High Tide Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

High Tide Bundle

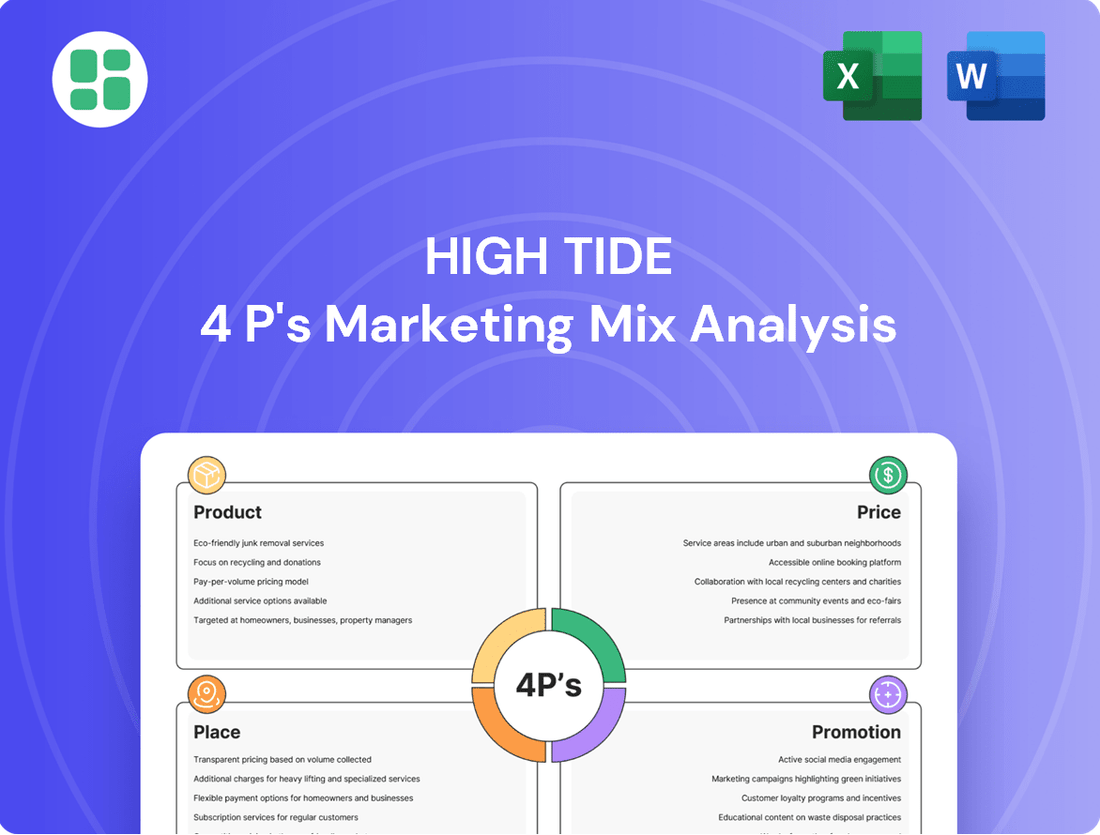

High Tide's marketing strategy is a masterclass in leveraging its product offerings, competitive pricing, strategic distribution, and impactful promotions. Discover how these elements intertwine to create a powerful market presence.

Uncover the full story behind High Tide's success by diving into our comprehensive 4Ps Marketing Mix Analysis. This in-depth report provides actionable insights, ready for your strategic planning or academic research.

Product

High Tide's product strategy is built on a diverse portfolio, encompassing both recreational cannabis and a wide selection of consumption accessories and lifestyle goods. This dual focus allows them to capture a broader market share by meeting varied consumer demands, from those seeking the core cannabis product to individuals interested in complementary items.

In 2024, High Tide's extensive product offering, including over 10,000 SKUs across its retail banners, highlights this commitment. Their accessory business, which is a significant revenue driver, demonstrates their ability to leverage the growing cannabis lifestyle market beyond just the plant itself.

High Tide's proprietary accessory brands are a cornerstone of their marketing strategy, offering a distinct advantage through vertical integration. This approach allows for meticulous control over product quality and design, ensuring a superior customer experience. For instance, the acquisition of Queen of Bud in 2024 bolstered their portfolio with premium white-label products and innovative accessories.

By owning and developing these brands, High Tide can directly influence their supply chain, from manufacturing to distribution. This not only enhances operational efficiency but also strengthens their competitive positioning in the market. Brands like Grasscity and Smoke Cartel further solidify this strategy by leading in online accessory retail, creating a comprehensive ecosystem.

High Tide is bolstering its product line through premium white-label cannabis offerings, featuring established brands like Queen of Bud and Cabana Cannabis Co. This strategic move enhances their product assortment with high-quality options, including Queen of Bud's distinctive crystal-inspired experiences.

The growth in these white-label Stock Keeping Units (SKUs) is a key aspect of High Tide's product strategy, enabling them to offer customized selections across their retail footprint and cater to diverse consumer preferences.

Innovative Retail Technology (Fastendr)

Fastendr represents High Tide's commitment to enhancing the retail experience through proprietary automated technology. This innovative product aims to streamline the entire in-store customer journey, from browsing to final pick-up.

The system utilizes retail kiosks to facilitate seamless ordering and efficient product retrieval, offering a modern and convenient purchasing method. This technology is designed to reduce friction points and improve overall customer satisfaction in physical retail spaces.

High Tide's investment in Fastendr aligns with the growing trend of integrating digital solutions into brick-and-mortar environments. The company is focused on leveraging technology to create a more engaging and efficient shopping experience for consumers.

- Product Innovation: Fastendr offers automated retail kiosks for browsing, ordering, and pick-up.

- Customer Experience: Aims to streamline the in-store buying journey, enhancing convenience and efficiency.

- Market Trend: Reflects the increasing integration of digital technology in physical retail.

CBD and Health & Wellness s

High Tide is actively expanding its footprint in the health and wellness sector through its portfolio of CBD brands, including NuLeaf Naturals, FAB CBD, and Blessed CBD. This strategic move diversifies their consumer base beyond traditional cannabis and accessories, tapping into a growing market segment interested in wellness solutions. The global CBD market, valued at approximately $12.8 billion in 2023, is projected to reach $65.3 billion by 2030, demonstrating significant growth potential.

This diversification allows High Tide to cater to a broader audience seeking the potential benefits of CBD for various wellness applications. The company's investment in these brands positions them to capture a share of this expanding market. For instance, the US CBD market alone was estimated to be worth over $5 billion in 2023.

- Brand Expansion: High Tide operates established CBD brands like NuLeaf Naturals, FAB CBD, and Blessed CBD.

- Market Reach: This strategy broadens High Tide's appeal to consumers focused on health and wellness.

- Market Growth: The global CBD market is experiencing substantial growth, with projections indicating continued expansion.

- Consumer Segment: High Tide is targeting a distinct segment of consumers interested in CBD for wellness purposes.

High Tide's product strategy is a multi-faceted approach, encompassing a vast array of cannabis consumption accessories, lifestyle goods, and a growing portfolio of white-label cannabis products. This breadth ensures they cater to diverse consumer needs within the evolving cannabis market. Their commitment to proprietary accessory brands, like those under Grasscity and Smoke Cartel, offers a competitive edge through controlled quality and design.

The company is also making significant inroads into the health and wellness sector with established CBD brands such as NuLeaf Naturals and FAB CBD. This diversification taps into the rapidly expanding global CBD market, which was valued at approximately $12.8 billion in 2023 and is projected for substantial growth. Furthermore, High Tide is innovating the retail experience with its proprietary automated technology, Fastendr, designed to streamline in-store customer interactions.

| Product Category | Key Brands/Initiatives | Strategic Focus |

|---|---|---|

| Cannabis Accessories & Lifestyle Goods | Grasscity, Smoke Cartel, Queen of Bud | Vertical integration, brand ownership, broad online retail presence |

| White-Label Cannabis Products | Queen of Bud (crystal-inspired), Cabana Cannabis Co. | Expanding product assortment, catering to diverse preferences |

| CBD & Health Wellness | NuLeaf Naturals, FAB CBD, Blessed CBD | Diversification into a high-growth market segment |

| Retail Technology | Fastendr | Enhancing in-store customer experience through automation |

What is included in the product

This analysis provides a comprehensive breakdown of High Tide's marketing strategies across Product, Price, Place, and Promotion, offering actionable insights for strategic decision-making.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of information overload for busy teams.

Provides a clear, concise overview of High Tide's marketing approach, easing the burden of understanding and communicating strategic decisions.

Place

High Tide boasts an extensive Canadian retail network, primarily through its Canna Cabana stores, making it one of the country's largest cannabis retailers by sheer number of locations. As of August 2025, the company has successfully opened over 200 Canna Cabana outlets, a significant expansion from its previous milestones.

The strategic goal is to reach more than 300 locations across Canada by the end of 2025, a move designed to significantly enhance physical accessibility and capture a broader consumer base in diverse markets. This widespread presence is a key component of High Tide's market penetration strategy.

High Tide is actively pursuing strategic store expansion, aiming for 20 to 30 new openings each year. This growth is primarily financed through the company's own cash flow, demonstrating a strong internal financial foundation.

The selection of new store locations is a deliberate process, focusing on high-traffic areas. This includes a strategic push into underserved markets, which are identified as having significant growth potential and aligning well with High Tide's discount club model.

High Tide operates a robust global e-commerce strategy, utilizing prominent platforms like Grasscity.com, SmokeCartel.com, and DailyHighClub.com to reach a diverse international customer base. These digital storefronts significantly extend High Tide's market presence beyond its brick-and-mortar locations, offering an extensive selection of consumption accessories. In 2024, High Tide reported that its e-commerce segment represented a substantial portion of its overall revenue, demonstrating the critical role these platforms play in driving sales and brand accessibility.

Wholesale Distribution Capabilities

High Tide leverages its wholesale distribution capabilities through Valiant Distribution to extend the reach of its proprietary accessory brands. This strategic move ensures that their products are available not only within High Tide's own retail footprint but also to a broader international market. This dual approach cultivates a more resilient and diversified revenue model.

Valiant Distribution facilitates access to an extensive network of retail and distribution partners across various geographies. This expansion strategy is crucial for capturing market share and building brand recognition beyond High Tide's direct-to-consumer channels. For instance, in the first quarter of fiscal 2024, High Tide reported a significant increase in wholesale revenue, demonstrating the growing impact of this distribution strategy.

- Proprietary Brands: Distribution of High Tide's owned accessory brands, enhancing brand control and margins.

- International Reach: Access to a global network of retail and distribution partners, expanding market penetration.

- Diversified Revenue: Creation of multiple income streams through wholesale channels, reducing reliance on retail sales alone.

- Valiant Distribution: The dedicated entity managing and executing the wholesale strategy, optimizing logistics and partner relationships.

International Market Entry

High Tide is actively pursuing international market expansion, with a significant focus on Germany. Discussions are underway for the acquisition of medical cannabis importers and wholesalers in this key European market. This strategic move is designed to capitalize on High Tide's established procurement capabilities to serve the burgeoning medical cannabis sector in Germany and other international regions.

This expansion into Germany is particularly noteworthy given the country's progressive stance on medical cannabis. As of early 2024, Germany's medical cannabis market has seen consistent growth, with patient numbers and prescription volumes steadily increasing. High Tide's entry aims to tap into this demand by providing a reliable supply chain, leveraging the expertise of potential acquisition targets.

- Germany's medical cannabis market is projected to reach approximately €1.5 billion by 2025, presenting a substantial opportunity for High Tide.

- The country's regulatory framework supports the import and distribution of medical cannabis, creating a favorable environment for international players.

- High Tide's strategy involves acquiring established local businesses to expedite market penetration and gain immediate access to distribution networks.

- This global distribution strategy aligns with High Tide's broader objective to become a leading international cannabis company.

High Tide's physical "Place" strategy centers on an expansive Canadian retail footprint, primarily through its Canna Cabana stores. By August 2025, over 200 Canna Cabana locations were operational, with a target of exceeding 300 by year-end 2025. This aggressive expansion is strategically focused on high-traffic areas and underserved markets, aiming to maximize accessibility and leverage its discount club model.

Complementing its retail presence, High Tide maintains a robust global e-commerce operation, featuring platforms like Grasscity.com and SmokeCartel.com. This digital strategy significantly broadens its market reach beyond physical stores, offering a wide array of consumption accessories to an international customer base. The e-commerce segment proved to be a substantial revenue driver in 2024.

Furthermore, High Tide utilizes Valiant Distribution for wholesale operations, extending its proprietary accessory brands globally. This dual approach, encompassing both direct-to-consumer retail and wholesale partnerships, cultivates a diversified revenue stream and enhances brand penetration across various geographies. Wholesale revenue saw a notable increase in Q1 fiscal 2024, underscoring the effectiveness of this strategy.

The company is also actively pursuing international expansion, with Germany being a key focus. High Tide is exploring acquisitions of medical cannabis importers and wholesalers in Germany to tap into its growing medical cannabis market, which was projected to reach approximately €1.5 billion by 2025.

Full Version Awaits

High Tide 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of High Tide's 4P's Marketing Mix is fully complete and ready for your immediate use.

Promotion

High Tide's Cabana Club loyalty program is a cornerstone of its promotional strategy, boasting over 2 million members in Canada and a significant global footprint of more than 5.87 million members as of June 2025. This program is designed to foster deep customer engagement and encourage repeat business through its innovative three-tier pricing structure and a suite of exclusive member benefits.

High Tide actively promotes its discount club model, a cornerstone of its marketing strategy, especially evident at its Canna Cabana locations. This model provides significant price advantages to its loyalty members, directly appealing to a broad consumer base.

This focus on competitive pricing through the discount club has demonstrably boosted same-store sales and expanded market share within Canada. For instance, in the first quarter of fiscal year 2024, High Tide reported a 7.5% increase in same-store sales, a testament to the model's effectiveness in attracting and retaining customers, particularly those sensitive to price points.

High Tide leverages its significant retail presence for impactful in-store marketing and events. For instance, the June 2025 'Buy Local' initiative exemplifies this by allocating prominent shelf space to locally sourced cannabis products, fostering community connections and boosting brand affinity.

Digital and Social Media Engagement

High Tide effectively leverages its e-commerce sites, such as Grasscity.com, to connect with a vast online audience. Through targeted newsletters and active social media channels, the company fosters direct engagement with millions of customers and followers.

This robust digital strategy not only promotes product offerings but also cultivates strong brand communities. For instance, by Q1 2024, High Tide reported a significant increase in its online customer base, with social media engagement metrics showing a 25% year-over-year growth.

- E-commerce Reach: Grasscity.com and other platforms serve as central hubs for digital interaction.

- Direct Communication: Newsletters and social media facilitate direct engagement with millions of customers.

- Community Building: The digital presence is key to fostering brand loyalty and community among followers.

- Engagement Growth: High Tide has seen substantial year-over-year increases in social media engagement, indicating successful digital marketing efforts.

Public Relations and Industry Recognition

High Tide actively leverages public relations to showcase its progress and industry standing. A prime example is its consistent recognition as one of Canada's Top Growing Companies by The Globe and Mail, an honor it has held for four consecutive years through 2024. This sustained acknowledgment significantly bolsters brand credibility and signals market leadership to a broad audience, including investors and consumers.

These industry accolades serve as powerful endorsements, reinforcing High Tide's market position. For instance, the company's repeated inclusion in such prestigious rankings underscores its operational success and strategic execution in a competitive landscape. This consistent positive media attention is a key component of its promotional strategy, building trust and awareness.

- Sustained Growth Recognition: High Tide named one of Canada's Top Growing Companies by The Globe and Mail for four consecutive years (through 2024).

- Enhanced Brand Reputation: Industry awards and positive media coverage build significant brand credibility and consumer trust.

- Investor Confidence: Public relations efforts highlighting achievements communicate market leadership, attracting and retaining investor interest.

- Market Differentiation: Consistent recognition helps differentiate High Tide from competitors, solidifying its position in the market.

High Tide's promotional activities are multifaceted, focusing on loyalty, digital engagement, and public relations. The Cabana Club, with over 5.87 million global members as of June 2025, drives repeat business through tiered benefits and discounts. This loyalty program, coupled with a strong e-commerce presence on platforms like Grasscity.com and active social media engagement, fosters a robust brand community. Furthermore, consistent recognition, such as being named one of Canada's Top Growing Companies by The Globe and Mail for four consecutive years through 2024, significantly bolsters brand credibility and market perception.

| Promotional Tactic | Key Metric/Example | Impact |

|---|---|---|

| Cabana Club Loyalty Program | Over 5.87 million global members (June 2025) | Drives repeat purchases and customer loyalty |

| E-commerce & Digital Marketing | 25% YoY social media engagement growth (Q1 2024) | Expands reach and builds online community |

| Public Relations | Canada's Top Growing Companies (4 consecutive years through 2024) | Enhances brand credibility and investor confidence |

| In-store Promotions | 'Buy Local' initiative (June 2025) | Boosts community connection and brand affinity |

Price

High Tide utilizes a competitive pricing strategy, particularly evident in its discount club model, offering compelling prices to its Cabana Club members. This strategy is designed to boost sales volume and capture greater market share within the highly competitive cannabis retail sector, ensuring their products remain attractive to a broad customer base.

High Tide likely leverages value-based pricing for its proprietary consumption accessories and cannabis lifestyle products. This strategy aligns the price with the perceived worth of items like the Puffco Peak Pro or Ooze products, considering their quality, innovative design, and brand appeal. For instance, accessories that enhance the user experience or offer unique features can command higher price points, differentiating High Tide’s offerings in a competitive market.

High Tide strategically employs dynamic pricing and a robust promotional calendar to drive sales and customer loyalty. For instance, their '4/20' promotions are a significant revenue driver, capitalizing on a key industry event. This approach allows them to adjust prices based on real-time demand and competitive pressures, ensuring optimal sales performance.

International Market Pricing Strategy

High Tide's international market pricing strategy is designed for adaptability, especially as they enter markets like Germany. They anticipate leveraging premium pricing for medical cannabis, a segment known for its higher value and strict regulatory oversight.

This approach allows High Tide to maximize profitability by aligning prices with local market conditions and regulatory frameworks. For instance, in Germany, the medical cannabis market is expected to grow significantly, with projections indicating a substantial increase in patient numbers and prescription volumes through 2025.

- Premium Pricing: Targeting higher price points for medical cannabis in regulated markets like Germany.

- Regulatory Alignment: Adjusting pricing to comply with and capitalize on local cannabis laws and taxation structures.

- Market Optimization: Strategically setting prices to balance demand, competition, and margin goals in diverse international settings.

- Growth Potential: Capitalizing on the expanding medical cannabis sector in key European markets, with Germany being a primary focus for 2024-2025.

Loyalty Tiered Pricing

High Tide's Cabana Club loyalty program utilizes a tiered pricing strategy, featuring an ELITE paid membership. This structure incentivizes increased customer spending and fosters deeper brand loyalty by offering exclusive benefits and potentially preferential pricing to its members. This directly enhances pricing effectiveness and customer lifetime value.

The tiered approach aims to capture a broader customer base while rewarding the most engaged patrons. For instance, in early 2024, cannabis retail loyalty programs generally saw increased participation, with many reporting a 15-20% uplift in average transaction value from members compared to non-members.

- Tiered Pricing: Cabana Club offers multiple membership levels.

- ELITE Membership: A premium, paid tier with enhanced perks.

- Customer Loyalty: Encourages repeat purchases and higher spending.

- Value Enhancement: Directly impacts customer lifetime value and pricing strategy.

High Tide's pricing strategy is multifaceted, balancing competitive offers with value-based and premium approaches. Their Cabana Club, including the ELITE tier, is central to this, aiming to drive loyalty and increase average transaction values, with similar programs often seeing 15-20% uplifts in member spending.

| Pricing Strategy Element | Description | Example/Impact |

|---|---|---|

| Competitive Pricing | Offering attractive prices, especially through discount clubs. | Boosts sales volume and market share in a competitive sector. |

| Value-Based Pricing | Aligning prices with perceived worth for proprietary products. | Commands higher prices for quality accessories like Puffco Peak Pro. |

| Dynamic & Promotional Pricing | Adjusting prices based on demand and events. | Key revenue driver during events like '4/20'. |

| Premium Pricing (International) | Higher price points for specific segments like medical cannabis. | Maximizes profitability in regulated markets like Germany through 2025. |

| Tiered Loyalty Pricing | Offering different benefits and potential pricing across membership levels. | Enhances customer lifetime value and encourages repeat business. |

4P's Marketing Mix Analysis Data Sources

Our High Tide 4P's Marketing Mix Analysis is constructed using a comprehensive blend of proprietary market research, direct competitor analysis, and publicly available company disclosures. We leverage insights from High Tide's official investor relations materials, product launch announcements, and retail footprint data, alongside industry-specific reports and consumer sentiment surveys.