Hengli Petrochemical Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hengli Petrochemical Bundle

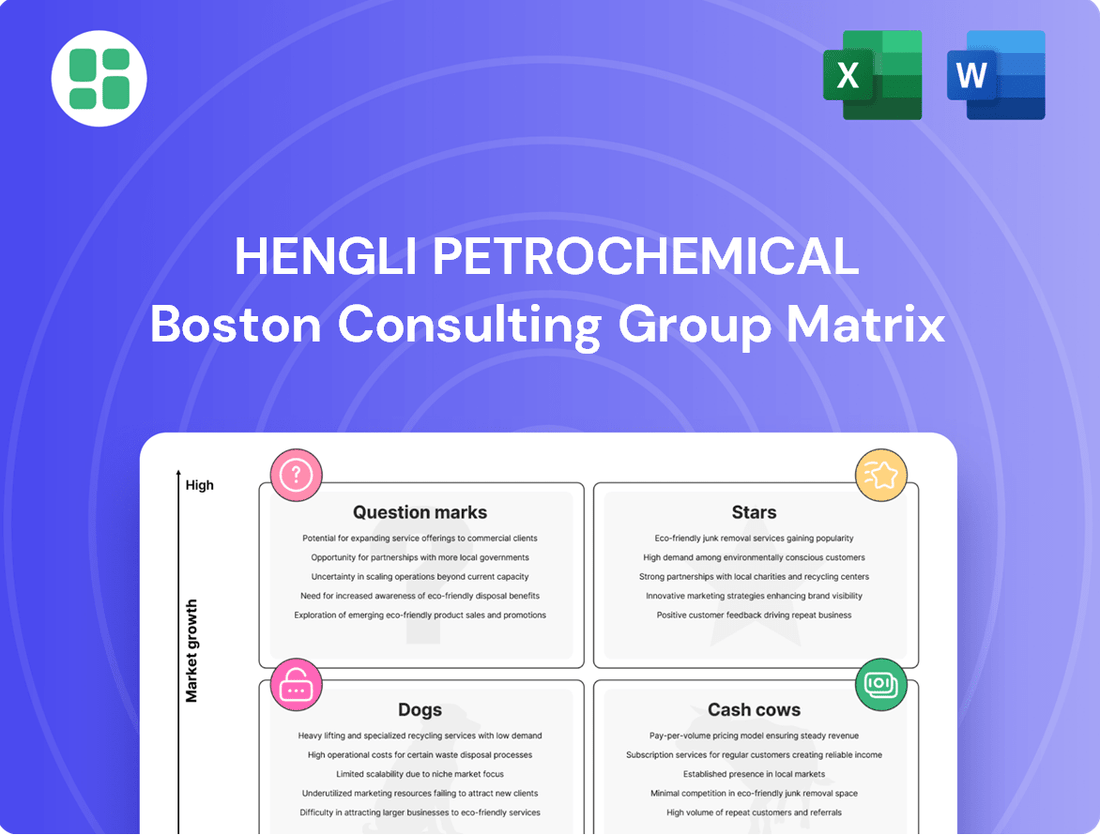

Curious about Hengli Petrochemical's market performance? This glimpse into their BCG Matrix highlights key product segments, but to truly unlock strategic advantage, you need the full picture. Discover which products are driving growth and which require careful consideration.

Don't just guess where Hengli Petrochemical's future lies. Purchase the complete BCG Matrix for a detailed quadrant analysis, revealing Stars, Cash Cows, Dogs, and Question Marks with actionable insights. This comprehensive report is your essential guide to smart investment and product portfolio management.

Stars

Hengli Petrochemical's HDPE Pipe-Grade Material (PE100 Certified) is a star performer, addressing a critical need in the domestic high-end pipe sector. This product's PE100 certification underscores its superior quality, allowing Hengli to secure a significant portion of this expanding market. For instance, the global market for PE pipes was valued at approximately USD 36.5 billion in 2023 and is projected to grow, with high-density polyethylene being a key component.

Hengli Chemical Fiber has achieved mass production of ultra-fine fibers, specifically noting the 27D/144f specification. This advancement positions them strongly in the global textile market, catering to a growing demand for advanced materials.

The company's success in this segment, characterized by high-performance textiles, is a testament to their technological prowess. In 2023, Hengli Petrochemical reported significant revenue growth, with their chemical fiber segment playing a crucial role, underscoring the market's positive reception to these innovative products.

Hengli Petrochemical's strategic push into advanced polyester new materials, with significant projects already operational, firmly places these products in the Stars category of the BCG Matrix. These innovative materials are designed for high-value, niche markets experiencing robust demand growth. For instance, Hengli's investment in specialized polyester films for electronics and packaging underscores this focus.

Biodegradable Plastics (PBS Projects)

Hengli Petrochemical's planned significant annual production capacities for PBS biodegradable plastics position them to capitalize on the burgeoning sustainable materials market. This strategic move aligns with increasing global environmental regulations and a growing consumer demand for eco-friendly alternatives.

The PBS projects represent a strong potential for Hengli Petrochemical to capture a substantial share of this rapidly expanding sector. By focusing on aggressive market development and efficient production scaling, Hengli aims to establish a dominant presence in the biodegradable plastics industry.

- Market Growth: The global biodegradable plastics market is projected to reach over $10 billion by 2027, with PBS being a key contributor.

- Production Focus: Hengli's planned PBS capacity aims to meet the rising demand driven by sustainability initiatives.

- Competitive Edge: Early investment and scaling are crucial for Hengli to secure a leading position against emerging competitors.

Lithium-ion Battery Separator Films

Hengli Petrochemical's venture into lithium-ion battery separator films positions it within a burgeoning high-growth sector. This strategic move taps into the escalating demand fueled by the electric vehicle and energy storage industries, both projected for significant expansion in the coming years. For instance, the global lithium-ion battery market was valued at approximately USD 50 billion in 2023 and is expected to reach over USD 150 billion by 2030, according to various market analyses.

The company's substantial annual production capacity for these films is a key differentiator. This capacity allows Hengli to meet the increasing needs of battery manufacturers. The rapid advancements in battery technology, driven by the push for higher energy density and faster charging, underscore the critical role of high-performance separator films. By 2024, the demand for separator films alone is anticipated to grow substantially as EV production scales up globally.

Establishing a strong market presence necessitates strategic alliances and rapid commercialization. Hengli's focus on these aspects will be crucial for navigating this competitive landscape. Key success factors include securing reliable raw material supply chains and developing advanced manufacturing processes to ensure product quality and cost-effectiveness. The company's ability to quickly adapt to evolving technological standards will be paramount.

- Market Growth: The global lithium-ion battery market is experiencing rapid expansion, with separator films being a critical component.

- Capacity Investment: Hengli's significant production capacity aims to meet the rising demand from the EV and energy storage sectors.

- Technological Importance: High-performance separator films are essential for advancements in battery energy density and charging capabilities.

- Strategic Focus: Partnerships and swift commercialization are vital for Hengli to solidify its position in this dynamic market.

Hengli Petrochemical's advanced polyester new materials, including specialized films for electronics and packaging, are firmly positioned as Stars. These products cater to high-value, niche markets with strong demand growth, reflecting significant investment and operational success in these innovative segments.

The company's ultra-fine fibers, specifically the 27D/144f specification, have achieved mass production and are driving revenue growth in the chemical fiber segment. This success highlights the market's positive reception to Hengli's advanced textile materials.

Hengli's HDPE Pipe-Grade Material (PE100 Certified) is a star performer, capturing a significant share of the high-end domestic pipe market. The global PE pipe market, valued at approximately USD 36.5 billion in 2023, continues to expand, with PE100 certification giving Hengli a competitive edge.

The venture into lithium-ion battery separator films places Hengli in a high-growth sector driven by the EV and energy storage industries. The global lithium-ion battery market was valued at around USD 50 billion in 2023, with separator films being a critical component experiencing substantial demand growth.

| Product Segment | BCG Category | Key Growth Drivers | Market Data Point (2023/2024) |

|---|---|---|---|

| Advanced Polyester New Materials | Star | High-value niche markets, robust demand | Hengli's operational projects signify strong market entry |

| Ultra-fine Fibers (27D/144f) | Star | Demand for advanced textiles | Significant revenue contribution to chemical fiber segment |

| HDPE Pipe-Grade Material (PE100) | Star | Growth in high-end domestic pipe sector | Global PE pipe market ~USD 36.5 billion |

| Lithium-ion Battery Separator Films | Star | EV and energy storage expansion | Global Li-ion battery market ~USD 50 billion |

What is included in the product

The Hengli Petrochemical BCG Matrix offers a tailored analysis of its product portfolio, highlighting which units to invest in, hold, or divest.

Hengli Petrochemical's BCG Matrix provides a clear visual of business unit performance, easing the pain of strategic uncertainty.

Cash Cows

Hengli Petrochemical's crude oil refining operations, boasting a substantial 400,000 barrels per day capacity, serve as a cornerstone cash cow. This integrated complex consistently generates significant revenue, even amidst market volatility, thanks to its efficient feedstock management and stable output. The mature nature of the refining sector allows Hengli to capitalize on its scale and operational efficiency, yielding robust cash flow without the need for substantial growth-oriented capital expenditures.

Hengli Petrochemical's Purified Terephthalic Acid (PTA) production stands as a prime example of a cash cow. As one of the globe's largest PTA manufacturers, Hengli commands a significant portion of this vital chemical precursor market.

Despite PTA being a mature commodity, Hengli's massive scale and efficient operations translate into robust profit margins and consistent cash flow. In 2023, Hengli's PTA segment contributed significantly to its overall revenue, demonstrating its reliable cash-generating capabilities.

The company's ongoing expansion of its PTA production capacity further solidifies its status as a dependable cash cow, ensuring continued strong performance in this segment.

Conventional polyester chips and fibers are Hengli Petrochemical's established Cash Cows. These products dominate a significant portion of Hengli's downstream polyester operations, boasting a substantial market share within the mature textile and packaging sectors.

Despite potentially low market growth, the unwavering demand for these staples, coupled with Hengli's robust competitive edge, translates into dependable cash flow generation. In 2023, Hengli Petrochemical reported robust performance in its polyester segment, contributing significantly to overall revenue.

These mature products necessitate minimal marketing expenditure, allowing them to consistently bolster the company's profitability. Their stable, predictable earnings are crucial for funding other business ventures and maintaining overall financial health.

Basic Petrochemical Products (e.g., PX, Ethylene)

Basic petrochemical products like paraxylene (PX) and ethylene are fundamental to Hengli Petrochemical's vertically integrated business model, serving as significant contributors to both revenue and cash flow. These high-volume commodities benefit from established global markets where Hengli holds a robust position.

Their consistent production underpins the entire Hengli value chain, providing a dependable stream of funds. For instance, in 2023, Hengli reported substantial production volumes for key petrochemicals, reinforcing their role as cash cows.

- PX Production: Hengli is a major global producer of paraxylene, a key component in polyester production.

- Ethylene Output: The company's ethylene production is critical for downstream chemical manufacturing.

- Revenue Contribution: These basic petrochemicals consistently generate a significant portion of Hengli's overall sales.

- Market Share: Hengli maintains a competitive market share in these commodity segments, ensuring stable demand.

Integrated Chemical Platform

Hengli Petrochemical's integrated chemical platform is a prime example of a Cash Cow. This extensive setup, covering everything from crude oil refining to the production of various downstream chemical products, is designed for maximum efficiency and cost optimization. In 2024, Hengli's refining and chemical segment reported strong performance, benefiting from this integrated model.

The synergy across Hengli's value chain is a key driver of its Cash Cow status. By controlling multiple stages of production, the company achieves superior asset utilization and tighter cost management, especially crucial in the often-cyclical petrochemical industry. This allows for consistent and substantial cash generation.

- Integrated Operations: Spanning refining to downstream chemicals, enhancing cost control.

- Operational Efficiency: Maximizes value extraction across the entire petrochemical chain.

- Cost Optimization: Achieved through synergistic structure and superior asset utilization.

- Strong Cash Generation: The platform consistently produces significant cash flow.

Hengli Petrochemical's crude oil refining operations, with a capacity of 400,000 barrels per day, are a significant cash cow. This efficiency, coupled with strong feedstock management, ensures consistent revenue generation even in volatile markets. The mature refining sector allows Hengli to leverage its scale and operational prowess for robust cash flow, minimizing the need for extensive growth investments.

Purified Terephthalic Acid (PTA) production is another key cash cow for Hengli, positioning it as a global leader. Despite PTA being a mature commodity, Hengli's immense scale and operational efficiency yield strong profit margins and reliable cash flow. In 2023, the PTA segment was a major contributor to Hengli's revenue, underscoring its dependable cash-generating capacity.

Conventional polyester chips and fibers represent Hengli's established cash cows, holding a substantial market share in the mature textile and packaging industries. The consistent demand for these products, combined with Hengli's competitive advantages, generates dependable cash flow, requiring minimal marketing expenditure and bolstering overall profitability.

Basic petrochemicals like paraxylene (PX) and ethylene are foundational to Hengli's integrated model, acting as significant revenue and cash flow drivers. Hengli's strong market position in these high-volume commodities ensures a steady stream of funds, supporting its entire value chain. For instance, in 2023, Hengli reported substantial production volumes for these key petrochemicals, solidifying their cash cow status.

| Product Segment | 2023 Revenue Contribution (Approx.) | Key Characteristics | Cash Flow Generation |

|---|---|---|---|

| Crude Oil Refining | Significant | High capacity, operational efficiency | Robust and stable |

| Purified Terephthalic Acid (PTA) | Major | Global leadership, scale advantage | Consistent and strong |

| Polyester Chips & Fibers | Substantial | Mature market, strong demand | Dependable and predictable |

| Basic Petrochemicals (PX, Ethylene) | Significant | Integrated value chain, high volume | Steady and foundational |

Preview = Final Product

Hengli Petrochemical BCG Matrix

The Hengli Petrochemical BCG Matrix preview you are viewing is the precise, fully formatted report you will receive immediately after purchase. This means no watermarks or demo content, just a professionally analyzed and ready-to-use strategic document. You can confidently use this preview as a direct representation of the valuable insights you'll gain into Hengli Petrochemical's business units.

Dogs

Older, undifferentiated polyester fibers represent a challenging segment for Hengli Petrochemical. These products are characterized by intense competition and a significant market oversupply, placing them squarely in the 'Dogs' category of the BCG Matrix. This means they likely exhibit low growth prospects and a low market share for Hengli.

Consequently, these fiber types may find it difficult to command competitive pricing or achieve meaningful differentiation in the marketplace. This situation can lead to minimal, or even negative, profit contributions to the company's overall performance. For instance, the global polyester fiber market, while large, sees significant price pressure on commodity grades.

Given these dynamics, Hengli Petrochemical might need to consider divesting these specific product lines or undertaking a substantial re-evaluation of their strategy. Continuing to invest resources in these 'dog' segments could drain capital and hinder the company's ability to focus on more promising areas of its business.

Certain commodity chemicals within Hengli Petrochemical's extensive product line may be classified as dogs, especially those operating in markets characterized by significant oversupply and subdued demand. These products typically generate narrow profit margins and offer little in the way of substantial contribution to the company's overall financial health.

For instance, in 2024, the global ethylene market, a key commodity chemical, faced overcapacity issues, with production exceeding demand by a notable margin. This often translates to lower pricing power for producers like Hengli, impacting profitability on these specific product segments.

Continuing to invest in or maintain these low-margin, high-volume commodity chemical segments without a clear strategy for differentiation or cost leadership can indeed tie up valuable capital. This capital could otherwise be strategically deployed into more promising areas of the business, such as specialty chemicals or advanced materials, which typically offer higher returns and growth potential.

Inefficient legacy production facilities within Hengli Petrochemical's portfolio are likely to be characterized by older technologies that lag behind their modern, integrated counterparts. These older units may exhibit higher energy consumption and greater waste generation, directly impacting their cost-effectiveness. For instance, if a legacy plant requires 10% more energy per ton of output compared to a new facility, its operating costs will be significantly higher, eroding profit margins.

Such facilities might be struggling to maintain profitability and market share due to these inherent inefficiencies. In 2023, Hengli Petrochemical reported a net profit margin of 7.5%, and older, less efficient plants would drag this figure down considerably. Strategic decisions regarding modernization or the eventual phasing out of these assets are crucial for optimizing overall operational performance and resource allocation.

Products Heavily Exposed to Volatile Raw Material Prices without Effective Hedging

Hengli Petrochemical's product lines heavily exposed to volatile raw material prices without effective hedging could be facing significant margin pressure. This is particularly true for products where cost increases stemming from upstream fluctuations, such as crude oil and naphtha, cannot be fully absorbed by the market. In 2024, the petrochemical industry experienced considerable price swings in these essential inputs, directly impacting the profitability of segments like Purified Terephthalic Acid (PTA) and polyester fibers. When hedging strategies are insufficient, these segments can become underperformers, dragging down overall returns.

These segments may generate low returns and contribute to margin erosion, especially if robust hedging strategies are not in place to mitigate price risks. For instance, a significant portion of Hengli's revenue is derived from PTA, a key component in polyester production. Fluctuations in crude oil prices, a primary feedstock, directly affect PTA production costs. Without adequate financial instruments to lock in raw material prices, any spike in crude oil can lead to a direct reduction in PTA profit margins. In the first half of 2024, Brent crude oil prices averaged around $83 per barrel, a notable increase from previous periods, highlighting the potential for margin compression in unhedged PTA production.

- PTA (Purified Terephthalic Acid): Profitability directly tied to crude oil and naphtha prices.

- Polyester Fibers: Dependent on PTA availability and cost, making them susceptible to upstream volatility.

- Polypropylene: Feedstock costs, often linked to propane and naphtha, can significantly impact margins.

- Ethylene Glycol (MEG): Another key polyester precursor, exposed to ethylene price volatility.

Non-Core, Underperforming Small-Scale Ventures

Hengli Petrochemical's smaller, non-strategic ventures that haven't achieved profitability in low-growth markets would be classified here. These units often drain resources without adding significant value to the company's overall strategy or financial performance.

These ventures typically struggle to gain market share and may operate in niche sectors with limited expansion potential. Their underperformance can divert crucial capital and management focus away from more promising core businesses.

- Low Market Share: Ventures with minimal penetration in their respective markets.

- Lack of Profitability: Segments that consistently fail to generate positive earnings.

- Resource Drain: Units that consume management time and financial capital without commensurate returns.

- Limited Strategic Fit: Businesses that do not align with Hengli's primary strategic objectives.

Certain commodity chemicals within Hengli Petrochemical's portfolio, particularly those facing oversupply and weak demand in 2024, can be categorized as dogs. These products typically yield low profit margins and contribute minimally to the company's overall financial health, exemplified by the ethylene market's overcapacity in 2024, which compressed pricing power for producers.

Inefficient legacy production facilities at Hengli Petrochemical, characterized by outdated technology and higher operating costs, also fall into the dog category. These units struggle with profitability and market share due to inherent inefficiencies, and in 2023, Hengli's overall net profit margin was 7.5%, with less efficient plants likely dragging this figure down.

Products heavily exposed to volatile raw material prices without adequate hedging, such as PTA and polyester fibers, also represent dogs for Hengli. The petrochemical industry saw significant input price swings in 2024, directly impacting profitability for these segments, especially when hedging strategies are insufficient to mitigate risks.

Hengli Petrochemical's smaller, non-strategic ventures that are unprofitable in low-growth markets also fit the dog classification, often consuming resources without adding significant strategic or financial value. These ventures typically struggle with market share and have limited expansion potential, diverting capital and focus from core businesses.

| Product Segment | BCG Category | Key Challenges | 2024 Market Context | Strategic Implication |

| Undifferentiated Polyester Fibers | Dog | Intense competition, oversupply, low pricing power | Global polyester fiber market faces price pressure on commodity grades | Consider divestment or strategic re-evaluation |

| Commodity Chemicals (e.g., Ethylene) | Dog | Oversupply, subdued demand, narrow profit margins | Global ethylene market faced overcapacity in 2024 | Strategic deployment of capital needed elsewhere |

| Inefficient Legacy Facilities | Dog | Higher energy consumption, waste generation, cost inefficiencies | 2023 Net Profit Margin: 7.5%; older plants reduce overall efficiency | Modernization or phasing out of assets crucial |

| Unhedged Volatile Raw Material Exposed Products (e.g., PTA, Polyester) | Dog | Margin pressure from raw material price swings | Brent crude averaged ~$83/barrel in H1 2024, impacting input costs | Inadequate hedging leads to profit margin compression |

| Non-Strategic, Unprofitable Ventures | Dog | Low market share, lack of profitability, resource drain | Limited expansion potential in niche sectors | Divert capital and management focus from core businesses |

Question Marks

Hengli Petrochemical's investment in new advanced materials for niche applications positions it as a potential innovator, but these ventures likely represent a question mark in the BCG matrix. While R&D efforts are focused on high-growth sectors, initial market share in these specialized areas may be limited, requiring significant investment to gain traction. For instance, the company's reported investment in high-performance polymers, a key area for advanced materials, saw a notable increase in its 2023 capital expenditure, signaling a commitment to these nascent markets.

Hengli Petrochemical's specialty chemicals for emerging industries like electric vehicles (EVs) and semiconductors represent a significant growth opportunity, but the company's position is likely that of a question mark in the BCG matrix. While these sectors are experiencing robust expansion, driven by global trends towards electrification and advanced technology, Hengli's current market penetration in these technically sophisticated and fiercely competitive arenas is probably limited.

The demand for high-purity chemicals in semiconductor manufacturing, for instance, is immense, with the global semiconductor materials market projected to reach $120 billion by 2028, growing at a CAGR of 6.5%. Similarly, the EV battery market requires specialized electrolytes and cathode materials, a sector expected to grow substantially. For Hengli to capitalize on this, substantial investment in research and development, alongside the establishment of advanced manufacturing capabilities and targeted market entry strategies, will be crucial to transform this potential into tangible market share and competitive advantage.

Hengli Petrochemical's ambition to establish a global presence, targeting promising new markets in Southeast Asia, Europe, and North America, positions these ventures as potential Stars in its BCG Matrix. These regions offer significant growth opportunities, though Hengli's initial market share is expected to be minimal.

The company's strategic push into these new overseas markets necessitates considerable capital outlay. This investment will be directed towards developing robust logistics and distribution infrastructure, alongside targeted, localized marketing campaigns designed to cultivate brand awareness and capture a customer base. For context, in 2024, global petrochemical demand is projected to see moderate growth, with emerging markets in Asia and Southeast Asia leading the expansion, underscoring the strategic rationale for Hengli's focus.

Pilot Projects from Hengli-DUT Research Institute

Pilot projects from the Hengli-DUT Research Institute represent potential stars in Hengli Petrochemical's portfolio. These innovations, born from a blend of academic rigor and industry application, offer significant future growth prospects. For instance, their work on advanced catalysts for polyethylene production, a key area for petrochemicals, aims to improve efficiency and reduce environmental impact.

While these projects are technologically advanced, they are typically in their nascent stages of market penetration. This means they require substantial funding and careful strategic nurturing to scale up. The institute's focus on areas like high-performance polymers and sustainable chemical processes underscores their commitment to future market trends.

- Innovation Focus: Development of next-generation materials and sustainable chemical processes.

- Market Position: Early commercialization, limited market share, high growth potential.

- Strategic Need: Intensive investment and pilot programs to drive market adoption.

- Example Area: Advanced catalysts for enhanced polymer production efficiency.

Emerging Circular Economy Solutions and Recycled Products

Hengli Petrochemical is actively exploring green manufacturing and the potential for new products derived from recycled materials, aligning with the growing circular economy trend. While the global circular economy market is projected to reach $4.5 trillion by 2030, Hengli's specific ventures in this emerging area may currently hold a low market share as they establish themselves.

These innovative circular economy solutions, such as advanced recycling technologies or products made from post-consumer waste, require substantial capital investment. This funding is necessary not only to scale production capabilities but also to build consumer and industrial acceptance for the unique sustainable attributes of these recycled products.

- Market Growth: The circular economy is a rapidly expanding sector, with significant global growth anticipated.

- Hengli's Position: Hengli's entry into this space is likely in its early stages, potentially facing initial low market share.

- Investment Needs: Significant financial commitment is crucial for scaling production and gaining market traction for recycled goods.

Hengli Petrochemical's ventures into advanced materials and specialty chemicals for high-growth sectors like EVs and semiconductors are classic question marks. These areas offer immense future potential, with the global semiconductor materials market alone expected to hit $120 billion by 2028. However, Hengli's current market share in these technically demanding and competitive fields is likely minimal, necessitating substantial investment in R&D and manufacturing to establish a strong foothold.

The company's focus on green manufacturing and the circular economy also falls into the question mark category. While the circular economy market is projected to reach $4.5 trillion by 2030, Hengli's specific initiatives in this nascent space are likely in their early stages, requiring significant capital for scaling production and building market acceptance for recycled products.

| Category | Hengli's Position | Market Growth | Investment Requirement | Key Considerations |

| Advanced Materials | Question Mark | High (niche applications) | High (R&D, production) | Limited initial market share, need for scaling |

| Specialty Chemicals (EVs, Semiconductors) | Question Mark | Very High (global trends) | Very High (technology, market entry) | Intense competition, technical expertise needed |

| Green Manufacturing/Circular Economy | Question Mark | High (growing trend) | High (scaling, market acceptance) | Early stage development, consumer perception |

BCG Matrix Data Sources

Our Hengli Petrochemical BCG Matrix is built on comprehensive data, integrating financial statements, market research reports, and industry growth forecasts to provide a clear strategic overview.