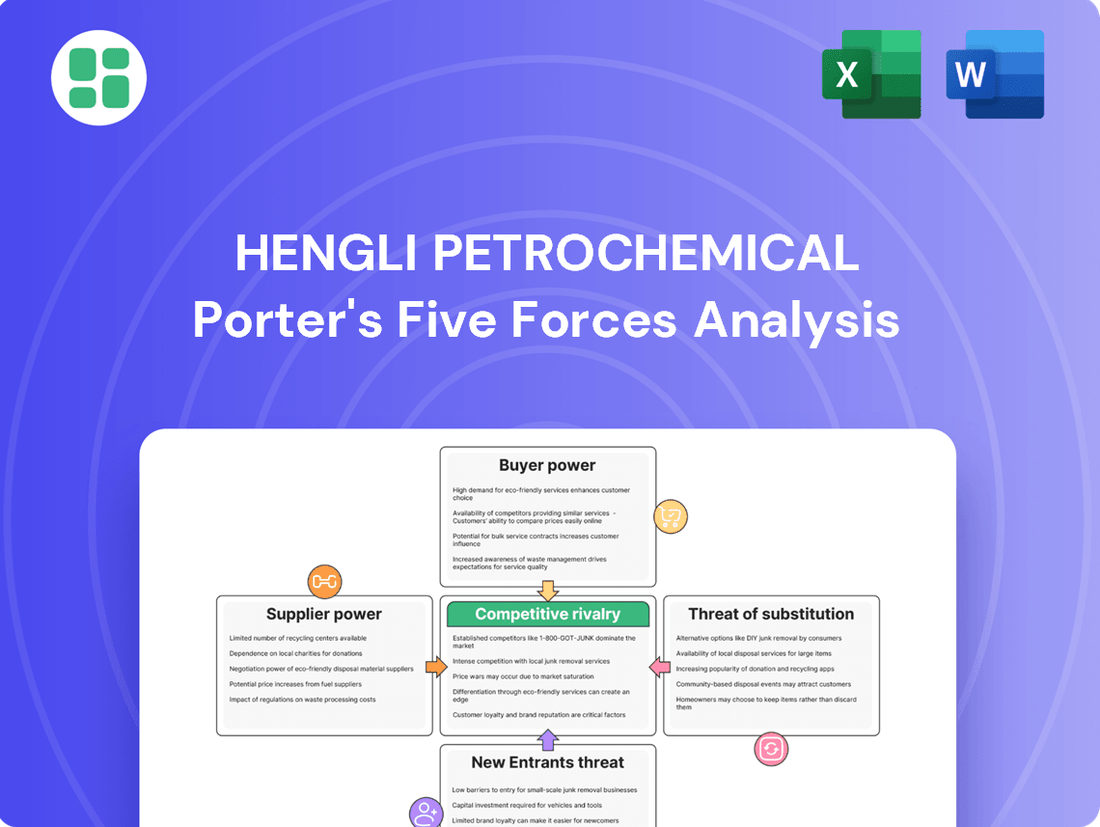

Hengli Petrochemical Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hengli Petrochemical Bundle

Hengli Petrochemical navigates a complex landscape shaped by intense industry rivalry and significant buyer power, particularly from downstream manufacturers. The threat of new entrants is moderately high due to substantial capital requirements, while the bargaining power of suppliers is a key consideration in raw material sourcing.

The complete report reveals the real forces shaping Hengli Petrochemical’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Hengli Petrochemical's reliance on crude oil, its primary input, faces a significant challenge due to the concentrated nature of global oil suppliers. A handful of large state-owned and international oil corporations control a substantial portion of the market, granting them considerable leverage over buyers like Hengli.

This supplier concentration means Hengli must navigate relationships with these powerful entities to ensure a steady, high-volume flow of crude oil essential for its refining processes. For instance, in 2023, crude oil prices saw considerable volatility, impacting procurement costs for refiners globally.

Hengli actively manages its crude oil sourcing through subsidiaries like Hengli Petrochemical International Pte. Ltd. and Hengli Oilchem Pte. Ltd. in Singapore, securing supplies from regions including the Middle East, America, and West Africa, and has agreements with major players like Sinochem for imports.

Hengli Petrochemical faces significant supplier bargaining power when it comes to crude oil, largely due to high switching costs for alternative raw materials. These costs stem from existing long-term contracts, the complexities of establishing new logistics, and the potential need to reconfigure refining processes if different crude oil grades are used. In 2023, Hengli Petrochemical's integrated refining capacity stood at 20 million tons per annum, a scale that necessitates stable and predictable feedstock sourcing.

The company's massive, integrated refining and petrochemical complex is specifically engineered to process particular types of crude oil. This specialization means that switching to different crude grades, even if available, would likely incur substantial economic penalties related to process adjustments and potential downtime. This inherent inflexibility in their operational setup reinforces the bargaining power of their current crude oil suppliers.

Major crude oil suppliers, especially national oil companies, are increasingly moving into downstream refining and petrochemical activities. This trend, known as forward integration, could limit the supply available to independent refiners like Hengli or give these suppliers more power. For example, Saudi Aramco, a key crude oil producer, has been looking into downstream investments in China, including potential stakes in petrochemical firms, signaling this growing integration by suppliers.

Impact of Volatile Crude Oil Prices

Fluctuations in global crude oil prices significantly influence Hengli Petrochemical's raw material costs. For instance, in 2024, reports indicated persistently high upstream raw material prices, directly affecting the company's cost structure. While Hengli's integrated value chain offers some resilience against these price swings, extended periods of elevated crude oil prices can squeeze profit margins if these increased costs cannot be fully passed on to consumers of their downstream products.

- Upstream Cost Pressures: Persistent high crude oil prices in 2024 directly increased Hengli's input expenses.

- Margin Compression Risk: Extended periods of high crude prices can reduce profit margins if costs aren't fully recouped downstream.

- Integrated Value Chain Benefit: Hengli's integration helps mitigate some of the impact of volatile raw material costs.

Availability of Specialized Catalysts and Technologies

Hengli Petrochemical's dependence on specialized catalysts and advanced technologies for its sophisticated production processes significantly amplifies supplier bargaining power. Beyond the primary commodity of crude oil, the company requires unique inputs for its petrochemical and new materials segments, including high-density polyethylene (HDPE) pipe-grade materials and ultra-fine fibers. These specialized components are often sourced from a limited pool of expert providers, granting them considerable influence over pricing and supply agreements.

The concentration within these niche supplier markets means Hengli faces suppliers who possess substantial leverage. For instance, a single provider of a critical catalyst or a proprietary processing technology could dictate terms, impacting Hengli's cost structure and production schedules. This is particularly relevant as Hengli pushes into advanced materials, necessitating access to the latest innovations.

Hengli's strategic direction, emphasizing innovation and the development of high-value new materials, inherently ties its success to the availability and cost of these cutting-edge inputs. The company's investment in areas like advanced polymers and specialty fibers underscores its need for suppliers who can deliver not just materials, but also the technological know-how to produce them efficiently and at scale. This reliance on specialized expertise further strengthens the bargaining position of these key suppliers.

- Dependence on Niche Inputs: Hengli requires specialized catalysts and proprietary technologies for advanced petrochemical and new materials production, moving beyond basic crude oil inputs.

- Concentrated Supplier Market: The providers of these specialized inputs are often few in number, leading to a concentrated market where suppliers hold significant leverage.

- Pricing and Terms Influence: Due to limited alternatives, these expert providers can exert considerable influence over pricing and the terms of supply agreements with Hengli.

- Innovation-Driven Need: Hengli's focus on innovation, including the production of HDPE pipe-grade material and ultra-fine fibers, necessitates access to cutting-edge technologies, further empowering specialized suppliers.

Hengli Petrochemical's bargaining power with crude oil suppliers is constrained by the industry's structure and the essential nature of its feedstock. The company's integrated refining capacity of 20 million tons per annum in 2023 necessitates consistent access to specific crude grades, making switching costly due to logistical and process reconfigurations.

The increasing forward integration by major oil producers, such as Saudi Aramco exploring downstream ventures in China, presents a potential challenge by reducing available supply for independent refiners and increasing supplier leverage.

Hengli's reliance on specialized catalysts and proprietary technologies for its advanced materials segments further amplifies supplier bargaining power. These niche inputs are often sourced from a limited number of expert providers who can dictate terms due to the lack of readily available alternatives.

| Factor | Impact on Hengli | Supplier Leverage |

| Crude Oil Sourcing | High dependence on specific grades; significant switching costs. | Strong, due to market concentration and integration needs. |

| Specialized Inputs | Reliance on niche catalysts and technologies for advanced materials. | Very Strong, from limited expert providers. |

| Forward Integration by Suppliers | Potential reduction in available supply and increased cost pressure. | Growing, as suppliers move downstream. |

What is included in the product

This analysis dissects the competitive forces impacting Hengli Petrochemical, revealing the intensity of rivalry, the power of buyers and suppliers, and the barriers to entry within the petrochemical industry.

Instantly diagnose competitive pressures with a visual, easy-to-understand breakdown of Hengli Petrochemical's market landscape.

Customers Bargaining Power

Hengli Petrochemical's customer base is spread across numerous sectors like textiles, packaging, automotive, and construction. This broad reach means no single customer or small group holds significant sway over Hengli's pricing or terms.

In 2023, Hengli Petrochemical reported revenue of approximately RMB 200 billion, underscoring the vastness of its customer network. This diversification inherently dilutes the bargaining power of individual customers, as the company’s overall sales are not dependent on any one industry segment.

Many of Hengli's downstream customers, especially those in textiles and plastics, operate in intensely competitive markets where price is a major factor. This means they often push for lower prices from Hengli, particularly for bulk items like PTA and polyester chips, to protect their own slim profit margins.

Customers in the textile and packaging sectors increasingly have access to a wider array of alternative materials. This includes natural fibers such as cotton, linen, hemp, bamboo, and Tencel, alongside bio-based plastics and recycled PET.

The expanding market for bioplastics and recycled PET, fueled by growing environmental awareness, directly translates to more choices for customers. This enhanced selection significantly bolsters their bargaining power against suppliers like Hengli Petrochemical. For instance, the global bioplastics market was valued at approximately USD 50.1 billion in 2023 and is projected to reach USD 127.1 billion by 2030, indicating a substantial shift in material availability.

Switching Costs for Customers

Switching costs for customers looking to move away from Hengli Petrochemical's offerings are a key factor in their bargaining power. For major industrial clients, the process of changing petrochemical suppliers can be complex and costly. This often involves re-evaluating and re-qualifying new materials to ensure they meet stringent production standards, potentially requiring adjustments to existing manufacturing equipment and processes. Furthermore, any shift in supplier can lead to disruptions in their established supply chains, impacting production schedules and overall operational efficiency.

For instance, in the broader petrochemical industry, a large automotive manufacturer switching from one supplier of specialized polymers might face costs upwards of millions of dollars due to retooling and testing alone. This complexity naturally raises the barrier for such customers to switch, thereby reducing their immediate bargaining power.

Conversely, for smaller businesses or consumers purchasing more commoditized petrochemical products, the hurdles to switching suppliers are generally much lower. These customers may only need to compare prices and availability, making it easier to change providers if a better deal is found. This segment of Hengli's customer base likely holds more significant bargaining power.

- High switching costs for industrial users: Re-qualification of materials, production line adjustments, and supply chain integration challenges.

- Lower switching costs for smaller/standardized product users: Primarily driven by price and availability comparisons.

- Impact on bargaining power: Reduced power for large industrial clients due to significant switching barriers, increased power for smaller clients.

Customer's Potential for Backward Integration

The bargaining power of customers is influenced by their potential for backward integration. For instance, major downstream manufacturers in the textile industry might explore integrating backward into PTA or polyester production. This move could secure their supply chains and potentially lower costs. However, such ventures demand significant capital outlay and specialized technical knowledge, acting as a natural deterrent.

Hengli Petrochemical's integrated business model, spanning from crude oil refining to the production of advanced materials like PTA and polyester, effectively counters this threat. By controlling the entire value chain, Hengli can offer a more comprehensive and cost-effective supply to its customers. This integration provides a competitive advantage, making backward integration by customers less appealing.

- Customer Integration Threat: Large downstream buyers could integrate backward into PTA or polyester production to gain supply security and cost advantages.

- Capital & Expertise Barrier: Backward integration requires substantial capital investment and significant technical expertise, limiting its feasibility for many customers.

- Hengli's Mitigation Strategy: Hengli Petrochemical's vertically integrated model, from refining to advanced materials, offers a cost-efficient and reliable supply, reducing customer incentive for backward integration.

- Competitive Advantage: This integrated approach strengthens Hengli's position by providing a comprehensive value proposition that is difficult for customers to replicate internally.

Hengli Petrochemical's customer base is diverse, spanning industries from textiles to construction, which generally dilutes individual customer bargaining power. However, customers in price-sensitive sectors like textiles often push for lower prices, especially for bulk products, to maintain their own profit margins.

The availability of alternative materials, including natural fibers and bioplastics, is growing, giving customers more options and thus increasing their leverage. For example, the global bioplastics market was valued at approximately USD 50.1 billion in 2023, highlighting this trend.

Switching costs vary significantly; large industrial clients face high costs due to re-qualification and supply chain adjustments, reducing their power. Conversely, smaller customers buying standardized products have lower switching costs, granting them greater bargaining influence.

| Customer Segment | Switching Costs | Bargaining Power |

|---|---|---|

| Large Industrial Clients (e.g., Automotive, Major Textiles) | High (re-qualification, retooling, supply chain integration) | Lower |

| Smaller Businesses / Commodity Product Buyers | Low (price and availability comparison) | Higher |

Preview Before You Purchase

Hengli Petrochemical Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces analysis for Hengli Petrochemical, detailing the competitive landscape and strategic implications within the industry. You are viewing the exact document you'll receive immediately after purchase, offering a comprehensive assessment of the forces shaping Hengli's market position. This professionally formatted analysis is ready for your immediate use, providing actionable insights without any placeholders or surprises.

Rivalry Among Competitors

Hengli Petrochemical faces intense competition from major domestic players in China's petrochemical sector. Companies like Sinopec and CNPC, often state-owned, command substantial market share due to their extensive infrastructure and government backing. This creates a challenging environment for Hengli as it vies for dominance.

In 2023, China's petrochemical industry saw significant output, with crude oil processing reaching approximately 715 million tons. Sinopec, as a leading entity, reported revenues of over 3 trillion yuan in 2023, highlighting the scale of the integrated domestic competitors Hengli must contend with.

The petrochemical sector demands massive upfront investment in facilities, creating substantial fixed costs. For instance, building a new integrated refining and petrochemical complex can easily run into billions of dollars. This financial burden means companies like Hengli Petrochemical must operate their plants at very high utilization rates to spread these costs and become profitable.

This intense pressure to utilize capacity drives fierce competition. When the market faces oversupply, companies are compelled to lower prices and boost sales volume to keep their expensive assets running efficiently. In 2024, global petrochemical capacity continues to expand, particularly in Asia, exacerbating this utilization pressure and intensifying rivalry among major players like Hengli.

The petrochemical industry, including Hengli Petrochemical, is grappling with a significant slowdown. This is driven by a turbulent global economy and weak demand from downstream markets. Volatile commodity prices further exacerbate these challenges, squeezing profitability across the sector.

Hengli Petrochemical experienced a notable dip in its net profit margin during the first quarter of 2025. This compression is a direct consequence of escalating input costs and the broader headwinds affecting the industry. Such margin pressures naturally intensify the competitive rivalry among players vying for market share.

Product Differentiation and Innovation

Hengli Petrochemical distinguishes itself in a market often characterized by commodity products by focusing on its integrated value chain and its commitment to developing high-end new materials and ultra-fine fibers. This strategic focus allows them to move beyond basic petrochemicals and capture higher margins.

Innovation and robust research and development are vital for Hengli to stay ahead. The establishment of the Hengli-DUT Research Institute underscores this commitment, aiming to foster breakthroughs in material science and production processes. For example, their development of PE100 certified HDPE material demonstrates a tangible output of this R&D focus, catering to specialized market needs.

- Hengli's Integrated Value Chain: From crude oil refining to downstream chemical production, this integration offers cost efficiencies and greater control over product quality.

- Focus on High-End Materials: Development of advanced polymers and fibers for sectors like automotive and textiles provides a competitive advantage over rivals focused on basic chemicals.

- R&D Investment: Significant investment in research, including collaborations like the Hengli-DUT Research Institute, drives product innovation and the creation of differentiated offerings.

- PE100 HDPE Certification: This specific achievement highlights their capability in producing high-performance materials meeting stringent industry standards, crucial for infrastructure projects.

Global Competition and Export Markets

Hengli Petrochemical faces intense competition not only within China but also on the global stage. Its refined petrochemical products are exported to various international markets, directly engaging with global competitors. For instance, in 2023, China's total petrochemical exports reached approximately $150 billion, highlighting the scale of this international trade and the competitive landscape Hengli operates within.

Major global chemical giants, such as BASF, present a significant competitive threat, particularly in segments like synthetic fibers and specialized chemical products. BASF, a leader in the chemical industry, consistently invests heavily in research and development, offering innovative products that challenge market incumbents. In 2024, BASF announced significant investments in new production facilities, underscoring their commitment to expanding their global market share.

Hengli's international trading subsidiaries, like Hengli Petrochemical International Pte. Ltd., are crucial for navigating these global markets and expanding its export reach. These entities facilitate the distribution of Hengli's products worldwide, allowing the company to compete with established international players. The company's strategic international presence is key to capturing a larger share of the global petrochemical demand, which is projected to grow steadily in the coming years.

- Global Market Presence: Hengli Petrochemical actively participates in international markets, exporting refined petrochemical products.

- Key International Competitors: Global players like BASF are significant rivals, especially in synthetic fibers and chemicals.

- Export Strategy: Hengli utilizes international trading arms, such as Hengli Petrochemical International Pte. Ltd., to facilitate global sales.

- Market Dynamics: In 2023, China's petrochemical exports were valued at around $150 billion, indicating a substantial and competitive global trade environment.

Hengli Petrochemical operates in a highly competitive landscape, facing pressure from both domestic giants like Sinopec and global chemical leaders such as BASF. The industry's high capital intensity and the need for high utilization rates to offset fixed costs intensify this rivalry, especially during periods of oversupply or economic slowdown. In 2024, continued global petrochemical capacity expansion, particularly in Asia, is expected to further heighten competitive pressures.

To counter these pressures, Hengli focuses on its integrated value chain and invests heavily in R&D to develop high-end materials and differentiated products. This strategy aims to move beyond commodity petrochemicals and capture higher margins, as evidenced by their development of specialized materials like PE100 certified HDPE. The company's net profit margin experienced compression in early 2025 due to rising input costs and weak demand, underscoring the challenging environment.

| Competitor Type | Key Players | 2023/2024 Data/Trends |

|---|---|---|

| Domestic | Sinopec, CNPC | Sinopec reported >3 trillion yuan revenue in 2023; significant state backing. |

| Global | BASF | BASF announced significant investment in new production facilities in 2024; strong R&D focus. |

| Industry Trend | Capacity Expansion | Global petrochemical capacity continues to expand, especially in Asia (2024). |

| Market Condition | Demand Slowdown | Weak downstream demand and volatile commodity prices impacting profitability (2024-Q1 2025). |

SSubstitutes Threaten

The rise of natural fibers poses a significant threat to Hengli Petrochemical's polyester segment. Consumers are increasingly prioritizing sustainability, driving demand for alternatives like organic cotton, linen, hemp, and bamboo. This shift is evident as the global sustainable textile market is projected to reach $10.1 billion by 2025, indicating substantial growth for natural fiber adoption.

The increasing adoption of bio-based plastics presents a growing threat of substitution for Hengli Petrochemical's traditional plastic products. The global bioplastics market is on a strong upward trajectory, with projections indicating it could reach substantial values by 2030 and 2034, fueled by stricter regulations on conventional plastics and a surge in consumer preference for eco-friendly packaging solutions.

These bio-based polymers, derived from renewable feedstocks such as corn and sugarcane, offer a sustainable alternative that directly challenges Hengli's reliance on petrochemical-based plastics. This shift towards greener materials could impact demand for Hengli's core offerings over the long term.

The increasing adoption of recycled PET (rPET) presents a significant threat to Hengli Petrochemical's core business. The global rPET market is experiencing robust growth, projected to reach approximately $11.7 billion by 2027, driven by heightened environmental awareness and regulatory pressures mandating higher recycled content. This trend directly challenges Hengli's reliance on virgin polyester and PET production, as more consumers and businesses opt for rPET in packaging and textiles.

Advancements in Next-Gen Synthetic Fibers

New synthetic fiber technologies, such as those utilizing bio-based ingredients, bacterial fermentation, or monomer recovery from textile waste, are emerging as innovative alternatives to conventional polyester. These advancements, while potentially facing hurdles in widespread adoption and cost parity, pose a future threat to established players like Hengli Petrochemical.

For instance, the global bio-based chemicals market, which includes bio-based fibers, was valued at approximately USD 104.5 billion in 2023 and is projected to grow significantly. This indicates a growing consumer and industry interest in more sustainable material options.

- Emerging Technologies: Bio-based fibers, bacterial fermentation, and monomer recovery from textile waste offer novel alternatives.

- Market Growth: The bio-based chemicals market, including fibers, shows strong growth potential, signaling shifting consumer preferences.

- Potential Impact: While currently facing adoption and cost challenges, these innovations represent a long-term threat to conventional polyester markets.

Performance-Price Trade-off and Consumer Awareness

The threat of substitutes for Hengli Petrochemical's products is influenced by how their price and performance stack up against alternatives. Consumers weigh this trade-off carefully. For instance, in 2024, while conventional plastics remain cost-effective for many applications, there's a noticeable rise in demand for bio-based polymers, even at a premium, driven by environmental concerns.

Consumer awareness regarding the environmental footprint of petrochemicals is a significant factor. This growing consciousness can sway purchasing decisions, even if switching to greener alternatives involves higher initial costs or some inconvenience. For example, the global bioplastics market was projected to reach over $12 billion in 2024, indicating a tangible shift in consumer preference.

- Price-Performance Evaluation: Consumers assess if substitute products offer comparable quality and functionality at a competitive price point.

- Environmental Consciousness: An increasing segment of consumers prioritizes sustainability, willing to pay more for eco-friendly petrochemical alternatives.

- Switching Costs: While traditional petrochemicals might have lower direct costs, the long-term environmental and regulatory costs associated with them could be factored into the substitute analysis.

- Emerging Alternatives: Innovations in materials science are continuously introducing new substitutes, potentially disrupting the market for conventional petrochemicals.

The threat of substitutes for Hengli Petrochemical is amplified by innovative materials and growing environmental awareness. Consumers are increasingly choosing bio-based plastics and natural fibers over traditional petrochemical products. For instance, the global bioplastics market was projected to exceed $12 billion in 2024, demonstrating a clear consumer shift towards sustainability, even with potential price premiums.

| Substitute Category | Key Examples | 2024 Market Outlook/Drivers | Potential Impact on Hengli |

|---|---|---|---|

| Natural Fibers | Organic Cotton, Linen, Hemp, Bamboo | Growing demand for sustainable textiles; global sustainable textile market projected to reach $10.1 billion by 2025. | Reduced demand for polyester in apparel and home furnishings. |

| Bio-based Plastics | PLA, PHA | Stricter regulations on conventional plastics; consumer preference for eco-friendly packaging; market projected to reach substantial values by 2030/2034. | Decreased demand for virgin PET and other petrochemical-based plastics. |

| Recycled Materials | rPET | Heightened environmental awareness; regulatory mandates for recycled content; global rPET market projected to reach ~$11.7 billion by 2027. | Direct competition for virgin polyester and PET production. |

| Advanced Synthetics | Bio-based ingredients, monomer recovery | Emerging technologies offering sustainable alternatives; global bio-based chemicals market valued at ~$104.5 billion in 2023. | Long-term threat to conventional polyester markets if cost and adoption hurdles are overcome. |

Entrants Threaten

The petrochemical industry, especially for integrated refining and chemical facilities like those operated by Hengli Petrochemical, demands colossal upfront capital. Establishing a new, competitive plant requires billions of dollars, creating a significant hurdle for potential newcomers. For instance, building a world-scale petrochemical complex can easily cost upwards of $10 billion.

New entrants face the challenge of achieving economies of scale to compete effectively on cost. Without the massive production volumes that come with substantial investment, smaller operations struggle to match the per-unit production costs of established players like Hengli. This scale advantage is crucial for profitability in a price-sensitive market.

New entrants into the petrochemical industry, particularly in China, confront formidable regulatory and environmental barriers. Stringent environmental protection laws and the intricate permitting procedures required for large-scale chemical operations pose significant challenges. For instance, as of 2024, China's Ministry of Ecology and Environment continues to emphasize stricter enforcement of environmental standards, making it difficult for new players to secure the necessary approvals without substantial investment in compliance technology.

Newcomers face significant hurdles in securing crucial raw materials like crude oil. Established petrochemical giants, including Hengli Petrochemical, often leverage long-term supply contracts and deeply entrenched relationships, making it challenging and expensive for new entrants to access these vital inputs at competitive prices. For instance, in 2024, global crude oil prices remained volatile, underscoring the importance of secure, cost-effective sourcing.

Developing robust distribution channels for petrochemicals and advanced materials presents another formidable barrier. Building out the necessary logistics, storage, and sales networks demands substantial capital and considerable time, giving incumbent firms like Hengli a distinct advantage due to their existing infrastructure and market penetration. The global petrochemical market, valued at trillions of dollars, requires extensive networks for efficient product delivery.

Technological Expertise and Proprietary Processes

Hengli Petrochemical's strength in advanced materials like purified terephthalic acid (PTA) and specialized fibers hinges on its deep technological expertise and proprietary manufacturing processes. New companies entering this space would face significant hurdles, needing substantial investment in research and development or the costly acquisition of existing, advanced technologies. For instance, the complex synthesis of PTA often involves patented catalyst technologies and precise reaction conditions, making replication difficult for newcomers.

The capital expenditure required to establish state-of-the-art production facilities, comparable to Hengli's integrated complexes, presents a formidable entry barrier. Building such infrastructure, complete with advanced control systems and safety protocols, demands billions of dollars. This high upfront cost, coupled with the need for specialized operational knowledge, effectively deters many potential new entrants from challenging established players like Hengli.

- Technological Sophistication: Hengli's focus on high-value petrochemicals necessitates advanced R&D and proprietary production methods, creating a high barrier to entry.

- Capital Investment: New entrants require massive upfront investment to build integrated facilities and acquire cutting-edge technology, a significant deterrent.

- Intellectual Property: Patented processes and specialized know-how in areas like PTA production are key competitive advantages that are difficult for new players to replicate.

Brand Recognition and Customer Loyalty

The petrochemical industry, while seemingly commoditized, is significantly influenced by brand recognition and customer loyalty, posing a substantial barrier to new entrants. Established companies like Hengli Petrochemical have cultivated strong reputations and deep-seated relationships with their downstream customers. These long-standing connections are built on trust, consistent product quality, and reliable supply chains, factors that are critical for manufacturers relying on petrochemical inputs. For a new player to gain traction, they would not only need to match existing quality standards but also invest heavily in building brand awareness and demonstrating unwavering dependability. For instance, in 2024, the global petrochemical market, valued at over $500 billion, continues to see demand driven by sectors where supplier reliability is non-negotiable, such as automotive and construction.

New entrants face the daunting task of overcoming the ingrained loyalty that customers have developed with incumbent firms. This loyalty is not merely about price; it encompasses a comprehensive package of service, technical support, and a proven track record. Consider the automotive sector, a major consumer of petrochemicals for plastics and synthetic materials; manufacturers in this space prioritize suppliers who can guarantee consistent delivery schedules and product specifications to avoid costly production line disruptions. Hengli Petrochemical's established presence means they likely benefit from long-term contracts and preferred supplier status, making it difficult for newcomers to secure significant market share without offering a demonstrably superior value proposition or a highly disruptive innovation.

- Brand Equity: Hengli Petrochemical benefits from years of building trust and recognition, making it harder for new companies to establish credibility.

- Customer Relationships: Downstream customers often prioritize established relationships for reliability and support, creating a loyalty hurdle for new entrants.

- Quality and Supply Assurance: In a market demanding consistent quality, new entrants must prove their ability to meet stringent standards and ensure uninterrupted supply, a challenge against established players.

- Market Inertia: The cost and effort for customers to switch suppliers can be substantial, favoring existing, well-regarded providers.

The threat of new entrants for Hengli Petrochemical is significantly low due to the immense capital required to establish competitive petrochemical operations. Building world-scale facilities can cost over $10 billion, a substantial barrier. Furthermore, achieving necessary economies of scale to compete on cost is difficult for newcomers without similar massive investments.

Stringent regulatory and environmental compliance, particularly in China as of 2024, adds another layer of difficulty for new players. Securing raw materials through long-term contracts and established relationships, as Hengli likely possesses, also presents a challenge for new entrants in a volatile market like that of 2024 crude oil prices.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Building integrated petrochemical complexes requires billions of dollars. | Very High |

| Economies of Scale | Established players benefit from lower per-unit costs due to high production volumes. | High |

| Regulatory Hurdles | Strict environmental laws and complex permitting processes in key markets. | High |

| Access to Raw Materials | Securing reliable and cost-effective crude oil supply is challenging. | High |

| Distribution Channels | Developing extensive logistics and sales networks demands significant investment. | High |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Hengli Petrochemical is built upon a foundation of robust data, including the company's annual reports, industry-specific market research from firms like IHS Markit, and official filings with regulatory bodies such as the China Securities Regulatory Commission (CSRC).