Hexaom Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hexaom Bundle

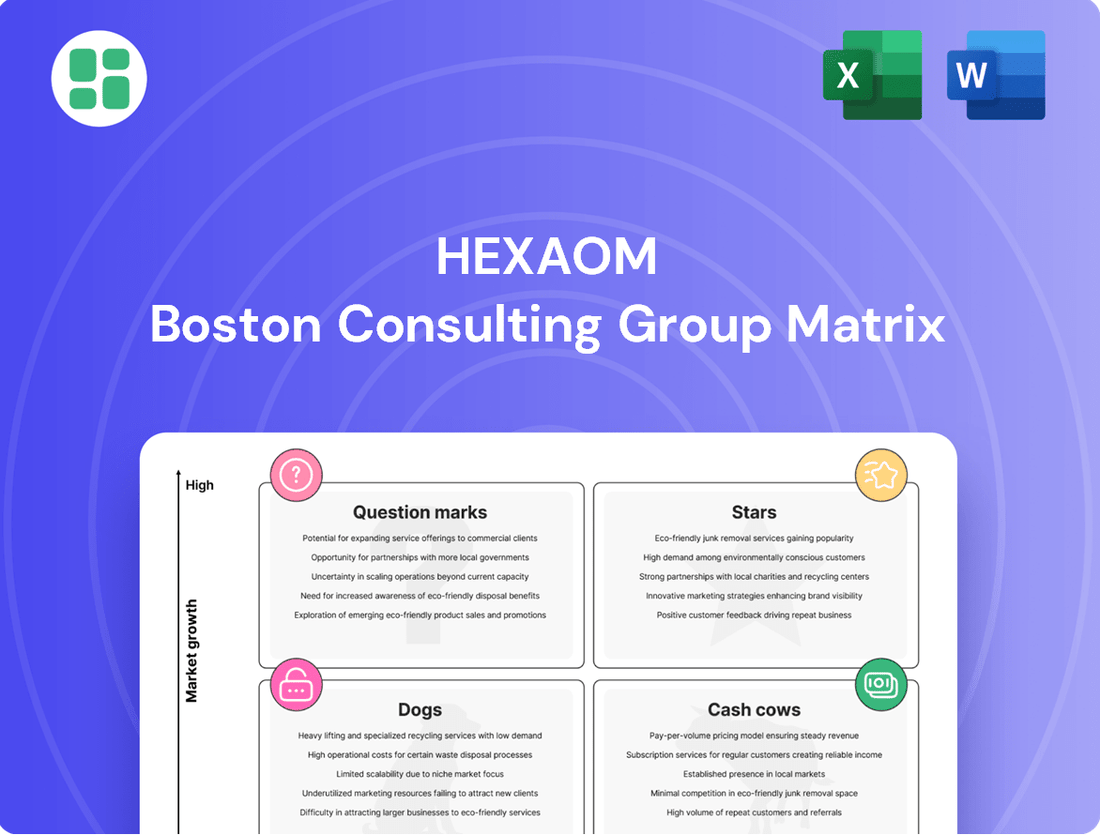

Curious about how this company's product portfolio stacks up? Our Hexaom BCG Matrix preview offers a glimpse into the strategic positioning of its offerings, highlighting potential Stars, Cash Cows, Dogs, and Question Marks.

To truly unlock the power of this analysis and translate insights into actionable strategies, you need the full Hexaom BCG Matrix. Purchase the complete report for a detailed quadrant breakdown, data-driven recommendations, and a clear roadmap for optimizing your investments and product development.

Don't just see the potential; seize it. Get the full Hexaom BCG Matrix today and gain the competitive edge you need to navigate market dynamics with confidence and drive sustainable growth.

Stars

The Intermediated Renovation Franchise Networks, including Illico Travaux and Camif Habitat, are a shining example of Hexaom's strategic success. In 2024, this segment experienced an impressive revenue surge exceeding 60%, with order intake climbing by a substantial 40.2%.

This robust performance highlights Hexaom's ability to capture significant market share within the renovation sector, a market demonstrating more resilience and growth compared to new construction. The company's deliberate investment in expanding these franchise networks clearly positions them as a dominant force in this dynamic and expanding segment of the construction industry.

Hexaom's strategic move into timber-frame housing through its Natilia franchisees and the introduction of 'tiny houses' via Natibox directly addresses the burgeoning demand for eco-friendly and affordable housing solutions. This expansion positions Hexaom to capture market share in segments prioritizing sustainability and efficient living spaces, reflecting a keen understanding of evolving consumer preferences and environmental consciousness.

Hexaom's acquisition of HDV Group, a significant player in homebuilding with substantial 2024 revenues, underscores a proactive strategy for market consolidation. This move is aimed at solidifying Hexaom's leadership position and expanding its footprint across crucial French regions, including Nouvelle-Aquitaine and Loiret.

The impact of this acquisition is already evident, with order volumes experiencing a nearly 70% surge in early 2025. This impressive growth highlights Hexaom's commitment to aggressively capturing market share within the recovering, yet still competitive, residential construction sector.

Integrated 'Build/Renovate' Offerings

Hexaom is strategically expanding its core home building operations by integrating 'Build/Renovate' offerings. This diversification leverages their established brand and existing customer relationships to tap into the burgeoning home improvement sector.

This expansion directly addresses the increasing consumer desire for home upgrades and energy efficiency solutions. By offering comprehensive housing solutions that span both new construction and renovations, Hexaom aims to capture a more significant portion of the overall residential market.

The market for home renovations is substantial. For instance, in 2024, the US home improvement market was projected to reach over $500 billion, indicating a strong demand for such services.

- Market Diversification: Hexaom moves beyond new builds to capture renovation and extension projects.

- Customer Base Leverage: Existing clients provide a foundation for the new service offering.

- Demand Alignment: Targets growth in home improvements and energy efficiency upgrades.

- Comprehensive Solutions: Positions Hexaom as a one-stop shop for housing needs.

Strong Q4 2024 and Early 2025 Sales Rebound in Home Building

Hexaom's performance in late 2024 and early 2025 paints a promising picture, suggesting a shift from previous headwinds. The company experienced a significant uplift in its order intake, particularly in the final quarter of 2024.

The home building sector saw a notable rebound, with Hexaom reporting an 18.2% increase in order intake for Q4 2024. This positive trend accelerated in December, which saw a substantial 32.2% surge in orders. This momentum has carried forward into the first quarter of 2025, indicating sustained demand.

This sales resurgence can be attributed to several favorable market factors. Hexaom appears well-positioned to leverage these improvements, which include more appealing interest rates and the impact of government incentives aimed at stimulating the housing market. Such conditions highlight Hexaom's competitive strength in its core market segments.

- Q4 2024 Order Intake Increase: 18.2%

- December 2024 Order Intake Surge: 32.2%

- Market Drivers: Improving interest rates and government incentives

- Sales Trend: Strong momentum continuing into Q1 2025

Stars in the BCG Matrix represent high-growth, high-market-share businesses. For Hexaom, the Intermediated Renovation Franchise Networks, including Illico Travaux and Camif Habitat, exemplify this category. In 2024, this segment achieved over 60% revenue growth and a 40.2% increase in order intake, demonstrating strong market leadership in a growing sector.

| Business Segment | Market Growth | Market Share | 2024 Performance Highlight |

|---|---|---|---|

| Intermediated Renovation Franchise Networks | High | High | Revenue > 60% growth, Order Intake +40.2% |

What is included in the product

The Hexaom BCG Matrix offers a strategic framework to analyze a company's product portfolio by categorizing each unit into Stars, Cash Cows, Question Marks, or Dogs, guiding investment and divestment decisions.

Visualize your portfolio's health with clear quadrant placement, easing strategic decision-making.

Cash Cows

Traditional single-family home construction, despite a significant 31.5% revenue drop in 2024 to €599.5 million due to market challenges, continues to be Hexaom's bedrock. This segment, while operating in a mature and currently subdued market, still commands a substantial market share, underscoring its enduring importance to the company's financial stability.

This established business is the primary engine for Hexaom's operational cash flow, generating the necessary funds to support and fuel the company's investments in other strategic areas. Its consistent, albeit currently challenged, performance is vital for the overall financial health and strategic flexibility of Hexaom.

Established home building brands within Hexaom's portfolio are prime examples of Cash Cows. Despite operating in a mature, low-growth French market, these nearly 50 brands leverage Hexaom's extensive network and strong reputation. This allows them to consistently attract customers and generate stable, predictable cash flows for the group.

Hexaom's General Contractor Renovation business stands as a prime example of a Cash Cow within its portfolio. Despite ongoing strategic shifts in other renovation segments, these core operations, especially those directly overseen by Hexaom, continue to be a robust revenue generator. In 2024, this segment brought in €31.8 million.

The profitability of this mature business is further underscored by its healthy operating margin of 6.3%. This financial strength demonstrates its capacity to produce consistent and reliable cash flow, a hallmark of a successful Cash Cow, even within a well-established market.

Ancillary Financial Services for Homeownership

Hexaom's ancillary financial services for homeownership, such as mortgage brokering and home insurance, represent a classic Cash Cow. These offerings tap into the stable demand within the mature housing market, complementing Hexaom's core construction business by providing essential support to buyers.

These services typically exhibit high profitability due to established customer bases and efficient operational models, generating consistent cash flow with minimal investment needs. For instance, the mortgage origination sector in 2024 saw continued activity, with the U.S. market originating an estimated $2.5 trillion in mortgages, indicating a robust environment for such ancillary services.

- Stable Revenue Streams: Ancillary services benefit from recurring income, such as ongoing insurance premiums or refinancing opportunities.

- Low Investment Needs: Mature markets require less capital for growth, allowing profits to be directed elsewhere.

- Synergy with Core Business: Cross-selling financial services to construction clients enhances customer loyalty and revenue per customer.

- Market Maturity: The homeownership market, while large, offers predictable, albeit slower, growth, characteristic of a Cash Cow.

Efficient Cost Management and Profitability in Core Business

Hexaom's core businesses are performing as cash cows, demonstrating resilience through efficient cost management. Despite a challenging real estate market in 2024, the company maintained an operating profitability of approximately 3% of its annual revenue. This financial discipline is crucial for ensuring consistent positive cash flow from these established, high-market-share segments, even when market activity slows.

This strong performance is supported by several factors:

- Consistent Profitability: The 3% operating profit margin in 2024 highlights Hexaom's ability to control expenses within its core operations.

- Positive Cash Flow Generation: These cash cows are reliably producing surplus cash, which can be reinvested or used to fund other business ventures.

- Market Dominance: Hexaom's significant market share in these core areas provides a stable foundation for profitability.

- Adaptability: The company's cost management strategies have proven effective in navigating market downturns, ensuring continued financial health.

Hexaom's established home construction and renovation businesses function as its Cash Cows. These segments, despite facing market headwinds in 2024 with a 31.5% revenue drop in traditional single-family homes, continue to generate substantial and stable cash flow. Their significant market share and efficient cost management, evidenced by a 3% operating profit margin in 2024, allow them to consistently produce surplus cash.

These mature operations, including nearly 50 established home building brands and the General Contractor Renovation business which generated €31.8 million in 2024, are vital for funding Hexaom's strategic investments. Ancillary services like mortgage brokering also contribute, capitalizing on the stable demand within the housing market.

| Business Segment | 2024 Revenue (Approx.) | Operating Margin (Approx.) | BCG Category |

| Traditional Single-Family Homes | €599.5 million | N/A (part of overall group margin) | Cash Cow |

| General Contractor Renovation | €31.8 million | 6.3% | Cash Cow |

| Ancillary Financial Services | N/A (synergistic) | High (estimated) | Cash Cow |

Delivered as Shown

Hexaom BCG Matrix

The preview you are currently viewing is the complete and final Hexaom BCG Matrix document you will receive upon purchase. This means you are seeing the exact, unwatermarked, and fully formatted report that is ready for immediate strategic application. No further edits or additions will be made; this is the professional-grade analysis you'll download to inform your business decisions and presentations.

Dogs

The Land Development segment in 2024 saw a sharp revenue decrease of 55.1%, falling to €11.3 million. This performance suggests a low market share within a contracting or difficult market, positioning it as a resource drain with minimal profit potential.

The general contractor renovation business within Hexaom experienced a significant revenue drop of 30.7% in 2024. This decline is directly linked to Hexaom's strategic pivot, channeling resources and focus toward its more robust franchise model.

This strategic shift implies that the directly managed general contractor operations were not meeting performance expectations. Consequently, these operations are being scaled back or phased out, a characteristic move for a business unit classified as a Dog in the BCG matrix.

Underperforming regional home building operations within Hexaom's portfolio likely fall into the Dogs category of the BCG Matrix. These branches are characterized by low market share in a slow-growing or declining regional market. Given the reported historic crisis in the French new home construction market, it's probable that some of these older or less agile regional units are facing significant challenges.

These struggling operations may be experiencing low profitability and struggling to achieve break-even points. For instance, if a particular region saw a decline in new housing starts by 15% in 2024 compared to the previous year, and Hexaom's market share in that specific region dropped to below 5%, it would solidify its position as a Dog. Such units might require significant restructuring or could be considered for divestiture to optimize Hexaom's overall performance.

Legacy Construction Methods/Brands

Legacy construction methods and brands within Hexaom's portfolio likely represent the Dogs in the BCG matrix. These are older, less innovative approaches or specific brand lines that have seen declining market relevance. For instance, a brand focused solely on traditional brick-and-mortar construction might struggle against the rising demand for pre-fabricated or modular building solutions.

Such offerings typically exhibit low market share and low growth potential. In 2024, the global construction market saw a significant shift towards sustainable building materials and smart technologies, with traditional methods often lagging behind. Brands heavily reliant on these older techniques may find their revenue contribution diminishing, possibly maintained only for specific, small niche markets.

Consider these characteristics for legacy construction methods/brands:

- Low Market Share: These methods or brands capture a small percentage of the overall construction market.

- Low Growth Rate: The demand for these older approaches is stagnant or declining.

- Limited Investment Appeal: They offer minimal future growth prospects and may not attract significant capital.

- Potential for Divestment or Niche Focus: Companies might consider phasing them out or maintaining them only for highly specialized, low-volume segments.

Segments Heavily Impacted by Expiring Government Incentives

Segments of the residential construction market that were heavily dependent on government incentives, such as the Pinel rental investment program which concluded at the end of 2024, are now experiencing a noticeable downturn in demand. This shift directly impacts Hexaom's exposure.

Any Hexaom business units or product lines with a significant concentration in these incentive-driven segments, without sufficient diversification, are vulnerable. For instance, the French residential real estate sector, which saw substantial investment driven by the Pinel law, is now facing a potential slowdown. In 2023, the Pinel law accounted for a significant portion of new rental property investments, and its absence in 2025 will undoubtedly reshape market dynamics.

These exposed segments could transition into the Dogs category of the Hexaom BCG Matrix. This is characterized by declining market prospects and a potentially weak competitive advantage in the new, incentive-free landscape.

- Pinel Law Termination: The expiration of the Pinel law at the end of 2024 removes a key driver for rental investment properties in France, directly impacting segments reliant on this incentive.

- Reduced Demand: Consequently, demand in these specific residential construction segments is expected to decrease, leading to lower sales volumes for Hexaom if its offerings are concentrated here.

- Weakening Competitive Position: Without the artificial boost of incentives, the inherent attractiveness and competitive advantage of projects in these segments may diminish, pushing them towards a Dog status.

- Market Shift: The market is likely to pivot towards other investment vehicles or property types, requiring Hexaom to adapt its portfolio to avoid being overexposed to these declining areas.

Hexaom's underperforming business units, particularly those in contracting and legacy construction methods, are firmly positioned as Dogs in the BCG Matrix. These segments are characterized by low market share and minimal growth potential, often serving as resource drains. For instance, the general contractor renovation business saw a 30.7% revenue drop in 2024, directly linked to Hexaom's strategic focus on its more successful franchise model.

The termination of government incentives like the Pinel law at the end of 2024 further exacerbates the challenges for Hexaom's segments heavily reliant on these programs. These areas now face reduced demand and a weakening competitive position, making them prime candidates for the Dog classification. Without these artificial boosts, their inherent market attractiveness diminishes, potentially leading to divestment or a niche focus.

The Land Development segment's sharp 55.1% revenue decrease in 2024, falling to €11.3 million, clearly illustrates a Dog's profile. This performance indicates a low market share within a contracting market, offering little profit potential and demanding significant resources for minimal return.

Question Marks

The Real Estate Development segment, within Hexaom's BCG Matrix, is positioned as a Question Mark. In 2024, this segment experienced a modest growth rate of 2.7%, contributing €71 million to Hexaom's overall revenue. Hexaom itself described this performance as 'less than hoped for,' despite recognizing real estate development as a 'growing activity.'

This scenario suggests that while the real estate development market holds promise, Hexaom's current penetration is relatively small. To elevate this segment from a Question Mark to a Star, substantial investment would be necessary to boost market share and capitalize on the market's expansion potential.

Rénovert, Hexaom's energy renovation franchise network, is positioned as a question mark within the BCG matrix. While it's a new entrant in a rapidly expanding market, fueled by environmental concerns and regulatory shifts, its current market share is minimal. Hexaom anticipates revenue generation from this venture starting in late 2024, highlighting its nascent stage and the significant investment required to build its presence.

Hexaom's strategic expansion into regions like Nouvelle-Aquitaine and Loiret, beyond acquisitions like HDV, signals a deliberate move into untapped geographic markets. These areas, with potentially lower existing market share for Hexaom, represent high-growth potential if they are experiencing robust economic development or have significant unmet demand in the housing sector. This approach aligns with identifying and capitalizing on emerging opportunities where Hexaom can establish a strong foothold.

Tiny Houses (Natibox)

Hexaom's introduction of 'tiny houses' through its Natibox dealer network positions it within a burgeoning segment of the housing market. This strategy targets consumers seeking economical, compact, and eco-friendly living solutions. The initiative represents a new venture for Hexaom, indicating a modest current market presence but substantial growth prospects.

The tiny house market, while niche, is experiencing notable expansion. In 2023, the global tiny house market was valued at approximately $3.5 billion, with projections suggesting a compound annual growth rate (CAGR) of around 5% through 2030. This growth is fueled by increasing urbanization, rising housing costs, and a growing preference for minimalist lifestyles.

- Market Niche: Hexaom is entering the specialized tiny house market, a segment driven by affordability and sustainability.

- Growth Potential: The global tiny house market is expanding, with a projected CAGR of 5% through 2030, indicating significant opportunity for new entrants.

- Hexaom's Position: As a relatively new offering, Natibox tiny houses likely have a low current market share but high potential for future growth.

- Consumer Demand: The increasing demand for compact, affordable, and eco-conscious housing solutions supports the viability of this product line.

New Digital Services and Construction Technologies

Hexaom's new digital services and advanced construction technologies, such as enhanced Building Information Modeling (BIM) integration and AI-driven project management tools, are positioned in the Question Marks quadrant of the BCG Matrix. These innovations target rapidly evolving digital markets within construction, a sector projected to see significant growth in technology adoption. For instance, the global construction technology market was valued at approximately $12.7 billion in 2023 and is expected to reach $33.7 billion by 2028, growing at a CAGR of 21.5%.

These initiatives represent Hexaom's investment in future growth areas, acknowledging their current low market share. The company is likely dedicating substantial resources to research, development, and piloting these technologies. This strategic placement signifies a commitment to capturing future market share in a high-potential, albeit currently nascent, segment of the construction industry.

- New Digital Services: Focus on AI-powered analytics for predictive maintenance and smart contract automation.

- Advanced Construction Technologies: Development of next-generation BIM platforms and drone-based site monitoring.

- Market Context: Operating in a high-growth tech adoption environment within construction, with significant investment required for scaling.

- Strategic Goal: Aim to increase market share in these evolving digital segments through continued innovation and strategic partnerships.

Question Marks represent business units or product lines with low market share in high-growth industries. These ventures require significant investment to increase their market share and potentially become Stars. Without substantial investment, they risk becoming Dogs if market growth slows or competitive pressures intensify.

Hexaom's Real Estate Development segment and its Rénovert franchise network are prime examples of Question Marks. While operating in expanding markets, their current market penetration is minimal, necessitating strategic capital allocation to foster growth and capture market potential.

The tiny houses initiative and new digital construction technologies also fall into the Question Mark category. These are innovative ventures tapping into emerging consumer trends and technological advancements within the construction sector, demanding investment to build brand recognition and market presence.

Hexaom's strategic expansion into new geographic regions, such as Nouvelle-Aquitaine and Loiret, can also be viewed as Question Marks. These efforts aim to establish a presence in markets with high growth potential but where Hexaom's current market share is likely low.

| Segment | Market Growth | Market Share | Investment Need |

|---|---|---|---|

| Real Estate Development | Moderate (2.7% in 2024) | Low | High |

| Rénovert Franchise | High (Environmental/Regulatory Driven) | Very Low (Revenue expected late 2024) | High |

| Tiny Houses (Natibox) | High (Global market ~$3.5B in 2023, 5% CAGR) | Low | High |

| Digital Services/Tech | Very High (Construction Tech Market $12.7B in 2023, 21.5% CAGR) | Low | High |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, encompassing sales figures, industry growth rates, and competitive landscape analysis to inform strategic decisions.