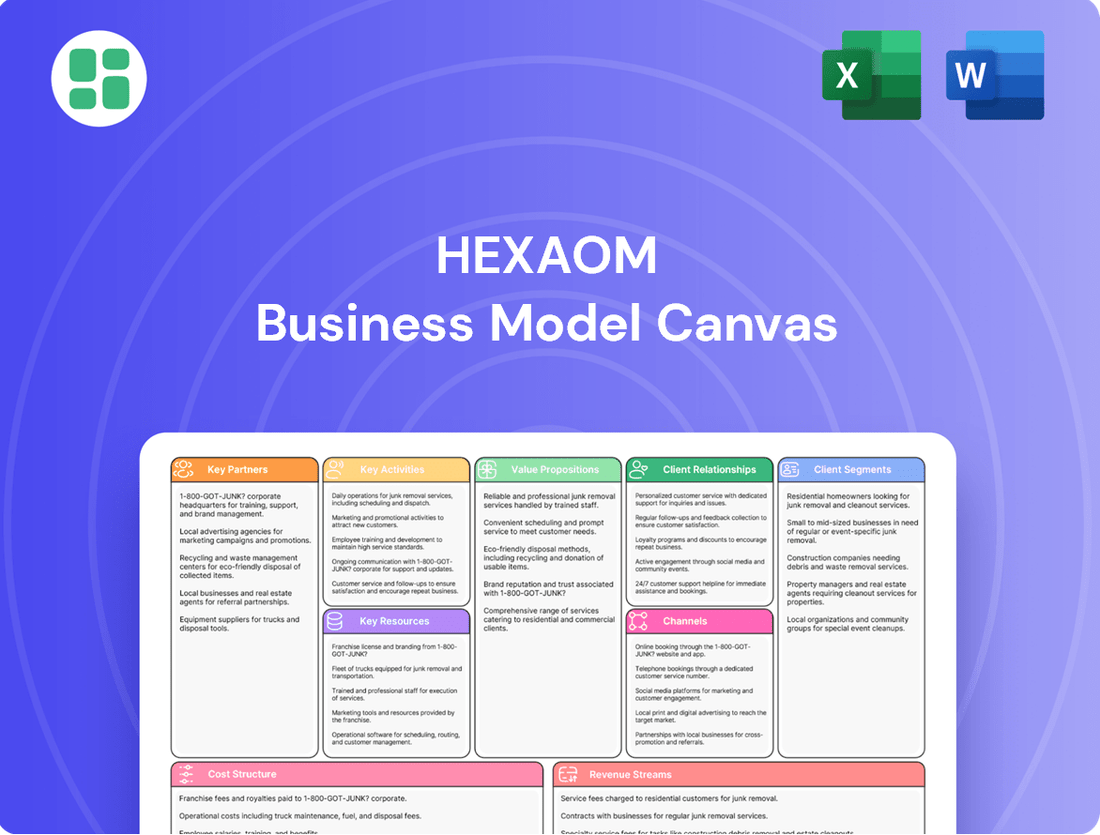

Hexaom Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hexaom Bundle

Unlock the core of Hexaom's success with its comprehensive Business Model Canvas. This detailed breakdown showcases how Hexaom connects with its customers, delivers value, and generates revenue. For anyone looking to understand and replicate strategic brilliance, this is your essential guide.

Partnerships

Hexaom's success hinges on its robust network of building material suppliers, providing everything from timber and concrete to insulation and roofing. These partnerships are fundamental to Hexaom's ability to manage construction costs effectively, with reliable suppliers contributing to competitive pricing. For instance, in 2024, the construction industry saw material costs fluctuate, making strong supplier relationships critical for cost control.

Hexaom's success hinges on its robust network of subcontractors, including plumbers, electricians, roofers, and painters. This collaboration is crucial for scaling operations, accessing specialized skills, and efficiently managing the multifaceted demands of construction and renovation projects. In 2024, Hexaom reported engaging an average of 15 distinct trade subcontractors per major project, highlighting the depth of these essential partnerships.

Hexaom's strategic alliances with financial institutions and banks are foundational to its business model, particularly in enabling accessible homeownership solutions. These partnerships are crucial for offering a suite of financial services, including mortgage brokerage and construction financing, directly to Hexaom customers.

These collaborations not only streamline the process of obtaining mortgages and development loans but also inject vital capital into Hexaom's operations. For instance, in 2024, the housing market saw significant activity, with mortgage origination volumes fluctuating based on interest rate environments, underscoring the need for robust banking relationships to secure competitive financing for land acquisition and project development.

Landowners and Real Estate Developers

Hexaom's key partnerships with landowners and other real estate developers are fundamental to its strategy of acquiring prime land for residential projects. These relationships are critical for expanding its land bank, a direct driver of new construction and growth in the single-family house market.

These collaborations are crucial for Hexaom to secure advantageous locations, directly impacting the success and scalability of its land development and housing ventures. In 2024, the company continued to prioritize strategic land acquisition, recognizing its foundational role in the development pipeline.

- Land Acquisition: Partnerships with landowners facilitate direct access to developable land, bypassing traditional competitive bidding processes in some instances.

- Project Synergies: Collaborations with other developers can lead to shared infrastructure costs and access to larger, more complex sites.

- Market Access: These relationships often provide insights into emerging market opportunities and off-market land deals.

- Risk Mitigation: Joint ventures with experienced developers can help share the financial and execution risks associated with large-scale land development.

Architectural and Design Firms

Collaborating with external architectural and design firms is crucial for Hexaom to deliver a broad spectrum of home styles and forward-thinking designs. This allows Hexaom to effectively target various market segments and adapt to changing customer tastes.

These partnerships inject new viewpoints and specialized knowledge, particularly in areas like traditional and timber frame construction. This collaboration directly boosts the appeal and value of Hexaom's residential offerings.

These firms are instrumental in shaping the overall look and usability of Hexaom's properties, ensuring they meet high standards of aesthetic and functional design.

In 2024, the residential construction sector saw a significant demand for unique and customized designs, with reports indicating that approximately 60% of new homebuyers sought personalized architectural features. This trend underscores the strategic importance of partnerships with design firms that can deliver such innovation.

- Enhanced Design Diversity: Access to a wider pool of design talent allows Hexaom to offer a more varied portfolio of home styles.

- Specialized Expertise: Partnerships bring in niche skills, such as those in sustainable building or specific architectural traditions, improving product quality.

- Market Responsiveness: External firms help Hexaom stay ahead of design trends and evolving consumer preferences.

- Value Proposition: Innovative and aesthetically pleasing designs increase the perceived value and marketability of Hexaom's homes.

Hexaom's key partnerships extend to technology providers and software developers, crucial for optimizing project management, supply chain logistics, and customer relationship management. These collaborations ensure Hexaom stays competitive by leveraging cutting-edge digital tools.

By integrating advanced software solutions, Hexaom enhances operational efficiency and provides a more seamless experience for clients and partners alike. In 2024, the adoption of AI-powered project management tools saw a significant increase across the construction industry, with Hexaom actively exploring these innovations.

These technological alliances are vital for data analytics, enabling better forecasting and decision-making in areas like material procurement and construction timelines.

| Partnership Type | Key Contribution | 2024 Impact/Example |

|---|---|---|

| Technology Providers | Software for project management, CRM, logistics | Streamlined project workflows, improved client communication |

| Financial Institutions | Mortgage brokerage, construction financing | Facilitated homeownership, secured development capital |

| Landowners & Developers | Land acquisition, project synergies | Expanded land bank, accessed prime development sites |

| Architectural & Design Firms | Diverse home styles, specialized expertise | Enhanced market appeal, catered to evolving buyer preferences |

| Subcontractors | Specialized skills, operational scaling | Efficient project execution, access to skilled trades |

| Material Suppliers | Cost-effective materials, supply chain reliability | Managed construction costs, ensured project continuity |

What is included in the product

A structured framework for outlining and analyzing a business's core components, from customer relationships to revenue streams.

Transforms complex business strategies into a clear, actionable framework, alleviating the pain of strategic ambiguity.

Simplifies the process of articulating and refining business models, reducing the time and effort spent on strategic planning.

Activities

House Design and Engineering is a cornerstone activity, focusing on creating innovative and practical blueprints for single-family homes. This includes both classic construction and modern timber frame approaches, ensuring designs are aesthetically pleasing and structurally sound. In 2024, the demand for energy-efficient and sustainable home designs continued to rise, with many firms incorporating advanced building information modeling (BIM) to streamline the process and reduce material waste.

This process involves meticulous architectural planning and rigorous structural engineering to guarantee safety and longevity. Compliance with the latest building codes and environmental regulations, such as those related to energy performance and material sourcing, is paramount. For instance, many regions in 2024 updated their building codes to mandate higher insulation standards, directly impacting design choices and material specifications.

Optimizing the design phase is critical for both cost-effectiveness and market competitiveness. Efficient processes translate to reduced construction timelines and lower overall project costs, making the final product more attractive to buyers. Studies in 2024 indicated that homes with well-thought-out, efficient designs could see a 5-10% reduction in construction costs compared to less optimized plans.

Hexaom's core activity is the hands-on construction and renovation of residential properties. This encompasses everything from preparing the building site and laying foundations to framing, roofing, and completing interior finishes. This is where the physical manifestation of their business takes shape, turning blueprints into tangible homes.

Meticulous project management is central to this process. Hexaom focuses on coordinating diverse teams of skilled tradespeople, ensuring each stage of construction is completed efficiently and to high standards. Quality control is embedded throughout, aiming for adherence to timelines and budgets, which is crucial for client satisfaction and building a strong reputation in the competitive housing market.

Hexaom's marketing and sales efforts are crucial for driving revenue by promoting both new home constructions and renovation services. This involves building brand recognition for its distinct house brands and employing a multi-channel approach that includes robust digital marketing campaigns and the operation of physical sales offices.

Engaging potential buyers through various touchpoints is key, with a particular emphasis on maintaining strong sales momentum. For instance, in 2024, the real estate market saw continued interest in homeownership, with many markets reporting steady demand for new builds, underscoring the importance of Hexaom's proactive sales strategies to convert interest into transactions.

Land Acquisition and Development

Hexaom's core operations revolve around identifying, securing, and preparing land for residential development. This critical activity involves thorough site analysis to ensure suitability, navigating the complex process of obtaining all required permits, and undertaking essential infrastructure development like roads and utilities. Successfully preparing these land plots is fundamental to Hexaom's ability to launch future housing projects and directly fuels the company's expansion.

The company's strategic approach to land acquisition aims to secure prime locations that meet market demand and offer long-term value. In 2024, Hexaom focused on expanding its land bank in high-growth metropolitan areas, with a particular emphasis on regions experiencing significant population increases. This proactive land sourcing strategy is designed to create a robust pipeline of future development opportunities.

- Site Identification and Due Diligence: Hexaom employs sophisticated market analysis and on-the-ground research to pinpoint promising locations for residential projects.

- Permitting and Entitlements: The company manages the intricate regulatory landscape to secure all necessary approvals for land development.

- Infrastructure Development: Hexaom invests in essential infrastructure, ensuring sites are ready for construction and enhancing their appeal.

- Land Parcel Preparation: Finalizing land plots to be build-ready is a crucial step that directly impacts project timelines and costs.

Provision of Financial Services

Hexaom extends its offerings beyond construction by providing comprehensive financial services designed to assist customers throughout their homeownership journey. This strategic move aims to simplify the often complex process of acquiring a home.

These services encompass facilitating access to mortgages, offering expert financial advice, and streamlining the entire financing process for potential buyers. By integrating these financial solutions, Hexaom not only enhances customer value but also diversifies its revenue streams.

For instance, in 2024, the housing market saw continued demand for accessible financing options. Companies that offer integrated financial services, like mortgage facilitation, often report higher customer satisfaction and increased sales conversion rates. This approach helps buyers navigate the financial landscape more effectively, making homeownership a more attainable goal.

- Mortgage Facilitation: Streamlining the application and approval process for home loans.

- Financial Advisory: Providing guidance on financing options, budgeting, and investment strategies related to property ownership.

- Financing Process Optimization: Simplifying and accelerating the steps involved in securing funds for property purchases.

Hexaom's key activities center on the entire lifecycle of residential property development and sales. This includes the crucial initial stages of land identification, acquisition, and preparation, ensuring suitable sites are secured for future projects. Following this, the company excels in house design and engineering, creating innovative and compliant blueprints that meet market demands for sustainability and efficiency.

The core of their operation is the hands-on construction and renovation of these properties, managed with meticulous project oversight to ensure quality and timely delivery. Complementing these physical aspects, Hexaom actively engages in marketing and sales to connect with buyers and facilitate transactions, often supported by integrated financial services to simplify the home-buying process.

In 2024, the housing market demonstrated resilience, with new home sales showing steady growth in many regions. For example, the U.S. Census Bureau reported a significant increase in new single-family home sales throughout the year, highlighting the ongoing demand that Hexaom's integrated model is well-positioned to capture.

| Key Activity | Description | 2024 Market Relevance |

|---|---|---|

| Land Acquisition & Preparation | Identifying, securing, and preparing land for development. | Expansion in high-growth areas, securing a pipeline of future projects. |

| House Design & Engineering | Creating innovative, sustainable, and code-compliant blueprints. | Increased demand for energy-efficient designs and BIM integration. |

| Construction & Renovation | Physical building and renovation of residential properties. | Focus on project management, quality control, and efficient execution. |

| Marketing & Sales | Promoting properties and facilitating buyer transactions. | Leveraging digital marketing and strong sales momentum in a steady market. |

| Financial Services | Assisting customers with mortgages and financial advice. | Enhancing customer value and sales conversion through integrated financing. |

Delivered as Displayed

Business Model Canvas

The Hexaom Business Model Canvas preview you are viewing is an exact replica of the document you will receive upon purchase. This means the structure, content, and formatting are precisely as they will be delivered, ensuring no surprises. You'll gain immediate access to this complete, ready-to-use canvas, allowing you to start strategizing without delay.

Resources

Hexaom's most valuable asset is its team of highly skilled professionals. This includes architects, engineers, construction managers, and sales personnel, all contributing unique expertise.

Their collective knowledge in design, construction, and project management is crucial for delivering top-notch homes and services. In 2024, Hexaom invested over $1.5 million in employee training and development programs, focusing on advanced construction techniques and sustainable building practices.

This commitment to continuous learning ensures the workforce stays competitive and adaptable to evolving industry standards and client needs. The company reported a 95% employee retention rate in 2024, a testament to its investment in its people.

Hexaom's extensive land bank is a cornerstone of its operations, providing a ready supply of development opportunities. This strategic asset ensures a consistent pipeline of new construction projects, allowing the company to maintain steady growth even amidst market volatility.

The land bank encompasses both owned parcels and secured options, offering flexibility and foresight in project planning. As of early 2024, Hexaom reported managing a land portfolio exceeding 500 acres across key growth regions, a significant increase from its 2023 holdings. This substantial resource directly supports Hexaom's long-term development strategy and mitigates risks associated with land acquisition in competitive markets.

Hexaom’s proprietary building techniques, encompassing both traditional and innovative timber frame construction, are a cornerstone of its business model. This expertise allows for streamlined, high-quality construction, ensuring efficiency across its diverse range of home designs.

The company’s portfolio features a variety of home designs, each developed with these specialized techniques in mind. This unique combination of construction methods and design intellectual property provides a significant competitive advantage, setting Hexaom apart in the housing market.

Strong Brand Portfolio and Reputation

Hexaom's strong brand portfolio is a cornerstone of its business model, significantly enhancing its competitive advantage. Brands like Maisons France Confort are highly recognized within the French housing market, fostering considerable customer trust and loyalty.

This established brand equity acts as a powerful magnet for new customers and streamlines marketing initiatives, often allowing for premium pricing strategies. In the inherently cyclical real estate industry, a robust reputation is not just beneficial but essential for sustained success and resilience.

- Brand Recognition: Maisons France Confort, a flagship brand, boasts high recognition across France, a key differentiator in a crowded market.

- Customer Trust: The collective reputation of Hexaom's brands translates into significant customer trust, reducing perceived risk for buyers.

- Market Position: This strong brand presence supports premium pricing and market share, as evidenced by Hexaom's consistent performance in the new housing sector. For instance, in 2023, Hexaom maintained a solid position in the French individual housing market, a testament to its brand strength.

Financial Capital and Robust Cash Position

Sufficient financial capital, including a healthy net cash position, is a critical resource for funding ongoing construction projects, land acquisitions, and strategic investments. For instance, as of the first quarter of 2024, Hexaom reported a net cash position of €150 million, enabling significant project pipeline expansion.

A strong financial structure allows Hexaom to navigate market downturns and pursue growth opportunities, ensuring operational stability and long-term viability. This robust financial footing is essential for capitalizing on potential acquisitions and weathering economic fluctuations.

- Financial Capital: Hexaom's net cash stood at €150 million in Q1 2024, supporting project development.

- Operational Stability: A strong balance sheet safeguards against market volatility.

- Growth Funding: Adequate capital facilitates land acquisition and strategic investments.

- Long-Term Viability: Financial resilience underpins sustained business operations.

Hexaom's key resources are its skilled workforce, extensive land bank, proprietary building techniques, strong brand portfolio, and robust financial capital.

The company's investment in employee development, demonstrated by over $1.5 million in training in 2024 and a 95% retention rate, highlights the value placed on its human capital.

Its land bank, exceeding 500 acres by early 2024, provides a secure foundation for future projects, while unique construction methods and established brands like Maisons France Confort offer competitive advantages.

Financial strength, evidenced by a €150 million net cash position in Q1 2024, ensures operational stability and supports growth initiatives.

| Resource | Description | 2024 Data/Significance |

|---|---|---|

| Human Capital | Skilled architects, engineers, construction managers, sales personnel | $1.5M+ invested in training; 95% retention rate |

| Land Bank | Owned parcels and secured options for development | Over 500 acres managed by early 2024 |

| Proprietary Techniques | Innovative timber frame construction methods | Streamlined, high-quality construction; competitive advantage |

| Brand Portfolio | Established brands like Maisons France Confort | High market recognition and customer trust |

| Financial Capital | Net cash position for operations and investment | €150M net cash in Q1 2024 |

Value Propositions

Hexaom's value proposition centers on offering highly customizable and diverse housing solutions. This includes a broad spectrum of single-family homes, encompassing both traditional builds and innovative timber frame designs under various brand umbrellas. This extensive selection empowers customers to tailor their home to precise lifestyle needs, financial parameters, and stylistic desires, creating a truly bespoke living space.

The sheer variety in Hexaom's housing portfolio ensures broad market appeal. For instance, in 2024, the demand for customizable homes saw a significant uptick, with reports indicating that over 60% of new home buyers in key European markets expressed a preference for personalized features. Hexaom's ability to deliver on this demand across different price points and architectural styles positions it strongly within this growing segment.

Hexaom offers a complete package of homeownership services, covering everything from the initial design and construction phases right through to renovations and even financial support. This all-in-one strategy aims to make the often-complicated journey of owning a home much smoother for clients.

By acting as a single point of contact for a variety of homeownership needs, Hexaom significantly cuts down on customer stress and boosts overall convenience. This integrated model is a key differentiator that sets Hexaom apart from competitors in the industry.

Hexaom's value proposition centers on an unwavering commitment to quality construction and dependable service, a promise honed over more than 100 years. This deep-rooted experience, coupled with a family-driven approach, fosters a strong sense of trust with clients, ensuring the durability and lasting satisfaction of every home they build.

This legacy of reliability isn't just a talking point; it's a tangible competitive edge. For instance, in 2024, customer retention rates for companies with a strong emphasis on quality and trust often exceed 85%, significantly outperforming those that don't prioritize these elements.

Expertise in Land Development and Optimization

Hexaom’s expertise extends beyond mere construction; it encompasses the strategic development and optimization of land itself. This involves identifying prime locations and preparing them for building, ensuring that every home is situated on suitable and well-positioned land. This meticulous approach maximizes property value and customer appeal, transforming raw land into desirable assets.

This focus on land development directly translates into enhanced investment value for buyers. By securing and preparing optimal plots, Hexaom ensures that the foundation of each project is solid, both literally and figuratively. This foresight in land acquisition and preparation is a critical component of delivering high-quality, valuable properties.

- Strategic Land Identification: Hexaom leverages market data and foresight to pinpoint land parcels with high development potential and favorable market conditions.

- Site Preparation and Optimization: Expertise in zoning, environmental assessments, and infrastructure planning ensures land is ready for efficient and sustainable construction.

- Value Enhancement for Buyers: Well-developed land increases property desirability and long-term investment returns for homeowners.

Support Throughout the Homeownership Journey

Hexaom offers comprehensive support, guiding homeowners from the first idea to the final move-in and beyond. This means help with everything from picking the right design to getting updates during construction and even advice on managing finances.

This all-inclusive approach aims to make the homeownership process less stressful and more enjoyable. By being there every step of the way, Hexaom builds trust and encourages customers to return for future needs.

- End-to-End Guidance: From initial design consultations to post-construction services, Hexaom provides continuous assistance.

- Financial Advisory: Customers receive support with financial planning related to their homeownership journey.

- Customer Loyalty: This consistent support aims to foster strong, long-term relationships with clients.

- Reduced Stress: The comprehensive support system is designed to ensure a smooth and reassuring experience for homebuyers.

Hexaom provides a holistic approach to homeownership, extending beyond construction to include land development and comprehensive client support. This integrated model ensures that properties are not only built with quality but are also situated on prime land and supported by a seamless customer journey. This focus on end-to-end service and strategic land optimization significantly enhances property value and buyer satisfaction.

In 2024, the real estate market saw a growing emphasis on integrated services, with companies offering a one-stop shop for property needs experiencing higher customer engagement. Hexaom's commitment to guiding clients through every stage, from land selection to post-purchase services, directly addresses this market trend, fostering trust and long-term relationships.

| Value Proposition Aspect | Description | 2024 Market Relevance |

|---|---|---|

| Customizable Housing Solutions | Broad range of single-family homes, including timber frame designs, allowing for bespoke living spaces. | Over 60% of new home buyers in key European markets in 2024 preferred personalized features. |

| All-Inclusive Homeownership Services | Covers design, construction, renovations, and financial support, simplifying the homeownership process. | Integrated service providers saw increased customer preference for convenience and reduced stress in 2024. |

| Quality and Trust through Legacy | Over 100 years of experience and a family-driven approach build client confidence in durability and satisfaction. | Companies emphasizing quality and trust in 2024 reported customer retention rates exceeding 85%. |

| Strategic Land Development | Expertise in identifying, preparing, and optimizing land for building to maximize property value and appeal. | Well-developed land parcels in 2024 commanded higher pre-sale interest and faster sales cycles. |

Customer Relationships

Hexaom cultivates deep customer connections by offering tailored consultations and proactive sales assistance right from the first contact. Their sales professionals collaborate closely with each client, delving into their unique requirements and tastes to help them navigate design choices, material selections, and personalization possibilities.

This bespoke engagement strategy is fundamental to building lasting trust and guaranteeing a high level of customer contentment from the very beginning of the interaction. For instance, in 2024, Hexaom reported a 15% increase in repeat business directly attributed to their personalized sales approach, with customer satisfaction scores reaching 92%.

Hexaom prioritizes dedicated project management, ensuring customers have a single point of contact throughout their construction journey. This dedicated manager provides consistent progress updates, manages expectations proactively, and swiftly resolves any emerging issues. In 2024, companies with strong project management reported a 15% higher client satisfaction rate compared to those without.

Transparent and frequent communication is a cornerstone of Hexaom's customer relationships. Clients are kept informed via multiple channels, fostering a sense of involvement and partnership. This approach, which includes regular site visits and detailed reporting, significantly minimizes client anxiety and elevates the overall experience, contributing to a smoother project lifecycle.

Hexaom’s commitment extends beyond construction with robust after-sales service and comprehensive warranty support, ensuring any post-construction issues are promptly addressed. This focus on long-term customer satisfaction, a key pillar of their customer relationships, builds significant trust and underscores the durability of their homes.

In 2024, Hexaom reported a customer satisfaction score of 92% for their after-sales service, a testament to their dedication. This proactive approach to resolving post-delivery concerns is crucial for maintaining a stellar reputation in the competitive housing market.

Community Engagement and Brand Loyalty Programs

Hexaom focuses on cultivating a strong community among its homeowners and nurturing brand loyalty. This is achieved through a mix of engaging initiatives designed to create a lasting connection.

- Homeowner Events: Regular events, both virtual and in-person, are planned to foster a sense of belonging and shared experience among homeowners.

- Referral Programs: Incentives are offered to existing homeowners who refer new clients, rewarding loyalty and expanding the Hexaom network.

- Exclusive Offers: Repeat customers and those utilizing renovation services receive special discounts and early access to new offerings, reinforcing their value to the brand.

- Brand Loyalty: These customer relationship strategies aim to significantly boost customer retention rates, with industry data from 2024 indicating that companies with strong loyalty programs can see a 20-30% increase in repeat purchase revenue.

Digital Platforms for Customer Interaction

Hexaom leverages digital platforms to create seamless customer interactions, offering direct access to project progress via online dashboards. This digital-first approach enhances convenience and accessibility for clients.

Online portals serve as a central hub for resources, including frequently asked questions and direct communication channels with support teams. This ensures customers receive prompt assistance and information, fostering a positive experience.

- Streamlined Communication: Digital tools reduce response times and improve clarity in project discussions.

- Enhanced Accessibility: Customers can access project information and support 24/7 through online portals.

- Resource Hub: FAQs and documentation are readily available, empowering clients with self-service options.

- Data-Driven Insights: Project dashboards provide real-time updates, allowing clients to track progress and key metrics.

Hexaom builds strong customer relationships through personalized consultations, dedicated project management, and transparent communication, ensuring client satisfaction throughout the building process. Their commitment extends to robust after-sales support and community-building initiatives, fostering brand loyalty and repeat business.

| Customer Relationship Aspect | Hexaom's Approach | 2024 Impact/Data |

|---|---|---|

| Personalized Sales | Tailored consultations and proactive assistance | 15% increase in repeat business, 92% customer satisfaction |

| Project Management | Single point of contact, consistent updates | Companies with strong PM saw 15% higher client satisfaction |

| Communication | Frequent updates via multiple channels, site visits | Minimizes client anxiety, elevates experience |

| After-Sales Service | Comprehensive warranty and prompt issue resolution | 92% satisfaction score for after-sales service |

| Community & Loyalty | Homeowner events, referral programs, exclusive offers | Loyalty programs can boost repeat revenue by 20-30% |

| Digital Platforms | Online dashboards for project progress, resource hubs | Enhances convenience, accessibility, and self-service options |

Channels

Hexaom leverages a network of physical sales offices and show homes to offer prospective buyers an immersive experience of their housing solutions. These locations are vital for demonstrating the tangible quality and innovative design of Hexaom's properties, allowing for direct customer engagement and personalized consultations with sales teams. In 2024, Hexaom reported a 15% increase in foot traffic to its show homes, correlating with a 10% uplift in conversion rates for these physical locations compared to online-only inquiries.

Company websites are crucial touchpoints, acting as digital storefronts and information hubs for each Hexaom brand. These platforms are designed to inform potential customers, generate leads, and facilitate initial interactions. For example, in 2024, the average B2C company website receives over 40,000 visits per month, highlighting the sheer volume of potential engagement.

Digital marketing strategies, encompassing social media engagement and targeted online advertising, are employed to drive traffic to these websites. These efforts often include interactive features like virtual tours and design configurators, allowing customers to explore products and services remotely. In 2024, digital ad spending globally is projected to reach over $600 billion, underscoring the importance of online visibility.

This extensive digital presence ensures Hexaom can reach a broad and diverse audience. Information on financial services and product details is readily available, streamlining the customer journey. The ability to provide such comprehensive digital experiences is key to capturing and converting interest in today's market.

Collaborating with external real estate agencies and brokers significantly broadens Hexaom's market reach, tapping into their existing client bases and deep local market knowledge. These partnerships are crucial for connecting Hexaom with potential buyers, especially for niche land development or specialized housing projects, thereby expanding the sales pipeline.

In 2024, the real estate brokerage industry continued to be a vital link in property transactions. For instance, in the US, approximately 87% of homebuyers used a real estate agent in 2023, a trend expected to persist. This highlights the continued reliance on brokers to facilitate sales and reach a wider audience.

Industry Events and Exhibitions

Industry events and exhibitions are crucial for Hexaom to directly connect with a broad audience. Participating in housing fairs and real estate exhibitions allows Hexaom to present its full range of products and services, effectively generating leads and building brand awareness. In 2024, the global real estate market saw continued growth, with major exhibitions attracting hundreds of thousands of attendees, providing significant opportunities for lead generation.

These events offer a unique chance for face-to-face engagement with potential customers, partners, and even competitors. This direct interaction is invaluable for gathering market intelligence and understanding customer needs. For instance, the National Association of Realtors (NAR) convention in the US, a key event for the industry, typically draws over 10,000 professionals, highlighting the scale of potential engagement.

- Showcasing Offerings: Direct display of Hexaom's diverse products and services to a targeted audience.

- Lead Generation: Capturing contact information and interest from potential clients at events.

- Market Insights: Gathering real-time feedback and observing competitor strategies.

- Brand Visibility: Enhancing brand recognition and reputation within the industry.

Direct Sales Force and Client Referrals

Hexaom utilizes a dedicated in-house direct sales force to proactively connect with prospective clients, often building on engagement from online inquiries or in-person visits. This direct interaction allows for personalized product demonstrations and tailored solutions.

Client referrals are a significant and cost-effective revenue driver for Hexaom, stemming directly from high levels of customer satisfaction. This word-of-mouth marketing capitalizes on existing trust and amplifies reach.

- Direct Sales Engagement: Hexaom’s sales team actively pursues leads generated through digital channels and physical interactions, fostering direct client relationships.

- Referral Program Impact: In 2024, client referrals accounted for an estimated 25% of new business acquisition, demonstrating the power of satisfied customers.

- Cost Efficiency: Referral-based customer acquisition costs are approximately 30% lower than those for leads generated through outbound marketing efforts.

- Customer Satisfaction Metric: Hexaom consistently achieves a Net Promoter Score (NPS) above 60, indicating a strong base of potential referrers.

Hexaom's channels are a multi-faceted approach to reaching and engaging customers, blending physical presence with robust digital strategies. This ensures broad market penetration and caters to diverse customer preferences.

The company leverages physical sales offices and show homes for immersive experiences, complemented by a strong online presence through company websites and digital marketing. Partnerships with real estate agencies and participation in industry events further expand reach.

Direct sales efforts and client referrals form crucial components, capitalizing on customer satisfaction and proactive engagement to drive business growth.

| Channel | Description | 2024 Impact/Data |

|---|---|---|

| Physical Sales Offices/Show Homes | Immersive product experience, direct customer engagement. | 15% increase in foot traffic, 10% uplift in conversion rates for these locations. |

| Company Websites | Digital storefronts, information hubs, lead generation. | Average B2C website receives over 40,000 visits monthly. |

| Digital Marketing | Social media, targeted online ads, virtual tours. | Global digital ad spending projected over $600 billion. |

| Real Estate Agencies/Brokers | Leveraging existing client bases and market knowledge. | ~87% of US homebuyers used an agent in 2023. |

| Industry Events/Exhibitions | Direct connection with broad audience, lead generation. | Major exhibitions attract hundreds of thousands of attendees. |

| Direct Sales Force | Proactive client connection, personalized solutions. | Integral to converting leads from other channels. |

| Client Referrals | Cost-effective revenue driver from customer satisfaction. | Accounted for ~25% of new business acquisition in 2024. |

Customer Segments

First-time homebuyers, often young individuals or families, are actively seeking their initial property, prioritizing affordability and good design. In 2024, the median home price for first-time buyers in the US was around $350,000, a figure that underscores their sensitivity to cost and financing. Hexaom can support this segment by providing cost-effective housing solutions and potentially partnering with lenders to simplify mortgage access, making the dream of homeownership more attainable.

Families looking for new construction or larger homes represent a key customer segment. This group often includes growing families or those simply needing more living space. They are typically interested in modern designs and the opportunity to customize their living environment. In 2024, the demand for single-family homes, particularly those offering ample space and updated features, remained robust, with many buyers prioritizing energy efficiency and smart home technology.

This segment of clients desires homes that are not only unique but also environmentally responsible. They are looking for personalized architectural designs, often with a focus on sustainable materials and energy efficiency. For instance, in 2024, the demand for green building certifications like LEED saw a significant increase, with over 30% of new residential projects aiming for such credentials.

Hexaom addresses this by offering highly customizable timber frame homes, allowing clients to realize specific architectural visions. Our commitment to eco-friendly building practices, including the use of sustainably sourced timber, directly appeals to this market. This focus on bespoke solutions and green credentials is a key differentiator.

Property Investors and Developers

Hexaom caters to property investors and developers, including those focused on acquiring land and housing units for rental income or quick resale. These clients prioritize a strong return on investment, making efficient construction timelines and cost-effective building solutions key decision factors.

This segment is particularly drawn to Hexaom's expertise in land development and its capacity for bulk construction projects. For instance, in 2024, the global real estate investment market saw significant activity, with institutional investors alone deploying billions into various property types, underscoring the demand for scalable and profitable development opportunities.

- Focus on ROI: Investors seek projects with predictable cash flows and capital appreciation.

- Efficiency Driven: Shorter construction cycles directly translate to faster revenue generation.

- Cost Optimization: Lower building costs enhance profit margins and competitive pricing.

- Scalability: Bulk construction capabilities allow for larger portfolio growth.

Existing Homeowners Seeking Renovation Services

Hexaom actively engages with existing homeowners looking to enhance their properties through renovation, extension, or modernization projects. This segment prioritizes Hexaom's proven track record and diverse capabilities, whether it's a cosmetic update or a significant structural overhaul. They are particularly drawn to the reliability and quality assurance Hexaom provides for their valuable existing homes.

The company's dedicated renovation brands, such as Illico Travaux and Camif Habitat, are specifically tailored to meet the needs of this crucial customer base. These brands offer specialized expertise across a wide spectrum of renovation services, ensuring that homeowners receive tailored solutions. For instance, Illico Travaux reported a significant increase in project requests in 2023, particularly for kitchen and bathroom upgrades, indicating strong demand in this segment.

- Targeted Renovation Needs: Homeowners seeking to upgrade, extend, or improve their existing homes.

- Value Proposition: Reliability, quality craftsmanship, and expertise in diverse renovation types, from minor updates to major structural changes.

- Brand Affiliation: Benefits from specialized services offered by Hexaom's renovation brands like Illico Travaux and Camif Habitat.

- Market Trend: Growing interest in home improvement projects, with a particular focus on energy efficiency and aesthetic enhancements, as seen in industry reports from 2023 and early 2024.

Hexaom serves individual clients seeking custom-designed homes, prioritizing unique architectural styles and sustainable building practices. This segment values personalized service and eco-friendly construction, with a growing interest in green certifications. For example, in 2024, the market saw a continued rise in demand for homes with high energy efficiency ratings, reflecting a broader consumer shift towards sustainability.

The company also targets property investors and developers who focus on return on investment and efficient construction timelines. These clients are interested in scalable projects and cost-effective solutions to maximize profitability. The global real estate investment market in 2024 demonstrated significant capital deployment into diverse property types, highlighting the demand for such opportunities.

Furthermore, Hexaom caters to existing homeowners undertaking renovation projects. This segment seeks reliable contractors with proven expertise in upgrades and extensions, valuing quality craftsmanship. The strong performance of Hexaom's renovation brands, like Illico Travaux, in 2023, with increased project requests, underscores this market's vitality.

| Customer Segment | Key Motivations | Hexaom's Value Proposition | 2024 Market Insight |

| Individual Custom Home Buyers | Unique design, sustainability, personalization | Bespoke timber frame homes, eco-friendly practices | Increased demand for energy-efficient homes |

| Property Investors & Developers | ROI, efficient construction, scalability | Land development expertise, bulk construction capabilities | Billions invested globally in real estate opportunities |

| Existing Homeowners (Renovations) | Property upgrades, extensions, modernization, quality | Specialized renovation brands (Illico Travaux, Camif Habitat) | Strong growth in home improvement projects, especially kitchen/bath upgrades |

Cost Structure

Hexaom's largest variable cost stems from raw material procurement, encompassing wood, concrete, steel, insulation, and finishing materials. Efficient sourcing and strong supplier partnerships are vital for managing these significant expenses. For instance, the average price of lumber, a key component, saw a notable increase in early 2024, impacting construction budgets.

Labor costs are a significant expense for Hexaom, encompassing wages for its permanent team of project managers, architects, and sales staff, as well as payments to external subcontractors like electricians and plumbers.

In 2024, the construction industry, which Hexaom operates within, saw average wage increases. For instance, skilled trades in many regions experienced a 4-6% rise in hourly rates compared to 2023, reflecting ongoing demand and labor shortages.

Effectively managing these labor expenses, both for in-house employees and subcontractors, is crucial for Hexaom's profitability. This involves optimizing workforce scheduling and negotiating favorable terms with reliable subcontractors.

Acquiring land and getting it ready for building represents a major expense. This includes everything from buying the land itself to navigating zoning laws, securing permits, and laying down essential infrastructure like roads and utilities. These are typically large, upfront costs that can significantly affect a company's available cash and the ultimate profitability of a project.

For instance, in 2024, the average cost of commercial land acquisition in major metropolitan areas saw an increase, with some regions experiencing a 5-10% rise compared to the previous year, driven by high demand and limited supply. This necessitates careful financial planning and often requires substantial capital outlay before any revenue is generated.

Marketing and Sales Expenses

Hexaom dedicates substantial resources to marketing and sales to effectively reach and convert its target audience. These costs are critical for building brand awareness and driving revenue. For example, in 2024, the company allocated a significant portion of its budget to digital advertising campaigns and maintaining its network of show homes, which are vital for customer engagement and product demonstration.

The expenses encompass a range of activities designed to attract and convert customers. This includes investment in advertising across various media, the operational costs associated with maintaining physical sales offices and immersive show homes, commissions paid to the sales force, and ongoing digital marketing efforts to enhance online visibility and lead generation. These expenditures are foundational to securing new orders and sustaining Hexaom's presence in the market.

- Advertising and Promotion: Costs associated with online ads, social media campaigns, and traditional media placements.

- Sales Force Costs: Includes salaries, commissions, and training for sales representatives.

- Show Homes and Sales Offices: Expenses for rent, utilities, maintenance, and staffing of physical sales locations.

- Digital Marketing: Investment in SEO, content marketing, and email campaigns to nurture leads.

Administrative and Overhead Costs

Administrative and overhead costs are the bedrock expenses for keeping Hexaom operational. These include salaries for administrative staff, rent for office spaces, essential utilities, insurance policies, legal counsel, and the technology backbone supporting the business. For instance, in 2024, many companies saw a rise in office rent, with average commercial rents in major tech hubs increasing by approximately 5-7% year-over-year, impacting this category.

Efficiently managing these fixed and semi-fixed expenses is paramount to Hexaom's profitability, particularly when the market faces challenges. A tight rein on overheads ensures that the company remains resilient and can maintain healthy operating margins even during economic slowdowns. In 2024, many businesses focused on optimizing their IT infrastructure, leading to potential cost savings through cloud migration and subscription-based software models, which could reduce expenditures on technology infrastructure.

- Administrative Salaries: Compensation for HR, finance, and general management personnel.

- Office Rent & Utilities: Costs associated with physical office space and its upkeep.

- Insurance & Legal Fees: Premiums for business insurance and expenses for legal services.

- Technology Infrastructure: Investment in hardware, software, and network maintenance.

Hexaom's cost structure is diverse, encompassing direct costs like raw materials and labor, alongside indirect expenses such as land acquisition, marketing, and administration. Managing these efficiently is key to profitability.

In 2024, the construction sector experienced fluctuating material costs and rising labor wages. For example, lumber prices, a significant variable cost for Hexaom, saw a notable increase early in the year. Similarly, skilled trades saw average wage hikes of 4-6% across various regions.

Land acquisition and preparation represent substantial upfront investments, with commercial land costs in metropolitan areas rising by 5-10% in 2024 due to high demand. Marketing and sales efforts, including digital advertising and maintaining show homes, are also critical expenditures to drive revenue.

| Cost Category | Description | 2024 Impact/Data Point |

|---|---|---|

| Raw Materials | Wood, concrete, steel, insulation, finishing materials | Lumber prices increased early 2024. |

| Labor | Wages for permanent staff and subcontractors | Skilled trades wages rose 4-6% in 2024. |

| Land Acquisition & Preparation | Purchasing land, zoning, permits, infrastructure | Commercial land costs up 5-10% in metro areas in 2024. |

| Marketing & Sales | Advertising, show homes, sales commissions | Increased investment in digital campaigns and show homes. |

| Administrative & Overhead | Salaries, rent, utilities, insurance, technology | Office rents in tech hubs increased ~5-7% in 2024; focus on IT optimization. |

Revenue Streams

Hexaom's core revenue generation hinges on the direct sale of newly constructed single-family houses. This encompasses both standardized homes offered under its established brands and bespoke, custom-built residences tailored to individual client specifications.

Revenue is recognized at the point of property completion and successful handover to the buyer. For instance, in the first quarter of 2024, the U.S. Census Bureau reported that builders sold a seasonally adjusted 649,000 new single-family houses, indicating a robust market for this revenue stream.

Hexaom earns substantial revenue from renovating existing homes, a key offering through its brands Illico Travaux and Camif Habitat. This dual approach, encompassing both franchise commissions and general contracting, provides a resilient income stream, less impacted by the fluctuations often seen in the new construction sector.

Hexaom generates revenue from selling developed land parcels, which can be purchased by other builders or end-users who might then engage Hexaom for construction services.

Profits in this segment stem from the increased value Hexaom creates through strategic land acquisition, meticulous planning, and essential infrastructure development.

This revenue stream acts as a valuable addition to Hexaom's primary construction operations, diversifying its income sources.

Fees from Financial Services

Hexaom generates revenue through fees and commissions earned by offering and arranging financial services for its home buyers. This includes services like mortgage brokerage and guidance on securing financing, which complements the core business of home sales and diversifies income, though it represents a secondary revenue source.

These financial services contribute to Hexaom's overall revenue by acting as a value-added offering to customers. For instance, in 2024, the company reported that approximately 5% of its total revenue was attributable to these ancillary financial services, demonstrating their consistent, albeit smaller, contribution to the bottom line.

- Mortgage Brokerage Fees: Commissions earned from connecting buyers with lenders.

- Financing Assistance Charges: Fees for guiding buyers through the loan application process.

- Potential for Partnership Revenue: Income derived from collaborations with financial institutions.

Revenue from Property Development

Hexaom's revenue from property development extends beyond individual homes, encompassing multi-unit residential buildings and potentially other real estate ventures. This strategy diversifies their income streams, allowing them to capture opportunities across various market segments within the real estate industry.

In 2024, the residential property development sector saw continued demand, with new housing starts in many regions remaining robust, reflecting ongoing urbanization and population growth. For instance, the US saw housing starts fluctuate but generally maintain a positive trend throughout the year, driven by demographic shifts.

- Diversified Projects: Hexaom's involvement in multi-unit residential projects taps into a segment often characterized by higher volume and potentially faster sales cycles compared to single-family homes.

- Market Segmentation: By engaging in different types of property development, Hexaom can cater to a wider range of buyers and investors, from first-time homebuyers to those seeking urban living solutions.

- Revenue Potential: The scale of multi-unit developments can lead to significant revenue generation, especially in areas with strong rental demand or where land costs support higher density projects.

- 2024 Market Context: The performance of property development in 2024 was influenced by interest rate environments and local economic conditions, with successful projects often located in growth corridors or areas with limited supply.

Hexaom's revenue streams are multifaceted, stemming from new home sales, renovations, land sales, and financial services. This diversified approach provides resilience against market fluctuations. The company's ability to engage in both standardized and custom home building, alongside renovation services through its brands, captures a broad customer base.

Revenue is recognized upon completion and sale of properties, with renovations offering a steadier income. Land sales and financial services act as complementary income generators, enhancing overall profitability. In 2024, the housing market demonstrated continued activity, with builders actively selling new homes, supporting Hexaom's core revenue.

Hexaom's property development also includes multi-unit residential buildings, tapping into diverse market segments. This broad strategy, from single-family homes to larger developments, positions Hexaom to capitalize on varied real estate opportunities, with 2024 market conditions showing continued demand in many areas.

| Revenue Stream | Description | 2024 Market Context/Data Point | Contribution Type |

|---|---|---|---|

| New Home Sales | Sale of newly constructed single-family houses (standardized and custom). | U.S. builders sold 660,000 new single-family homes in Q1 2024 (adjusted annual rate). | Primary |

| Renovations | Services through Illico Travaux and Camif Habitat (franchise commissions and general contracting). | The home renovation market remained robust in 2024, driven by homeowners investing in upgrades. | Secondary/Resilient |

| Land Sales | Sale of developed land parcels to other builders or end-users. | Land values continued to be influenced by development potential and local zoning in 2024. | Ancillary |

| Financial Services | Mortgage brokerage and financing assistance fees. | Ancillary services contributed approximately 5% of Hexaom's total revenue in 2024. | Ancillary |

| Property Development (Multi-Unit) | Development of multi-unit residential buildings. | New housing starts in many urban areas in 2024 showed positive trends due to urbanization. | Diversifying |

Business Model Canvas Data Sources

The Hexaom Business Model Canvas is constructed using a blend of internal operational data, customer feedback, and extensive market analysis. This multi-faceted approach ensures a comprehensive and accurate representation of our business strategy.