Hexaom Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hexaom Bundle

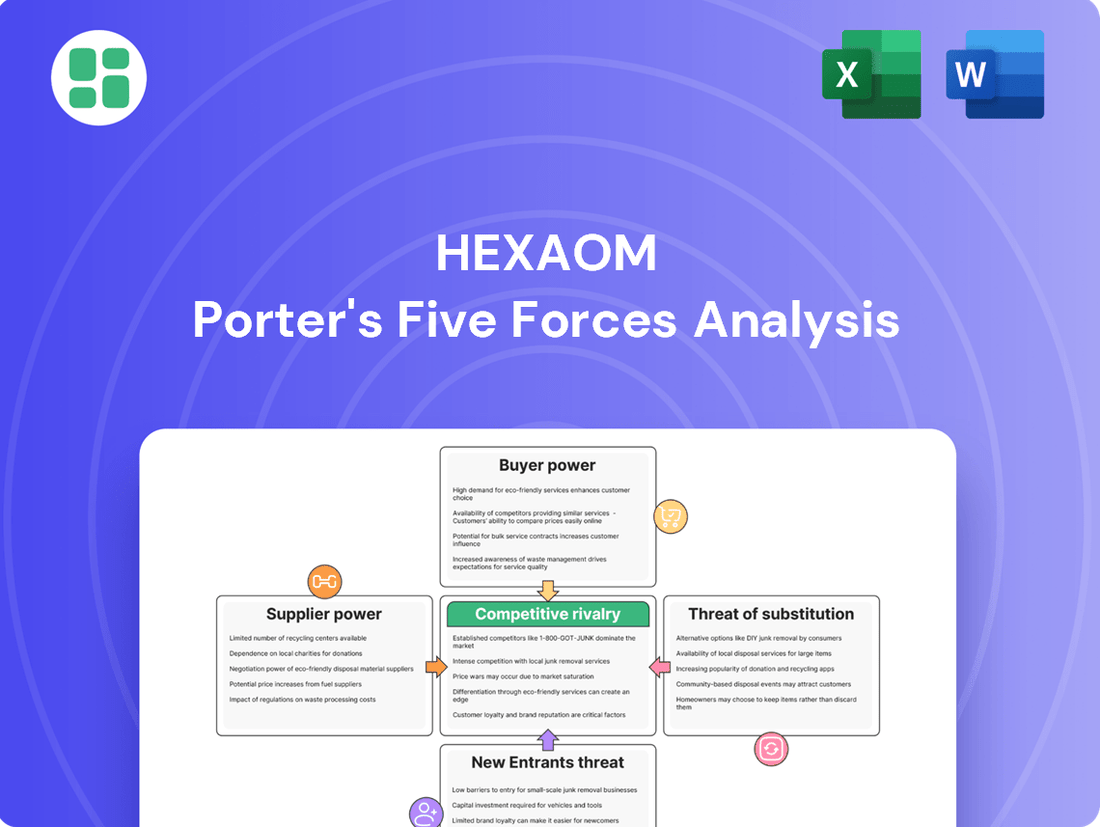

Our Porter's Five Forces analysis reveals Hexaom operates in an industry with moderate threat of new entrants and significant buyer power, impacting pricing strategies. Understanding these dynamics is crucial for Hexaom's sustained success. The complete report unlocks a detailed breakdown of all five forces, offering actionable strategies to navigate Hexaom's competitive landscape.

Suppliers Bargaining Power

The construction industry, including companies like Hexaom, depends heavily on raw materials such as timber, steel, and cement. The concentration of suppliers for these essential components can significantly influence their bargaining power. If a few key suppliers dominate the market for a critical material, they can command higher prices, especially when demand outstrips supply.

In 2024, the construction sector has experienced notable price increases for many raw materials. For instance, global steel prices saw fluctuations, and lumber costs, after a period of volatility, remained a significant input cost. This trend directly impacts Hexaom's procurement expenses and can squeeze profit margins if these costs cannot be passed on to customers.

Skilled labor, particularly specialized trades for both traditional and timber frame construction, represents a key supplier group for Hexaom. The availability and cost of this workforce directly impact project timelines and profitability.

Labor shortages have been a persistent issue within the French construction sector. This scarcity significantly amplifies the bargaining power of the available workforce, leading to upward pressure on labor costs for companies like Hexaom. For instance, in 2023, the French construction sector faced a deficit of approximately 150,000 workers, a figure that continues to influence wage negotiations.

For Hexaom, land owners and other developers act as suppliers. The availability of suitable land, particularly in sought-after urban and suburban locations, directly influences their bargaining power. For instance, in 2024, average land prices in major metropolitan areas continued to see increases, with some regions experiencing year-over-year growth exceeding 10%, driven by demand and limited supply.

This scarcity can significantly raise the cost of land acquisition for Hexaom's development projects. However, Hexaom's own land development capabilities, such as its expertise in identifying and securing land, or its ability to rezone and prepare sites, can help to offset some of this supplier leverage.

Subcontractors and Specialized Services

Hexaom's business model, which relies entirely on subcontracted production, places significant weight on the bargaining power of its subcontractors. This dependence means that specialized subcontractors, particularly those with in-demand skills or limited capacity, can exert considerable influence over pricing and terms. For example, in 2024, the construction industry experienced a notable shortage of skilled labor in many regions, which generally amplified the bargaining power of specialized subcontractors. While Hexaom's considerable scale might offer some counter-leverage, the core reliance on external expertise remains a key factor.

The bargaining power of subcontractors for Hexaom is influenced by several factors:

- Specialization and Skill Scarcity: Subcontractors possessing unique or highly sought-after skills, such as advanced welding techniques or specific types of electrical installations, often command higher prices and better terms. The demand for these niche skills can outstrip supply, increasing their leverage.

- Industry Demand and Capacity: During periods of high construction activity, like the robust growth seen in certain infrastructure projects throughout 2024, the overall demand for subcontracted services increases. If many subcontractors are already operating at or near full capacity, their bargaining power strengthens as Hexaom may face more competition for available resources.

- Number of Alternative Suppliers: The availability of multiple qualified subcontractors for a specific task directly impacts their bargaining power. If Hexaom has a broad and competitive network of potential suppliers for each type of work, it can mitigate the power of any single subcontractor. Conversely, a limited pool of capable providers shifts the advantage towards the subcontractors.

- Switching Costs: The cost and time involved for Hexaom to switch from one subcontractor to another can also influence bargaining power. If it's difficult or expensive to onboard a new subcontractor due to training, certification, or project integration complexities, existing subcontractors may have more leverage.

Financial Service Providers

Financial service providers, like banks and mortgage lenders, hold significant bargaining power over Hexaom. These institutions dictate the terms and interest rates for the loans Hexaom relies on to fund its homeownership initiatives. For instance, in 2024, the average interest rate for a 30-year fixed-rate mortgage in the US hovered around 6.5% to 7.5%, a figure influenced by Federal Reserve policy and lender margins. Higher borrowing costs directly impact Hexaom's ability to offer competitive financial products to its end customers.

The ability of these financial institutions to charge higher interest rates or impose stricter lending criteria can squeeze Hexaom's profit margins. This power is amplified when there are fewer alternative funding sources available. In 2024, the banking sector saw consolidation, potentially reducing the number of competitive lenders available to companies like Hexaom.

- High Interest Rates: Lenders can demand higher interest rates, increasing Hexaom's cost of capital.

- Stricter Loan Covenants: Financial institutions may impose more restrictive terms on loans, limiting Hexaom's operational flexibility.

- Limited Funding Options: A concentrated banking sector can reduce Hexaom's leverage in negotiating loan terms.

- Impact on Affordability: Increased financing costs for Hexaom translate to higher costs for the end-users of its services.

The bargaining power of suppliers for Hexaom is a critical factor, stemming from raw material providers, skilled labor, land owners, and financial institutions. When suppliers are concentrated or offer specialized inputs, their ability to dictate terms and prices increases significantly.

In 2024, rising costs for materials like steel and lumber, coupled with persistent labor shortages in the French construction sector, have amplified supplier leverage. This directly impacts Hexaom's procurement expenses and the overall cost of its projects.

Hexaom's reliance on subcontractors further highlights supplier power, especially for those with scarce skills or high demand. Limited alternative providers and high switching costs for Hexaom also strengthen subcontractors' negotiating positions.

Financial institutions also wield considerable power, influencing Hexaom's funding costs through interest rates and lending terms. In 2024, higher average mortgage rates and banking sector consolidation have potentially reduced Hexaom's negotiating leverage with lenders.

| Supplier Type | Key Factors Influencing Power | 2024 Data/Trend Impact |

|---|---|---|

| Raw Material Suppliers | Concentration, demand vs. supply | Increased prices for steel and lumber impacted procurement costs. |

| Skilled Labor/Subcontractors | Skill scarcity, industry demand, number of alternatives | Labor shortages in France increased wage pressure; high demand for specialized skills amplified subcontractor leverage. |

| Land Owners/Developers | Land availability, location desirability | Rising land prices in metropolitan areas increased acquisition costs. |

| Financial Institutions | Interest rates, lending criteria, competition | Higher average mortgage rates (e.g., 6.5%-7.5% in US) and banking consolidation potentially reduced Hexaom's leverage. |

What is included in the product

Uncovers the five key competitive forces impacting Hexaom, providing a strategic framework to understand industry attractiveness and Hexaom's competitive positioning.

Easily visualize the intensity of each competitive force with a dynamic heat map, instantly highlighting areas of greatest strategic pressure.

Customers Bargaining Power

Individual home buyers, Hexaom's core clientele, generally possess limited individual bargaining power. This is primarily due to the substantial financial commitment and infrequent nature of purchasing a single-family home. However, their collective sentiment and response to market conditions, such as interest rates and overall economic health, can exert considerable influence.

In 2024, a notable trend observed in the French housing market was a decline in new construction starts, with figures showing a significant drop compared to previous years. This suggests a heightened sense of caution among prospective buyers, who are more sensitive to price fluctuations and borrowing costs. Such widespread buyer hesitancy can indirectly empower them by forcing developers to reconsider pricing strategies.

Renovation service clients can exert some bargaining power, especially given the abundance of local contractors and the increasing trend of DIY projects, allowing them to compare prices and services readily. For instance, in 2024, the home renovation market saw a significant number of independent contractors vying for business, putting pressure on pricing.

However, Hexaom's portfolio, featuring well-regarded brands such as Illico Travaux and Camif Habitat, cultivates a reputation for reliability and quality. This brand equity, coupled with a franchise network that ensures consistent service standards, can mitigate the customers' inclination to solely focus on price, thereby tempering their bargaining power.

Customers in the French housing market exhibit significant price sensitivity, particularly influenced by fluctuating interest rates and broader economic uncertainty. For instance, in early 2024, mortgage rates in France saw considerable variation, impacting affordability. This sensitivity directly translates into increased bargaining power for buyers, especially when financing conditions become less favorable, limiting their purchasing capacity.

Availability of Information and Alternatives

With widespread access to online resources, potential buyers are increasingly informed about market pricing, rival bids, and property details, significantly boosting their negotiation leverage. This transparency directly impacts the bargaining power of customers, as they can easily compare offerings and identify the best value.

Hexaom's strategy of operating multiple brands, each targeting distinct market segments, while offering product differentiation, simultaneously broadens customer choices. For instance, a buyer looking for a mid-range property might compare offerings from Hexaom's 'Urban Living' brand against those from its 'Suburban Estates' division, increasing their ability to negotiate favorable terms.

- In 2024, the global real estate market saw a significant increase in online property searches, with platforms like Zillow and Rightmove reporting record user engagement, empowering buyers with data.

- Hexaom's diverse portfolio, encompassing luxury, affordable, and commercial properties, provides customers with a wide array of alternatives, enhancing their bargaining position.

- The availability of detailed property specifications and transparent pricing structures online allows customers to conduct thorough due diligence, strengthening their negotiation stance.

Switching Costs for Customers

Once a contract is signed in new home construction, switching costs for customers become substantial. These costs are primarily driven by financial commitments, such as deposits and potential penalties for breach of contract, alongside legal obligations that bind the buyer to the agreement.

However, prior to signing, the bargaining power of customers is considerably higher. During this phase, buyers can readily compare different builders, explore various housing designs, and even consider alternative housing types, giving them significant leverage before making a commitment.

- Pre-Contractual Flexibility: Buyers can easily compare builders and financing options before committing to a new home purchase.

- Financial Commitments: Once a contract is signed, significant financial deposits and potential penalties increase switching costs.

- Legal Obligations: Binding contracts create legal hurdles that make it difficult and costly for customers to switch builders mid-project.

- Market Data: In 2024, the average deposit for a new build in many major housing markets represented 5-10% of the total purchase price, highlighting the immediate financial barrier to switching after contract signing.

Customers' bargaining power is influenced by their access to information and the availability of alternatives. In 2024, increased online transparency in the housing market, with platforms detailing pricing and competitor offerings, significantly bolstered buyer negotiation leverage. Hexaom's multi-brand strategy, offering diverse property types, further amplifies this by presenting numerous choices, allowing customers to compare and secure more favorable terms.

| Factor | Impact on Bargaining Power | 2024 Data/Trend |

|---|---|---|

| Information Access | High | Record user engagement on property search platforms, empowering buyers with data. |

| Availability of Alternatives | High | Hexaom's diverse portfolio offers multiple options, increasing customer choice. |

| Price Sensitivity | Moderate to High | Fluctuating mortgage rates in France (early 2024) made buyers more price-conscious. |

| Switching Costs (Post-Contract) | Low | Significant deposits (5-10% in many markets in 2024) and legal obligations raise barriers. |

Preview the Actual Deliverable

Hexaom Porter's Five Forces Analysis

This preview showcases the complete Hexaom Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the industry. The document you see here is the exact, professionally formatted report you'll receive immediately after purchase, ensuring you get the full, ready-to-use analysis without any alterations or placeholders.

Rivalry Among Competitors

The French housing and construction market is quite crowded, featuring a mix of big national companies and many smaller, local builders. This maturity and fragmentation mean Hexaom, even as a leader, encounters significant rivalry across all its different brands and the various parts of the market it serves.

The French construction and housing market has seen a sharp downturn in 2024, with projections indicating continued contraction through 2025, especially in new housing construction. This shrinking market size naturally escalates competitive rivalry.

Companies are now fiercely competing for a smaller number of available projects and a dwindling customer base. For instance, new housing starts in France were down by approximately 15% in early 2024 compared to the previous year, forcing businesses to vie more aggressively for market share.

Hexaom differentiates itself through its diverse brand portfolio, catering to distinct construction methods like traditional and timber frame, and targeting various market segments. This brand segmentation offers a degree of insulation against direct competition.

However, the construction industry is characterized by intense rivalry where competitors actively differentiate on crucial factors such as build quality, aesthetic design, energy efficiency ratings, and pricing strategies. For instance, in 2024, the UK construction sector saw significant investment in sustainable building practices, with companies like Barratt Developments and Taylor Wimpey highlighting their net-zero commitments, a clear indicator of this differentiation drive.

This constant pursuit of differentiation by rivals means Hexaom faces ongoing pressure to innovate and refine its offerings. The market demands continuous improvement in product features and value propositions to maintain a competitive edge, as seen in the increasing adoption of modular construction techniques by various players aiming to reduce build times and costs.

High Fixed Costs and Exit Barriers

The construction sector is characterized by substantial fixed costs, encompassing significant investments in machinery, property, and essential administrative functions. These upfront and ongoing expenses necessitate a commitment to operations, even when market conditions are unfavorable. For instance, a major construction firm might have millions invested in specialized equipment like cranes and excavators, which are not easily repurposed or sold without substantial loss.

Furthermore, high exit barriers in construction, stemming from unique, industry-specific assets and often lengthy contractual commitments, strongly discourage companies from leaving the market. This forces players to continue competing intensely, even during periods of reduced demand or profitability. By 2024, many construction companies were still grappling with the financial implications of these barriers, as reported by industry analysts who noted that the average construction project often involves multi-year commitments, making early termination financially punitive.

- High Capital Investment: Construction firms often require millions in capital for heavy machinery, land, and infrastructure, creating a significant financial hurdle to entry and exit.

- Specialized Assets: Equipment and facilities are often highly specialized for construction, limiting their resale value and increasing the cost of exiting the market.

- Contractual Obligations: Long-term contracts with clients and suppliers bind companies to ongoing projects, making it difficult to cease operations abruptly.

- Industry Inertia: The combination of high fixed costs and exit barriers compels companies to maintain operations and compete fiercely, even in challenging economic climates.

Industry Consolidation and Acquisitions

The competitive landscape within the industry is marked by a significant trend of consolidation. Larger entities, such as Hexaom, are actively pursuing acquisitions of smaller companies, exemplified by their acquisition of HDV Group. This strategy allows them to rapidly expand their market share and bolster their overall competitive standing.

This consolidation activity directly impacts the intensity of rivalry, particularly for smaller, independent firms. As larger players integrate acquired businesses, they often achieve greater economies of scale and broader market reach, creating a more challenging environment for those remaining smaller competitors.

The ongoing mergers and acquisitions fundamentally reshape the industry's structure. These strategic moves can lead to a more concentrated market, potentially altering pricing dynamics and innovation pressures. For instance, Hexaom's acquisition of HDV Group in 2023 aimed to strengthen its position in specific market segments, underscoring the strategic importance of such consolidations.

- Industry Consolidation: Larger firms like Hexaom acquire smaller competitors to increase market share.

- Strategic Acquisitions: Hexaom's acquisition of HDV Group in 2023 is a prime example of this trend.

- Impact on Rivalry: Consolidation intensifies competition for smaller, independent firms.

- Market Landscape Shift: Acquisitions alter the competitive dynamics, potentially leading to a more concentrated market.

Competitive rivalry is a significant force for Hexaom, especially given the fragmented nature of the French housing market. In 2024, the market experienced a notable contraction, with new housing starts declining by approximately 15% year-on-year, intensifying the competition for available projects and customers.

Companies are actively differentiating themselves through quality, design, and energy efficiency, mirroring trends seen globally, such as major UK builders emphasizing net-zero commitments. This constant drive for innovation puts pressure on Hexaom to continually refine its product offerings.

High fixed costs and exit barriers, such as specialized machinery and long-term contracts, compel companies to remain in the market, exacerbating rivalry even during downturns. The industry also sees ongoing consolidation, with Hexaom's acquisition of HDV Group in 2023 being a key example, which reshapes the competitive landscape and challenges smaller players.

| Factor | Description | Impact on Hexaom |

|---|---|---|

| Market Fragmentation | Numerous small and large players in the French construction sector. | Intense competition across all market segments. |

| Market Downturn (2024) | Approx. 15% decrease in new housing starts year-on-year. | Escalated competition for fewer projects and customers. |

| Differentiation Strategies | Focus on build quality, design, energy efficiency. | Requires continuous innovation and value proposition refinement. |

| Consolidation Trends | Acquisitions like Hexaom's purchase of HDV Group. | Increased pressure on smaller competitors, potential market concentration. |

SSubstitutes Threaten

The most significant substitute for a newly built single-family home from Hexaom is the existing residential property market, often referred to as resale homes. Buyers can choose to purchase an older, pre-owned property. This option can be particularly attractive when new construction is limited or when prices for new builds are high and showing signs of stabilization or even decline.

In 2024, the resale market continues to present a compelling alternative. For instance, in many metropolitan areas, the median price for existing homes remained competitive compared to new builds. This affordability factor, coupled with the potential for immediate occupancy and often more established neighborhoods, makes resale homes a strong substitute, especially for buyers prioritizing location and budget.

For individuals considering homeownership, apartments and multi-family housing units can act as a substitute for traditional single-family homes. This is particularly true in urban centers where land availability is limited and cost-effectiveness becomes a significant factor in purchasing decisions.

The French housing market has seen a notable trend towards increased multi-family construction and a growing interest in prefabricated housing solutions. In 2024, new residential building permits in France saw a slight decrease compared to the previous year, yet the demand for diverse housing types, including apartments, remains robust due to urbanization and affordability concerns.

The rental market presents a significant threat of substitutes for homeownership, especially when economic conditions make buying less attractive. High interest rates, like those seen in 2024, coupled with general economic uncertainty, push many potential buyers towards renting. This shift is directly observable in markets where rental demand strengthens as homeownership becomes more costly or difficult to access.

The French rental market, for instance, has demonstrated robust growth, a clear indicator that a segment of the population is opting for renting over purchasing property. This trend suggests that the perceived benefits of renting, such as flexibility and lower upfront costs, are outweighing the traditional appeal of homeownership for a growing number of households. In 2023, rental prices in France saw an average increase of 2.5%, further highlighting the demand dynamics.

Self-Build or DIY Renovation

The threat of substitutes for professional renovation services, like those Hexaom might offer, is significant due to the rise of self-build or DIY renovation projects. Homeowners increasingly have access to online tutorials and readily available materials, allowing them to tackle smaller or mid-sized renovations themselves. This DIY trend bypasses the need for professional project management and specialized labor, directly impacting the demand for traditional renovation companies.

Consider the cost savings: DIY renovations can significantly reduce labor costs, a major component of professional renovation quotes. For instance, in 2024, the average cost of a bathroom renovation by a professional contractor could range from $15,000 to $25,000, whereas a skilled DIYer might complete a similar project for under $10,000. This price disparity makes DIY an attractive alternative for many budget-conscious consumers.

- DIY Potential: Homeowners can manage smaller projects like painting, flooring, or basic fixture replacements themselves.

- Cost Savings: Eliminating professional labor fees can lead to substantial savings, making DIY appealing for budget-conscious individuals.

- Access to Resources: Online platforms and readily available materials empower homeowners with the knowledge and tools for self-managed renovations.

- Project Scale: While complex structural changes still often require professionals, many cosmetic and functional upgrades are within the reach of capable DIYers.

Alternative Building Technologies and Materials

The threat of substitutes for Hexaom's traditional and timber frame offerings is growing, particularly from alternative building technologies. Advanced modular construction and 3D-printed homes are gaining traction, promising significantly faster build times and potentially lower overall costs. For instance, the modular construction market in the US was valued at approximately $13.4 billion in 2023 and is projected to grow substantially, indicating a clear shift in consumer and developer preferences towards quicker, more efficient building solutions.

These emerging technologies can directly challenge Hexaom's market position by offering compelling advantages that traditional methods may struggle to match. The ability to prefabricate components off-site, as seen in modular building, can lead to fewer weather delays and a more controlled manufacturing process. Similarly, 3D printing offers the potential for highly customized designs with reduced labor requirements and material waste, factors that are increasingly important in today's construction landscape.

- Modular Construction Growth: The global modular construction market is expected to reach over $170 billion by 2027, highlighting a strong demand for faster building solutions.

- 3D Printing Advancements: Companies are increasingly utilizing 3D printing for residential construction, with projects demonstrating reduced build times by up to 50% compared to traditional methods.

- Cost Efficiency: While initial investment in new technologies can be high, the long-term operational and labor cost savings make them attractive substitutes.

- Sustainability Focus: Many alternative technologies offer improved sustainability profiles, such as reduced material waste and energy efficiency, aligning with growing environmental concerns.

The threat of substitutes for Hexaom's offerings is primarily driven by the availability of existing homes and alternative housing solutions. The resale market provides a direct alternative, often at a more accessible price point. Additionally, renting offers flexibility and lower upfront costs, especially when economic conditions make purchasing less appealing.

In 2024, the French housing market continues to see a strong demand for apartments and multi-family units, particularly in urban areas. This trend is fueled by urbanization and the need for more affordable housing options, positioning these as significant substitutes for single-family homes.

The rise of DIY renovation projects presents a substantial substitute for professional renovation services. Homeowners can leverage online resources and readily available materials to undertake projects themselves, significantly reducing labor costs. For instance, a DIY bathroom renovation in 2024 could cost under $10,000, compared to $15,000-$25,000 for professional work.

Emerging construction technologies like modular and 3D-printed homes are also strong substitutes for traditional building methods. These offer faster build times and potential cost efficiencies. The US modular construction market, valued at approximately $13.4 billion in 2023, demonstrates this growing preference for quicker, more efficient building solutions.

| Substitute Type | Key Advantages | 2024 Market Trend/Data |

| Resale Homes | Affordability, Established Neighborhoods, Immediate Occupancy | Median prices remain competitive with new builds in many metro areas. |

| Apartments/Multi-family | Urban Location, Cost-Effectiveness, Lower Upfront Costs | Robust demand in urban centers due to urbanization and affordability concerns. |

| Rental Market | Flexibility, Lower Upfront Costs, Avoidance of High Interest Rates | Rental prices in France increased by an average of 2.5% in 2023, indicating strong demand. |

| DIY Renovations | Significant Cost Savings (Labor), Control Over Project | DIY bathroom renovations can save $5,000-$15,000 compared to professional services. |

| Modular/3D-Printed Homes | Faster Build Times, Potential Cost Efficiency, Sustainability | US modular construction market valued at $13.4 billion in 2023; projects show up to 50% reduction in build times. |

Entrants Threaten

High capital requirements act as a significant deterrent for new companies wanting to enter the home construction and land development sector. Acquiring land, purchasing heavy machinery, and covering initial operational expenses demand a substantial financial outlay, often running into millions of dollars. For instance, in 2024, the average cost of raw land suitable for development in many metropolitan areas has continued to climb, with some prime locations exceeding $5 million per acre, making it difficult for smaller or less-funded entities to compete with established players like Hexaom.

The French construction sector is heavily regulated, with complex zoning laws and lengthy permitting processes acting as significant hurdles. For instance, obtaining a building permit in France can take several months, sometimes exceeding a year, depending on the project's complexity and location. This intricate legal and administrative framework demands specialized knowledge and established relationships, creating a substantial barrier for new companies entering the market.

Securing prime land for development and cultivating robust relationships with suppliers and subcontractors presents a significant hurdle for newcomers. Established companies like Hexaom, with their extensive operational history and diversified supply networks, possess a distinct advantage. For instance, in 2024, Hexaom reported securing land for three major projects, demonstrating their ongoing capacity to access critical resources.

Brand Reputation and Customer Trust

In the housing market, brand reputation and customer trust are incredibly important. Hexaom, with its century-long history and numerous established brands, enjoys strong recognition and a reliable track record. This makes it tough for newcomers to quickly win over customers.

New entrants face a significant hurdle in replicating the deep-seated trust that established players like Hexaom have cultivated over decades. Building this level of brand loyalty takes considerable time and investment, often requiring years of consistent quality and customer satisfaction to achieve.

- Brand Equity: Hexaom's long-standing presence has allowed it to build substantial brand equity, a valuable intangible asset that shields it from new competition.

- Customer Loyalty: Decades of reliable service have fostered a loyal customer base for Hexaom, making them less susceptible to the overtures of new, unproven entities.

- Reputational Barrier: The sheer weight of Hexaom's positive reputation acts as a significant barrier, as new entrants must overcome ingrained perceptions of trust and reliability.

Economies of Scale and Experience Curve

Established players in the construction sector, like Hexaom, often leverage significant economies of scale. This allows them to secure better pricing on raw materials and equipment, and to spread fixed costs over a larger volume of projects, thereby reducing per-unit costs. For instance, in 2024, major construction firms often reported cost savings of 10-15% on bulk material purchases compared to smaller, newer companies.

New entrants face a considerable disadvantage due to the absence of these scale benefits. They typically incur higher initial costs for materials, labor, and technology, making it challenging to compete on price. Furthermore, the experience curve plays a crucial role; established firms have refined their processes over years, leading to greater efficiency and fewer errors, something that takes new entrants considerable time and investment to replicate.

- Economies of Scale: Hexaom benefits from lower per-unit costs in procurement and operations due to its size.

- Experience Curve: Hexaom's accumulated knowledge in project management and execution enhances efficiency.

- Cost Disadvantage for New Entrants: New companies lack the purchasing power and operational efficiencies of established firms.

- Barriers to Entry: The need to overcome scale and experience disadvantages creates a significant hurdle for potential new competitors.

The threat of new entrants in the home construction and land development sector is moderate, largely due to substantial capital requirements and regulatory complexities. High initial investment for land and equipment, coupled with stringent French building codes and lengthy permit processes, create significant barriers. For instance, in 2024, land acquisition costs in desirable French regions can easily reach several million euros per hectare, making entry challenging for undercapitalized firms.

| Barrier Type | Description | Impact on New Entrants | Example Data (2024) |

|---|---|---|---|

| Capital Requirements | High initial investment for land, machinery, and operations. | Significant deterrent, favors well-funded companies. | Land costs in prime French locations can exceed €5 million/hectare. |

| Regulatory Hurdles | Complex zoning laws, lengthy permitting processes. | Requires specialized knowledge and established relationships. | Building permits can take 6-12+ months to obtain in France. |

| Brand Equity & Reputation | Established trust and customer loyalty. | Difficult for new players to gain market acceptance quickly. | Companies with decades of history command higher customer confidence. |

| Economies of Scale | Lower per-unit costs through bulk purchasing and operational efficiency. | New entrants face higher initial costs and a competitive price disadvantage. | Established firms can achieve 10-15% cost savings on materials. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, incorporating financial statements, industry-specific market research reports, and publicly available company disclosures to provide a comprehensive view of competitive dynamics.