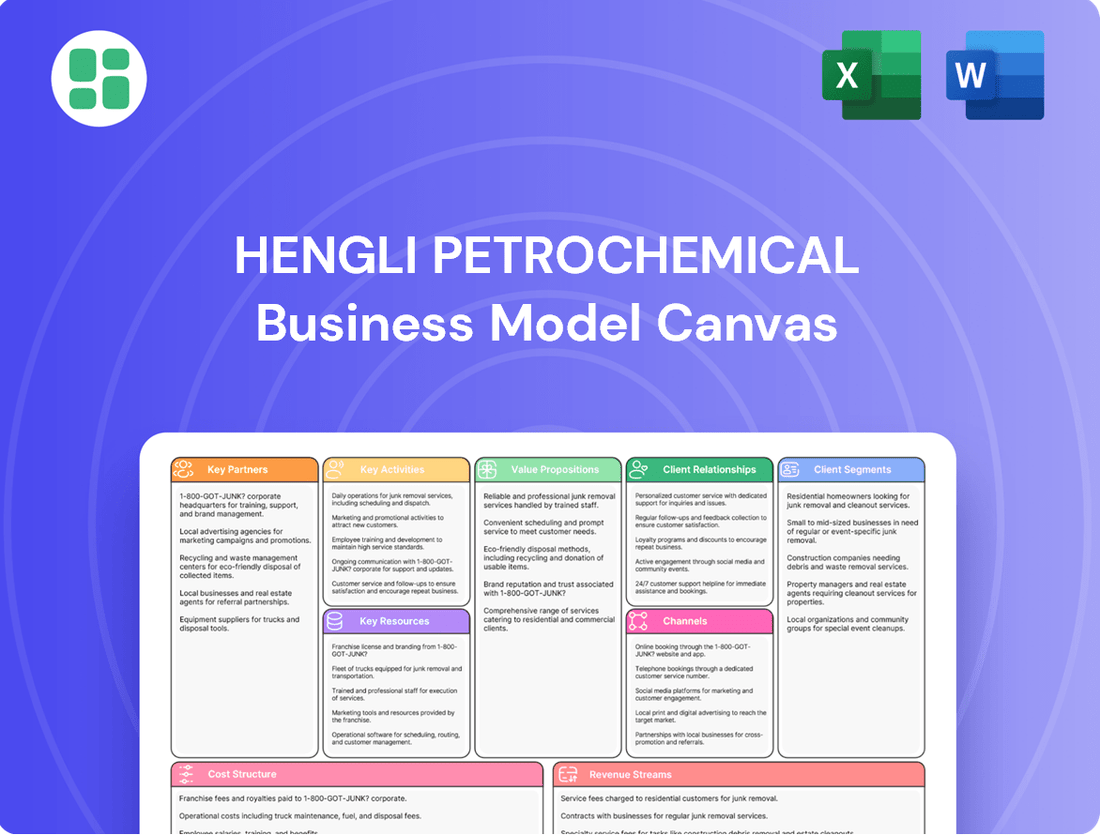

Hengli Petrochemical Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hengli Petrochemical Bundle

Unlock the full strategic blueprint behind Hengli Petrochemical's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Hengli Petrochemical actively cultivates strategic alliances, particularly with esteemed academic bodies such as Dalian University of Technology. These partnerships are instrumental in establishing joint research institutes, like the 'Hengli-DUT Research Institute,' designed to bridge industry, academia, and research sectors.

This collaborative approach is geared towards securing technological leadership and driving innovation in advanced petrochemical processes and the development of novel materials. Such alliances are crucial for staying ahead in a rapidly evolving industry, ensuring access to cutting-edge research and talent.

Hengli Petrochemical’s operational backbone relies heavily on its upstream raw material suppliers, primarily crude oil and other essential petrochemical feedstocks. These partnerships are critical for maintaining a consistent and economically viable supply chain, underpinning the company's vast refining and chemical production capabilities.

For instance, Hengli has actively pursued strategic discussions with major global energy players. Reports in 2024 indicated potential collaborations, such as exploring a 10% stake in Hengli with entities like Saudi Aramco, which would likely solidify long-term crude oil supply agreements. Such alliances are vital for securing the foundational resources needed for Hengli’s integrated business model.

Hengli Petrochemical actively partners with leading technology providers, securing crucial licensing agreements for advanced refining and chemical production processes. This strategic approach, exemplified by their collaborations with global licensors for proprietary catalyst technologies, allows Hengli to integrate cutting-edge manufacturing capabilities. For instance, in 2024, Hengli continued to leverage these partnerships to optimize yields and reduce energy consumption across its massive integrated refining and petrochemical complexes.

Value Chain Collaborators for Sustainability

Hengli Petrochemical actively collaborates with upstream suppliers and downstream customers to embed sustainability throughout its entire value chain. This strategic approach focuses on enhancing communication and joint efforts to implement eco-friendly practices.

The company aims to reduce its overall carbon footprint and champion green manufacturing initiatives by working closely with these partners. For instance, in 2024, Hengli Petrochemical continued its efforts to source more sustainable raw materials and to promote the use of recycled content in its products, aligning with global environmental standards.

- Supplier Engagement: Partnering with suppliers to ensure responsible sourcing and adherence to environmental regulations, with a focus on reducing emissions in raw material extraction and processing.

- Customer Collaboration: Working with customers to develop and promote products with lower environmental impact, encouraging circular economy principles and responsible end-of-life management.

- Logistics Optimization: Collaborating with logistics providers to implement more efficient and lower-emission transportation methods, such as utilizing cleaner fuels and optimizing shipping routes.

- Technology Partnerships: Engaging with technology providers to adopt and scale up green manufacturing processes and carbon capture technologies, aiming for significant reductions in industrial emissions.

Financial Institutions and Investors

Hengli Petrochemical cultivates robust partnerships with a wide array of financial institutions. These relationships are vital for securing the substantial capital required to fund its extensive capital expenditures, which in 2023 alone were reported to be in the billions of dollars for ongoing projects and expansions. This access to credit and diverse funding sources underpins their ability to operate and grow.

The company also places significant emphasis on its relationships with shareholders and the broader investor community. This engagement is critical for maintaining investor confidence and supporting sustained growth. Hengli Petrochemical’s commitment to shareholder value is often demonstrated through its dividend policies and proactive financial management, aiming to ensure financial stability and attractiveness for continued investment.

- Financial Institutions: Hengli Petrochemical leverages relationships with major banks and financial service providers for project financing, working capital, and other debt instruments.

- Shareholders: A strong base of institutional and retail shareholders provides equity capital and influences corporate governance.

- Investors: Ongoing engagement with investors through financial reporting and investor relations efforts is key to maintaining market valuation and access to capital markets.

- Strategic Financial Partners: Potential collaborations with financial entities for joint ventures or specific investment vehicles could also be part of their partnership strategy.

Hengli Petrochemical's key partnerships are foundational to its operational strength and strategic growth. These include collaborations with major global energy companies for crude oil supply, as seen in 2024 discussions for potential equity stakes, securing vital feedstock. Furthermore, partnerships with technology licensors are critical for integrating advanced refining processes and catalysts, enhancing efficiency and yield.

The company also fosters deep relationships with financial institutions, essential for funding its substantial capital expenditures, which amounted to billions in 2023 for ongoing projects. These financial alliances provide the necessary capital for expansion and operational continuity.

| Partner Type | Purpose | Example/Impact |

|---|---|---|

| Crude Oil Suppliers | Secure feedstock | Discussions with global energy players in 2024 for potential equity stakes to ensure long-term supply. |

| Technology Providers | Access advanced processes | Licensing agreements for catalysts and refining technologies to optimize yields and reduce energy consumption. |

| Financial Institutions | Capital funding | Securing billions in financing for capital expenditures and operational needs, as seen in 2023. |

What is included in the product

This Hengli Petrochemical Business Model Canvas provides a comprehensive overview of their integrated refining and chemical operations, highlighting key customer segments in downstream industries and their value proposition of high-quality, cost-effective petrochemical products.

Hengli Petrochemical's Business Model Canvas offers a clear, one-page snapshot of its integrated operations, simplifying complex value chains and identifying potential inefficiencies.

This structured approach allows for a rapid assessment of Hengli's competitive advantages, streamlining strategic planning and operational adjustments.

Activities

Crude oil refining is a cornerstone activity for Hengli Petrochemical, transforming raw crude oil into a spectrum of valuable petroleum products like gasoline, diesel, and jet fuel. This upstream process is vital for its integrated business model, supplying crucial feedstocks for its downstream petrochemical operations and bolstering its self-sufficiency.

In 2024, Hengli Petrochemical's refining capacity remained a significant driver of its performance. The company processed approximately 18.5 million tons of crude oil in the first half of 2024, demonstrating its substantial operational scale.

Hengli Petrochemical's core activities revolve around the large-scale production of essential petrochemicals. This includes a diverse portfolio such as aromatics, olefins, purified terephthalic acid (PTA), and ethylene glycol. These materials are fundamental building blocks for a vast array of downstream manufacturing sectors.

In 2024, Hengli Petrochemical continued to be a significant player in the global petrochemical market. The company's integrated refining and chemical complexes, particularly its major facility in Dalian, are designed for high-volume output. For instance, their PTA production capacity is among the largest globally, underscoring their manufacturing prowess.

Hengli Petrochemical's key activities include the production of a wide array of polyester new materials. This encompasses polyester chips, which are the building blocks for many downstream products, as well as various polyester fibers like filament yarn and staple fiber, crucial for the textile industry.

Beyond fibers, Hengli manufactures polyester films used in packaging and industrial applications, and specialized plastics such as high-density polyethylene (HDPE) pipe-grade material, highlighting their reach into advanced materials sectors. In 2023, Hengli Petrochemical reported a significant revenue contribution from its polyester segment, demonstrating its importance to the company's overall financial performance.

Research and Development (R&D)

Hengli Petrochemical's Research and Development (R&D) is a cornerstone, driving continuous investment in technological innovation and process optimization. This focus allows them to tackle complex industry challenges and develop advanced, high-performance materials. For instance, in 2023, Hengli reported significant R&D expenditure, a testament to their commitment to staying ahead.

This dedication to innovation is crucial for Hengli to overcome technical hurdles, create distinct product offerings, and solidify its position as an industry leader. Their R&D efforts directly contribute to product differentiation and the ability to respond to evolving market demands for specialized petrochemical products.

- Focus on Technological Innovation: Developing cutting-edge processes and new product formulations.

- Process Optimization: Enhancing efficiency and reducing costs in production.

- New Material Development: Creating high-performance polymers and specialty chemicals.

- Breaking Bottlenecks: Addressing and solving complex technical challenges in the petrochemical value chain.

Global Sales and Distribution

Hengli Petrochemical actively markets and distributes its wide array of refined products, petrochemicals, and advanced materials. This global reach necessitates managing a sophisticated logistics infrastructure to serve customers across numerous international markets.

The company's sales and distribution efforts are crucial for delivering its diverse product lines, which include everything from fuels to specialized chemical intermediates. By maintaining a robust supply chain, Hengli ensures timely and efficient delivery to its global clientele.

- Domestic and International Sales: Hengli Petrochemical's sales network spans both China's vast domestic market and key international regions, ensuring broad market penetration for its product portfolio.

- Logistics Network Management: The company operates a complex logistics system, managing transportation and storage to deliver refined petroleum products, petrochemicals, and new materials efficiently.

- Diverse Customer Base: Hengli serves a wide spectrum of customers, from large industrial consumers to specialized manufacturers, across various sectors that rely on its chemical and material outputs.

- Product Portfolio Distribution: The distribution strategy covers a comprehensive range of products, including fuels, aromatics, olefins, and high-performance polymers, each requiring tailored logistical solutions.

Hengli Petrochemical's key activities encompass the entire value chain, from crude oil refining to the production of advanced polyester materials. This integrated approach allows for significant operational efficiencies and feedstock security. Their core operations are centered around large-scale refining and petrochemical production, supplying essential building blocks for numerous industries.

The company's commitment to innovation through R&D is a critical activity, focusing on process optimization and the development of high-performance materials. This forward-looking strategy ensures competitiveness and responsiveness to market demands. Furthermore, an extensive sales and distribution network is vital for delivering their diverse product portfolio to a global customer base.

| Key Activity | Description | 2024 Highlight/Data |

|---|---|---|

| Crude Oil Refining | Transforming crude oil into gasoline, diesel, jet fuel, and feedstocks. | Processed ~18.5 million tons of crude oil in H1 2024. |

| Petrochemical Production | Manufacturing aromatics, olefins, PTA, and ethylene glycol. | Among the largest global PTA producers, with significant output from Dalian complex. |

| Polyester New Materials | Producing polyester chips, fibers, films, and specialized plastics. | Polyester segment was a significant revenue contributor in 2023. |

| Research & Development | Driving innovation, process optimization, and new material development. | Significant R&D expenditure reported in 2023. |

| Sales & Distribution | Marketing and distributing refined products, petrochemicals, and materials globally. | Manages a complex logistics network for domestic and international markets. |

Delivered as Displayed

Business Model Canvas

The Business Model Canvas for Hengli Petrochemical that you are previewing is the exact document you will receive upon purchase. This comprehensive overview outlines Hengli's strategic approach to its operations, detailing key partners, activities, resources, value propositions, customer relationships, channels, customer segments, cost structure, and revenue streams. You are seeing a genuine snapshot of the final, ready-to-use deliverable, ensuring full transparency and immediate utility for your business analysis.

Resources

Hengli Petrochemical's integrated refining and petrochemical complexes are the backbone of its operations. For instance, its Liaoning Province facility boasts a massive crude oil processing capacity, reaching 20 million tons per year, and a significant ethylene production capability of 1.5 million tons per year. These advanced sites are crucial for its integrated production strategy, allowing for high-volume, cost-effective manufacturing.

The Hengli Industrial Park in Dalian further solidifies this integrated approach. This strategic location houses state-of-the-art refining and chemical production units, enabling seamless feedstock integration and product diversification. This synergy between refining and petrochemicals allows Hengli to capture value across the entire hydrocarbon chain, enhancing its competitive edge.

Hengli Petrochemical's advanced production technology and patents are foundational to its competitive edge. The company leverages sophisticated processes and holds a significant portfolio of production patents, enabling the creation of high-quality, differentiated petrochemical products.

This technological leadership is evidenced by achievements such as obtaining PE100 certification for its HDPE pipe-grade material, a testament to its advanced manufacturing capabilities and robust intellectual property. In 2024, Hengli continued to invest heavily in research and development, aiming to further enhance its technological base and patent portfolio to maintain its market position.

Hengli Petrochemical's skilled human capital is a cornerstone of its operations, encompassing a robust team of engineers, researchers, and dedicated operational staff. This expertise is crucial for driving innovation within the company, ensuring the smooth and efficient running of its extensive petrochemical facilities.

The company's investment in its workforce directly translates to its capacity for developing advanced new products and upholding stringent quality standards across its diverse product lines. For instance, in 2024, Hengli Petrochemical continued its focus on talent development, aiming to enhance its research and development capabilities in areas like advanced materials and specialty chemicals.

Financial Capital and Strong Cash Flow

Hengli Petrochemical's substantial financial capital is a cornerstone of its operations. In 2023, the company reported operating revenue of approximately RMB 207.5 billion, underscoring its significant market presence. This financial might directly fuels its capacity for ambitious expansion projects, cutting-edge research and development, and the essential maintenance of robust liquidity.

The company's financial strength is further evidenced by its healthy net cash flow from operating activities. This consistent generation of cash provides the necessary foundation to pursue long-term strategic objectives, such as vertical integration and technological advancement. It also ensures resilience against market volatility and economic downturns.

- Significant Operating Revenue: RMB 207.5 billion in 2023 demonstrates considerable market scale and sales volume.

- Healthy Net Cash Flow from Operations: This indicates efficient cash generation from core business activities, vital for reinvestment and stability.

- Investment Capacity: Financial capital directly supports expansion, R&D, and maintaining liquidity, enabling strategic growth.

- Long-Term Strategic Support: Financial strength underpins the company's ability to execute its long-term vision and navigate market challenges.

Strategic Land Holdings and Infrastructure

Hengli Petrochemical's strategic land holdings, particularly its coastal locations, are a critical asset. These sites provide direct access for crude oil imports and finished product exports, significantly streamlining logistics. This geographic advantage is fundamental to their efficient, large-scale integrated refining and petrochemical operations.

The company's well-developed infrastructure further enhances its operational efficiency. This includes deep-water ports and extensive pipeline networks, which are vital for managing the vast quantities of raw materials and finished goods. In 2023, Hengli Petrochemical's integrated refining capacity reached approximately 20 million tons per annum, underscoring the scale of operations supported by this infrastructure.

- Coastal Access: Facilitates cost-effective crude oil imports and product exports.

- Integrated Infrastructure: Deep-water ports and pipelines support high-volume throughput.

- Logistical Efficiency: Reduces transportation costs, crucial for competitive pricing.

- Operational Scale: Enables the company to manage its large, integrated refining and petrochemical complexes.

Hengli Petrochemical's key resources are its integrated refining and petrochemical complexes, advanced production technology and patents, skilled human capital, substantial financial capital, and strategic land holdings with robust infrastructure. These assets collectively enable its high-volume, cost-effective manufacturing and market competitiveness.

The company's integrated complexes, like the one in Liaoning with 20 million tons/year crude processing capacity, are central. Its technological edge is supported by patents and R&D investments, as seen in its HDPE pipe-grade material certification. Skilled personnel drive innovation and operational efficiency, while strong financials, including RMB 207.5 billion operating revenue in 2023, fund growth.

Strategic coastal locations and infrastructure, including deep-water ports, are vital for logistics. In 2023, Hengli's refining capacity reached approximately 20 million tons per annum, highlighting the scale these resources support.

| Key Resource | Description | Supporting Data/Facts |

|---|---|---|

| Integrated Complexes | Refining and petrochemical production sites | Liaoning facility: 20 million tons/year crude processing; 1.5 million tons/year ethylene production. |

| Technology & Patents | Advanced processes and intellectual property | PE100 certification for HDPE pipe-grade material; ongoing R&D investment in 2024. |

| Human Capital | Skilled workforce (engineers, researchers, operators) | Focus on talent development for advanced materials and specialty chemicals in 2024. |

| Financial Capital | Company's financial strength and liquidity | 2023 Operating Revenue: RMB 207.5 billion; healthy net cash flow from operations. |

| Land & Infrastructure | Strategic locations and logistical assets | Coastal access for imports/exports; deep-water ports and pipelines; 20 million tons/year refining capacity in 2023. |

Value Propositions

Hengli Petrochemical's integrated full industry chain is a cornerstone of its value proposition. This means they manage everything from refining crude oil into basic components to producing advanced materials and chemicals. This comprehensive approach allows for significant cost savings and operational efficiencies throughout the entire production process.

This vertical integration provides Hengli with a distinct competitive edge. By controlling each stage of production, they can ensure consistent product quality and a reliable supply chain, which is crucial in the volatile petrochemical market. For example, in 2024, Hengli's refining capacity reached 20 million tons per year, directly feeding its downstream chemical production units.

Hengli Petrochemical offers a diverse portfolio of high-quality, differentiated petrochemical and polyester new materials. This includes specialized products like PE100 certified HDPE pipe-grade material, crucial for robust infrastructure projects, and advanced ultra-fine fibers utilized in performance textiles and filtration. These offerings are designed to meet demanding industry specifications and capture niche, high-value market segments.

Hengli Petrochemical's dedication to pioneering new technologies and investing heavily in research and development solidifies its standing as a frontrunner in the petrochemical industry. This focus ensures they are not just participants but shapers of industry advancements.

The company's pursuit of state-of-the-art processes and the creation of environmentally conscious materials showcase its capacity to deliver sophisticated solutions. This adaptability is crucial for meeting the dynamic demands of the global market, positioning Hengli as a forward-thinking provider.

In 2023, Hengli Petrochemical reported significant R&D expenditures, demonstrating a tangible commitment to innovation. For instance, their investment in advanced refining technologies contributed to a notable increase in the production of high-value chemical products, enhancing their competitive edge.

Reliable and Stable Supply

Hengli Petrochemical's commitment to reliable and stable supply is a cornerstone of its value proposition. Leveraging massive production capacities, including its integrated refining and petrochemical complex in Dalian, the company ensures consistent product availability for its industrial customers. This operational scale is crucial for clients who require uninterrupted material flow for their manufacturing operations, especially during periods of global economic uncertainty.

This stability is not just about volume; it's about predictability. Hengli's integrated model, from crude oil refining to downstream chemical production, minimizes external dependencies and allows for greater control over the supply chain. For instance, in 2023, Hengli Petrochemical reported significant operational uptime across its key production units, underscoring its ability to maintain consistent output even with fluctuating market dynamics.

- Massive Production Capacity: Hengli operates one of the world's largest integrated refining and petrochemical complexes, enabling substantial output.

- Integrated Operations: Control over the entire value chain, from refining to chemical production, enhances supply chain resilience.

- Market Stability: Provides industrial clients with predictable access to essential raw materials, supporting their production planning.

- Operational Uptime: Demonstrated high operational efficiency and reliability in its production facilities throughout 2023.

Commitment to Sustainable and Green Practices

Hengli Petrochemical demonstrates a strong commitment to sustainable and green practices, integrating these principles throughout its operations. This dedication translates into tangible value for customers and stakeholders who prioritize environmental responsibility.

The company actively implements comprehensive energy-saving measures and robust waste reduction programs. Furthermore, Hengli Petrochemical has adopted eco-friendly manufacturing processes, minimizing its environmental footprint.

This commitment is underscored by its recognition as a National Green Factory. Hengli Petrochemical's strategic focus on reducing carbon emissions directly appeals to environmentally conscious consumers and investors alike.

- National Green Factory Designation: A testament to its environmentally sound operations.

- Carbon Emission Reduction Focus: Aligning with global sustainability goals.

- Energy Efficiency Initiatives: Demonstrating responsible resource management.

- Waste Minimization Programs: Contributing to a circular economy approach.

Hengli Petrochemical's value proposition centers on its comprehensive, integrated industry chain, ensuring cost efficiencies and consistent quality. This vertical integration from refining to advanced materials provides a significant competitive advantage, guaranteeing a reliable supply chain for its diverse, high-quality product portfolio. The company's commitment to innovation and sustainability further solidifies its position as a forward-thinking leader.

| Value Proposition Element | Description | Supporting Data/Fact |

|---|---|---|

| Integrated Industry Chain | End-to-end control from refining to advanced materials | 2024 refining capacity: 20 million tons/year |

| Diverse Product Portfolio | High-quality, differentiated petrochemical and polyester new materials | Includes PE100 certified HDPE pipe-grade material |

| Reliable Supply Chain | Massive production capacity and operational uptime | High operational uptime reported in 2023 |

| Commitment to Sustainability | Eco-friendly manufacturing and carbon emission reduction | Designated as a National Green Factory |

Customer Relationships

Hengli Petrochemical cultivates robust customer connections via specialized sales representatives and technical support. These teams offer expert guidance and customized solutions, ensuring clients receive thorough assistance throughout their engagement, from choosing products to application advice and problem-solving.

Hengli Petrochemical cultivates long-term strategic partnerships with major industrial clients, fostering collaborative relationships that extend beyond simple transactions. This approach involves deeply understanding their evolving requirements to co-create tailored products and innovative solutions.

Hengli Petrochemical cultivates customer trust through a steadfast commitment to delivering superior quality products that consistently adhere to rigorous industry specifications. This dedication to excellence is a cornerstone of their customer relationships.

The company's meticulous approach to refinement and its pursuit of perfection in every stage of production solidify its reputation as a dependable and reliable supplier in the petrochemical sector.

For instance, in 2024, Hengli Petrochemical reported a revenue of approximately RMB 210.5 billion, underscoring its significant market presence and the trust customers place in its output.

Responsiveness to Market Needs

Hengli Petrochemical excels at responding to market shifts by dynamically altering its product mix and sharpening cost management in reaction to price volatility and evolving demand. This adaptability ensures they can offer competitive pricing and consistently satisfy customer requirements.

For instance, during periods of fluctuating crude oil prices in 2024, Hengli was able to pivot its production to higher-demand refined products, mitigating the impact of lower feedstock costs on its overall profitability. This agility is crucial in the fast-paced petrochemical industry.

- Product Mix Adjustment: Hengli's ability to quickly reallocate resources to produce chemicals or refined fuels that are in higher demand allows them to capitalize on market opportunities and meet immediate customer needs.

- Cost Control Initiatives: In 2024, the company intensified its focus on operational efficiency, reportedly achieving a 5% reduction in production costs for key product lines through process optimization and supply chain enhancements.

- Market Intelligence Integration: By closely monitoring global market trends and customer feedback, Hengli ensures its product development and production schedules are aligned with current and anticipated market demands, fostering strong customer loyalty.

Corporate Social Responsibility Engagement

Hengli Petrochemical's Customer Relationships are significantly shaped by its Corporate Social Responsibility (CSR) engagement. Through programs like 'Hengli Cares,' the company actively participates in community development and social welfare projects, fostering a positive connection with local populations. This proactive approach builds trust and goodwill, extending beyond transactional interactions to create a stronger, more favorable perception among customers and the wider community.

The company's commitment to CSR directly influences its stakeholder relationships. By demonstrating a genuine concern for social and environmental issues, Hengli Petrochemical enhances its brand image and cultivates loyalty. For instance, in 2023, Hengli Petrochemical reported significant investments in environmental protection and community support initiatives, underscoring its dedication to sustainable development and responsible corporate citizenship.

- Community Investment: Hengli Cares focuses on local development, education, and poverty alleviation.

- Reputation Enhancement: CSR activities build a positive brand image, attracting and retaining customers.

- Stakeholder Trust: Demonstrating social responsibility fosters trust among customers, employees, and investors.

- Sustainable Practices: Integrating CSR into operations aligns with growing customer demand for ethical and eco-friendly products.

Hengli Petrochemical builds strong customer ties through dedicated sales and technical teams, offering tailored solutions and expert support. This personalized approach ensures clients receive comprehensive assistance, from product selection to application guidance and troubleshooting.

The company prioritizes long-term partnerships with key industrial clients, understanding their evolving needs to co-develop customized products and innovative solutions. This collaborative strategy fosters deep client engagement and mutual growth.

Hengli's commitment to superior product quality and consistent adherence to industry standards underpins customer trust and loyalty. For instance, in 2024, the company's revenue reached approximately RMB 210.5 billion, reflecting significant market confidence.

| Customer Relationship Aspect | Description | 2024 Impact/Data |

|---|---|---|

| Specialized Support | Dedicated sales and technical teams provide expert advice and customized solutions. | Facilitated client retention and new business acquisition. |

| Strategic Partnerships | Collaborative development with major industrial clients based on deep understanding of needs. | Drove innovation and secured long-term supply agreements. |

| Quality Assurance | Unwavering commitment to high-quality products meeting rigorous industry specifications. | Contributed to Hengli's RMB 210.5 billion revenue, signaling strong customer trust. |

Channels

Hengli Petrochemical leverages a dedicated direct sales force to connect with its core customer base, primarily industrial clients and textile manufacturers. This approach fosters direct engagement, enabling nuanced discussions on product specifications and pricing.

This direct channel is crucial for understanding specific customer needs, allowing Hengli to offer tailored petrochemical solutions. For instance, in 2024, Hengli's focus on high-quality PTA (Purified Terephthalic Acid) for the textile industry meant their sales teams were actively working with manufacturers to ensure product suitability for advanced weaving and dyeing processes.

Hengli Petrochemical leverages a vast domestic distribution network spanning China, ensuring its diverse petrochemical and polyester products reach a wide array of industries and regions efficiently. This robust infrastructure is key to achieving broad market penetration and maintaining a consistent supply chain for its domestic clientele.

Hengli Petrochemical actively utilizes international export channels to serve a global customer base, with a significant focus on markets in Southeast Asia and Europe. This strategic reach allows the company to diversify its revenue streams and capitalize on international demand for its petrochemical products.

Managing these export operations involves navigating complex international logistics and adhering to diverse trade regulations. In 2023, Hengli's export sales contributed significantly to its overall performance, demonstrating its growing presence in the global petrochemical landscape.

To further enhance its international footprint, Hengli often collaborates with international distributors and agents. These partnerships are crucial for understanding local market dynamics, building customer relationships, and ensuring efficient product delivery across different regions.

Online Presence and Digital Platforms

Hengli Petrochemical leverages digital platforms to enhance its corporate image and communicate crucial information to stakeholders. While direct online sales of bulk petrochemicals might be less common, these platforms serve as vital hubs for brand building and engaging with potential large-scale clients.

The company's digital footprint supports transparency and accessibility, crucial for maintaining investor confidence and attracting business partners. This strategic online presence is fundamental in today's interconnected business environment.

- Brand Visibility: A strong online presence ensures Hengli Petrochemical remains top-of-mind for industry participants.

- Stakeholder Engagement: Digital platforms facilitate communication with investors, customers, and the broader market.

- Information Dissemination: Key corporate news, financial reports, and product information are readily available online.

- Client Inquiries: While not direct sales, platforms can streamline initial contact and information gathering for major clients.

Industry Exhibitions and Trade Fairs

Hengli Petrochemical actively participates in key industry exhibitions and trade fairs, such as the China International Petroleum & Petrochemical Industry Exhibition (CIPPE). These events are vital for demonstrating their latest product innovations and technological advancements to a global audience. In 2024, Hengli showcased its high-performance polyethylene and polypropylene grades, attracting significant interest from potential downstream customers and international buyers.

These exhibitions offer a prime opportunity for Hengli to foster relationships with new clients and strengthen existing partnerships. The company leverages these platforms for direct engagement, allowing them to understand market demands and gather valuable feedback. For instance, at a major Asian petrochemical conference in late 2024, Hengli reported a substantial increase in qualified leads generated compared to previous years, highlighting the effectiveness of their presence.

Industry exhibitions are instrumental in enhancing Hengli's brand visibility and market positioning. They provide a competitive edge by allowing direct comparison of their offerings with those of industry peers. The company's strategic participation in these events directly contributes to their business development objectives, facilitating market penetration and expansion.

- Product Showcase: Hengli uses exhibitions to unveil new petrochemical products and advanced manufacturing technologies.

- Networking Opportunities: These events are critical for connecting with potential clients, suppliers, and strategic partners.

- Market Intelligence: Participation provides insights into market trends, competitor activities, and customer needs.

- Brand Visibility: Exhibitions enhance Hengli's brand recognition and reputation within the global petrochemical sector.

Hengli Petrochemical's channels are multifaceted, encompassing direct sales, extensive domestic distribution, and strategic international exports. This integrated approach ensures broad market reach and caters to diverse client needs. The company also leverages digital platforms for brand building and stakeholder engagement, and actively participates in industry exhibitions to showcase innovations and forge new partnerships.

| Channel Type | Description | 2024 Focus/Activity | Impact |

|---|---|---|---|

| Direct Sales Force | Engages industrial clients and textile manufacturers for tailored solutions. | Focus on high-quality PTA for advanced textile processes. | Deepens customer relationships and ensures product suitability. |

| Domestic Distribution | Vast network across China for efficient product delivery. | Ensures consistent supply chain for domestic clientele. | Achieves broad market penetration. |

| International Exports | Serves global customers, particularly in Southeast Asia and Europe. | Diversifies revenue and capitalizes on international demand. | Expands global presence and revenue streams. |

| Digital Platforms | Enhances corporate image and communicates with stakeholders. | Brand building and engaging potential large-scale clients. | Supports transparency and investor confidence. |

| Industry Exhibitions | Showcases innovations and builds relationships at trade fairs. | Demonstrated high-performance polyethylene and polypropylene grades. | Boosts brand visibility and market intelligence. |

Customer Segments

Hengli Petrochemical primarily serves large industrial manufacturers, supplying them with substantial quantities of essential petrochemical products. These clients operate across diverse sectors like automotive, construction, and packaging, all reliant on a steady flow of basic chemical feedstocks for their production lines.

Textile and apparel manufacturers represent a core customer segment for Hengli Petrochemical. These businesses rely on Hengli's polyester fibers, filament yarn, and staple fiber as essential raw materials for creating a wide array of fabrics and finished garments.

Hengli's ability to offer differentiated fiber products is crucial, as it allows these manufacturers to meet specific quality, performance, and aesthetic requirements demanded by the fashion and textile markets. For instance, the global textile market was valued at approximately $1 trillion in 2023 and is projected to grow, showcasing the significant demand for Hengli's output.

Hengli Petrochemical's downstream chemical product producers are vital partners, transforming key intermediates like purified terephthalic acid (PTA), ethylene glycol, and various olefins and aromatics into a wide range of specialized chemicals and materials. These customers are the backbone of numerous industries, from textiles and packaging to automotive and construction.

For instance, in 2024, the global market for PTA, a primary feedstock for polyester production, continued to see robust demand, with Hengli being a significant supplier to manufacturers of polyester fibers and PET resins. Similarly, ethylene glycol, another core product, is crucial for antifreeze and polyester production, feeding into sectors that experienced steady growth throughout the year.

Advanced Materials Industries

Hengli Petrochemical caters to the Advanced Materials sector by supplying specialized polymers crucial for high-performance applications. This includes products like high-density polyethylene (HDPE), which is vital for durable pipes and robust engineering plastics used in demanding environments.

Customers in this segment prioritize materials that offer superior strength, chemical resistance, and longevity. For instance, Hengli's commitment to quality in HDPE production supports industries needing reliable infrastructure components. The global market for advanced polymers is substantial, with projections indicating continued growth driven by innovation and demand for lighter, stronger materials across various sectors.

- Key Products: High-density polyethylene (HDPE) for pipes and engineering plastics.

- Customer Needs: High performance, durability, and chemical resistance for demanding applications.

- Market Relevance: Supports infrastructure development and specialized manufacturing requiring advanced polymer properties.

Domestic Chinese Market

Hengli Petrochemical's primary customer base is the immense domestic Chinese market. The company has established a significant footprint across numerous industries within China, acting as a key supplier of crucial petrochemicals and textile products.

This extensive reach within China allows Hengli to cater to a wide array of downstream manufacturers and consumers. In 2023, China's petrochemical industry continued to grow, with demand driven by sectors like automotive, construction, and consumer goods.

Hengli's operations are deeply integrated into China's industrial landscape. For instance, the company's refining capacity, which stood at around 16 million tons per annum by late 2023, directly feeds into the production of materials vital for these domestic industries.

- Vast Domestic Demand: China's large population and rapidly developing economy create substantial ongoing demand for petrochemical products.

- Key Supplier Role: Hengli is a critical provider of essential raw materials for China's manufacturing sector, including plastics, synthetic fibers, and other chemical intermediates.

- Industry Integration: The company's products support a wide range of industries, from packaging and textiles to automotive and electronics, all within the domestic market.

- Market Share: Hengli holds a significant position in the Chinese petrochemical market, contributing to the nation's self-sufficiency in many key chemical products.

Hengli Petrochemical's customer segments are diverse, ranging from large industrial manufacturers needing bulk petrochemicals to specialized downstream producers transforming intermediates. Key sectors include automotive, construction, and packaging, all reliant on Hengli's foundational chemical feedstocks.

The textile and apparel industry is a significant focus, with manufacturers depending on Hengli's polyester fibers and yarns for fabric production. This segment values Hengli's ability to supply differentiated fibers that meet specific market demands, reflecting the global textile market's substantial value, estimated at around $1 trillion in 2023.

Downstream chemical producers are crucial partners, utilizing Hengli's PTA and ethylene glycol to create a wide array of specialized materials. The demand for these intermediates remained strong in 2024, with Hengli playing a vital role in supplying the polyester and PET resin markets.

Furthermore, Hengli serves the Advanced Materials sector by providing high-performance polymers like HDPE, essential for durable pipes and engineering plastics. These customers prioritize superior strength and chemical resistance, underscoring the market's need for advanced polymer solutions.

| Primary Customer Segment | Key Products Supplied | Customer Needs/Value Proposition | 2023/2024 Market Context |

|---|---|---|---|

| Large Industrial Manufacturers | Bulk Petrochemicals (Olefins, Aromatics) | Reliable supply of essential feedstocks for diverse production lines. | China's petrochemical industry saw continued growth in 2023, driven by domestic demand. |

| Textile & Apparel Manufacturers | Polyester Fibers, Filament Yarn, Staple Fiber | High-quality, differentiated fibers for fabric and garment production. | Global textile market valued at ~$1 trillion in 2023; demand for polyester remains robust. |

| Downstream Chemical Producers | PTA, Ethylene Glycol, Olefins, Aromatics | Essential intermediates for creating specialized chemicals and materials. | PTA and ethylene glycol markets experienced strong demand in 2024. |

| Advanced Materials Sector | High-Density Polyethylene (HDPE), Specialty Polymers | High-performance polymers offering superior strength, chemical resistance, and durability. | Growing demand for advanced polymers in infrastructure and specialized manufacturing. |

Cost Structure

Hengli Petrochemical's business model demands substantial capital expenditure. This is primarily driven by the need to build, maintain, and expand its vast integrated refining and petrochemical complexes. These investments cover crucial areas like new production units, adopting advanced technologies, and enhancing essential infrastructure.

For instance, in 2023, Hengli Petrochemical reported capital expenditures of approximately RMB 13.6 billion (roughly $1.9 billion USD), underscoring the scale of investment required to keep its operations at the forefront of the industry and to fuel future growth initiatives.

Raw material procurement, predominantly crude oil and chemical feedstocks, represents a significant portion of Hengli Petrochemical's cost structure. For instance, in 2023, crude oil prices saw considerable volatility, with Brent crude averaging around $82 per barrel, directly influencing Hengli's input expenses.

Effective management of these fluctuating global commodity prices is crucial. Hengli Petrochemical likely employs sophisticated supply chain strategies and hedging instruments to mitigate the impact of price swings on its profitability and maintain competitive pricing for its refined products.

Hengli Petrochemical's commitment to innovation is clearly reflected in its substantial Research and Development (R&D) expenses, a critical component of its business model. These investments are not merely operational costs but strategic outlays aimed at driving future growth and market leadership.

In 2023, Hengli Petrochemical reported R&D expenses amounting to approximately RMB 2.3 billion. This significant figure underscores the company's focus on developing advanced materials, optimizing production processes, and securing intellectual property to stay ahead in the competitive petrochemical landscape.

These R&D efforts are crucial for Hengli's strategy of product differentiation, allowing them to offer high-value, specialized products. By continuously investing in research, the company aims to enhance its technological capabilities and maintain a strong competitive advantage.

Operational and Production Costs

Hengli Petrochemical's operational and production costs are substantial, encompassing daily energy consumption, wages for its extensive workforce, rigorous plant maintenance, and logistical expenditures. These are the backbone of their day-to-day business.

Optimizing these essential costs is paramount for maintaining profitability. This involves a continuous focus on enhancing production efficiency and investing in technological upgrades to streamline operations.

- Energy Consumption: A significant portion of daily operational costs, influenced by global energy prices and plant efficiency.

- Labor Wages: Reflecting the large workforce required for complex petrochemical operations.

- Plant Maintenance: Essential for ensuring safety, uptime, and longevity of sophisticated equipment.

- Logistics Expenses: Covering the transportation of raw materials and finished products.

Financing and Debt Servicing Costs

Hengli Petrochemical's business model is heavily influenced by its financing and debt servicing costs. Given the immense capital required for petrochemical operations, the company carries substantial debt. In 2024, Hengli Petrochemical's interest expenses represented a significant portion of its operating costs, reflecting the cost of servicing its various loans and bonds used to fund its massive refining and chemical complexes. This financial leverage is a critical factor in its overall profitability and financial resilience.

The company's financial health is directly tied to its debt-to-equity ratio and the prevailing cost of funding in the market. A higher debt-to-equity ratio, while potentially amplifying returns during good times, also increases financial risk. Hengli's ability to manage its debt obligations efficiently, particularly in a fluctuating interest rate environment, is paramount for its sustained operations and growth. For instance, changes in global interest rates in early 2025 could directly impact the company's borrowing costs.

- Financing Costs: Interest payments on significant borrowings are a major expense.

- Debt Servicing: Meeting obligations on loans and bonds is crucial for financial stability.

- Debt-to-Equity Ratio: This metric highlights the company's financial leverage and associated risk.

- Cost of Funding: Market interest rates directly affect the expense of debt servicing.

Hengli Petrochemical's cost structure is dominated by capital expenditures for its integrated complexes, raw material procurement, and significant R&D investments. Operational costs, including energy, labor, and maintenance, are also substantial. Financing costs, stemming from extensive debt to fund its operations, represent a critical expense category.

| Cost Category | 2023 (Approximate) | Significance |

|---|---|---|

| Capital Expenditures | RMB 13.6 billion ($1.9 billion USD) | Building, maintaining, and expanding facilities. |

| R&D Expenses | RMB 2.3 billion | Driving innovation and product differentiation. |

| Raw Material Costs | Influenced by crude oil prices (e.g., Brent avg. ~$82/barrel in 2023) | Major input expense, subject to market volatility. |

| Financing Costs | Significant portion of operating costs (2024) | Servicing debt for massive infrastructure. |

Revenue Streams

Hengli Petrochemical's primary revenue driver is the sale of refined oil products, a direct result of its substantial crude oil processing capabilities. This segment includes key commodities like gasoline, diesel, jet fuel, and various other petroleum-based fuels, forming the bedrock of its integrated petrochemical operations.

In 2024, Hengli Petrochemical reported significant sales volumes for its refined products. For instance, its refining segment processed an average of approximately 20 million tons of crude oil annually, translating into billions of dollars in revenue from these fuel sales, underscoring their critical role in the company's financial performance.

Hengli Petrochemical's core revenue driver is the sale of fundamental petrochemical building blocks. This includes vital aromatics like benzene and xylene, as well as olefins such as ethylene. These materials are essential inputs for a vast array of downstream manufacturing processes.

Further bolstering this revenue stream are intermediate products like purified terephthalic acid (PTA) and ethylene glycol. These are critical components in the production of polyester fibers and PET resins, widely used in textiles and packaging. In 2023, Hengli Petrochemical reported a significant portion of its revenue derived from these petrochemical sales, reflecting strong demand from industrial customers across multiple sectors.

Hengli Petrochemical generates significant revenue from selling polyester chips and a variety of polyester fibers, such as filament yarn and staple fiber. These products are essential raw materials for the textile and apparel sectors, forming a crucial part of the company's integrated downstream business. In 2023, Hengli Petrochemical's polyester segment reported robust sales, contributing substantially to its overall financial performance.

Sales of Advanced New Materials and Films

Hengli Petrochemical generates revenue by selling advanced new materials and films. This segment includes specialized products such as high-density polyethylene (HDPE) pipe-grade material, which is crucial for infrastructure development, and a variety of high-performance films used in packaging and industrial applications. These advanced materials often carry higher profit margins due to their specialized nature and the technology involved in their production.

For instance, in 2024, the demand for advanced polymer materials remained robust, driven by sectors like automotive, construction, and consumer goods. Hengli's focus on innovation in this area allows them to capture value from these growing markets. The company's strategic investments in research and development for new material formulations directly contribute to the profitability of this revenue stream.

- High-Density Polyethylene (HDPE) Pipe-Grade Material: Essential for water, gas, and industrial piping systems, offering durability and corrosion resistance.

- Specialty Films: Including BOPET (biaxially oriented polyethylene terephthalate) and BOPP (biaxially oriented polypropylene) films used in flexible packaging, labeling, and industrial applications, often with enhanced barrier properties.

- Higher Margins: Achieved through product differentiation, technological expertise, and catering to niche market demands for performance and specific functionalities.

Potential Technology Licensing and Services

Hengli Petrochemical is exploring avenues beyond its core product sales, with potential technology licensing and related services presenting a significant future revenue diversification opportunity. Discussions with major players like Saudi Aramco highlight the potential for monetizing its proprietary technologies and technical expertise.

This strategic move could unlock new income streams derived from intellectual property and specialized services, reducing reliance on the cyclical nature of commodity petrochemical markets. Such licensing agreements would not only generate revenue but also foster technological collaboration and innovation.

- Technology Licensing: Potential to license advanced petrochemical processing technologies to third parties.

- Technical Services: Offering consulting, engineering, and operational support based on its accumulated expertise.

- Intellectual Property Monetization: Leveraging patents and proprietary know-how for commercial gain.

- Strategic Partnerships: Collaborating with international entities like Saudi Aramco to explore and implement these new revenue models.

Hengli Petrochemical's revenue streams are multifaceted, stemming from its integrated refining and petrochemical operations. The company generates substantial income from the sale of refined oil products, including gasoline and diesel, and a wide array of petrochemical building blocks like benzene and ethylene. These fundamental chemicals are crucial for numerous downstream industries.

Further revenue is derived from intermediate petrochemicals such as PTA and ethylene glycol, which are key components for polyester production. The company also profits from the sale of finished polyester products, including chips, filament yarn, and staple fiber, serving the textile sector. In 2023, these petrochemical and polyester segments were significant contributors to Hengli's overall revenue, reflecting strong market demand.

Hengli also capitalizes on advanced new materials and films, such as HDPE pipe-grade material and specialty films, which often command higher margins due to their specialized applications and technological sophistication. For 2024, the demand for these advanced materials remained robust, driven by growth in construction and packaging sectors.

| Revenue Stream | Key Products | 2023/2024 Relevance |

|---|---|---|

| Refined Oil Products | Gasoline, Diesel, Jet Fuel | Core revenue driver, substantial processing volumes |

| Petrochemical Building Blocks | Benzene, Xylene, Ethylene | Essential inputs for downstream manufacturing |

| Intermediate Petrochemicals | PTA, Ethylene Glycol | Key for polyester and PET resin production |

| Polyester Products | Polyester Chips, Filament Yarn, Staple Fiber | Significant sales to textile and apparel industries |

| Advanced Materials & Films | HDPE Pipe-Grade, Specialty Films (BOPET, BOPP) | Higher margins, catering to infrastructure and packaging |

Business Model Canvas Data Sources

The Hengli Petrochemical Business Model Canvas is constructed using a blend of financial disclosures, extensive market research, and internal operational data. These sources provide a robust foundation for understanding customer segments, value propositions, and revenue streams.