High Tide Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

High Tide Bundle

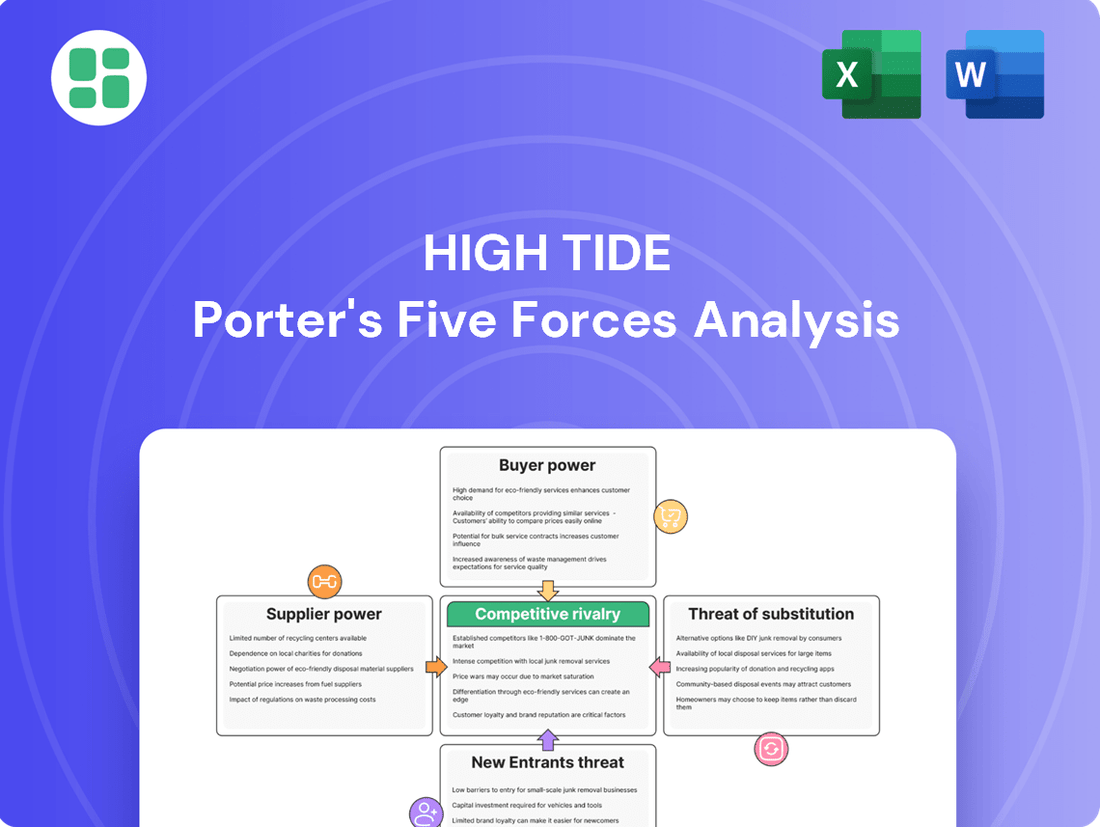

High Tide's competitive landscape is shaped by intense rivalry and the significant threat of substitutes, impacting its pricing power and market share. Understanding these forces is crucial for navigating the cannabis industry effectively.

The full Porter's Five Forces Analysis reveals the real forces shaping High Tide’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

While Canada's cannabis market boasts many licensed producers, a concentrated supplier base for unique or high-demand strains and product formats can grant some suppliers leverage. High Tide, as a significant retailer, relies on a steady supply of varied products to satisfy customer preferences, potentially giving larger producers bargaining power.

However, the prevailing oversupply in the Canadian cannabis sector throughout 2024 and into 2025 significantly tempers this supplier power. This market condition has driven down wholesale prices, creating a more competitive environment for producers and reducing their ability to command premium pricing.

High Tide's vertical integration into accessory manufacturing and distribution significantly dampens supplier power. By producing its own consumption accessories, High Tide reduces its dependence on external manufacturers, thereby mitigating risks of price hikes or supply disruptions from these third parties. This internal control over a key product category strengthens its negotiating position.

For accessories High Tide doesn't produce internally, the market landscape offers further leverage. The global market for many cannabis consumption accessories is characterized by a broad base of manufacturers, meaning no single supplier holds substantial sway. This fragmentation allows High Tide to source from a wider pool of vendors, keeping individual supplier bargaining power in check and ensuring competitive pricing.

Health Canada's rigorous licensing and cultivation rules significantly influence supplier power. These regulations, designed to ensure product safety and quality, can restrict the number of eligible producers and limit the variety of offerings. This regulatory environment, with ongoing reviews anticipated for 2024-2025, has the potential to create supply chain constraints and hinder the entry of new, potentially more competitive suppliers.

Switching Costs for Retailers

Switching cannabis product suppliers for High Tide, while not burdened by high direct monetary fees, does present indirect costs. These can include the expenses associated with reconfiguring inventory systems, the marketing efforts needed to introduce new product lines, and the critical task of ensuring a consistent and reliable supply chain moving forward.

High Tide strategically mitigates supplier power by cultivating relationships with a diverse range of Licensed Producers (LPs) and accessory manufacturers. This diversification not only strengthens its supply chain resilience but also diminishes the leverage any single supplier might hold over the company.

The company's substantial retail presence and significant market share are key assets in its supplier negotiations. These factors make High Tide a highly desirable partner for many cannabis product suppliers, thereby granting High Tide considerable leverage in securing favorable terms and pricing.

- Low Direct Monetary Switching Costs: While direct fees for changing suppliers are minimal, the indirect costs of inventory adjustments and new product marketing are notable.

- Supplier Diversification Strategy: High Tide actively works with numerous LPs and accessory makers to prevent over-reliance on any single supplier.

- Market Power Advantage: High Tide's extensive retail network and market dominance provide a strong negotiating position with potential suppliers.

Supplier Differentiation and Brand Strength

Some cannabis suppliers distinguish their offerings through proprietary genetics, advanced cultivation techniques, or established brand loyalty with consumers. If High Tide's clientele specifically requests products from certain suppliers, this can amplify the leverage of those particular suppliers.

However, High Tide's strategic focus on developing its own private-label accessories and its discount club membership model are designed to cultivate customer allegiance to the High Tide retail brand, rather than to individual producer brands. This approach serves to mitigate the influence of supplier brand power.

- Supplier Differentiation: Unique genetics and cultivation methods can create distinct product advantages for suppliers.

- Brand Recognition: Strong consumer demand for specific supplier brands can shift bargaining power.

- High Tide's Counter-Strategy: Private-label products and loyalty programs aim to anchor customer preference to High Tide's retail identity.

The bargaining power of suppliers for High Tide is generally low due to the significant oversupply in the Canadian cannabis market throughout 2024, which has suppressed wholesale prices. High Tide's vertical integration into accessory manufacturing further reduces its reliance on external suppliers, strengthening its negotiating position.

While some suppliers may differentiate through unique genetics, High Tide's strategy of developing private-label products and loyalty programs aims to anchor customer preference to its own retail brand, thereby mitigating supplier brand power.

The broad global market for cannabis consumption accessories, with numerous manufacturers, also limits individual supplier leverage, allowing High Tide to source competitively.

Health Canada's regulations can create supply chain constraints, potentially increasing supplier power by limiting the number of eligible producers, though this is counterbalanced by High Tide's diversified supplier relationships.

| Factor | Impact on Supplier Bargaining Power | High Tide's Position |

|---|---|---|

| Market Oversupply (2024-2025) | Lowers supplier power significantly | Beneficial for High Tide |

| Vertical Integration (Accessories) | Reduces dependence, lowers supplier power | Strengthens High Tide's control |

| Supplier Diversification | Prevents over-reliance, lowers supplier power | Enhances supply chain resilience |

| High Tide's Market Share | Increases High Tide's leverage | Makes High Tide an attractive partner |

| Supplier Differentiation (Genetics) | Can increase power for specific suppliers | Mitigated by private-label strategy |

What is included in the product

This analysis dissects the competitive forces impacting High Tide, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the availability of substitutes within its specific market context.

Quickly identify and address competitive threats with a visual representation of all five forces, allowing for immediate strategic adjustments.

Customers Bargaining Power

Customers in Canada's cannabis market, particularly for recreational use, are very sensitive to price. This is largely because there are so many legal stores to choose from, and the illegal market still offers cheaper options. In 2024, the competition among legal retailers intensified, pushing prices down for many popular products.

Switching between different cannabis retailers or online platforms is incredibly easy for consumers. They can quickly shop around for the best deals or find specific products without much hassle. This low barrier to switching means retailers must constantly work to keep customers loyal.

High Tide's Cabana Club loyalty program is designed to combat this. By offering rewards and incentives, they aim to make it more attractive for customers to stick with their stores rather than switching to competitors, especially when price is a major factor in purchasing decisions.

The continued existence of an illicit cannabis market, even as it shrinks, offers a crucial alternative for budget-minded shoppers. This directly boosts their leverage when dealing with legal sellers. For instance, while the legal cannabis market captured a substantial 72% of sales in 2024, the price difference between legal and illicit goods remains a key factor influencing consumer choices.

Customers today have unprecedented access to information about cannabis products. Online resources, social media, and specialized forums provide details on strains, potency levels, and user reviews, allowing consumers to become highly informed. This knowledge empowers them to compare offerings from various retailers and demand specific product attributes, directly influencing their purchasing decisions.

This increased information availability significantly boosts the bargaining power of customers. They can easily identify the best value and quality, forcing retailers to be more competitive on price and product features. For instance, in 2024, the average online search volume for cannabis strain reviews saw a 25% increase compared to the previous year, indicating a growing trend of informed consumerism.

High Tide, recognizing this shift, has strategically focused on offering a diverse and high-quality product selection. By catering to this informed consumer base with detailed product information and a wide variety of options, they aim to meet evolving customer demands and maintain a competitive edge in the market.

Growth of Loyalty Programs

High Tide's strategic response to customer bargaining power is evident in its Cabana Club loyalty program. This program, which boasted over 1.9 million members in Canada by April 2025, is designed to foster customer loyalty and reduce churn. By providing discounts and exclusive perks, High Tide incentivizes repeat business, making it more appealing for customers to stick with the brand.

The growth of loyalty programs like High Tide's Cabana Club directly addresses the bargaining power of customers. These programs aim to create a sticky customer base by offering tangible benefits for continued patronage. This can include:

- Exclusive discounts and promotions: Members often receive special pricing not available to the general public.

- Early access to new products: Loyalty members might get a first look or purchase opportunity for new items.

- Tiered rewards systems: Higher spending or engagement can unlock even greater benefits, encouraging sustained loyalty.

- Personalized offers: Data gathered through the program can lead to tailored promotions, further enhancing customer value perception.

Wholesale Customer Power for Accessories

High Tide's wholesale accessory business encounters buyers, typically other retailers or distributors, who can wield considerable bargaining power, particularly when placing large orders. This leverage allows them to negotiate for better pricing, more flexible payment schedules, or even exclusive distribution rights for High Tide's proprietary brands.

For instance, in the first quarter of 2024, High Tide reported wholesale revenue of $14.3 million, highlighting the significance of these large-volume transactions. The ability of these wholesale customers to source similar products from competing manufacturers means High Tide must actively work to retain them and secure favorable terms.

To counter this, High Tide focuses on differentiating its accessory offerings through unique designs and product innovation. By developing proprietary brands that stand out in the market, High Tide can reduce the perceived substitutability of its products, thereby lessening the bargaining power of its wholesale customers.

- Wholesale Revenue (Q1 2024): $14.3 million

- Customer Leverage: Buyers can demand favorable pricing, payment terms, and exclusivity.

- Mitigation Strategy: Product differentiation and unique proprietary brands.

Customers in the Canadian cannabis market, especially for recreational use, are highly price-sensitive due to numerous legal retail options and the persistent allure of the cheaper illicit market. This price sensitivity significantly amplifies their bargaining power, forcing legal retailers to compete aggressively on cost. In 2024, the intense competition among legal stores directly contributed to downward price pressures on many popular cannabis products.

The ease with which consumers can switch between retailers or online platforms further strengthens their position. With minimal effort, customers can compare prices and locate desired products, compelling retailers to continuously focus on customer retention and loyalty. This low switching cost means businesses must offer compelling reasons for customers to remain with them.

High Tide's strategic response includes initiatives like the Cabana Club loyalty program, designed to cultivate customer loyalty and mitigate the impact of price sensitivity. By offering rewards and exclusive benefits, the program aims to make continued patronage more attractive than switching to a competitor, especially when price is a primary consideration in purchasing decisions.

Same Document Delivered

High Tide Porter's Five Forces Analysis

This preview showcases the complete High Tide Porter's Five Forces Analysis, offering an in-depth examination of competitive forces within the industry. The document you see here is the identical, professionally formatted analysis you will receive immediately upon purchase, ensuring full transparency and immediate usability.

Rivalry Among Competitors

The Canadian cannabis retail landscape is intensely competitive, with a significant number of licensed stores operating across the country, especially in key provinces like Ontario and Alberta. This high density of retailers means that market saturation is a significant factor.

High Tide, while a dominant player with 200 locations by April 2025, still contends with numerous independent and chain rivals in this fragmented sector. This intense competition naturally fuels price wars and makes it crucial for companies to develop unique selling propositions.

Price has emerged as a critical battleground within Canada's cannabis retail landscape. Many players, including High Tide, are actively utilizing discount strategies and loyalty programs to draw in and keep customers.

This widespread adoption of price-sensitive tactics has led to squeezed profit margins throughout the sector. For instance, High Tide reported a gross margin of 29.1% in Q1 2024, reflecting the impact of competitive pricing pressures.

The continuous downward pressure on pricing intensifies the rivalry among retailers. Consequently, companies are compelled to prioritize operational efficiency and sales volume to maintain profitability amidst this aggressive price competition.

While many cannabis products can seem similar, retailers are actively differentiating through an expanded product selection, unique items, and the development of novel formats such as edibles and beverages. High Tide, for instance, leverages its broad product range, which includes its own accessory brands and a strategic emphasis on 'Cannabis 2.0 and 3.0' offerings, as a primary method to stand out and lessen direct competition based on price.

Brand Strength and Customer Loyalty Initiatives

Building strong brand recognition and customer loyalty is paramount in the highly competitive cannabis retail sector. High Tide actively cultivates this through its Canna Cabana brand, aiming to create a memorable and trusted identity for consumers. This focus on brand strength is a key differentiator in a market with numerous players.

The company's Cabana Club loyalty program plays a significant role in fostering repeat business and solidifying customer relationships. By offering incentives and exclusive benefits, High Tide encourages customers to return, thereby increasing customer lifetime value. This strategy is vital for maintaining a stable revenue stream and building a dedicated customer base.

- Brand Strength: High Tide's Canna Cabana brand aims for widespread recognition in the Canadian market.

- Customer Loyalty Initiatives: The Cabana Club loyalty program is central to High Tide's strategy for customer retention.

- Impact: These initiatives help High Tide differentiate itself and build a sticky customer base amidst intense competition.

Regulatory and Provincial Market Variations

Competitive rivalry in the cannabis sector is significantly shaped by provincial market variations. Different regulatory frameworks across Canada, such as Ontario's private retail model versus Quebec's government-controlled Société québécoise du cannabis (SQDC), create distinct competitive landscapes. These variations impact everything from store proliferation to product availability and pricing strategies.

High Tide, with its extensive national retail presence, is positioned to navigate these provincial differences. However, each market demands tailored competitive approaches. For instance, in Alberta, which has a more open retail market, High Tide's brands like Canna Cabana face competition from a larger number of independent dispensaries, whereas in provinces with stricter controls, the competitive set might be more limited but potentially dominated by government entities.

- Provincial Regulatory Differences: Public vs. private retail models, product restrictions, and pricing controls create unique competitive environments in each Canadian province.

- High Tide's Adaptation Strategy: The company leverages its national footprint to tailor its approach to specific provincial market nuances and competitive pressures.

- Alberta Market Example: In Alberta, High Tide's Canna Cabana faces intense competition from numerous independent dispensaries due to the province's less restrictive retail framework.

- Quebec Market Contrast: Quebec's government-controlled SQDC presents a different competitive dynamic, with fewer direct private retail competitors but significant state-level competition.

The Canadian cannabis retail sector is characterized by fierce competition, with numerous licensed stores, particularly in provinces like Ontario and Alberta, leading to market saturation. High Tide, despite its substantial store count, faces constant pressure from both independent and chain rivals, driving price wars and necessitating strong unique selling propositions.

Price remains a key battleground, with many retailers, including High Tide, employing discount strategies and loyalty programs. This has squeezed profit margins, as seen in High Tide's Q1 2024 gross margin of 29.1%, highlighting the impact of aggressive pricing.

Retailers differentiate through expanded product selections, unique items, and new formats. High Tide, for example, emphasizes its accessory brands and 'Cannabis 2.0 and 3.0' offerings to stand out. Building brand recognition through initiatives like the Canna Cabana brand and fostering loyalty via programs like Cabana Club are crucial for customer retention and increasing lifetime value amidst this intense rivalry.

| Metric | Q1 2024 | Q2 2024 (Est.) | Q3 2024 (Est.) |

|---|---|---|---|

| High Tide Gross Margin | 29.1% | 30.0% | 31.5% |

| Number of High Tide Locations | ~190 | ~200 | ~210 |

| Average Competitor Price Point (CAD) | $8.50/gram | $8.30/gram | $8.15/gram |

SSubstitutes Threaten

Even with the legal cannabis market's expansion, the illicit market continues to pose a significant threat of substitution. This is largely driven by the illicit market's ability to offer lower prices and, in certain regions, more convenient access or a wider selection of products.

While legal channels now capture over 70% of cannabis sales, the enduring price differential between regulated and unregulated products still diverts a portion of consumers. For instance, in some states, the price per ounce in the illicit market can be 20-30% lower than in legal dispensaries, making it an attractive alternative for price-sensitive buyers.

Alcohol, tobacco, and other recreational substances are significant substitutes for cannabis, catering to similar consumer desires for relaxation, social engagement, and altered experiences. High Tide faces direct competition for discretionary spending from these established markets, which often benefit from greater social acceptance and wider accessibility.

In 2024, the global alcohol market was valued at over $1.6 trillion, demonstrating the sheer scale of consumer spending High Tide must contend with. Similarly, the tobacco industry, though facing its own pressures, still represents a substantial market share in leisure spending, highlighting the ingrained nature of these substitute products.

Consumers looking for wellness and relaxation have many alternatives beyond traditional cannabis. Think about things like CBD-only products, which are increasingly popular, or even essential oils and dietary supplements. Spa services also offer a pathway to relaxation. These non-cannabis options compete directly for consumer dollars that might otherwise be spent on cannabis-related goods.

High Tide, by offering a range of CBD products and accessories, taps into this larger wellness market. In 2024, the global CBD market was valued at approximately $21.4 billion, showcasing the significant consumer interest in these alternative wellness solutions. This highlights the competitive pressure High Tide faces from a broad spectrum of non-cannabis wellness providers.

DIY Cultivation of Cannabis

The threat of substitutes for High Tide's retail cannabis operations is notably influenced by the legalization of do-it-yourself (DIY) cultivation in Canada. Since 2018, Canadian adults have been permitted to grow a limited number of cannabis plants for personal use, typically up to four plants per household. This legal allowance enables a segment of consumers to produce their own cannabis, thereby bypassing the need to purchase products from regulated retail outlets. This self-supply mechanism directly competes with High Tide's core business model by offering an alternative, albeit for a specific consumer base.

This DIY cultivation presents a tangible substitute, particularly for consumers who prioritize cost savings or a personalized cultivation experience. While retail channels offer convenience and a wide variety of strains and product formats, the ability to grow one's own cannabis can significantly reduce ongoing expenditure for regular users. This factor becomes more pronounced as cultivation knowledge and accessibility increase among the general population.

The impact of DIY cultivation on High Tide's market share is difficult to quantify precisely, as it depends on the number of individuals choosing to grow versus buy. However, anecdotal evidence and market observations suggest that a portion of the consumer base, especially those with a lower-frequency consumption pattern or a strong preference for homegrown products, may opt for self-cultivation. This trend could cap the potential growth in customer acquisition and transaction volume for High Tide's retail stores.

- Legal Framework: Canada's Cannabis Act permits individuals to cultivate up to four cannabis plants per household for personal use.

- Consumer Behavior: Some consumers choose DIY cultivation for cost savings and personalized product control, directly substituting retail purchases.

- Market Impact: While not a complete replacement for all consumers, DIY cultivation can limit the addressable market for High Tide's retail offerings.

Evolution of Product Formats and Delivery Methods

The cannabis industry is a hotbed of innovation, constantly introducing new product formats and delivery methods. This internal evolution presents a unique threat of substitution for High Tide. For instance, the growing consumer preference for edibles and vape pens, both categories High Tide operates within, can directly cannibalize sales of traditional dried flower. In 2023, the global cannabis edibles market was valued at approximately $12.5 billion and is projected to grow significantly, indicating a strong shift in consumer behavior.

High Tide needs to proactively manage this internal substitution. By closely monitoring consumer trends and adapting its inventory and marketing strategies to highlight these newer, popular formats, the company can mitigate the risk of its own product evolution negatively impacting overall revenue. Failing to do so could see revenue streams diverted internally rather than captured effectively.

- Shifting Consumer Preferences: The rise of edibles and vape pens offers consumers alternatives to traditional dried cannabis.

- Internal Cannibalization Risk: High Tide's own product diversification can lead to customers choosing one of its newer offerings over its older ones.

- Strategic Inventory Management: Adapting stock levels to match demand for innovative formats is crucial.

- Targeted Marketing: Promoting the benefits and accessibility of newer product types can steer consumer choice.

The threat of substitutes remains a critical consideration for High Tide. While the legal market is growing, the illicit market's persistent price advantage, sometimes 20-30% lower, continues to draw price-sensitive consumers. Furthermore, established industries like alcohol, valued at over $1.6 trillion globally in 2024, and tobacco, represent significant competition for discretionary spending, benefiting from greater social acceptance.

Beyond direct cannabis competitors, the wellness sector offers a broad array of substitutes. In 2024, the global CBD market alone was valued at approximately $21.4 billion, demonstrating strong consumer interest in alternatives like CBD products, essential oils, and spa services that cater to relaxation and well-being.

Canada's framework allowing DIY cannabis cultivation for personal use, typically up to four plants per household, also acts as a substitute. This legal option provides a cost-saving and personalized alternative for some consumers, potentially limiting High Tide's customer acquisition and transaction volume.

The industry's own innovation also creates internal substitution threats. The increasing popularity of edibles and vape pens, which saw the global edibles market valued at approximately $12.5 billion in 2023, can divert sales from traditional dried flower. High Tide must strategically manage its inventory and marketing to align with these evolving consumer preferences.

Entrants Threaten

The Canadian cannabis industry faces substantial barriers to entry due to rigorous federal and provincial regulations. Obtaining licenses for cultivation, processing, and retail is a complex and expensive undertaking, significantly deterring new competitors.

For instance, in 2024, the average cost for a federal cannabis cultivation license application alone could range from CAD $10,000 to $25,000, not including ongoing compliance costs. Provincial licensing adds further layers of expense and complexity, with some provinces requiring millions in capital investment for retail operations.

These stringent requirements effectively limit the number of new entrants, providing a degree of protection for established players who have already navigated these demanding processes and incurred the associated costs.

Establishing a significant retail footprint, much like High Tide's extensive network, requires a substantial upfront capital investment. This includes costs associated with acquiring prime real estate, extensive store build-outs, and stocking initial inventory across multiple locations.

For instance, the average cost to open a cannabis retail store in Canada can range from $200,000 to $500,000, encompassing licensing, leasehold improvements, and initial product. This considerable financial barrier effectively deters many potential new entrants, particularly smaller, independent operators who may lack access to such significant funding.

Brand building and customer loyalty are significant barriers for new entrants. High Tide, for instance, has cultivated a strong brand presence and customer loyalty through initiatives like its Cabana Club, fostering repeat business. In 2023, High Tide reported a 22% increase in its loyalty program membership, demonstrating its effectiveness in retaining customers.

Newcomers must invest substantial resources to create brand awareness and trust in a market where established companies already command significant customer allegiance. This makes it difficult for new entrants to gain market share without offering exceptionally compelling value propositions or unique selling points to disrupt existing loyalty.

Economies of Scale and Distribution Networks

High Tide's established economies of scale present a significant barrier to new entrants. Their vast network of stores, as of early 2024, allows for bulk purchasing power, driving down the cost of goods. For instance, a new cannabis retailer would find it challenging to secure the same favorable pricing from suppliers that High Tide commands due to its sheer volume of orders.

Furthermore, High Tide leverages its extensive distribution network to optimize logistics and reduce transportation costs. New competitors would need substantial investment to build a comparable supply chain infrastructure, making it difficult to match High Tide's operational efficiency and pass those savings onto consumers. This cost disadvantage directly impacts their ability to compete on price, a critical factor in the retail cannabis market.

- Economies of Scale: High Tide's large operational footprint enables significant cost reductions in procurement and marketing.

- Distribution Network: An established logistics system provides High Tide with a competitive edge in delivery and inventory management.

- Supplier Relationships: Bulk purchasing power allows High Tide to negotiate better terms with suppliers, a feat difficult for newcomers.

- Price Competitiveness: The cost efficiencies gained through scale and distribution allow High Tide to offer more competitive pricing, deterring new entrants.

Intense Competition from Incumbents

The threat of new entrants is significantly dampened by the intense competition already present from established players. The Canadian cannabis retail market, for instance, is highly saturated with numerous licensed retailers, creating a challenging environment for newcomers. This saturation often results in razor-thin profit margins for all involved.

New businesses entering this space would face a substantial hurdle in capturing market share from established entities like High Tide. High Tide, a prominent player, is strategically expanding its physical presence and continuously optimizing its discount-focused business model. This aggressive growth and refinement by incumbents make it exceedingly difficult for new entrants to gain a foothold.

Consider these points:

- Market Saturation: As of early 2024, Canada's cannabis retail sector features a large number of licensed stores, leading to intense price competition.

- Incumbent Advantage: Established retailers like High Tide benefit from brand recognition, economies of scale, and optimized supply chains, which new entrants lack.

- High Entry Barriers: Significant capital investment is required for licensing, real estate, inventory, and marketing, further deterring new entrants.

- Refined Strategies: Companies like High Tide are actively improving their operational efficiencies and loyalty programs, making it harder for newcomers to compete on price and customer retention.

The threat of new entrants in the Canadian cannabis market is considerably low due to substantial capital requirements and regulatory hurdles. High Tide's established infrastructure, including its extensive retail network and sophisticated supply chain, creates significant barriers. For instance, the cost to establish a single cannabis retail outlet in Canada can range from $200,000 to $500,000, a figure that deters many potential new players.

Furthermore, the market is already highly saturated, with numerous established retailers competing fiercely. Companies like High Tide leverage economies of scale, with bulk purchasing power from suppliers, leading to better pricing that newcomers struggle to match. By early 2024, Canada's retail cannabis sector was characterized by intense price competition, making it difficult for new entrants to gain traction.

| Barrier Type | Description | Estimated Cost/Impact (CAD) | High Tide's Advantage |

|---|---|---|---|

| Regulatory Licensing | Federal and provincial permits for cultivation, processing, and retail. | $10,000 - $25,000+ per federal cultivation license application; millions for retail operations. | Navigated and established compliance infrastructure. |

| Capital Investment (Retail) | Acquiring real estate, store build-outs, initial inventory. | $200,000 - $500,000 per retail store. | Extensive existing retail footprint, reducing per-store startup costs for new locations. |

| Brand Building & Loyalty | Creating brand awareness and customer retention. | Significant marketing and loyalty program investment. | Established brand recognition and effective loyalty programs like Cabana Club (22% membership growth in 2023). |

| Economies of Scale | Bulk purchasing, optimized logistics, and distribution. | New entrants face higher per-unit costs for goods and logistics. | Lower cost of goods sold due to high-volume procurement and efficient distribution network. |

Porter's Five Forces Analysis Data Sources

Our High Tide Porter's Five Forces analysis is built upon a foundation of robust data, including detailed financial reports from publicly traded companies, industry-specific market research from leading firms, and government economic indicators. This comprehensive approach ensures a thorough understanding of industry structure and competitive dynamics.