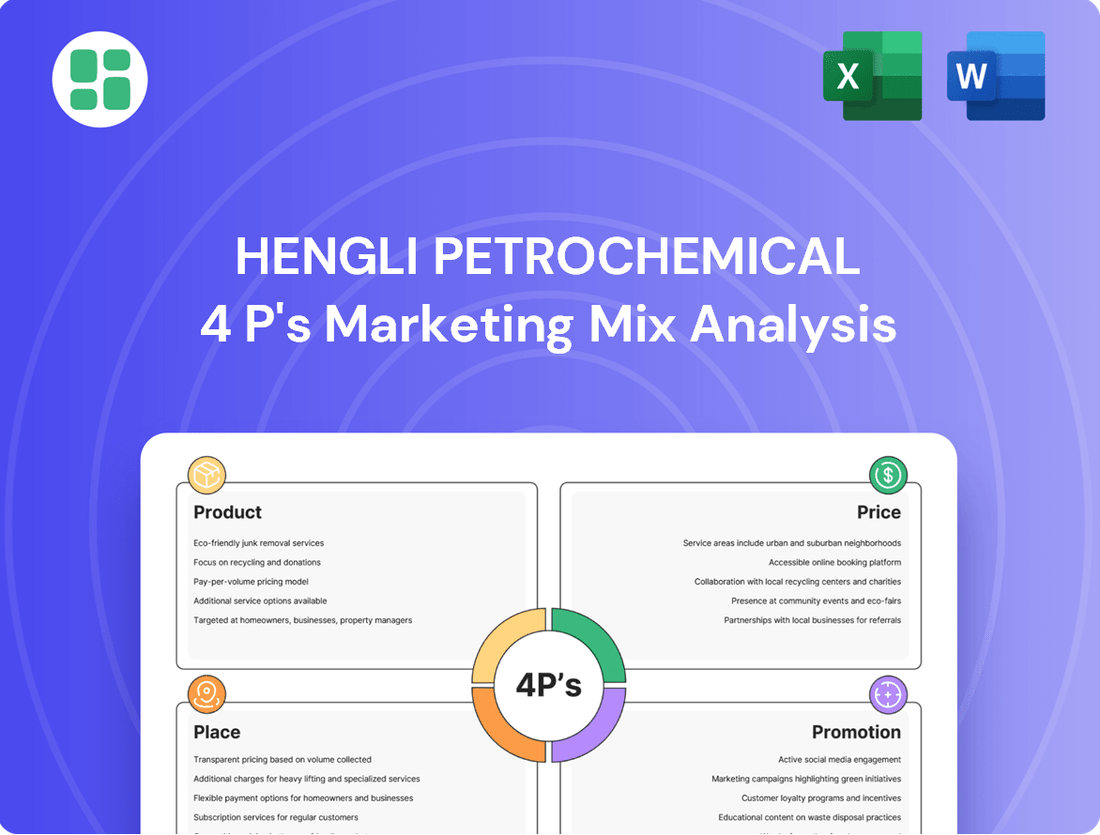

Hengli Petrochemical Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hengli Petrochemical Bundle

Hengli Petrochemical's marketing mix is a masterclass in strategic execution, showcasing how they leverage their diverse product portfolio, competitive pricing, expansive distribution network, and targeted promotional efforts. This analysis delves into how these elements synergize to capture market share and build brand loyalty within the petrochemical industry.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Hengli Petrochemical's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights into a global leader.

Product

Hengli Petrochemical's product strategy is deeply integrated, covering the full spectrum from crude oil refining to advanced polyester materials. This means they produce everything from basic refined products to the specialized materials that go into textiles, offering a one-stop shop for many customers.

This integration is a key strength, ensuring a stable and reliable supply of raw materials and intermediates. For example, in 2023, Hengli Petrochemical reported significant production capacities in PTA (Purified Terephthalic Acid), a crucial polyester feedstock, demonstrating their upstream strength that feeds their downstream textile material production.

The breadth of their product portfolio, encompassing upstream, midstream, and downstream segments, allows them to capture value across the entire chain. This comprehensive offering is designed to meet diverse market needs within both the petrochemical and textile industries, providing a competitive edge.

Hengli Petrochemical's product strategy centers on core chemical building blocks, notably purified terephthalic acid (PTA). PTA is a critical precursor for polyester production, a widely used material in textiles and packaging. In 2023, Hengli Petrochemical maintained its position as a leading PTA producer, with its integrated refining and petrochemical complex contributing significantly to its output capacity.

Hengli Petrochemical's advanced polyester materials and fibers showcase a commitment to innovation and market leadership. Their product range encompasses a wide array of polyester chips and specialized fibers, catering to diverse industrial needs.

Recent advancements highlight Hengli's strategic push into high-value segments. The company has achieved mass production of ultra-fine fiber (27D/144f), a material sought after for its premium feel and performance in textiles. Furthermore, their PE100 certified HDPE pipe-grade material signifies a move into essential infrastructure components, backed by rigorous quality standards.

Diversified Applications

Hengli Petrochemical's product portfolio extends far beyond its origins in textiles, showcasing diversified applications that touch numerous sectors. The company supplies essential polymers and chemicals crucial for manufacturing, packaging, and infrastructure development. This broad reach allows Hengli to meet diverse market demands and mitigate risks associated with over-reliance on a single industry.

This strategic diversification is evident in Hengli's robust product offerings. For instance, their production of PTA (Purified Terephthalic Acid) and MEG (Monoethylene Glycol) are fundamental building blocks not only for polyester fibers used in textiles but also for PET (Polyethylene Terephthalate) resins vital for beverage bottles and food packaging. In 2023, Hengli Petrochemical reported significant production capacities for these key materials, underscoring their widespread industrial utility.

- Textiles: Polyester fibers for apparel and home furnishings.

- Packaging: PET resins for bottles, films, and containers.

- Manufacturing: Polymers for automotive parts, electronics, and consumer goods.

- Infrastructure: Chemicals used in construction materials and coatings.

Commitment to Quality and Innovation

Hengli Petrochemical places a strong emphasis on quality and innovation, evident in its dedication to high-efficiency production and environmental stewardship. This commitment translates into advanced manufacturing processes designed to minimize waste and maximize output, aligning with global sustainability trends. For instance, in 2023, the company continued its focus on upgrading production lines to enhance energy efficiency, contributing to its green environmental protection goals.

The company’s proactive investment in research and development is a cornerstone of its strategy. The establishment of the 'Hengli-DUT Research Institute' underscores this commitment, fostering collaboration to pioneer new technologies and materials. This initiative is crucial for localizing the production of high-end petrochemical products, a key factor in Hengli's competitive edge. By pushing the boundaries of material science, Hengli aims to set new industry benchmarks and meet the evolving demands of sophisticated markets.

- Commitment to Green Production: Hengli Petrochemical actively pursues environmentally friendly manufacturing practices, aiming to reduce its ecological footprint.

- R&D Investment: Significant resources are allocated to research and development, exemplified by the Hengli-DUT Research Institute, to foster technological advancements.

- Localization of High-End Materials: The company focuses on developing and producing advanced materials domestically, reducing reliance on imports and enhancing supply chain resilience.

- Industry Standard Setting: Through its innovative approach and quality focus, Hengli Petrochemical strives to elevate industry standards in petrochemical production and material science.

Hengli Petrochemical's product strategy is characterized by its deep integration across the value chain, from refining to advanced polyester materials. This comprehensive approach ensures a stable supply of key feedstocks like PTA, a critical component for polyester production. In 2023, Hengli maintained its status as a leading PTA producer, leveraging its integrated complexes to support downstream manufacturing.

The company's product portfolio extends to high-value segments, including specialized polyester fibers and PE100 certified HDPE pipe-grade material, demonstrating a commitment to innovation and diverse market needs. This diversification caters to sectors like textiles, packaging, manufacturing, and infrastructure, as seen in their 2023 production capacities for PTA and MEG, vital for both textiles and PET bottles.

Hengli Petrochemical prioritizes quality and sustainability, investing heavily in R&D, exemplified by the Hengli-DUT Research Institute, to develop advanced materials and localize high-end production. This focus on innovation and green manufacturing aims to set new industry benchmarks and enhance supply chain resilience.

| Product Segment | Key Products | 2023 Production Focus/Capacity Highlight | Key Applications | Strategic Importance |

|---|---|---|---|---|

| Upstream Refining | Refined fuels, Naphtha | Stable feedstock supply for petrochemicals | Energy, Chemical feedstock | Foundation of integrated operations |

| Petrochemicals | PTA, MEG, Benzene | Leading PTA producer; significant MEG capacity | Polyester fibers, PET bottles, Packaging | Core building blocks for downstream products |

| Advanced Materials | Polyester Chips, Specialized Fibers (e.g., 27D/144f), HDPE Pipe-grade | Mass production of ultra-fine fiber; PE100 certification | Apparel, Home furnishings, Infrastructure, Consumer goods | Value-added products, market leadership |

What is included in the product

This analysis provides a comprehensive breakdown of Hengli Petrochemical's marketing strategies, examining its product portfolio, pricing tactics, distribution channels, and promotional efforts within the competitive petrochemical landscape.

This analysis simplifies Hengli Petrochemical's complex 4Ps strategy, offering a clear roadmap to address market challenges and optimize customer engagement.

It serves as a concise, actionable guide for stakeholders to quickly understand and implement Hengli's marketing approach, alleviating concerns about market competitiveness.

Place

Hengli Petrochemical boasts a robust network of large-scale integrated industrial parks, strategically situated in key economic zones across China. Its primary hubs in Liaoning Province (Dalian), Jiangsu, and Guangdong Provinces are crucial for optimizing production and ensuring efficient logistics.

Hengli Petrochemical's integrated supply chain logistics are a cornerstone of its operational efficiency. The company's vertical integration, from crude oil refining to advanced materials, allows for seamless internal movement of goods. This model optimizes resource allocation and minimizes transportation costs across its extensive network.

Hengli Petrochemical's marketing strategy heavily leverages its deep penetration into the domestic Chinese market. This focus allows it to efficiently supply essential petrochemical products, including PTA and polyester, to key sectors like textiles, automotive, and construction, which are vital to China's economic engine. In 2023, Hengli Petrochemical reported operating revenue of approximately RMB 198.2 billion, underscoring its significant scale and influence within the national economy.

Growing International Presence

Hengli Petrochemical is actively broadening its international footprint, driven by a global strategy. This expansion is spearheaded by its dedicated trading entity, Hengli Petrochemical International Pte. Ltd., strategically located in Singapore. This move is designed to effectively tap into and serve diverse international markets, with a particular focus on the petrochemical and maritime logistics industries.

The company's internationalization efforts are multifaceted, aiming to build a robust global presence. Key initiatives include forging strategic alliances and leveraging its Singaporean base for enhanced trading operations. This approach is crucial for Hengli to compete on a global scale and secure new revenue streams beyond its domestic market.

- Global Trading Hub: Hengli Petrochemical International Pte. Ltd. in Singapore acts as a crucial nexus for international trade.

- Market Penetration: The company is targeting key international markets, especially in petrochemicals and maritime logistics.

- Strategic Partnerships: Collaborations are a cornerstone of Hengli's strategy to accelerate its global market penetration.

- Logistics Focus: Expansion into maritime logistics underscores Hengli's commitment to a comprehensive global supply chain.

Strategic Partnerships for Distribution

Hengli Petrochemical strengthens its distribution network through strategic alliances with key players in the energy sector. Collaborations with giants like Sinochem and Sinopec are crucial for managing both crude oil imports and the export of refined fuels, significantly boosting its reach across China. This ensures efficient product placement and market penetration.

Further solidifying its global supply chain, Hengli is in discussions with Aramco regarding a potential stake acquisition. These talks also encompass cooperative efforts in securing crude oil and raw material supplies, alongside joint ventures for product sales. Such a partnership could unlock new international markets and enhance Hengli's competitive edge.

- Sinochem and Sinopec Partnerships: Facilitate substantial crude oil imports and fuel exports within China, optimizing domestic distribution.

- Aramco Discussions: Potential stake acquisition includes cooperation on crude and raw material supply, alongside product sales, expanding global reach.

- 2024/2025 Outlook: These partnerships are expected to contribute to Hengli's market share growth and operational efficiency in the coming years.

Hengli Petrochemical's place strategy centers on its integrated industrial parks, strategically located in China's key economic zones like Dalian, Jiangsu, and Guangdong. This physical presence is augmented by a global trading hub in Singapore, managed by Hengli Petrochemical International Pte. Ltd., to serve diverse international markets, particularly in petrochemicals and maritime logistics.

| Location Focus | Key Activities | Strategic Importance |

|---|---|---|

| Domestic China (Dalian, Jiangsu, Guangdong) | Large-scale integrated production, efficient logistics | Optimized supply chain, domestic market penetration |

| Singapore | International trading hub, market development | Global market access, enhanced trading operations |

| Global Maritime Logistics | Supply chain expansion, international partnerships | Comprehensive global reach, competitive advantage |

Same Document Delivered

Hengli Petrochemical 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Hengli Petrochemical 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion strategies in detail. You'll gain immediate access to actionable insights for understanding their market positioning.

Promotion

Hengli Petrochemical's promotional strategy heavily emphasizes its innovative spirit, positioning itself as a leader that not only creates but also sets industry standards. This narrative underscores their dedication to technological progress and product uniqueness as key differentiators in a competitive landscape.

Hengli Petrochemical champions its 'Green-to-Core' philosophy, underscoring a deep commitment to sustainable manufacturing. This focus on environmental responsibility is a key element of its marketing strategy, aiming to build trust and a positive brand image. The company's investment in eco-friendly technologies and processes directly supports its 'Green-to-Core' mission.

Through its 'Hengli Cares' committee, the company actively contributes to societal well-being and promotes environmentally conscious work habits. This engagement strengthens its public perception, demonstrating a dedication to corporate citizenship beyond its core business operations. These initiatives are designed to resonate with increasingly socially conscious consumers and stakeholders.

Hengli Petrochemical prioritizes investor relations by providing detailed annual reports and quarterly earnings releases. These documents offer comprehensive financial data and operational insights, ensuring transparency for its financially-literate audience of investors and stakeholders.

For instance, Hengli's 2023 annual report detailed a revenue of RMB 207.5 billion, showcasing their commitment to sharing key performance indicators. This consistent flow of information empowers informed decision-making among its target market.

Industry Leadership and Brand Recognition

Hengli Petrochemical's brand strength is a key promotional asset, consistently earning a spot among the Top 500 World Brands. This prestigious recognition underscores the company's significant market influence and leadership position. The brand's enduring strength is built on continuous innovation and a solid foundation in its core business areas.

This industry leadership translates directly into a powerful promotional advantage, attracting customers and stakeholders alike. For instance, in 2023, Hengli Petrochemical was ranked as one of the top global brands, reflecting its sustained efforts in product development and market penetration. This brand equity allows Hengli to command greater market share and build stronger customer loyalty.

The company's commitment to excellence has been validated by numerous accolades, further solidifying its promotional appeal. These include various industry awards for technological advancement and sustainable practices. Such recognition not only enhances brand perception but also acts as a direct catalyst for increased sales and market opportunities.

Key aspects of Hengli's promotional strategy through brand recognition include:

- Global Brand Ranking: Consistent inclusion in the Top 500 World Brands list, signaling strong international market presence.

- Market Leadership: Demonstrated leadership through sustained breakthroughs and a focus on core competencies.

- Promotional Leverage: Utilizing brand recognition as a significant tool to attract customers and partners.

- Customer Trust: Building trust and loyalty through a well-established and respected brand name.

Business-to-Business (B2B) Engagement

Hengli Petrochemical's business-to-business (B2B) promotion strategy is deeply rooted in its industrial clientele. This involves a dedicated direct sales force that cultivates relationships with key accounts in sectors like manufacturing and shipping. Their presence at industry-specific trade conferences, such as the China International Petrochemical Exhibition, is crucial for showcasing new products and forging partnerships.

Specialized trade publications and digital platforms catering to the petrochemical and manufacturing industries serve as vital channels for Hengli's promotional efforts. These platforms allow for targeted advertising and thought leadership content, reaching decision-makers directly. For instance, in 2024, Hengli actively participated in events like the Asia Pacific Petrochemical Summit, highlighting their advancements in high-performance polymers.

- Direct Sales Force: Focused on building long-term relationships with industrial clients.

- Industry Trade Conferences: Participation in events like the China International Petrochemical Exhibition to showcase capabilities.

- Specialized Trade Publications: Targeted advertising and content in industry-specific media.

- Digital Engagement: Utilizing online platforms to reach and inform potential B2B customers.

Hengli Petrochemical's promotional strategy leverages its strong brand reputation, consistently ranking among the Top 500 World Brands, to attract customers and partners. This global recognition, reinforced by industry awards for innovation and sustainability, builds customer trust and loyalty.

The company actively engages in B2B promotion through a dedicated sales force and participation in key industry events, such as the Asia Pacific Petrochemical Summit in 2024. Targeted advertising in specialized trade publications and digital platforms further enhances their reach to industrial clients.

Hengli's commitment to transparency is demonstrated through detailed annual reports, like the 2023 report showing RMB 207.5 billion in revenue, which inform investors and stakeholders. Their 'Green-to-Core' philosophy and 'Hengli Cares' initiatives also form a crucial part of their communication, highlighting environmental responsibility and corporate citizenship.

| Promotional Aspect | Description | Key Data/Event |

|---|---|---|

| Brand Strength | Global recognition and market leadership | Ranked among Top 500 World Brands |

| B2B Engagement | Direct sales, trade shows, industry publications | Participation in Asia Pacific Petrochemical Summit 2024 |

| Transparency | Financial reporting and operational insights | 2023 Annual Report: RMB 207.5 billion revenue |

| Corporate Philosophy | Sustainability and social responsibility | 'Green-to-Core' philosophy, 'Hengli Cares' initiatives |

Price

Hengli Petrochemical's pricing is deeply tied to the ebb and flow of global commodity markets, especially crude oil. For instance, crude oil prices saw significant volatility in late 2023 and early 2024, with Brent crude oscillating between $70 and $90 per barrel, directly influencing Hengli's raw material costs.

To navigate this, Hengli employs dynamic pricing strategies, adjusting product prices swiftly to reflect changes in feedstock costs and market demand. This agility is crucial for maintaining margins in a sector where input price fluctuations can quickly erode profitability.

Hengli Petrochemical is actively pursuing cost optimization and technological enhancements to navigate a challenging market. This strategy is crucial for maintaining profitability amidst external pressures. For instance, in 2023, the company focused on improving its operational efficiency, contributing to a more robust financial performance.

A key element of Hengli's approach involves achieving historically low financing costs, a significant advantage in the current economic climate. This focus on internal efficiencies directly supports their objective to boost profit margins, demonstrating a commitment to operational excellence.

Hengli Petrochemical's strategy for advanced materials like high-density polyethylene (HDPE) pipe-grade material and ultra-fine fibers moves beyond simple cost-plus models. These specialized products enable value-based pricing, allowing Hengli to capture premiums based on their superior performance and application benefits rather than just production costs.

This approach is particularly advantageous when the broader petrochemical market faces downward price pressure. For instance, in late 2024 and early 2025, while many commodity petrochemicals experienced volatility, demand for high-performance materials remained robust, supporting stronger price differentials for Hengli's differentiated offerings.

Strategic Investment and Capacity Impact

Hengli Petrochemical's significant capital expenditures, particularly in expanding its Purified Terephthalic Acid (PTA) production capacity, are designed to bolster its pricing power. By achieving greater economies of scale, the company can potentially lower its per-unit production costs, allowing for more competitive pricing even in a saturated market. This strategic move aims to solidify its market share and enhance its competitive edge.

The company's capacity expansion is a direct response to market dynamics, particularly in products like PTA where oversupply can pressure margins.

- Capacity Expansion: Hengli Petrochemical has been a significant investor in expanding its PTA production lines, with notable capacity increases reported in recent years, aiming to reach tens of millions of tons annually.

- Economies of Scale: Larger production volumes directly translate to lower fixed costs per unit, improving cost competitiveness.

- Market Share: Increased capacity is a lever to capture a larger portion of the domestic and potentially international PTA market.

- Pricing Power: By controlling a larger share and operating at higher efficiency, Hengli can exert more influence on pricing, especially during periods of demand fluctuation.

Financial Performance and Shareholder Returns

Hengli Petrochemical's pricing strategy is closely tied to its dedication to shareholder value, demonstrated through a consistent dividend payout. For instance, in 2023, the company declared a dividend of RMB 1.00 per share, reflecting a commitment to returning profits to investors.

However, the company's net profit can face headwinds from broader economic conditions. A slowdown in market demand and shrinking profit margins, which were observed in parts of 2023 due to global economic uncertainties, can impact profitability. This pressure necessitates careful consideration of future pricing adjustments and strategic investment decisions to maintain financial health and shareholder returns.

- Dividend Consistency: Hengli Petrochemical has maintained a policy of consistent dividend distribution, aiming to reward shareholders directly.

- Market Challenges: Factors such as sluggish market demand and margin compression can negatively affect net profit.

- Strategic Adjustments: These market pressures may lead to adjustments in pricing strategies and future investment plans.

- 2023 Performance Context: For example, while dividends were paid, the broader petrochemical market in 2023 experienced volatility impacting overall profitability.

Hengli Petrochemical's pricing strategy is multifaceted, balancing commodity market fluctuations with the premium commanded by specialized materials. The company leverages economies of scale from its significant capacity expansions, particularly in PTA, to offer competitive pricing while aiming to influence market rates. This allows for value-based pricing on advanced products like high-density polyethylene, capturing higher margins when market conditions permit, as seen with robust demand for high-performance materials in late 2024 and early 2025.

| Product Segment | Pricing Driver | 2023/2024 Trend Impact | 2025 Outlook Consideration |

|---|---|---|---|

| Commodity Petrochemicals (e.g., PTA) | Crude oil prices, Supply/Demand Balance | Volatility, Margin Pressure | Continued sensitivity to feedstock costs, potential for oversupply |

| Advanced Materials (e.g., HDPE Pipe-Grade, Ultra-Fine Fibers) | Performance Benefits, Application Value | Premium Pricing, Robust Demand | Sustained demand for specialized applications, potential for differentiated pricing |

| Overall Strategy | Cost Optimization, Economies of Scale | Improved Efficiency, Enhanced Competitiveness | Focus on operational excellence to mitigate market volatility |

4P's Marketing Mix Analysis Data Sources

Our Hengli Petrochemical 4P's analysis is grounded in comprehensive data, including official company reports, investor relations materials, and industry-specific market intelligence. We leverage insights from their product portfolio, pricing strategies, distribution networks, and promotional activities to provide a holistic view.