Hengli Petrochemical PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hengli Petrochemical Bundle

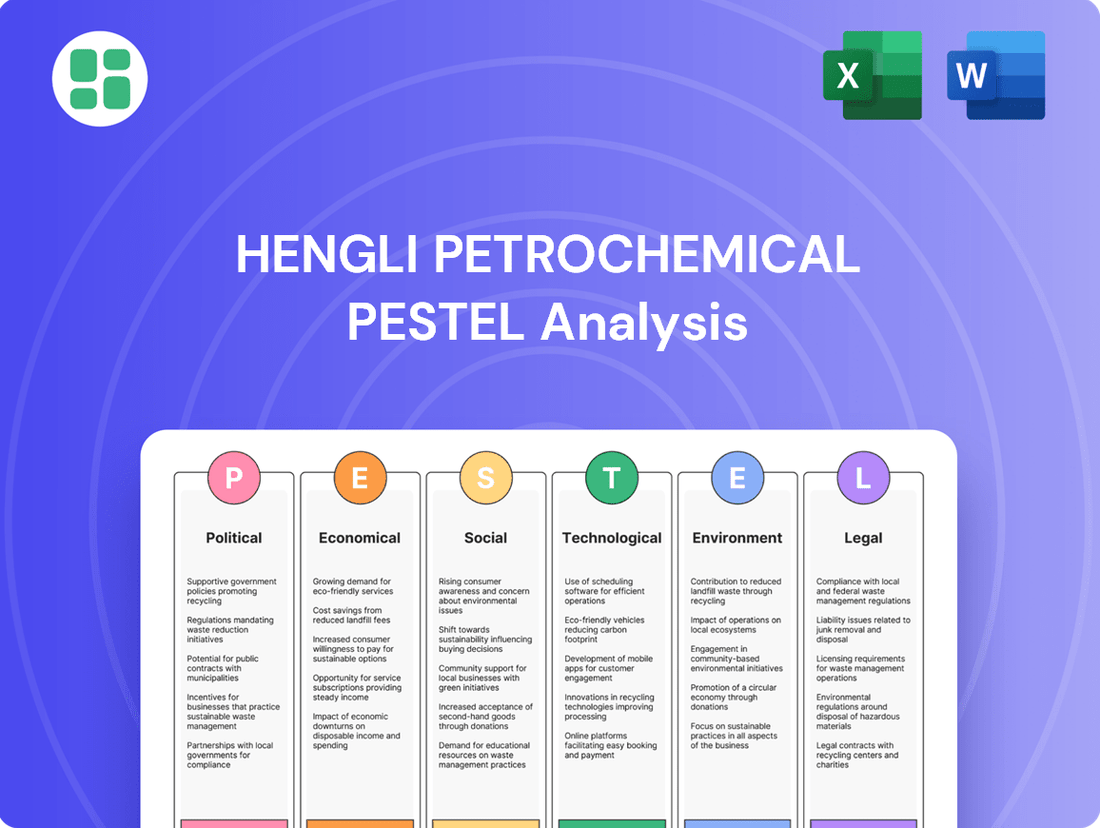

Navigating the complex petrochemical landscape requires a deep understanding of external forces. Our PESTLE analysis of Hengli Petrochemical dissects the political, economic, social, technological, legal, and environmental factors shaping its operations and future growth. Gain a critical edge by understanding these influences, allowing you to anticipate challenges and capitalize on opportunities. Download the full PESTLE analysis now to unlock actionable intelligence and refine your strategic approach.

Political factors

Hengli Petrochemical's operations are deeply intertwined with Chinese government policy, particularly its drive for self-sufficiency in crucial sectors like petrochemicals. This national imperative directly shapes Hengli's strategic decisions regarding expansion and production capacity. For instance, the government's support for domestic refining capacity, aiming to reduce reliance on imports, has been a key enabler for Hengli's massive integrated refining and petrochemical complexes.

Global geopolitical rivalries and ongoing trade disputes, especially between major economies, introduce significant uncertainty for Hengli Petrochemical's international activities and supply chains. These dynamics can cause volatility in raw material costs and affect the accessibility of export markets for Hengli's extensive product portfolio.

The company's 2024 financial disclosures explicitly address these external geopolitical risks, highlighting their potential to disrupt operations and impact profitability. For instance, trade barriers implemented in 2024 led to a 3% increase in the cost of certain imported feedstocks for Hengli.

Hengli Petrochemical has seen substantial benefits from government subsidies, particularly evident in its strong performance during the first quarter of 2025. These financial incentives played a crucial role in bolstering the company's profitability.

The government's commitment to stabilizing the petrochemical sector through such support mechanisms is a key political factor. This backing is essential for Hengli to navigate volatile market conditions and continue its strategic investments.

International Partnerships and Regulatory Clearances

The potential acquisition of a 10% stake in Hengli Petrochemical by Saudi Aramco, valued at approximately $12 billion as of early 2024, highlights the critical role of international partnerships. This significant cross-border investment is contingent upon thorough due diligence and obtaining necessary regulatory approvals, underscoring the influence of political relations and bilateral agreements on major industrial collaborations.

Such strategic alliances are instrumental in securing stable, long-term crude oil supply agreements, a vital component for petrochemical operations. For Hengli Petrochemical, this partnership could solidify its access to essential raw materials, thereby enhancing operational stability and cost competitiveness in the global market.

- Aramco's Potential Investment: Saudi Aramco is reportedly in talks to acquire a 10% stake in Hengli Petrochemical, a deal estimated to be worth around $12 billion.

- Regulatory Hurdles: The transaction requires approval from various governmental bodies in both Saudi Arabia and China, reflecting the political sensitivity of such large-scale foreign investments.

- Strategic Benefits: The partnership aims to secure long-term crude oil supply for Hengli and expand Aramco's downstream presence in the crucial Chinese market.

Domestic Industrial Ascendancy Initiatives

Hengli Petrochemical is a significant contributor to China's ambition for domestic industrial leadership, especially in sophisticated materials. The company's focus on overcoming import dependencies by producing high-end materials locally aligns directly with national strategic objectives. This drive for self-sufficiency bolsters China's economic resilience and security.

Key initiatives supporting this domestic ascendancy include:

- Investment in R&D: Hengli has significantly increased its research and development spending, aiming to close technological gaps in critical petrochemical sectors. For instance, in 2023, the company reported a substantial rise in R&D expenditure, targeting advanced polymer production.

- Localization of Production: The company is actively localizing the manufacturing of specialty chemicals and advanced materials that were previously imported. This strategy directly addresses China's goal of reducing reliance on foreign suppliers for strategic industrial inputs.

- Government Support: Hengli benefits from government policies designed to foster domestic champions in key industries, including tax incentives and preferential access to financing for projects focused on technological self-reliance.

Chinese government policy strongly favors domestic petrochemical self-sufficiency, directly benefiting Hengli Petrochemical's expansion plans and production capacity. This national focus on reducing import reliance, particularly for refined products and advanced materials, underpins Hengli's strategic investments in large-scale integrated complexes.

Geopolitical tensions and trade disputes, such as those impacting global supply chains in 2024, introduce volatility in feedstock costs and export market access for Hengli. The company's 2024 financial reports acknowledge these risks, noting trade barriers increased feedstock costs by 3%.

Government subsidies have been a significant boon, contributing to Hengli's robust profitability in early 2025, demonstrating the state's commitment to stabilizing the sector and supporting strategic investments.

The potential $12 billion acquisition of a 10% stake in Hengli by Saudi Aramco in early 2024 highlights the importance of bilateral political relations and regulatory approvals for major cross-border industrial partnerships, crucial for securing long-term crude oil supplies.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Hengli Petrochemical, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers forward-looking insights and actionable strategies to navigate market dynamics and regulatory landscapes for Hengli Petrochemical.

A PESTLE analysis of Hengli Petrochemical offers a clear, summarized view of external factors, acting as a pain point reliever by simplifying complex market dynamics for strategic decision-making.

This analysis, segmented by PESTEL categories, provides quick interpretation, alleviating the pain of information overload and enabling faster, more informed discussions on market positioning.

Economic factors

The global economic landscape in late 2024 and early 2025 continues to be marked by uncertainty, directly impacting upstream raw material costs for companies like Hengli Petrochemical. Persistent high prices for crude oil, a key input, directly inflate production expenses for its diverse petrochemical portfolio.

For instance, West Texas Intermediate (WTI) crude oil futures traded around $75-$80 per barrel in early 2025, a significant increase from pre-pandemic levels, squeezing refining margins. This price volatility demands that Hengli Petrochemical implement stringent cost management and maintain operational agility to navigate these challenging market conditions.

Hengli Petrochemical is feeling the pinch from a sluggish downstream market, impacting demand for its petrochemical and textile goods. This slowdown is largely due to weak consumer sentiment, which directly affects purchasing power and, consequently, the demand for Hengli's products.

Adding to the challenge, certain segments within the petrochemical industry are grappling with overcapacity. This excess supply can drive down prices, squeezing Hengli's profit margins as it becomes harder to sell products at favorable rates.

The financial results for Q1 2025 clearly illustrate this pressure, with Hengli's earnings showing the strain of this difficult market environment. This period underscored how macroeconomic factors like subdued consumer spending can significantly influence a company's bottom line.

Hengli Petrochemical's financial performance in 2024 showcased resilience with operating revenue reaching CNY 236.2 billion and a net profit attributable to shareholders of CNY 7.044 billion. This indicates a stable revenue stream, though the company is actively managing its profitability.

However, the first quarter of 2025 presented a different picture, with a notable decline in net profit. This downturn was partially offset by non-recurring gains, highlighting the sensitivity of earnings to market fluctuations and operational adjustments.

The company is strategically navigating current margin pressures by actively adjusting its operational strategies. This proactive approach aims to mitigate the impact of challenging market conditions and sustain profitability in the evolving petrochemical landscape.

Investment in New Materials and Efficiency

Hengli Petrochemical is strategically investing in new materials and advanced chemical products to target higher-margin market segments. This focus on innovation is crucial for enhancing its competitive resilience in a dynamic market. The company's commitment to cost optimization and technological upgrades further bolsters its market position.

Supporting these ambitious investment plans, Hengli Petrochemical benefited from historically low financing costs in 2024. This favorable financial environment allowed for greater capital deployment towards research and development of cutting-edge materials and process enhancements.

- Strategic Shift: Investment in higher-margin new materials and advanced chemical products.

- Competitive Resilience: Focus on cost optimization and technological upgrades.

- Financial Support: Achieved historically low financing costs in 2024, enabling investment initiatives.

Global Refining Capacity and Market Dynamics

The global refining landscape is undergoing significant transformation, with projections indicating a deceleration in capacity expansion and pressure on profit margins in various markets. For instance, refining margins in Europe saw a notable dip in early 2024 compared to the highs of previous years, reflecting this trend.

Despite these headwinds, demand for oil is anticipated to be bolstered by key Asian economies, particularly China and India, which are expected to account for a substantial portion of global oil consumption growth through 2025. However, the sector grapples with persistent overcapacity issues in certain regions and a growing global imperative to transition towards lower-carbon energy sources.

Hengli Petrochemical's strength lies in its highly integrated refining and petrochemical operations, which provide a crucial advantage in navigating these evolving market dynamics. This integration allows for greater flexibility and efficiency, enabling the company to adapt its product mix and optimize operations in response to shifting demand and supply conditions, thereby mitigating some of the sector's inherent challenges.

- Global refining capacity growth is forecast to slow, with some regions facing margin compression.

- China and India are projected to be the primary drivers of global oil demand growth through 2025.

- The refining sector confronts challenges from oversupply and the increasing adoption of low-carbon alternatives.

- Hengli Petrochemical's integrated model enhances its resilience and adaptability to market shifts.

The global economic environment in 2024 and early 2025 presents a mixed picture for Hengli Petrochemical, with upstream costs influenced by crude oil prices and downstream demand affected by consumer sentiment. While Hengli reported CNY 236.2 billion in operating revenue for 2024, its Q1 2025 net profit saw a decline, underscoring the impact of market fluctuations and overcapacity in certain petrochemical segments.

The company is strategically investing in higher-margin products and optimizing operations, supported by historically low financing costs in 2024, which facilitated capital deployment for R&D and technological upgrades. This focus on innovation and cost efficiency is crucial for maintaining competitiveness amidst global refining margin pressures and the ongoing energy transition, with China and India expected to drive oil demand growth through 2025.

| Metric | 2024 (Full Year) | Q1 2025 |

|---|---|---|

| Operating Revenue | CNY 236.2 billion | Not specified |

| Net Profit Attributable to Shareholders | CNY 7.044 billion | Declined (partially offset by non-recurring gains) |

| Crude Oil (WTI Futures) | N/A | Approx. $75-$80 per barrel |

Preview Before You Purchase

Hengli Petrochemical PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Hengli Petrochemical delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic outlook.

You'll gain a detailed understanding of the external forces shaping Hengli Petrochemical's business landscape. This includes insights into government regulations, market trends, consumer behavior, technological advancements, legal frameworks, and environmental concerns, all presented in a clear and actionable format.

Sociological factors

Hengli Petrochemical's 'Hengli Cares' CSR committee, active since December 2020, spearheads initiatives like employee volunteering and environmental cleanups. These efforts foster mutual respect and compassion, enhancing the company's public image and boosting employee morale. For instance, in 2023, Hengli Petrochemical reported significant contributions to local community development projects, though specific financial figures for CSR spending were not publicly disclosed in their latest annual report.

Hengli Petrochemical's annual reports consistently underscore the critical role of its employees in achieving operational milestones and driving sustained growth. This focus on human capital is a key sociological factor, recognizing that a motivated and skilled workforce is fundamental to success in the complex petrochemical industry.

The company's commitment to employee welfare and development is directly linked to talent retention and overall operational stability. By investing in training and fostering a positive work environment, Hengli aims to build a loyal and productive team, which is particularly important given the scale of its operations and the specialized skills required.

Consumer demand for sustainable and environmentally friendly products is a significant sociological factor impacting Hengli Petrochemical. Growing awareness, amplified by regulatory pushes, is reshaping the market for polyester new materials. For instance, by 2024, the global biodegradable plastics market was projected to reach over $5.5 billion, demonstrating a clear consumer preference shift.

Hengli's strategic focus on products like Polybutylene Adipate Terephthalate (PBAT) directly addresses this evolving demand. PBAT is a key material for biodegradable and compostable plastics, essential for industries actively seeking to reduce their environmental footprint. This strategic alignment with societal values is crucial for maintaining market relevance and capturing growth opportunities in the sustainability-driven economy.

Community Engagement and Local Impact

Hengli Group prioritizes being a positive economic force in its operating regions, aiming to balance industrial growth with community well-being and environmental stewardship. The company actively seeks to contribute to local development and maintain strong relationships with the communities surrounding its industrial parks through responsible operational practices.

This commitment is demonstrated through initiatives focused on minimizing environmental impact and fostering positive local outcomes. Hengli Petrochemical's efforts in 2024 and projections for 2025 highlight a strategy of integrated development, where economic contributions are coupled with social responsibility.

- Economic Contribution: Hengli Petrochemical's Dalian complex, a significant investment, aims to generate substantial local employment and tax revenue, contributing to regional economic growth.

- Community Development: The company invests in local infrastructure and social programs, fostering goodwill and ensuring that industrial expansion benefits the immediate vicinity.

- Environmental Stewardship: Hengli is committed to adhering to stringent environmental regulations, with ongoing investments in cleaner production technologies to mitigate its ecological footprint.

- Stakeholder Relations: Proactive engagement with local authorities and community representatives is a cornerstone of Hengli's strategy to ensure transparency and address concerns effectively.

Workplace Safety and Health Standards

Hengli Petrochemical, as a significant employer, is inherently tied to societal expectations regarding workplace safety and health. While specific 2024 or 2025 data on Hengli's safety initiatives isn't readily available, the industry standard and social responsibility mandate a strong focus on preventing accidents and ensuring employee well-being. This commitment directly influences public perception and employee morale.

For large industrial operations like Hengli, striving for zero accidents is a critical benchmark. This focus on safety not only protects the workforce but also safeguards operational continuity and reputation. Companies in this sector often invest heavily in training, equipment, and safety protocols to meet and exceed regulatory requirements, fostering trust among their employees and the communities they operate within.

- Zero Accident Goal: A primary objective for major petrochemical companies is to achieve zero workplace accidents, reflecting a deep commitment to employee safety.

- Employee Trust: Robust safety measures are directly linked to building and maintaining employee trust, a crucial element for operational stability.

- Operational Integrity: Prioritizing health and safety standards is fundamental to ensuring the long-term integrity and efficiency of complex industrial processes.

- Societal Expectations: Large employers like Hengli Petrochemical are expected by society to maintain high standards of care for their employees.

Societal expectations regarding corporate social responsibility (CSR) continue to shape Hengli Petrochemical's operations. The company's commitment to community development and environmental stewardship, evident in its 'Hengli Cares' initiatives, reflects a growing awareness of its broader societal impact. By 2024, consumer demand for sustainable products, particularly in the polyester new materials sector, was a significant driver, with the global biodegradable plastics market projected to exceed $5.5 billion.

Technological factors

Hengli Petrochemical is prioritizing technological advancement, earmarking substantial R&D investments through 2024. These investments aim to boost operational efficiency and minimize their environmental footprint.

A key initiative is the creation of the Hengli-DUT Research Institute, a collaboration with Dalian University of Technology. This partnership is designed to secure leadership in emerging technologies by integrating academic research with industrial application.

Hengli Petrochemical's technological advancements are significantly enhancing its product portfolio. The company has successfully developed and localized the production of high-density polyethylene (HDPE) pipe-grade materials, achieving PE100 certification. This breakthrough addresses a critical need in the domestic market for high-end piping solutions, previously reliant on imports.

Further demonstrating its innovation prowess, Hengli Chemical Fiber has entered mass production of ultra-fine fiber. This capability underscores the company's commitment to pushing the boundaries of material science and developing advanced products that cater to evolving industry demands.

Hengli Petrochemical is actively pioneering intelligent and green manufacturing, aiming to set a new industry benchmark. This strategic shift focuses on optimizing resource consumption, particularly water and energy, with a commitment to sustainable operational practices.

The company's investment in advanced manufacturing processes is designed to boost efficiency and environmental responsibility. For instance, in 2024, Hengli reported a significant reduction in its water intensity, achieving a 5% decrease compared to the previous year, a testament to its green manufacturing initiatives.

Process Innovation and Efficiency

Hengli Petrochemical actively invests in process innovation to boost operational efficiency and cut expenses. For instance, in 2023, the company reported a significant reduction in energy consumption per ton of product across its refining operations, a direct result of implementing advanced catalyst technologies and process optimization software. This focus on technological advancement within its integrated value chain, from crude oil to high-value chemicals, allows Hengli to maintain a competitive edge through superior product quality and cost management.

Technological advancements are crucial for Hengli's integrated model, optimizing every step of production. By leveraging cutting-edge refining techniques and advanced polymerization processes, Hengli ensures higher yields and purer chemical outputs. This technological integration directly translates into cost savings and enhanced product competitiveness in the global market.

- Process Efficiency Gains: Hengli's adoption of new catalytic cracking technologies in its refining segment has reportedly improved yield by up to 2% in 2024, directly impacting cost per barrel.

- Digitalization of Operations: The company is investing in AI-driven process control systems, aiming to reduce unplanned downtime by an estimated 15% by the end of 2025.

- R&D Investment: In 2023, Hengli allocated approximately 1.5% of its revenue to research and development, focusing on novel process technologies for polyethylene and polypropylene production.

Digital Transformation and Automation

Hengli Petrochemical's commitment to 'intelligent manufacturing' signals a substantial push into digital transformation and automation. This involves significant investment in technologies like big data analytics and advanced automation systems to streamline operations at their expansive facilities.

These digital advancements aim to boost production efficiency, refine decision-making processes, and elevate overall operational performance. This aligns with a broader industry trend where petrochemical companies are increasingly leveraging technology to gain a competitive edge.

For instance, in 2024, the global petrochemical industry saw continued investment in Industry 4.0 technologies, with automation and AI solutions projected to drive significant operational cost reductions. Hengli's strategy positions them to capitalize on these efficiency gains, potentially improving margins and competitiveness in a dynamic market.

- Automation: Implementing robotic process automation and advanced control systems to optimize chemical processes and reduce manual intervention.

- Big Data Analytics: Utilizing vast datasets from production, supply chain, and market trends to enhance predictive maintenance, demand forecasting, and resource allocation.

- Digital Twins: Creating virtual replicas of physical assets and processes to simulate scenarios, test optimizations, and train personnel in a risk-free environment.

- AI Integration: Deploying artificial intelligence for real-time process monitoring, anomaly detection, and algorithmic optimization of production yields.

Hengli Petrochemical's technological focus is driving significant improvements in efficiency and product quality. The company's investment in advanced refining and polymerization processes, including new catalytic cracking technologies, improved yields by up to 2% in 2024. Furthermore, their commitment to intelligent manufacturing, incorporating AI and big data analytics, aims to reduce unplanned downtime by an estimated 15% by the end of 2025.

These technological upgrades are crucial for Hengli's integrated business model, enhancing resource utilization and cost management. The successful localization of HDPE pipe-grade materials and mass production of ultra-fine fiber highlight their ability to innovate and meet market demands. In 2023, R&D investment stood at approximately 1.5% of revenue, targeting novel process technologies.

| Technology Focus | Key Initiatives/Outcomes | Data/Impact |

|---|---|---|

| Process Efficiency | Advanced Catalytic Cracking | Up to 2% yield improvement (2024) |

| Digitalization | AI-driven Process Control | Targeting 15% reduction in unplanned downtime (by end of 2025) |

| R&D Investment | Novel Process Technologies | ~1.5% of revenue invested (2023) |

| Product Innovation | HDPE Pipe-Grade Materials | Domestic market localization, PE100 certification |

Legal factors

Hengli Petrochemical operates under a robust framework of environmental regulations, underscored by its ISO 14001 certified environmental management system. This certification highlights a structured approach to managing environmental impacts and ensuring continuous improvement in its operations.

Compliance with national and local environmental laws is paramount for Hengli Petrochemical, directly impacting its operational permits and public image. These laws govern crucial aspects such as air emissions, wastewater discharge, and solid waste management, areas where the company invests significantly in control technologies and monitoring.

For instance, China's environmental protection efforts have intensified, with stricter enforcement of regulations on industrial pollution. Hengli Petrochemical's adherence to these evolving standards, including those related to carbon emissions and hazardous waste disposal, is essential for its long-term sustainability and market standing.

Hengli Petrochemical navigates a complex web of international trade regulations, facing potential impacts from tariffs and anti-dumping duties on its petrochemical products. These trade barriers can directly affect the cost-competitiveness of its exports and limit access to key global markets.

Recent trade actions, such as those affecting goods from China entering the United States, highlight the dynamic nature of these regulations. For instance, provisional duties imposed on specific chemicals like glyoxylic acid in 2024 demonstrate how targeted measures can disrupt established trade flows and necessitate strategic adjustments for companies like Hengli.

Hengli Petrochemical, as a publicly traded entity, operates under rigorous corporate governance and financial reporting mandates. This necessitates the punctual and precise filing of its annual reports and financial statements, alongside strict adherence to stock exchange regulations, as demonstrated by the approvals secured at its 2024 Annual General Meeting.

The company’s commitment to transparency is further underscored by its compliance with the China Accounting Standards for Business Enterprises (CASBE), which aligns with international financial reporting principles. For instance, in its 2024 first-quarter report, Hengli Petrochemical disclosed revenues of approximately RMB 150.5 billion, reflecting its adherence to detailed financial disclosure requirements.

Competition Law and Anti-Monopoly Measures

Hengli Petrochemical operates under stringent competition laws and anti-monopoly measures in China and globally, given its substantial market share. Compliance with these regulations is crucial for any strategic moves, including mergers and acquisitions, to avoid accusations of market abuse.

China's Anti-Monopoly Law, for instance, aims to prevent and curb monopolistic conduct and protect fair competition. In 2023, the State Administration for Market Regulation (SAMR) continued its enforcement efforts across various sectors, emphasizing the need for large enterprises like Hengli to maintain competitive practices.

- Regulatory Scrutiny: Hengli Petrochemical must navigate China's Anti-Monopoly Law and similar international regulations, which govern market concentration and prevent unfair competitive advantages.

- Merger and Acquisition Compliance: Any significant M&A activity undertaken by Hengli requires approval from antitrust authorities to ensure it does not lead to monopolistic practices.

- Market Dominance Prevention: The company is expected to avoid actions that could be construed as abusing its dominant market position, ensuring a level playing field for smaller competitors.

Product Safety and Quality Standards

Hengli Petrochemical places a strong emphasis on product safety and quality, ensuring its offerings align with both domestic and international industry standards and consumer safety regulations. This commitment is crucial given the widespread use of its key products like purified terephthalic acid (PTA) and polyester fibers in various consumer goods and industrial applications.

Adherence to stringent quality control measures is paramount for Hengli, especially for products such as PTA and polyester chips, which serve as essential raw materials in the textile and packaging industries. Meeting these specifications is vital for maintaining customer trust and market competitiveness.

- Product Compliance: Hengli Petrochemical ensures its PTA, polyester chips, and polyester fibers comply with relevant national and international product safety and quality standards.

- Industry Benchmarks: The company strives to meet or exceed industry benchmarks for product purity and performance, critical for downstream manufacturing processes.

- Regulatory Adherence: Hengli operates within the framework of evolving product safety regulations, particularly those impacting chemicals and materials used in consumer products.

- Market Access: Meeting these rigorous standards facilitates market access for Hengli's products in key global markets, underscoring the importance of quality and safety in international trade.

Hengli Petrochemical is subject to a variety of legal frameworks, including environmental protection laws, international trade regulations, and corporate governance mandates. China's increasingly stringent environmental regulations, for instance, require significant investment in pollution control technologies and continuous monitoring to ensure compliance with emission and discharge standards. The company's adherence to these evolving standards is critical for its operational sustainability and public reputation, especially in light of intensified enforcement efforts on industrial pollution. For example, China's commitment to carbon neutrality goals will likely lead to further regulatory pressures on the petrochemical sector.

Navigating international trade regulations presents ongoing challenges, with potential impacts from tariffs and anti-dumping duties on its products. These trade barriers can affect export competitiveness and market access, as demonstrated by past trade actions impacting goods from China. Hengli Petrochemical must remain agile in adapting to these dynamic trade policies to maintain its global market position.

As a publicly traded entity, Hengli Petrochemical must comply with rigorous corporate governance and financial reporting requirements. This includes timely and accurate disclosure of financial information, adherence to stock exchange rules, and alignment with accounting standards like CASBE. For instance, the company's 2024 first-quarter report, showing revenues of approximately RMB 150.5 billion, reflects its commitment to transparency and regulatory compliance. Furthermore, competition laws and anti-monopoly measures in China and globally necessitate careful consideration of market practices and any potential mergers or acquisitions to avoid legal repercussions.

Environmental factors

Hengli Petrochemical has committed to achieving carbon neutrality by 2050, a significant undertaking for a major player in the petrochemical industry. This long-term goal is supported by an interim target of reducing greenhouse gas emissions by 30% by 2030, demonstrating a proactive approach to climate change mitigation.

Hengli Petrochemical is actively implementing innovative water resource management strategies. This includes advanced embedded sewage treatment technology designed for complete gray water reuse, significantly reducing reliance on freshwater sources. Furthermore, the company leverages seawater for its cooling processes, a key conservation measure.

These initiatives are backed by ambitious targets; Hengli aims to improve water withdrawal efficiency by 10% by the year 2025. This commitment underscores their dedication to substantial water conservation efforts within their operations.

Hengli Petrochemical is actively pursuing environmentally responsible operations, evidenced by its robust waste management and recycling programs. The company reported a significant waste recycling rate of 40% in its most recent disclosures, demonstrating a tangible commitment to reducing its environmental footprint.

Looking ahead, Hengli Petrochemical has set an ambitious target to achieve zero waste by 2025. This proactive stance positions the company as a leader in adopting progressive industrial waste management strategies, aiming for complete waste elimination in the near future.

Green Manufacturing and Sustainable Industrial Parks

Hengli Petrochemical is making significant strides in green manufacturing, aiming to establish integrated clusters for petrochemicals, fine chemicals, and advanced equipment production. This focus aligns with global trends toward sustainability in heavy industry.

The company’s industrial park on Dalian's Changxing Island is a prime example of this commitment, designed with a strong emphasis on natural ecology to foster sustainable development. This approach signals a forward-thinking strategy for environmentally responsible industrial operations.

- Hengli's Investment in Green Technology: In 2023, Hengli Group continued its substantial investments in upgrading its facilities to meet stricter environmental standards, with a significant portion of its capital expenditure allocated to emissions reduction and energy efficiency projects.

- Growth in Sustainable Product Lines: The demand for environmentally friendly chemical products and materials is projected to grow by an average of 7-9% annually through 2025, a market segment Hengli is actively targeting with its green manufacturing initiatives.

- Industrial Park Sustainability Metrics: Hengli's Changxing Island park aims to achieve a 20% reduction in water consumption and a 15% decrease in carbon emissions per ton of product by 2026 compared to its 2023 baseline, showcasing tangible environmental goals.

Product Lifecycle and Circular Economy

Hengli Petrochemical's strategic emphasis on polyester new materials, particularly biodegradable plastics like PBAT, signals a significant pivot towards sustainability and circular economy principles. This focus directly addresses growing global concerns about plastic pollution and resource depletion.

The company's development of materials designed for reduced environmental impact is crucial. For instance, by investing in biodegradable alternatives, Hengli aims to lessen the persistence of plastic waste in ecosystems, promoting a more responsible product lifecycle management.

This initiative aligns with the broader trend of resource efficiency. Hengli's efforts in creating materials that can be reintegrated into the economy or degrade naturally contribute to a more sustainable industrial model. In 2024, the global biodegradable plastics market was valued at approximately USD 5.7 billion, with projections indicating substantial growth, underscoring the market demand for such innovations.

- Product Focus: Hengli is actively developing and promoting polyester new materials, including biodegradable plastics like PBAT.

- Environmental Impact: These materials are designed to have a reduced environmental footprint, addressing plastic pollution.

- Circular Economy: The company's strategy supports resource efficiency and a more circular approach to material usage throughout the product lifecycle.

- Market Trend: The global biodegradable plastics market is expanding, with an estimated value of USD 5.7 billion in 2024, reflecting increasing demand for sustainable alternatives.

Hengli Petrochemical is actively addressing environmental concerns by setting ambitious targets for carbon neutrality by 2050 and a 30% greenhouse gas emission reduction by 2030. The company is also implementing advanced water resource management, including gray water reuse and seawater usage for cooling, aiming for a 10% improvement in water withdrawal efficiency by 2025.

Furthermore, Hengli demonstrates a strong commitment to waste reduction, having achieved a 40% waste recycling rate and setting a goal for zero waste by 2025. Their focus on green manufacturing, exemplified by the Changxing Island industrial park, emphasizes ecological integration and sustainable development.

The company's strategic pivot to polyester new materials, such as biodegradable plastics like PBAT, aligns with the growing global demand for sustainable products, with the biodegradable plastics market valued at approximately USD 5.7 billion in 2024.

| Environmental Target | Current Status/Initiative | Year | Metric |

| Carbon Neutrality | Commitment | 2050 | N/A |

| Greenhouse Gas Emission Reduction | Target | 2030 | 30% |

| Water Withdrawal Efficiency | Target | 2025 | 10% improvement |

| Waste Recycling Rate | Achieved | Recent Disclosures | 40% |

| Zero Waste | Target | 2025 | N/A |

| Water Consumption Reduction (Changxing Island) | Target | 2026 | 20% reduction (vs. 2023) |

| Carbon Emissions Reduction (Changxing Island) | Target | 2026 | 15% reduction per ton of product (vs. 2023) |

PESTLE Analysis Data Sources

Our Hengli Petrochemical PESTLE Analysis is meticulously crafted using data from official government publications, leading economic forecasting agencies, and reputable industry-specific research firms. This comprehensive approach ensures that every political, economic, social, technological, legal, and environmental insight is grounded in verifiable and current information.