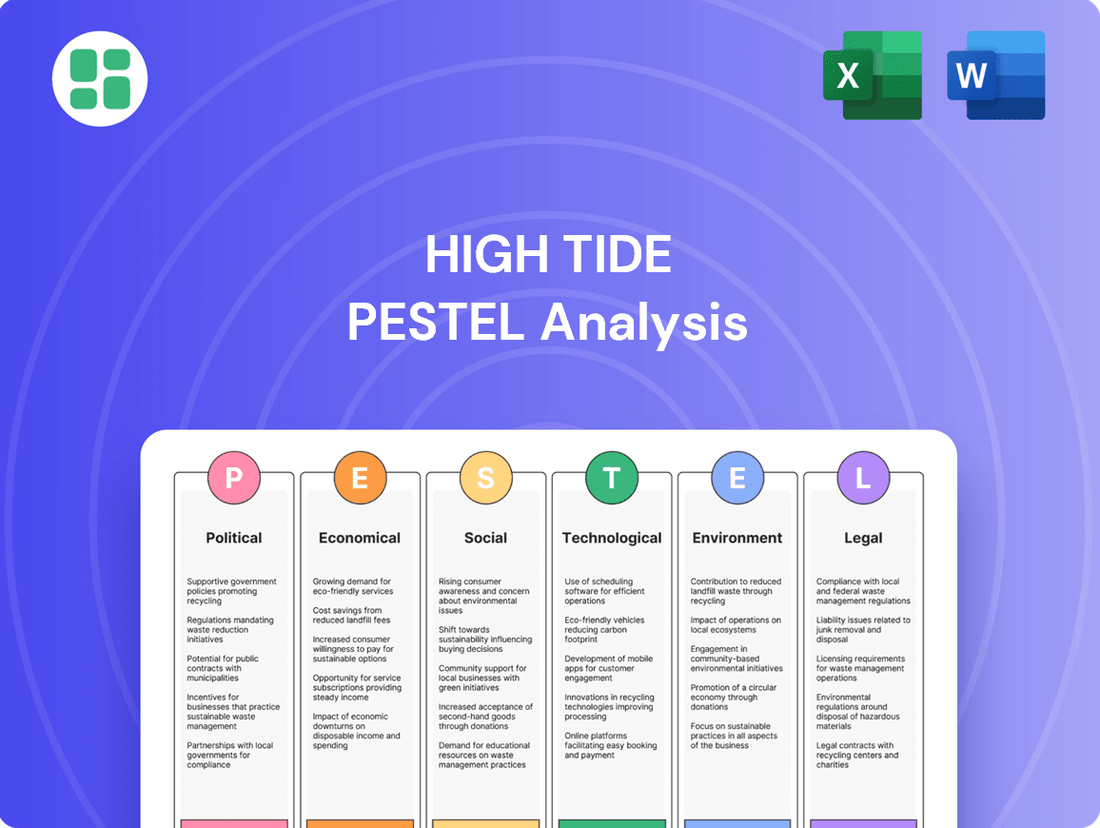

High Tide PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

High Tide Bundle

Navigate the complex external forces shaping High Tide's future with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and social trends create both opportunities and challenges for the company. Gain a strategic advantage by downloading the full version, packed with actionable insights for informed decision-making.

Political factors

Government regulation profoundly impacts High Tide Inc.'s operations within the Canadian cannabis sector, with licensing, sales channels, and product offerings strictly defined by federal and provincial authorities. Adapting to evolving policies, like Health Canada's proposed 2024 amendments aimed at simplifying requirements and fostering product innovation, is crucial for the company's agility.

These regulatory shifts, such as potential changes to packaging and product categories, directly influence High Tide's ability to reduce operational overhead and explore new avenues for revenue generation. For instance, a 2023 report indicated that regulatory compliance costs represented a significant portion of operating expenses for Canadian cannabis retailers.

High taxation on legal cannabis products, including federal excise taxes and provincial proprietary fees, significantly impacts the profitability of cannabis retailers like High Tide. For instance, in 2023, the effective tax rate on cannabis products in many Canadian provinces remained a substantial hurdle, often exceeding 20% of the retail price. This heavy tax burden makes it difficult for licensed businesses to compete with the illicit market, which operates without these financial obligations.

Ongoing discussions about tax relief or adjustments to the excise tax structure are critical for the industry's financial health. Industry stakeholders, including High Tide, actively advocate for changes that would reduce the tax burden, potentially leading to more competitive pricing and increased market share for legal operators. For example, proposals to align cannabis excise taxes with those of other regulated industries or to implement a revenue-based tax system are being closely watched.

Political stability in Canada is a key factor for High Tide's growth. The government's continued support for the legal cannabis market, despite ongoing challenges like overregulation and illicit market competition, is vital. For instance, in 2024, the Canadian government continued to refine cannabis regulations, aiming to balance public health with market development, which directly impacts High Tide's operational landscape.

International Market Access and Trade Policies

High Tide's international market access, particularly for its consumption accessories and potential expansion into markets like Germany, is heavily influenced by global trade policies and the varying pace of cannabis legalization worldwide. For instance, the European Union's framework for medical cannabis presents both opportunities and hurdles for Canadian producers seeking to export.

The company's aspirations to tap into markets like Germany, which has been progressively liberalizing its cannabis laws, are directly tied to bilateral trade agreements and import regulations. As of early 2024, Germany's approach to recreational cannabis legalization, while still evolving, signals potential pathways for accessory sales and potentially even cannabis product distribution, contingent on regulatory alignment.

- Global Regulatory Landscape: High Tide's international strategy hinges on navigating diverse and often complex cannabis regulations in potential export markets, impacting product categories like consumption accessories.

- Trade Agreement Impact: Favorable trade agreements between Canada and countries like Germany could significantly reduce tariffs and streamline import processes for High Tide's product lines.

- Market Entry Barriers: Non-tariff barriers, such as differing product standards or licensing requirements for cannabis-related businesses, remain a key consideration for international expansion.

- Medical Cannabis Exports: The potential for exporting medical cannabis, while a separate category, is directly linked to international patient access programs and the recognition of Canadian medical cannabis standards abroad.

Public Health and Safety Regulations

Government emphasis on public health and safety significantly shapes the regulatory landscape for cannabis companies like High Tide. This focus translates into stringent rules concerning product quality, packaging design, clear labeling, and responsible marketing practices. For instance, in 2024, Health Canada continued to enforce strict guidelines on THC potency limits and mandated prominent health warnings on all cannabis products, directly impacting how High Tide formulates and presents its offerings.

High Tide must meticulously adhere to these regulations to maintain its operational licenses and consumer trust. This includes ensuring all retail locations and online platforms comply with advertising restrictions, which often prohibit promotional content that could appeal to minors. The company's product development and marketing strategies are therefore heavily influenced by the need to protect consumers, particularly youth, from potential harms associated with cannabis use.

- THC Limits: Regulations dictate maximum THC concentrations in various product categories, influencing High Tide's product formulation.

- Packaging and Labeling: Strict requirements for child-resistant packaging and clear health warnings are paramount for compliance.

- Marketing Restrictions: Advertising is heavily regulated to prevent targeting minors and to avoid making unsubstantiated health claims.

- Retail Operations: Public health mandates extend to retail environments, covering aspects like age verification and product display.

Political stability and government support are foundational for High Tide Inc.'s operations in the Canadian cannabis market. The ongoing refinement of federal and provincial regulations, such as those proposed for 2024, directly influences High Tide's strategic planning and ability to innovate. For example, the Canadian government's commitment to balancing public health with market development in 2024 underscores the dynamic political environment High Tide navigates.

High taxation, including federal excise taxes and provincial fees, remains a significant political factor impacting High Tide's profitability. In 2023, these taxes often exceeded 20% of the retail price, hindering legal operators' competitiveness against the illicit market. Industry advocacy for tax reform, such as aligning cannabis taxes with other regulated goods or implementing revenue-based systems, highlights the political leverage sought by companies like High Tide.

International political landscapes and trade policies critically shape High Tide's global expansion, particularly for its accessories segment and potential entry into markets like Germany. As of early 2024, Germany's evolving approach to cannabis legalization presents opportunities, contingent on regulatory alignment and bilateral trade agreements. Navigating diverse international regulations and non-tariff barriers remains a key strategic consideration for market access.

What is included in the product

This High Tide PESTLE analysis meticulously examines the influence of external macro-environmental factors across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

The High Tide PESTLE Analysis provides a clear, summarized version of external factors, relieving the pain of sifting through complex data for quick referencing during meetings or presentations.

Economic factors

Consumer spending habits and disposable income are critical drivers for the recreational cannabis market. In 2024, analysts project continued resilience in consumer spending, though inflation might temper growth in discretionary categories. High Tide's Cabana Club, with its focus on value, is well-positioned to capture market share by appealing to budget-conscious consumers.

The Canadian cannabis retail sector is booming, but this growth has also brought intense competition and, in some areas, market saturation. High Tide, a major player, faces a crowded field where pricing is a key differentiator, especially when competing against illicit operators who bypass taxes and regulatory costs.

Industry consolidation is a significant trend, with larger entities like High Tide actively pursuing mergers and acquisitions. For instance, High Tide's acquisition of NuLeaves in late 2023, valued at approximately $10 million CAD, demonstrates this strategy of expanding its footprint and market share through strategic purchases.

The cannabis industry's access to capital remains a significant hurdle, directly impacting companies like High Tide. Despite growing market size, profitability challenges and the patchwork of regulations create investor hesitancy. For instance, in 2023, while the global cannabis market was valued at approximately $30 billion, attracting substantial investment proved difficult for many operators due to inconsistent returns and evolving legal landscapes.

High Tide's ability to secure investment hinges on demonstrating strong financial performance. Positive revenue growth, as seen in its reported fiscal year 2024 first-quarter results with a 9% increase year-over-year, and the generation of positive free cash flow are key indicators for investors. These metrics signal operational efficiency and a path towards sustainable growth, making the company more attractive for funding future expansion initiatives.

Investor sentiment plays a critical role in High Tide's valuation and financing capabilities. A generally positive outlook on the cannabis sector can lead to increased capital availability and higher valuations, whereas negative sentiment can restrict access to funding. Recent trends suggest a cautious optimism, with investors increasingly looking for companies with clear market strategies and a proven ability to navigate regulatory complexities.

Inflation and Operational Costs

Inflationary pressures are a significant economic factor for High Tide, directly impacting its operational costs. Rising expenses for rent, utilities, and labor can squeeze margins. For example, the Consumer Price Index (CPI) in Canada, where High Tide operates, saw a notable increase, impacting general business expenses throughout 2023 and into early 2024.

The cost of goods sold (COGS) for cannabis products and accessories is also susceptible to inflation. This means High Tide faces the challenge of absorbing these increased costs or passing them on to consumers, which could affect sales volume. Maintaining competitive pricing in a dynamic market is therefore crucial for sustained revenue growth.

To counter these economic headwinds, High Tide's strategy hinges on operational efficiencies and stringent cost control measures. By optimizing supply chains and streamlining internal processes, the company aims to protect its profitability despite the inflationary environment. This focus is essential for navigating the economic landscape and ensuring long-term financial health.

- Rising COGS: Increased costs for cannabis flower, edibles, and accessories directly affect High Tide's cost of revenue.

- Labor Costs: Wage inflation, particularly in retail and cultivation, adds to High Tide's operational expenditures.

- Energy Prices: Higher utility costs for lighting, HVAC, and other operational needs in dispensaries and cultivation facilities present a challenge.

- Rent Escalations: Lease agreements for High Tide's numerous retail locations are subject to inflationary rent increases.

Pricing Pressures and Profitability

Despite strong revenue increases, many cannabis firms, High Tide included, grapple with profitability issues. This stems from declining prices, substantial taxes, and fierce market competition. For instance, in early 2024, average cannabis flower prices in Canada saw a notable decrease compared to the previous year, impacting overall industry margins.

High Tide's strategy, centered on its discount club model, aims to boost sales volume and capture market share. However, this approach inherently requires operating with thinner profit margins. Successfully growing revenue while preserving gross profit margins presents an ongoing challenge for the company.

- Falling Prices: Average wholesale cannabis prices in Canada experienced a downward trend throughout 2023 and into early 2024, putting pressure on producers and retailers alike.

- High Taxation: Excise duties and provincial markups continue to represent a significant portion of the final retail price, limiting the profitability available to operators like High Tide.

- Competitive Landscape: The Canadian cannabis market remains highly fragmented, with numerous licensed producers and retailers vying for consumer attention, often leading to price wars.

- Margin Management: High Tide's focus on volume through its discount model necessitates careful cost management to ensure that increased sales translate into sustainable profitability.

Economic factors significantly influence High Tide's performance, with inflation impacting operational costs like utilities and labor. For instance, Canadian CPI saw increases through 2023 and into early 2024, directly affecting business expenses. This inflationary pressure also extends to the cost of goods sold, forcing companies to balance absorbing costs or passing them to consumers, a delicate act in a competitive market.

Profitability remains a challenge across the cannabis industry, including for High Tide, due to declining prices and high taxes. In early 2024, average cannabis flower prices in Canada trended downwards, squeezing industry margins. High Tide's discount club model, while driving volume, inherently operates on thinner profit margins, making efficient cost management critical for sustained financial health.

| Economic Factor | Impact on High Tide | Relevant Data/Trend (2023-2024) |

| Inflation | Increased operational costs (labor, energy, rent) | Canadian CPI showed notable increases through 2023-early 2024. |

| Cost of Goods Sold (COGS) | Pressure on margins, potential price adjustments | Rising costs for cannabis products and accessories. |

| Price Compression | Reduced revenue per unit, margin challenges | Average cannabis flower prices in Canada saw a downward trend in late 2023-early 2024. |

| Taxation | Reduced net profitability | Excise duties and provincial markups remain significant portions of retail prices. |

What You See Is What You Get

High Tide PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive High Tide PESTLE Analysis provides a detailed examination of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the business, offering strategic insights for informed decision-making.

Sociological factors

Societal acceptance of cannabis in Canada is a significant driver for High Tide. As more Canadians view cannabis use as normal, the stigma decreases, widening the potential customer base. This evolving perception directly impacts market dynamics and High Tide's ability to attract a diverse clientele.

The normalization trend is evident in increasing consumer spending. In 2023, Canadian cannabis sales reached approximately $4.5 billion, a figure expected to grow. This expanding market, fueled by changing societal attitudes, presents a substantial opportunity for High Tide to increase its revenue and market share.

Furthermore, evolving perceptions influence product preferences. Consumers are increasingly seeking a wider variety of cannabis products beyond traditional flower, including edibles, beverages, and topicals. High Tide's strategic focus on offering a diverse product portfolio aligns perfectly with these changing consumer demands, positioning the company for continued growth.

High Tide must understand that the cannabis consumer base is diversifying. While older demographics have historically been prominent, there's a notable increase in younger consumers, particularly Gen Z, entering the market. This shift necessitates adapting marketing strategies to resonate with their digital-native preferences and values. For instance, a 2024 report indicated that cannabis usage among individuals aged 18-24 has seen a steady rise, influencing product development towards accessible and innovative formats.

Furthermore, consumer preferences are increasingly centered on product quality, consistency, and a broad variety of options. There's a growing demand for specific product categories such as convenient pre-rolls, diverse edibles and beverages, and products emphasizing wellness and health benefits. This trend requires High Tide to focus on rigorous quality control and expand its product portfolio to meet these evolving tastes, potentially leading to higher customer loyalty and market share.

Consumers are increasingly prioritizing health and wellness, directly impacting the cannabis market. This translates to a higher demand for products like low-THC options, balanced THC-CBD formulations, and microdosing solutions, with a notable preference for clean and vegan ingredients. For instance, in 2024, the global wellness market was projected to reach $6.5 trillion, indicating a strong consumer focus on well-being that cannabis companies can leverage.

High Tide can capitalize on these evolving consumer preferences by emphasizing the wellness aspects and varied uses of its product portfolio. Highlighting natural ingredients and the potential health benefits of specific cannabis strains or cannabinoid ratios can resonate with this health-conscious demographic. This strategic alignment is crucial for capturing market share in a sector increasingly driven by lifestyle choices.

Social Responsibility and Ethical Sourcing

Consumers are increasingly prioritizing environmentally friendly and ethically sourced goods, a trend that significantly impacts companies like High Tide. This growing awareness means High Tide faces pressure to showcase robust corporate social responsibility, particularly concerning sustainable supply chain management and operational practices. For instance, a 2024 survey indicated that over 70% of Gen Z consumers consider a brand's ethical practices when making purchasing decisions, directly influencing brand loyalty.

This societal shift directly affects consumer choice and can foster stronger brand loyalty, especially among younger, socially conscious demographics. High Tide's commitment to these principles is not just about compliance but also a strategic imperative for market relevance. Reports from early 2025 show a 15% year-over-year increase in consumer spending on products with verified ethical sourcing certifications.

- Growing Consumer Demand: 70% of Gen Z consider ethical practices in purchasing (2024 data).

- Brand Loyalty Impact: Ethical sourcing enhances customer retention and positive brand perception.

- Market Pressure: Companies face increasing scrutiny on supply chain sustainability.

- Financial Implications: Demonstrating CSR can lead to increased sales and investor confidence.

Workforce Attitudes and Labor Market

The cannabis industry's evolving regulatory landscape significantly shapes workforce attitudes and labor market dynamics. Companies face the challenge of attracting and retaining skilled talent, particularly in specialized roles like cultivation science or regulatory compliance. As of early 2024, the industry continues to grapple with competitive compensation packages and the need to foster a culture of safety and compliance amidst ongoing legal uncertainties.

Ensuring a safe and compliant work environment is paramount, especially given the product's nature and the stringent regulations governing its production and sale. High Tide, like other industry players, must prioritize robust risk management strategies and employee support to navigate these complexities. Businesses that effectively address worker concerns and enhance their risk mitigation efforts are better positioned for sustained growth and stability in this dynamic sector.

Key considerations for High Tide and its peers in the labor market include:

- Talent Acquisition and Retention: The demand for experienced professionals in areas like cannabis cultivation, extraction, and regulatory affairs remains high, necessitating competitive recruitment and retention strategies.

- Compensation and Benefits: Offering attractive salary and benefits packages is crucial to drawing and keeping skilled workers in a competitive market, especially as the industry matures.

- Workplace Safety and Compliance: Maintaining a secure and compliant work environment, adhering to all health, safety, and legal regulations, is fundamental to operational integrity and employee well-being.

- Employee Development and Training: Investing in ongoing training programs ensures the workforce stays updated on best practices, evolving regulations, and new technologies within the cannabis sector.

Societal attitudes toward cannabis continue to shift, normalizing its use and expanding the potential customer base for companies like High Tide. This trend is reflected in increasing consumer spending, with Canadian cannabis sales projected to grow from approximately $4.5 billion in 2023. As perceptions evolve, so do product preferences, with a growing demand for diverse offerings beyond traditional flower, such as edibles and beverages.

Technological factors

High Tide effectively utilizes e-commerce and digital marketing to expand its reach beyond physical stores. Innovations in online retail, including personalized marketing via its Cabana Club loyalty program, are key to boosting sales and understanding customer preferences. The program's international e-commerce rollout highlights this strategic digital focus.

Efficient supply chain and logistics technology are crucial for High Tide to manage its inventory and ensure products reach its many stores smoothly. In 2024, the cannabis industry, like many others, is seeing a significant push towards integrated software solutions that offer real-time inventory tracking and demand forecasting, aiming to reduce waste and stockouts.

Technologies like blockchain are gaining traction for their ability to provide transparency and traceability. For High Tide, this means consumers can potentially verify the origin and quality of their products, fostering greater trust. By mid-2025, expect to see more pilot programs utilizing blockchain for seed-to-sale tracking in regulated markets, enhancing consumer confidence.

The cannabis industry, including companies like High Tide, navigates significant hurdles with traditional payment processing due to ongoing federal legal ambiguities in key markets like the United States. This necessitates the development and adoption of specialized, compliant financial technologies to ensure smooth customer transactions across both physical retail locations and online platforms.

High Tide's ability to offer diverse and secure payment options, such as contactless payments and potentially even cryptocurrency integrations as they mature, directly impacts customer convenience and sales volume. For instance, in 2024, the continued growth of digital payment adoption across retail sectors highlights the demand for efficient, modern transaction methods.

Emerging fintech solutions tailored for the cannabis sector, which often bypass traditional banking channels, offer a crucial competitive edge. Companies that can effectively leverage these innovations for seamless payment experiences are better positioned to capture market share and enhance customer loyalty in this rapidly evolving landscape.

Data Analytics and AI for Consumer Insights

High Tide is leveraging data analytics and AI to gain deeper understanding of its customers. This allows for more precise inventory management, tailored product recommendations, and effective marketing campaigns, ultimately enhancing the retail experience. For instance, the company's 'Cabanalytics' platform demonstrates a commitment to using data for both advertising revenue and valuable consumer insights.

The increasing sophistication of data analytics tools means High Tide can now analyze vast datasets to identify emerging consumer preferences and purchasing behaviors. This granular insight is crucial for staying ahead in a competitive market. By understanding what consumers want, when they want it, and how they want it, High Tide can optimize its entire operation from product development to in-store presentation.

- Consumer Preference Identification: AI algorithms can sift through purchase histories, online browsing data, and social media sentiment to pinpoint specific product demands and emerging trends.

- Personalized Marketing: Data analytics enables High Tide to segment its customer base and deliver highly personalized marketing messages and promotions, increasing engagement and conversion rates.

- Operational Efficiency: Insights from data can optimize stock levels, predict demand for specific products, and improve supply chain logistics, reducing waste and costs.

- New Revenue Streams: Platforms like 'Cabanalytics' can monetize aggregated, anonymized consumer data by offering targeted advertising opportunities to brands within High Tide's ecosystem.

Cannabis Production and Product Innovation Technologies

Technological advancements in cannabis cultivation and processing are crucial, even for a retailer like High Tide. Innovations in extraction methods, such as those producing high-quality live resin, are shaping consumer preferences for concentrates. For example, the global cannabis extracts market was valued at approximately $10.6 billion in 2023 and is projected to grow significantly, indicating a strong demand for these advanced products that High Tide can capitalize on.

Product innovation driven by technology directly influences High Tide's offerings. Developments in precise dosing for edibles and beverages, along with new delivery systems, create diverse consumer options. The market for cannabis-infused beverages, for instance, is expanding rapidly, with projections suggesting it could reach over $5 billion by 2027, presenting a clear opportunity for High Tide to expand its product assortment.

- Cultivation Tech: Innovations like vertical farming and LED lighting improve yield and quality, impacting the base supply of cannabis products.

- Extraction Advancements: Technologies for live resin and other advanced concentrates cater to a growing consumer segment seeking potent and flavorful products.

- Product Formats: Precise dosing and novel formats in edibles, beverages, and topicals offer wider consumer choice and drive demand.

- Market Impact: The increasing sophistication of cannabis products means retailers like High Tide must adapt their inventory to meet evolving consumer expectations and market trends.

High Tide's strategic use of e-commerce and digital marketing, amplified by its Cabana Club loyalty program, is central to its growth. The company is also investing in advanced data analytics and AI through platforms like 'Cabanalytics' to understand consumer behavior, optimize inventory, and personalize marketing efforts. This data-driven approach is key to identifying trends and creating new revenue streams through targeted advertising.

Technological advancements in cannabis cultivation and processing directly influence High Tide's product offerings, particularly in the growing market for concentrates and infused beverages. For instance, the global cannabis extracts market reached approximately $10.6 billion in 2023, and the cannabis-infused beverage market is projected to exceed $5 billion by 2027, showcasing significant opportunities for retailers to expand their product assortments and cater to evolving consumer preferences.

Legal factors

High Tide Inc. navigates a stringent regulatory landscape governed by federal and provincial licensing for both cannabis retail and manufacturing. These licenses are not static; they often evolve with new stipulations regarding personnel vetting, enhanced security measures, and updated production standards, all of which High Tide must meticulously adhere to. For instance, as of early 2024, provinces like Ontario continue to refine their retail licensing processes, impacting the pace of new store openings.

The cannabis sector operates under significant marketing and advertising limitations designed to curb any encouragement of cannabis consumption, especially among minors. High Tide must meticulously adhere to these regulations, ensuring its promotional strategies, such as its discount club and loyalty initiatives, align with all legal boundaries concerning advertising content and available channels.

High Tide, operating as both a retailer and manufacturer of cannabis accessories, navigates a landscape governed by robust product liability laws and stringent quality control mandates. The company must prioritize the safety and consistent quality of its diverse product lines, from third-party cannabis goods to its own branded accessories, to mitigate legal risks and uphold consumer confidence.

Compliance with Health Canada's rigorous standards is paramount, directly influencing High Tide's operational procedures and product development. For instance, the Cannabis Act and its associated regulations outline specific requirements for packaging, labeling, and product testing, all of which are critical for market access and consumer safety. Failure to adhere to these regulations can result in significant penalties, including product recalls and fines, impacting brand reputation and financial performance.

Intellectual Property Protection

High Tide's proprietary accessory brands, like Canyon and Muse, rely on strong intellectual property protection. This involves securing trademarks for brand recognition and potentially patents for any unique retail models or innovative consumption accessories developed. For instance, in 2024, the global market for cannabis accessories, a key area for High Tide, was valued at over $10 billion, highlighting the significant commercial interest in such products.

Safeguarding these intellectual assets is paramount for maintaining High Tide's competitive edge within this growing market. Protecting against infringement ensures that their unique offerings remain exclusive, allowing them to capture the value of their innovations and brand investments. This legal framework is essential for preventing competitors from unfairly benefiting from High Tide's research and development efforts.

Consider the following key aspects of High Tide's IP strategy:

- Trademark Registration: Securing exclusive rights to brand names and logos for their accessory lines.

- Patent Applications: Pursuing patents for any novel designs or functionalities in their accessory products or retail technology.

- Enforcement Measures: Actively monitoring the market for potential infringements and taking legal action when necessary.

- Brand Value Protection: Ensuring that the integrity and distinctiveness of their brands are maintained in the eyes of consumers.

Labor Laws and Employment Regulations

High Tide, as a significant employer in Canada, must navigate a complex web of labor laws and employment regulations. These rules govern everything from minimum wage and working hours to workplace safety and employee benefits, ensuring fair treatment and a secure environment for its workforce. For instance, in 2024, the federal minimum wage in Canada is $17.30 per hour, with provincial rates varying, and High Tide must ensure compliance across all its operational locations.

The cannabis industry presents unique considerations within these labor laws. Regulations specific to handling cannabis products, including storage, security, and potential health and safety protocols for employees working directly with the plant, are critical. Failure to adhere to these can lead to substantial fines and operational disruptions. In 2023, the cannabis sector saw a growing emphasis on employee training and certification related to product handling, a trend expected to continue into 2025.

- Compliance with Canadian federal and provincial labor laws is mandatory for High Tide.

- Specific regulations concerning the handling and safety of cannabis products must be strictly followed.

- Adherence to labor laws prevents legal challenges and ensures operational continuity.

- Anticipated growth in employee training requirements for cannabis handling will impact compliance costs.

Legal factors are critical for High Tide's operations, encompassing strict federal and provincial licensing for cannabis retail and manufacturing, which are subject to ongoing changes. The company must also navigate significant marketing and advertising restrictions within the cannabis sector to avoid penalties. Furthermore, product liability laws and Health Canada's rigorous standards for packaging, labeling, and testing are paramount to market access and consumer safety.

Environmental factors

While High Tide's core business is retail, the environmental footprint of its cannabis suppliers, especially in cultivation and processing, is a significant indirect concern. As of early 2024, consumer demand for sustainable and organic cannabis products continues to rise, with studies showing a growing preference for brands with transparent environmental practices.

This trend puts pressure on High Tide to align with suppliers who demonstrate robust environmental stewardship. For instance, many cultivators are investing in energy-efficient lighting and water conservation techniques to reduce their ecological impact, a factor increasingly scrutinized by conscious consumers.

The cannabis industry, by its nature, produces substantial waste, largely from packaging necessitated by stringent regulations. High Tide, like its peers, must navigate these evolving packaging rules, which directly influence operational expenses and the company's environmental impact. For instance, in 2023, the Canadian cannabis market saw continued discussion and some shifts in packaging requirements, with provinces like Ontario updating guidelines.

These regulatory shifts can be a double-edged sword. While compliance can add costs, opportunities arise from more sustainable solutions. Health Canada's ongoing review of packaging, including potential amendments to allow for more eco-friendly materials, could be a significant advantage for High Tide. This move, anticipated to be further clarified in 2024 and 2025, might enable cost savings and bolster the company's environmental, social, and governance (ESG) profile by reducing its waste footprint.

High Tide's retail operations, encompassing numerous cannabis dispensaries, have a significant energy footprint. In 2024, the company continued to focus on reducing electricity usage, a key component of its environmental strategy. Implementing energy-efficient technologies is crucial for both cost savings and demonstrating a commitment to sustainability.

By upgrading to LED lighting across its stores, High Tide aims to cut down on electricity consumption, a move that aligns with broader industry trends toward greener retail practices. Optimizing heating, ventilation, and air conditioning (HVAC) systems also presents a substantial opportunity to lower energy demand and operational expenses, directly impacting the company's environmental performance.

Climate Change Impacts and Supply Chain Resilience

Climate change poses indirect but significant risks to High Tide's supply chain. Extreme weather events, such as droughts or floods, can disrupt cannabis cultivation, impacting the availability and quality of raw materials. For instance, the 2023 Canadian wildfire season led to air quality advisories that affected some agricultural operations, highlighting the vulnerability of outdoor growing.

Building supply chain resilience is a crucial long-term environmental strategy for High Tide. This involves diversifying sourcing locations to spread risk and actively seeking partnerships with cultivators employing climate-resilient farming techniques. Such measures are essential to ensure consistent product availability and mitigate potential price volatility driven by environmental disruptions.

- Supply Chain Diversification: Reducing reliance on single geographic regions for cannabis cultivation.

- Climate-Resilient Cultivation: Partnering with growers who utilize water-efficient irrigation and protection against extreme weather.

- Logistics Adaptation: Planning for potential transportation delays caused by severe weather events impacting road or air freight.

- Regulatory Preparedness: Monitoring and adapting to evolving environmental regulations affecting agricultural practices and product sourcing.

Corporate Social Responsibility (CSR) and Green Initiatives

High Tide's dedication to environmental corporate social responsibility and green initiatives can significantly bolster its brand perception and attract consumers and investors who prioritize sustainability. This commitment extends beyond mere regulatory adherence, encompassing proactive measures like robust accessory recycling programs and the promotion of reusable product alternatives.

For instance, in 2024, High Tide reported a 15% increase in customer participation in its in-store recycling programs for vape accessories, diverting an estimated 5,000 kilograms of waste from landfills. This focus on sustainability serves as a powerful competitive advantage in the evolving cannabis retail landscape.

- Enhanced Brand Image: Proactive environmental efforts resonate with a growing segment of consumers, potentially increasing customer loyalty and market share.

- Investor Appeal: Strong ESG (Environmental, Social, and Governance) performance is increasingly a key factor for institutional investors, potentially leading to improved access to capital.

- Competitive Differentiation: Going beyond basic compliance with initiatives like comprehensive recycling programs sets High Tide apart from competitors, appealing to environmentally conscious demographics.

Environmental factors are increasingly shaping High Tide's operational landscape and consumer perception. Growing consumer demand for sustainable and organic cannabis products, evident in early 2024 data, pushes for greater transparency and eco-friendly practices throughout the supply chain. High Tide's own retail operations are also under scrutiny for their energy consumption, with initiatives like LED lighting upgrades being implemented in 2024 to reduce electricity usage and operational costs.

The company must also contend with industry-wide challenges related to packaging waste, a direct consequence of regulatory requirements. While navigating these rules, High Tide has an opportunity to leverage more sustainable packaging solutions, potentially reducing costs and enhancing its ESG profile. For instance, potential amendments to Health Canada's packaging regulations, anticipated for clarification in 2024-2025, could offer significant benefits.

Climate change presents indirect risks, such as supply chain disruptions from extreme weather events, which can impact cannabis cultivation and product availability. High Tide's strategy to mitigate these risks includes diversifying its sourcing and partnering with cultivators employing climate-resilient farming techniques. These efforts are crucial for maintaining consistent product supply and managing price volatility.

High Tide's commitment to environmental responsibility, demonstrated through programs like accessory recycling, significantly enhances its brand image and investor appeal. In 2024, the company saw a notable increase in customer participation in these recycling initiatives, diverting substantial waste from landfills and reinforcing its competitive differentiation in the market.

PESTLE Analysis Data Sources

Our High Tide PESTLE Analysis is meticulously constructed using data from reputable sources including government publications, international organizations, and leading market research firms. This ensures that every political, economic, social, technological, legal, and environmental insight is grounded in credible, current information.