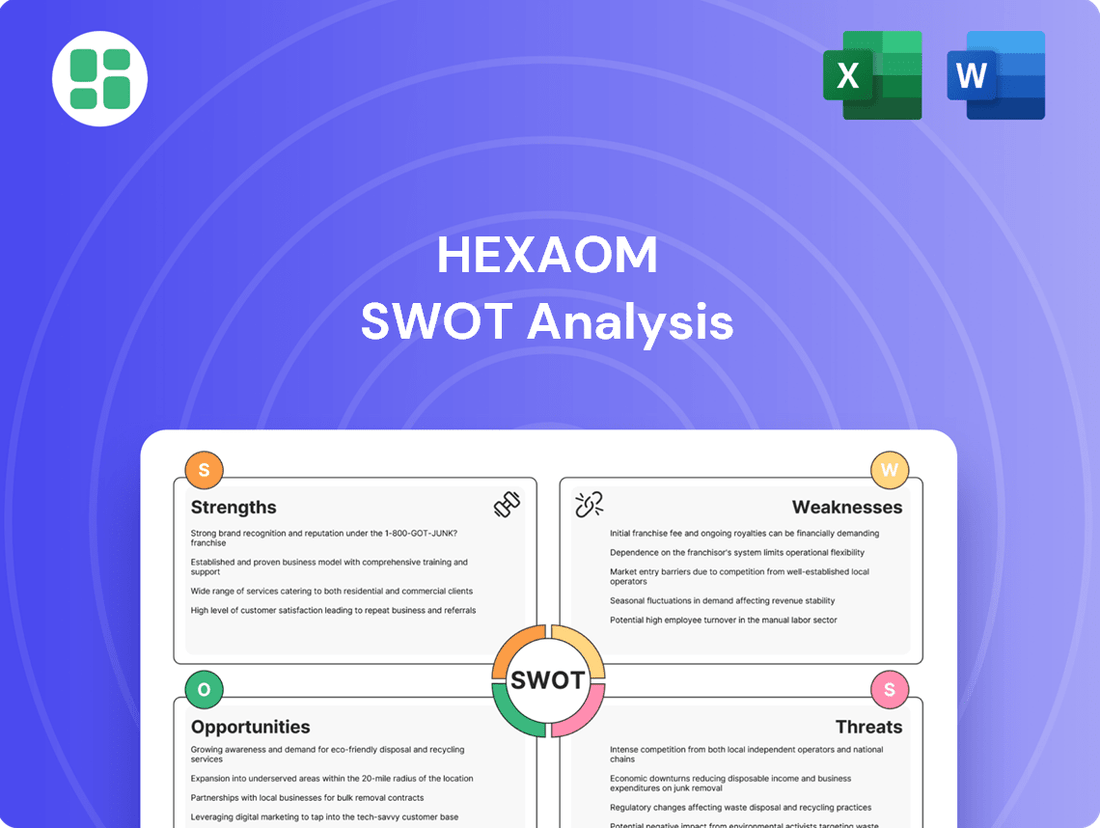

Hexaom SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hexaom Bundle

Hexaom's strengths lie in its innovative technology and dedicated team, but are they enough to overcome emerging market threats and potential operational weaknesses? Our comprehensive SWOT analysis dives deep into these dynamics.

Unlock the full story behind Hexaom's market position, including detailed opportunities for expansion and potential challenges. Purchase the complete SWOT analysis to gain actionable insights and strategic takeaways, perfect for investors and business strategists.

Strengths

Hexaom's diversified business model is a significant strength, encompassing single-family home construction, renovation services, land development, and financial services. This multi-faceted approach effectively reduces the risk tied to any single market segment, ensuring a more stable and varied income. The company's resilience is further bolstered by the robust performance of its intermediated renovation business, which saw notable growth in 2024.

Hexaom commands a dominant position within the French market, particularly in home building, renovation, and catering to first-time homeowners. This leadership is built on a foundation of over a century of experience.

The company's impressive track record, having delivered more than 150,000 houses and completed 90,000 renovations, translates into significant brand recognition and a loyal customer base. This extensive history underpins its strong market standing.

Hexaom's proven adaptability and cost control were critical strengths in 2024. Despite a severe real estate market downturn, the company managed to keep its operating profitability positive, reaching around 2.8% of its annual revenue. This resilience highlights its capacity to navigate significant economic headwinds effectively.

A key factor in this success is Hexaom's 100% subcontracting model. This structure allows for exceptional flexibility, enabling the group to rapidly adjust its cost base in response to market fluctuations. Such agility is invaluable, especially during periods of economic uncertainty, ensuring operational efficiency.

Strategic Diversification and Acquisitions

Hexaom's strategic diversification is a key strength, evident in its expansion of renovation services through franchise networks such as Illico Travaux and Camif Habitat, alongside its development of timber-frame housing solutions with Natilia. This multi-pronged approach mitigates risk by tapping into different segments of the construction and renovation market.

The acquisition of HDV Group in late 2024 significantly bolsters Hexaom's market position and revenue streams. This strategic move enhances its presence, particularly in key regions like Nouvelle-Aquitaine and the Loiret department, demonstrating a clear intent to consolidate and grow through targeted M&A activity.

- Diversified Renovation Services: Franchise networks like Illico Travaux and Camif Habitat broaden Hexaom's reach in the renovation sector.

- Timber-Frame Housing Expansion: Natilia's development caters to growing demand for sustainable building solutions.

- Strategic Acquisition: The late 2024 acquisition of HDV Group strengthens market presence and revenue, especially in specific French departments.

Robust Financial Health

Hexaom's robust financial health is a significant strength, underscored by its strong net cash position. The company concluded 2024 with €84.3 million in net cash, demonstrating a solid financial foundation. This healthy balance sheet offers considerable stability, allowing Hexaom to effectively manage market volatility and capitalize on emerging growth prospects as economic conditions improve.

This financial resilience translates into several key advantages:

- Financial Stability: A substantial net cash reserve provides a buffer against unforeseen economic downturns or industry-specific challenges.

- Investment Capacity: The strong cash position enables Hexaom to pursue strategic investments in research and development, acquisitions, or market expansion without relying heavily on external financing.

- Operational Flexibility: Ample liquidity grants the company the freedom to adapt its operational strategies and respond quickly to market shifts or competitive pressures.

- Shareholder Confidence: A healthy financial standing often boosts investor confidence, potentially leading to a more favorable valuation and easier access to capital markets if needed in the future.

Hexaom's diversified business model, covering home construction, renovation, land development, and financial services, significantly mitigates risk. This multi-pronged approach, combined with a 100% subcontracting model, provides exceptional flexibility to adjust costs during market fluctuations. The company's resilience was evident in 2024, maintaining positive operating profitability of around 2.8% despite a challenging real estate market.

Hexaom's market leadership in France, built over a century, is a major strength. This is reinforced by its extensive track record of delivering over 150,000 houses and completing 90,000 renovations, fostering strong brand recognition and customer loyalty.

The strategic expansion of renovation services through franchises like Illico Travaux and Camif Habitat, along with timber-frame housing solutions via Natilia, diversifies revenue and taps into growing market segments. The late 2024 acquisition of HDV Group further solidifies its market position and revenue streams, particularly in key French regions.

Hexaom's robust financial health is a key strength, evidenced by its strong net cash position of €84.3 million at the end of 2024. This provides financial stability, enables strategic investments, and enhances operational flexibility.

| Metric | 2023 (approx.) | 2024 (approx.) | Significance |

|---|---|---|---|

| Operating Profitability | N/A | 2.8% of revenue | Demonstrates resilience amid market downturn |

| Net Cash Position | N/A | €84.3 million | Indicates strong financial stability and investment capacity |

| Houses Delivered (Cumulative) | 150,000+ | 150,000+ | Underpins brand recognition and market standing |

| Renovations Completed (Cumulative) | 90,000+ | 90,000+ | Reinforces market presence and customer base |

What is included in the product

Delivers a strategic overview of Hexaom’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Hexaom's SWOT analysis simplifies complex strategic challenges into actionable insights, relieving the pain of overwhelming data for clearer decision-making.

Weaknesses

Hexaom faced a significant revenue drop of 29% in 2024, bringing in €727.2 million. This sharp decline was largely due to the ongoing real estate crisis, which heavily affected new home construction orders.

Hexaom's primary reliance on the home building sector, which represents the majority of its revenue, makes it highly susceptible to the inherent cyclicality of the housing market. This vulnerability was starkly evident in 2024, with a significant 31.5% contraction in this core business segment.

The direct correlation between home building performance and real estate market fluctuations exposes Hexaom to considerable risk during economic downturns. Such periods often coincide with decreased consumer confidence and reduced purchasing power, directly impacting sales and profitability.

Hexaom is experiencing pressure on its operating profitability, with its operating margin declining from 3.7% in 2023 to 2.8% in 2024. This dip, while still maintaining positive profitability, signals that tougher market conditions are impacting earnings.

Factors contributing to this squeeze include lower production volumes and the impact of non-recurring costs associated with necessary structural adjustments. These elements combined are making it more challenging for Hexaom to translate its revenue into profit.

Underperforming Land Development Segment

Hexaom's land development segment has faced significant headwinds, evidenced by a substantial revenue drop. In 2024, this crucial business area recorded a revenue decrease of 55.1%. This sharp decline points to potential challenges in acquiring and advancing new land parcels, which could directly affect the company's future home construction project pipeline.

The underperformance in land development raises concerns about Hexaom's ability to replenish its development inventory. This situation could limit future growth opportunities and impact the company's overall strategic positioning within the competitive real estate market.

- Revenue Decline: Land development revenue fell by 55.1% in 2024.

- Pipeline Impact: Difficulties in securing new land plots hinder future home building projects.

- Growth Constraint: Underperformance limits the replenishment of the development inventory.

Exposure to Rising Costs and Stricter Regulations

Hexaom, like other players in the French construction sector, is vulnerable to escalating material expenses and persistent inflation. For instance, the price of key construction materials such as cement and steel saw significant increases throughout 2023 and into early 2024, impacting overall project budgets. This upward cost pressure directly affects Hexaom's ability to maintain healthy profit margins on its projects.

Furthermore, the tightening of environmental regulations within France presents another significant challenge. These evolving standards, aimed at promoting sustainability and energy efficiency, can necessitate costly modifications to building designs and construction processes. Compliance with these stricter rules might lead to increased project expenses and potential delays for Hexaom.

- Rising Material Costs: Continued inflation in construction materials like timber and concrete could erode profit margins.

- Stricter Environmental Regulations: New building codes focusing on energy efficiency might increase project development costs for Hexaom.

- Supply Chain Disruptions: Lingering global supply chain issues could still impact the availability and cost of essential building components.

Hexaom's significant revenue decline in 2024, down 29% to €727.2 million, highlights its deep vulnerability to the real estate market's downturn. The company's heavy reliance on new home construction, which saw a 31.5% contraction in 2024, directly exposes it to economic fluctuations and reduced consumer spending. This over-dependence on a single, cyclical sector limits its resilience during market slumps.

The company's operating margin also took a hit, falling from 3.7% in 2023 to 2.8% in 2024, indicating that rising costs and lower volumes are squeezing profitability. Compounding these issues, Hexaom's land development segment experienced a dramatic 55.1% revenue drop in 2024, raising concerns about its ability to secure future projects and maintain a healthy development pipeline.

| Metric | 2023 | 2024 | Change |

|---|---|---|---|

| Total Revenue | €1,024.2 million | €727.2 million | -29.0% |

| Home Building Revenue | N/A | Significant decline (31.5% contraction) | N/A |

| Land Development Revenue | N/A | -55.1% | N/A |

| Operating Margin | 3.7% | 2.8% | -0.9 pp |

Full Version Awaits

Hexaom SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of Hexaom's strategic position.

This is a real excerpt from the complete Hexaom SWOT analysis document. Once purchased, you’ll receive the full, editable version to leverage for your business planning.

You’re viewing a live preview of the actual Hexaom SWOT analysis file. The complete version, packed with detailed insights, becomes available after checkout.

Opportunities

The French property market is showing promising signs, with a noticeable uptick in buyer interest and completed sales towards the end of 2024. This trend suggests a potential turning point after a period of slower activity.

Looking ahead to 2025, economists and market analysts are predicting a stabilization, and possibly a moderate recovery, in both property transaction volumes and average prices. For instance, some projections indicate a 2-3% increase in housing transactions nationwide for 2025 compared to 2024.

This anticipated market improvement creates a more conducive operating environment for Hexaom, potentially leading to increased demand for its services and a more predictable revenue stream.

The French government's extension of interest-free loans (PTZ) to all territories and for various new housing types, particularly benefiting first-time buyers, is a significant opportunity. This initiative is projected to directly stimulate housing demand, which is crucial for Hexaom's core business of new home construction.

In 2024, the PTZ scheme continues to be a vital tool for supporting the real estate market. For instance, the program aims to make homeownership more accessible, potentially increasing the number of transactions for new builds, directly benefiting companies like Hexaom.

The renovation and home maintenance sector, particularly for energy-efficient improvements, is experiencing robust growth. This trend is fueled by increasing environmental consciousness and evolving regulatory mandates. For instance, the global green building market, which encompasses energy-efficient renovations, was valued at approximately $1.07 trillion in 2023 and is expected to reach $1.78 trillion by 2027, showcasing significant expansion potential.

Hexaom is strategically positioned to leverage this expanding market. With its existing renovation services and a growing franchise network, the company is well-equipped to meet the rising demand for sustainable and energy-saving home upgrades. This presents a substantial opportunity for Hexaom to increase its market share and revenue streams.

Increasing Demand for Sustainable Construction

The market is showing a clear shift towards sustainability, with consumers increasingly favoring energy-efficient and eco-friendly homes, such as those built with timber frames. This trend presents a significant opportunity for Hexaom.

Hexaom's established expertise in timber-frame construction, notably through its Natilia brand, positions it advantageously. Furthermore, the company's strategic pivot to a 'Build/Renovate' model directly addresses this growing demand for greener building solutions.

This alignment is supported by market data indicating robust growth in the green building sector. For instance, the global green building materials market was valued at approximately USD 245.8 billion in 2023 and is projected to reach USD 496.9 billion by 2030, growing at a compound annual growth rate (CAGR) of 10.5% during the forecast period. This growth is driven by increasing environmental awareness and government regulations promoting sustainable construction practices.

Key opportunities stemming from this trend include:

- Expanding market share in the eco-friendly housing segment.

- Leveraging the Natilia brand for increased visibility and customer trust in sustainable building.

- Capitalizing on the 'Build/Renovate' strategy to capture both new construction and retrofitting projects focused on energy efficiency.

- Potentially increasing profit margins due to the premium consumers are often willing to pay for sustainable properties.

Market Consolidation and Acquisition Potential

Challenging market conditions are paving the way for consolidation, presenting Hexaom with a prime opportunity to expand its market presence. Weaker competitors may be forced out, allowing stronger entities like Hexaom to acquire them and absorb their customer base and technological assets. This strategic acquisition approach was evident in Hexaom's successful integration of the HDV Group, which demonstrably broadened its operational reach and service offerings.

Hexaom's ability to capitalize on market consolidation is further supported by its robust financial standing. As of late 2024, Hexaom reported a healthy cash reserve, enabling it to pursue strategic acquisitions without significant financial strain. This positions the company advantageously to absorb struggling competitors and integrate their operations, thereby increasing market share and synergistic efficiencies.

- Strategic Acquisitions: Hexaom can acquire competitors weakened by market downturns to gain market share.

- Footprint Expansion: The HDV Group integration showcases Hexaom's capability to expand its geographic and service reach through acquisitions.

- Synergy Realization: Integrating acquired entities allows Hexaom to realize cost savings and operational efficiencies.

- Competitive Advantage: Consolidating the market strengthens Hexaom's position against remaining rivals.

The French property market's anticipated stabilization and moderate recovery in 2025, with potential transaction volume increases of 2-3%, offers Hexaom a more favorable operating environment. This trend, coupled with ongoing government support like the PTZ loan scheme, directly stimulates demand for new housing, a core business for Hexaom. The growing emphasis on sustainable and energy-efficient renovations, a market projected to reach $1.78 trillion globally by 2027, presents a significant avenue for Hexaom's expansion, especially with its expertise in timber-frame construction via Natilia and its 'Build/Renovate' strategy. Furthermore, market consolidation driven by challenging conditions provides Hexaom opportunities for strategic acquisitions, as demonstrated by the successful HDV Group integration, to expand its footprint and achieve greater market share.

| Opportunity Area | Key Driver | Hexaom's Advantage | Market Data/Projection |

|---|---|---|---|

| French Property Market Recovery | Stabilization and moderate recovery predicted for 2025 | Improved demand for new construction | 2-3% increase in housing transactions projected for 2025 |

| Government Support (PTZ) | Extension of interest-free loans | Stimulates demand for first-time buyers and new builds | PTZ scheme continues to be vital for market support |

| Sustainable Renovation Market | Growing environmental consciousness and regulations | Expertise in timber-frame construction (Natilia), 'Build/Renovate' model | Global green building market to reach $1.78 trillion by 2027 |

| Market Consolidation | Challenging market conditions forcing weaker competitors out | Ability to acquire competitors and expand market presence (e.g., HDV Group integration) | Robust cash reserves in late 2024 enable strategic acquisitions |

Threats

The French real estate market's prolonged crisis, now in its fourth year, presents a significant threat. New housing starts have plummeted to historically low levels, a trend that continued into early 2024, with projections for the full year indicating a substantial year-on-year decline. This sustained downturn directly impacts Hexaom's core business by suppressing demand for its construction services.

A continued slump in property sales and development activity could further erode Hexaom's revenue pipeline. For instance, if new housing starts remain below the 300,000 unit mark annually, as seen in recent years, Hexaom's order book for new construction projects will likely face continued pressure, impacting its top-line growth throughout 2024 and into 2025.

While mortgage rates have seen a modest dip, they remain significantly higher than in prior years, impacting how much buyers can afford and their ability to secure home loans. This persistent financial pressure is likely to continue dampening sales volumes for Hexaom and could necessitate larger down payments from its clientele.

For instance, the average 30-year fixed mortgage rate hovered around 6.8% in early 2024, a notable increase from sub-3% rates seen in 2021. This directly translates to higher monthly payments for potential buyers, reducing their purchasing power and potentially leading to a slowdown in demand for real estate services and products offered by companies like Hexaom.

Global economic slowdowns, such as the projected 2.4% growth for the global economy in 2024 according to the IMF, coupled with ongoing international trade tensions, can significantly dampen consumer confidence and investment in sectors like construction. This macroeconomic volatility directly impacts Hexaom's business outlook, potentially leading to reduced project pipelines and increased operational costs.

Domestic political uncertainties, including upcoming elections or shifts in government policy, can create a less predictable operating environment for Hexaom. Such instability might delay or cancel construction projects, impacting revenue streams and requiring agile strategic adjustments to mitigate financial risks.

Intensified Competitive Landscape

The construction and renovation market is seeing increased competition as companies adapt to evolving economic conditions. This intensified rivalry could put pressure on Hexaom's pricing strategies and potentially shrink profit margins.

Hexaom may face difficulties in securing new projects as more companies vie for a limited pool of opportunities. This competitive pressure is a significant threat, especially considering the sector's sensitivity to economic fluctuations.

- Pricing Pressure: Increased competition can force companies like Hexaom to lower prices to remain competitive, impacting profitability.

- Margin Erosion: Aggressive pricing and higher operational costs due to competition can lead to reduced profit margins for Hexaom.

- Market Share Challenges: Securing new contracts becomes more challenging, potentially hindering Hexaom's ability to grow or maintain its market share.

Supply Chain Disruptions and Labor Shortages

Hexaom faces ongoing threats from supply chain disruptions, which can cause volatile material prices and project delays. For instance, in 2024, the global shipping industry continued to grapple with port congestion and container imbalances, directly impacting the availability and cost of construction materials like steel and lumber. This unpredictability makes it challenging for Hexaom to maintain stable project budgets and timelines.

Furthermore, a significant shortage of skilled labor remains a critical challenge for the construction sector. Reports from late 2024 indicated a widening gap between the demand for experienced tradespeople and the available workforce, a trend expected to persist into 2025. This labor scarcity directly affects Hexaom's ability to execute projects efficiently, potentially increasing labor costs and extending project completion dates.

- Supply Chain Volatility: Unpredictable material costs due to global logistics issues in 2024-2025.

- Skilled Labor Deficit: Persistent shortage of qualified construction workers impacting project timelines and costs.

- Increased Operational Expenses: Higher labor and material costs due to shortages and disruptions.

Hexaom operates within a challenging French real estate market, now in its fourth year of crisis, marked by historically low new housing starts continuing into early 2024. This prolonged downturn directly suppresses demand for Hexaom's construction services, impacting its revenue pipeline and order book throughout 2024 and into 2025, especially if annual starts remain below 300,000 units.

Persistent higher mortgage rates, averaging around 6.8% for a 30-year fixed loan in early 2024 compared to sub-3% in 2021, continue to dampen buyer affordability and sales volumes. Global economic slowdowns, projected at 2.4% growth for 2024 by the IMF, and domestic political uncertainties further create volatility, potentially delaying projects and increasing operational costs for Hexaom.

Intensified competition within the construction and renovation market poses a threat of pricing pressure and margin erosion for Hexaom. Supply chain disruptions, evident in 2024 with port congestion affecting material costs, and a persistent shortage of skilled labor, impacting project efficiency and increasing labor expenses, add further operational challenges for the company into 2025.

| Threat Factor | Impact on Hexaom | Data Point/Context |

|---|---|---|

| Real Estate Market Crisis | Reduced demand for construction services | New housing starts historically low, projected decline in 2024 |

| Mortgage Rates | Dampened buyer affordability and sales | Avg. 30-year fixed rate ~6.8% (early 2024) vs. <3% (2021) |

| Economic & Political Volatility | Project delays, increased costs, reduced confidence | Global growth projected at 2.4% (2024); domestic political uncertainties |

| Increased Competition | Pricing pressure, margin erosion | Companies adapting to economic conditions vie for limited projects |

| Supply Chain & Labor Shortages | Volatile material prices, project delays, higher labor costs | Port congestion impacting materials; skilled labor deficit persisting into 2025 |

SWOT Analysis Data Sources

This Hexaom SWOT analysis is built upon a robust foundation of data, drawing from Hexaom's official financial filings, comprehensive market intelligence reports, and the expert opinions of industry analysts to provide a well-rounded strategic overview.