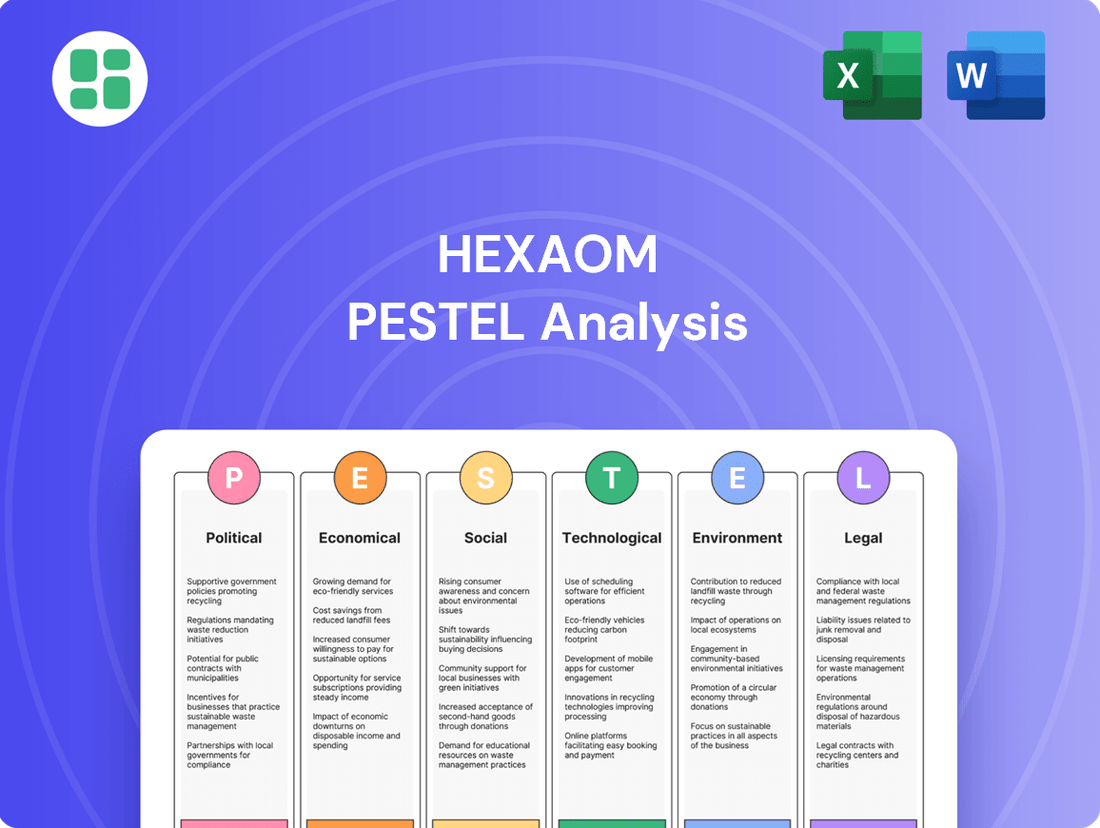

Hexaom PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hexaom Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Hexaom's trajectory. Our meticulously researched PESTLE analysis provides actionable intelligence to inform your strategic decisions and competitive advantage. Download the full report now to gain a comprehensive understanding of Hexaom's external landscape.

Political factors

The French government's 2025 Finance Act is set to reintroduce the zero-rate loan (PTZ) for individual housing in designated areas. This policy shift is expected to foster a more supportive market for homebuilders such as Hexaom.

The extension of the PTZ program to all first-time homebuyers purchasing new homes across France is projected to assist around 15,000 additional families with housing by 2025. Hexaom views this as a significant positive development for its market outlook in 2025, potentially driving a sales recovery.

The impending expiration of the Pinel rental investment program on December 31, 2024, signals a significant shift in French real estate incentives. This program, which offered substantial tax reductions for those investing in and renting out new or renovated housing, has been a key driver for demand in the rental property market. Its discontinuation is likely to dampen investor appetite for new builds, potentially affecting companies like Hexaom that are involved in constructing such properties.

While the Pinel program winds down, the MaPrimeRénov scheme, designed to support energy efficiency upgrades, is slated to continue through 2025. However, there are indications that its 2025 budget might be reduced. This potential budgetary constraint could lead to a slowdown in renovation activity, impacting the demand for renovation services and materials, which could indirectly influence Hexaom's business operations if they engage in such projects.

Political stability in France, a key component of the investment climate, is currently facing headwinds. Recent shifts in government leadership have introduced a degree of uncertainty, potentially impacting both consumer and corporate confidence, particularly within the real estate sector. This instability can directly influence investment decisions and cast a shadow over the construction industry's economic prospects.

The ongoing political landscape, coupled with the increasing possibility of trade tensions, contributes to a more cautious sentiment among French households and businesses. For instance, the OECD's Economic Outlook for France in late 2024 projected a subdued growth rate, partly attributable to these geopolitical and domestic uncertainties, which can deter significant capital deployment.

Public Spending and Budgetary Constraints

France's commitment to fiscal responsibility is evident in its goal to lower the budget deficit to 5.4% of GDP in 2025, down from 5.8% in 2024. This tightening fiscal environment could mean less public money for regional governments and projects focused on the green transition. Consequently, this might affect public infrastructure projects and specific housing initiatives.

However, the 2025 Budget does signal a slight rise in overall net spending compared to the previous year. This suggests a nuanced approach, balancing deficit reduction with continued, albeit potentially targeted, public investment. The government's spending decisions will be a key factor to monitor for businesses involved in public contracts or sectors heavily reliant on government support.

- Budget Deficit Target: 5.4% of GDP in 2025 (down from 5.8% in 2024).

- Potential Impact: Reduced funding for local authorities and ecological transition initiatives.

- Public Spending Trend: Slight increase in net expenditure in the approved 2025 Budget.

Green Procurement and Sustainable Development Mandates

France's commitment to green procurement is intensifying, with the State Procurement Department releasing new tool sheets between November 2024 and February 2025. These resources are designed to help public bodies embed environmental criteria into their contracts, directly impacting sectors like construction. This push is a key component of the 'France Relance Plan,' which prioritizes sustainable and affordable housing solutions.

Hexaom, as a major player in the construction industry, must navigate these evolving regulations. The government's focus on eco-friendly building practices, driven by these mandates, means that companies like Hexaom will need to demonstrate strong adherence to sustainability standards to secure public contracts.

- November 2024 - February 2025: Release of State Procurement Department's green procurement tool sheets.

- France Relance Plan: A national strategy emphasizing sustainable and affordable housing.

- Impact on Hexaom: Requirement to integrate environmental considerations into public procurement.

- Governmental Emphasis: Growing priority on eco-friendly construction practices.

Political factors significantly shape Hexaom's operating environment, with government housing policies being a primary driver. The reintroduction of the zero-rate loan (PTZ) for individual housing in designated areas for 2025, and its extension to all first-time homebuyers, is a positive signal for Hexaom, potentially boosting sales. Conversely, the discontinuation of the Pinel rental investment program at the end of 2024 could temper investor demand for new builds.

The French government's fiscal strategy for 2025 targets a budget deficit reduction to 5.4% of GDP, down from 5.8% in 2024. While this indicates fiscal prudence, it may also lead to scaled-back public spending on regional projects and the green transition, potentially impacting infrastructure and specific housing initiatives. Nevertheless, the 2025 Budget does show a slight increase in overall net spending, suggesting continued, albeit possibly more targeted, public investment.

France's commitment to sustainability is increasingly reflected in public procurement, with new tool sheets released between November 2024 and February 2025 to embed environmental criteria. This focus, part of the France Relance Plan, necessitates that companies like Hexaom prioritize eco-friendly construction practices to secure public contracts.

| Policy/Factor | Description | Projected Impact on Hexaom | Timeline |

|---|---|---|---|

| Zero-Rate Loan (PTZ) | Reintroduced for individual housing, extended to all first-time homebuyers. | Positive for sales recovery and market outlook. | Effective 2025 |

| Pinel Rental Investment Program | Expiration of tax incentives for rental property investment. | Potential dampening of investor appetite for new builds. | Ends December 31, 2024 |

| Budget Deficit Target | 5.4% of GDP in 2025 (down from 5.8% in 2024). | May lead to reduced public funding for certain projects. | 2025 |

| Green Procurement | Integration of environmental criteria into public contracts. | Requirement to adopt eco-friendly building practices for public works. | Ongoing, with new tools Nov 2024 - Feb 2025 |

What is included in the product

The Hexaom PESTLE analysis comprehensively examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting Hexaom, providing actionable insights for strategic decision-making.

Hexaom's PESTLE analysis offers a clear, summarized version of complex external factors, simplifying strategic discussions and reducing the pain of information overload during planning.

Economic factors

Fluctuations in interest rates significantly impact Hexaom's operating environment. For instance, mortgage interest rates in France, which peaked at 3.90% in January 2024, have been on a downward trajectory, reaching an average of 3.20% by March 2025.

Current projections for 2025 indicate a continued easing, with rates potentially settling around 3%. This trend of decreasing borrowing costs makes real estate more accessible, directly benefiting Hexaom by stimulating demand for its products and services within the housing sector.

Renovation costs in France saw a significant jump of 5% in 2025 compared to 2023, largely driven by escalating material expenses. This trend highlights broader inflationary pressures impacting the entire construction sector.

The construction industry's economic viability is being tested by these rising costs, which have a direct bearing on project feasibility and profitability. For companies like Hexaom, this translates into a challenging environment where maintaining healthy margins requires careful cost management.

Consequently, Hexaom faces the risk of compressed profit margins as increased construction costs strain its ability to absorb these expenses, even with strategic efforts to control overall profitability.

The French housing market is navigating a challenging period, with the construction sector contracting by 3.9% in 2024. The building industry, in particular, faced a steeper decline of 5.5%. However, projections suggest a less severe downturn for 2025, with an anticipated slowdown to a 2.6% decrease.

New housing permits have also seen a notable drop in 2024. Looking ahead to 2025, this decline is expected to moderate to 3.3%, with around 320,000 housing units anticipated to be authorized, signaling a potential easing of the contraction.

Hexaom, a key player, experienced a substantial 29% reduction in turnover during 2024. The company forecasts a more manageable decline of approximately 10% for 2025, suggesting a possible stabilization in market conditions for the sector.

Consumer Purchasing Power and Affordability

Consumer purchasing power is a significant driver for sectors like real estate, directly impacting companies such as Hexaom. When households have more disposable income and can borrow more affordably, their capacity to make larger purchases, like homes, increases. This trend is clearly visible in recent data.

Improved household purchasing power, fueled by factors like lower interest rates and potential income growth, is bolstering demand in the real estate market. This translates into greater affordability for consumers. For instance, the measure of real estate purchasing power, indicating the square meters a household can afford, saw an increase to 78 square meters in 2024, up from 75 square meters in 2023. Projections suggest this trend will continue, with an estimated rise to 85 square meters by 2025.

This enhanced affordability is a direct boon for Hexaom, as it broadens the pool of potential customers who can now consider purchasing properties or related services. The ability to afford more space or higher-value properties means a larger segment of the population becomes addressable market for Hexaom's offerings.

- Increased Real Estate Affordability: Purchasing power rose to 78m² in 2024 from 75m² in 2023.

- Positive Future Outlook: Forecasts indicate purchasing power could reach 85m² by 2025.

- Expanded Customer Base: Higher affordability directly benefits Hexaom by widening its potential market.

- Economic Indicator: This trend reflects a broader improvement in household financial capacity.

Hexaom's Financial Performance and Outlook

Hexaom faced a significant downturn in 2024, with its net profit dropping by a substantial 58%. This was accompanied by a 29% decrease in annual turnover compared to the previous year, largely attributable to a severe crisis within the real estate market.

Looking ahead to 2025, Hexaom anticipates a less severe contraction in turnover, projecting a decline of approximately 10%. The company is targeting a return of its profit margin to above 3% during this period.

Encouragingly, Hexaom has observed a positive shift since the final quarter of 2024. This trend manifests as an increase in sales across its various business segments, indicating the early stages of a cautious market recovery.

- 2024 Performance: Net profit down 58%, turnover down 29% YoY.

- 2025 Outlook: Turnover decline expected to moderate to ~10%.

- Margin Target: Aiming for profit margin to exceed 3% in 2025.

- Market Signal: Q4 2024 saw an upturn in sales, suggesting recovery.

Economic factors significantly shape Hexaom's operational landscape. Declining interest rates, projected to reach 3% by early 2025, are making real estate more affordable, which should boost demand for Hexaom's offerings. However, renovation costs jumped 5% in 2025 due to material expenses, squeezing profit margins for construction firms like Hexaom.

The French construction sector, contracting by 3.9% in 2024, is expected to see a slower decline of 2.6% in 2025, with housing permits also moderating. Hexaom experienced a 29% turnover drop in 2024 but forecasts a less severe 10% decline for 2025, signaling potential stabilization.

Improved household purchasing power, evidenced by real estate affordability increasing to 85 square meters by 2025, directly benefits Hexaom by expanding its customer base.

| Economic Factor | 2024 Data/Projection | 2025 Projection | Impact on Hexaom |

|---|---|---|---|

| Interest Rates (France) | Peaked ~3.90% (Jan 2024) | Target ~3.00% | Increased affordability, potential demand boost |

| Renovation Costs (France) | Up 5% vs 2023 | Continued pressure | Margin compression risk |

| Construction Sector Growth (France) | -3.9% | -2.6% | Moderating market challenges |

| Real Estate Affordability (m²) | 78m² (up from 75m² in 2023) | 85m² | Expanded customer base |

Same Document Delivered

Hexaom PESTLE Analysis

The preview shown here is the exact Hexaom PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use. You can trust that the detailed breakdown of Political, Economic, Social, Technological, Legal, and Environmental factors impacting Hexaom will be delivered precisely as you see it.

Sociological factors

Societal shifts, like an aging population, are reshaping the housing market, driving demand for specific types of residences. For instance, in many developed nations, the proportion of individuals aged 65 and over is projected to reach over 20% by 2030, impacting the need for accessible and smaller living spaces.

University towns are experiencing a surge in student populations, creating intense demand for rental housing. In 2024, many popular university cities reported rental vacancy rates below 3%, directly contributing to escalating rental prices and presenting opportunities for developers like Hexaom to focus on student accommodation solutions.

These evolving demographic patterns, including the growing number of single-person households which now represent over 30% of all households in some Western European countries, require homebuilders to adopt flexible strategies. Hexaom must consider building a wider range of housing options, from starter homes to senior living communities, to effectively serve these diverse and changing consumer needs.

Consumers increasingly seek living environments that emphasize quality of life, often with a preference for less crowded locales. This trend saw a notable acceleration during the pandemic, with a significant move towards rural settings.

However, as work-from-home policies stabilize, a more nuanced demand is emerging, balancing the appeal of both urban and rural living. For instance, in 2024, reports indicated a sustained interest in suburban and exurban markets, showing a preference for more space while retaining access to urban amenities.

Hexaom's portfolio, which includes a range of housing types such as single-family homes, is well-positioned to address these shifting lifestyle preferences, offering options that cater to both the desire for spaciousness and the evolving dynamics of where people choose to live and work.

Consumers in France are increasingly prioritizing environmental impact when making purchasing decisions, particularly in the housing sector. This heightened awareness translates into a strong demand for sustainable homes, with buyers actively seeking properties that offer better energy efficiency. For instance, a 2024 survey indicated that over 60% of French homebuyers consider energy performance a key factor in their choice, a significant rise from previous years.

This shift in consumer preference is driving demand for homes equipped with features like superior insulation, modern energy-efficient heating systems, and renewable energy sources such as solar panels. This growing market for eco-friendly housing directly influences Hexaom's strategic direction, pushing the company to innovate and develop more sustainable and energy-conscious building solutions to meet evolving customer expectations.

Labor Market Challenges in Construction

The French construction sector is grappling with persistent labor shortages, a situation that directly impacts project execution by causing delays and escalating costs. This scarcity of skilled workers is a critical operational hurdle for companies like Hexaom, potentially constraining their ability to scale production and adhere to project schedules.

The employment landscape in France's building industry saw a decline in 2024, and this trend is anticipated to worsen. Projections indicate a further downturn in 2025, with an estimated 50,000 jobs potentially being lost within the sector.

- Labor Shortages: Persistent scarcity of skilled labor in French construction.

- Project Impact: Delays and increased costs due to workforce gaps.

- Employment Downturn: Building industry employment decreased in 2024.

- 2025 Projections: Expected acceleration of job losses, with 50,000 positions at risk.

Consumer Confidence and Economic Outlook

Consumer confidence is a significant sociological factor impacting Hexaom, particularly given the prevailing economic uncertainties. Despite some positive signals in the housing sector, households are adopting a cautious approach. This hesitation is largely driven by ongoing international trade disputes and a noticeable slowdown in economic growth across Europe, creating a general sense of unease.

The broader economic outlook remains a primary concern for many. In fact, recent surveys indicate that nearly 90% of French citizens express apprehension about the general economic environment. This widespread concern directly influences consumer behavior, making individuals less inclined to commit to substantial expenditures such as purchasing property or embarking on large-scale home improvement projects.

For Hexaom, this sociological landscape presents a clear challenge and opportunity. The company's success will hinge on its capacity to effectively communicate value and build trust with its customer base. Instilling confidence in Hexaom's products and services is paramount to encouraging consumer spending, especially for significant investments that are highly sensitive to economic sentiment.

Key considerations for Hexaom include:

- Monitoring Consumer Sentiment: Regularly tracking consumer confidence indices and sentiment surveys in key markets will provide early warnings of shifts in spending appetite.

- Value Proposition Clarity: Emphasizing the long-term value and return on investment of Hexaom's offerings can help overcome hesitancy related to major purchases.

- Economic Communication: Proactively addressing consumer concerns about the economic outlook through transparent communication about Hexaom's stability and future prospects is essential.

- Targeted Marketing: Tailoring marketing efforts to segments of the population that may be less affected by economic downturns or are actively seeking renovation opportunities could mitigate the impact of broader consumer caution.

Societal trends are profoundly influencing housing demand, with an aging demographic in many developed nations, expected to see over 20% of the population aged 65+ by 2030, driving a need for accessible living spaces.

University towns are experiencing robust rental demand, with vacancy rates in popular cities often falling below 3% in 2024, pushing rental prices up and creating opportunities for student housing developers.

The increasing prevalence of single-person households, now exceeding 30% in some Western European countries, necessitates flexible housing solutions from builders like Hexaom, ranging from starter homes to senior living communities.

Consumers are increasingly prioritizing quality of life and are drawn to less crowded locales, a trend that saw a notable acceleration towards rural settings during the pandemic, though a balanced interest in suburban and exurban markets persists in 2024.

Environmental consciousness is a growing factor in purchasing decisions, with over 60% of French homebuyers in 2024 considering energy performance crucial, boosting demand for sustainable and energy-efficient homes.

Consumer confidence remains a key concern, with nearly 90% of French citizens expressing apprehension about the economic environment in recent surveys, leading to caution in major expenditures like property purchases.

Technological factors

The French construction sector is increasingly adopting advanced techniques like multi-family and prefabricated building to manage expenses and speed up project delivery. These methods, including modular prefabrication and off-site construction, are becoming more popular for their efficiency and sustainability benefits.

In 2024, the prefabricated construction market in France was valued at approximately €1.5 billion, with projections indicating substantial growth. Hexaom can capitalize on this trend by integrating these innovative approaches to streamline its operations and shorten construction cycles, potentially boosting its competitive edge.

Smart home technologies, particularly those focused on energy optimization, are increasingly becoming a standard in new, eco-conscious housing developments. This trend directly addresses the growing consumer preference for sustainable and efficient living spaces. For instance, the global smart home market was valued at approximately $100 billion in 2023 and is projected to grow significantly, with some forecasts suggesting it could reach over $200 billion by 2028. Hexaom can leverage this by integrating advanced energy management systems into its properties, enhancing their marketability and meeting the demand for intelligent homes.

The push for energy-efficient building materials is accelerating. This trend is driven by a strong focus on sustainability and reducing the environmental footprint of construction projects. Companies are actively exploring and adopting materials such as timber and other bio-sourced options to comply with evolving regulations and environmental standards.

France, for instance, has implemented a significant mandate requiring new public buildings to incorporate at least 50% timber or other natural materials. This policy, effective from 2024 onwards, is likely to shape construction practices across the private sector as well, encouraging a broader shift towards greener building solutions.

Digitalization and Building Information Modeling (BIM) Adoption

The construction industry is undergoing a significant digital transformation, with Building Information Modeling (BIM) leading the charge. BIM facilitates accurate digital design, simulation, and infrastructure management, which greatly enhances coordination and precision throughout project lifecycles. This digital integration is vital for effective project planning and execution, presenting substantial avenues for growth.

Hexaom can leverage BIM and other advanced digital tools to optimize its design and construction workflows. By embracing these technologies, the company can significantly reduce errors and the need for costly rework, ultimately improving efficiency and project outcomes. For instance, a 2024 report indicated that BIM adoption can lead to a 10-15% reduction in project costs due to fewer design clashes and better resource allocation.

- Digitalization Impact: BIM adoption is projected to increase project efficiency by up to 20% in the coming years.

- Coordination Improvements: Enhanced collaboration through BIM platforms can reduce coordination issues by an estimated 30%.

- Error Reduction: Implementing BIM practices can cut down on rework and errors by as much as 25%.

- Growth Opportunities: The global BIM market was valued at approximately $7.5 billion in 2023 and is expected to grow at a CAGR of over 15% through 2030.

Emergence of AI and Automation in Construction

The French construction sector is increasingly adopting AI and automation, with robots now handling tasks like bricklaying, material transport, and site surveillance. This integration is projected to significantly cut down project timelines and boost accuracy. For instance, by 2024, it's estimated that AI-powered automation could reduce construction project completion times by up to 20% in some segments.

AI tools are also revolutionizing the design phase, offering intelligent suggestions for house plans. These systems analyze plot specifics, sunlight exposure, and wind patterns to propose the most efficient and comfortable layouts, fostering smarter development from the outset. This smart planning capability is crucial for optimizing resource use and building performance.

- Robotic Bricklaying: AI-driven robots can lay bricks with unparalleled speed and precision, potentially increasing laying rates by 30-40% compared to manual labor.

- AI-Assisted Design: Software now suggests optimal building orientations and layouts, considering factors like solar gain and natural ventilation, contributing to energy efficiency gains of up to 15% in new builds.

- Site Security: Automated drones and AI-powered surveillance systems enhance site safety and prevent unauthorized access, reducing incidents and potential losses.

These technological advancements present significant opportunities for Hexaom to elevate operational efficiency, improve worker safety, and deliver higher quality construction projects, aligning with the industry's push towards digital transformation and sustainability.

The French construction sector is rapidly embracing digital tools, with Building Information Modeling (BIM) at the forefront. BIM enhances design accuracy and project management, leading to significant efficiency gains. For instance, BIM adoption can reduce project costs by 10-15% through better coordination and resource allocation.

AI and automation are also transforming construction, with robots handling tasks like bricklaying and site surveillance, potentially cutting project timelines by up to 20% by 2024. AI-assisted design tools are optimizing building layouts for energy efficiency, contributing to up to 15% gains in new builds.

The adoption of prefabricated and modular building techniques is on the rise in France, valued at approximately €1.5 billion in 2024, to improve efficiency and speed. Smart home technologies are becoming standard, with the global market projected to exceed $200 billion by 2028, reflecting a strong consumer demand for sustainable and intelligent living spaces.

| Technology | Impact on Construction | Key Data/Projections (2024-2025) |

|---|---|---|

| BIM | Improved design accuracy, coordination, and project management | 10-15% reduction in project costs; market growth CAGR >15% through 2030 |

| AI & Automation | Increased speed, accuracy, and safety (e.g., robotic bricklaying) | Up to 20% reduction in project completion times; 30-40% increase in bricklaying rates |

| Prefabrication/Modular | Faster project delivery, cost efficiency | French market valued at ~€1.5 billion in 2024 |

| Smart Home Tech | Enhanced energy efficiency, user experience | Global market projected >$200 billion by 2028; up to 15% energy efficiency gains |

Legal factors

France's RE2020 environmental regulation, progressively tightening its grip in 2025, 2028, and 2031, mandates a comprehensive assessment of a building's carbon footprint across its entire lifecycle. This means Hexaom must consistently evolve its construction techniques and material sourcing to align with increasingly rigorous emission limits.

Energy Performance Certificates, known as 'diagnostic de performance énergétique' (DPE) in France, are a legal requirement for any property transaction, whether it's a sale or a rental. Since 2021, these ratings have become legally binding, meaning sellers and landlords must accurately reflect a property's energy efficiency.

The French government is progressively tightening these regulations. Starting in 2025, properties with a G energy rating will be banned from being rented out. This will be followed by even stricter rules in 2028, which will prohibit the rental of properties with an F rating.

These evolving legal mandates have a direct bearing on Hexaom. The company's renovation services will likely see increased demand as property owners seek to improve their energy efficiency to comply with the new rental prohibitions. Furthermore, Hexaom's new construction projects will need to meet these elevated energy efficiency standards to remain marketable and legally compliant.

Consumer protection laws, particularly those around energy performance, are tightening. In 2024, the EU's Energy Performance of Buildings Directive (EPBD) revisions are making Energy Performance Certificates (EPCs) legally binding, meaning property owners can pursue compensation if a building fails to meet its stated energy efficiency. This directly impacts companies like Hexaom, increasing their liability for accurate energy performance declarations.

This shift means builders and renovators must rigorously ensure the accuracy of their energy performance claims. Failure to do so could lead to legal challenges, as buyers and tenants gain stronger recourse. For Hexaom, this necessitates robust quality assurance processes and strict adherence to evolving building standards to mitigate potential litigation and maintain client trust.

Land Use and Urban Planning Regulations

Land use and urban planning regulations significantly impact development, particularly with the push towards ambitious 'zero net artificialization' goals aimed at preserving natural environments. This objective creates pressure on available building land, a critical factor for companies like Hexaom involved in property development or requiring physical expansion.

Further complicating matters, regulations now prohibit the construction of new non-residential buildings exceeding a specific size on already artificialized soil. This measure underscores a strong governmental commitment to limiting urban sprawl and promoting more sustainable land management practices.

These stringent land use rules directly affect Hexaom's ability to acquire and develop new sites, potentially limiting growth opportunities and requiring the company to adopt more innovative strategies for site utilization and brownfield redevelopment. For instance, in France, the 'Zéro Artificialisation Nette' (ZAN) policy aims to achieve zero net artificialization of soil by 2050, with interim targets for 2031. This policy directly influences the availability and cost of land for development projects across the country.

- Zero Net Artificialization (ZAN) Goals: Aim to halt the increase in artificialized land, impacting land availability for development.

- Prohibition on New Non-Residential Buildings: Restrictions on building size on artificialized soil limit expansion options.

- Impact on Hexaom: Necessitates innovative site utilization and potentially increases land acquisition costs or lead times.

Labor Laws and Employment Regulations

Changes in labor laws and employment regulations, particularly those concerning working conditions, safety standards, and social contributions, directly influence operational expenses and human resource strategies for construction firms. While specific legislative updates impacting Hexaom in this area were not detailed, the broader construction industry faces significant employment challenges. For instance, the U.S. Bureau of Labor Statistics indicated a projected decline in construction employment in certain sectors through 2032, suggesting a tightening labor market in some specialties and potential downward pressure on wages in others.

Hexaom, as an employer, must proactively manage these evolving labor market dynamics and ensure strict adherence to all applicable employment legislation. This includes staying abreast of any new regulations regarding minimum wage, overtime, worker classification, and workplace safety, which can vary significantly by jurisdiction. Compliance is crucial to avoid penalties and maintain a stable workforce.

Key considerations for Hexaom include:

- Navigating potential shifts in overtime rules or benefits mandates.

- Ensuring compliance with updated workplace safety protocols, especially in light of any new industry standards or government directives.

- Adapting HR strategies to address potential labor shortages or surpluses predicted in specific construction trades.

- Staying informed about changes in social contribution requirements, such as payroll taxes or pension fund contributions.

The French legal landscape is increasingly focused on environmental performance and energy efficiency. New regulations, like the RE2020, are compelling companies like Hexaom to adopt more sustainable building practices and materials to meet stricter carbon footprint requirements, with progressive tightening in 2025, 2028, and 2031.

Energy Performance Certificates (EPCs) are now legally binding, meaning inaccurate declarations can lead to compensation claims from buyers or tenants, as seen with the EU's EPBD revisions in 2024. This places a greater onus on Hexaom to ensure the accuracy of its energy performance assessments and to comply with evolving standards to avoid litigation.

Land use regulations, particularly France's 'Zéro Artificialisation Nette' (ZAN) policy aiming for zero net soil artificialization by 2050, directly impact Hexaom's development plans by limiting land availability and potentially increasing acquisition costs.

Changes in labor laws, including workplace safety and social contributions, necessitate proactive management by Hexaom to ensure compliance and adapt HR strategies to potential labor market shifts, such as those predicted by the U.S. Bureau of Labor Statistics for certain construction sectors through 2032.

Environmental factors

France is implementing stricter regulations for new buildings, mandating designs that mitigate the effects of summer heatwaves without excessive reliance on air conditioning. This shift, effective from 2025, requires builders to prioritize advanced insulation and natural ventilation techniques. For Hexaom, this means adapting its construction methods and material sourcing to meet these new environmental standards, potentially increasing upfront costs but reducing long-term operational expenses for building owners.

The construction sector is experiencing a significant shift towards sustainable building materials, driven by both regulatory pressures and evolving consumer tastes. Companies are increasingly opting for wood and other bio-sourced alternatives to comply with new environmental standards and appeal to eco-conscious buyers.

France set a precedent in 2022 by requiring new public buildings to incorporate at least 50% timber or other natural materials, a policy that is influencing construction practices across Europe. This regulatory push highlights a growing market for sustainable solutions.

Hexaom's strategic focus on wood, a key sustainable material, positions it favorably to capitalize on this demand. By integrating these materials, Hexaom can bolster its environmental reputation and attract a wider customer base seeking greener construction options.

France's Extended Producer Responsibility (EPR) law mandates that building material manufacturers create systems for collecting, reusing, repairing, or recycling their products. This initiative aims to foster a circular economy within the construction sector, with Hexaom needing to adapt its operations to comply with these waste reduction and recycling requirements.

In 2023, the French government continued to strengthen its waste management policies, with a particular focus on the construction and demolition (CDW) sector. The goal is to significantly increase the recycling rate of CDW, which currently represents a substantial portion of national waste. Hexaom's commitment to these directives means investing in infrastructure and partnerships to manage end-of-life building materials effectively, aligning with national targets for waste diversion from landfills.

Carbon Footprint Reduction and Emission Targets

The RE2020 regulation in France is a significant environmental factor, pushing for a reduced carbon footprint in buildings across their entire lifecycle. This regulation has set progressively stricter targets for 2025, 2028, and 2031, directly impacting industries like Hexaom involved in construction and building services.

Buildings account for a substantial share of national greenhouse gas emissions, prompting regulatory bodies to establish maximum limits for emissions stemming from energy consumption. This necessitates a shift away from traditional heating methods.

- RE2020 targets: Increasingly stringent carbon footprint reduction goals for buildings in France, with key milestones in 2025, 2028, and 2031.

- Emission sources: Buildings are a major contributor to national gas emissions, driving regulatory action on energy consumption.

- Heating transition: The regulations will lead to a phased withdrawal of gas heating in new construction projects.

- Hexaom's response: This trend will compel Hexaom to accelerate its adoption of low-carbon heating solutions to comply with evolving environmental standards.

Biodiversity Protection and Land Artificialization

New regulations in 2024 are significantly impacting land development by restricting the construction of non-residential buildings exceeding 10,000 square meters if the project involves artificializing surrounding soil. This initiative aligns with a national objective of achieving zero net artificialization by 2050, aiming to halt the conversion of natural and agricultural lands into sealed surfaces. For companies like Hexaom, this means a heightened focus on ecological impact assessments and the adoption of sustainable land management strategies to navigate these evolving environmental constraints.

The push for biodiversity protection and the reduction of land artificialization presents both challenges and opportunities for Hexaom's land development operations. By 2025, it's projected that over 70% of European land will be affected by human activities, underscoring the urgency of these measures. Hexaom must therefore prioritize projects that minimize soil sealing and explore innovative solutions for land reuse and ecological restoration to ensure compliance and foster long-term sustainability.

- Regulatory Impact: Restrictions on large-scale non-residential developments over 10,000 sqm that involve soil artificialization.

- Zero Net Artificialization: A government-wide goal to halt and reverse the trend of converting natural land.

- Biodiversity Concerns: The direct link between soil sealing and habitat loss, impacting biodiversity.

- Hexaom's Strategy: Need to integrate sustainable land use practices and ecological considerations into all development plans.

France's environmental regulations are increasingly stringent, impacting construction and land development. The RE2020 regulation, with its 2025 milestones, mandates reduced carbon footprints in buildings, pushing for low-carbon heating and sustainable materials like wood, which Hexaom is already prioritizing. Furthermore, new 2024 rules restrict large developments that artificialize soil, aligning with a national goal of zero net artificialization by 2050, requiring Hexaom to focus on ecological impact and land reuse.

| Environmental Factor | Description | Impact on Hexaom | Key Dates/Targets | Relevant Data |

|---|---|---|---|---|

| Building Carbon Footprint | RE2020 regulation for reduced carbon emissions in buildings. | Requires adoption of low-carbon heating and sustainable materials. | Progressive targets for 2025, 2028, 2031. | Buildings are a major source of national greenhouse gas emissions. |

| Sustainable Materials | Shift towards wood and bio-sourced alternatives in construction. | Positions Hexaom favorably due to its focus on wood. | Public buildings required to use 50% timber (2022 precedent). | Growing market for eco-friendly construction options. |

| Waste Management | Extended Producer Responsibility (EPR) law for product lifecycle management. | Hexaom must adapt operations for waste reduction and recycling. | Focus on construction and demolition waste (CDW) recycling. | Aim to significantly increase CDW recycling rates. |

| Land Artificialization | Restrictions on non-residential buildings over 10,000 sqm involving soil sealing. | Requires focus on ecological impact assessments and land reuse. | Zero net artificialization goal by 2050. | Over 70% of European land projected to be affected by human activities by 2025. |

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on a robust foundation of data from leading international organizations, governmental bodies, and reputable market research firms. We meticulously gather information on political stability, economic indicators, technological advancements, environmental regulations, and social trends to provide comprehensive insights.