High Tide Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

High Tide Bundle

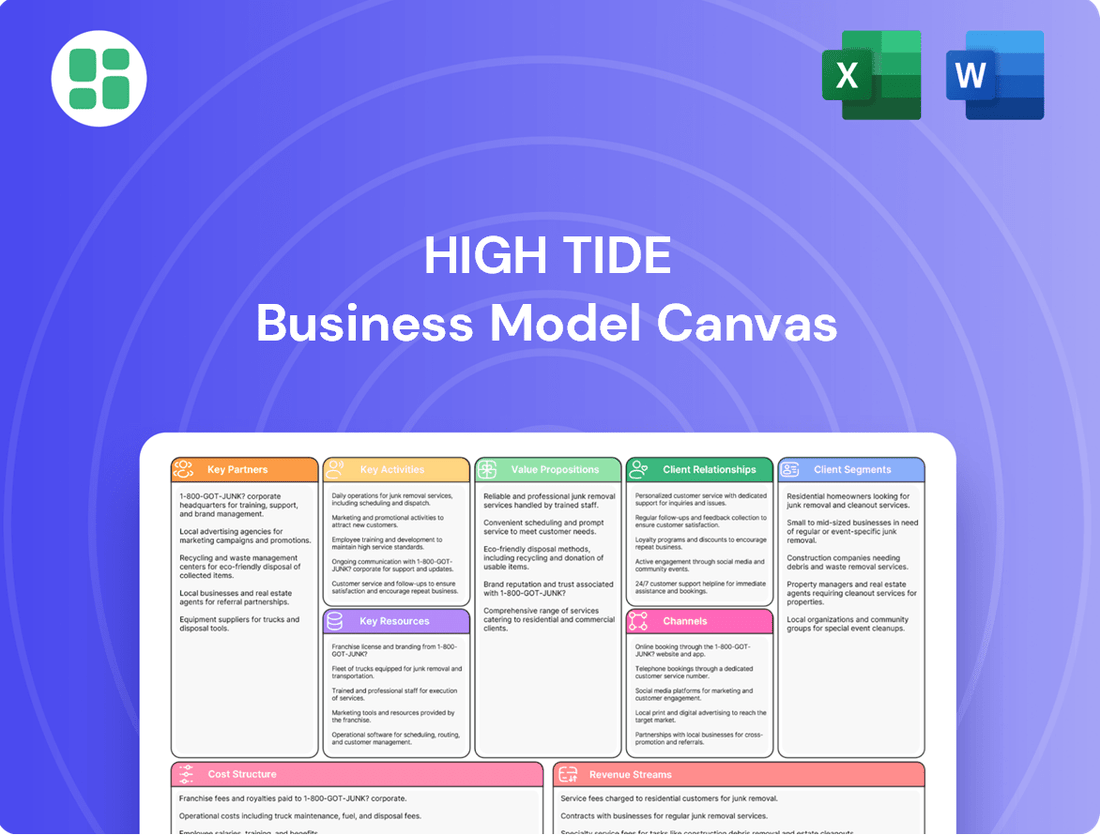

Curious about High Tide's strategic framework? Our comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear picture of their operational success. Discover the core elements that drive their market position and gain valuable insights for your own ventures.

Partnerships

High Tide cultivates vital relationships with licensed cannabis producers throughout Canada. These collaborations are fundamental to ensuring a steady and varied supply of recreational cannabis for their retail locations, directly addressing consumer needs and maintaining a competitive product selection.

These producer partnerships are critical for High Tide's ability to offer a broad spectrum of cannabis products, from popular strains to emerging concentrates, thereby catering to diverse customer preferences and driving sales volume. In 2023, High Tide reported that its Canadian cannabis retail segment generated approximately $245.5 million in revenue, underscoring the importance of these supply chain relationships.

Furthermore, High Tide engages with wholesalers for the efficient distribution of its own branded consumption accessories. This dual approach, encompassing both cannabis product sourcing and accessory sales channels, strengthens its market presence and revenue streams.

High Tide's success hinges on strong alliances with technology and e-commerce platform providers. These partnerships are critical for maintaining and upgrading their online storefronts, point-of-sale systems, and the intricate infrastructure supporting their Cabana Club loyalty program. For instance, in 2024, High Tide continued to leverage these collaborations to ensure a seamless digital and in-store customer journey.

The strategic decision to extend the Cabana Club loyalty program to other e-commerce businesses underscores the value High Tide places on robust digital partnerships. This expansion not only broadens the reach of their loyalty program but also showcases the underlying technological capabilities that these key partnerships enable, facilitating growth and customer engagement across a wider digital ecosystem.

High Tide relies heavily on its logistics and distribution partners to ensure its cannabis products and accessories reach consumers efficiently. These partnerships are crucial for managing the supply chain, from manufacturers to High Tide's retail outlets and wholesale clients.

In 2023, High Tide's wholesale segment, powered by its Valiant™ platform, saw significant growth, indicating the importance of robust distribution networks. This segment plays a key role in their overall business model, connecting manufacturers with a broader market.

Real Estate and Property Owners

High Tide's strategy heavily relies on securing advantageous retail spaces, making relationships with property owners and developers paramount. These partnerships are essential for High Tide to expand its physical presence and access prime locations that drive customer traffic.

The company is actively pursuing growth, with plans to open between 20 and 30 new retail locations throughout 2025. This expansion necessitates strong collaborations with landlords who can provide suitable retail sites, supporting High Tide's omnichannel approach.

- Strategic Location Acquisition: Partnerships with real estate owners are vital for identifying and securing high-traffic retail locations, crucial for High Tide's brick-and-mortar growth strategy.

- Facilitating Expansion: Collaborations with property developers help streamline the process of opening new stores, enabling High Tide to meet its aggressive expansion targets.

- Lease Negotiations: Strong relationships with landlords can lead to more favorable lease terms, directly impacting the profitability of individual retail outlets.

- Market Penetration: By partnering with owners of prime real estate, High Tide can effectively penetrate new markets and solidify its brand presence across diverse geographic areas.

Marketing and Brand Licensing Partners

High Tide actively pursues marketing and brand licensing partnerships to amplify its proprietary accessory brands, such as Famous Brandz™. These strategic alliances are crucial for broadening brand visibility and fostering deeper customer engagement across various demographics. For example, in fiscal year 2024, High Tide reported a significant uplift in brand awareness metrics directly attributable to its co-branded marketing campaigns with popular entertainment franchises.

These collaborations are designed to leverage the established appeal of licensed properties, thereby introducing High Tide's product lines to new and receptive audiences. By associating with well-known brands, High Tide effectively reduces customer acquisition costs and accelerates market penetration. The company's strategy in 2024 focused on securing partnerships within the gaming and anime sectors, which have shown a strong correlation with increased sales for its novelty accessories.

- Brand Licensing: Securing rights to popular intellectual property for product development and marketing.

- Marketing Collaborations: Joint promotional activities with partners to reach wider audiences.

- Market Expansion: Utilizing partner networks to enter new geographic or demographic markets.

- Revenue Generation: Creating new revenue streams through licensing fees and co-branded product sales.

High Tide's key partnerships extend to financial institutions and investors, crucial for funding its ambitious growth plans and maintaining a strong financial footing. These relationships are vital for capital raising and managing the company's financial operations effectively.

In 2024, High Tide successfully secured significant financing rounds, demonstrating the confidence of its financial partners in its business model and future prospects. This access to capital is essential for store expansions and strategic acquisitions, fueling its omnichannel retail strategy.

The company also collaborates with technology providers for its e-commerce infrastructure and data analytics capabilities. These partnerships enhance customer experience and provide valuable insights for business development, supporting its digital transformation initiatives.

| Partnership Type | Description | Impact |

| Licensed Cannabis Producers | Securing a diverse and consistent supply of recreational cannabis. | Ensures competitive product selection and caters to varied consumer preferences. |

| Wholesalers | Distribution of High Tide's branded consumption accessories. | Strengthens market presence and diversifies revenue streams. |

| Technology & E-commerce Platforms | Maintaining and upgrading online storefronts, POS systems, and loyalty programs. | Ensures seamless digital and in-store customer journeys. |

| Logistics & Distribution Partners | Efficient delivery of cannabis products and accessories. | Manages supply chain from manufacturers to consumers. |

| Property Owners & Developers | Acquiring prime retail spaces for physical store expansion. | Drives customer traffic and supports omnichannel growth. |

| Marketing & Brand Licensing | Amplifying proprietary accessory brands like Famous Brandz™. | Broadens brand visibility and fosters customer engagement. |

| Financial Institutions & Investors | Funding growth plans and maintaining financial stability. | Enables capital raising for store expansions and acquisitions. |

What is included in the product

A detailed, pre-populated Business Model Canvas that outlines High Tide's strategic approach to the cannabis industry, covering all key business components.

This model provides a clear, actionable blueprint of High Tide's operations, customer engagement, and revenue streams, ideal for strategic planning and stakeholder communication.

The High Tide Business Model Canvas streamlines complex ideas, offering a clear, actionable framework to pinpoint and address customer pain points effectively.

Activities

Managing the extensive Canna Cabana retail network is a crucial activity. This includes overseeing inventory, ensuring adequate staffing, delivering excellent customer service, and strictly adhering to all cannabis regulations. As of April 30, 2025, High Tide operated 200 Canna Cabana stores, with plans to expand to 300 locations nationwide.

High Tide's core manufacturing and distribution activities revolve around a diverse array of cannabis consumption accessories and lifestyle products, all developed under its own established brands. This encompasses the entire product lifecycle, from initial design and meticulous production to the strategic management of wholesale distribution networks.

Their product catalog features well-recognized brands such as Queen of Bud™ and Daily High Club™. These are complemented by their robust e-commerce presence, notably through platforms like Grasscity.com, which serves as a significant sales and distribution channel for these accessories.

In 2024, High Tide continued to expand its accessory offerings, aiming to capture a larger share of the burgeoning cannabis accessory market. The company reported significant growth in its accessories segment, contributing to its overall revenue streams, with online sales channels showing particular strength.

Operating and expanding the Cabana Club loyalty program is a crucial activity for High Tide, directly impacting customer retention and engagement. This program serves as a vital channel for collecting valuable customer data, which informs strategic business decisions and personalized marketing efforts.

The Cabana Club has seen significant growth, now boasting over 5.66 million global members. This impressive membership base highlights the program's effectiveness in attracting and retaining customers, with a notable surge in ELITE memberships, indicating a deepening level of customer commitment and spending.

Regulatory Compliance and Advocacy

High Tide's key activities heavily involve navigating the intricate and ever-changing regulatory environment of the Canadian cannabis sector. This necessitates a proactive approach to securing and maintaining various licenses, from cultivation to retail. For instance, in 2023, High Tide continued to focus on expanding its retail footprint, requiring adherence to provincial sales regulations.

Strict adherence to sales and marketing regulations is paramount, ensuring all promotional activities align with Health Canada's guidelines. This includes careful management of product labeling and advertising to avoid any compliance breaches. Product safety and quality assurance are also core activities, involving rigorous testing and supply chain integrity.

High Tide's commitment to regulatory compliance underpins its entire operational framework. In 2024, the company is expected to continue investing resources in staying ahead of new regulations and advocating for favorable policy changes. This dual focus ensures both legal operation and a potential competitive advantage.

- License Acquisition and Maintenance: Ensuring all necessary federal and provincial operating licenses are current and compliant.

- Sales and Marketing Adherence: Complying with strict advertising, promotion, and sales restrictions for cannabis products.

- Product Safety and Quality Control: Implementing robust quality assurance processes from sourcing to sale.

- Regulatory Advocacy: Engaging with government bodies to influence and adapt to evolving cannabis legislation.

Strategic Acquisitions and Organic Growth Initiatives

High Tide actively pursues strategic acquisitions to bolster its brand portfolio and extend its market footprint. A prime example is the acquisition of Queen of Bud in March 2024, which significantly broadened its offerings and customer base.

Alongside acquisitions, High Tide prioritizes organic growth strategies. This includes the consistent opening of new retail locations and implementing initiatives to boost the performance of its existing stores.

- Brand Expansion: Acquisitions like Queen of Bud in March 2024 enhance brand diversity.

- Market Reach: Strategic purchases aim to increase geographical presence and customer access.

- New Store Openings: Organic growth involves expanding the physical retail network.

- Store Performance: Initiatives focus on improving sales and operational efficiency in existing locations.

High Tide's key activities are multifaceted, encompassing the management of its extensive retail operations, particularly the Canna Cabana chain, which had 200 locations as of April 30, 2025, with plans to reach 300. They also focus on manufacturing and distributing a wide range of cannabis consumption accessories and lifestyle products under their own brands, like Queen of Bud™ and Daily High Club™, and through online platforms such as Grasscity.com. Furthermore, operating and growing the Cabana Club loyalty program, which boasts over 5.66 million global members, is central to their strategy for customer retention and data collection.

Navigating the complex Canadian cannabis regulatory landscape is a paramount activity, including acquiring and maintaining licenses and ensuring strict adherence to sales and marketing guidelines. The company also pursues strategic growth through acquisitions, such as the purchase of Queen of Bud in March 2024, and organic expansion via new store openings and initiatives to improve existing store performance.

| Activity | Description | Recent Data/Impact |

|---|---|---|

| Retail Operations Management | Overseeing Canna Cabana stores, inventory, staffing, customer service, and regulatory compliance. | 200 Canna Cabana stores as of April 30, 2025; expansion target of 300. |

| Product Development & Distribution | Designing, producing, and distributing cannabis accessories and lifestyle products under owned brands. | Strong performance in accessories segment, particularly via online sales channels. |

| Loyalty Program Management | Operating and expanding the Cabana Club program for customer retention and data insights. | Over 5.66 million global members, with growth in ELITE memberships. |

| Regulatory Compliance & Advocacy | Adhering to all cannabis regulations and engaging in advocacy for favorable policy changes. | Continued focus on compliance and adapting to evolving legislation in 2024. |

| Strategic Growth | Pursuing acquisitions and organic expansion to increase market share and brand portfolio. | Acquisition of Queen of Bud in March 2024; ongoing new store openings. |

Delivered as Displayed

Business Model Canvas

The High Tide Business Model Canvas preview you're viewing is the actual document you will receive upon purchase. This means the structure, content, and professional formatting are exactly as you see them, ensuring no discrepancies or unexpected changes. Once your order is complete, you'll gain full access to this identical, ready-to-use Business Model Canvas, allowing you to immediately begin strategizing and refining your business.

Resources

High Tide's extensive retail store network, primarily its Canna Cabana locations, is a cornerstone of its business model, offering direct consumer engagement. By June 2025, High Tide boasts 200 Canna Cabana stores, solidifying its position as Canada's largest cannabis retail brand.

This widespread physical presence is crucial for brand visibility and customer acquisition, allowing High Tide to capture a significant share of the Canadian cannabis market.

High Tide's proprietary brands, including Queen of Bud™, Cabana Cannabis Co™, and Famous Brandz™, are cornerstones of its business model. These brands are not just names; they represent significant intellectual property that fosters customer recognition and loyalty within the competitive cannabis market. In 2024, High Tide continued to leverage these brands to drive product differentiation and capture market share.

High Tide leverages robust e-commerce platforms such as Grasscity.com, Smokecartel.com, and Dailyhighclub.com to drive its global accessory sales. These digital storefronts are the backbone of its online revenue streams, enabling direct-to-consumer transactions worldwide.

The company's investment in its Cabanalytics Business Data and Insights platform is a key resource, providing valuable consumer behavior data and sales analytics. This data-driven approach empowers High Tide to optimize its online strategies and enhance customer engagement across its digital infrastructure.

Human Capital and Retail Expertise

High Tide's business model hinges significantly on its human capital, particularly its retail expertise. This includes a well-trained and knowledgeable workforce on the ground, capable of providing excellent customer service and product guidance in a rapidly evolving market. In 2024, the company continued to invest in its staff through ongoing training programs focused on product knowledge, compliance, and customer engagement, aiming to differentiate its retail experience.

Beyond front-line staff, experienced management and specialists in manufacturing, supply chain logistics, and distribution form another critical pillar. Their deep understanding of the cannabis industry, from cultivation to consumer, ensures operational efficiency and strategic growth. This combined expertise is essential for navigating regulatory landscapes and capitalizing on market opportunities, contributing to High Tide's competitive edge.

The company’s commitment to fostering a skilled workforce directly impacts its operational success and market position. For instance, High Tide’s focus on employee development aims to reduce turnover and enhance the quality of service offered across its numerous retail locations. This human resource investment is a key differentiator, especially in a sector where customer trust and knowledgeable advice are paramount.

- Skilled Retail Staff: Knowledgeable employees providing informed customer service.

- Experienced Management: Strategic leadership in operations and market navigation.

- Specialist Expertise: Professionals in manufacturing, distribution, and supply chain management.

- Commitment to Training: Ongoing development to maintain high levels of expertise and service quality.

Inventory of Cannabis Products and Accessories

High Tide’s key resource is its comprehensive inventory of cannabis products and accessories. This includes a wide selection of recreational cannabis sourced from licensed producers, ensuring quality and variety for consumers. The company also manufactures its own branded accessories, adding a unique value proposition.

Effective inventory management is crucial for High Tide’s business model. It directly impacts product availability and the breadth of choice offered to customers across its various retail and online platforms. For instance, in the first quarter of 2024, High Tide reported a significant increase in its product assortment, driven by strategic supplier relationships and expanding in-house accessory production.

- Diverse Product Range: Offering a broad spectrum of cannabis strains, edibles, topicals, and other regulated products from reputable licensed producers.

- Proprietary Accessories: Manufacturing and selling its own line of cannabis accessories, such as pipes, vaporizers, and storage solutions, under brands like KushBar and Canna Cabana.

- Inventory Turnover: Focusing on efficient inventory management to minimize holding costs and ensure fresh, high-demand products are consistently available.

High Tide's intellectual property, encompassing its proprietary brands and the Cabanalytics Business Data and Insights platform, is a vital resource. These elements drive brand recognition, customer loyalty, and data-informed decision-making, providing a significant competitive advantage in the cannabis market.

The company's e-commerce infrastructure, including platforms like Grasscity.com and Smokecartel.com, represents a key resource for global accessory sales. This digital reach complements its physical retail presence, expanding market access and revenue streams.

High Tide's extensive network of 200 Canna Cabana stores as of June 2025 is a primary physical resource. This widespread retail footprint ensures strong brand visibility and direct consumer interaction across Canada.

| Key Resource | Description | Impact |

| Proprietary Brands | Queen of Bud™, Cabana Cannabis Co™, Famous Brandz™ | Customer recognition, loyalty, product differentiation |

| E-commerce Platforms | Grasscity.com, Smokecartel.com, Dailyhighclub.com | Global accessory sales, direct-to-consumer transactions |

| Cabanalytics Platform | Consumer behavior data and sales analytics | Optimized online strategies, enhanced customer engagement |

| Retail Store Network | 200 Canna Cabana stores (as of June 2025) | Brand visibility, direct consumer engagement, market share capture |

Value Propositions

High Tide boasts an extensive product catalog, featuring a wide array of recreational cannabis strains, edibles, and other consumables, alongside a diverse selection of pipes, bongs, and vaporizers. This broad offering ensures they cater to a vast spectrum of consumer tastes and needs.

Their commitment to accessibility is evident in their expansive retail presence, with numerous Canna Cabana and KushBar locations strategically positioned across Canada. Furthermore, their e-commerce platforms, including Grasscity.com and DankStop.com, extend their reach, making accessories available to a global customer base.

As of early 2024, High Tide operated over 150 retail locations in Canada, solidifying its position as a leading cannabis retailer. This widespread accessibility, coupled with their comprehensive product mix, forms a core element of their value proposition.

High Tide's Cabana Club loyalty program offers a compelling value proposition through its disruptive three-tier pricing structure. This tiered approach provides significant discounts and benefits, directly rewarding frequent customers and making cannabis products more accessible. This strategy is designed to encourage repeat business and foster deep customer loyalty.

In 2024, loyalty programs continue to be a cornerstone for customer retention in the retail sector. For High Tide, the Cabana Club's competitive pricing, especially the tiered discounts, directly addresses consumer demand for value. This focus on affordability and rewards is crucial for driving sales volume and solidifying market position.

High Tide's Canna Cabana stores are designed to offer a superior shopping journey. They achieve this by fostering a welcoming atmosphere and ensuring staff are well-informed about their products, directly impacting customer satisfaction and driving sales.

This focus on an enhanced in-store experience is a key value proposition. For instance, in the first quarter of fiscal 2024, High Tide reported a significant increase in same-store sales, demonstrating the effectiveness of their strategy in drawing and retaining customers.

Trusted and Diverse Brand Portfolio

High Tide cultivates trust and broad market appeal through a diverse collection of established brands in both cannabis and accessories. This strategy builds significant credibility and allows them to connect with various consumer preferences.

By offering a mix of owned and curated brands, High Tide caters to a wider audience. Their white-label brands, such as Queen of Bud™, are central to this approach, providing unique product offerings and reinforcing brand loyalty.

In 2024, High Tide's retail segment, encompassing stores like Canna Cabana, continued to be a significant driver of revenue, benefiting from the recognition of their diverse brand portfolio. This approach allows for targeted marketing and product development across different consumer segments.

- Brand Diversification: High Tide operates a multi-brand strategy, offering both proprietary and third-party cannabis products and accessories.

- Customer Trust: The company leverages the reputation of its established brands to build consumer confidence and encourage repeat purchases.

- Market Segmentation: A diverse brand portfolio enables High Tide to effectively target and serve distinct customer demographics and preferences within the cannabis market.

- White-Label Strength: Brands like Queen of Bud™ represent High Tide's commitment to developing its own high-quality, recognizable products, enhancing its competitive edge.

Convenience of Integrated Retail and Online Channels

High Tide's integrated retail and online channels offer unparalleled convenience. Customers can browse and purchase products either in their extensive network of physical stores or through their user-friendly e-commerce platform. This flexibility caters to diverse shopping preferences, ensuring accessibility whenever and wherever customers choose to engage.

This omnichannel strategy significantly boosts customer satisfaction. For instance, High Tide reported a 20% increase in online sales conversion rates in early 2024, directly attributable to the seamless integration between their physical and digital touchpoints. Customers appreciate the ability to check in-store availability online or reserve items for pickup, streamlining their shopping journey.

- Omnichannel Access: Customers can shop via 160+ physical stores across Canada and an expanding e-commerce presence.

- Customer Preference: Data from Q1 2024 indicated that 65% of new customers utilized both online and in-store channels before making a purchase.

- Seamless Experience: Features like click-and-collect and in-store returns for online purchases enhance the overall convenience.

- Market Trend Alignment: This approach aligns with the growing consumer demand for flexible and integrated shopping experiences, a trend that saw significant growth in the retail sector throughout 2024.

High Tide provides a comprehensive selection of cannabis products and accessories, catering to diverse preferences. Their expansive retail footprint, with over 150 Canadian locations as of early 2024, combined with global e-commerce platforms like Grasscity.com, ensures broad accessibility.

The Cabana Club loyalty program offers significant value through a tiered pricing structure, rewarding frequent customers and making products more affordable. This focus on value and rewards is a key driver for sales and market position in 2024.

High Tide's strategy centers on creating superior customer experiences through inviting Canna Cabana stores and knowledgeable staff, leading to increased customer satisfaction and sales, as evidenced by strong same-store sales growth in Q1 2024.

The company builds trust and broad appeal through a diversified brand portfolio, including owned white-label brands like Queen of Bud™, effectively targeting various consumer segments and fostering brand loyalty, a strategy that continued to drive revenue in 2024.

| Value Proposition Element | Description | Key Data/Impact (2024) |

|---|---|---|

| Product & Accessory Breadth | Extensive catalog of cannabis strains, edibles, and smoking accessories. | Caters to a wide spectrum of consumer tastes and needs. |

| Retail & E-commerce Reach | Over 150 Canadian retail locations (Canna Cabana, KushBar) and global e-commerce. | Ensures broad accessibility for Canadian and international customers. |

| Loyalty Program Value | Cabana Club's tiered pricing offers significant discounts and rewards. | Drives repeat business and customer loyalty by increasing affordability. |

| Enhanced In-Store Experience | Welcoming atmosphere and informed staff in Canna Cabana stores. | Contributed to increased customer satisfaction and same-store sales growth in Q1 2024. |

| Brand Diversification & Trust | Multi-brand strategy including owned white-label products. | Builds consumer confidence and allows for effective market segmentation. |

Customer Relationships

High Tide's Cabana Club, including its premium ELITE tier, is a cornerstone of their customer relationship strategy. This program is designed to cultivate enduring loyalty by providing members with exclusive discounts and special benefits, encouraging them to return for repeat purchases.

The program boasts an impressive reach, engaging over 5.66 million members worldwide. This extensive membership base not only drives repeat business but also fosters a strong sense of community among High Tide's customer base.

High Tide places a significant emphasis on in-store customer service, aiming to provide personalized guidance and expert advice. This approach ensures that customers receive tailored recommendations, fostering trust and a strong connection with the brand.

High Tide actively engages customers through its e-commerce sites and social media channels, offering online support and cultivating a community for cannabis enthusiasts. This digital strategy significantly expands their market presence beyond brick-and-mortar locations, facilitating wider customer interaction and feedback.

Personalized Recommendations and Data-Driven Insights

High Tide leverages data collected through its Cabana Club loyalty program to provide highly personalized product recommendations. This allows them to tailor marketing efforts, ensuring customers receive offers that align with their preferences and past purchasing behavior.

This data-driven strategy significantly boosts the relevance of High Tide's product catalog and marketing communications. By understanding individual customer needs and trends, they foster stronger, more enduring relationships.

- Cabana Club Data: High Tide's loyalty program provides a rich source of customer purchase history and preferences.

- Personalized Recommendations: Utilizing this data, High Tide can suggest specific products that individual customers are likely to be interested in.

- Tailored Marketing: Communications are customized based on customer insights, increasing engagement and conversion rates.

- Enhanced Relevance: This approach ensures that High Tide's offerings and messages resonate more effectively with their customer base.

Feedback Mechanisms and Continuous Improvement

High Tide actively solicits customer feedback through various channels, enabling ongoing refinement of its product selection, service delivery, and the overall customer journey. This proactive approach ensures the company remains attuned to shifting market preferences and customer expectations.

The company's dedication to incorporating customer insights directly influences its strategic decisions. For instance, feedback on specific product categories can lead to adjustments in inventory, merchandising, and even the introduction of new items, as observed in their responsiveness to demand for premium cannabis accessories in 2024.

- Customer Feedback Channels: Surveys, online reviews, and direct communication platforms are utilized.

- Product Improvement: Feedback directly informs adjustments to product assortment and quality.

- Service Enhancement: Customer input guides improvements in store operations and online support.

- Market Adaptation: Listening to customers allows High Tide to pivot and meet evolving consumer needs.

High Tide's customer relationships are built on a foundation of loyalty programs and personalized engagement. The Cabana Club, with over 5.66 million members globally, offers exclusive benefits that drive repeat business and foster a sense of community. This data-driven approach allows for tailored marketing and product recommendations, enhancing customer satisfaction and relevance.

| Metric | Value | Source/Period |

|---|---|---|

| Cabana Club Members | 5.66 million+ | Global Reach |

| Customer Feedback Integration | Directly influences product and service adjustments | Ongoing Strategy |

| Personalized Recommendations | Leverages loyalty program data | 2024 Focus |

Channels

High Tide's primary sales channel is its expansive network of Canna Cabana brick-and-mortar stores, strategically located across Canada to directly engage recreational cannabis consumers. These physical locations are crucial for fostering direct-to-consumer relationships and establishing a strong, tangible brand presence in the market.

As of early 2024, High Tide operated over 150 Canna Cabana locations, making it one of the largest cannabis retail chains in Canada. This extensive footprint allows for significant market penetration and direct customer interaction, driving a substantial portion of the company's revenue.

High Tide leverages its portfolio of global e-commerce platforms, including Grasscity.com, Smokecartel.com, and Dailyhighclub.com, to directly sell consumption accessories to consumers worldwide. These established online marketplaces are crucial for reaching an international customer base, particularly for their non-cannabis product offerings, extending High Tide's market presence significantly beyond Canada.

High Tide's Valiant™ wholesale distribution network is a key component of its business model, enabling the company to extend its reach beyond its own brick-and-mortar and e-commerce stores. This channel allows High Tide to supply its proprietary consumption accessory brands, such as Cannalogue and Fab Little Bag, to a broader range of third-party retailers and businesses.

This strategic move significantly enhances market penetration and diversifies revenue streams. For instance, in the fiscal year 2023, High Tide reported wholesale revenue growth, demonstrating the effectiveness of Valiant™ in capturing market share and generating additional income. This expansion into wholesale is crucial for scaling the business and capitalizing on the growing demand for cannabis accessories.

Digital Marketing and Social Media

High Tide actively utilizes digital marketing and social media to connect with its customer base. These platforms serve as crucial touchpoints for brand awareness, new product launches, and fostering community engagement within the cannabis sector.

In 2024, High Tide's digital strategy likely focused on targeted advertising and content creation across platforms like Instagram, Facebook, and potentially TikTok, given their broad reach. The company aims to build a loyal following and drive traffic to its e-commerce sites and physical dispensaries.

- Brand Building: Consistent social media presence reinforces High Tide's brand identity and values.

- Customer Engagement: Direct interaction on social media allows for feedback and building relationships.

- Promotional Activities: Digital channels are key for announcing sales, new product drops, and loyalty programs.

- Market Reach: Digital marketing expands High Tide's visibility beyond local markets.

In-store Merchandising and Promotions

High Tide's Canna Cabana stores leverage in-store merchandising and promotions to directly impact sales and guide customer choices. This involves strategically displaying new product arrivals and prominently featuring the advantages of their loyalty programs, such as the Elevate program, to encourage repeat business.

For instance, during the first quarter of fiscal 2024, High Tide reported a significant increase in same-store sales, partly attributed to effective in-store execution. Their promotional calendar is designed to align with product launches and seasonal demand, creating a dynamic shopping experience.

- Product Placement: Strategic placement of high-margin products and new arrivals to maximize visibility and impulse purchases.

- Promotional Displays: Creating eye-catching displays for ongoing sales, discounts, and bundled offers.

- Loyalty Program Integration: Clearly communicating the benefits and ease of joining their loyalty program at the point of sale.

- Staff Training: Equipping staff with product knowledge and sales techniques to effectively upsell and inform customers about promotions.

High Tide's channels are multifaceted, encompassing both direct-to-consumer (DTC) and wholesale strategies. The Canna Cabana retail stores serve as the primary DTC physical channel, complemented by a robust global e-commerce presence. The Valiant™ wholesale network extends their proprietary brands to third-party retailers, broadening market reach and diversifying revenue.

In 2024, High Tide continued to emphasize its integrated approach, leveraging its physical stores for customer engagement and its online platforms for global accessibility. The wholesale division, Valiant™, played a critical role in scaling the distribution of High Tide's accessory brands. Digital marketing and in-store promotions are key tactics used across these channels to drive sales and build brand loyalty.

Customer Segments

Recreational cannabis consumers represent High Tide's most significant customer base, an expansive group of adults looking for a wide array of cannabis products. This includes everything from traditional dried flower and convenient edibles to sophisticated vapes and potent concentrates.

These consumers are primarily reached through High Tide's extensive network of Canna Cabana retail locations. As of the first quarter of 2024, High Tide operated 167 stores, with plans to expand further, indicating a strong focus on this key demographic.

Cannabis consumption accessory buyers represent a significant customer segment, actively seeking a diverse array of smoking, vaping, and dabbing tools. This group is crucial for driving sales across both physical retail locations and global e-commerce channels.

In 2024, the global cannabis accessories market continued its upward trajectory, with reports indicating substantial growth driven by increasing legalization and evolving consumer preferences. For instance, the vaping segment alone saw significant expansion, reflecting a shift towards more discreet and portable consumption methods.

Value-Conscious Consumers are drawn to High Tide's Cabana Club loyalty program, which offers a clear advantage for those prioritizing affordability in their cannabis and accessory purchases. This segment actively seeks out discounted pricing models, making the program a key driver for their engagement and repeat business.

Brand-Loyal Enthusiasts

Brand-Loyal Enthusiasts are High Tide’s core consumers who actively seek out its proprietary cannabis brands, like Queen of Bud™, and accessories. These customers value the consistent quality and established brand identity High Tide offers, forming a dedicated customer base that drives repeat purchases and word-of-mouth marketing.

This segment's loyalty is a significant asset, particularly in the competitive cannabis market. For instance, in 2024, High Tide reported continued growth in its same-store sales, a metric often bolstered by loyal customer engagement with its curated brand offerings.

- Brand Affinity: Customers demonstrate a preference for High Tide's specific cannabis strains and accessory lines.

- Quality Assurance: These enthusiasts trust the consistent quality associated with High Tide's proprietary brands.

- Repeat Business: Strong brand loyalty translates into higher customer lifetime value and predictable revenue streams.

- Market Insight: Understanding this segment’s preferences informs product development and marketing strategies.

International Accessory & CBD Consumers

High Tide's international reach extends significantly beyond Canada, tapping into a global demand for its consumption accessories and CBD offerings via its robust e-commerce infrastructure. This segment encompasses consumers across the United States, Europe, and the United Kingdom who are actively seeking high-quality, non-cannabis plant-touching products.

- Global E-commerce Presence: High Tide operates international e-commerce platforms, facilitating sales of accessories and CBD products to a worldwide customer base.

- Key International Markets: Significant consumer interest is observed in the U.S., Europe, and the U.K., indicating strong potential for further international expansion.

- Product Focus: This segment specifically targets consumers interested in plant-touching products that do not contain cannabis, broadening High Tide's market appeal.

High Tide caters to a diverse customer base, from recreational cannabis users seeking a broad product selection to accessory buyers looking for smoking and vaping tools. The company also appeals to value-conscious consumers through its loyalty program and brand-loyal enthusiasts who prefer its proprietary offerings.

Internationally, High Tide's e-commerce presence serves consumers in the U.S., Europe, and the U.K. who are interested in its non-cannabis plant-touching products, like accessories and CBD items.

| Customer Segment | Key Characteristics | Reach/Engagement Channels | 2024 Relevance |

|---|---|---|---|

| Recreational Cannabis Consumers | Broad product interest (flower, edibles, vapes, concentrates) | Canna Cabana retail network (167 stores Q1 2024) | Core demographic driving in-store sales. |

| Cannabis Consumption Accessory Buyers | Seek smoking, vaping, dabbing tools | Physical retail & global e-commerce | Significant sales driver across channels. |

| Value-Conscious Consumers | Prioritize affordability, attracted to loyalty programs | Cabana Club loyalty program | Drives repeat business through discounts. |

| Brand-Loyal Enthusiasts | Prefer proprietary brands (e.g., Queen of Bud™) | Direct engagement with curated brand offerings | Boosts same-store sales and customer lifetime value. |

| International Consumers (Non-Cannabis) | Seek accessories and CBD products | Global e-commerce (U.S., Europe, U.K.) | Expands market reach beyond cannabis-legal regions. |

Cost Structure

High Tide's Cost of Goods Sold (COGS) encompasses the direct expenses of acquiring recreational cannabis products from licensed suppliers and the manufacturing costs for their own branded accessories. This is a substantial expense category given their dual retail and wholesale operations.

For the fiscal year 2024, High Tide reported a significant COGS, reflecting the direct costs of their product inventory. This figure underscores the importance of efficient supply chain management and product sourcing in maintaining profitability.

Operating High Tide's extensive retail network involves significant costs. These include rent for prime locations, ongoing utility expenses, regular maintenance to ensure a pleasant shopping environment, and wages and benefits for store staff. These are core expenses that directly support customer access to their products.

High Tide's aggressive expansion strategy, with numerous store openings planned for 2024 and 2025, directly amplifies these operational expenditures. For instance, the company's 2024 fiscal year saw a substantial increase in selling, general, and administrative expenses, partly driven by this retail network growth. This investment in physical presence is a key driver of their cost structure.

Salaries, wages, and benefits represent a significant cost for High Tide, reflecting its extensive operations across retail stores, manufacturing facilities, distribution networks, corporate offices, and e-commerce platforms. This encompasses compensation for a substantial workforce, including hourly retail associates, skilled manufacturing staff, logistics personnel, administrative teams, and management across all divisions.

In 2024, the cannabis industry, including companies like High Tide, continued to navigate competitive labor markets. For instance, average hourly wages for retail cannabis workers in Canada, where High Tide has a strong presence, often range from $15 to $20 CAD, with benefits packages adding an additional percentage to total compensation. For specialized roles in manufacturing or corporate functions, salaries can be considerably higher, reflecting required expertise and experience.

Marketing and Advertising Expenses

High Tide allocates significant resources to marketing and advertising, a crucial component for driving customer acquisition and fostering brand loyalty. These expenditures cover a wide array of promotional activities aimed at increasing brand visibility and product sales.

The company’s marketing efforts span multiple channels. This includes robust digital marketing campaigns, engaging in-store promotions to enhance the customer experience at their retail locations, and strategic brand licensing agreements to expand market reach. These initiatives are fundamental to High Tide's growth strategy.

- Digital Marketing: Investments in online advertising, social media engagement, and search engine optimization to reach a broad consumer base.

- In-Store Promotions: Costs associated with point-of-sale displays, special offers, and events within their physical retail spaces.

- Brand Licensing: Expenditures related to partnerships that allow the use of High Tide's brand on various products, thereby increasing brand presence and revenue streams.

- Customer Loyalty Programs: Funding for programs designed to reward repeat customers and encourage continued engagement with High Tide's offerings.

General and Administrative (G&A) Expenses

General and Administrative (G&A) expenses encompass the essential overhead that keeps High Tide's operations running smoothly. This includes costs like executive and corporate staff salaries, legal and accounting fees, rent for office spaces, and the technology infrastructure that supports the entire business. These are the foundational costs of doing business that aren't directly tied to producing a specific product or service.

High Tide has been actively working to improve its cost efficiency within G&A. For instance, in the fiscal year ending September 30, 2023, High Tide reported G&A expenses of $31.9 million. This represents a strategic effort to streamline operations and ensure these costs are managed effectively as a proportion of the company's overall revenue, aiming for sustainable growth.

- Key G&A Components: Corporate salaries, professional services (legal, accounting), office rent and utilities, IT support and software.

- Cost Management Focus: High Tide's strategy involves scrutinizing these overhead costs to identify areas for reduction and efficiency gains.

- 2023 G&A Snapshot: The company reported $31.9 million in G&A expenses for the fiscal year ending September 30, 2023.

High Tide's cost structure is heavily influenced by its extensive retail footprint and the direct costs of its cannabis products. Key expenses include the cost of goods sold, operational costs for its numerous stores, and significant investment in its workforce. The company also dedicates substantial resources to marketing and general administrative functions to support its growth.

For the fiscal year 2024, High Tide's cost of goods sold and operating expenses were significant drivers of its overall cost structure. The company's strategy involves managing these costs while expanding its market presence.

As of the fiscal year ending September 30, 2023, High Tide reported $31.9 million in General and Administrative (G&A) expenses. This highlights the overhead required to manage its diverse operations, including corporate functions and administrative support across its retail and wholesale segments.

| Expense Category | Description | Fiscal Year 2023 (Millions USD) |

|---|---|---|

| Cost of Goods Sold (COGS) | Direct costs of acquiring and manufacturing products. | Not explicitly broken out in the provided G&A data, but a primary cost driver. |

| Operating Expenses (Retail) | Rent, utilities, maintenance, staff wages for physical stores. | Significant portion of overall operating costs, amplified by expansion. |

| Salaries, Wages, and Benefits | Compensation for all employees across various functions. | A major component of operating and G&A expenses. |

| Marketing and Advertising | Promotional activities, digital campaigns, in-store events. | Essential for customer acquisition and brand building. |

| General and Administrative (G&A) | Corporate overhead, professional fees, IT, office expenses. | $31.9 |

Revenue Streams

Direct-to-consumer cannabis sales are the bedrock of High Tide's revenue, primarily through its Canna Cabana stores. This channel captures the largest share of their overall income, reflecting strong consumer demand for their recreational products across Canada.

In the fiscal year ending September 30, 2023, High Tide reported significant growth in its retail segment, with gross profit from continuing operations reaching $71.7 million. This highlights the substantial contribution of these direct sales to the company's financial performance.

High Tide generates revenue from direct-to-consumer sales of cannabis consumption accessories. This includes a broad array of lifestyle products offered through their extensive network of physical retail locations and their global e-commerce sites, such as Grasscity.com and Dailyhighclub.com.

High Tide generates revenue through the wholesale distribution of its proprietary accessories, such as those from the Famous Brandz™ line. This strategy allows the company to reach a wider customer base by supplying its manufactured goods to other retailers and businesses, extending its market presence beyond its own physical and online stores.

Cabanalytics Business Data and Advertising Revenue

High Tide leverages its Cabanalytics platform to generate revenue through the sale of business data and insights. This segment also encompasses advertising opportunities within the platform, offering brands targeted reach to a specific demographic.

Beyond its core data and advertising offerings, High Tide's revenue streams are diversified. This includes income derived from management fees, interest earned on investments, and rental income from its properties.

- Cabanalytics Data & Insights: Revenue from providing business intelligence and analytics.

- Advertising Revenue: Income generated from advertising placements on the Cabanalytics platform.

- Management Fees: Fees earned for managing various business operations or assets.

- Interest Income: Revenue from interest on financial holdings.

- Rental Income: Income from leasing out company-owned properties.

ELITE Membership Fees

ELITE membership fees represent a key revenue stream, distinct from the volume-driven Cabana Club loyalty program. This paid tier offers exclusive benefits, fostering a dedicated customer base and generating predictable, recurring income for High Tide.

In 2024, High Tide reported significant growth in its retail segment, with a notable portion of this growth attributed to its premium membership offerings. While specific figures for the ELITE tier's contribution are often integrated into broader retail revenue, the strategy clearly aims to capture higher value from engaged customers.

- Direct Revenue: ELITE membership fees provide a direct and reliable revenue source, complementing other income streams.

- Recurring Income: The subscription model ensures a consistent flow of revenue, enhancing financial predictability.

- Premium Value: This tier caters to a segment willing to pay for enhanced perks and exclusive access, increasing average revenue per user.

- Customer Loyalty: The program incentivizes repeat business and deeper engagement with the High Tide brand.

High Tide's diverse revenue streams are anchored by its extensive cannabis retail operations, including the Canna Cabana brand. Beyond direct sales, the company profits from the wholesale distribution of its accessory brands, like Famous Brandz™, and from its proprietary Cabanalytics platform, which offers valuable business data and advertising opportunities.

The company also benefits from recurring income through its ELITE membership program, which provides premium customer benefits. Further diversification comes from management fees, interest income, and rental income from its properties, showcasing a multi-faceted approach to revenue generation.

| Revenue Stream | Description | 2023 Data/Notes |

|---|---|---|

| Direct-to-Consumer Cannabis Sales | Sales through Canna Cabana stores and other retail channels. | Gross profit from continuing operations was $71.7 million in FY2023. |

| Cannabis Consumption Accessories | Sales of lifestyle products via physical stores and e-commerce (Grasscity.com, Dailyhighclub.com). | A significant contributor to retail revenue. |

| Wholesale Accessory Distribution | Supplying proprietary accessories (e.g., Famous Brandz™) to other retailers. | Expands market reach beyond High Tide's own channels. |

| Cabanalytics Data & Insights | Providing business intelligence and analytics. | Includes revenue from data sales and advertising on the platform. |

| ELITE Membership Fees | Recurring income from a paid tier offering exclusive customer benefits. | Aims to capture higher value from engaged customers, contributing to retail growth in 2024. |

| Other Revenue Streams | Management fees, interest income, and rental income. | Contributes to overall financial stability and diversification. |

Business Model Canvas Data Sources

The High Tide Business Model Canvas is built using a combination of internal sales data, customer feedback surveys, and competitive analysis reports. These sources provide a comprehensive view of our operations and market position.