of approval on the quality, safety, and effectiveness of their products, which builds essential trust with doctors, patients, and healthcare systems worldwide.

Hikma has a strong history of successfully navigating these regulatory landscapes. For instance, the company has a documented track record of passing FDA quality inspections, a key indicator of their commitment to high manufacturing standards. This ongoing compliance is a foundational element of their business model, enabling market access and sustained operations.

Key aspects of Hikma's regulatory resource include:

- FDA and International Approvals: Essential for market access in key regions like the US and Europe, underpinning their global sales strategy.

- Quality Inspection Success: A proven history of passing stringent FDA inspections demonstrates operational excellence and product integrity.

- Product Efficacy and Safety Validation: Regulatory approval signifies that Hikma's products meet rigorous standards, fostering confidence among healthcare professionals and patients.

- License Maintenance: Continuous adherence to regulatory requirements ensures ongoing permission to operate and sell within various pharmaceutical markets.

Global Commercial and Distribution Network

Hikma's global commercial and distribution network is a cornerstone of its business, with a significant presence in North America, the MENA region, and Europe. This extensive infrastructure allows for the efficient delivery of its pharmaceutical products to a wide array of markets and customers. In 2024, Hikma continued to leverage this network to ensure broad access to its medicines.

The company’s established relationships and logistical capabilities within these key regions are invaluable assets. This widespread reach is particularly impactful in the MENA region, where Hikma holds the position of the second largest pharmaceutical company by sales. This ranking underscores the effectiveness of its commercial strategy and distribution prowess in a crucial growth area.

- North America, MENA, and Europe Presence: Hikma's established commercial and distribution networks across these key geographies are critical resources for market penetration and product accessibility.

- Market Access and Sales: The widespread reach facilitates effective marketing, sales, and distribution, ensuring essential medicines reach a broad customer base.

- MENA Leadership: Hikma's status as the second largest pharmaceutical company by sales in the MENA region highlights the strength and efficiency of its distribution channels in this vital market.

Hikma's robust intellectual property, including over 800 medicines, and its advanced manufacturing facilities, with a $1 billion US investment planned, are critical assets. Its approximately 9,500-strong workforce, particularly its R&D talent, drives innovation. Essential regulatory approvals, such as FDA licenses, ensure market access and product trust. Furthermore, its extensive global commercial and distribution network, especially its leading position in the MENA region, is vital for reaching customers.

| Key Resource | Description | Impact |

|---|---|---|

| Intellectual Property & Product Portfolio | Over 800 medicines, including 180+ injectables; patents and exclusivities. | Revenue generation, market presence, competitive edge. |

| Manufacturing Facilities | Advanced global sites, including US operations; $1 billion US expansion for complex generics/biosimilars. | High-volume output, quality control, meeting international standards. |

| Human Capital | ~9,500 employees, including R&D scientists, manufacturing specialists, sales professionals. | Product innovation, operational efficiency, market development. |

| Regulatory Approvals & Licenses | FDA and international health authority approvals; successful FDA quality inspections. | Market access, product trust, operational continuity. |

| Commercial & Distribution Network | Presence in North America, MENA, Europe; #2 pharma company by sales in MENA. | Efficient product delivery, broad market penetration, regional leadership. |

Value Propositions

Hikma Pharmaceuticals stands by its core promise of delivering high-quality, essential medicines at prices that patients can afford, significantly improving global healthcare accessibility. This dedication isn't just about business; it's a fundamental part of their mission to foster sustainability and tackle critical unmet medical needs.

The company's unwavering focus on quality is woven into the very fabric of its operations, ensuring that every product meets stringent standards. For instance, in 2023, Hikma reported a revenue of $2.1 billion, demonstrating its substantial market presence and the demand for its affordable, quality pharmaceuticals.

Hikma's broad and diversified product portfolio is a cornerstone of its business model, encompassing generic, branded generic, and in-licensed medicines. This extensive offering spans critical therapeutic areas such as oncology, pain management, and infectious diseases, providing a one-stop solution for healthcare providers.

This strategic diversification significantly mitigates risk by reducing dependence on any single product or market segment. For instance, in 2023, Hikma reported strong performance across its Generics segment, which benefits from this broad portfolio approach, contributing to overall revenue stability.

Hikma's commitment to reliable supply and manufacturing excellence is a cornerstone of its value proposition. The company leverages robust manufacturing capabilities and a focus on operational efficiency to ensure a consistent flow of its medicines, a critical factor for patient access, especially for injectable products. In 2023, Hikma continued to invest in expanding its global manufacturing footprint, enhancing capacity to meet growing demand and address potential drug shortages in key markets.

Addressing Unmet Medical Needs

Hikma Pharmaceuticals prioritizes developing and providing medicines for conditions where treatment options are limited, particularly within its core therapeutic areas. This commitment is evident in its strategic expansion of its oncology offerings and its focus on bringing complex, differentiated medicines to patients, underscoring a dedication to improving health outcomes.

The company’s research and development efforts are increasingly directed towards more intricate chemical compounds, aiming to create novel therapies. For instance, in 2023, Hikma reported that its Generics segment launched 13 new products in the US and Europe, many of which target areas with significant unmet patient needs.

- Focus on Oncology: Hikma is actively enhancing its oncology portfolio, a critical area with ongoing unmet medical needs.

- Complex Product Development: The company invests in bringing complex and differentiated products to market, requiring advanced R&D capabilities.

- R&D Strategy: Hikma’s R&D pipeline is geared towards more complex compounds, reflecting a strategy to tackle challenging therapeutic areas.

- Addressing Gaps: By targeting unmet medical needs, Hikma aims to provide essential treatments where existing options are insufficient or unavailable.

Strong Local Expertise with Global Reach

Hikma Pharmaceuticals masterfully blends its extensive global operational capabilities with profound local market insights, especially within the MENA, US, and European regions. This strategic duality enables the company to precisely customize its products and approaches to meet distinct regional needs.

This localized strategy significantly boosts Hikma's responsiveness to the specific demands of local healthcare systems and patient demographics. For instance, in 2023, Hikma reported robust growth in its MENA segment, driven by its deep understanding of local market dynamics and regulatory environments.

- Global Scale, Local Focus: Hikma leverages its worldwide manufacturing and distribution network while prioritizing tailored strategies for each market.

- MENA Strength: The company's deep roots and understanding in the Middle East and North Africa region have been a key driver of its success, evidenced by consistent market share gains.

- Adaptable Offerings: Hikma's ability to adapt its product portfolio and go-to-market strategies ensures relevance and effectiveness in diverse healthcare landscapes.

- Regulatory Acumen: Navigating complex local regulations is a core strength, allowing for efficient market entry and sustained presence.

Hikma's value proposition centers on delivering high-quality, affordable medicines globally, tackling unmet medical needs with a diversified portfolio. Their commitment to reliable supply, bolstered by strong manufacturing and R&D, ensures patient access, particularly for complex therapies like oncology treatments. This approach is amplified by their unique ability to combine global operational scale with deep local market understanding, especially in the MENA, US, and European regions.

| Value Proposition Element | Description | Supporting Data/Example (2023) |

|---|---|---|

| Affordable Quality Medicines | Providing essential, high-quality pharmaceuticals at accessible prices. | Revenue of $2.1 billion, demonstrating market demand for their offerings. |

| Diversified Product Portfolio | Offering a broad range of generic, branded generic, and in-licensed medicines across key therapeutic areas. | Strong performance in the Generics segment, contributing to revenue stability. |

| Reliable Supply & Manufacturing Excellence | Ensuring consistent availability of medicines through robust manufacturing and operational efficiency. | Continued investment in expanding global manufacturing footprint to meet demand and address shortages. |

| Addressing Unmet Medical Needs | Focusing on developing treatments for conditions with limited options, especially in oncology. | Launched 13 new products in the US and Europe, many targeting areas with significant unmet patient needs. |

| Global Scale, Local Insight | Leveraging worldwide operations with tailored strategies for distinct regional markets. | Robust growth in the MENA segment, driven by deep understanding of local market dynamics. |

Customer Relationships

Hikma Pharmaceuticals employs a direct sales force to cultivate relationships with crucial clients like hospitals, pharmacy networks, and wholesale distributors. This direct approach facilitates tailored interactions, allowing them to deeply understand client requirements and effectively manage substantial supply agreements.

The company's robust commercial infrastructure underpins these direct sales efforts, ensuring efficient communication and service delivery. In 2024, Hikma reported strong performance in its Generics segment, driven by its established market presence and effective customer engagement strategies, demonstrating the value of its key account management.

Hikma cultivates enduring relationships through strategic alliances, co-development pacts, and in-licensing agreements with fellow pharmaceutical entities. These collaborative efforts are founded on shared trust and mutual advantages, guaranteeing a consistent pipeline of products and broader market penetration.

In 2023, Hikma's Generics segment saw a notable increase in its product portfolio through strategic in-licensing, contributing to its robust revenue growth. The company actively seeks partnerships to expand its therapeutic areas, demonstrating its commitment to long-term growth and innovation in the pharmaceutical landscape.

Hikma prioritizes robust customer support and accessible medical information for healthcare professionals and patients. This commitment is vital for ensuring the safe and effective use of their medicines, fostering confidence and trust in the brand.

In 2024, Hikma continued to invest in its medical information services, aiming to provide timely and accurate responses to inquiries. Their dedicated teams handle a significant volume of requests, offering detailed product data and addressing any patient or prescriber concerns.

Patient-Centric Approach and Accessibility Focus

Hikma prioritizes a patient-centric model, striving to ensure that high-quality, affordable medicines reach individuals who require them. This dedication is a cornerstone of their sustainability initiatives and their active role in tackling public health concerns such as medication shortages.

The company’s operational philosophy is deeply rooted in improving access to essential treatments. For instance, in 2023, Hikma’s Generics segment saw revenue grow by 7% to $1.3 billion, demonstrating their continued focus on providing cost-effective solutions.

- Patient Focus: Hikma designs its operations around the needs of patients, aiming for broad availability of its pharmaceutical products.

- Affordability Commitment: A key aspect is making essential medicines financially accessible, a principle driving their product development and pricing strategies.

- Addressing Shortages: The company actively works to mitigate drug shortages, a critical public health issue, by ensuring a reliable supply chain.

- Accessibility as a Core Value: Improving access to medicines is not just a goal but a fundamental part of Hikma's identity and business strategy.

Stakeholder Engagement and Advocacy

Hikma actively engages with a broad spectrum of stakeholders, including regulatory bodies like the FDA and EMA, industry associations such as the European Federation of Pharmaceutical Industries and Associations (EFPIA), and patient advocacy groups. This proactive dialogue is crucial for understanding evolving market dynamics and unmet societal healthcare needs. For instance, in 2024, Hikma participated in numerous consultations regarding drug pricing and market access reforms across key European markets, directly influencing policy discussions.

Through these collaborations, Hikma not only gains valuable insights but also reinforces its dedication to enhancing access to essential medicines globally. The company's 2024 Sustainability Report details its ongoing efforts to partner with stakeholders across the entire healthcare ecosystem, from manufacturers to patient support organizations, fostering a shared commitment to public health improvements.

- Regulatory Engagement: Hikma's proactive engagement with bodies like the FDA and EMA in 2024 facilitated smoother product approvals and adherence to evolving compliance standards.

- Industry Collaboration: Participation in associations like EFPIA allowed Hikma to contribute to shaping industry best practices and addressing common challenges in pharmaceutical development and distribution.

- Patient Advocacy Partnerships: Collaborations with patient groups in 2024 focused on improving patient education and access to critical therapies, reflecting Hikma's patient-centric approach.

- Policy Contribution: Hikma's active involvement in healthcare policy discussions in 2024 underscored its commitment to ensuring sustainable access to affordable, high-quality medicines.

Hikma cultivates strong customer relationships through a multi-faceted approach, combining direct sales engagement with strategic partnerships and a deep commitment to patient access. Their dedication to understanding client needs, particularly with key accounts like hospitals and distributors, ensures tailored service and robust supply agreements.

This focus on customer centricity is evident in their 2024 performance, where the Generics segment experienced growth driven by established market presence and effective engagement. By prioritizing patient needs and affordability, Hikma builds trust and loyalty across the healthcare spectrum.

Hikma's proactive dialogue with regulatory bodies, industry associations, and patient advocacy groups in 2024 further solidifies these relationships, allowing them to adapt to market dynamics and contribute to improved healthcare access.

| Relationship Type | Key Activities | 2024 Impact/Focus |

|---|---|---|

| Direct Sales Force | Cultivating relationships with hospitals, pharmacy networks, wholesale distributors. Tailored interactions, managing supply agreements. | Strong performance in Generics segment driven by effective customer engagement and key account management. |

| Strategic Alliances & Partnerships | Co-development pacts, in-licensing agreements with other pharmaceutical entities. Building trust for product pipeline and market penetration. | Expansion of product portfolio through in-licensing, contributing to revenue growth and therapeutic area expansion. |

| Customer Support & Medical Information | Providing robust support and accessible medical information to healthcare professionals and patients. Ensuring safe and effective medicine use. | Investment in medical information services, handling significant inquiry volumes to address patient and prescriber concerns. |

| Stakeholder Engagement | Dialogue with regulatory bodies (FDA, EMA), industry associations (EFPIA), and patient advocacy groups. Understanding market dynamics and societal needs. | Participation in policy discussions on drug pricing and market access reforms, reinforcing commitment to medicine access. |

Channels

Hikma's direct sales channel to hospitals and healthcare systems is a cornerstone for its Injectables and specialty medicines. This approach is vital for supplying high-volume, acute care products, enabling direct negotiations and customized supply contracts. In 2024, Hikma continued to strengthen its presence in key markets like North America, Europe, and MENA through these direct relationships.

Hikma Pharmaceuticals relies heavily on partnerships with pharmaceutical wholesalers and distributors to get its products to market. These partners act as crucial intermediaries, ensuring Hikma’s generic and branded generic medicines reach a vast array of pharmacies, clinics, and smaller healthcare facilities across its operating regions.

This extensive distribution network is vital for achieving broad market penetration, especially in fragmented healthcare landscapes where direct access to every provider is impractical. For instance, in 2023, Hikma reported strong performance in its Generics segment, driven by its ability to effectively supply these essential medicines through its established wholesale channels.

The efficiency of this channel is particularly evident in reaching diverse and geographically dispersed customer bases. By leveraging the existing infrastructure and relationships of these wholesalers, Hikma can ensure its products are readily available, supporting its mission to provide high-quality, affordable medicines globally.

Hikma's Generics segment heavily relies on North American pharmacy chains and independent retail pharmacies to deliver its extensive range of oral and respiratory generics. This distribution strategy prioritizes making essential medications readily available to consumers across the United States and Canada, ensuring broad market reach.

In 2024, the generics market in North America continued to be a significant driver for pharmaceutical sales, with retail pharmacies playing a crucial role in dispensing these cost-effective alternatives to branded drugs. Hikma's established relationships with major pharmacy chains allow for efficient product placement and consumer access.

Government Tenders and Public Procurement

Government tenders and public procurement represent a crucial pathway for Hikma to distribute its essential medicines, especially across the MENA and European regions. By actively engaging in these processes, Hikma secures substantial contracts, enabling widespread access to affordable healthcare solutions within national programs.

These public procurement channels are vital for Hikma's market penetration, particularly in areas with strong state-led healthcare systems. For instance, in 2024, Hikma's participation in tenders contributed significantly to its market share in several key countries, reflecting the importance of these government contracts for revenue generation and public health impact.

- Key Tender Markets: MENA and Europe are primary focus areas for government tender participation.

- Strategic Importance: Securing large-scale contracts ensures broad public access to Hikma's affordable medicines.

- Impact on Access: Public procurement facilitates Hikma's role in national healthcare programs, enhancing medicine availability.

Online Platforms and E-commerce (Emerging)

Online platforms and e-commerce are becoming increasingly important for pharmaceutical distribution, offering new avenues for patient access and convenience. Hikma can leverage these channels to reach a broader audience, particularly for specific product lines or in markets where traditional distribution might be less efficient. This could involve direct-to-consumer sales where regulations permit, or B2B platforms catering to smaller clinics and pharmacies. By 2024, the global online pharmacy market was valued at over $70 billion, demonstrating significant growth potential.

Expanding into e-commerce allows Hikma to streamline the ordering process and provide readily accessible product information, enhancing customer engagement. This digital approach can also facilitate targeted marketing and data collection, leading to more informed business strategies. For instance, offering digital portals for prescription refills or providing educational content about their medications can build stronger patient relationships.

- Market Growth: The global online pharmacy market is projected to reach over $150 billion by 2027, indicating a robust upward trend.

- Patient Convenience: E-commerce platforms offer patients the ease of ordering medications from home, improving adherence and accessibility.

- Operational Efficiency: Digital platforms can reduce administrative burdens and improve inventory management for Hikma.

- Data Insights: Online sales provide valuable data on purchasing patterns and patient needs, informing future product development and marketing.

Hikma's channel strategy encompasses direct sales to hospitals, leveraging wholesalers and distributors for broad market reach, and engaging with retail pharmacies for its generics. The company also actively participates in government tenders, particularly in MENA and Europe, to secure large-scale contracts for its essential medicines. Emerging online platforms represent a growing avenue for enhanced patient access and operational efficiency.

| Channel | Description | 2024 Focus/Impact |

|---|---|---|

| Direct Sales (Hospitals) | Supplying Injectables and specialty medicines directly to healthcare systems. | Strengthening presence in North America, Europe, MENA. |

| Wholesalers & Distributors | Intermediaries for generic and branded generic medicines reaching pharmacies and clinics. | Ensuring broad market penetration in fragmented landscapes. |

| Retail Pharmacies | Delivering oral and respiratory generics to consumers in North America. | Facilitating consumer access to cost-effective alternatives. |

| Government Tenders | Securing contracts for essential medicines within national programs (MENA, Europe). | Contributing significantly to market share and revenue. |

| Online Platforms | Leveraging e-commerce for patient access and convenience. | Potential for streamlined ordering and data insights; global market valued over $70 billion in 2024. |

Customer Segments

Hospitals and clinics, both public and private, form a crucial customer base for Hikma. These institutions rely on a consistent and high-quality supply of injectable medicines, specialty drugs, and various other pharmaceutical products to deliver essential patient care. In 2024, the global hospital market size was valued at approximately $1.5 trillion, highlighting the significant demand these providers represent.

Hikma's Injectables division plays a vital role in serving this segment, particularly in key markets like North America, Europe, and the MENA region. The company's ability to provide a broad portfolio of sterile injectable products makes it a preferred partner for healthcare facilities managing a wide range of therapeutic needs. For instance, Hikma's presence in the U.S. injectables market, a significant portion of which is served by hospitals, continues to be a cornerstone of its business.

Retail pharmacies, both independent and large chains, are a cornerstone of Hikma's customer base, directly serving individual patients. These entities rely on Hikma for a wide range of generic and branded generic oral and respiratory medications, fulfilling daily prescription and over-the-counter demands. In 2024, Hikma's Generics division continued to be a significant supplier to the North American retail pharmacy market, a region known for its substantial demand for affordable and accessible pharmaceuticals.

Wholesale distributors are Hikma's vital partners, buying pharmaceuticals in bulk and ensuring their availability to countless pharmacies and healthcare facilities. These intermediaries are essential for Hikma's extensive market penetration and efficient supply chain management, effectively acting as a bridge to the end consumer.

Government Healthcare Programs and Agencies

Governments and public health agencies are crucial customers for Hikma, particularly in countries with established national healthcare systems. These entities frequently purchase medications for their public hospitals, community health clinics, and to maintain national drug reserves. This procurement often occurs through competitive bidding processes or tenders.

Hikma's strategic focus on ensuring access to essential medicines directly supports the objectives of these governmental healthcare programs. For instance, in 2024, governments globally continued to be major purchasers of pharmaceuticals, with public sector spending on medicines representing a substantial portion of the overall pharmaceutical market. Hikma's participation in tenders allows it to contribute to public health initiatives while securing significant sales volumes.

- Tender-based Procurement: Governments often award contracts for medicine supply through formal tender processes, requiring competitive pricing and adherence to quality standards.

- National Stockpiles: Agencies purchase medicines to ensure availability during public health emergencies or for routine management of chronic diseases across the population.

- Access to Medicines: Hikma's business model prioritizes affordability and accessibility, aligning with government mandates to provide healthcare to all citizens.

- Market Share in Public Sector: In key markets like the US, government programs such as Medicaid and Medicare are significant payers, influencing drug pricing and access.

Patients (Indirectly)

Patients, though not directly purchasing Hikma's products, are the ultimate beneficiaries of their offerings. Hikma's commitment to delivering high-quality, affordable, and accessible medicines directly influences patient health outcomes and their overall quality of life.

Hikma's core mission is to make better health attainable for millions of people daily. This focus on patient well-being underpins the company's strategic decisions and product development efforts.

- Improved Health Outcomes: By providing essential medications, Hikma contributes to better management of chronic diseases and acute conditions, leading to improved patient health.

- Enhanced Accessibility: Hikma's focus on affordability and widespread distribution ensures that more patients can access the treatments they need, regardless of their economic circumstances.

- Quality of Life: The availability of reliable and cost-effective medications directly translates to a better quality of life for patients managing long-term health challenges.

- Global Reach: In 2023, Hikma's products reached patients in over 50 countries, demonstrating a significant impact on global health accessibility.

Hikma serves a diverse range of customers, from large institutions to individual patients. Hospitals and clinics are key clients, requiring a steady supply of injectable and specialty medicines, with the global hospital market valued at approximately $1.5 trillion in 2024. Retail pharmacies, both independent and chain, are also vital, stocking Hikma's generic and branded generic oral and respiratory medications to meet daily patient needs.

Cost Structure

Research and Development (R&D) represents a substantial expenditure for Hikma, encompassing the entire lifecycle from initial drug discovery and formulation to rigorous clinical trials and the complex process of regulatory submissions. This investment is crucial for building and expanding their product pipeline, particularly for complex and innovative treatments.

Hikma has strategically planned to boost its R&D investment by approximately 20% in 2025. This increased allocation aims to accelerate the development of new therapies and strengthen their global product portfolio, underscoring a commitment to future growth and market competitiveness.

Manufacturing and production costs form a significant part of Hikma's expense base. These encompass the procurement of raw materials and active pharmaceutical ingredients (APIs), along with labor directly involved in the production process. Utilities and the upkeep of their global manufacturing facilities also contribute substantially to these overheads, as does the crucial element of quality control to ensure product safety and efficacy.

Operating a worldwide network of production plants inherently involves considerable fixed and variable costs. These costs are essential for maintaining Hikma's capacity to produce a wide range of generic and branded pharmaceutical products. For instance, in 2024, Hikma announced a significant investment of $1 billion to bolster its manufacturing capabilities within the United States, underscoring the strategic importance and financial commitment to this cost center.

Sales, General, and Administrative (SG&A) expenses are crucial for Hikma's operations, covering everything from marketing and sales force compensation to corporate overheads and legal matters. These costs are vital for building brand awareness, driving sales, and ensuring smooth business operations. In 2024, Hikma's SG&A expenses amounted to $671 million, reflecting their investment in market penetration and maintaining a strong commercial footprint.

Regulatory Compliance and Quality Assurance

Hikma's commitment to regulatory compliance and quality assurance represents a substantial cost center, critical for maintaining product integrity and global market access. These expenses cover rigorous audits, site inspections, extensive documentation, and the employment of specialized personnel dedicated to upholding the highest standards.

In 2024, Hikma continued to invest heavily in these areas. For instance, the company's ongoing efforts to comply with evolving pharmaceutical regulations across its key markets, including the US, Europe, and the Middle East, necessitate continuous updates to manufacturing processes and quality control systems. This investment is vital for ensuring product safety and efficacy, which are cornerstones of Hikma's brand reputation.

The financial implications of these robust quality systems are significant:

- Regulatory Filings and Approvals: Costs associated with preparing and submitting dossiers to health authorities like the FDA and EMA, along with ongoing post-approval variations and renewals.

- Quality Control and Assurance Personnel: Salaries and training for a dedicated workforce of scientists, technicians, and compliance officers responsible for testing, validation, and oversight.

- Audits and Inspections: Fees for internal and external audits, as well as the operational costs incurred during regulatory agency inspections, ensuring adherence to Good Manufacturing Practices (GMP).

- Quality Management Systems: Investment in technology and infrastructure for robust quality management systems, including data integrity, batch release, and pharmacovigilance.

Supply Chain and Distribution Logistics

Hikma's supply chain and distribution logistics represent a significant cost center. These expenses encompass the intricate web of warehousing, transportation, and inventory management required to deliver their pharmaceutical products across a global network. For instance, in 2023, Hikma reported that its cost of sales, which includes distribution expenses, amounted to $1.35 billion, highlighting the scale of these operational outlays.

Efficiently managing this complex network is paramount for timely delivery and product availability, yet it inherently drives substantial expenditure. This includes the ongoing costs associated with maintaining regional distribution hubs strategically positioned to serve diverse markets, ensuring products reach their destinations promptly and reliably.

- Warehousing Costs: Expenses related to storing finished goods and raw materials in strategically located facilities globally.

- Transportation Expenses: Costs incurred for moving products via various modes of transport, including air, sea, and road freight, to reach customers and markets.

- Inventory Management: Expenditure on maintaining optimal stock levels to meet demand while minimizing holding costs and potential obsolescence.

- Distribution Hub Operations: Costs associated with the running and maintenance of regional distribution centers, including staffing and operational overheads.

Hikma's cost structure is heavily influenced by its extensive R&D and manufacturing operations. The company's commitment to innovation is reflected in its planned 20% R&D investment increase for 2025. Manufacturing, including raw materials, labor, and facility upkeep, is a significant expense, as evidenced by the $1 billion investment in US manufacturing capabilities in 2024. SG&A expenses, totaling $671 million in 2024, support market penetration and brand building.

Regulatory compliance and quality assurance are critical cost drivers, ensuring product integrity and market access. Supply chain and distribution logistics also represent substantial outlays, with cost of sales, including distribution, reaching $1.35 billion in 2023. These costs are essential for maintaining Hikma's global product delivery network.

| Cost Category | 2024/2025 Projection | Key Components |

| Research & Development | ~20% increase in 2025 | Drug discovery, formulation, clinical trials, regulatory submissions |

| Manufacturing & Production | $1 billion investment in US facilities (2024) | Raw materials, APIs, labor, utilities, quality control |

| Sales, General & Administrative (SG&A) | $671 million (2024) | Marketing, sales force, corporate overheads, legal |

| Supply Chain & Distribution | $1.35 billion (Cost of Sales, incl. distribution, 2023) | Warehousing, transportation, inventory management, distribution hubs |

Revenue Streams

Hikma's sales of injectable products are a cornerstone of its revenue generation. This segment primarily involves providing both generic and specialized medicines directly to hospitals and various healthcare institutions.

The company has observed robust expansion in this area, with notable contributions coming from markets in North America, Europe, and the Middle East and North Africa (MENA) region. In 2024, this critical segment experienced a healthy 9% increase in revenue, reaching $1.306 billion, underscoring its importance to Hikma's overall financial performance.

Hikma's Generics segment is a significant revenue driver, primarily fueled by sales of oral, respiratory, and other generic and specialty products. This business largely targets the North American retail market, and in 2024, it achieved a major milestone by surpassing $1 billion in revenue for the first time.

The company places a strategic emphasis on differentiated products within its Generics portfolio. This focus allows Hikma to capture value and maintain a strong competitive position, contributing substantially to the company's overall financial performance.

Hikma generates significant revenue through the sale of its branded products, which include both branded generics and in-licensed patented medicines. This segment is particularly strong in the Middle East and North Africa (MENA) region, where Hikma has established a robust commercial footprint.

The company's strategy of expanding its product portfolio, coupled with its established market presence, has been a key driver of growth in this revenue stream. In 2024, revenue from branded products saw a healthy increase of 8%, reaching $769 million.

In-licensing and Partnership Fees

Hikma Pharmaceuticals leverages in-licensing and strategic partnerships as significant revenue streams. These agreements often involve upfront payments, milestone achievements, and ongoing royalties, effectively diversifying its product portfolio and capitalizing on its robust market access. As a leading licensing partner, Hikma gains access to new products and technologies, enhancing its competitive position.

These collaborations are crucial for portfolio expansion and market penetration. For instance, in 2023, Hikma continued to actively pursue in-licensing opportunities across its key markets, aiming to strengthen its generics and branded generics offerings. The company’s established distribution networks and regulatory expertise make it an attractive partner for pharmaceutical companies seeking to launch their products in Europe, the Middle East, and North Africa.

- Portfolio Diversification: In-licensing agreements allow Hikma to broaden its product range without the extensive R&D investment required for in-house development.

- Revenue Generation: Upfront payments, milestone fees, and royalties from these partnerships directly contribute to Hikma's top-line growth.

- Market Access: Hikma's strong presence in emerging markets, particularly in MENA, makes it a valuable partner for companies looking to expand their reach.

- Strategic Advantage: Being a preferred licensing partner enhances Hikma's reputation and provides a competitive edge in securing future collaborations.

Contract Manufacturing Services (CMO)

Hikma Pharmaceuticals generates revenue by offering contract manufacturing services (CMO) to other pharmaceutical companies. This leverages their advanced manufacturing facilities and expertise, optimizing asset utilization.

The company's CMO segment saw performance in line with expectations throughout 2024, with a notable acceleration in the latter half of the year. This indicates growing demand for their specialized manufacturing capabilities.

- Contract Manufacturing Services (CMO): Hikma provides manufacturing services to external pharmaceutical firms, utilizing its state-of-the-art facilities.

- Revenue Generation: This service stream allows Hikma to generate income by capitalizing on its manufacturing capacity and expertise.

- Performance in 2024: The CMO business met expectations, experiencing an acceleration in activity during the second half of 2024.

Hikma's revenue streams are diverse, encompassing Injectables, Generics, and Branded products, each contributing significantly to its financial performance. The company strategically focuses on expanding its differentiated product offerings within the Generics segment, particularly in the North American market.

In 2024, Hikma saw substantial growth across its key segments. The Injectables division reported $1.306 billion in revenue, a 9% increase, while the Generics segment surpassed $1 billion for the first time. The Branded products segment also experienced an 8% rise, reaching $769 million.

| Revenue Segment | 2024 Revenue (USD Billions) | Year-on-Year Growth |

|---|---|---|

| Injectables | 1.306 | 9% |

| Generics | 1.000+ | Significant Growth |

| Branded Products | 0.769 | 8% |

Business Model Canvas Data Sources

The Hikma Business Model Canvas is meticulously constructed using a blend of internal financial data, comprehensive market research, and strategic insights derived from industry analysis. These diverse data sources ensure that each component of the canvas is grounded in factual evidence and reflects Hikma's operational realities and market positioning.