High Tide SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

High Tide Bundle

High Tide's market position is defined by its strong brand recognition and expanding retail footprint, but also faces intense competition and evolving regulatory landscapes. Understanding these dynamics is crucial for any investor or strategist looking to capitalize on opportunities within the cannabis sector.

Want the full story behind High Tide's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

High Tide boasts the largest cannabis retail network in Canada, operating over 200 Canna Cabana stores as of July 2025. This extensive presence ensures broad consumer reach and significant market penetration across multiple provinces.

The company's leadership is further solidified by its substantial market share, holding 18% in Alberta and 10% in Ontario. This translates to an impressive 11-12% overall market share in Canada, positioning High Tide as the highest revenue-generating cannabis company in Canadian dollars.

High Tide's strength lies in its diversified revenue streams, extending beyond its prominent retail footprint. The company actively generates income through wholesale distribution of its own branded consumption accessories, bolstering its market reach. This multifaceted approach ensures resilience against market volatility in any single sector.

Further diversifying its income, High Tide leverages e-commerce platforms like Grasscity, Smoke Cartel, and NuLeaf Naturals for accessories and CBD products. The addition of its data analytics platform, Cabanalytics, creates an integrated ecosystem. This integration not only hedges against sector-specific downturns but also unlocks significant cross-selling potential, enhancing overall customer value and revenue generation.

High Tide's Cabana Club membership program is a significant strength, with over 5.87 million global members as of April 2025, including 1.9 million in Canada. This extensive loyalty base is a key differentiator in the competitive cannabis market.

The program demonstrably drives customer behavior, contributing to a 6.2% year-over-year increase in same-store sales for Q2 2025. This growth significantly outpaces the broader market and highlights the program's effectiveness in fostering repeat business and increasing purchase frequency.

Furthermore, the paid ELITE tier within the Cabana Club program specifically encourages higher spending and more frequent visits from its members. This tiered approach not only enhances customer retention but also directly boosts overall revenue streams.

Proven Financial Performance and Free Cash Flow Generation

High Tide has showcased robust financial performance, with record revenues reported in both Q1 and Q2 of 2025. Their trailing revenue has now exceeded $550 million, indicating sustained growth and market presence.

The company's ability to consistently generate free cash flow is a significant strength. For instance, they reported $4.9 million in free cash flow in Q2 2025, and a substantial $22.0 million over the trailing four quarters of 2024. This financial health provides a solid foundation for future expansion and strategic initiatives.

- Record Revenue Growth: Q1 and Q2 2025 saw record revenue figures, with trailing revenue surpassing $550 million.

- Consistent Free Cash Flow: Multiple consecutive quarters of positive free cash flow, including $4.9 million in Q2 2025 and $22.0 million in trailing twelve months of 2024.

- Financial Discipline: This consistent cash generation supports organic growth and allows for strategic investments.

Strategic Expansion and Innovation Initiatives

High Tide is aggressively pursuing growth, with plans to open 20-30 new retail locations in Canada during 2025. This expansion is part of a larger ambition to reach 300 stores nationwide.

The company is also setting its sights beyond Canadian borders, with a keen interest in entering the German medical cannabis market. This international push is complemented by the successful introduction of its own white-label cannabis brands, including Queen of Bud and Cabana Cannabis Co., which are designed to offer distinct market propositions.

Furthermore, High Tide's 'Buy Local' initiative is a strategic move to deepen its connection with communities and solidify its market presence. This focus on local engagement aims to foster brand loyalty and create a competitive advantage.

- Expansion Targets: 20-30 new Canadian stores in 2025, with a long-term goal of 300 locations.

- International Exploration: Active pursuit of opportunities in the German medical cannabis sector.

- Brand Development: Successful launch of proprietary white-label brands like Queen of Bud and Cabana Cannabis Co.

- Community Engagement: Strategic 'Buy Local' initiative to enhance market penetration and customer relationships.

High Tide's extensive retail network, exceeding 200 Canna Cabana stores as of July 2025, provides unparalleled market access and brand visibility across Canada. This broad footprint is complemented by significant market share, holding 18% in Alberta and 10% in Ontario, contributing to an overall 11-12% national market share, making it the top revenue-generating cannabis company in Canada.

The company benefits from diversified revenue streams, including wholesale distribution of its branded accessories and robust e-commerce operations through platforms like Grasscity and Smoke Cartel. This multi-pronged approach, further enhanced by its Cabanalytics data platform, creates a resilient business model and unlocks cross-selling opportunities.

The Cabana Club loyalty program is a standout strength, boasting over 5.87 million global members by April 2025, with 1.9 million in Canada. This program demonstrably drives customer engagement, evidenced by a 6.2% year-over-year increase in same-store sales in Q2 2025, significantly outperforming the market.

High Tide's financial health is robust, marked by record revenues in Q1 and Q2 2025, with trailing revenue surpassing $550 million. The company consistently generates free cash flow, reporting $4.9 million in Q2 2025 and $22.0 million over the trailing four quarters of 2024, providing a strong foundation for expansion and strategic investments.

| Metric | Value (as of July 2025) | Significance |

|---|---|---|

| Retail Stores | 200+ Canna Cabana locations | Largest retail network in Canada |

| Market Share (Alberta) | 18% | Strong regional presence |

| Market Share (Ontario) | 10% | Key provincial penetration |

| Total Canadian Market Share | 11-12% | Leading revenue generation |

| Cabana Club Members (Global) | 5.87 million+ | Extensive customer loyalty base |

| Cabana Club Members (Canada) | 1.9 million+ | Significant domestic engagement |

| Same-Store Sales Growth (Q2 2025) | 6.2% YoY | Outperforming market trends |

| Trailing Revenue | >$550 million | Sustained financial growth |

| Free Cash Flow (Q2 2025) | $4.9 million | Positive operational cash generation |

| Free Cash Flow (Trailing 12 Months 2024) | $22.0 million | Strong financial stability |

What is included in the product

Analyzes High Tide’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a structured framework to identify and address potential roadblocks, transforming strategic challenges into actionable solutions.

Weaknesses

High Tide has navigated a challenging period, reporting net losses despite a strong revenue trajectory. For instance, the company posted a net loss of $2.8 million in the second quarter of fiscal year 2025 and $2.7 million in the first quarter of fiscal year 2025. These figures emerge even as the company achieved record revenues and generated positive free cash flow, highlighting the impact of strategic investments on immediate profitability.

A significant factor contributing to these net losses is the considerable expense tied to expanding its retail footprint. Opening new stores necessitates upfront investment, and these locations typically require a period to reach full profitability. Furthermore, High Tide has strategically reduced its gross margins within the e-commerce sector as part of a broader initiative to implement a global loyalty program, a move designed to foster long-term customer engagement and market share growth.

Despite an overall revenue increase, High Tide experienced a year-over-year decline in e-commerce sales, with this segment operating at a net loss. This trend is concerning for future growth.

Furthermore, the company's gross profit margin dipped from 28% to 26% in Q2 2025. This reduction was partly a strategic choice to expand the Cabana Club loyalty program to e-commerce, involving a deliberate lowering of margins to drive customer acquisition and volume.

The Canadian cannabis retail sector is becoming increasingly crowded as it matures, with many companies competing for customer attention. High Tide, despite its leading position, faces the challenge of maintaining its edge through continuous innovation and aggressive pricing strategies, which could impact its profitability.

Market consolidation is a notable trend, as larger retail chains gain prominence, making it difficult for smaller, independent operators to survive. This intensified competition necessitates strategic agility for High Tide to secure and grow its market share.

Regulatory Complexities and Fragmentation in Canada

The Canadian cannabis sector grapples with a patchwork of provincial regulations, creating a complex environment for businesses like High Tide. These differences in rules for retail operations, product offerings, and distribution channels across provinces directly impact operational efficiency and market access.

This regulatory fragmentation translates into significant challenges for multi-province operators. High Tide, for instance, must navigate varying compliance requirements, which inflates operational costs and hinders streamlined supply chain management. The inability to implement uniform strategies across all markets can also impede rapid scaling and market penetration.

- Provincial Divergence: Regulations concerning retail store formats, licensing fees, and product marketing vary significantly between provinces like Ontario, Alberta, and British Columbia.

- Logistical Hurdles: Inconsistent distribution models and product availability rules across provinces create complex logistical demands, impacting inventory management and delivery timelines.

- Increased Compliance Burden: Adhering to distinct provincial legal frameworks necessitates dedicated compliance resources, adding to overall operating expenses and potentially slowing down expansion plans.

- Market Access Barriers: Some provinces may have stricter limitations on product categories or advertising, potentially limiting High Tide's ability to offer its full product suite nationwide.

Vulnerability to Sector-Wide Weak Investor Sentiment

High Tide's stock performance, despite its operational strengths and perceived undervaluation, has been significantly hampered by a general downturn in investor sentiment across the entire cannabis sector. This broad market malaise, coupled with increased stock market volatility, has suppressed High Tide's share price, preventing it from reaching its true market valuation. For instance, during periods of heightened sector-wide pessimism, even companies with solid fundamentals like High Tide can see their stock prices decline disproportionately.

This vulnerability means that High Tide's individual financial health and impressive growth trajectory can be overshadowed by external, sector-specific headwinds. The challenge lies in decoupling the company's intrinsic value from the broader market's perception of the cannabis industry. This can make it difficult for the company to attract the investment needed to fully capitalize on its growth opportunities.

- Sector-wide investor sentiment: A general bearish outlook on the cannabis industry can negatively impact High Tide's stock price.

- Market volatility: Broader stock market fluctuations can exacerbate the decline in cannabis stocks, including High Tide's.

- Valuation challenges: Weak sentiment makes it difficult for High Tide to achieve its full market valuation, irrespective of its financial performance.

High Tide is grappling with net losses, reporting $2.8 million in Q2 fiscal 2025 and $2.7 million in Q1 fiscal 2025, despite strong revenue. This is partly due to significant expenses from expanding its retail footprint and a strategic reduction in e-commerce gross margins to support its loyalty program. The company also saw a year-over-year decline in e-commerce sales, which operated at a net loss.

The company's gross profit margin decreased from 28% to 26% in Q2 2025, a deliberate move to boost customer acquisition for its Cabana Club loyalty program. This strategy, while aimed at long-term growth, impacts immediate profitability.

The increasingly competitive Canadian cannabis retail market, coupled with regulatory fragmentation across provinces, presents significant operational challenges and increased compliance costs for High Tide. Market consolidation also poses a threat to its market share.

Investor sentiment towards the cannabis sector has negatively impacted High Tide's stock performance, preventing it from reaching its perceived valuation despite solid fundamentals and growth. This sector-wide pessimism creates valuation challenges.

What You See Is What You Get

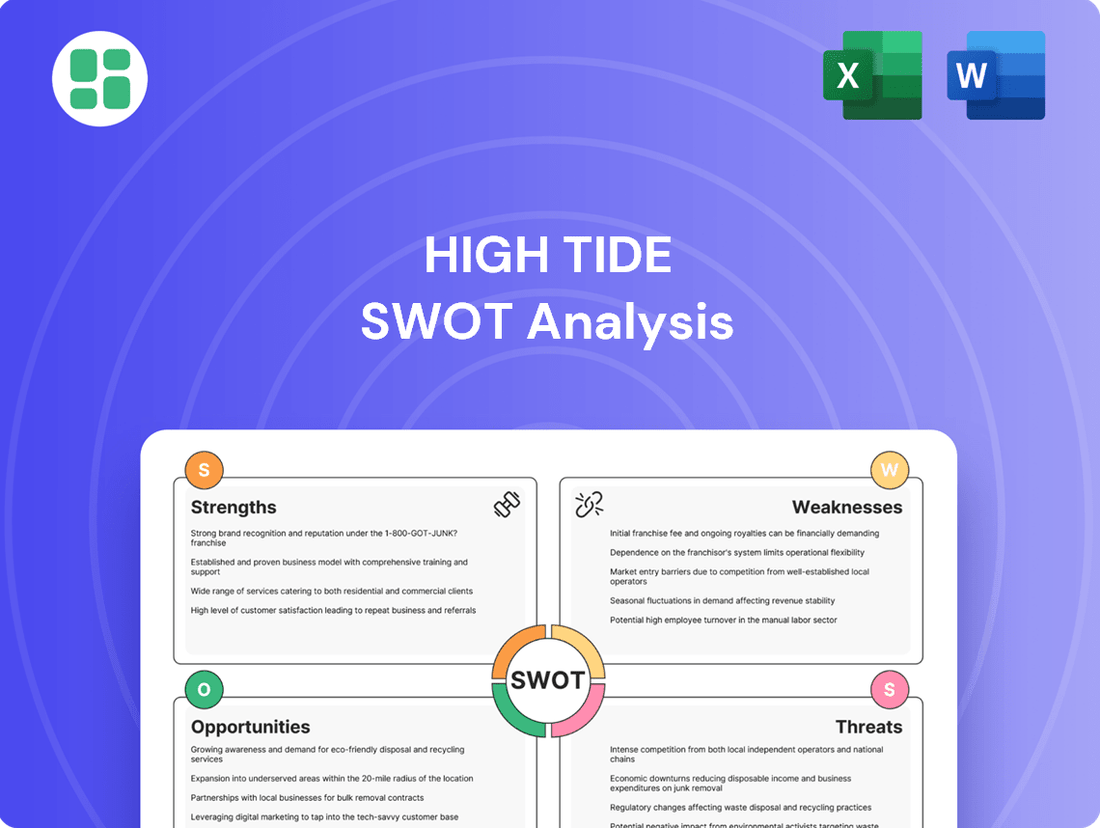

High Tide SWOT Analysis

The preview you see is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. This means you can be confident in the content and structure of the report you're acquiring. Once you complete your purchase, the full, detailed version of this analysis will be immediately available for download.

Opportunities

High Tide is actively pursuing international expansion, with Germany identified as a key growth market. Despite a temporary pause on its Purecan GmbH acquisition, the company is engaged in exclusive discussions for a new arrangement with a prominent German medical cannabis importer and wholesaler. This strategic move, coupled with a submitted model project proposal, highlights the significant revenue potential within Germany's burgeoning medical cannabis sector.

The global market for cannabis accessories and CBD products is experiencing robust growth, presenting a clear opportunity for High Tide. This expansion extends beyond recreational cannabis, tapping into wellness and consumer goods sectors. For instance, the global CBD market alone was valued at approximately $5.2 billion in 2023 and is projected to reach over $15 billion by 2029, indicating substantial untapped potential.

High Tide is well-positioned to leverage this trend through its established e-commerce infrastructure and distribution channels. Its existing presence in the US and UK with CBD brands allows for immediate engagement with these burgeoning markets. This strategic advantage enables High Tide to not only capture a larger share of the cannabis accessory market but also to significantly diversify its revenue streams by expanding its CBD product portfolio.

High Tide's extensive Cabana Club loyalty program, boasting over 5.87 million members, presents a significant opportunity. This rich dataset allows for granular analysis of customer behavior and preferences.

By effectively utilizing this data, High Tide can refine inventory management, ensuring popular items are consistently stocked and reducing waste on less desired products. This data-driven approach can optimize the supply chain.

Furthermore, the loyalty data empowers highly personalized marketing campaigns, increasing their effectiveness and return on investment. This allows for tailored promotions and product recommendations, boosting sales and customer satisfaction.

The insights gained can also drive the development of new, niche product lines specifically designed to meet the identified demands of their customer base, creating new revenue streams and strengthening market position.

Continued Strategic Acquisitions and Market Consolidation

The Canadian cannabis sector is actively consolidating, and High Tide, with its robust free cash flow, is strategically positioned to acquire smaller rivals or businesses that enhance its operations. This approach is crucial for expanding market presence and operational scale.

High Tide's financial strength, evidenced by its positive free cash flow, allows it to pursue strategic acquisitions in the evolving Canadian cannabis landscape. The company's ability to integrate new entities can lead to significant improvements in production, supply chain efficiency, and overall market share. For instance, as of the first quarter of 2024, High Tide reported a significant increase in its revenue, demonstrating its capacity for growth through both organic means and strategic M&A activities.

- Market Consolidation Advantage: High Tide can leverage its financial stability to acquire smaller, potentially struggling competitors, thereby increasing its market share.

- Enhanced Operational Synergies: Acquisitions can lead to optimized supply chains, improved production capabilities, and cost efficiencies through economies of scale.

- Revenue Growth Potential: Successful integration of acquired businesses can directly contribute to revenue growth and profitability, solidifying High Tide's dominant position.

- Access to New Markets/Products: Strategic buys can provide access to new geographic markets or complementary product lines, diversifying High Tide's portfolio.

Introduction of New Cannabis Product Categories (2.0 and 3.0)

The Canadian legal cannabis market is experiencing a significant shift, with consumers increasingly seeking out innovative Cannabis 2.0 and 3.0 products. This includes a growing appetite for edibles, beverages, concentrates, and specialized wellness-focused items. For instance, the edibles market alone was projected to reach over CAD $2.5 billion by 2026, indicating substantial consumer interest.

High Tide has a clear opportunity to capitalize on this trend by expanding its product offerings. By introducing more higher-margin, value-added products within these categories, the company can attract a wider demographic of consumers. This strategic move is crucial for driving future revenue growth and solidifying its market position.

- Expanding into edibles and beverages: These categories offer higher profit margins compared to traditional flower products.

- Focusing on concentrates and vapes: The demand for convenient and potent consumption methods continues to rise.

- Developing wellness-oriented products: Incorporating CBD and other cannabinoids into topical and ingestible wellness items taps into a growing health-conscious market.

- Leveraging existing retail footprint: High Tide's extensive network of stores provides an ideal platform for launching and promoting these new product lines.

High Tide's international expansion, particularly into Germany, presents a significant opportunity for revenue growth, especially with its focus on the burgeoning medical cannabis sector. The company's strategic positioning to tap into the global cannabis accessories and CBD markets, which saw the CBD market valued at approximately $5.2 billion in 2023 and projected to exceed $15 billion by 2029, further solidifies its growth potential. Furthermore, High Tide's substantial Cabana Club loyalty program, with over 5.87 million members, offers invaluable data for personalized marketing and product development, enhancing customer engagement and driving sales.

The Canadian cannabis market's consolidation phase allows High Tide to leverage its strong free cash flow for strategic acquisitions, enhancing market presence and operational scale. The increasing consumer demand for innovative Cannabis 2.0 and 3.0 products, such as edibles and concentrates, offers High Tide a prime opportunity to expand its higher-margin product portfolio and capture a wider consumer base. The company's robust financial standing, evidenced by positive free cash flow and revenue growth in early 2024, supports these expansionary strategies.

| Opportunity Area | Key Metric/Data Point | Potential Impact |

|---|---|---|

| International Expansion (Germany) | Exclusive discussions with prominent German importer/wholesaler; submitted model project proposal. | Significant revenue potential in a growing medical cannabis market. |

| Global CBD & Accessories Market | CBD market valued at ~$5.2B (2023), projected to reach >$15B by 2029. | Diversification of revenue streams and capture of a growing wellness sector. |

| Loyalty Program (Cabana Club) | Over 5.87 million members. | Enhanced customer insights for personalized marketing, optimized inventory, and new product development. |

| Canadian Market Consolidation | Positive free cash flow; revenue growth in Q1 2024. | Strategic acquisition opportunities to increase market share and operational efficiencies. |

| Cannabis 2.0/3.0 Products | Edibles market projected >CAD $2.5B by 2026. | Expansion into higher-margin products, attracting new demographics and driving revenue. |

Threats

The cannabis sector faces a dynamic and often tightening regulatory landscape. In Canada, for instance, regulations governing product types, THC potency, and advertising are subject to ongoing review and potential amendment by Health Canada, directly influencing High Tide's product development and market reach.

Changes in excise tax structures or the speed at which regulatory reforms are implemented present significant financial and strategic challenges. For example, shifts in provincial cannabis tax rates can directly impact High Tide's gross margins and its ability to compete effectively across different markets.

The Canadian cannabis retail landscape is fiercely competitive, with numerous players vying for market share. This intense price competition, particularly in more saturated regions, puts pressure on gross profit margins for all retailers, including High Tide. For instance, the average price per gram of cannabis in Canada has seen a downward trend, impacting profitability across the board.

The illicit cannabis market remains a persistent threat, even as legal markets expand. These untaxed and unregulated operations can offer significantly lower prices, directly competing for consumer spending. For High Tide, this means a portion of potential sales are siphoned off by these underground channels.

While statistics from early 2024 indicate a decline in the illicit market's share in Canada, it hasn't been entirely eradicated. Reports suggest the illicit market still captures a notable percentage of sales, impacting the overall revenue potential for legitimate businesses like High Tide and potentially hindering their market share growth.

Economic Downturn and Impact on Discretionary Spending

Cannabis products, especially those for recreational use, are often viewed as discretionary purchases. This means that during periods of economic contraction, such as the potential slowdowns anticipated in late 2024 and into 2025 due to persistent inflation and interest rate hikes, consumers may cut back on non-essential spending.

A significant economic downturn or a sustained period of reduced consumer purchasing power directly threatens High Tide's revenue streams. As disposable income tightens, demand for products like those offered by High Tide could see a noticeable decline, impacting sales volumes and overall financial performance.

- Economic Sensitivity: Recreational cannabis sales are highly susceptible to economic fluctuations, often being one of the first categories consumers reduce spending on when budgets are strained.

- Inflationary Pressures: Persistent inflation in 2024 and projected into 2025 continues to erode consumer purchasing power, making discretionary items like cannabis less affordable.

- Demand Reduction: A weakening economy could lead to a substantial drop in demand for High Tide's product offerings, directly impacting revenue and profitability.

Supply Chain Disruptions and Rising Operating Costs

The cannabis sector faces significant risks from supply chain interruptions, which can lead to shortages and increased product expenses. For instance, in early 2024, several Canadian Licensed Producers reported delays in the delivery of essential cultivation supplies due to global shipping challenges, impacting their production schedules.

Rising operational expenditures present another considerable hurdle. For Canadian cannabis companies, this includes escalating costs for labor, energy, and the stringent compliance requirements mandated by regulatory bodies. These increased expenses, if not offset by revenue growth or efficiency gains, could significantly reduce profit margins.

- Supply Chain Vulnerability: Disruptions in the global supply chain can affect the availability and cost of critical inputs like nutrients, lighting, and packaging for cannabis producers.

- Rising Operating Costs: Canadian cannabis companies are grappling with higher expenses for energy, with electricity costs in some provinces seeing increases of over 15% in the past year, alongside rising minimum wages and compliance-related administrative burdens.

- Margin Erosion: The combination of supply chain issues and increasing operational costs poses a direct threat to profit margins, requiring careful cost management and strategic sourcing to mitigate the impact.

The evolving regulatory environment presents ongoing challenges for High Tide, with potential changes in product restrictions or advertising rules impacting market strategies. Additionally, shifts in provincial tax structures, such as potential increases in excise duties, could directly affect High Tide's profitability and competitive pricing. The persistent presence of the illicit market, despite efforts to curb it, continues to siphon consumer spending, with early 2024 data indicating it still captures a significant portion of the market, directly impacting High Tide's revenue potential.

Economic downturns, exacerbated by inflation and interest rate hikes anticipated through late 2024 and into 2025, pose a substantial threat as cannabis is often a discretionary purchase. This economic sensitivity means reduced consumer spending power can lead to lower sales volumes for High Tide. Furthermore, supply chain vulnerabilities and rising operational costs, including energy and labor, are squeezing profit margins, requiring robust cost management strategies.

| Threat Category | Specific Challenge | Impact on High Tide | Relevant Data/Observation (2024-2025) |

| Regulatory Uncertainty | Potential changes in product potency limits or advertising restrictions | May necessitate product reformulation or marketing adjustments | Health Canada continues to review and update cannabis regulations; specific changes are unpredictable. |

| Taxation Policies | Increases in provincial cannabis excise taxes | Could reduce gross margins and necessitate price increases, impacting competitiveness | Provincial governments periodically review tax rates; some provinces have higher excise duties than others. |

| Illicit Market Competition | Continued sales through untaxed channels | Diverts potential revenue from legal dispensaries like High Tide | While declining, the illicit market still accounted for an estimated 30-40% of cannabis sales in Canada in early 2024, according to industry reports. |

| Economic Downturn/Inflation | Reduced consumer disposable income | Leads to decreased demand for discretionary items, impacting sales volume | Inflation remained a concern through 2024, impacting consumer purchasing power; interest rate hikes may further dampen spending in 2025. |

| Supply Chain & Operational Costs | Disruptions in global supply chains and rising input costs (energy, labor) | Increases cost of goods sold and operating expenses, potentially eroding profit margins | Energy costs in some Canadian provinces saw increases exceeding 10% year-over-year in late 2023/early 2024; minimum wage adjustments also contribute to labor cost increases. |

SWOT Analysis Data Sources

This High Tide SWOT analysis is built upon a robust foundation of data, including official company financial statements, comprehensive market research reports, and expert industry analysis to provide a well-rounded perspective.